Pressure Sensitive Tapes Market Size, Share, Trends and Forecast by Type, Technology, Resin Type, Material Type, Application, and Region, 2025-2033

Pressure Sensitive Tapes Market Size and Trends:

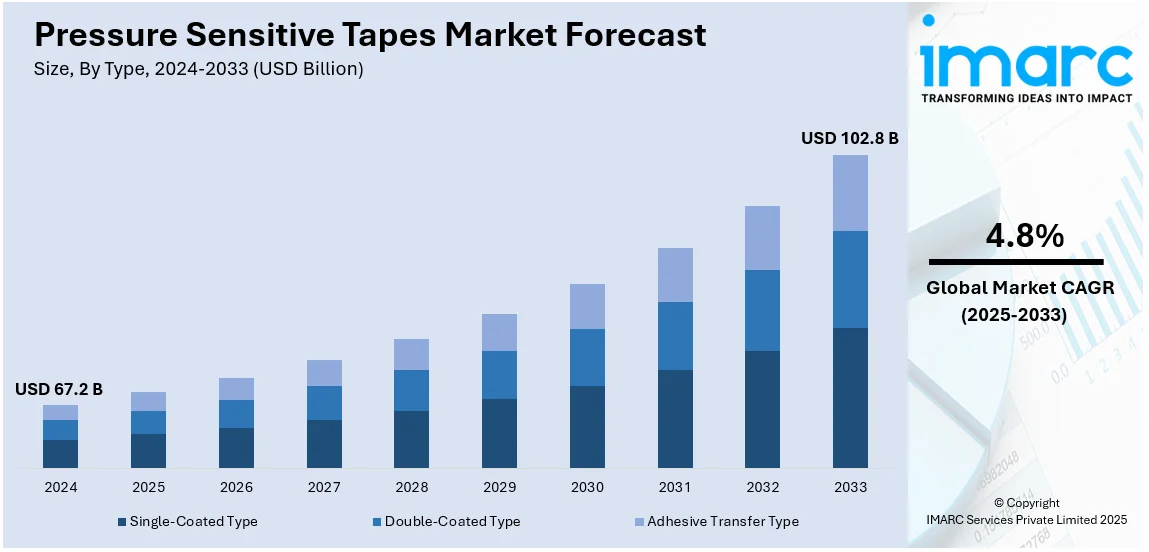

The global pressure sensitive tapes market size was valued at USD 67.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 102.8 Billion by 2033, exhibiting a CAGR of 4.8% from 2025-2033. Asia Pacific currently dominates the pressure sensitive tapes market share in 2024 at 36.9%. The region's market is propelled by fast-paced industrialization, a rising need for packaging solutions, and substantial expansion in sectors like automotive, electronics, and construction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 67.2 Billion |

|

Market Forecast in 2033

|

USD 102.8 Billion |

| Market Growth Rate (2025-2033) | 4.8% |

The global pressure sensitive tapes market demand is on the rise, fueled by the growing need for packaging, especially in the e-commerce and food sectors. In addition to this, the automotive sector's need for durable and efficient adhesive solutions is supporting the market growth. Moreover, ongoing advancements in electronics are creating demand for specialized tapes in device assembly and providing an impetus to the market. Also, the construction industry's growth contributes to rising tape usage for sealing and insulation, which is fueling the market demand. In addition, the increasing focus on sustainability has driven the creation of environmentally friendly tapes, further supporting market growth. For example, Bostik's ultraviolet (UV) pressure-sensitive adhesives are ideal for high-performance applications like specialty tapes, medical products, and labels, offering fast cure speeds, 100% solids, low energy consumption, and high-temperature performance for enhanced efficiency and longevity. These further enhance the versatility and performance of pressure-sensitive tapes, catalyzing the market growth.

The United States pressure sensitive tapes market growth is primarily driven by the surging adoption of automation and robotics in manufacturing processes. This further increases the demand for high-performance tapes for assembly and automation. For instance, pressure-sensitive adhesive solutions were introduced by Arkema, featuring all the main technologies in the market, including hot melt, waterborne, UV, and specialty solution acrylics. Alongside this, the growing demand for medical-grade tapes in wound care and surgical procedures is contributing to the market's expansion. Concurrently, the growth of the aerospace sector, requiring lightweight and strong tapes for composite materials, is boosting the market demand. Additionally, stricter regulations in packaging and labeling enhance the need for high-quality, compliant adhesive solutions, which is providing an impetus to the market. Apart from this, the increased focus on energy-efficient building materials is driving the demand for tapes used in insulation and sealing applications, thereby propelling the market forward.

Pressure Sensitive Tapes Market Trends:

Increasing Product Application in the Packaging Industry

The increasing adoption of pressure-sensitive tapes in the packaging sector is enhancing the pressure sensitive tapes market outlook. These tapes are widely employed in industries such as packaging to seal cartons, boxes, and any other packages of different types and made of different materials. Similarly, the upward spiral in the e-commerce, e-retail segment, and online orders for food and delivery services is adding to the requirements of packaging items such as pressure sensitive tapes. The rise in e-commerce and demand for sustainable packaging creates a significant opportunity for pressure-sensitive tapes. Their versatility in sealing, branding, and tamper-proof applications enhances the market potential within the growing packaging sector. As an example, in Germany, the paper packaging material had a higher growth in the year 2022 as compared to the previous years. Moreover, the Packaging Industry Association of India (PIAI) has revealed that the packaging industry will have a compound annual growth rate (CAGR) of 22% for the forecast period. Moreover, the packaging market in India is expected to expand at a CAGR of 14.50%, reaching a value of USD 204.81 billion by 2025. This kind of steep rise in online retailing is expected to drive pressure sensitive tape market growth. However, a key challenge in the packaging industry is the need for environmentally friendly adhesive solutions. Pressure-sensitive tapes must evolve to meet sustainability demands, requiring innovations in materials and adhesives while maintaining cost-efficiency and performance standards.

Expanding Automotive Industry

A substantial increase in the automotive sector is creating favorable growth prospects in the pressure sensitive tapes market trends. Pressure-sensitive tapes are widely applied in the automotive industry for trim adhesion, emblem, and badge attaching, moldings and weather strip fastening, insulation of wires harness, and masking during the painting procedures. As the automotive industry expands, there is increasing demand for specialized tapes for bonding, insulation, and noise reduction. Pressure-sensitive tapes offer lightweight, durable, and cost-effective solutions, driving growth in this sector. Furthermore, the growing usage of automobiles due to increasing purchasing powers of people coupled with improvements in their living standards also put up the pressure sensitive tapes market demand. For instance, according to reports, passenger vehicle wholesale sales increased to 4,218,746 units in the 2023-24 financial year, marking an 8.4% rise compared to the previous fiscal year. In confluence with this, the total sales for the commercial vehicle also rose from 7,16,566 to 9,62,468 units. Also, in its latest report, IMARC identified the global commercial vehicles market size at USD 803.6 billion in 2023. According to IMARC analysis, the market is forecasted to achieve USD 1,114.2 Billion by 2032 by growing at 3.6% CAGR across the forecast period 2024-2032. As a result, a higher growth rate in this segment is likely to boost the pressure sensitive tapes market share in the automobile industry. Besides this, the automotive industry's strict requirements for performance, durability, and safety standards pose a challenge. Pressure-sensitive tapes must meet high-temperature resistance, adhesion, and environmental performance, making it necessary for manufacturers to invest in advanced technology and testing.

Growing Product Innovations

Ongoing innovations in the areas of adhesives, backing materials, and particular application characteristics are generating continuous growth in the global market for tapes. Also, there is a rising investment by several key market players regarding research and development activities for developing new pressure sensitive tapes tailored to different industries which are contributing to the pressure sensitive tapes market growth. The trend of product innovations in adhesives allows for the development of high-performance, multifunctional pressure-sensitive tapes. Innovations in materials, such as eco-friendly and stronger adhesives, create a promising market for new, specialized tape solutions. For instance, in November 2022, an industrial adhesive company known as Bostik unveiled two adhesive products in the tape and label market of India. Moreover, in February 2023, Arkema launched pressure-sensitive adhesives solutions, that offer all key industry technologies from hot melt to waterborne and UV and specialty solution acrylics. These innovations offer new market opportunities for the growth of tape-based products across a broad range of sectors such as packaging, automotive, construction, and electronics while at the same time enhancing competition and product differentiation among manufacturers of tapes. While innovation drives market growth, the rapid pace of technological advancements presents challenges in terms of production costs and time-to-market. Manufacturers must balance innovation with cost-effectiveness and ensure that new products meet evolving industry needs.

Pressure Sensitive Tapes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pressure sensitive tapes market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, resin type, material type, and application.

Analysis by Type:

- Single-Coated Type

- Double-Coated Type

- Adhesive Transfer Type

Single-coated pressure-sensitive tapes are the largest market segment because the adhesive is coated on one side of the backing material, and its applications include packaging, masking, and labeling. They afford simplicity of application and can be designed to meet precise needs such as thermal and UV stability, thus playing crucial roles in industries requiring firmly bonded surfaces that do not require additional chemical fixatives. It can be tailored for use depending on the requirement, such as high heat, UV stability, and higher levels of durability, which makes them suitable for many sectors. These tapes offer reliable performance for both temporary and long-term uses,whether used for light-duty applications or more demanding environments, thus impelling the market growth.

Analysis by Technology:

- Water Type

- Solution Based

- Emulsion Based

- Solvent Type

- Hot-Melt Type

- Radiation Type

Hot-melt type technology holds a dominant position in the pressure sensitive tapes market share, accounting for 43.6% of the market share. This technology is preferred due to its superior adhesive performance and environmental benefits, as it contains no solvents and reduces the need for additional curing processes. Hot-melt pressure-sensitive tapes offer excellent bonding strength, fast application, and enhanced durability, making them ideal for a wide range of industries, including automotive, electronics, packaging, and healthcare. Furthermore, the rising demand for environmentally friendly and cost-efficient solutions has played a key role in the increased adoption of hot-melt tapes. As industries continue to prioritize sustainability and efficiency, the market share of hot-melt technology is expected to expand further.

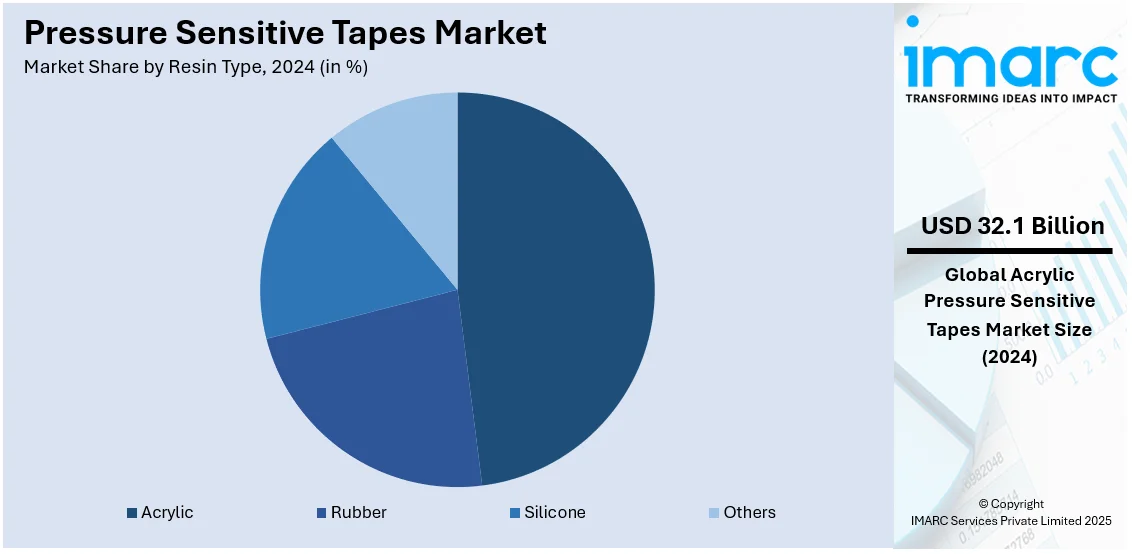

Analysis by Resin Type:

- Acrylic

- Rubber

- Silicone

- Others

Acrylic resin tapes lead the market with 47.8% shares. They are widely known for their durability, UV resistance, and temperature stability. They are widely used in packaging, construction, automotive, and electronics industries due to their excellent adhesive properties and versatility. These types of acrylic resin tapes are known to have good adhesive properties and are therefore suitable for use on a wide range of substrates such as plastic, metal, and glass and therefore can be used indoors or outside. These traits of material make them resistant to moisture as well as UV exposure, making them perfect to perform in challenging environmental conditions. The combination of strength and flexibility makes acrylic resin tapes the right product for many applications in the industrial market, thus driving the market demand.

Analysis by Material Type:

- Foam

- Film

- Paper

- Others

Paper leads the market due to its versatility, cost-effectiveness, and eco-friendly characteristics. It is extensively utilized in industries such as packaging, printing, and labeling because of its simple processing and recyclability. Being biodegradable, paper products help reduce environmental impact, a crucial factor for both businesses and consumers. Moreover, paper is highly versatile, available in different thicknesses and finishes to suit specific application requirements. Its ability to be printed on and its compatibility with adhesives further contribute to its popularity. As sustainability continues to be a priority, paper remains a leading material in the market.

Analysis by Application:

- Automotive

- Packaging

- Electronics

- Others

The automotive industry has the largest demand for pressure sensitive tapes as they are used in manufacture, assembly, and component fastening. These tapes offer exceptionally good adhesion, sealing, and insulation characteristics needed in automobile applications including instrument panels, door liners, and electrical connections, among others. Moreover, because of their ability to manage temperature fluctuation, UV light, and vibration, they are suitable for automobiles. With the growth in electric automobiles and advanced lightweight and metallic material options, the pressure sensitive tape demand is rising at a rapid pace in the automotive sector.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia Pacific region held the largest market share, accounting for 36.9%. As per the pressure sensitive tapes market statistics by IMARC, the pressure sensitive tapes market exhibits a diverse geographical landscape with a significant presence across North America, Europe, Asia Pacific, and regions like Latin America and the Middle East. Each region shows varying demand dynamics influenced by industrial growth, infrastructure development, and manufacturing activities, driving market expansion and innovation. The increasing number of construction projects and the expanding packaging industry, especially in developing nations, are positively impacting the pressure sensitive tapes industry. For instance, China, India, Japan, and South Korea account for over 80% of the demand for pressure-sensitive adhesives. The Chinese packaging industry continues to expand quickly because of the expanding economy and growing middle class with elevated purchasing power. Among all packaging sectors food packaging remains the largest contributor with approximately 60% of China's total market share. The Indian pressure-sensitive adhesives market shows strong potential for growth because of increasing demands from applications including transparent and film labels and FMCG manufacturing shrink-wrap labels while also requiring flexible labels and multicolor wrap-around labels.

Key Regional Takeaways:

North America Pressure Sensitive Tapes Market Analysis

The North American pressure sensitive tapes market is witnessing moderate growth in demand which is backed by the automotive, healthcare, packaging, and construction industries. The manufacturing industry in this region is well developed, and industries need some kinds of tapes for assembly, sealing, and insulation. Besides this, the automotive industry has been incorporating high-performance adhesive tapes mostly in lightweight applications to enhance fuel economy due to the reduction of vehicle weight. For instance, Bostik provides a broad range of pressure-sensitive adhesive technologies, emphasizing sustainable and innovative solutions for various applications, which are well-aligned with the automotive sector's shift toward lighter and more energy-efficient solutions. Healthcare products are also included in the growth sector with medical tapes for wound and surgical applications. Also, global packaging demand has been driven by the fast-growing e-commerce sector that also demands more packaging materials. Furthermore, automotive growth, along with the developments in regulations associated with sustainability and safer products is enhancing the market dynamics toward the use of environment-friendly and high-performance tapes.

Mexico is a significant player in the pressure-sensitive tape market in North America. These tapes serve numerous industries throughout Mexico starting from automotive production to electronics and packaging and construction applications. The growing manufacturing sector in the region, particularly in automotive production, drives the need for durable and versatile tapes. The market has been adopting pressure sensitive tapes including masking and double-sided and foam varieties because they require no heat or solvent for bonding. Also, the local tape production sector together with United States Mexico Canada Agreement (USMCA) trade agreements allows Mexico to obtain superior adhesive solutions thus making itself appealing to tape manufacturers at home and abroad.

United States Pressure Sensitive Tapes Market Analysis

Expanding healthcare and flexible packaging industries drive growth in the pressure-sensitive tapes market of the United States. As per Flexible Packaging Association, in 2022, the US flexible packaging industry generated USD 41.5 Billion in sales. Such statistics depict an expanding demand for packaging solutions that are efficient, light, and sturdy. In such sectors, the use of pressure-sensitive tapes delivers sealing and tamper-evident benefits. A key growth driver in the healthcare sector is the rising prevalence of diabetes. As reported by BMC Population Health Metrics, the number of people diagnosed with diabetes in the United States is expected to triple by 2060. One of the most common complications of diabetes, diabetic foot ulcers, frequently require surgical interventions, thereby upping the ante for medical-grade pressure-sensitive tapes. These tapes are important in wound care and surgical applications because they are hypoallergenic, breathable, and durable. The factors mentioned are what are propelling the growth of the market.

Europe Pressure Sensitive Tapes Market Analysis

The growth rate in Europe for pressure-sensitive tapes is remarkable as it keeps abreast with the development in retail e-commerce. The European region holds a third spot worldwide, generating revenues of around USD 631.9 Billion in 2022. International Trade Administration estimated the growth at 9.31 percent year-over-year while projecting that this would hit around USD 902.3 Billion by 2027. This e-commerce boom is driving the demand for efficient and durable packaging solutions, in which pressure-sensitive tapes play a crucial role. These tapes are necessary for sealing, securing, and tamper-proofing packages to ensure safe delivery across the supply chain. As consumers increasingly demand fast and reliable delivery, companies are adopting advanced packaging materials, further boosting the use of pressure-sensitive tapes. Rising trends for sustainable packaging in Europe further lead to innovative products in the category of eco-friendly adhesive tape, in tune with the emphasis put on Europe's environmental responsibility and circular economy. The above factors help propel market growth.

France is one of the biggest markets for pressure sensitive tapes in Europe. The advanced sectors of automotive manufacturing electronics production and construction activities in France depend heavily on pressure sensitive tapes for their applications. France has increased its need for sustainable packaging solutions which has generated rising demand for pressure-sensitive tapes in packaging applications. The established research facilities and distribution networks in France enable the development of high-performance tapes which benefit the market. Furthermore, the European Union membership position provides France easy market access to neighboring European countries thus strengthening its leading role in tape industry operations across the region.

Asia Pacific Pressure Sensitive Tapes Market Analysis

The Asia-Pacific pressure-sensitive tapes market is poised to grow substantially, driven by the rapid adoption of electric vehicles and the strong automotive industry. The Indian government has set a target of achieving 100% ZEVs by 2030, which, with incentives and technological advancements, is fueling a surge in EV adoption across the region. Improvements in EV technology, particularly extended driving ranges, are reducing range anxiety and boosting consumer confidence. According to the International Organization of Motor Vehicle Manufacturers, or OICA, in 2023 the production of new passenger cars in China reached 26.06 million units, up 10.6% from the level recorded in 2022, 23.56 million units. Such impressive growth in car and automotive production creates an enormous demand for pressure-sensitive adhesives used for bonding, insulation, and vibration damping in both electric and non-electric vehicles. Further, lightweight materials and sustainable solutions in the automotive industry help to advance the adoption of advanced adhesive technologies and further market growth.

Latin America Pressure Sensitive Tapes Market Analysis

Latin America is a huge market with massive growth potential for pressure-sensitive tapes, mainly driven by the boom in e-commerce and investments in the automotive sector. Brazil is the largest market in the region and has 77.4 million e-commerce users, while an additional 38.8 million shopped online in 2023, according to industry reports. This online retail boom is pushing the demand for strong packaging solutions, where pressure-sensitive tapes are playing a very important role in securing and tamper-proofing parcels. At the same time, industrial policy changes lately in Brazil have pushed vehicle manufacturers towards modernizing and focusing on environmentally friendly mobility solutions, such as electric and hybrid vehicles. According to the Brazilian Association of Vehicle Manufacturers, in 2023 alone, a record USD 22 Billion has been disclosed in investments, focused on modernization, research, and development through 2032. Pressure-sensitive tapes are an essential part of the automotive applications of bonding, insulation, and vibration damping. Thus, with manufacturers innovating and expanding production in the region, increased demand is sure.

The Central and South American pressure sensitive tape market experiences continuous growth because of expanding industrial operations and infrastructure construction. The construction sector together with the packaging and automotive industries demonstrate substantial growth throughout Colombia Argentina and Chile. These industries rely on pressure-sensitive tapes for their applications in sealing insulation and bonding needs. The market also demonstrates the growing use of adhesive solutions in consumer and do-it-yourself applications. Apart from this, the market expansion in this region happens through rising demands for economical and flexible tapes that require simple use while manufacturers concentrate on low-cost production techniques and better adhesive solutions to meet increasing industrial requirements.

Brazil, as the largest economy in South America, plays a crucial role in the pressure sensitive tape market. The strong industrial foundation of Brazil particularly in the automotive and packaging and construction sectors drives the high consumption of pressure-sensitive tapes. Brazilian manufacturers need tapes that combine strong adhesive properties with environmental resistance capabilities because this leads them to select specialized products such as weather-resistant and high-strength tapes. Furthermore, the expanding e-commerce industry in Brazil drives the need for packaging tapes which expands the overall market potential. The Brazilian economy presents market challenges yet Brazil continues to be a top pressure-sensitive tape market in Latin America.

Middle East and Africa Pressure Sensitive Tapes Market Analysis

The Middle East and Africa pressure-sensitive tapes market are expected to gain momentum due to the growth in the e-commerce sector and growing industrial activities. Industry reports show that the volume of the e-commerce market is expected to grow to USD 50 Billion in the Middle East by 2025, evidencing the rise in consumerism and digital transformation in the region. This rapid expansion requires efficient and reliable packaging solutions, with pressure-sensitive tapes playing a critical role in securing and tamper-proofing parcels for safe delivery. The construction, automotive, and manufacturing industries in Africa continue to push the demand for pressure-sensitive tapes further. Such tapes are a vital bonding, sealing, and insulating component for various sectors. Moreover, the region's trend toward sustainable packaging is an indicator of its preference for environmentally friendly adhesive solutions, thus boosting innovation in the market. Therefore, as e-commerce and industrial activity continue to accelerate, pressure-sensitive tape demand should increase in the Middle East and Africa, thus, positioning the market for steady growth in the upcoming years.

Competitive Landscape:

The competitive landscape of the pressure-sensitive tapes market is driven by active strategies including mergers, acquisitions, partnerships, and product innovations by key players. Companies are focusing on expanding their product portfolios with specialty tapes designed for specific applications like automotive, electronics, and packaging. Top manufacturers are focusing more on research and development to improve adhesive performance, boost durability, and develop environmentally sustainable options. Sustainability is a major trend, with a growing emphasis on reducing volatile organic compound (VOC) emissions and using recyclable or biodegradable materials. Additionally, market players are strengthening their presence in emerging markets like Asia-Pacific by establishing production facilities and forming strategic collaborations. These initiatives are designed to take advantage of the growing demand across multiple industries.

The report provides a comprehensive analysis of the competitive landscape in the pressure sensitive tapes market with detailed profiles of all major companies, including:

- Advance Tapes International Ltd.

- 3M Company

- American Biltrite Inc.

- CCT Tapes

- H.B. Fuller Company

- Jonson Tapes Ltd.

- LINTEC Corporation

- NICHIBAN Co. Ltd.

- Nitto Denko

- Scapa Group

- Tesa SE

Latest News and Developments:

- June 2024: Avery Dennison launched pressure-sensitive tapes for the interior building and construction segment.

- May 2024: Innovia Films introduced their new material science creation of Rayoface AQBHA which represents a two-side coated cavitated film. This tape can be used for pressure sensitive labeling (PSL) applications.

- February 2024: Tesa Tapes India Pvt Ltd, a multinational corporation specializing in creating adhesive taped and self-adhesive solutions, participated in LOGIMAT INDIA 2024, an event organized by Messe Stuttgart India. The company unveiled sustainable products at the event.

Pressure Sensitive Tapes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single-Coated Type, Double-Coated Type, Adhesive Transfer Type |

| Technologies Covered |

|

| Resin Types Covered | Acrylic, Rubber, Silicone, Others |

| Material Types Covered | Foam, Film, Paper, Others |

| Applications Covered | Automotive, Packaging, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advance Tapes International Ltd., 3M Company, American Biltrite Inc., CCT Tapes, H.B. Fuller Company, Jonson Tapes Ltd., LINTEC Corporation, NICHIBAN Co. Ltd., Nitto Denko, Scapa Group, Tesa SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pressure sensitive tapes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pressure sensitive tapes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pressure sensitive tapes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure sensitive tapes market was valued at USD 67.2 Billion in 2024.

IMARC estimates the pressure sensitive tapes market to exhibit a CAGR of 4.8% during 2025-2033, expecting to reach USD 102.8 Billion by 2033.

Key factors driving the pressure-sensitive tapes market include the growing demand for packaging solutions, particularly in the e-commerce and food industries, the automotive sector's need for lightweight, durable adhesives, advancements in electronics requiring specialized tapes, and the construction industry's need for sealing and insulation materials.

Asia Pacific currently dominates the market, driven by rapid industrialization, growing demand for packaging, automotive, and electronics sectors, and increasing consumer spending in emerging economies like China and India.

Some of the major players in the pressure sensitive tapes market include Advance Tapes International Ltd., 3M Company, American Biltrite Inc., CCT Tapes, H.B. Fuller Company, Jonson Tapes Ltd., LINTEC Corporation, NICHIBAN Co. Ltd., Nitto Denko, Scapa Group, Tesa SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)