Pressure Reducing Valve Market Size, Share, Trends and Forecast by Type, Operating Pressure, End User, and Region, 2025-2033

Pressure Reducing Valve Market Size and Share:

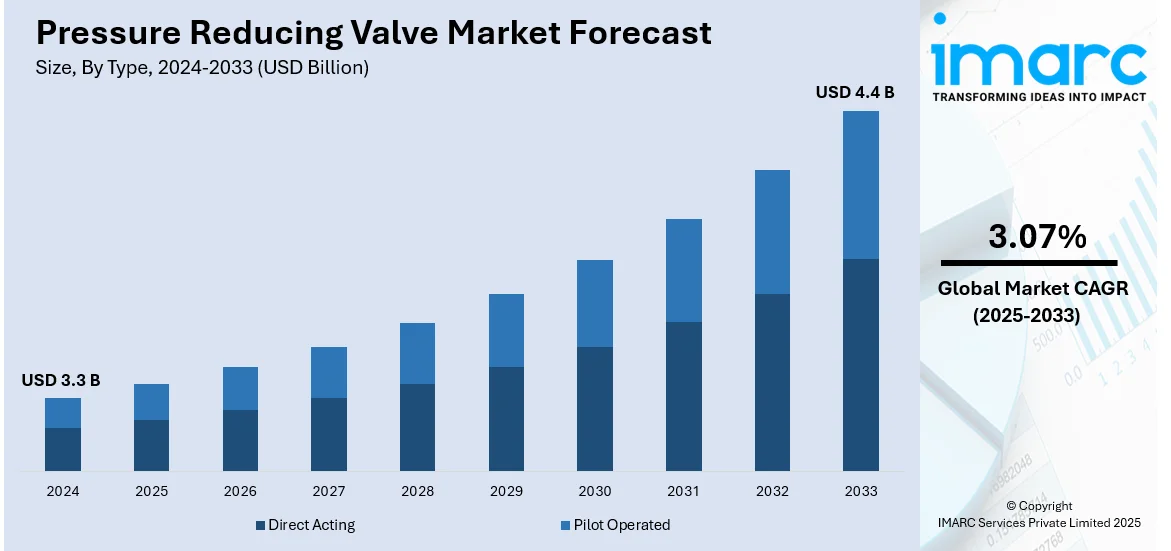

The global pressure reducing valve market size was valued at USD 3.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.4 Billion by 2033, exhibiting a (CAGR) of 3.07% from 2025-2033. Asia Pacific currently dominates the pressure reducing valve market share by holding over 36.8% in 2024. The market in the region is driven by rapid industrialization, expanding oil & gas infrastructure, increasing urbanization, and rising investments in water treatment and fire safety systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.3 Billion |

|

Market Forecast in 2033

|

USD 4.4 Billion |

| Market Growth Rate (2025-2033) | 3.07% |

The global pressure reducing valve (PRV) market demand is driven by the expanding oil & gas industry, as the growing energy demand and refinery expansions increase PRV adoption for pressure regulation and safety. In addition, the rapid infrastructure growth worldwide fuels demand for efficient water and gas distribution systems, boosting the market growth. For instance, the U.S. Department of Energy’s (DOE) 2024 funding of $38 million for 16 projects focuses on cross-sector technologies aimed at industrial efficiency and decarbonization. Such investments underscore the need for reliable PRVs in modernizing water and gas distribution systems. Moreover, governments enforce strict guidelines in industries like fire safety, manufacturing, and water treatment, boosting PRV usage and driving the market demand. Besides this, the increasing investments in water treatment plants resolve the need for stable water pressure in municipal and industrial applications, providing an impetus to the market. Furthermore, ongoing advancements in PRV technology integrate innovations in flow-modulated and smart PRVs to enhance efficiency and reliability, thus impelling the market growth.

Pressure reducing valve (PRV) market growth in the United States is reinforced by the country’s 87.50% share of the market. The demand is primarily driven by aging infrastructure upgrades, as the replacement of outdated water and gas pipeline systems increases PRV demand for pressure stability. In line with this, the expanding shale gas production boosts the surge in hydraulic fracturing and natural gas processing, as it requires PRVs for safe pressure management, thus strengthening the PRV market share. Concurrently, growth in smart city projects fuels investments in intelligent water and energy distribution, driving PRV adoption and contributing to the market expansion. Additionally, stricter NFPA regulations drive PRV use in commercial and industrial buildings, which is significantly supporting the market growth. Also, PRVs are essential for precise pressure control in drug manufacturing, providing an impetus to the market. Apart from this, the rising adoption of energy-efficient heating, ventilation, and air conditioning (HVAC) systems boosts the demand for PRVs as the U.S. focuses on sustainability and energy savings, thereby propelling the market growth.

Pressure Reducing Valve Market Trends:

Growing Demand in the Oil & Gas Industry

A considerable expansion in the oil and gas industry, in confluence with the extensive investments in research and development (R&D) activities, represents one of the key factors influencing the pressure reducing valve market trends. According to industry reports, the global oil and gas market size is expected to reach USD 72.6 billion by 2033, growing at a CAGR of 15.21% during 2025-2033. PRVs aid in maintaining pressure in the pipeline and preventing pipes from bursting. They also find application in protecting against leakage and preventing overheating of pipes. As a result, there is a rise in the need for these valves in the petroleum and oil industry around the world. The expansion of refineries and increasing energy demands further strengthen the adoption of PRVs.

Rising Adoption of Fire Safety Trucks

The rising adoption of these valves in fire safety trucks is enhancing the pressure reducing valve market outlook. This can be accredited to their pressure-controlling mechanism, which is required during the emission of water. Consequently, the expansion of the fire trucks market, which reached USD 5.1 billion in 2024 and is projected to grow at a CAGR of 4.41% during 2025-2033, according to the IMARC Group, is significantly supporting industry expansion. With stricter fire safety regulations and growing urbanization, the need for advanced firefighting equipment is rising. PRVs help ensure controlled pressure levels in water hoses, improving firefighting efficiency and safety. This trend is especially notable in high-risk industries such as oil & gas, chemicals, and manufacturing, where fire safety measures are crucial.

Advancements in Flow-Modulated PRVs & Industry Expansion

Leading players are introducing flow-modulated PRVs that produce constant pressure at critical points within the distribution system. This, along with the significant investments in new refineries, development of existing facilities, and increasing mergers and acquisitions (M&A), are some of the other factors fueling the market growth. Moreover, the market is projected to propel in the coming years on account of rapid urbanization and industrialization worldwide. These innovations improve system reliability, reduce maintenance costs, and enhance overall efficiency. As industrial infrastructure expands and energy demands grow, PRVs are becoming integral to fluid management systems across various sectors, ensuring stable operations in refineries, manufacturing plants, and municipal water networks.

Pressure Reducing Valve Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pressure reducing valve market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, operating pressure, and end user.

Analysis by Type:

- Direct Acting

- Pilot Operated

Pilot-operated pressure reducing valves hold the largest market share in the PRV industry due to their high precision, durability, and ability to regulate pressure in high-flow applications. These valves are widely used in oil & gas, water distribution, power generation, and industrial processing due to their superior performance in maintaining stable pressure levels. Increasing investments in refinery expansions, water treatment plants, and energy infrastructure are key growth drivers. Additionally, the adoption of smart pilot-operated PRVs with the Internet of Things (IoT) integration is rising, enhancing real-time monitoring and efficiency. The segment’s growth is further fueled by stringent safety regulations and the need for reliable pressure control in complex systems.

Analysis by Operating Pressure:

- Below 300 Psig

- 301-600 Psig

- Above 600 Psig

The below 300 Psig segment dominates the pressure reducing valve (PRV) market, holding a 55.3% share in 2024. This dominance is driven by the extensive use of low-to-medium pressure PRVs in municipal water distribution, HVAC systems, and fire protection networks. The rising demand for efficient water pressure control in residential and commercial buildings further supports growth. Additionally, industries such as food and beverage, pharmaceuticals, and manufacturing require precise low-pressure regulation to ensure operational safety and efficiency. Increasing urbanization, infrastructure development, and investments in water treatment plants continue to fuel demand, making this segment a key driver of overall market expansion.

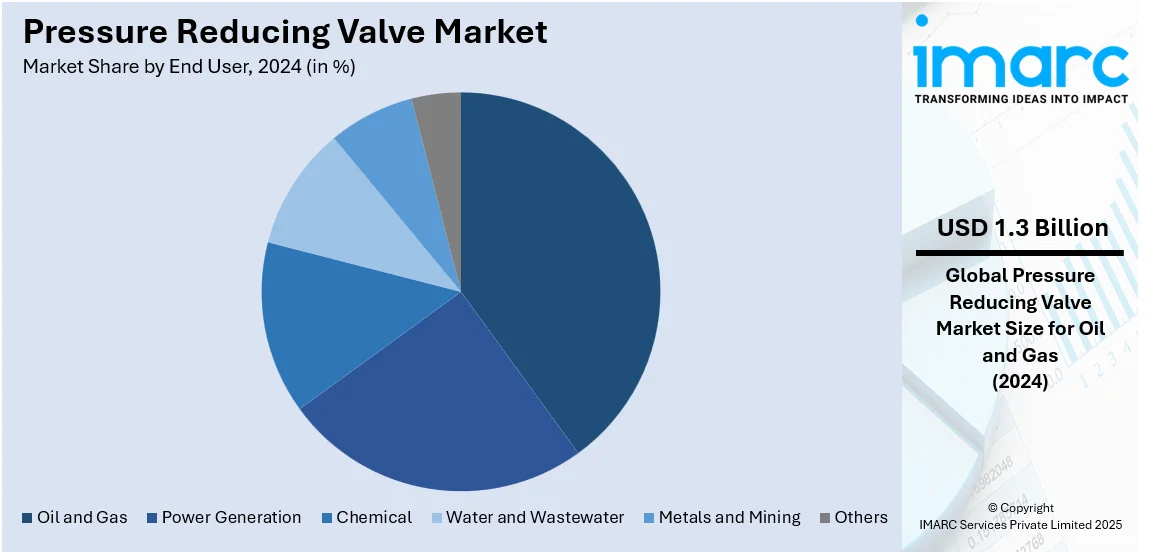

Analysis by End User:

- Oil and Gas

- Power Generation

- Chemical

- Water and Wastewater

- Metals and Mining

- Others

The oil and gas sector holds the largest share in the pressure reducing valve (PRV) market, accounting for 38.7% in 2024. PRVs play a crucial role in maintaining pipeline integrity, preventing overpressure, and ensuring safe fluid handling in upstream, midstream, and downstream operations. The expansion of refineries, increasing shale gas exploration, and rising global energy demand are key growth drivers. Additionally, strict safety regulations and the need for efficient pressure management in high-risk environments boost adoption. Investments in LNG infrastructure, offshore drilling, and pipeline upgrades further accelerate market growth, solidifying the oil and gas industry as a dominant end user segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the pressure reducing valve (PRV) market, holding a 36.8% share in 2024. This growth is driven by rapid industrialization, expanding oil & gas infrastructure, and increasing urbanization. The rise in water treatment projects, power generation facilities, and manufacturing activities further boosts demand. Additionally, government initiatives for infrastructure modernization and smart city development fuel PRV adoption in municipal water and HVAC systems. Furthermore, the growing chemical and pharmaceutical industries also contribute to market expansion. With rising investments in fire protection systems and stringent safety regulations, the region continues to be the fastest-growing market for PRVs globally.

Key Regional Takeaways:

North America Pressure Reducing Valve Market Analysis

North America is a key market for pressure reducing valves (PRVs), driven by aging infrastructure upgrades, stringent safety regulations, and increasing industrial automation. The region benefits from expanding oil & gas exploration, particularly in the U.S. and Canada, where PRVs play a vital role in pressure management and pipeline safety. Additionally, rising investments in water treatment plants, HVAC systems, and fire protection networks are fueling demand. For example, the Biden-Harris Administration's $200 million investment in replacing aging gas pipelines is further driving the PRV market by enhancing pipeline safety, reducing pressure fluctuations, and ensuring regulatory compliance. The growing pharmaceutical and food processing industries, which require precise pressure control, further support market growth. Technological advancements, including smart PRVs with IoT integration, are gaining traction. With strict regulatory compliance and infrastructure modernization efforts, North America continues to be a major player in the global PRV market.

United States Pressure Reducing Valve Market Analysis

The United States pressure reducing valve (PRV) market is experiencing significant growth, driven by several key factors. A primary driver is the expansion of industrial infrastructure across sectors such as oil and gas, petrochemicals, power generation, and water treatment. According to a report by the IMARC Group, the United States oil and gas market is projected to reach USD 339.5 Billion by 2033, growing at a CAGR of 3.26% during 2025-2033. These industries rely heavily on PRVs to maintain safe and controlled pressures within their systems, ensuring operational efficiency and safety. Additionally, the increasing emphasis on energy efficiency and sustainable resource management is propelling the adoption of PRVs. By regulating pressure levels, these valves contribute to energy conservation and the reduction of operational costs, aligning with the growing demand for environmentally responsible practices. The trend toward industrial automation and the integration of smart technologies also play a crucial role in the market's expansion. Modern PRVs equipped with digital capabilities enable real-time monitoring and predictive maintenance, enhancing the precision and reliability of pressure control systems. This technological advancement meets the evolving needs of industries seeking to optimize operations through automation. Furthermore, the robust growth of the construction industry, particularly in the residential and commercial sectors, is contributing to the demand for PRVs. As new buildings and infrastructure projects emerge, the need for effective pressure regulation in plumbing and HVAC systems becomes increasingly critical.

Europe Pressure Reducing Valve Market Analysis

The Europe pressure reducing valve (PRV) market is witnessing major growth. This is mainly due to increasing regulatory focus on safety standards and environmental compliance across industries. There are more stringent European industrial safety regulations being applied. As a result, PRVs are essential for ensuring that systems operate under safe pressure limits to avoid equipment failures and environmental hazards. Particularly, the increasing requirement for infrastructure advancements, particularly in old water distribution systems in several cities in Europe, is fueling industry expansion. PRVs are critical for optimizing water management, which is vital in upgrading these systems. The growing emphasis on smart cities and urban development because of an increasing rate of urbanization also helps in increasing the sales of PRVs as these valves are vital in controlling water, gas, and HVAC systems that are placed in the new smart infrastructure. As per industry reports, in 2024, 75.6% of the total population in Europe lived in urban areas. In addition to that, the IoT integration in the manufacturing process due to the trend of automation and Industry 4.0 is also contributing to the growth of the PRV market as advanced PRVs implemented with IoT connectivity provide real-time monitoring of pressure data, enabling predictive maintenance and data-driven decision-making. Additionally, the rapidly growing use of alternative energy, including solar and wind, necessitates effective pressure management of energy storage and transmission systems, consequently bolstering the demand for PRV across the region.

Asia Pacific Pressure Reducing Valve Market Analysis

The growth of the Asia Pacific Pressure Reducing Valve (PRV) market is largely driven by the region's increasing urbanization and population growth, which intensifies the demand for efficient infrastructure, particularly in water, gas, and HVAC systems. According to recent reports, 52.9% of the total population in Asia lived in urban cities in 2024. As more cities expand, effective pressure management in public utilities and residential buildings becomes essential to ensure a steady supply of resources and reduce wastage. The rising focus on industrial automation and the adoption of smart technologies further contributes to the market, as advanced PRVs with digital monitoring and control systems are increasingly integrated into manufacturing plants. Additionally, government initiatives promoting industrial safety standards and energy efficiency are encouraging investments in pressure regulation solutions. The growing trend toward modernizing and replacing aging infrastructure in both developed and developing economies also creates opportunities for PRV adoption.

Latin America Pressure Reducing Valve Market Analysis

The Latin America pressure reducing valve (PRV) market is chiefly driven by the swift-paced industrialization processes in nations such as Brazil and Mexico, leading to increased demand for PRVs across oil and gas, mining, and water treatment sectors. In addition, increasing construction activities and infrastructure modernization also create further demand for reliable and efficient pressure-control solutions across several industries in the region. According to recent industry reports, the Brazil construction market size reached USD 150.0 Billion in 2024 and is expected to grow at a CAGR of 4% during 2025-2033. The construction market in Argentina is also expected to grow at a CAGR of 3.50% during 2024-2032. Coupled with this, the region's investments in infrastructure improvements, specifically in the urban water and sewage systems, have increased the demand for effective pressure regulation.

Middle East and Africa Pressure Reducing Valve Market Analysis

Many factors are driving the growth of the Middle East and Africa pressure reducing valve (PRV) market. The need for effective infrastructure and rapid urbanization in countries, such as UAE, Saudi Arabia, and South Africa are increasing the demand for pressure reducing valves (PRVs) in water distribution and HVAC systems. Additionally, the region's growing oil and gas industry requires reliable pressure control solutions to maintain operational safety and efficiency. For instance, the UAE oil and gas market is forecasted to grow at a CAGR of 3.7% during 2025-2033. Similarly, the oil and gas market in Egypt is projected to grow at a CAGR of 4.60% during 2025-2033. In addition, government programs encouraging energy savings and environmental sustainability have promoted the application of PRVs, especially in industrial fields.

Competitive Landscape:

Market players in the pressure reducing valve (PRV) industry are actively engaging in product innovations, strategic partnerships, and facility expansions to strengthen their market presence. Leading companies are developing advanced flow-modulated and smart PRVs integrated with IoT and automation for improved efficiency and remote monitoring. Additionally, mergers and acquisitions (M&A) are increasing as firms seek to expand their technological capabilities and geographic reach. Investments in sustainable and energy-efficient PRVs are rising to meet stringent environmental regulations. Moreover, key manufacturers are focusing on customized solutions to cater to diverse industry needs, including oil & gas, water treatment, and fire safety. The expansion of manufacturing plants in emerging economies is also a notable trend, aimed at reducing production costs and strengthening supply chains.

The report provides a comprehensive analysis of the competitive landscape in the pressure reducing valve market with detailed profiles of all major companies, including:

- Aalberts N.V.

- Armstrong International Inc.

- CIRCOR International Inc.

- Eaton Corporation plc

- Forbes Marshall

- Honeywell International Inc.

- KSB SE & Co. KGaA

- Parker-Hannifin Corp.

- Reliance Worldwide Corporation Limited

- Spirax-Sarco Engineering plc

- TALIS Management Holding GmbH

- Watts Water Technologies Inc.

Latest News and Developments:

- February 2025: Emerson has launched the Anderson Greenwood Type 84 PRV (Pressure Relief Valve), which is specially developed to safeguard tanks and ships that are used for hydrogen and various other high-pressure gases. The Type 84 PRV provides outstanding leak-proofness, durability against brittleness, optimal seat tension, excellent dependability, and extended duration of use.

- June 2024: The new Zurn Wilkins 600XL3 and 625XL3 pressure reduction valves have been introduced by Zurn Elkay Water Solutions, a leading provider of clean water treatments and eco-friendly water management solutions globally. These valves provide uniform pressure by using venturi technologies to maintain optimal pressure for water at larger flow rates.

- May 2024: Emerson has recently introduced the novel AVENTICS Series 625 Sentronic Proportional Pressure Control Valves that provide precise electrical proportional pressure controls. Additionally, the Series 625 Sentronic valves come with data collection software (DaS) that enables rapid valve startup, monitoring, and control directly on private computers.

- April 2024: AGF, a renowned supplier of cutting-edge fire safety solutions, has entered into a partnership with Zurn Elkay Water Solutions. With this collaboration, AGF will integrate Zurn’s Model ZW5004 customizable PRV (pressure reducing valve) into its Model 8511 Sprinkler Floor Control to deliver unparalleled effectiveness and dependability for the fire suppression sprinkler systems industry.

- January 2024: Emerson has launched the FisherTM 63EGLP-16 Pilot Operated Relief Valve, a new product that can be installed on pressurized bullet containers that hold anhydrous ammonia and liquid propane. The product has been granted the American Society of Mechanical Engineers (ASME) Section VIII and UL132 certifications.

Pressure Reducing Valve Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Direct Acting, Pilot Operated |

| Operating Pressures Covered | Below 300 Psig, 301-600 Psig, Above 600 Psig |

| End Users Covered | Oil and Gas, Power Generation, Chemical, Water and Wastewater, Metals and Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aalberts N.V., Armstrong International Inc., CIRCOR International Inc., Eaton Corporation plc, Forbes Marshall, Honeywell International Inc., KSB SE & Co. KGaA, Parker-Hannifin Corp., Reliance Worldwide Corporation Limited, Spirax-Sarco Engineering plc, TALIS Management Holding GmbH, Watts Water Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pressure reducing valve market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pressure reducing valve market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pressure reducing valve industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pressure reducing valve market was valued at USD 3.3 Billion in 2024.

IMARC estimates the pressure reducing valve market to exhibit a CAGR of 3.07% during 2025-2033, expecting to reach USD 4.4 Billion by 2033.

Key factors driving the pressure reducing valve market include expanding oil & gas and water treatment sectors, rapid urbanization, increasing stringent safety regulations, rising heating, ventilation, and air conditioning (HVAC) demand, integration of smart PRV advancements, and expanding infrastructure modernization.

Asia Pacific currently dominates the market, accounting for a share exceeding 36.8% in 2024. This dominance is fueled by the rising demand for power generation facilities, expanding chemical and pharmaceutical industries, increasing construction of smart cities, robust manufacturing sector growth, enhanced municipal water distribution networks, and government-led infrastructure modernization projects.

Some of the major players in the pressure reducing valve market include Aalberts N.V., Armstrong International Inc., CIRCOR International Inc., Eaton Corporation plc, Forbes Marshall, Honeywell International Inc., KSB SE & Co. KGaA, Parker-Hannifin Corp., Reliance Worldwide Corporation Limited, Spirax-Sarco Engineering plc, TALIS Management Holding GmbH, Watts Water Technologies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)