Premium Bottled Water Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Premium Bottled Water Market Size and Share:

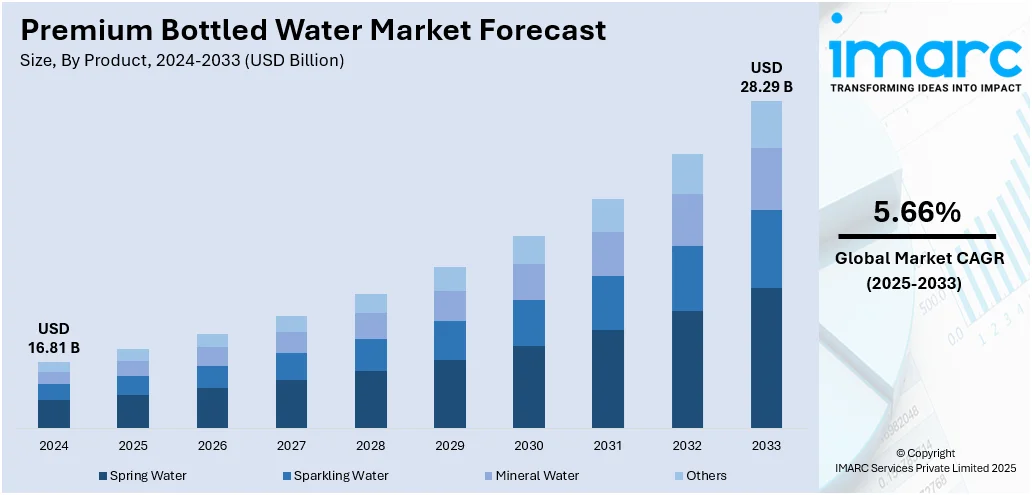

The global premium bottled water market size was valued at USD 16.81 Billion in 2024. The market is projected to reach USD 28.29 Billion by 2033, exhibiting a CAGR of 5.66% from 2025-2033. North America currently dominates the market, holding a market share of over 36.7% in 2024. The market is underpinned by heightening health consciousness, lifestyle-led consumption, and enhanced retail and e-commerce infrastructure. Consumers are gravitating towards functionally enhanced, environmentally friendly, and naturally sourced forms of hydration. Increasing demand for healthier drinks, sustainability-oriented consumption, and new-age branding and packaging advances are driving market growth globally. Urbanization, trend towards fitness, and the decline of sugary beverages are driving premiumization further, supporting the robust upward direction of the premium bottled water market share among regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.81 Billion |

| Market Forecast in 2033 | USD 28.29 Billion |

| Market Growth Rate (2025-2033) | 5.66% |

One major global driver of the premium bottled water market is escalating consumer interest in health-oriented hydration. As awareness grows of the adverse health effects of sugary beverages, consumers globally are turning towards natural, mineral-based bottled water. Premium packaged water is seen as safe, clean, and healthy for overall well-being, thus becoming the choice of health-conscious consumers. This trend is supported by a universal movement toward holistic well-being, with hydration at the center of fitness, cleansing, and healthy lifestyles. Furthermore, increased disposable incomes and exposure to luxury goods through travel, tourism, and wellness experiences are supporting premium appeal of packaged water. Brands providing eco-friendly packaging and responsible sourcing are becoming highly popular as consumers connect their buying decisions with environmental values. For instance, in February 2025, One Water launched its patented Interlocking Bottle Technology at Davos, revolutionizing the premium bottled water category through sustainable design, six global spring sourcing regions, and high-level sustainability leadership. Moreover, these tendencies are consistently driving demand for premium bottled water worldwide, especially among higher-income and urban consumers searching for purity, health, and brand refinement.

To get more information on this market, Request Sample

Premium bottled water in the United States had 88.60% market share in 2024, supported by amplifying demand for high-end and health-oriented beverage products. American consumers are increasingly demanding wellness, convenience, and product quality, leading to a decline in favor of conventional carbonated beverages. Premium bottled water taps into these demands by providing a sophisticated, clean beverage option with enhanced value from improvements in taste, mineral quality, and brand. As per the sources, in March 2025, Beyond Water announced its June U.S. launch of atmospheric water generation (AWG) technology, providing a sustainable, scalable solution to generate premium drinking water directly from air. Furthermore, the growth of fitness culture, on-the-go living, and the need for personalized wellness experiences have fueled premium bottled water to become a staple of luxury retail channels, boutique fitness clubs, high-end spas, and hospitality environments. The appeal to purity and prestige also contributes to its growth among consumers who are image-driven. As increasingly more people aim to incorporate health into their day-to-day decision-making processes without settling for quality or beauty sacrifice, high-quality bottled water continues to grow in U.S. homes, solidifying its stand as a leading choice for hydration among a refined and health-conscious population.

Premium Bottled Water Market Trends:

Health Trends Elevate Demand for Premium Bottled Water

Heightened health awareness and a desire for healthier drink alternatives are key drivers of the global premium bottled water industry. According to a survey by the International Food Information Council, 54% of consumers are actively trying to drink more water, marking an increasing emphasis on hydration and overall wellbeing. The trend benefits most notably premium bottled water brands, which are considered a healthier option than artificially flavored and sugary drinks. Premium bottled water brands such as Fiji Water and Evian have capitalized on the trend by highlighting the purity and natural sourcing of their product such as Fiji Water from isolated artesian aquifers and Evian from pristine glaciers. This focus on natural sources appeals to consumers' increased attention to the adverse health effects associated with sugary beverages. Studies show that the regular intake of one or more sugar-sweetened beverages can increase the complications of type 2 diabetes, obesity, and cardiovascular illnesses. This awareness of health complications nudges consumers to choose premium bottled water as a healthier option.

Economic Uncertainty Reduces Premium Purchase Intent

Economic uncertainty and decreased consumer purchases significantly deter the growth of the global premium bottled water market outlook. During economic uncertainty, like recessions or slowdowns, consumers are more price-sensitive and prefer to make only necessary purchases over premium or luxury items. This shift in consumer behavior directly influences the sales of premium bottled water, which generally retails above standard bottled water or tap water. A further survey also showed that 49% of respondents would be willing to switch to cheaper alternatives when facing economic hard times and opt for cheaper brands. The trend in premium bottled water represents a significant challenge for premium bottled water businesses, who rely on consumers' willingness to pay a premium for the perceived extra value and luxury of their products.

Social Media Drives Consumer Engagement and Brand Growth

The increasing influence and use of social media presents significant opportunities for premium bottled water brands to engage with consumers and drive demand. Premium bottled water brands can leverage this wide audience by creating aesthetically pleasing content that showcases their upscale and aspirational status. Brands like Fiji Water and Evian have successfully used the potential of social media by placing their products in aesthetically pleasing settings and collaborating with influencers and celebrities. This approach not only increases brand visibility but also links these brands to aspirational lifestyles, thereby deepening consumer interaction. According to Influencer Marketing Hub, influencer marketing campaigns can generate up to USD 5.78 in earned media value for every USD 1 spent, highlighting the high return on investment for high-end brands. Moreover, social networking sites offer significant data and insights, allowing brands to understand consumer attitudes, trends, and engagement levels, which can help them optimize their marketing campaigns. As per Sprout Social, 57% of shoppers are more likely to spend more on a social media-followed brand.

Premium bottled water Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global premium bottled water market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, and distribution channel.

Analysis by Product:

- Spring Water

- Sparkling Water

- Mineral Water

- Others

Mineral water commanded a strong 27.7% value share in the premium bottled water segment in 2024, fueled by consumer interest in naturally sourced hydration full of vital minerals. Its positioning as a health-enabling drink resonates with consumers looking for functional benefits over mere hydration. Mineral water is typically viewed as cleaner, safer, and more healthy because it naturally contains calcium, magnesium, and potassium, which enhance wellbeing and encourage active lives. This category is also gaining momentum in luxury hotels, spas, and upscale restaurants where quality and source purity are at the forefront. Increasing concern about digestive and metabolic wellness further sustains demand for mineral-based drinks. Transparency labelling, origin-focused branding, and eco-friendly packaging innovations are major drivers of differentiation in this segment. With consumers worldwide becoming more health-focused and ingredient-savvy, mineral water should continue to lead growth in both mature and emerging markets in the premium bottled water category.

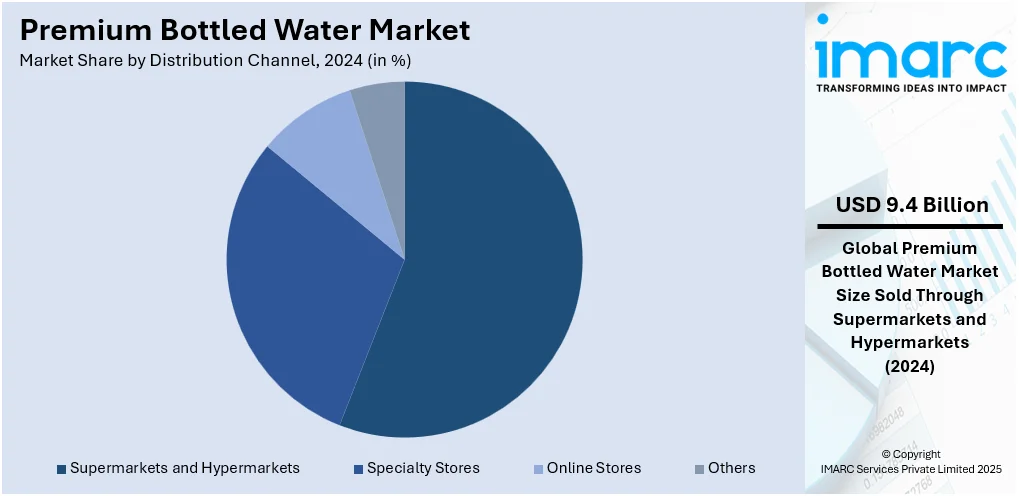

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

As per premium bottled water market analysis, supermarkets and hypermarkets held 55.9% market share in 2024 and were the most favored distribution channel because of their extensive reach, convenience, and visibility for products. They provide buyers with access to a variety of premium bottled water products ranging from imported mineral waters to local artisanal brands. Structured retail formats enable consumers to compare packaging, ingredient, and price directly, reinforcing confidence and premium buying. In-store promotions, wellness aisles, and premium placement on shelves have further boosted consumer visibility of high-end hydration products. As urbanization and disposable incomes increase, especially in developed and semi-urban markets, these channels enjoy growing foot traffic and basket sizes. Moreover, inclusion of omni-channel services—click-and-collect and home delivery—has enhanced customer convenience, supporting loyalty towards established retail chains. Through uniform product availability and brand range, supermarkets and hypermarkets are likely to continue playing a critical role in premium bottled water distribution.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominated the premium bottled water category with a 36.7% share in 2024 due to high health, hydration, and lifestyle branding awareness among consumers. The developed retail infrastructure, strong wellness culture, and increasing trend for functional drinks have established premium bottled water as part of everyday essentials among many consumers. Demand is particularly robust in urban areas, where active lifestyles and fitness cultures promote on-the-go consumption and perceived health benefits. Sustainability responsiveness among North American consumers also prompts brands to introduce green packaging and carbon-neutral supply chains. Increased digital retail, influencer marketing, and high quality placement in hospitality and fitness facilities continues to drive premium bottled water market growth. As shoppers highly upgrade from standard bottled water to premium products, regional demand is set to keep on accelerating. As technology advances in terms of flavor, packaging, and source reveal, North America will lead the way in dictating premium bottled water consumption patterns.

Key Regional Takeaways:

United States Premium Bottled Water Market Analysis

The United States premium bottled water market is mainly fueled by changing lifestyle preferences, urbanization, and increasing disposable incomes. As per the United States Bureau of Economic Analysis, United States disposable personal income was up by USD 102.0 Billion or 0.5% in March 2025. With consumers increasingly looking for convenience in their hectic lifestyles, there is a growing demand for ready-to-drink, high-quality beverages like premium bottled water. In contrast to mass-market water brands, premium brands provide compelling value propositions like artisanal sourcing, naturally filtered or glacial origin, and luxury branding, all which appeal to discerning consumers. Increasing consciousness regarding water pollution and the need for assured safety and quality are also incentivizing consumers to invest in premium brands they can trust. Further, the rise in fitness culture and popularity of holistic wellness habits is driving demand for hydration products that support active lifestyles. Premium bottled water is also typically packaged in attractive-looking bottles, which increases its value as a status product in social and corporate environments. Consequently, restaurants, hotels, and corporate functions are now stocking premium water to fit their upscale brand names, thus complementing demand across the hospitality industry. Aside from this, advances in bottling technology, filtration, and traceability are also offering differentiation in a crowded marketplace.

Asia Pacific Premium Bottled Water Market Analysis

Asia Pacific premium bottled water market is growing as a result of the fast urbanization in countries like China, India, and Southeast Asia, which increased the need for clean and convenient hydration that is hygienic in particular in regions where tap water supply is unreliable. Elevated disposable incomes and a rising middle class are facilitating consumers to go for premium products giving perceived benefits in terms of health and better quality. For example, per capita disposable income in India stood at USD 2.54 Thousand in 2023 and is predicted to stand at USD 4.34 Thousand by 2029, according to the India Brand Equity Foundation (IBEF). Moreover, fear of water pollution and contamination is encouraging consumers to opt for bottled water as a safer option. For example, 70% of India's surface water is polluted with several contaminants and not fit for drinking, according to a World Economic Forum (WEF) 2019 report. Trends in health and well-being are also impacting consumer behavior, as many people are looking for functional waters that are fortified with vitamins, minerals, and electrolytes.

Europe Premium Bottled Water Market Analysis

The expansion of the premium bottled water market in Europe is primarily driven by an expanding health-oriented consumer base, which is increasingly turning to premium bottled water compared to soft drinks, appreciating its perceived purity and health aspects. This trend is most pronounced in nations like Germany, France, and the United Kingdom, where consumers are demanding functional and flavored waters that provide nutritional benefit. Sustainability issues are also having a great impact on purchase decisions, and customers are showing preference for brands that employ green packaging and sustainable sourcing. The expansion of the tourism and hospitality sector in Europe has also boosted the demand for premium bottled water in hotels, restaurants, and resorts, where it is usually served as part of the high-end experience. For example, 65% of EU citizens who are 15 years and older took at least one personal journey trip in 2023, marking a remarkable upsurge compared to 2022 at 62%, 2021 at 56%, and 2020 at 52%, based on Eurostat. Aside from this, the growth in online distribution channels has increased premium bottled water to reach more people, thus its upsurge in a number of European markets. Product innovations, including the launch of sparkling and mineral-enhanced waters, are also addressing changing consumer desires for distinct and premium hydration choices.

Latin America Premium Bottled Water Market Analysis

The Latin America premium bottled water market is highly driven by changing consumer attitudes toward luxury and wellness, whereby hydration is being increasingly positioned as part of an overall lifestyle option. An increasing population of image-conscious and better-off consumers is fueling demand for high-quality, good-looking water with global prestige tag. Brazil and Mexico are spearheading the market, with a developing retail infrastructure and increasing online platforms boosting product availability. For example, Brazil's e-commerce industry is witnessing a strong growth of 14.3% and is likely to cross USD 200 Billion by 2026. Apart from this, efforts by the government and public campaigns for healthy living and nutritious eating are also indirectly contributing to bottled water demand.

Middle East and Africa Premium Bottled Water Market Analysis

The African and Middle Eastern premium bottled water industry is witnessing strong growth because of increasing demand for luxury consumption experiences, especially from high-net-worth individuals and a young aspirational class. In the GCC nations, premium bottled water is increasingly becoming a lifestyle icon, with a lot of prominence being given to it at corporate gatherings, high-end restaurants, and VIP clubs. The expanding hospitality and tourism industry in the UAE and Saudi Arabia is also fueling demand for premium bottled water in hotels, resorts, and restaurants. For example, Saudi Arabia saw 17.5 Million global visitors from January to July 2024 with a 10% increase compared to January-July 2023. Government initiatives to diversify economies via tourism and entertainment industries have also spurred demand for premium products, such as imported and craft water brands.

Competitive Landscape:

The premium bottled water market's competitive landscape is characterized by strategic differentiation, robust branding, and changing shopper expectations. Consumers are prioritizing origin-based sourcing, mineral content, and sustainable packaging to drive value perception and appeal to health-conscious consumers. Lifestyle positioning and wellness branding are key drivers of purchasing decisions, especially among urban and high-income consumers. With growing digital penetration, brands are using social media, influencer marketing, and data-driven interactions to drive visibility and loyalty. Proliferation into premium retail stores, hotels, and direct-to-consumer channels is also heating up market competition. In accordance with premium bottled water market forecast, businesses are investing in novel packaging, sustainable materials, and intelligent distribution schemes in order to maintain long-term growth. With growing demand for high-quality, natural hydration options, the market will continue to experience incessant evolution with premiumization trends, changing consumer lifestyles, and environmental factors influencing product and brand innovation in global and regional markets.

The report provides a comprehensive analysis of the competitive landscape in the premium bottled water market with detailed profiles of all major companies, including:

- Alpine Glacier Water Inc.

- Berg Water

- Beverly Hills Drink Company

- Bling H2O

- Blvd Water

- Danone S.A.

- Gerolsteiner Brunnen GmbH & Co. KG

- Lofoten Arctic Water AS

- MINUS 181 GmbH

- NEVAS GmbH

- Roiwater

- Uisge Source Inc.

- Veen

Latest News and Developments:

- June 2025: Deer Park Spring Water launched a special limited-edition premium bottled water product in honor of the city of Atlanta. The new 25-ounce aluminum container, crafted by the artist George F. Baker III, honors Atlanta's creativity and sense of community. These limited-edition bottles, which have a unique design influenced by the cityscape of Atlanta, are presently offered anywhere Deer Park Spring Water is offered for sale.

- June 2025: Toshmineralsuv and Gentlebrand Design Agency established a partnership to elevate the company's flagship product, Tashkentskaya mineral water, to a new degree of sophistication. The premium bottled water is now available in a sleek, modern PET format that aims to expand its market reach and enhance its premium standing.

- May 2025: Rhea Raheja collaborated with her school companion Ishaan Nangia to unveil Impact Water, stepping into India’s $9.5 billion packaged water market.

- January 2025: Surya Yadavalli’s brand Nyla announced its initiative to become world’s first to manufacture premium bottles water from moisture present in the air. The brand is employing reverse osmosis system to carry out the manufacturing process.

- January 2025: VOSS Water, a worldwide symbol of premium hydration, launched its 250ml Still Water bottle in the UAE market, merging cutting-edge design, sustainability, and outstanding quality. Designed to enhance the hydration experience for those on the move, these new compact bottles are produced from 100% recycled PET and are ideally tailored to fit the UAE’s dynamic, luxury-oriented lifestyle.

Premium Bottled Water Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Spring Water, Sparkling Water, Mineral Water, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alpine Glacier Water Inc., Berg Water, Beverly Hills Drink Company, Bling H2O, Blvd Water, Danone S.A., Gerolsteiner Brunnen GmbH & Co. KG, Lofoten Arctic Water AS, MINUS 181 GmbH, NEVAS GmbH, Roiwater, Uisge Source Inc., Veen, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the premium bottled water market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global premium bottled water market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the premium bottled water industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The premium bottled water market was valued at USD 16.81 Billion in 2024.

The premium bottled water market is projected to exhibit a CAGR of 5.66% during 2025-2033, reaching a value of USD 28.29 Billion by 2033.

The premium bottled water market is largely spurred by rising health consciousness, growing demand for natural and mineral content drinks, and increasing consumer preference for environmentally friendly packaging. Urbanization, fitness lifestyles, and a move away from sugary beverages further fuel the growth of the market. Greater brand narrative and the role of social media further bolster premium product positioning and consumer attraction.

North America currently dominates the premium bottled water market, accounting for a share of 36.7%. backed by robust wellness and health trends, premium disposable incomes, and highly developed retail infrastructure. Consumers within the region are drawn to functional, environmentally friendly, and premium hydrating products. Increasing e-commerce, lifestyle branding, and extensive fitness culture keep driving demand in urban and suburban markets.

Some of the major players in the premium bottled water market include Alpine Glacier Water Inc., Berg Water, Beverly Hills Drink Company, Bling H2O, Blvd Water, Danone S.A., Gerolsteiner Brunnen GmbH & Co. KG, Lofoten Arctic Water AS, MINUS 181 GmbH, NEVAS GmbH, Roiwater, Uisge Source Inc., Veen, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)