Power Inverter Market Size, Share, Trends and Forecast by Type, Application, End Use Sector, and Region, 2026-2034

Power Inverter Market 2025, Size and Share:

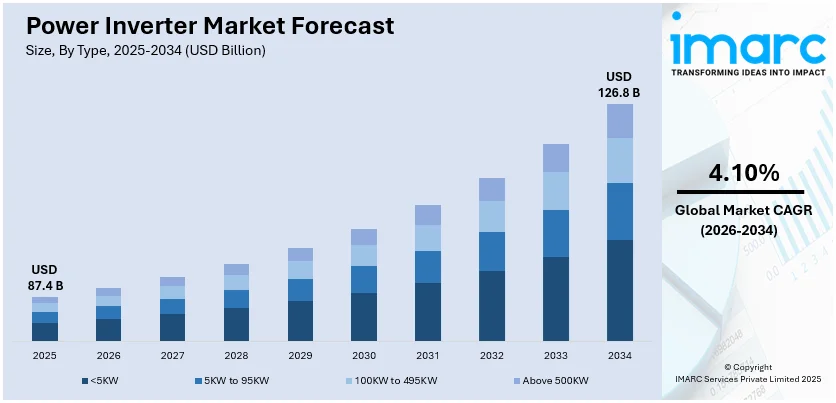

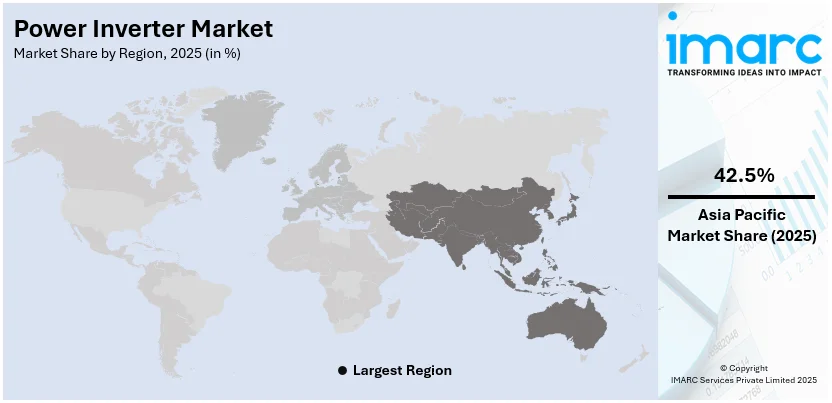

The global power inverter market size was valued at USD 87.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 126.8 Billion by 2034, exhibiting a CAGR of 4.10% from 2026-2034. Asia Pacific currently dominates the market due to the rising demand for renewable energy integration, increasing adoption of electric vehicles (EVs) requiring efficient energy conversion, and growing reliance on portable power solutions. Also, ongoing technological advancements enhancing inverter efficiency and government incentives promoting clean energy usage further contribute to the market’s expansion across residential, commercial, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 87.4 Billion |

|

Market Forecast in 2034

|

USD 126.8 Billion |

| Market Growth Rate (2026-2034) | 4.10% |

A major driver in the power inverter market is the increasing adoption of renewable energy systems. As global efforts to reduce carbon emissions intensify, there is a growing reliance on solar and wind energy solutions, which require efficient energy conversion systems to integrate with existing grids. Power inverters are vital devices that transform direct current (DC), produced by renewable sources, into alternating current (AC), making it usable for residential, commercial, and industrial purposes. Government policies promoting clean energy adoption, coupled with technological advancements improving inverter efficiency and durability, are further accelerating the demand for power inverters in renewable energy applications.

To get more information on this market Request Sample

The U.S. power inverter market is driven by the growing adoption of renewable energy systems, particularly solar power, supported by government incentives like the Investment Tax Credit (ITC). The increasing integration of EVs, which rely on inverters for energy conversion, also fuels market growth. A robust residential and commercial focus on energy efficiency and backup power solutions further strengthens the market demand. In addition to this, in U.S. solar industry has seen substantial growth, with over 219 gigawatts (GW) of solar capacity installed nationwide, enough to power over 37 million homes. Technological advancements in high-efficiency inverters and the development of smart grid infrastructure enhance market dynamics. The U.S. continues to be a leading force in the global power inverter market, thanks to its robust manufacturing infrastructure and significant investments in research and development (R&D).

Power Inverter Market Trends:

Growing adoption of renewable energy systems

The integration of renewable energy sources, such as solar and wind, is significantly influencing the power inverter market. Power inverters are essential for converting DC electricity generated by these sources into AC power suitable for use in residential, commercial, and industrial applications. To promote the deployment of renewable energy, governments worldwide are introducing policies and subsidies, thereby driving the demand for advanced inverters. Innovations in inverter technologies, such as improved efficiency and reliability, further support this trend. Additionally, the decreasing cost of renewable energy systems is making them more accessible, expanding their adoption. The increased emphasis on sustainable energy and reducing carbon emissions positions renewable energy integration as a primary trend shaping the power inverter market.

Increasing adoption of electric vehicles (EVs)

The rising popularity of electric vehicles is a major trend driving the power inverter market. EVs rely on inverters to convert energy from batteries into usable power for the motor. As governments and automakers push for a transition to sustainable transportation, investments in EV infrastructure, including charging stations equipped with inverters, are growing. This trend is fueled by consumer demand for cleaner mobility solutions and advancements in battery technology. In response, manufacturers are developing high-performance inverters to enhance vehicle efficiency and reduce energy loss. The growing penetration of EVs globally is creating substantial opportunities for the power inverter industry to support this transformative shift.

Advancement in smart grid technology

The evolution of smart grid infrastructure is a key trend in the power inverter market. Smart grids enable efficient energy management by integrating advanced inverters capable of real-time monitoring and bidirectional energy flow. These inverters are crucial for improving grid stability, optimizing the distribution of energy, and integrating decentralized renewable energy sources. The growing focus on grid modernization and the implementation of energy storage systems further boost demand for intelligent inverters. Moreover, technological innovations in communication protocols and software integration allow inverters to provide predictive maintenance and performance analytics. The synergy between smart grid advancements and inverter technology is reshaping energy management strategies worldwide.

Power Inverter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global power inverter market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, application and end-use sector.

Analysis by Type:

- <5KW

- 5KW to 95KW

- 100KW to 495KW

- Above 500KW

100KW to 495KW stands as the largest component in 2025, due to its versatile applications across industrial, commercial, and large-scale renewable energy projects. This capacity range is well-suited for medium to large installations, including solar farms, wind power plants, and industrial machinery, making it highly demanded. The ongoing transition to sustainable energy sources further drives the adoption of inverters in this capacity range, as they offer the efficiency and scalability required for grid-tied and off-grid systems. Technological advancements improving inverter reliability and performance contribute to the segment's growth. Additionally, increasing investments in smart grid infrastructure and renewable energy expansion globally enhance demand, solidifying this capacity range as the largest contributor in the market.

Analysis by Application:

- Motor Drives

- Uninterruptible Power Supply (UPS)

- Rail Traction

- Wind Turbines

- Electric Vehicles/Hybrid Electric Vehicles (EVs/HEVs)

- Solar PVs

- Others

Motor drives leads the market in 2025 due to their critical role in industrial automation, manufacturing, and energy efficiency applications. Inverters used in motor drives convert DC power into AC, enabling precise control of motor speed and torque. This functionality is essential for optimizing energy consumption, reducing operational costs, and enhancing the lifespan of motors in industries such as automotive, electronics, and HVAC systems. The rising adoption of EVs and renewable energy systems further amplifies the demand for motor drives, as they are integral to these applications. Technological advancements in variable frequency drives (VFDs) and the growing emphasis on smart and energy-efficient systems contribute to the segment’s dominance in the power inverter market.

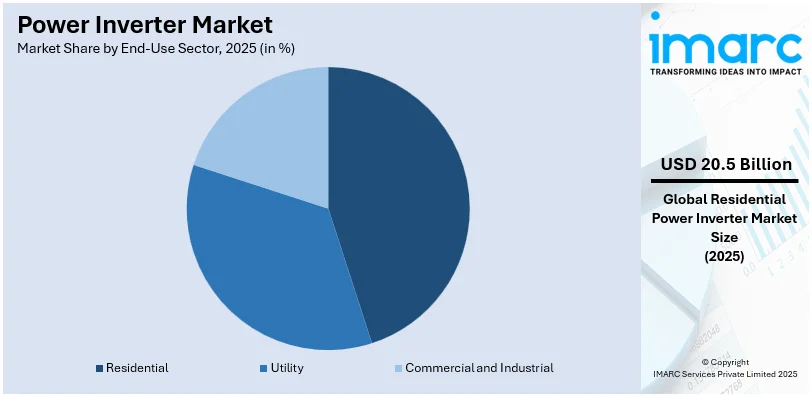

Analysis by End-Use Sector:

Access the comprehensive market breakdown Request Sample

- Utility

- Residential

- Commercial and Industrial

In 2025, utility accounts for the majority of the market due to its pivotal role in large-scale renewable energy projects, including solar farms and wind energy installations. Power inverters are critical for converting DC electricity generated by renewable sources into AC power suitable for grid integration. With the global transition toward cleaner energy and the increasing adoption of sustainable practices, utility companies are investing heavily in advanced inverter technologies. Additionally, the expansion of smart grid infrastructure and energy storage systems further drives the demand for inverters in the utility sector. These inverters enhance grid stability, enable efficient energy distribution, and support decentralized energy sources, solidifying the utility sector's position as the largest market contributor.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2025, Asia Pacific accounted for the largest market share of over XX% due to the region’s rapid growth in renewable energy adoption, particularly solar power. Countries like China and India are leading the way in large-scale solar installations, driving demand for high-capacity inverters. Additionally, APAC’s industrial and commercial sectors are increasingly investing in energy-efficient technologies, further boosting the need for inverters. The region's growing focus on electric vehicle adoption, supported by government incentives and policies, also contributes to the power inverter market's expansion. Technological advancements, cost-effective production, and a strong manufacturing base in countries like China enhance the availability and affordability of inverters, making them more accessible. As a result, APAC remains the largest market for power inverters globally.

Key Regional Takeaways:

North America Power Inverter Market Analysis

The North America power inverter market is driven by the region's increasing emphasis on renewable energy adoption, particularly solar and wind energy. Government incentives, tax credits, and policies promoting clean energy solutions significantly boost demand for advanced inverters. The residential sector sees growing adoption of rooftop solar systems, while the commercial and industrial sectors focus on renewable energy integration to meet sustainability goals. Additionally, the rise of electric vehicles (EVs) has created substantial demand for inverters, critical for energy conversion in EVs and associated charging infrastructure. Technological advancements in inverter efficiency, durability, and smart features further support market growth. North America’s robust energy infrastructure and ongoing investments in smart grid technology enhance the market dynamics, as inverters play a pivotal role in energy distribution and management. Moreover, the region’s focus on backup power solutions and portable energy systems to address power outages drives adoption. Together, these factors solidify North America’s position as a key player in the global power inverter market.

United States Power Inverter Market Analysis

Urbanization is a key driver for the increased adoption of power inverters in developed regions. As urban areas expand, the demand for consistent and reliable electricity grows, necessitating the need for power inverters. According to reports, a surge in urbanization is fuelling smart home adoption in America, with smart households growing from 6.9% in 2015 to 22.3% in 2023. This trend boosts demand for power inverters, essential for managing energy-efficient systems in modern smart homes. The shift highlights the synergy between urban living and sustainable technology. These devices ensure uninterrupted power supply, particularly in areas where the grid may be unreliable or prone to surges. With more people moving to urban settings, the need for backup energy sources rises, especially in commercial, residential, and industrial facilities. Power inverters provide essential support in these growing urban areas by converting DC to AC power for appliances, equipment, and essential services. The ongoing construction of smart cities, modern buildings, and other infrastructure projects further amplifies the demand for power inverters to maintain seamless energy distribution. This trend is particularly noticeable in areas where rapid population growth outpaces traditional energy systems, creating a need for adaptable, efficient power solutions that can integrate with renewable energy systems like solar power.

Europe Power Inverter Market Analysis

In Europe, the increasing adoption of solar energy is driving the demand for power inverters. In solar energy systems, inverters are necessary to convert the direct current (DC) generated by solar panels into alternating current (AC), making it compatible for use in residential and commercial spaces. As solar power adoption grows due to its environmental benefits and cost-effectiveness, the need for reliable, efficient power inverters has surged. According to preliminary estimates by SolarPower Europe, the European Union installed 65.5 GW of new solar capacity in 2024, a 4% rise from 2023, reaching over 330 GW. Declining component prices reduced capital expenditure, driving solar energy demand and boosting the market for solar PVs. These advancements support efficient energy generation and grid integration. Most of the European countries are seeking to implement renewable energy and are motivating private households and industries to take on solar-based solutions. With technological support, it becomes more accessible and efficient, as the costs of such installations have dropped considerably. This also makes the region more aware of attaining sustainability as a result of integrating such energy in the overall mechanism. Among these alternatives, power inverters form an integral component that can properly function in solar installations. In addition, with the growing demand to reduce carbon footprints, both residential and commercial sectors are shifting toward solar solutions, which requires inverters to be reliable and long-lasting. As Europe looks to make the transition toward a greener future, the prospects for solar-powered systems, including the power inverters that go with them, look bright across the region.

Asia Pacific Power Inverter Market Analysis

In the Asia-Pacific region, the rise of Uninterruptible Power Supply (UPS) systems is fuelling the demand for power inverters. According to India Brand Equity Foundation, India's growing IT sector, with a projected 11.1% rise in IT spending to USD 138.6 Billion in 2024, is driving demand for Uninterruptible Power Supply (UPS) systems. These systems ensure seamless power backup, critical for IT infrastructure. This surge also boosts the adoption of power inverters, enhancing operational efficiency and reliability. As industries, data centers, and businesses increasingly rely on continuous power for their operations, the need for reliable UPS systems has escalated. Power inverters are critical components of these systems, as they ensure the smooth conversion of power from a backup source to maintain operation during outages. With growing industrialization and technological advancement in the region, data centers and businesses require uninterrupted power, especially in emerging sectors like telecommunications and manufacturing. As digital services expand, UPS systems provide a safeguard against power interruptions, ensuring high uptime. The continued reliance on digital infrastructure also means that power inverters are becoming more prevalent, supporting the broader UPS industry’s growth and making them an essential part of business continuity planning. With demand from both residential and commercial sectors increasing, UPS systems, and thus power inverters, have become integral to maintaining efficiency and preventing downtime in critical operations.

Latin America Power Inverter Market Analysis

Latin American rising disposable incomes account for growing adoption of power inverters. As increasing proportions of people are achieving enhanced levels of disposable income, it leaves an opening for more spending in vital electronic and electrical gadgets. Most of the important electronics and electrical apparatus, as such, necessitate continuous and reliable supply from inverting. Reports say that by 2040, Latin America's disposable income will rise by nearly 60%, due to regional equity and economic changes, increasing the demand for power inverters as people continue to invest in energy solutions. In this case, power inverters play a crucial role in making it possible for households and small businesses to maintain electricity supply even in the event of grid disruption. This is more so especially in areas that are prone to power supply interruption or those with unstable power quality. With increased disposable income, the consumers can invest in backup power solution such as inverters for the safety of their homes and businesses from loss of energy. The need for reliable energy systems is rising in both urban and rural regions with frequent interruptions. As middle-class consumers expand, so too does the need for energy reliability, boosting power inverter adoption to provide smooth, continuous electricity for everyday activities. The trend of rising incomes also means more consumers are able to invest in renewable energy systems like solar power, which further drives the demand for inverters.

Middle East and Africa Power Inverter Market Analysis

In the Middle East and Africa, rapid real estate and infrastructure growth is a major catalyst for the increasing adoption of power inverters. The construction boom, especially in large cities and urban centers, has created a need for efficient, reliable power sources to support residential, commercial, and industrial developments. For instance, UAE construction activities grew by 6.2% in Q1 2024, boosting demand for power inverters to support energy needs in expanding infrastructure projects. Power inverters are crucial in these sectors, as they help regulate energy flow, especially in buildings with varying power needs. Infrastructure projects such as hospitals, shopping malls, and office buildings often require backup power systems, ensuring that inverters are in high demand. The rising number of high-end residential properties and commercial buildings also drives the need for energy solutions that offer uninterrupted power. With the continued modernization and development of the region's infrastructure, power inverters become essential components in supporting energy management in new constructions. Incorporation of inverters into such buildings will result in improved energy efficiency, reliability, and adaptability to renewable sources, which are consistent with the trend of sustainable construction and green building.

Competitive Landscape:

The competitive landscape for the power inverter market is marked by many multinational and regional players trying their best to innovate and have a good share of this market. Key manufacturers lead through their advanced product portfolios along with a strong distribution network. These players are now focusing on R&D to introduce high-efficiency, durable, and smart inverters suited to renewable energy systems and EV applications. Cost-effective solutions for niche markets make the emergence of new competitors possible and create a fierce competition. Strategic partnerships, mergers, and acquisitions are also quite common as market presence and technological capabilities are to be expanded. Moreover, sustainable practices and customer-centric solutions from manufacturers have helped strengthen market positions globally.

The report provides a comprehensive analysis of the competitive landscape in the power inverter market with detailed profiles of all major companies, including:

- Delta Electronics, Inc.

- Enphase Energy, Inc.

- Fronius International GmbH

- GoodWe

- Luminous Power Technologies Pvt. Ltd. (Schneider Electric SE)

- PowerBright

- Samlex America Inc.

- SMA Solar Technology AG (SMA Group)

- SolarEdge Technologies, Inc.

- Sungrow Power Supply Co., Ltd

- TMEIC Corporation

Latest News and Developments:

- In December 2024, Eastman, a prominent energy solutions provider, has launched its largest inverter battery range to date. This innovative lineup aims to address diverse power needs with enhanced efficiency and reliability. The new range underscores Eastman's commitment to advancing renewable energy solutions. This development is set to strengthen the company's market presence.

- In December 2024, GoodWe unveiled its GT Series C&I string inverter, boasting a power rating exceeding 100kW. Designed for commercial and industrial sectors, the inverter enhances energy efficiency and sustainability. It promises substantial energy cost savings and a strong return on investment. The GT Series reflects GoodWe’s commitment to innovative, high-performance power solutions. This launch strengthens its portfolio in the renewable energy sector.

- In December 2024, SCZONE inaugurated the Chinese Elite Solar PV factory in TEDA, Ain Sokhna, within its integrated economic zone. The USD 150 Million facility will produce N-type solar cells and photovoltaic systems, including modules, cells, and wafers. With a capacity of 2 GW, it aims to bolster Egypt's renewable energy infrastructure. Chairperson Walid Gamal El-Din highlighted its significance at the groundbreaking event. This marks a major step in advancing sustainable energy solutions in the region.

- In November 2024, Ola Electric launched the Ola PowerPod, a compact and portable inverter that serves as a backup power source for essential household devices. Equipped with a 1.5 kWh battery, it offers a maximum output of 500W. The PowerPod is designed to ensure seamless energy access during outages. Ola aims to cater to modern energy needs with this innovative device. It marks another step in Ola's expansion into sustainable energy solutions.

- In November 2024, Sunlit introduced the EV3600, a bidirectional inverter designed for PV carports and balcony solar setups. It enables users with dynamic electricity tariffs to store energy when rates are low. The inverter also supports vehicle-to-home and vehicle-to-grid extensions, enhancing energy flexibility. Sunlit’s innovation aims to optimize energy use and reduce costs. This launch highlights advancements in sustainable energy management.

Power Inverter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | <5KW, 5KW to 95KW, 100KW to 495KW, Above 500KW |

| Applications Covered | Motor Drives, Uninterruptible Power Supply (UPS), Rail Traction, Wind Turbines, Electric Vehicles/Hybrid Electric Vehicles (EVs/HEVs), Solar PVs, and Others |

| End-Use Sectors Covered | Utility, Residential, Commercial and Industrial |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Delta Electronics, Inc., Enphase Energy, Inc., Fronius International GmbH, GoodWe, Luminous Power Technologies Pvt. Ltd. (Schneider Electric SE), PowerBright, Samlex America Inc., SMA Solar Technology AG (SMA Group), SolarEdge Technologies, Inc., Sungrow Power Supply Co., Ltd, TMEIC Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the power inverter market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global power inverter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the power inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A power inverter is an electronic device that converts DC electricity into AC electricity. It is commonly used in renewable energy systems, electric vehicles, and backup power solutions, enabling energy from sources like solar panels or batteries to be used in standard AC-powered devices.

The power inverter market was valued at USD 87.4 Billion in 2025.

IMARC estimates the global power inverter market to exhibit a CAGR of 4.10% during 2026-2034.

Key factors driving the global power inverter market include the growing adoption of renewable energy sources like solar and wind, increasing demand for electric vehicles, advancements in inverter efficiency and smart technologies, government incentives promoting clean energy, and the rising need for energy storage and backup power solutions.

In 2025, 100KW to 495KW represented the largest segment by type, driven by its versatility in large-scale renewable energy projects and industrial applications requiring high capacity.

Motor drives leads the market by application owing to their essential role in controlling motor speed and efficiency across various industrial applications.

The utility is the leading segment by end use sector, driven by high demand for inverters in large-scale renewable energy and grid integration projects.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global power inverter market include Delta Electronics, Inc., Enphase Energy, Inc., Fronius International GmbH, GoodWe, Luminous Power Technologies Pvt. Ltd. (Schneider Electric SE), PowerBright, Samlex America Inc., SMA Solar Technology AG (SMA Group), SolarEdge Technologies, Inc., Sungrow Power Supply Co., Ltd, TMEIC Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)