Chocolate Market Size, Share, Trends and Forecast by Product Type, Product Form, Application, Pricing, Distribution, and Region, 2026-2034

Chocolate Market Size and Share:

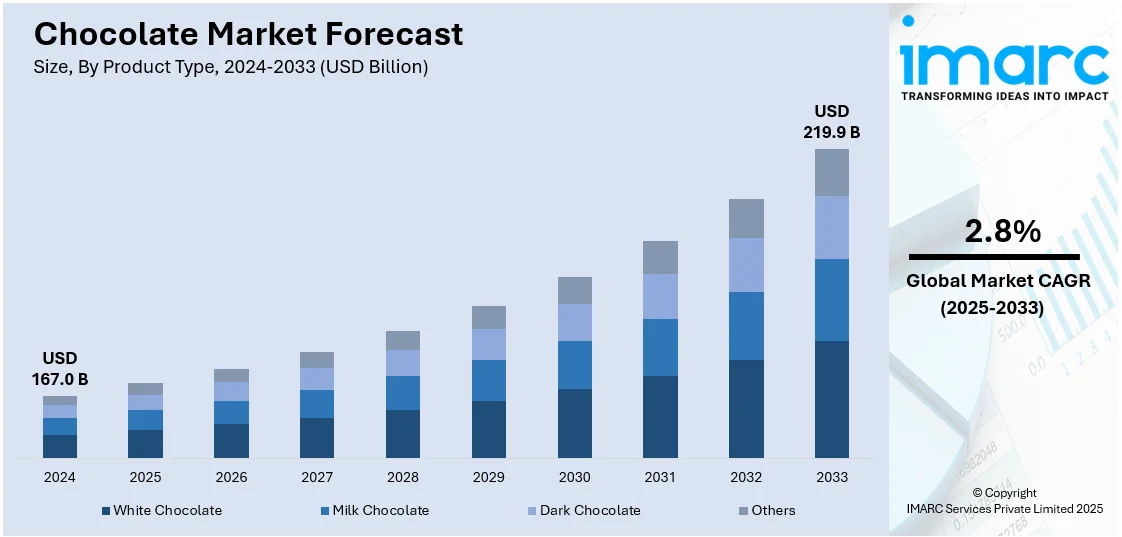

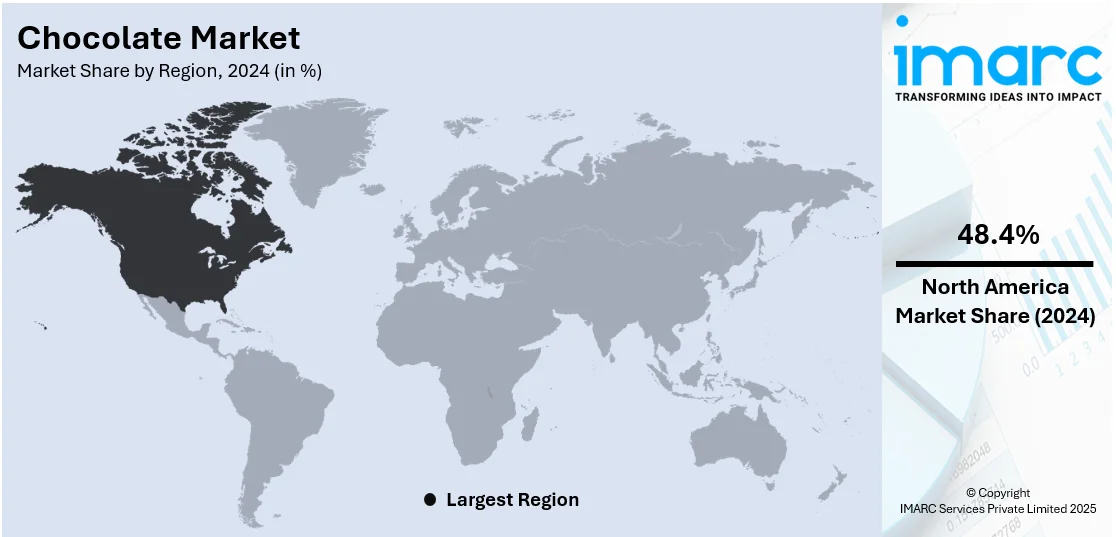

The global chocolate market size was valued at USD 167.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 219.9 Billion by 2034, exhibiting a CAGR of 2.8% during 2026-2034. North America currently dominates the market, holding a significant market share of over 48.4% in 2024. The growing consumer preference for premium and organic products, increasing demand for dark chocolate due to its perceived health benefits, innovation in flavors and packaging, and rising popularity of seasonal and gift chocolates are propelling the market growth in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 167.0 Billion |

| Market Forecast in 2034 | USD 219.9 Billion |

| Market Growth Rate (2026-2034) | 2.8% |

The market is mainly driven by changing consumer preferences for premium artisanal chocolates. Quality and indulgence in eating, coupled with increasing usage of dark chocolate for its perceived health benefits related to its antioxidant content are driving the global market for chocolate toward growth. Sustainable and organic choices have additionally contributed to the market growth as the publics seek ethical sourcing and environment-friendly practices. Innovation in flavors, textures, and packaging is significantly attracting the younger audience who tend to seek different experiences from consuming unique chocolates. There is also market growth as seasonal demand, such as Valentine's Day and Halloween onward to Christmas, increases. Increased urbanization and percentage growth in disposable incomes also broaden the horizons of chocolate consumption in developing regions, thus complementing global consumption.

To get more information on this market, Request Sample

In the United States, the market is influenced by the increasing preference for artisanal, premium, and ethically sourced products as consumers focus on sustainability and quality. For instance, in October 2024, Leading luxury chocolate manufacturer GODIVA announced the debut of its new limited-edition Belgian Heritage Collection, a unique selection of Belgian candies and chocolates never offered for sale in the U.S. The collection consists of 12 distinctive chocolate and confections made using some of GODIVA's most cherished and custom recipes in Brussels, where the company was established almost a century ago. In line with this, the growing demand for dark chocolate owing to its perceived benefits including antioxidants is fueling its popularity in the market.

Chocolate Market Trends:

Innovations in Flavors and Ingredients

Consumers are increasingly seeking new and exotic flavors that go beyond traditional offerings. This has led to the creation of chocolates infused with unusual ingredients, such as spices, herbs, flowers, and even savory elements like bacon or cheese. Recent research indicates that 60% of Indians consumed chocolates in the last quarter with a significant portion expressing interest in exploring new flavors. In addition to this, the rising shift towards incorporating inclusions such as fruits, seeds, and nuts into chocolates, adds texture and nutritional value. For example, in January 2024, Haldiram's Nagpur launched its premium chocolate brand, Cocobay, in the Indian market, offering 100% original cocoa chocolates with unique fruit and spice flavors. According to the chocolate market dynamics, this is acting as a significant growth-inducing factor.

Rise of Vegan and Plant-Based Chocolates

The increasing demand for dairy-free substitutes that do not compromise quality or taste is bolstering the growth of the market. The market has also witnessed notable growth in developing chocolates made with plant-based milk alternatives including coconut, oat, or almond milk. According to a survey, 8.5% of Generation Z (about 5.7 Million people) and 9.5% of Millennials identified as vegan or vegetarian. These statistics highlight a growing trend among younger generations toward plant-based diets and meatless alternatives. Moreover, according to the Bloomberg Intelligence Report, plant-based food sales are expected to increase fivefold by 2030. Chocolate market highlights indicate that brands also use natural sweeteners and ethically sourced cacao to appeal to this demographic, reflecting the increasing consumer demand for sustainable and health-conscious products in the chocolate industry. For instance, in May 2024, Ferrero announced the launch of plant-based Nutella in Italy. The new vegan-certified chocolate spread, aimed at flexitarians and lactose-intolerant consumers, replaces milk powder with a plant-based ingredient while retaining palm oil in the recipe.

Increasing Health-Conscious Options

There is a growing demand for chocolate products with healthier ingredients as consumers become more health conscious. A recent survey by Accenture highlights that health and fitness are considered essential expenses, comparable to groceries and household cleaning products, even amid economic pressures and financial challenges. Despite 66% of respondents reporting financial strain, an impressive 80% indicated they intend to maintain or increase their spending on health-related areas. In addition, there is an increasing interest in chocolate products that incorporate functional ingredients like superfoods, probiotics, and plant-based alternatives. For example, in January 2024, Fazer launched a world-first chocolate product made using "protein out of thin air," called Solein, in Singapore. This innovative chocolate is high in iron and fiber, catering to vegan and health-conscious consumers. The product, named "Taste the Future," incorporates oat puffs for added texture and aims to appeal to a broad audience looking for healthier food options.

Chocolate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chocolate market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, product form, pricing, application, and distribution channel.

Analysis by Product Type:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

Milk chocolate stands as the largest product type in 2024, holding around 39.6% of the market. Milk chocolates’ smooth texture, along with sweet flavor perfectly balances out its versatility in majority kinds of products ranging from bars, candy, and desserts to beverages. Milk chocolates are, moreover, affordable and extremely accessible to consumers. Strong branding and marketing certainly benefit this type of product through major players in the industry. It is often associated with comfort and indulgence, further driving its popularity. Additionally, its milder taste as compared to dark chocolate appeals to a broader consumer base, ensuring steady demand in both developed and emerging markets and solidifying its dominant position.

Analysis by Product Form:

- Molded

- Countlines

- Others

Countlines lead the market with around 47.8% of the market share in 2024. Countlines hold the largest market share due to their convenience, affordability, and widespread appeal. These individually wrapped bars and snacks cater to on-the-go consumption, making them popular among busy consumers seeking quick energy boosts or indulgent treats. Their versatility, with a mix of chocolate, nougat, caramel, and nuts, appeals to diverse taste preferences. For instance, in June 2024, The British sugar confectionery firm Swizzels broadened its Marvellous Mallows lineup by launching the new Mallow Countline, Marvellous Mallows Giant, as this category keeps gaining popularity. The new Mallow Countline features the nostalgic flavour of Drumstick, combining Raspberry and Milk with a mixture of light and soft textures, designed as a convenient option for those seeking their beloved treat in a more portable form.

Analysis by Application:

- Food products

- Bakery products

- Sugar confectionary

- Desserts

- Others

- Beverages

- Others

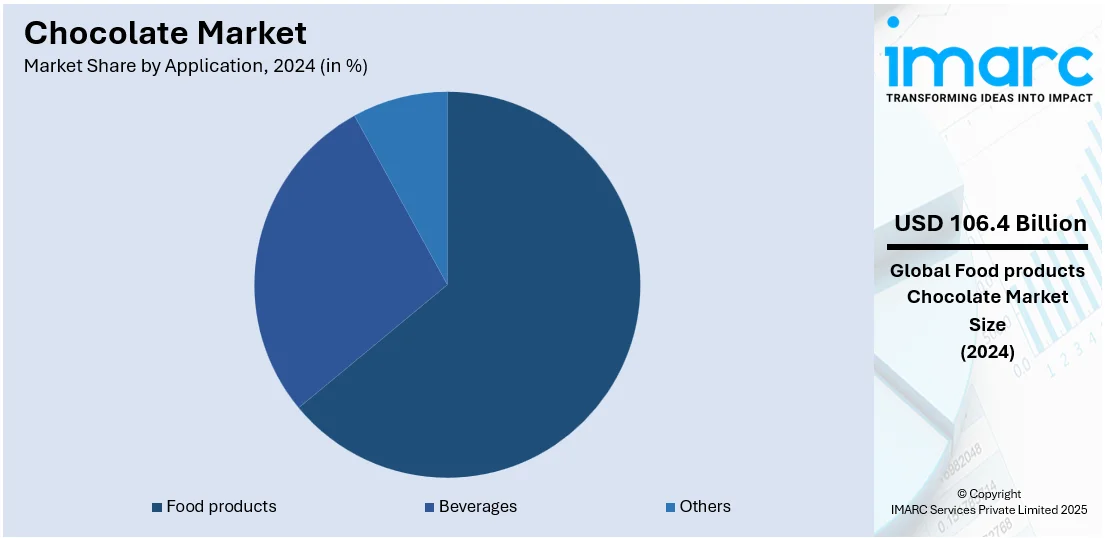

Food products leads the market with around 63.7% of market share in 2024. The food products segment holds a huge range of consumable goods. They vary from chocolates bars, candies, spreads, and baked items to meet different consumers' interests. Chocolate is the most adaptable product; it can be used in desserts, snacks, and confectioneries; thus, making it an integral part of the food industry. Its appeal as a comfort food and indulgent treat drives consistent demand across demographics. The popularity of ready-to-eat chocolate products and their convenience for on-the-go consumption further support their dominance. Additionally, extensive availability through retail and e-commerce channels ensures broad accessibility, solidifying the category's market leadership. For instance, in August 2024, Mondelez India announced the launch of their new dessert range ‘Cadbury Silk Desserts’. The range has two decadent offerings, ‘Cadbury Silk Dessert Brownie’ and ‘Cadbury Silk Dessert Plum Cake.'

Analysis by Pricing:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

Everyday chocolate leads the market with around 52.5% of the market share in 2024. The everyday chocolate category tends to be highly accessible and affordable, such as milk chocolate bars, chocolate-covered nuts, or simple dark chocolate pieces; these are good for everyday consumption since they combine indulgence with affordability and hence have a wide target demographic. Their availability in various formats, such as bars, bites, and pouches, enhances convenience for both individual and shared consumption. Everyday chocolates benefit from extensive distribution networks across supermarkets, convenience stores, and online platforms. Frequent promotional activities and bundling deals further drive their popularity. Additionally, their ability to balance quality and cost ensures consistent demand, solidifying their dominance in the chocolate market.

Analysis by Distribution Channel:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 36.4% of market share in 2024. Supermarkets and hypermarkets offer a wide variety of options to consumers. These large retail outlets provide extensive shelf space for chocolate brands, ranging from mass-market favorites to premium selections. According to global chocolate market insights, the demand for chocolates is driven by the increasing consumer preference for convenience, which supermarkets and hypermarkets fulfill through their accessibility and diverse product range. This accessibility makes them pivotal in driving chocolate sales across various regions. For instance, in October 2024, Aldi partnered with the “world’s best chocolate” to create three new blocks that are “a lot cheaper” than the cult-version. The budget supermarket recently joined Tony’s Open Chain, an initiative created by confectionary brand Tony’s Chocolonely with the aim of “ending exploitation in the cocoa industry”. Aldi is Australia’s first supermarket to join Tony’s mission to “transform the chocolate industry”, releasing a new chocolate range made with cocoa beans sourced through the initiative’s “5 Sourcing Principles”.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 48.4%. In North America, the market is driven by increasing consumer preference for premium, artisanal, and ethically sourced products, with an emphasis on quality and sustainability. Health-conscious consumers are fueling the demand for dark chocolate, due to its perceived benefits like antioxidants. For instance, in May 2024, Lindt introduced a plant-based variant of Lindor truffles in the United States. The eagerly awaited Lindt Lindor Non-Dairy OatMilk Truffles and Lindt Lindor Dark Chocolate OatMilk Truffles offer an ideal treat for individuals who avoid dairy yet desire a luxurious chocolate experience. In addition to this, innovation in flavors, textures, and packaging is attracting younger demographics, while seasonal products during occasions like Halloween and Christmas boost sales.

Key Regional Takeaways:

United States Chocolate Market Analysis

The United States accounts for 81.4% of the market share in North America. A key driver of chocolate consumption in the U.S. is its status as a comforting and affordable indulgence, particularly during times of economic uncertainty. According to the 2024 report by the National Confectioners Association, chocolate sales reached a record $21.4 billion, reflecting its enduring popularity. Consumers’ emotional connection to chocolate is evident, with 94% purchasing it for personal enjoyment and 72% considering it an essential part of a happy, balanced lifestyle. Additionally, 21% of Americans reported increasing their chocolate consumption over the past year, further highlighting its role as a go-to treat for self-care and celebration.

Moreover, over the forecasted years, the U.S. chocolate market is expected to grow on account of the growing innovation in sustainable and alternative chocolate production. For instance, Voyage Foods is set to expand its cocoa-free chocolate production with a new 284,000 sq. ft. facility in Mason, which is expected to be operational by 2025. The plant will significantly enhance the company's manufacturing capacity, allowing for an annual production of 10,000 tonnes of chocolate. This expansion, supported by Voyage's partnership with agri-food giant Cargill positioned as its exclusive global B2B distributor illustrates the increasing focus on innovative production methods to meet evolving consumer demands.

Asia Pacific Chocolate Market Analysis

Chocolate consumption in Asia Pacific is primarily driven by rapid urbanization, the rise of a growing middle class, and the expanding young population, which exhibits a higher demand for chocolate compared to other demographics, including more affluent groups. These factors are reshaping consumer preferences and boosting chocolate's popularity as a convenient and indulgent treat across the region. Also, according to the Sector Trends Analysis – Confectionery Trends in India by the Government of Canada, the confectionery market in India experienced robust growth, with sales increasing at an annual rate of 10.3% from 2019 to 2023, primarily driven by the strong performance of chocolate confectionery. Post-pandemic, the resurgence in celebratory and festive occasions significantly boosted the demand for chocolate, highlighting its cultural importance and role as a staple for indulgence and gifting during special events.

Europe Chocolate Market Analysis

The European chocolate market is poised for continued growth, driven by shifting consumer preferences toward health-conscious and premium offerings. Increasing demand for luxury chocolates labeled as organic, natural, cacao-rich, and single-origin highlights a focus on wellness and indulgence. Dark chocolates with higher cocoa content are particularly popular due to their perceived health benefits, including antioxidants. According to CBI.eu, Europe stands as the world's largest importer of cocoa beans, paste, butter, and powder, serving as a crucial trade hub for cocoa and chocolate products. The region's strong demand for certification and sustainability in cocoa sourcing is a significant driver of the chocolate market, reflecting consumers' preferences for ethically produced and environmentally friendly products. The European chocolate market is projected to grow at an average annual rate of 4.8% between 2022 and 2027, highlighting steady expansion in the industry. Notably, the Netherlands plays a pivotal role in the global cocoa trade, being the largest importer of cocoa beans worldwide. In 2022, the country imported 759,000 tonnes of cocoa beans from producing nations, underscoring its importance in the European cocoa supply chain and its contribution to the region's thriving chocolate market.

Europe's rich chocolate tradition and high per capita consumption further reinforce its position as a dominant market. This heritage also provides a strategic advantage for expanding into emerging markets, where European chocolates are highly regarded. Innovations in product development and sustainable practices, combined with leveraging Europe's legacy, are expected to drive future market growth.

Latin America Chocolate Market Analysis

A significant driver for the global chocolate market is the rising prominence of Latin America in cocoa production, particularly in the premium and sustainable cocoa segments. While West Africa has traditionally dominated the global cocoa market, countries like Ecuador, Peru, and Colombia are gaining recognition for their high-quality, ethically sourced cocoa, meeting the increasing demand for premium chocolate worldwide.

The growing importance of Latin America is further highlighted by the World Cocoa Foundation's (WCF) decision to host its annual Partnership Meeting in São Paulo, Brazil, in March 2025. This move reflects the region's expanding role in the global cocoa supply chain and its potential to drive innovation and sustainability in the chocolate industry. In the coming years, the strategic expansion of major industry players into emerging markets to strengthen their global footprint is expected to favor the market in Latin America. For example, Nestlé has announced plans to acquire a majority stake in Grupo CRM, a premium chocolate leader in Brazil. Grupo CRM operates over 1,000 chocolate boutiques under the Kopenhagen and Brasil Cacau brands and boasts a rapidly growing online presence.

Middle East and Africa Chocolate Market Analysis

In the Middle East and Africa, the chocolate market is poised for growth, driven by increasing urbanization, a rising middle class, and evolving consumer preferences. Africa's robust cocoa production supports local chocolate manufacturing, while the Middle East's demand for premium and innovative chocolate products continues to rise. According to CBI.eu, Africa dominates global cocoa production, accounting for 75% of the world's cocoa output in 2022-2023. Côte d'Ivoire and Ghana lead the industry, contributing over 59% of global production. This dominance highlights the region's critical role in supplying raw materials to the global chocolate market.

Apart from this, the growing local demand, combined with the strategic geographic position of countries in the region, is attracting major players to expand their presence and tap into both local and regional markets. For example, Swiss chocolate giant Barry Callebaut is set to invest $30 million in establishing a chocolate manufacturing factory in Egypt. This initiative aims to cater to the large local market while positioning Egypt as a regional hub for exporting the company’s products to the Middle East and African countries. As one of the world’s leading chocolate and cocoa producers, operating 66 factories globally, Barry Callebaut's investment highlights the potential of the region as a key player in the global chocolate supply chain.

Competitive Landscape:

The market is highly competitive, dominated by global players like Mars, Nestlé, Mondelez International, and Ferrero, alongside regional and artisanal brands. Key players focus on innovation in flavors, healthier formulations, and sustainable sourcing to attract health-conscious and eco-aware consumers. Premium and organic brands are gaining traction, driven by evolving consumer preferences. Seasonal products and strategic marketing campaigns are pivotal in capturing market share. Smaller brands compete by emphasizing unique offerings, such as single-origin chocolates and plant-based options. Additionally, robust distribution networks, partnerships with retailers, and expanding e-commerce presence are critical strategies shaping the competitive landscape in this dynamic market. For instance, in July 2024, Galaxy Flutes, Mars Wrigley's newest product, was introduced in India. The company is well-known for its wide variety of chocolates, chewing gum, mints, and fruity treats. Galaxy Flutes entered the market to compete with well-known brands like Cadbury Perk, Nestle Munch, Nestle KitKat, and Milkybar, at a competitive price of Rs 10.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Arcor

- Barry Callebaut

- Chocoladefabriken Lindt & Sprüngli AG

- Chocolaterie Guylian

- Ferrero International

- Mars Incorporated

- Meiji Co. Ltd.

- Mondelez International Inc. (Kraft Foods)

- Moonstruck Chocolate Company

- Nestlé S.A.

- The Hershey Company

Latest News and Developments:

- September 2025: Nestlé launched its new KitKat slab range at an exclusive media event in Muldersdrift, South Africa. The three new flavors, including Hazelnut, Double Chocolate, and Salted Caramel, were introduced through an immersive, multi-sensory experience. The slabs are now available at major retailers across the country, catering to a trend of premium, indulgent chocolate products.

- September 2025: Ferrero Rocher launched its new chocolate squares in the US, offering a modern twist on its classic praline. It is available in four flavors, including Milk, Dark, White, and Caramel Hazelnut.

- September 2025: Cadbury Dairy Milk launched Milkinis in India, a crème-filled chocolate bar targeting evolving snacking habits. It features a milk crème center wrapped in Cadbury chocolate.

- July 2025: Kreol Group and Lagardère partnered to launch Petit Gourmet’s Pistachio Kunafa Chocolate at Abu Dhabi Duty Free. The 470g family-sharing bar blends regional flavors with global appeal, offering a premium, culturally inspired gifting option.

- June 2025: One Brands and Hershey’s launched the One x Hershey’s Double Chocolate protein bar. It contains 18g of protein and just 1g of sugar, combining Hershey’s cocoa and chocolate chips for a rich flavor.

- May 2025: Conrad Abu Dhabi Etihad Towers launched a limited-edition Wonka Bar-inspired chocolate collection. Created by executive pastry chef Sumeda Palihakkara, the bars feature local flavors and hidden golden tickets. Winners receive a luxury culinary experience including a hotel stay, chocolate tasting, and a private masterclass.

Chocolate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Chocolate, Milk Chocolate, Dark Chocolate, Others |

| Product Forms Covered | Molded, Countlines, Others |

| Applications Covered |

|

| Pricings Covered | Everyday Chocolate, Premium Chocolate, Seasonal Chocolate |

| Distributions Covered | Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arcor, Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Chocolaterie Guylian, Ferrero International, Mars Incorporated, Meiji Co. Ltd., Mondelez International Inc. (Kraft Foods), Moonstruck Chocolate Company, Nestlé S.A., The Hershey Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chocolate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global chocolate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chocolate industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Chocolate is a sweet, edible product made from roasted and ground cacao beans. It is often combined with sugar, milk, and other ingredients to create various forms, including dark, milk, and white chocolate. Known for its rich flavor and creamy texture, chocolate is widely enjoyed as a treat or ingredient.

The global chocolate market was valued at USD 167.0 Billion in 2024.

IMARC estimates the global chocolate market to exhibit a CAGR of 2.8% during 2025-2033.

The key factors driving the market are the rising demand for premium and organic products, health-conscious preferences for dark chocolate, seasonal celebrations, innovative flavors and packaging, and growing consumption in developing regions. Ethical sourcing, convenience, and the popularity of plant-based and low-sugar options also contribute to its sustained growth globally.

According to the report, milk chocolate represented the largest segment by product type, driven by its versatility is used in various products from bars to desserts.

Countlines leads the market by product form as they are a significant segment in the confectionery industry, appealing to consumers looking for quick, satisfying snacks.

Food products lead the market by application owing to its versatility of chocolate food products allows it to be used in countless applications, from confectionery to desserts, making it a staple in the global food industry.

Everyday chocolate leads the market by pricing as these products are designed to provide a moment of indulgence without the need for special occasions.

Supermarkets and hypermarkets lead the market by distribution as these large retail outlets provide extensive shelf space for chocolate brands, ranging from mass-market favorites to premium selections.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global chocolate market include Arcor, Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Chocolaterie Guylian, Ferrero International, Mars Incorporated, Meiji Co. Ltd., Mondelez International Inc. (Kraft Foods), Moonstruck Chocolate Company, Nestlé S.A., The Hershey Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)