Precision Agriculture Market Size, Share, Trends and Forecast by Technology, Type, Component, Application, and Region, 2025-2033

Precision Agriculture Market Size, Share Analysis & Industry Outlook:

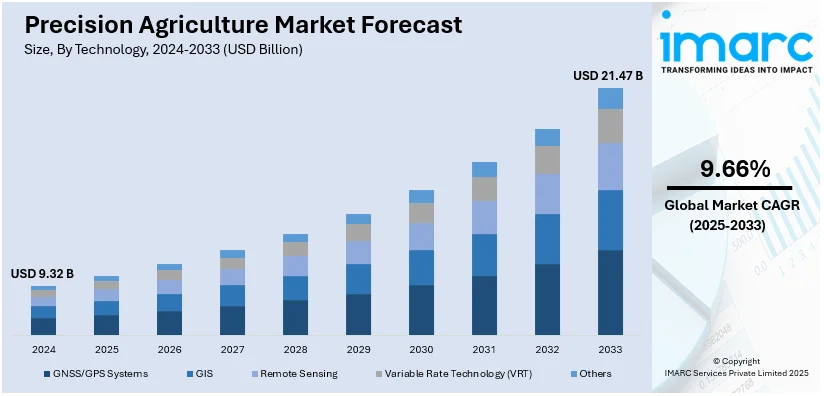

The global precision agriculture market size was valued at USD 9.32 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.47 Billion by 2033, exhibiting a CAGR of 9.66% from 2025-2033. North America currently dominates the market, holding a market share of over 51.2% in 2024. The market is driven by advanced technological adoption, substantial investments in smart farming solutions, and a strong emphasis on optimizing agricultural productivity and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.32 Billion |

|

Market Forecast in 2033

|

USD 21.47 Billion |

| Market Growth Rate (2025-2033) | 9.66% |

The global precision agriculture market is driven by the rising demand for food due to population growth necessitates efficient farming methods to enhance crop yield. In addition, the increasing adoption of the Internet of Things (IoT) and artificial intelligence (AI) technologies enables real-time data analysis for better decision-making, aiding the market growth. Moreover, the growing awareness of resource conservation promotes the use of precision tools to reduce waste and improve sustainability, providing an impetus to the market. Besides this, government support through subsidies and policies encourages technology adoption in agriculture, contributing to the market expansion. According to the US Department of Agriculture (USDA), in October 2024, more than $2.14 billion was for distribution among eligible producers and landowners under key conservation and safety-net programs, thus catalyzing the market growth.

The United States (US) precision agriculture market holds a share of 85.30%. The market demand in the region is expanding, as high labor costs, encourage farmers to invest in automation and smart technologies. In line with this, the growing need for crop monitoring solutions supports the adoption of drones and satellite imagery, supporting the market growth. Concurrently, strong collaborations between universities, research institutions, and the agricultural sector spur innovation, driving the market demand. Additionally, rising consumer demand for traceable and high-quality produce drives the integration of data-driven systems, which is fostering the market growth. Apart from this, advanced telecommunications infrastructure enables real-time data sharing, thereby propelling the market growth.

Precision Agriculture Market Trends:

Technological advancements

Precision agriculture is witnessing significant growth primarily due to major technological developments in the agricultural industry. Sensors, global positioning systems (GPS), unmanned aerial vehicles (UAVs) or drones, and even big data are drastically changing the way farms are run. These advancements offer farmers a variety of different tools and data with which to manage their businesses. Advanced sensors can collect data on soil moisture, temperature, and nutrient levels, allowing farmers to make data-driven decisions regarding irrigation and fertilization. GPS systems help in planting and harvesting with accuracy in the depth of planting and time of maturity of crops respectively. According to industrial reports, drones equipped with multispectral cameras cover up to 1,000 acres per flight, providing actionable insights on crop health. Data analytics play a crucial role in processing and interpreting the vast amounts of data generated by these technologies. Farmers can use data that was previously collected, meteorological data, and real-time data to make decisions on when to plant and how, when to water, and when to use fertilizers or pesticides. This level of precision not only increases crop yields but also reduces resource waste, making agriculture more sustainable.

Increasing need for food security

The increasing need for global food security is propelling the growth of the market. There is an uplift in the call for enhanced production to feed the increasing population across the globe with food crops. By optimizing farming practices and improving resource management, it enables farmers to produce more food with fewer resources. This includes precise control over irrigation, fertilization, and pest management, which results in higher crop yields and reduced waste. Studies show precision irrigation reduces water use by 20–50%, while site-specific fertilization improves crop yields by 10–20%. Governing agencies of various countries and international organizations are recognizing the importance of food security and are actively promoting sustainable agricultural practices. Precision agriculture aligns with these goals as it improves yields while at the same time reducing the effects of the practices on the environment. This makes it a preferred option for policymakers and stakeholders in agriculture across the globe. Additionally, precision agriculture provides a solution to the above issue by supporting local and regional production of food and cutting on the long-haul distribution networks that make foods and other produce vulnerable in crisis times.

Environmental concerns and sustainability

Precision agriculture is steadily gaining momentum because of increasing environmental consciousness and the increasing need for sustainable farming. Conventional agricultural practices are attributed to the overuse of fertilizers and pesticides, high water intake, and pollution of the soil. Precision agriculture addresses these issues by promoting efficient and environment-friendly farming. The other important principle of precision agriculture is to avoid waste of resources as much as possible. By using advanced technology, such as sensors, GPS, and data analytics, farmers can precisely tailor their inputs, including water, fertilizers, and pesticides, to the specific needs of their crops. This differential strategy not only increases yield but also decreases externality cost, for instance, pollution of groundwater and erosion of soil. Adopting no-till precision farming reduces soil erosion by up to 90%, preserving soil health. Furthermore, precision agriculture contributes to the preservation of natural habitats and biodiversity. Furthermore, it is effective in slashing chemical inputs and decreasing the adverse impacts that harm ecological systems, making agriculture more sustainable with mother nature.

Precision Agriculture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global precision agriculture market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on technology, type, component, and application.

Analysis by Technology:

- GNSS/GPS Systems

- GIS

- Remote Sensing

- Variable Rate Technology (VRT)

- Others

GNSS/GPS systems lead the market with around 35.3% of the market share in 2024. Global navigation satellite system (GNSS)/GPS enables accurate farm equipment mapping and tracking, allowing farmers to determine their position within a field precisely. Moreover, direct seeding enhances proper orientation by the GPS-controlled tractors and equipment and reduces the cost of inputs through the right use, lack of overlap, and high returns through productivity. Additionally, new technologies such as GPS systems allow farmers to generate field maps, apply variable rates, and assess the efficiency of machinery operation, which contribute to better farm management and improved yields.

Analysis by Type:

- Automation and Control Systems

- Sensing and Monitoring Devices

- Farm Management Systems

Automation and control systems lead the market with around 46.3% of the market share in 2024. Precision agriculture is based on automation and control systems, which provide farmers with efficient instruments for work. These systems include automatic equipment, robotics, and control software. Self-driving tractors can plant, sow, cultivate, and harvest crops on their own. Additionally, the hired workforce for work such as weeding and harvesting is eliminated by the use of robotics which makes the process quicker and more economical. Furthermore, through the implementation of these technologies, they gain greater precision, minimize the involvement of human input, and thus improve their yields.

Analysis by Component:

- Hardware

- Software

Hardware leads the market with around 69.8% of the market share in 2024. This segment involves all the physical hardware used in farming such as the GPS receivers, sensors, drones, and other physical tools in the farm such as automated machinery among others. GPS receivers and guidance systems form a key part of the positioning and navigation system that is crucial for appropriate planting, harvesting, and field operations. Soil moisture and crop health sensors offer information that is vital in decision-making processes. Moreover, airborne images coupled with multispectral sensors are recorded by camera-mounted drones for crops under monitoring and assessment. Concurrently, the use of automatic machinery such as tractor guidance systems and robotic implements some of the activities being made easier, cheap on labor, and increases efficiency on the farm. Apart from this, the hardware infrastructure facilitates the efficient use of data to improve the efficiency of farming.

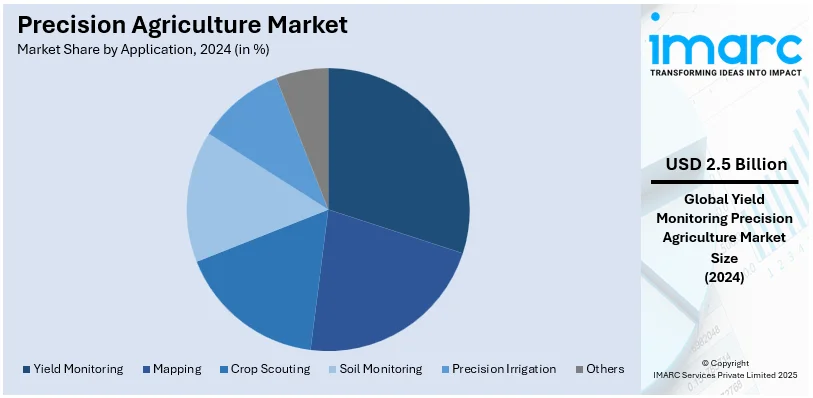

Analysis by Application:

- Mapping

- Crop Scouting

- Yield Monitoring

- Soil Monitoring

- Precision Irrigation

- Others

Yield monitoring leads the market with around 26.9% of the market share in 2024. Yield monitoring is the largest segment in precision agriculture and is crucial for assessing crop performance and optimizing productivity. This application is used in gathering data during the harvest stage to determine the actual crop yield in various regions of the field. Yield monitor systems are usually associated with GPS and sensors provide the farmer with information on yields, moisture content, and quality of grain immediately. These help farmers to determine areas that are either strategic or less productive, plan for future planting and resource use, and enhance farm management. Also, by leveraging yield data, farmers can improve financial returns, optimize resource utilization, and improve the efficiency of modern farming as an economic and environmental enterprise.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 51.2%. This region dominates because of its developed technological base, increased usage of smart farming products, and focus on increasing the efficiency of agriculture. The region uses IoT extensively, drones, and GPS-enabled equipment to monitor and collect data in real-time. Subsidies and grants offered by the government add to the use of precision farming technologies among the farmers. Such technologies are widely used by extensive farms in the United States and Canada to increase production efficiency and minimize expenses. The region also consists of solid support for agritech businesses and research organizations to foster innovation constantly. Besides this, the increasing environmental consciousness and scarcity of resources especially in the agricultural sector have led to the higher incidence of precision tools and techniques in North America.

Precision Agriculture Market Regional Takeaways:

United States Precision Agriculture Market Analysis

The U.S. precision agriculture market is growing with technological adoption and government support towards sustainable farming. According to the USDA data, in 2023, U.S. agricultural exports reached approximately USD 178 Billion, showing the growth of the sector. Investment in technologies such as GPS, IoT, and AI-driven tools has enhanced crop yield and resource efficiency. According to the AgTech industry reports, more than 60% of large farms have adopted precision farming techniques. Dominating players like John Deere and Trimble create innovation in terms of better machinery and software. Federal grants and subsidies on smart technologies for farming have been given, and rising climate change and environmental conservations drive the market upward. Demand for exporting agri-tech products from the U.S. helps to support the market by making it one of the leading countries in the precision agriculture market across the world.

Europe Precision Agriculture Market Analysis

The European market for precision agriculture is expanding, focusing on sustainability and productivity. According to the European Commission, the European Union allocated EUR 264 billion (USD 290.4 Billion) to its Common Agricultural Policy for 2023-2027, encouraging innovative farming practices. Germany, France, and the Netherlands top the list of countries that adopt smart farming technologies such as precision irrigation and drone monitoring. According to International Data Corporation, the agri-tech sector in Europe is growing 10% in 2023, mainly on account of demand for efficient resource utilization. In this regard, the environment-friendly policies and R&D funding by the EU enable technological advancements. Key companies such as AGCO Corporation and Bayer AG invest in solutions for precision farming, for example, sensors and software, customized according to regional requirements. Government-sponsored partnerships with research facilities further boost adoption, making Europe a strategic location for agricultural innovation that is sustainable.

Asia Pacific Precision Agriculture Market Analysis

Precision agriculture is a rapidly emerging industry in the Asia Pacific due to increasing food requirements and investment in technology. According to an industrial report, it was found that Asia contributes over 90% to world rice production, pointing towards a need for this practice efficiency. For 2023-24, the Department of Agriculture, Cooperation and Farmers' Welfare in India received USD 15.9 Billion (INR. 1.24 lakh crore) in the Union Budget, and for the Department of Agricultural Research and Education, it was allocated USD 1.1 Billion (INR. 8,514 crore). Countries like China, India, and Japan are joining drones, AI, and IoT to optimize productivity. Companies like Kubota and Mahindra & Mahindra lead with localized solutions. Government-backed programs, including China's Rural Vitalization Strategy, focus on embracing technology to ensure food security. International players collaborate to promote knowledge transfer and innovation and accelerate growth, putting Asia Pacific at the center of global precision agriculture innovations.

Latin America Precision Agriculture Market Analysis

The Latin America precision agriculture market is increasing due to the growth in agricultural exports and technological adoption. According to the Government of Brazil, Brazil's agricultural exports have surpassed USD 166 Billion in the 12 months from October 2023 to September 2024, showing a 1.8% increase from the previous 12-month period. The country heavily invests in satellite-based technologies and IoT for real-time crop monitoring. Next is Argentina and Chile, which have quite a high adoption of smart irrigation and pest management systems. Brazilian Association of Precision and Digital Agriculture reveals that more than 15% of Brazil's large farms use precision technique methods since government policies are more enabling them. Companies such as AG Leader and Raven Industries offer customized solutions after tying with local firms. Regional climate challenges also make the adoption of precision technologies necessary for yield optimization and resource conservation, ensuring long-term growth in the market.

Middle East and Africa Precision Agriculture Market Analysis

In the Middle East and Africa, the precision agriculture market is gaining momentum, due to water scarcity and food security issues. According to an industry report. the agriculture industry in the MENA region alone consumes about 65% of total water usage, and in Africa, about 88% of the water used is for agriculture, meaning how much water-intensive farming the region does. Countries like Saudi and UAE are leading investment sectors regarding precision irrigation and greenhouse technology. Companies like Netafim and Agritechnica have developed revolutionary new solutions for arid condition applications. Government policies to spur sustainable farming, under their Vision 2030 framework, are promoting farmers adopting technology. Global and local players form partnerships, furthering knowledge transfers and increasing adoption, establishing the region as a strong emerging market for precision agriculture.

Leading Precision Agriculture Companies:

Key players in the precision agriculture market are actively investing in research and development (R&D) to improve technological solutions and expand their product portfolios. They are focusing on integrating AI, machine learning (ML), and big data analytics into their offerings to provide farmers with more sophisticated decision support tools. Additionally, many companies are working on enhancing connectivity and data-sharing capabilities to enable seamless communication between farm equipment and software platforms. Concerning the company’s priorities, sustainability and environmental aspects are among the key components as well as the focus on the innovation of the precision agriculture solutions with less resource consumption and less negative effect on the environment. In addition, industry leaders are dedicated to advancing the industry’s growth and supporting farmers’ pursuit of greater productivity and environmentally sustainable agriculture.

The report provides a comprehensive analysis of the competitive landscape in the precision agriculture market with detailed profiles of all major companies, including:

- Ag leader Technology

- AgEagle Aerial Systems Inc.

- CropX Inc.

- Deere & Company

- DICKEY-john

- Lindsay Corporation

- PTx Trimble

- Raven Industries Inc.

- Teejet Technologies

- Topcon Positioning Systems, Inc.

- Yara International ASA

Latest News and Developments:

- December 2024: Wingspire Equipment Finance stated that they have arranged USD 10 Million of equipment financing for one of the world’s largest agricultural manufacturers. The funds will upgrade the flagship Canadian facility with precision agriculture capabilities.

- December 2024: Burro and GEODNET have joined hands to bring low-cost RTK GPS technology to Burro's autonomous robots for improved navigation accuracy and flexibility. The collaboration is enabling the rapid deployment of GPS base stations to allow for efficient agricultural operations.

- November 2024: Case IH's Active Implement Guidance makes precision agriculture different. Implements automatically follow the tractors up slopes and around curves for precise tracking of inputs like strip tilling. Says Kendal Quandahl, this feature ensures optimized input placement on any farming operation that needs maximum yield and productivity.

- November 2024: Bayer and Orbia Netafim strengthened their partnership to advance precision agriculture with digital solutions for fruit and vegetable growers. Bayer's HortiView platform streamlines data collection, enabling customized agronomic services. Orbia Netafim's GrowSphere™ brings together irrigation, crop protection, and fertigation insights to support resource optimization and sustainable farming practices.

- March 2023: Case IH Agriculture announced its collaboration with Agri Technovation to empower producers to farm more accurately. AFS system of Case IH allows the farmer to plant, spray, and harvest with great accuracy, while Agri Technovation helps with all the data processing from planting till after harvesting.

Precision Agriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | GNSS/GPS Systems, GIS, Remote Sensing, Variable Rate Technology (VRT), Others |

| Types Covered | Automation and Control Systems, Sensing and Monitoring Devices, Farm Management Systems |

| Components Covered | Hardware, Software |

| Applications Covered | Mapping, Crop Scouting, Yield Monitoring, Soil Monitoring, Precision Irrigation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ag leader Technology, AgEagle Aerial Systems Inc., CropX Inc., Deere & Company, DICKEY-john, Lindsay Corporation, PTx Trimble, Raven Industries Inc., Teejet Technologies, Topcon Positioning Systems, Inc., Yara International ASA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the precision agriculture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global precision agriculture market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the precision agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The precision agriculture market was valued at USD 9.32 Billion in 2024.

IMARC estimates the precision agriculture market to exhibit a CAGR of 9.66% during 2025-2033, reaching a value of USD 21.47 Billion by 2033.

The precision agriculture market is driven by the rising demand for food due to population growth, the adoption of IoT and AI technologies for real-time data analysis, government support through subsidies and policies, and the growing emphasis on optimizing productivity while ensuring sustainability in farming practices.

North America currently dominates the precision agriculture market, accounting for a share exceeding 51.2%. This dominance is fueled by the developed technological base, extensive usage of smart farming products, and government incentives encouraging the adoption of precision farming technologies.

Some of the major players in the precision agriculture market include Ag leader Technology, AgEagle Aerial Systems Inc., CropX Inc., Deere & Company, DICKEY-john, Lindsay Corporation, PTx Trimble, Raven Industries Inc., Teejet Technologies, Topcon Positioning Systems, Inc., and Yara International ASA, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)