Power Cables Market Size, Share, Trends and Forecast by Installation, Voltage, End-Use Sector, Material, and Region, 2026-2034

Power Cables Market Size and Share:

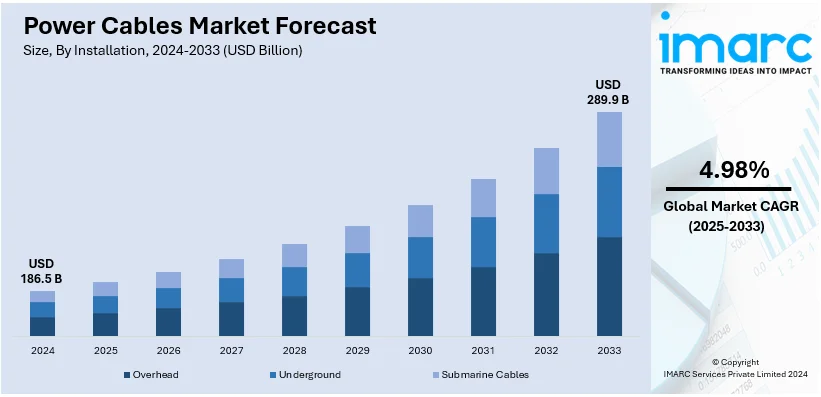

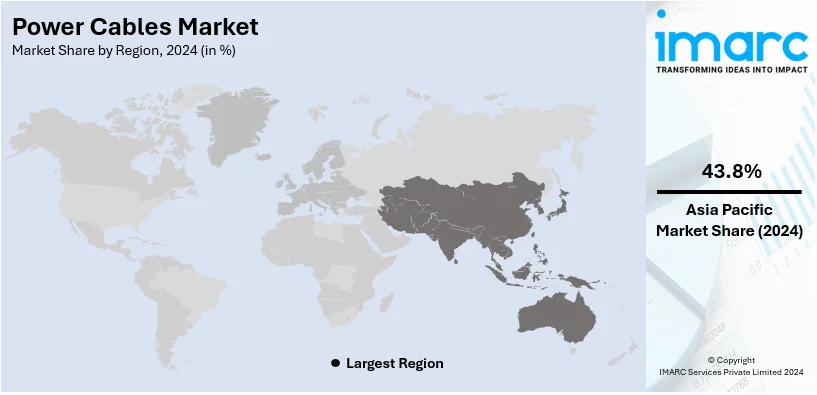

The global power cables market size reached USD 186.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 289.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.98% during 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 43.8% in 2024. Some of the factors driving the market's expansion include the rising electricity demand, soaring investments in renewable energy sources, ongoing technological advancements, rapid urbanization and industrialization, imposition of government policies encouraging energy efficiency, adoption of smart grid systems, growing environmental consciousness, and the introduction of electric vehicles (EVs) and related charging infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 186.5 Billion |

|

Market Forecast in 2034

|

USD 289.9 Billion |

| Market Growth Rate (2026-2034) | 4.98% |

Rapid urbanization and industrialization, particularly in emerging economies, are key drivers of the power cables market. According to the data by United Nations Population Division, over half of the world's population now resides in cities, up from around one-third in 1950 and expected to rise to about two-thirds by 2050. As urban areas expand, there is a growing need to establish and upgrade power transmission and distribution infrastructure to support residential, commercial, and industrial sectors. The surge in construction and infrastructure development projects also fuels the demand for power cables, as they are important components for providing a stable power supply. Additionally, industrialization drives the establishment of manufacturing facilities that require robust power distribution systems, further boosting the demand for power cables tailored to industrial applications.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor with a share of over 80.50% in North America. This dominance is driven by the increasing investment in energy and infrastructure development, rapid adoption of electric vehicles (EVs), and the expansion of data centers. U.S. Energy Information Administration forecasts that solar power generation will grow by 75% from 163 billion kilowatt-hours in 2023 to 286 billion kilowatt-hours in 2025, while wind power is expected to increase by 11% during the same period. These developments necessitate substantial investments in power cables to integrate renewable energy into the national grid effectively. Additionally, EV sales in the U.S. have surged, with over 3.5 million EV registrations by September 2024, marking a 140% increase since early 2023. This rapid adoption necessitates the expansion of EV charging infrastructure, which relies on robust power cabling for electricity transmission.

Power Cables Market Trends:

Growing Demand for Electricity

The increasing global demand for electricity stands as a pivotal driver in the power cables market. Apart from the recoveries following the global financial crisis and the COVID-19 pandemic, global demand is expected to increase by about 4% from 2.5% in 2023, the fastest yearly growth rate in the previous 20 years, as per International Energy Agency. As economies expand and populations grow, the need for a reliable and efficient power supply becomes paramount. This is additionally supported by the electrification of rural areas, the rise of electric vehicles (EVs), and the proliferation of electronic devices. Moreover, power cable manufacturers are compelled to produce cables that can transmit electricity efficiently over long distances. As a result, investments in power transmission and distribution networks are on the rise to ensure adequate and stable power supply to homes, businesses, and industries.

Rapid Renewable Energy Growth

The global transition to renewable energy sources is causing a major influence on the power cables market because of the growing environmental consciousness and the push to lower carbon emissions, which have resulted in large investments in wind and solar energy projects. According to the International Renewable Energy Agency, 8440 TWh, or 29.1%, of the world's power was produced by renewable energy sources in 2022. In 2022 alone, renewable electricity hiked by 7.2% in comparison to the year 2021. They require specialized power cables capable of transmitting electricity generated from intermittent sources over long distances with minimal loss. Consequently, manufacturers are developing high-performance cables designed to accommodate the unique needs of renewable energy installations, driving the growth in this sector.

Increasing Technological Advancements

Technological advancements in cable materials and insulation techniques play a pivotal role in shaping the power cables market. Power cables are now more durable and efficient because of advancements in materials like superconductors and sophisticated insulation. Higher voltage transmission and lower energy losses during distribution are also made possible by these advancements. To remain competitive in the market, cable makers continue spending money on research and development (R&D), concentrating on improving cable performance, lowering maintenance costs, and raising overall dependability. For example, one of KEI Industries Limited's main projects is a huge greenfield project in Sanand, Ahmedabad, which is expected to cost between INR 1,700 and 1,800 crore. This project focuses on expanding their capabilities in LT, HT, and Extra-High Voltage Cables (EHV), with the first phase of the commercial production set to begin by the end of FY 2024-25.

Power Cables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global power cables market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on installation, voltage, end-use sector and material.

Analysis by Installation:

- Overhead

- Underground

- Submarine Cables

Overhead leads the market with around 45.6% of market share in 2024. This is primarily due to increasing demands for low-cost power transmission solutions, particularly in areas with a lack of feasible infrastructure like installation underground or submarine cables for remote and rural regions. These cables are known to provide a cost-effective and simple solution for long-distance power delivery. Their ability to handle high voltage levels efficiently makes them essential for connecting power generation sites, including renewable energy plants and distribution grids.

Analysis by Voltage:

- High

- Medium

- Low

Low voltage leads the market with around 43.7% of market share in 2024. The low-end segment of the power cables market is driven by cost-effective solutions suitable for basic power transmission needs. It caters to smaller-scale projects, residential areas, and budget-conscious consumers. Moreover, factors such as affordability, ease of installation, and compliance with minimal regulatory standards steer the demand for low-end power cables. Furthermore, replacement and maintenance of existing cable infrastructure also contribute to the sustained demand in this segment.

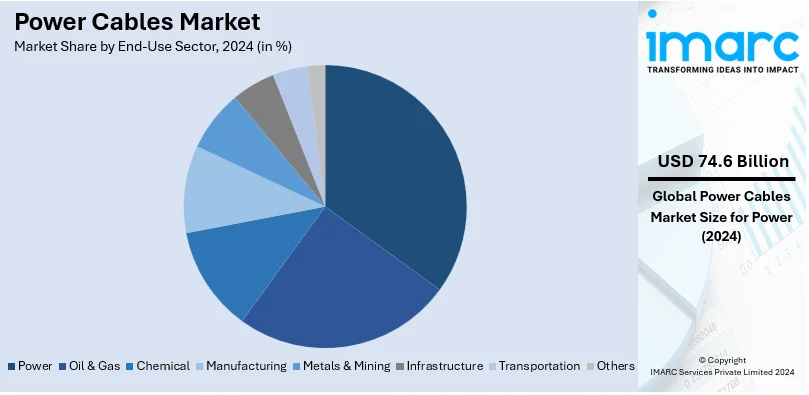

Analysis by End-Use Sector:

- Power

- Oil & Gas

- Chemical

- Manufacturing

- Metals & Mining

- Infrastructure

- Transportation

- Others

Power leads the market with around 40.0% of market share in 2024. The growing need for energy worldwide that lead to the need for investments in power production, transmission, and distribution infrastructure, is propelling the power segment. The necessity for grid renovation, technical developments, and the move toward renewable energy sources further support this industry's expansion. High-capacity and long-lasting cables are in greater demand in this industry due to the government's efforts to incorporate renewable energy sources and the increased emphasis on updating outdated grid infrastructure.

Analysis by Material:

- Copper

- Aluminum

Aluminum is dominating the market in the year 2024. Weight and cost-effectiveness are two variables that drive the aluminum industry. Because aluminum power cables are typically less expensive than their copper equivalents, they are a desirable choice, especially for projects with limited funds. Recyclability is another advantage of this material, which supports environmental concerns and sustainability objectives. Additionally, because aluminum cables are ideal for long-distance power transmission, the growth of renewable energy projects and infrastructure development has increased the demand for them, therefore reinforcing their market domination.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific held the largest market share in 2024, with over 43.8%. Rapid urbanization and industrialization are the main causes affecting the power cables market in the Asia Pacific region. The region's growing energy needs and government spending on infrastructure projects is fueling the need for power lines that can support heavy loads and provide a steady supply of electricity. Furthermore, Asia Pacific leads the world in the use of renewable energy, and large-scale projects that necessitates the widespread installation of high-capacity power connections. The industry is further boosted by the region's governments' strong focus on increasing rural electrification and upgrading old infrastructure.

Key Regional Takeaways:

North America Power Cables Market Analysis

The North American power cables market is characterized by robust demand driven by infrastructure modernization, renewable energy expansion, and increasing electricity consumption. The United States leads the region with substantial investments in upgrading aging grid systems to improve reliability and efficiency. Renewable energy projects, particularly solar and wind farms, are fueling the demand for high-capacity power cables to integrate these sources into the grid. Additionally, the rapid growth of electric vehicles and their charging infrastructure in the region is further propelling the market. Canada and Mexico are also contributing to market growth through investments in energy transmission networks and cross-border electricity trade. With strong government support and advancements in cable technologies, North America remains a significant player in the global power cables industry.

United States Power Cables Market Analysis

United States is a leading market with over 80.50% market share in North America. Modernization of infrastructure, increasing electricity consumption, and the growth of renewable energy projects are driving the power cables market in the US. Power grid development has accelerated because of the U.S. Department of Energy's goal of achieving 100% clean electricity by 2035, which requires the use of advanced cabling technologies. The small-scale solar PV generation capacity in the United States was estimated to be 47,704 MW at the end of 2023, requiring the installation of significant transmission infrastructure.

Another key driver is the rise of electric cars (EVs), which captured 25% of all sales in 2023 and require networks of charging stations and grid changes. The cable business directly benefits from the USD 65 Billion allocated for electricity grid modernisation under the federal government's Infrastructure Investment and Jobs Act. Secondly, urbanization as well as population increase lead to a greater demand for electricity use in homes and commercial outlets; the United States produced 4,000 TWh in 2023. Finally, technological advances involving HVDC systems as well as superconducting cables accelerate the expansion of the market. Major firms like General Cable, and Southwire invest considerable capital in research in a bid to meet the changes in the energy sector's tastes.

Europe Power Cables Market Analysis

The market for power cables in Europe is primarily driven by the region's ambitious goals for grid integration and renewable energy. The European Union has invested heavily in wind and solar energy projects to meet its objective of reducing greenhouse gas emissions by 55% by 2030. Offshore wind projects like Dogger Bank in the UK are also increasing demand for cables, so Europe installed more than 17 GW of wind generating capacity in 2023.

Long-distance, high-capacity power cables are required for cross-border electrical connectivity, which the European Green Deal and programs like the Trans-European Networks for Energy (TEN-E) emphasize. The new developments in smart grids and digital energy systems are also increasingly demanding advanced cable technology. Demand for cables is further driven by the necessity of significant charging infrastructure due to the adoption of EVs, which will sell nearly 2.4 Million units in 2023. Major manufacturers like Prysmian Group and Nexans are capitalizing on these trends by developing innovative, eco-friendly cabling solutions.

Asia Pacific Power Cables Market Analysis

Asia-Pacific dominates the market for power cables due to the region's rising urbanisation, industrialisation, and renewable energy initiatives. The two biggest contributors, China and India, together accounted for more than 40% of the world's power consumption in 2023, according to Energy Institute. In 2023 alone, China added an estimated 200 GW of solar capacity, more than double the 2022 record of 87GW, requiring significant cabling infrastructure.

Government programs in India like the Integrated Power Development Scheme, which aims to strengthen the power distribution system, increase demand for cables. To boost economic growth, Southeast Asian countries like Vietnam and Indonesia are investing in grid modernization and electrification. Demand for power cables is also boosted by the growing EV sector in the region. For example, in 2023, India has sold nearly 1.5 Million EV cars. In such a changing business scenario, advancements in Ultra-High Voltage cables also enhance transmission efficiency over long distance.

Latin America Power Cables Market Analysis

Latin American power cables market is mainly promoted by the increasing initiatives for the electrification of rural areas and growth in the renewable energy projects. According to the International Energy Agency (IEA), the region will increase its capacity by an additional 165 GW between 2023 and 2028, with just four markets accounting for 90% of this growth: Brazil (108 GW), Chile (25 GW), Mexico (10 GW), and Argentina (4 GW). Wide-ranging high-capacity transmission lines are also needed for Brazil's continuing hydropower projects. Due to the fact that the demand for electricity in the region is likely to increase substantially, the governments are investing in the modernization of the grid in order to reduce transmission losses and encourage industrialization. Moreover, the increase in population and urbanization lead to a demand for distribution cables in the residential and commercial sectors. Foreign investments, such as infrastructural projects initiated by China, also fuel the market.

Middle East and Africa Power Cables Market Analysis

The market for power cables in the Middle East and Africa is being driven by investments in infrastructure development and renewable energy. Solar projects like the Dubai Al Dhafra Solar Park, which built more than 2 GW of capacity in 2023, are being funded by Saudi Arabia and the United Arab Emirates. Moreover, grid expansion plans in Sub-Saharan Africa aim to bring power to more than 600 million people. The need for advanced gearbox systems is rising as economies that rely on oil and gasoline transition to sustainable energy. With governments giving industrial expansion and electrification the highest priority, the market is anticipated to increase gradually.

Competitive Landscape:

To maintain their competitive edge and meet the evolving needs of the industry, the major players in the power cables market are highly engaged in a series of strategic activities. These activities include cable material and design innovations, focusing on the development of high-performance, and environmentally friendly power cables. Moreover, to explore new markets with great development opportunities, industry leaders are expanding their geographical presence through collaborations and acquisitions. In addition, they are adding funds in research and development (R&D) activities to supply world-class technologies that can respond to the developing demand for transmission of safe energy and smart grids. Furthermore, players are adopting a practice of adhering strictly to certain rules and standards of quality, and making sure the products meet safety and environmental standards with continuous demands for effective power transmission.

The report provides a comprehensive analysis of the competitive landscape in the power cables market with detailed profiles of all major companies, including:

- Prysmian S.p.A

- Belden Inc.

- Encore Wire Corporation

- Finolex Cables Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- HENGTONG GROUP CO., LTD.

- KEI Industries Limited

- LS Cable & System Ltd.

- Leoni AG

- Nexans

- NKT A/S

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- TPC Wire & Cable Corp.

Latest News and Developments:

- October 2025: Prysmian Group has obtained the contract to design and implement a submarine high voltage direct current cable system for the Italy–Tunisia electrical interconnection project, ELMED. The bid was jointly released by Italy’s transmission system operator, Terna SpA, along with Société Tunisienne de l’Électricité et du Gaz. The contract is worth up to EUR460 million and features a preliminary activation phase that is contingent on certain conditions.

- September 2025: Xlinks, via its subsidiary Xlinks Germany GmbH, has independently created a new initiative, Sila Atlantik, supported by German energy companies E.ON and Uniper. The project takes an ambitious route to transmit Morocco’s plentiful solar and wind energy straight to German consumers via an innovative underwater cable network. This follows the British government's dismissal in late June, which effectively stopped the UK-centered initiative to import renewable energy from Morocco.

- August 2025: In a significant urban infrastructure initiative, the Telangana government has announced a INR 13,500-crore plan to substitute 25,000 km of overhead power lines with underground (UG) cables throughout the core urban areas, including Greater Hyderabad and Bharat Future City. Spearheaded by Southern Power Distribution Company of Telangana (TGSPDCL), the project seeks to improve safety, decrease outages during the monsoon season, and lower maintenance expenses. Currently, with merely 1,300 km of underground cables in place, the state will implement Bengaluru’s horizontal drilling approach to reduce road damage and lessen public disruption during installation.

- July 2025: Chief Minister Rekha Gupta initiated a pilot project aimed at relocating the overhead power lines underground at BH Block, Janta Flats Colony, within her Shalimar Bagh constituency. The initiative, costing Rs 8 crore, is anticipated to be finished within three months. While launching the product, Gupta stated that it will transform the appearance of the heavily populated colony by eliminating the clutter of overhead cables.

- June 2025: Sumitomo Electric Industries, Ltd. began the implementation of its 525kV XLPE High-Voltage Direct Current (HVDC) underground cable system for the Corridor A-Nord initiative in Germany. This milestone signifies a major progress in one of the nation’s essential energy infrastructure projects. The Corridor A-Nord initiative is pivotal in aiding Germany’s Energy Transition strategy, designed to incorporate renewable energy into the nation’s High-Voltage Network and substantially lower carbon emissions. The commencement of installation work marks our involvement in this change.

- October 2024: Founded in 1981, NKT, a provider of cables and cable accessories for the energy industry, has launched the testing system for the world’s longest superconducting power cable system, SuperLink, in Munich, Germany. SuperLink is a groundbreaking superconducting power cable system created for high-density power transmission, allowing for the movement of significant electrical energy through a streamlined cable structure.

Power Cables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Overhead, Underground, Submarine Cables |

| Voltages Covered | High, Medium, Low |

| End-Use Sectors Covered | Power, Oil & Gas, Chemical, Manufacturing, Metals & Mining, Infrastructure, Transportation, Others |

| Materials Covered | Copper, Aluminum |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Prysmian S.p.A, Belden Inc., Encore Wire Corporation, Finolex Cables Ltd., Fujikura Ltd., Furukawa Electric Co., Ltd., HENGTONG GROUP CO., LTD., KEI Industries Limited, LS Cable & System Ltd., Leoni AG, Nexans, NKT A/S, Southwire Company, LLC., Sumitomo Electric Industries, Ltd., TPC Wire & Cable Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the power cables market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global power cables market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the power cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Power cables are electrical conductors used to transmit and distribute electricity over short or long distances. They consist of insulated wires made from materials like copper or aluminum, enclosed in protective sheathing. Power cables are essential for energy transmission in residential, commercial, industrial, and utility sectors.

The power cables market was valued at USD 186.5 Billion in 2024.

IMARC estimates the global power cables market to exhibit a CAGR of 4.98% during 2025-2033.

The global power cables market is driven by rapid urbanization, increasing investments in renewable energy projects, infrastructure modernization, and the rising adoption of electric vehicles. Additional factors include growing energy demands, advancements in cable technologies, and the expansion of data centers and rural electrification initiatives worldwide.

According to the report, overhead represented the largest segment by installation, due to its lower cost, ease of deployment, and accessibility for maintenance.

Low voltage cables lead the market by voltage as they are extensively used in residential, commercial, and small industrial applications.

Power is the leading segment by end-use sector, as this sector relies heavily on power cables for electricity generation, transmission, and distribution.

Aluminum is the leading segment by material, as it is cost-effective, lightweight, and offers high conductivity.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global power cables market include Prysmian S.p.A, Belden Inc., Encore Wire Corporation, Finolex Cables Ltd., Fujikura Ltd., Furukawa Electric Co., Ltd., HENGTONG GROUP CO., LTD., KEI Industries Limited, LS Cable & System Ltd., Leoni AG, Nexans, NKT A/S, Southwire Company, LLC., Sumitomo Electric Industries, Ltd., TPC Wire & Cable Corp., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)