Powder Metallurgy Market Size, Share, Trends and Forecast by Type, Material, Manufacturing Process, Application, and Region, 2025-2033

Global Powder Metallurgy Market:

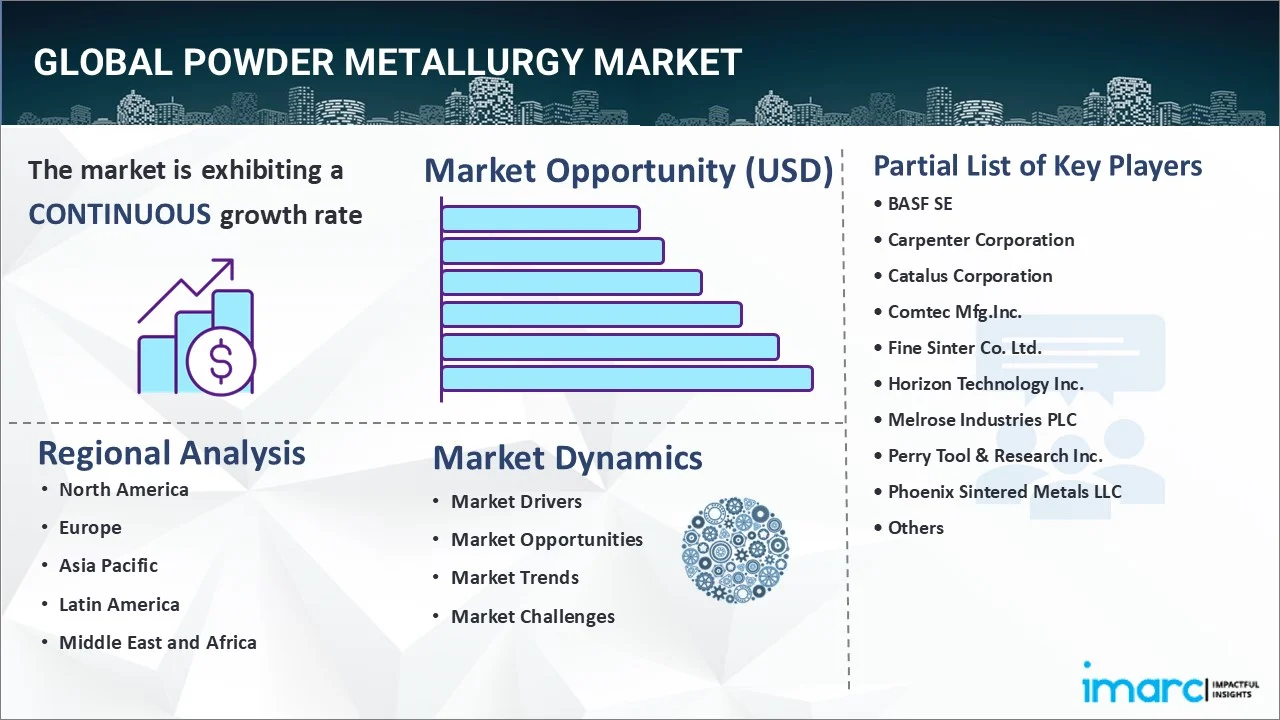

The global powder metallurgy market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.13% during 2025-2033. The expanding automotive industry, increasing product usage in manufacturing inert machine parts, and rising penetration of low-cost products represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.4 Billion |

|

Market Forecast in 2033

|

USD 7.1 Billion |

| Market Growth Rate (2025-2033) |

8.13%

|

Powder Metallurgy Market Analysis:

- Major Market Drivers: The growing automotive industry, surging demand for cost-effective, efficient, and lightweight materials, rising number of infrastructure projects, etc., are propelling the market growth. Moreover, the increasing usage of powder metallurgy in various electronic devices is escalating the powder metallurgy market demand.

- Key Market Trends: Ongoing advancements in material science, growing adoption of additive manufacturing, and increasing preferences towards green manufacturing are some of the factors expected to stimulate the market growth. Moreover, with the rising demand for miniaturized devices, powder metallurgy is advancing to meet these requirements. Techniques like metal injection molding (MIM) and micro powder injection molding (μPIM) enable the production of small, complex parts with tight tolerances and excellent surface finishes, thereby stimulating the industry’s growth.

- Competitive Landscape: Some of the leading powder metallurgy market companies are BASF SE, Carpenter Corporation, Catalus Corporation, Comtec Mfg.Inc., Fine Sinter Co. Ltd., Horizon Technology Inc., Melrose Industries PLC, Perry Tool & Research Inc., Phoenix Sintered Metals LLC, Precision Sintered Parts LLC, Sandvik AB, and Sumitomo Electric Industries Ltd., among many others.

- Geographical Trends: According to the report, Asia Pacific accounted for the largest market share. Some of the factors driving the regional powder metallurgy market included the growing demand for enhanced infrastructures, rising adoption of additive manufacturing in the automotive sector, increasing need for lightweight components with improved performance, etc.

- Challenges and Opportunities: High initial investment costs, time-consuming manufacturing process, environmental regulations, and quality control are some of the factors hampering the market growth. However, the rise of additive manufacturing (AM) technologies presents significant powder metallurgy market recent opportunities. AM techniques like selective laser melting (SLM) and metal binder jetting allow for the production of complex, customized parts with minimal material waste, thereby propelling the market growth.

Powder Metallurgy Market Trends:

Rising Demand from the Automotive Industry

With increasing pressure to improve fuel efficiency and reduce emissions, automotive manufacturers are turning to lightweight materials. Powder metallurgy offers lightweight components with high strength and precision, contributing to overall vehicle weight reduction. For instance, according to the U.S. Department of Energy, by 2030, one-fourth of the U.S. vehicular fleet could save over 5 billion gallons of fuel yearly due to advanced materials that enable lightweight components and high-efficiency engines. Powder metallurgy is widely used in the production of gears for engines and transmissions. PM gears offer high strength, wear resistance, and dimensional accuracy, making them suitable for demanding applications. For instance, Amsted Automotive presented cutting-edge innovations that are essential for the development of powertrains in May 2024, at the CTI Symposium. The company's exhibit highlighted the strengths of Means Industries, Burgess-Norton, and Transform Automotive, its three main business divisions. Throughout the event, Burgess-Norton showcased its acclaimed powder metal technology in a number of applications, such as gears, pocket and notch plates, sprockets, cam plates, and more. Powder metallurgy offers cost-effective solutions for automotive parts production. PM processes, including metal injection molding (MIM) and powder bed fusion (PBF) in 3D printing, have significantly lower material waste compared to traditional manufacturing methods. This is because PM processes typically start with fine metal powders, which are precisely shaped into the final part. This minimizes material waste and reduces the overall cost of production. In November 2023, researchers at IIT-Mandi discovered that the extrusion-based metal additive manufacturing process is the most superior and cost-effective way when compared to other approaches to metal 3D printing. Metal additive manufacturing (metal AM) uses thin metal powders to create strong, complicated components using computer-aided design (CAD) software or 3D scanning. These factors are further bolstering the powder metallurgy market revenue.

Growing Adoption of Additive Manufacturing

Additive manufacturing (AM), particularly in the form of 3D printing, is a significant driver of growth in the powder metallurgy (PM) market. 3D printing allows for the creation of complex geometries that are difficult or impossible to achieve with traditional manufacturing methods. This is particularly advantageous for powder metallurgy, as it enables the production of intricate shapes and internal structures without the need for specialized tooling or assembly. As a result, manufacturers can create highly optimized components with improved performance and functionality. For instance, in February 2024, Volkmann launched the PowTReX basic metal powder reprocessing system, that allows additive manufacturers to recover powder for reuse. It aims to support powder-based metal 3D printer users. Moreover, additive manufacturing allows for the creation of intricate lattice structures within metal parts, providing high strength-to-weight ratios and customized mechanical properties. Powder metallurgy supplies the metal powders used to create these lattice structures, offering opportunities for lightweighting and design optimization. For instance, in February 2024, researchers from RMIT University in Australia created a novel type of metamaterial made additively from Ti-6Al-4V titanium. The unusual lattice structures, with very high strength-to-weight ratios, have the potential to benefit a wide range of applications, including medical implants and aircraft or rocket parts. The researchers designed a hollow tubular lattice structure with a thin band running inside it manufactured using Laser Beam Powder Bed Fusion. These factors are positively influencing the powder metallurgy market forecast.

Increasing Utilization in the Aerospace Sector

The escalating demand in the aerospace industry is one of the prominent factors adding to the market growth. Aerospace manufacturers are constantly seeking ways to reduce aircraft weight to improve fuel efficiency and reduce operating costs. Powder metallurgy offers lightweight components with high strength-to-weight ratios, making it ideal for aerospace applications. PM components contribute to the overall weight reduction of aircraft, leading to fuel savings and lower emissions. For instance, in November 2023, ArcelorMittal SA, one of the world's major steel firms, announced the development of an industrial-scale atomizer in Aviles, Spain, to create steel powders for a variety of additive manufacturing technologies, including aerospace, defense, automotive, medical, and energy. Moreover, they formed a new company, ArcelorMittal Powders, to commercialize its metal powders, with a focus on Laser Beam Powder Bed Fusion (PBF-LB), Binder Jetting (BJT), and Directed Energy Deposition (DED) AM technologies. In addition, powder metallurgy allows for the development and production of advanced materials and alloys tailored for aerospace applications. These materials can withstand high temperatures, extreme pressures, and harsh environments encountered in aerospace operations. PM techniques enable the incorporation of elements like titanium, nickel, and aluminum into alloys, creating materials with exceptional properties required for aerospace components. For instance, according to the article published by the National Library of Medicine in 2023, powder metallurgy is a versatile and commonly utilized method of creating composite materials. Cu-TiO2 composites gained significance in recent years due to its prospective uses in a variety of areas, including aerospace, electrical, and biomedicine. The key benefits of employing this process to prepare Cu-TiO2 (titanium dioxide) composites include the ability to control the composite's microstructure, low cost, and high efficiency. In the aircraft industry, composite materials can be utilized to make components like turbine blades, which require high strength and wear resistance. These factors are further contributing to the powder metallurgy market share.

Powder Metallurgy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global powder metallurgy market report, along with forecasts at the global, regional and country levels for 2025-2033. Our report has categorized the market based on type, material, manufacturing process, and application.

Breakup by Type:

- Ferrous

- Non-Ferrous

Ferrous dominates the market

The report has provided a detailed breakup and analysis of the powder metallurgy market based on the type. This includes ferrous and non-ferrous. According to the powder metallurgy report, ferrous represented the largest segment.

As industries like automotive, aerospace, and electronics continue to demand lightweight yet strong components, powder metallurgy offers an attractive solution. Ferrous materials, such as iron and steel powders, allow for the production of parts with high strength-to-weight ratios, making them ideal for applications where weight reduction is crucial. Moreover, innovations in powder production techniques, such as water atomization, gas atomization, and mechanical alloying, have improved the quality, purity, and consistency of ferrous powders. These advancements enable manufacturers to produce powders with tailored properties suitable for specific applications, driving the adoption of ferrous materials in powder metallurgy. For instance, in November 2023, ArcelorMittal SA, one of the world's major steel firms, announced to develop an industrial-scale atomizer in Aviles, Spain, to create steel powders for a variety of additive manufacturing technologies, including aerospace, defense, automotive, medical, and energy.

Breakup by Material:

- Titanium

- Steel

- Nickel

- Aluminum

- Others

Steel hold the largest share in the market

A detailed breakup and analysis of the powder metallurgy market based on the material has also been provided in the report. This includes titanium, steel, nickel, aluminum, and others. According to the report, steel accounted for the largest market share.

According to the powder metallurgy market outlook, steel is one of the most widely used materials in powder metallurgy due to its versatility, strength, and cost-effectiveness. Steel powder is the primary raw material in PM for producing steel parts. It's typically produced through processes such as water atomization, gas atomization, or electrolytic deposition. These methods allow for the production of steel powders with controlled particle size, shape, and composition. Moreover, various alloying elements can be added to steel powders to enhance specific properties of the final components. Common alloying elements include nickel, molybdenum, chromium, and copper. Alloying helps improve properties such as strength, hardness, wear resistance, and corrosion resistance, making steel suitable for diverse applications. For instance, in May 2024, Swiss Steel Group, headquartered in Lucerne, Switzerland, launched a line of gas-atomized metal powders designed for the additive manufacturing sector. The company offers low- and medium-alloy steels under its Bainidur additive manufacturing line.

Breakup by Manufacturing Process:

- Additive Manufacturing

- Powder Bed

- Blown Powder

- Metal Injection Molding

- Powder Metal Hot Isostatic Pressing

- Others

Powder metal hot isostatic pressing accounts for the majority of the market share

A detailed breakup and analysis of the powder metallurgy market based on the manufacturing process has also been provided in the report. This includes additive manufacturing, powder bed, blown powder, metal injection molding, powder metal hot isostatic pressing, and others. According to the report, powder metal hot isostatic pressing accounted for the largest market share.

As per the powder metallurgy market outlook, Hot Isostatic Pressing (HIP) in powder metallurgy involves subjecting a material to both high temperature and high pressure simultaneously in order to consolidate and densify it. Various industries such as aerospace, automotive, oil & gas, and medical devices require components with high strength, precision, and reliability. PM HIP offers a way to produce such components with superior mechanical properties, including high density, excellent microstructure, and enhanced fatigue resistance. In September 2023, the Wallwork Group installed a Quintus Technologies Hot Isostatic Press (HIP) at its new HIP Centre in Bury, England. The press is equipped with Quintus' patented uniform rapid cooling (URC) technology, which, according to Quintus, allows for optimal temperature management and higher productivity while delivering the high material uniformity needed for parts intended for mission-critical applications.

Breakup by Application:

- Automotive

- Aerospace

- Electrical and Electronics

- Oil and Gas

- Others

Automotive holds the largest share in the market

A detailed breakup and analysis of the powder metallurgy market based on the application has also been provided in the report. This includes automotive, aerospace, electrical and electronics, oil and gas, and others. According to the report, automotive accounted for the largest market share.

Powder metallurgy is extensively used in the production of various engine components in the automotive industry due to its ability to create complex shapes and maintain tight tolerances. Parts such as connecting rods, crankshafts, camshaft sprockets, oil pump gears, and pulleys are commonly manufactured using PM. These components require high strength, wear resistance, and dimensional accuracy, which can be achieved through PM. Moreover, powder metallurgy is utilized for manufacturing components in automatic and manual transmissions. Gears, synchronizer hubs, shift forks, and planetary carriers are examples of transmission components produced using PM. This offers advantages such as reduced weight, improved efficiency, and cost-effectiveness compared to traditional manufacturing methods. For instance, in February 2024, GKN Powder Metallurgy, a global pioneer in powder metallurgy and creative, sustainable solutions for a wide range of automotive and industrial applications, received the EcoVadis Platinum Rating for exceptional environmental performance.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for powder metallurgy.

The automotive sector in Asia Pacific is one of the largest consumers of PM parts. With increasing vehicle production and demand for lightweight, high-performance components, powder metallurgy is extensively used for producing engine parts, chassis, and brake system parts. The rapid growth of the automotive industry in countries like China, India, Japan, and South Korea is a major driver for the powder metallurgy market in the region. Moreover, the ongoing industrialization and urbanization in Asia Pacific countries are driving the demand for PM components in various industries such as aerospace, consumer goods, industrial machinery, electronics, etc. PM parts find applications in a wide range of sectors, including power tools, household appliances, medical devices, and construction equipment, contributing to market growth. For instance, in February 2024, SAP Parts, Maharashtra, installed a new metal powder press at its sintering plant to boost powder metallurgy production.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global powder metallurgy market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- BASF SE

- Carpenter Corporation

- Catalus Corporation

- Comtec Mfg.Inc.

- Fine Sinter Co. Ltd.

- Horizon Technology Inc.

- Melrose Industries PLC

- Perry Tool & Research Inc.

- Phoenix Sintered Metals LLC

- Precision Sintered Parts LLC

- Sandvik AB

- Sumitomo Electric Industries Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Powder Metallurgy Market Recent Developments:

- May 2024: Uzbekistan's President Shavkat Mirziyoyev announced its plans to construct rare earth projects totaling US$ 500 Million. During a conference, the President suggested that the manufacturing of items in the country's new Powder Metallurgy industry might generate US$ 300 Million per year.

- May 2024: Swiss Steel Group, headquartered in Lucerne, Switzerland, launched a line of gas-atomized metal powders designed for the additive manufacturing sector.

- April 2024: Linde Advanced Material Technologies Inc. partnered with the National Aeronautics and Space Administration (NASA) to sell GRX-810 alloy metal powder.

- February 2024: SAP Parts, Maharashtra, installed a new metal powder press at its sintering plant to boost powder metallurgy production.

Powder Metallurgy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Ferrous, Non-Ferrous |

| Materials Covered | Titanium, Steel, Nickel, Aluminum, Others |

| Manufacturing Process Covered | Additive Manufacturing, Powder Bed, Blown Powder, Metal Injection Molding, Powder Metal Hot Isostatic Pressing, Others |

| Applications Covered | Automotive, Aerospace, Electrical and Electronics, Oil and Gas, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Carpenter Corporation, Catalus Corporation, Comtec Mfg.Inc., Fine Sinter Co. Ltd., Horizon Technology Inc., Melrose Industries PLC, Perry Tool & Research Inc., Phoenix Sintered Metals LLC, Precision Sintered Parts LLC, Sandvik AB, Sumitomo Electric Industries Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the powder metallurgy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global powder metallurgy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the powder metallurgy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global powder metallurgy market was valued at USD 3.4 Billion in 2024.

We expect the global powder metallurgy market to exhibit a CAGR of 8.13% during 2025-2033.

The rising application of powder metallurgy in washing machines, power tools, copiers, hunting knives, oil and gas drilling well-head components, etc., is primarily driving the global powder metallurgy market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of various end use industries for powder metallurgy.

Based on the type, the global powder metallurgy market has been bifurcated into ferrous and non- ferrous, where ferrous type exhibits a clear dominance in the market.

Based on the material, the global powder metallurgy market can be divided into titanium, steel, nickel, aluminum, and others. Among these, steel exhibits a clear dominance in the market.

Based on the manufacturing process, the global powder metallurgy market has been categorized into additive manufacturing, powder bed, blown powder, metal injection molding, powder metal hot isostatic pressing, and others. Currently, powder metal hot isostatic pressing holds the majority of the total market share.

Based on the application, the global powder metallurgy market can be segmented into automotive, aerospace, electrical and electronics, oil and gas, and others. Among these, the automotive sector currently represents the largest market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where Asia-Pacific currently dominates the global market.

Some of the major players in the global powder metallurgy market include BASF SE, Carpenter Corporation, Catalus Corporation, Comtec Mfg.Inc., Fine Sinter Co. Ltd., Horizon Technology Inc., Melrose Industries PLC, Perry Tool & Research Inc., Phoenix Sintered Metals LLC, Precision Sintered Parts LLC, Sandvik AB, and Sumitomo Electric Industries Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)