Poultry Feed Market Size, Share, Trends and Forecast by Nature, Form, Additives, Animal Type, Distribution Channel, and Region, 2025-2033

Poultry Feed Market Size and Share:

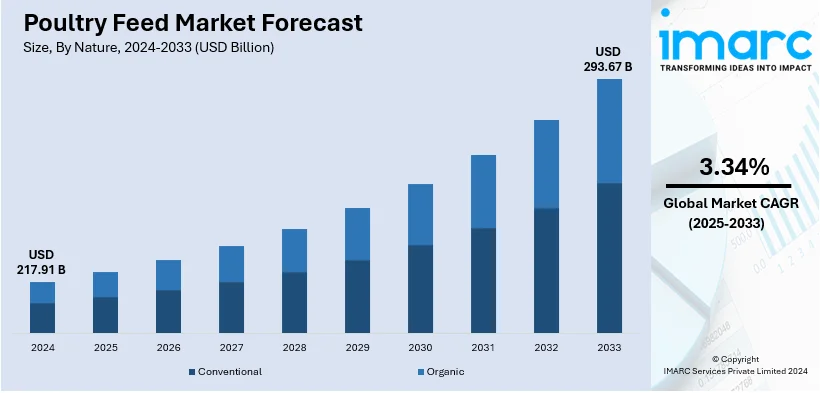

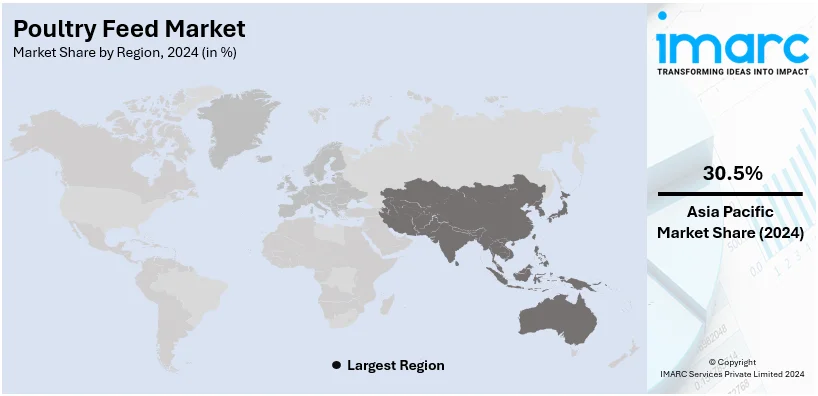

The global poultry feed market size was valued at USD 217.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 293.67 Billion by 2033, exhibiting a CAGR of 3.34% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 30.5% in 2024. Some of the key factors driving the market include the growing consumption of poultry, rising consumer health consciousness, notable technological developments, the implementation of supportive agricultural policies, a growing emphasis on sustainable farming methods, and the expansion of international trade agreements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 217.91 Billion |

| Market Forecast in 2033 | USD 293.67 Billion |

| Market Growth Rate (2025-2033) | 3.34% |

Population growth and changing dietary tastes have been the main drivers of the steady increase in the demand for chicken meat and eggs worldwide. In August 2024, the United States produced around 9.08 billion eggs. The lower cost of chicken and its reputation as a healthier substitute for red meats are major factors in this increase. Furthermore, in 2032, the amount of meat consumed per person increased by 2%, with poultry meat contributing significantly to this growth. Poultry farmers are thereby increasing output, which raises the need for high-quality feed to sustain the expanding poultry population.

With a market share of over 70% in North America, the United States stands out as a significant market disruptor. Chicken meat production in the country was recorded at 21.08 million metric tons in the year 2023. Along with that, the number of broilers produced within the same timeframe was 9.16 billion. This expansion is linked to factors such as improved and scientifically proven methods of production, economical feed costs, and good consumer demand within the country. There are also strict food safety regulations that apply to the U.S. poultry industry to ensure the health of consumers. Chicken meat produced in the U.S. is expected to grow by 2% over 2025 to reach a record 21.7 million tons, along with a slight increase in exports as it is forecasted to rise by 1% to 3.1 million tons. This emphasizes the need for compliance with domestic and international requirements. Such standards insist on the use of top-grade feed ingredients and the complete exclusion of harmful additives.

Poultry Feed Market Trends:

The Increasing Poultry Consumption Across the Globe

Poultry's high protein content, affordability, and variety have made it a staple food across the world. The Food and Agriculture Organization (FAO) estimates that the production of poultry meat reached 139 million metric tons worldwide in 2023, representing a consistent growth rate of around 2.5 percent each year. In addition, the demand for chicken products has increased dramatically because of the growing cultural shift towards meat eating and producers' strong marketing campaigns. This increase extends beyond traditional meat cuts to processed goods like sausages, nuggets, and other convenience items made with chicken. Because of the increased customer interest, poultry farms are under pressure to boost output, which raises the need for high-quality chicken feed. In addition, the increased feed demand also emphasizes quality, as consumers are focusing on healthy and ethically sourced products. Moreover, poultry farms are investing in quality feeds that enhance meat quality, reduce diseases, and adhere to increasingly stringent food safety regulations.

Growing Health Consciousness Among Consumers

The awareness regarding health and nutrition is another factor that greatly influences the poultry feed market. Consumers are mainly concerned with their well-being, as well as the nutritional quality of the food they consume. This focus on health is also taking into account the quality of poultry products available in the market, thus creating an impact on the types of feeds poultry farmers use. According to the American Feed Industry Association study, 36% of U.S. consumers consider animal welfare and feed quality when purchasing poultry products. Furthermore, the health-conscious consumer seeks to enjoy organic, antibiotic-free, or free-range poultry products, indicating an increased willingness to pay a premium for perceived better quality. Moreover, health consciousness has ignited a national food safety conversation that is attracting attention in all sectors.

Significant Technological Advancements

Technological innovations are increasingly becoming the most fundamental factors in the poultry feed market. With this perspective, the latest developments in nutritional science, which offer more accurately formulated feeds, can optimize poultry growth and improve disease resistance while offering better quality poultry products. For example, research has determined that the usage of additives in feed - such as probiotics and enzymes have proven to elevate feed conversion ratios by 10 percent. Ongoing R&D also is actively researching nutriculture into nutrient-enhanced, high-digested feeds which will elevate poultry performance from 8 to 10 percent based on a feed unit improvement. In addition, the concern for science research and development, especially on feed with high nutritional content and easily digestible feeds that maximize feed conversion ratios, is another growth-boosting factor. Furthermore, the introduction of cutting-edge manufacturing technologies, such as automation and data analytics, which allow for consistent quality and efficient production methods, reducing the cost per unit of feed, is contributing to the market growth.

Poultry Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the poultry feed market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on nature, form, additives, animal type, and distribution channel.

Analysis by Nature:

- Conventional

- Organic

Conventional leads the market with around 63.03% of market share in 2024. Conventional chicken feed is often less expensive to produce than organic or specialty feeds, making it more easily available to both farmers and consumers. Furthermore, even in isolated or underdeveloped areas, conventional feed is easily accessible because to its extensive manufacturing and delivery networks. Aside from that, these feeds have been in use for a long time, making them a popular and trusted choice among many chicken producers. Additionally, compared to organic or non-GMO feeds, it has less legal obstacles, which makes production and market introduction simpler. Aside from that, traditional feeds have more constant nutritional content due to supervised production methods, making them a dependable choice for chicken health and growth.

Analysis by Form:

- Mashed

- Pellets

- Crumbles

- Others

Pellets leads the market with around 45.0% of market share in 2024. Pellets provide a balanced blend of nutrients in each unit, ensuring that birds have a constant nutritional intake, which is critical for good growth and health. Additionally, because pellets are less likely to be dispersed than crushed or lost grain, their compact structure reduces feed waste. In addition, heat treatment is frequently used during the pelleting process, which improves feed conversion rates and the general health of the chickens by making some nutrients easier to digest. Moreover, compared to other types of chicken feed, they are more convenient to handle, store, and transport, which contributes to their popularity. They are also less prone to spoiling and need less storage space due to their compact form.

Analysis by Additives:

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

Amino acid leads the market with around 44.2% of market share in 2024. Poultry development, repair, and general health depend on amino acids, which are the structural components of proteins. A number of critical amino acids, such as lysine and threonine, are necessary supplements as birds are unable to synthesize them and must obtain them from their food. Additionally, adding amino acids to chicken feed improves feed conversion ratios, which lowers total feed costs by enabling birds to reach the required weight and growth with less feed. Furthermore, full protein sources like fish or soybean meal are more expensive than amino acid additions. They are the preferred option for poultry farmers seeking to optimize profits.

Analysis by Animal Type:

- Layers

- Broilers

- Turkey

- Others

Broilers leads the market with around 71.0% of market share in 2024. Broilers are engineered to develop and produce meat quickly, thus requiring a steady supply of high-quality feed. Furthermore, due to their short growth cycle and high feed-to-meat conversion ratio, broilers are among the most economical poultry to rear. This increases the need for specialist broiler feed by making them a desirable option for chicken growers. Additionally, they have specific dietary needs to achieve optimal growth and meat quality. These specialized requirements increase the demand for targeted poultry feeds. Moreover, broilers often benefit from vertically integrated supply chains where feed producers, farmers, and meat processors collaborate closely. This ensures a steady and optimized feed supply.

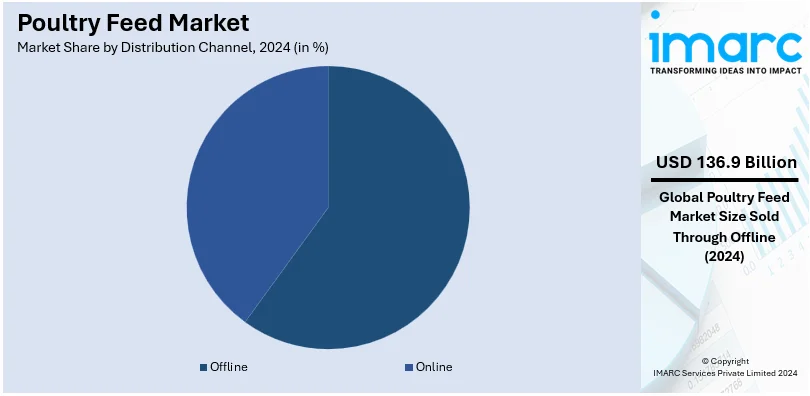

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with around 62.8% of market share in 2024. Offline distribution channels have established supply chain logistics, which enable efficient and reliable delivery of poultry feed to various markets, from urban centers to rural areas. Furthermore, many poultry farmers prefer to physically inspect the feed before purchase, something that offline retail allows. Additionally, offline channels are known to offer immediate and fast access to poultry feed without the waiting period that are associated with shipping. Moreover, the direct interactions between distributors and customers in offline channels often result in long-standing relationships based on trust and personalized service. Apart from this, retailers and distributors in offline channels have specialized knowledge about poultry feed, offering customers valuable advice and recommendations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 30.5%. The rapid population expansion in Asia Pacific is driving the demand for chicken products and, in turn, poultry feed. Furthermore, the rising disposable income among the middle class, which leads to increased consumption of meat and poultry products, is another growth driver. In addition, the region's numerous cultures and religions that accept and eat chicken, has raised the need for poultry feed. Additionally, the region's predominance of smallholder farmers is making it easier to meet specific requirements with specialized feed. Moreover, the imposition of various supportive policies by regional governments, such as subsidies and training programs, to boost poultry farming is contributing to the market growth. Along with this, the lower labor costs in many Asia Pacific countries, which makes poultry farming and feed production more cost-effective, are strengthening the market growth.

Key Regional Takeaways:

North America Poultry Feed Market Analysis

The poultry feed industry in North America is steadily growing, owing to the region's robust chicken output and increasing consumer demand for poultry meat and eggs. For instance, the United States of America produced almost 52 billion pounds of chicken in 2022, demonstrating its dominance in the poultry market. The rising demand for chicken feed is a result of consumers' increased choice for this inexpensive, high-protein food source. Technological developments in feed formulation, such as the use of probiotics and enzymes, also increase nutritional efficiency and reduce environmental impact. Also, growing antibiotic-free and organic feed adoption stands to bond well with consumer tastes toward sustainable and health-conscious farm practices.

United States Poultry Feed Market Analysis

The United States is a leading market for poultry feed in North America with a market share of over 70%. Growing consumer demand for chicken products and improvements in feed formulation are driving demand growth in the U.S. poultry feed market. The need for chicken feed has been rising significantly over time, with the U.S. poultry industry producing 59.7 billion pounds of broiler meat in 2023 alone, according to the U.S. Department of Agriculture. The big players of the game such as Cargill and Tyson Foods also take an advantage of this trend of growth, widening the number of their products and optimizing the feed efficiency. New approaches like probiotics and enzymes have been implemented to support healthy poultry growth and continue propelling the feed market forward. The United States also emerges as one of the prominent feed exporting countries worldwide, where several shipments go to Middle Eastern and Asian countries. Government policies on sustainable farming practices and reduced feed costs are also increasing the market's growth potential.

Europe Poultry Feed Market Analysis

Europe's poultry feed market is growing, based on increased production of poultry and exportation activities. The European Union is the largest producer of poultry in the world with an estimated production of around 13.4 million tons annually, while it acts as a net exporter. The European Commission indicates that the European Union exports less value poultry products but imports the high value ones such as breast meat, and this occurs from Brazil, Thailand, and Ukraine among others. This gives poultry feed a dynamic market. The EU also has strict marketing and quality standards, which make the market more competitive because of the uniformity of products in the region. In 2023, the EU introduced several trade measures, such as import duties and tariff quotas, to protect local producers and maintain a competitive internal market. Moreover, EU policies offer income support to poultry farmers, which further increases feed demand. This leads to increased continuity of sustainability emphasis and higher-quality poultry production enhancing market growth, thus positioning it as a major global player.

Asia Pacific Poultry Feed Market Analysis

The Asia Pacific poultry feed market is growing rapidly as the region's agricultural activities rise and more people eat chicken. The Indian Ministry of Agriculture projects that the country's poultry production would rise by 4.5% year, creating a significant demand for feed. Because of the expanding middle class and rising disposable incomes, the region's consumption of poultry is increasing. Adding probiotics and enzymes makes feed more cost-effective and nutrient-dense. Feed becomes more economical and nutrient-dense when probiotics and enzymes are added. The adoption of more effective feed technology is one of the contemporary chicken farming practices that the Chinese government has been aggressively supporting. Guangdong Haid Group and CP Group are some of the dominant market players within the region with a significant level of research investment in order to keep with the increasing animal protein consumption.

Latin America Poultry Feed Market Analysis

The Latin American poultry feed market is expanding due to robust exports and rising chicken output. Brazil exported over 5 million metric tons of poultry in 2023, according to the Brazilian Animal Protein Association (ABPA), which increased demand for high-quality poultry feed. Mexico's poultry feed market is growing as well, with an emphasis on boosting feed efficiency. The middle class is growing in countries like Brazil and Argentina, which is increasing the demand for poultry products. The trend of adopting advanced feed technologies, such as prebiotics and organic feed, is enhancing the overall market dynamics. Government policies that encourage local poultry production and reduce feed import costs are further strengthening the market's growth.

Middle East and Africa Poultry Feed Market Analysis

As a result of government policies, increased investment, and rising demand for chicken products, the poultry feed markets in the Middle East and Africa are experiencing rapid growth. As stated in reports from the Middle East Chicken Expo, the Saudi government has invested billions of dollars in the feed, egg, and chicken breeding industries to meet the nation's food requirements. Consequently, by 2020, it achieved 60% self-sufficiency in poultry meat, and by 2025, it aims to reach 80% self-sufficiency. Saudi Arabia is exporting table eggs to countries such as Bahrain, Qatar, and the United Arab Emirates after achieving 116% self-sufficiency. According to the Ministry of Environment, Water, and Agriculture, the total investment approvals for poultry and table egg initiatives exceeded 600 million riyals (USD 159.99 million) in 2020. Poultry represents the largest market in the area, featuring more than 2,600 projects throughout the country. Saudi Arabia is one of the largest consumers of poultry meat, averaging 50 kilograms per person each year.

Competitive Landscape:

Major players are investing in research and innovation to formulate feeds with enhanced nutritional profiles that promote better growth, health, and productivity in poultry. Furthermore, the growing emphasis on sustainability is prompting market leaders to source ingredients from sustainable supply chains and also offer organic feed options. Besides this, companies are offering customized feeds that are tailored to different poultry species and even breeds. Additionally, leading companies are acquiring smaller, specialized companies or merging with other market leaders to diversify product portfolios and increase market share. Apart from this, they are adopting direct-to-farmer sales and distribution models to eliminate intermediaries and offer more competitive prices. Moreover, companies are focusing on maintaining consistent product quality by carrying out robust quality assurance programs to gain farmers' trust.

The report provides a comprehensive analysis of the competitive landscape in the poultry feed market with detailed profiles of all major companies, including:

- AFGRI Animal Feeds

- Alltech

- Archer-Daniels-Midland Company

- BASF SE

- Cargill Inc.

- Charoen Pokphand Foods Public Company Limited

- Chr. Hansen Holdings A/S

- De Heus Animal Nutrition

- ForFarmers N.V.

- Kent Nutrition Group (Kent Corporation)

- Koninklijke DSM N.V.

- Novus International Inc. (Mitsui & Co. (U.S.A.) Inc.).

Latest News and Developments:

- November 2024: ForFarmers and team agrar agreed to form 50/50 joint venture for Germany by merging feed activities. Under this name, ForFarmers team agrar will provide both increased market coverage and profit by sharing competencies and resources.

- October 2024: De Heus opened its fifth production site at Purwodadi, in Central Java, focusing on poultry feed. The factory, manufacturing 15,000 tons of monthly capacity, further strengthens the commitment of De Heus toward supporting local poultry farmers with excellent feed solutions.

- September 2024: Ginkgo Bioworks and Novus International collaborated to create cutting-edge feed additives by utilizing Ginkgo's enzyme services. In light of tightening margins and growing feed costs, the alliance seeks to increase animal agriculture's efficiency and sustainability, which is critical for livestock health.

- September 2024: By acquiring two U.S. feed mills from Compana Pet Brands, Cargill increased the amount of animal and pet nutrition it produced. Cargill's growth in the fast growing pet food sector is supported by the deal, with sales expected to reach USD 250 billion by 2030.

- August 2024: CP Foods teamed up with VEGA Instruments to incorporate cutting-edge radar sensor technology into their animal feed production process and enhance real-time raw material level monitoring. This helps improve efficiency and optimizes resource use across all operations in Thailand and Southeast Asia.

Poultry Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Conventional, Organic |

| Forms Covered | Mashed, Pellets, Crumbles, Others |

| Additives Covered | Antibiotics, Vitamins, Antioxidants, Amino Acid, Feed Enzymes, Feed Acidifiers, Others |

| Animal Types Covered | Layers, Broilers, Turkey, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AFGRI Animal Feeds, Alltech, Archer-Daniels-Midland Company, BASF SE, Cargill Inc., Charoen Pokphand Foods Public Company Limited, Chr. Hansen Holdings A/S, De Heus Animal Nutrition, ForFarmers N.V., Kent Nutrition Group (Kent Corporation), Koninklijke DSM N.V., Novus International Inc. (Mitsui & Co. (U.S.A.) Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the poultry feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global poultry feed market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the poultry feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Poultry feed is a specialized blend of nutrients, including grains, proteins, vitamins, and minerals, formulated to meet the dietary needs of poultry such as chickens, turkeys, and ducks. It supports optimal growth, egg production, and overall health, ensuring quality meat and egg yields for the poultry industry.

The poultry feed market was valued at USD 217.91 Billion in 2024.

IMARC estimates the global poultry feed market to exhibit a CAGR of 3.34% during 2025-2033.

The key factors driving the global poultry feed market include increasing poultry consumption, rapid advancements in feed formulations for improved productivity, strict food safety regulations, expansion of poultry farming, and growing adoption of sustainable and organic feed solutions to meet consumer preferences.

According to the report, conventional represented the largest segment by nature, due to its affordability and widespread availability.

Pellets leads the market by form as they reduce feed wastage and ensure uniform nutrient distribution.

Amino acid is the leading segment by additives, as they are essential for optimizing poultry growth and improving feed efficiency.

Broilers are the leading segment by animal type, due to their high demand for meat production, which requires nutrient-rich feed for rapid growth.

Offline is the leading segment by distribution channel, as they provide direct access to farmers, ensuring timely delivery of bulk feed.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global poultry feed market include AFGRI Animal Feeds, Alltech, Archer-Daniels-Midland Company, BASF SE, Cargill Inc., Charoen Pokphand Foods Public Company Limited, Chr. Hansen Holdings A/S, De Heus Animal Nutrition, ForFarmers N.V., Kent Nutrition Group (Kent Corporation), Koninklijke DSM N.V., Novus International Inc. (Mitsui & Co. (U.S.A.) Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)