Postoperative Pain Therapeutics Market Size, Share, Trends and Forecast by Drug Class, Route of Administration, Distribution Channel, and Region, 2025-2033

Postoperative Pain Therapeutics Market Size and Share:

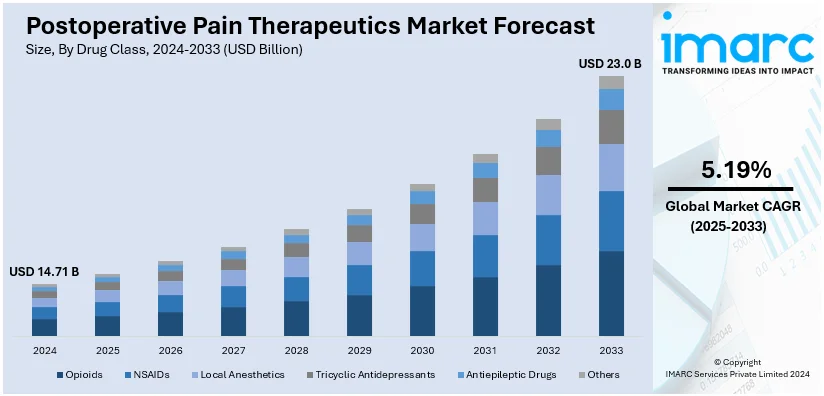

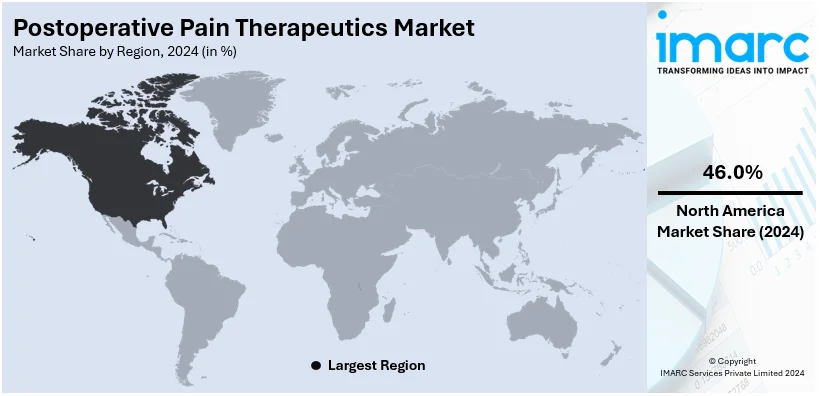

The global postoperative pain therapeutics market size was valued at USD 14.71 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.0 Billion by 2033, exhibiting a CAGR of 5.19% from 2025-2033. North America currently dominates the market, holding a market share of over 46.0% in 2024. The increasing number of orthopedic surgeries, improving healthcare infrastructure, and extensive research and development (R&D) activities represent some of the key factors driving the market in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.71 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Market Growth Rate (2025-2033) | 5.19% |

A major driver in the postoperative pain therapeutics market is the increasing global surgical procedures and the subsequent demand for effective pain management. As the number of surgeries, both elective and emergency rises worldwide, there is a growing need for effective postoperative pain relief solutions. This demand is driven by the focus on enhancing patient outcomes, improving recovery times, and reducing the risk of complications. Advances in pain management, including novel analgesics and multimodal therapies, are shaping the market, offering patients better control over postoperative pain while minimizing side effects associated with traditional treatments.

In the U.S., the postoperative pain therapeutics market holds a significant share of 88.50% leading to a high volume of surgical procedures and a strong focus on improving patient care and recovery. With an aging population and increasing prevalence of chronic conditions, there is a rising demand for effective pain management solutions. For instance, in 2024, the U.S. performed 51.4 million surgical procedures, including 1.3 million Cesarean sections and 719,000 total knee replacements, driving the demand for advanced postoperative pain therapeutics. The market is influenced by advancements in opioid alternatives, such as non-opioid analgesics, regional anesthesia, and nerve blocks as the country faces an opioid crisis. Regulatory initiatives and healthcare policies promoting safer pain management options are further propelling the adoption of innovative therapeutics to enhance recovery outcomes and minimize opioid dependency risks.

Postoperative Pain Therapeutics Market Trends:

Rising demand for non-opioid pain management

The growing concern over opioid addiction and misuse has led to a significant shift toward non-opioid pain management solutions in the postoperative pain therapeutics market. Healthcare providers are increasingly opting for alternatives such as non-steroidal anti-inflammatory drugs (NSAIDs), local anesthetics, and novel analgesics like nerve growth factor inhibitors and cannabinoids. These alternatives offer effective pain relief while reducing the risk of dependency and adverse side effects commonly associated with opioids. This trend is particularly prominent in countries like the U.S., where regulatory measures and public health initiatives are focused on combating the opioid epidemic. The shift toward non-opioid therapies is expected to continue as more effective and safer pain management options emerge.

Advancement in personalized pain management

Personalized pain management is becoming a key trend in the postoperative pain therapeutics market. Healthcare providers are increasingly tailoring pain management strategies based on individual patient profiles, considering factors such as genetics, underlying health conditions, and pain sensitivity. This approach allows for more precise and effective pain relief while minimizing the risk of side effects. Advances in genetic testing, biomarkers, and artificial intelligence (AI) are enabling clinicians to develop personalized treatment plans that optimize the efficacy of postoperative pain therapies. This trend is being driven by the growing recognition that a one-size-fits-all approach to pain management is not always effective and that personalized care can improve patient outcomes.

Increased use of multimodal pain management approaches

Multimodal pain management, which combines different analgesic techniques to manage postoperative pain, is gaining traction in the market. By using a combination of medications and techniques such as local anesthetics, opioids (in lower doses), NSAIDs, and physical therapy, healthcare providers can offer more comprehensive and effective pain relief while reducing the need for high opioid doses. This approach not only enhances the efficacy of pain management but also helps minimize opioid-related risks and side effects. The growing emphasis on reducing opioid use in postoperative care, coupled with advances in pain management technology, is expected to further drive the adoption of multimodal pain management strategies in the coming years.

Postoperative Pain Therapeutics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global postoperative pain therapeutics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug class, route of administration, and distribution channel.

Analysis by Drug Class:

- Opioids

- NSAIDs

- Local Anesthetics

- Tricyclic Antidepressants

- Antiepileptic Drugs

- Others

Opioids stands as the largest component in 2024, holding around 61.2% of the market due to their long-standing efficacy in managing moderate to severe pain. Opioids, such as morphine, hydrocodone, and oxycodone, are commonly prescribed following surgeries due to their potent analgesic properties, which provide quick and effective relief for patients recovering from major procedures. Despite growing concerns over opioid misuse and dependency, opioids remain a primary choice in postoperative care, especially for acute pain management. The widespread availability and established clinical guidelines for opioid use, along with their ability to address complex pain scenarios, contribute to their continued dominance in the market. However, ongoing efforts to reduce opioid dependence are impelling the interest in alternative therapies.

Analysis by Route of Administration:

- Oral

- Intravenous

- Intramuscular

- Others

Oral leads the market at a fair 37.9% share by the end of 2024. The convenience and ease in giving, combined with its overall efficacy in treating moderate pain during postoperative periods, make oral pain relief pills and capsules popular. Patients prefer the ease of an oral route in administering non-invasive means to reduce the pain encountered during their recovery. Oral analgesics encompass the use of both opioids and NSAIDs or other types of non-opioids. These preparations are favored for out-patient treatment because they allow patients to take their medication at home. Oral pain medications are popular because they are cost-effective, available, and familiar to both providers and patients. However, increasing perceptions of misuse fuel a growing trend toward alternatives in the market.

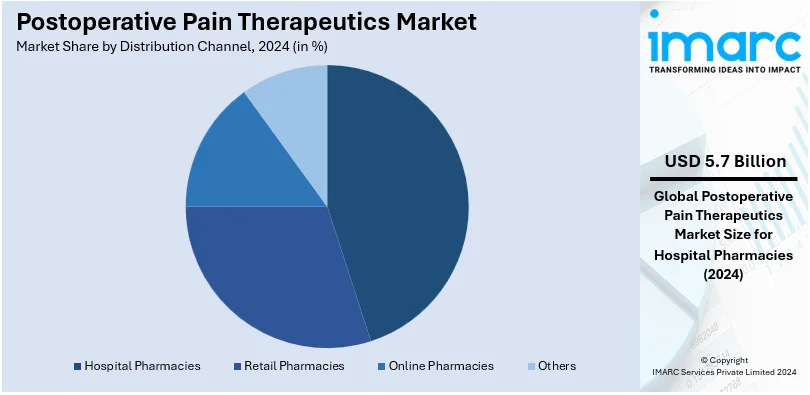

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

In 2024, hospital pharmacies accounts for the majority of the market at around 38.7%. This dominance is driven by the central role hospital pharmacies play in managing postoperative care, particularly in the inpatient setting. Hospitals are the main site for surgeries and hence represent the main dispensation points for postoperative analgesics, which comprise both opioids and non-opioids, as well as regional anesthetics. It is in the hospitals where these pharmacies offer specific pain management prescriptions; thus, patients receive medications corresponding to their surgical procedures. Also, the availability of expert personnel, such as pharmacists and pain management experts, ensures the correct utilization of medication, with lower tendencies towards misuse. Hospitals are also better placed to tackle complex pain management regimens and monitor the consequences on patients.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 46.0%, spurred the volume of procedures conducted in the region, especially in the U.S. Increasing elderly population, prevalence of chronic diseases, and the state of evolution of surgical technology increase the rising demand for effective solutions to pain management. To add to that, North America houses major pharmaceutical players as well as a health care infrastructure, which makes the development and delivery of innovative pain relief therapies faster. The trend in minimizing opioid misuse, along with a preference for non-opioid alternatives and multimodal pain management, contributes to region-specific growth in the market.

Key Regional Takeaways:

United States Postoperative Pain Therapeutics Market Analysis

The postoperative pain therapeutics market in the United States is driven by several factors, including the aging population, increasing surgical procedures, and a growing prevalence of chronic diseases. According to the U.S. Department of Health and Human Services, an estimated 129 million Americans suffer from at least one major chronic condition, such as heart disease, cancer, diabetes, obesity, or hypertension. This rising burden of chronic diseases necessitates an increased number of surgical procedures, thus further increasing demand for effective postoperative pain management. Improved drug formulation, such as extended-release formulations and targeted delivery systems, also enhances pain relief and reduces side effects. Growing concerns over opioid addiction are promoting the need for non-opioid alternatives such as nerve blocks and regional anesthesia, further driving the demand for effective postoperative pain management. Well-established healthcare infrastructure in the U.S. helps to establish a high adoption rate for these new therapies. The positive reimbursement policies for pain treatments, along with recovery outcome improvements, are pushing the growth of the postoperative pain therapeutics market. Personalized medicine, the development of which will base pain management strategies on specific patient requirements, is also anticipated to be a significant growth driver for the postoperative pain therapeutics market in the U.S.

Europe Postoperative Pain Therapeutics Market Analysis

The European postoperative pain therapeutics market is motivated by several factors, like the ageing population, an increase in surgical procedures, and more attention to patient-centered care. Eurostat, the European Union's statistical office, estimated that, as of 1 January 2023, the population of the EU stood at 448.8 Million with more than a fifth of them (21.3%) aged 65 years and over. This demographic shift is causing a proliferation of age-related surgeries that involve joint replacements, cataract surgeries, and cardiovascular procedures, making up the bulk of this substantial demand for effective postoperative pain management. Cost-effectiveness and efficiency have come to be at the top of Europe's health concerns, thus the growing adaptation of advanced pain management therapies that enhance patient outcomes as well as reduce recovery periods. With an increasing attention to opioid usage in terms of growing addiction issues, the current demand for alternatives to treatment, including non-opioid analgesics and nerve blocks with regional anesthetics, is at an all-time high. The adoption of innovative therapies for pain across Europe benefits from robust regulatory frameworks coupled with sound reimbursement policies. The continually evolving medical research and newer technologies in drug delivery devices, such as extended-release formulations and transdermal patches, are also enhanced to increase the effectiveness of postoperative pain management. With government initiatives and private healthcare infrastructures, these advanced technologies are also being adopted among the developed and emerging markets of Europe.

Asia Pacific Postoperative Pain Therapeutics Market Analysis

The Asia-Pacific postoperative pain therapeutics market is driven mostly by the rising number of surgeries, increasing healthcare awareness, and a growing demand for advanced pain management solutions. The aging population is a significant factor, with the number of older persons in the region expected to more than double from 630 Million in 2020 to approximately 1.3 Billion by 2050, as stated by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP). This demographic shift is responsible for an increased number of surgeries, including joint replacements and cardiovascular procedures. The demand for efficient pain management strategies is also enhanced due to this. A rise in the preference for minimally invasive surgeries requires efficient postoperative pain solutions to enhance recovery. The increased concerns over opioid addiction drive a shift toward non-opioid analgesics and alternative therapies. Improved access to and infrastructure of health care, especially in the emerging markets of India and China, are also enhancing market growth by allowing a wider adoption of advanced pain management treatments.

Latin America Postoperative Pain Therapeutics Market Analysis

The Latin American market for postoperative pain therapeutics is driven by a rising number of surgeries, increasing population, and aged populace. According to NCBI, in Latin America and Caribbean region, about 71 Million is over 60 years and make up 11.2% of the population. The percentage aged 60+ is the highest in the Caribbean at 13.2%, followed by South America at 11.7% and Central America at 9.6%. Rising levels of the elderly population means that the incidence of surgical conditions is high, thus calling for effective pain management solutions; growing health awareness and changes toward less dependent alternatives, such as the non-opioid drug, enhance market growth.

Middle East and Africa Postoperative Pain Therapeutics Market Analysis

The Middle East and Africa postoperative pain therapeutics market is expected to grow with increased healthcare investments, a growing number of surgical procedures, and an expanding patient population. According to Dubai Health Care Authority, GCC's healthcare spending is expected to reach a compound annual growth rate (CAGR) of 4.9% in the GCC, which is estimated to touch USD 99.6 billion in 2023 compared with USD 86.2 billion in 2020. The demand for these advanced pain management therapies, especially in the UAE, Saudi Arabia, and other GCC countries, increases because of better healthcare systems. Increasing levels of opioid substitutes are also making the non-opioid pain management solution experience wider growth.

Competitive Landscape:

The postoperative pain therapeutics market is highly competitive, with large and small companies vying to develop novel pain management solutions in response to increased demand for effective postoperative care. The key market players dominate the market with their long-standing well-established pain relief products such as opioids and non-opioid analgesics. Furthermore, innovations by manufacturers are also leading the market through novel treatments including extended-release formulations and cryoablation probes. New entrants focus on regional anesthesia and nerve block technologies. Collaboration, partnership, and acquisition remain common ways of expanding market presence. Also, due to the opioid crisis, a preference for non-opioid alternatives has grown, increasing investment in alternative therapies, thus increasing competition.

The report provides a comprehensive analysis of the competitive landscape in the postoperative pain therapeutics market with detailed profiles of all major companies, including:

- Heron Therapeutics

- Mallinckrodt Pharmaceuticals

- Pacira BioSciences, Inc.

- Pfizer, Inc.

- Trevena, Inc.

Latest News and Developments:

- In October 2024, Allay Therapeutics expanded its Clinical and Scientific Advisory Boards, appointing nine experts in pain management, orthopedics, clinical research, and related fields. They will guide the company as it advances ATX101 through a Phase 2B trial, focusing on novel, extended-duration postoperative pain management solutions.

- In October 2024, AtriCure introduced the cryoSPHERE MAX™ cryoablation probe for postoperative pain management. The probe reduces freeze times by 50% compared to its predecessor and improves efficiency with a larger 10 mm ball tip, enhanced insulation, and real-time temperature monitoring, optimizing Cryo Nerve Block™ therapy.

- In April 2024, AtriCure launched the cryoSPHERE®+ cryoablation probe for postoperative pain, reducing freeze times by 25%. The FDA-cleared device improved efficiency and reduced operative time by minimizing thermal loss and optimizing energy at the ball tip.

- In January 2024, Heron Therapeutics formed a five-year partnership with CrossLink Life Sciences to expand the sales network for ZYNRELEF® (bupivacaine and meloxicam). The partnership added 650 representatives, focusing on orthopedic indications. CrossLink to be compensated based on vial sales growth, aiming to improve access to ZYNRELEF for postoperative pain management.

Postoperative Pain Therapeutics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Opioids, NSAIDs, Local Anesthetics, Tricyclic Antidepressants, Antiepileptic Drugs, Others |

| Route of Administrations Covered | Oral, Intravenous, Intramuscular, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Heron Therapeutics, Mallinckrodt Pharmaceuticals, Pacira BioSciences, Inc., Pfizer, Inc., Trevena, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the postoperative pain therapeutics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global postoperative pain therapeutics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the postoperative pain therapeutics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Postoperative pain therapeutics refers to treatments and medications used to manage pain following surgery. These therapies aim to provide effective pain relief while minimizing side effects. Common approaches include opioid and non-opioid analgesics, nerve blocks, regional anesthesia, and innovative drug delivery systems, focusing on enhancing recovery and reducing dependency risks.

The postoperative pain therapeutics market was valued at USD 14.71 Billion in 2024.

IMARC estimates the global postoperative pain therapeutics market to exhibit a CAGR of 5.19% during 2025-2033.

Key factors driving the global postoperative pain therapeutics market include the increasing volume of surgeries, aging populations, rising prevalence of chronic conditions, advancements in opioid alternatives, and growing demand for non-opioid analgesics. Additionally, healthcare policies promoting safer pain management and enhanced recovery outcomes further support market growth.

In 2024, opioids represented the largest segment by drug class, driven by their widespread use and effectiveness.

Oral leads the market by route of administration owing to its convenience, ease of use, and patient preference.

Hospital pharmacies are the leading segment by distribution channel, driven by direct access to surgical patients and healthcare systems.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global postoperative pain therapeutics market include Heron Therapeutics, Mallinckrodt Pharmaceuticals, Pacira BioSciences, Inc., Pfizer, Inc., Trevena, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)