Positive Airway Pressure Devices Market Report by Product Type (Automatic Positive Airway Pressure (APAP) Devices, Continuous Positive Airway Pressure (CPAP) Devices, Bi-level Positive Airway Pressure (BiPAP) Devices), End User (Hospitals and Sleep Labs, Home Care, and Others), and Region 2025-2033

Global Positive Airway Pressure Devices Market:

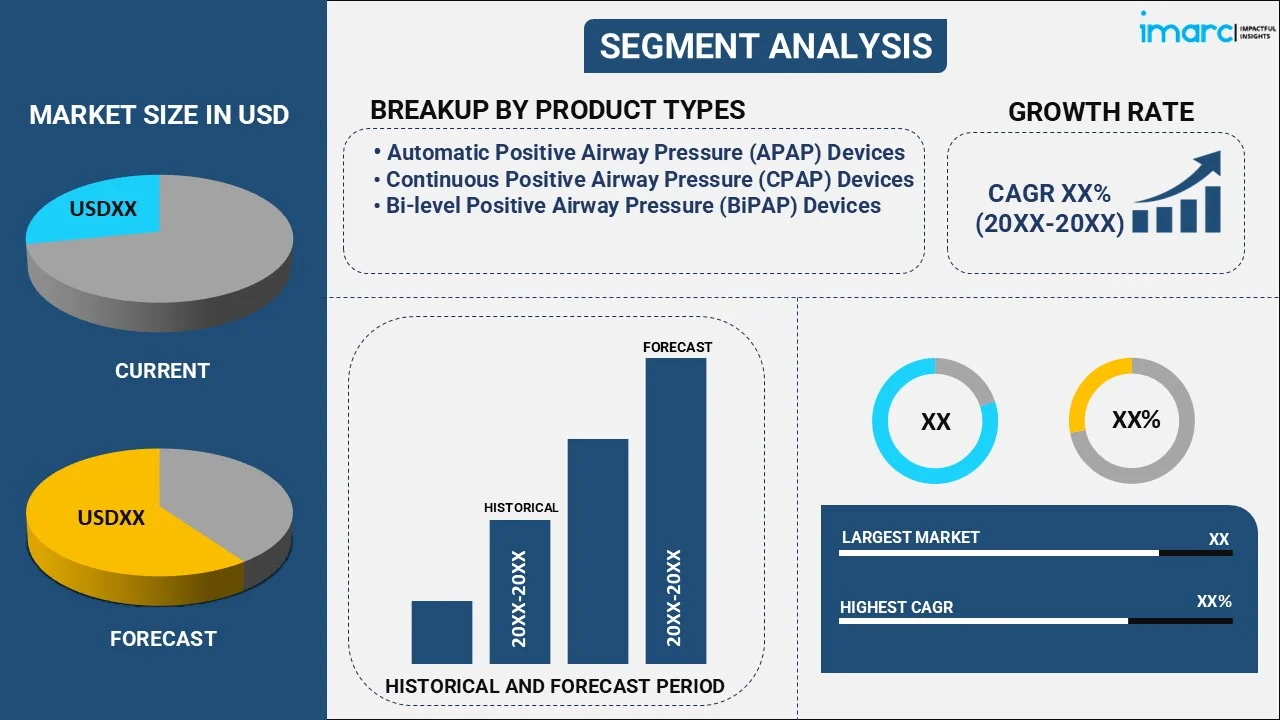

The global positive airway pressure devices market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.14% during 2025-2033. The increasing occurrence of depression, hypertension, diabetes, and heart disorders is stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.8 Billion |

|

Market Forecast in 2033

|

USD 6.1 Billion |

| Market Growth Rate (2025-2033) | 5.14% |

Positive Airway Pressure Devices Market Analysis:

- Major Market Drivers: The wide availability of favorable reimbursement policies by government bodies is one of the key factors bolstering the market.

- Key Market Trends: The introduction of compact and convenient product variants with enhanced noise reduction features is positively impacting the market.

- Competitive Landscape: Some of the prominent companies in the global market include 3B Medical Inc., Apex Medical Corp., Compumedics Limited (D & DJ Burton Holdings Pty Ltd.), Drive Devilbiss Healthcare (Drive International LLC), Fisher & Paykel Healthcare Limited, Koninklijke Philips N.V., Resmed Inc., Smiths Group Plc, Somnetics International Inc., and Vyaire Medical Inc., among many others.

- Geographical Trends: The increasing number of studies conducted by healthcare institutes is contributing to the market in North America.

- Challenges and Opportunities: The high cost related to devices is hampering the market. However, the development of user-friendly and comfortable PAP devices to enhance patient adherence is expected to fuel the market in the coming years.

Positive Airway Pressure Devices Market Trends:

Increasing Prevalence of Sleep Apnea

The rising awareness towards the occurrence of sleep disorders is escalating the demand for diagnosis and treatment, which is catalyzing the market. For example, in May 2024, Dutch healthcare company Philips launched continuous positive airway pressure (CPAP) therapy devices that are used to treat sleep apnea. Moreover, in India, Philips offered support through a hotline and website. This is contributing to the positive airway pressure devices market outlook.

Rising Technological Advancements

Continuous innovations, which enhance treatment efficacy, automatically adjust pressure levels based on the user's needs, elevate patient comfort, etc., are stimulating the market. Furthermore, advances in mask design with features aimed at minimizing noise are also propelling the overall market. In July 2024, Varon, previously known for oxygen concentrator solutions, introduced its new Sunnygrand series that offer effective and comfortable treatment for sleep apnea patients, integrating with doctors' prescribed settings and therapy plans. It also supports ongoing monitoring and adjustments by healthcare professionals. As per the positive airway pressure devices market analysis report, it is acting as a significant growth-inducing factor.

Escalating Demand for Home Healthcare

With the inflating healthcare costs and the increasing emphasis on patient-centric care, more individuals are opting for home-based management of sleep apnea. It allows healthcare providers to monitor and adjust treatment remotely. In March 2024, React Health developed a travel CPAP called the Luna TravelPAP. It is a small, lightweight positive airway pressure device with CPAP and AutoCPAP modes. Additionally, it has supply reminders, an optional carrying case, a light ring indicator, etc.

Global Positive Airway Pressure Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the positive airway pressure devices market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the product type and end user.

Breakup by Product Type:

- Automatic Positive Airway Pressure (APAP) Devices

- Continuous Positive Airway Pressure (CPAP) Devices

- Bi-level Positive Airway Pressure (BiPAP) Devices

Continuous positive airway pressure (CPAP) devices dominate the total positive airway pressure devices market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes automatic positive airway pressure (APAP) devices, continuous positive airway pressure (CPAP) devices, and Bi-level positive airway pressure (BiPAP) devices. According to the report, continuous positive airway pressure (CPAP) devices represented the largest market segmentation.

The inflating requirement for enhanced user comfort and treatment efficacy is driving the segment's growth. For example, the development of ResMed's AirSense 11, which features an auto-adjusting algorithm and integrated connectivity that enables personalized therapy adjustments and remote monitoring.

Breakup by End User:

- Hospitals and Sleep Labs

- Home Care

- Others

Hospitals and sleep labs hold the majority of the global positive airway pressure devices market demand

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and sleep labs, home care, and others. According to the report, hospitals and sleep labs represented the largest market segmentation.

In these clinical settings, advanced PAP devices are utilized to ensure accurate diagnosis and effective treatment. For example, the Philips Respironics DreamStation BiPAP AutoSV is frequently adopted in hospitals for patients with complex sleep apnea, owing to its ability to adjust pressure levels automatically based on the patient's needs. This is expanding the positive airway pressure devices market forecast report.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The positive airway pressure devices market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The widespread prevalence of sleep apnea and other respiratory disorders is augmenting the positive airway pressure devices market outlook report in North America. In February 2024, ResMed introduced its AirCurve 11 series bilevel positive airway pressure devices in the U.S. It is designed to help providers treat sleep apnea while patients start and stay on therapy.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- 3B Medical Inc.

- Apex Medical Corp.

- Compumedics Limited (D & DJ Burton Holdings Pty Ltd.)

- Drive Devilbiss Healthcare (Drive International LLC)

- Fisher & Paykel Healthcare Limited

- Koninklijke Philips N.V.

- Resmed Inc.

- Smiths Group Plc

- Somnetics International Inc.

- Vyaire Medical Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Positive Airway Pressure Devices Market Recent Developments:

- July 2024: Varon, previously known for oxygen concentrator solutions, introduced its new Sunnygrand series that offer effective and comfortable treatment for sleep apnea patients, integrating with doctors' prescribed settings and therapy plans.

- May 2024: Dutch healthcare company Philips launched continuous positive airway pressure (CPAP) therapy devices that are used to treat sleep apnea.

- March 2024: React Health developed a travel CPAP called the Luna TravelPAP. It is a small, lightweight positive airway pressure device with CPAP and AutoCPAP modes.

Positive Airway Pressure Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Automatic Positive Airway Pressure (APAP) Devices, Continuous Positive Airway Pressure (CPAP) Devices, Bi-level Positive Airway Pressure (BiPAP) Devices |

| End Users Covered | Hospitals and Sleep Labs, Home Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3B Medical Inc., Apex Medical Corp., Compumedics Limited (D & DJ Burton Holdings Pty Ltd.), Drive Devilbiss Healthcare (Drive International LLC), Fisher & Paykel Healthcare Limited, Koninklijke Philips N.V., Resmed Inc., Smiths Group Plc, Somnetics International Inc., Vyaire Medical Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the positive airway pressure devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global positive airway pressure devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the positive airway pressure devices industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global positive airway pressure devices market was valued at USD 3.8 Billion in 2024.

We expect the global positive airway pressure devices market to exhibit a CAGR of 5.14% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the rising deployment of positive airway pressure devices to treat type 1 respiratory failure in the coronavirus-infected patients.

The growing prevalence of hypertension, depression, diabetes, and heart disorders, along with the increasing adoption of respiratory ventilation to improve the oxygenation of patients in ICUs, is primarily driving the global positive airway pressure devices market growth.

Based on the product type, the global positive airway pressure devices market has been segregated into Automatic Positive Airway Pressure (APAP) devices, Continuous Positive Airway Pressure (CPAP) devices, and Bi-level Positive Airway Pressure (BiPAP) devices. Among these, Continuous Positive Airway Pressure (CPAP) devices currently account for the majority of the total market share.

Based on the end user, the global positive airway pressure devices market can be bifurcated into hospitals and sleep labs, home care, and others. Currently, hospitals and sleep labs exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global positive airway pressure devices market include 3B Medical Inc., Apex Medical Corp., Compumedics Limited (D & DJ Burton Holdings Pty Ltd.), Drive Devilbiss Healthcare (Drive International LLC), Fisher & Paykel Healthcare Limited, Koninklijke Philips N.V., Resmed Inc., Smiths Group Plc, Somnetics International Inc., and Vyaire Medical Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)