Population Health Management Market Report by Component (Software, Services), Mode of Delivery (Cloud-based, Web-based, On-premises), End User (Healthcare Providers, Healthcare Payers, Employer Groups, Government Bodies), and Region 2026-2034

Global Population Health Management Market:

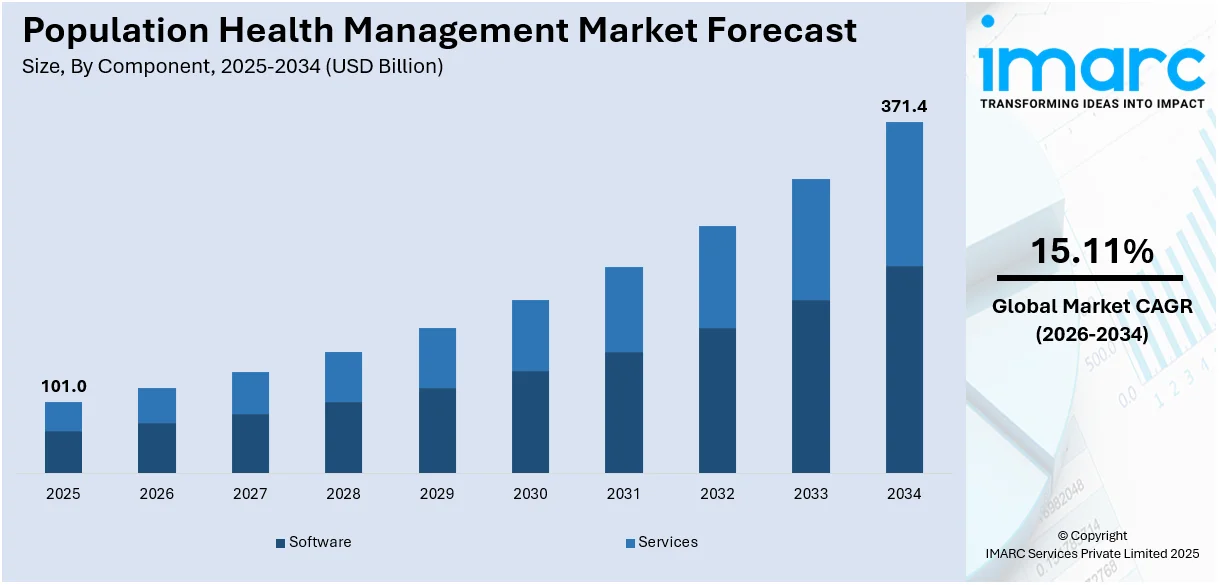

The global population health management market size reached USD 101.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 371.4 Billion by 2034, exhibiting a growth rate (CAGR) of 15.11% during 2026-2034. The growing preference among individuals for personalized medicine, along with the continuous advancements in the healthcare industry, are propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 101.0 Billion |

|

Market Forecast in 2034

|

USD 371.4 Billion |

| Market Growth Rate 2026-2034 | 15.11% |

Population Health Management Market Analysis:

- Major Market Drivers: The increasing geriatric population prone to acute and chronic medical ailments is stimulating the market. Additionally, the growing focus among healthcare providers on offering patient-centric care to individuals by ensuring appropriate interventions and minimizing readmission rates is further bolstering the overall population health management market.

- Key Market Trends: The rising integration of advanced analytics solutions, as they aid in faster and more accurate diagnoses, delivery of data digitally, generation of precise models for analyzing disease trajectory, etc., is one of the emerging trends catalyzing the market.

- Competitive Landscape: Some of the prominent companies across the global market include Athenahealth, Cedar Gate Technologies, Conifer Health Solutions, eClinicalWorks, Health Catalyst, Lightbeam Health Solutions, Medical Information Technology, Inc., NXGN Management, LLC, Optum, Inc., Oracle, and Veradigm LLC, among many others.

- Geographical Trends: According to the population health management market overview, North America currently dominates the market. This is attributed to the growing emphasis of government bodies on providing preventive healthcare and the management of chronic conditions. Moreover, the escalating demand for advanced technologies, including artificial intelligence, big data analytics, electronic health records (EHRs), etc., which enable healthcare providers to analyze vast amounts of data, will continue to fuel the regional market in the coming years.

- Challenges and Opportunities: Various healthcare providers adopt several platforms that often do not communicate seamlessly, thereby complicating the consolidation of data crucial for effective population health management. However, the development of novel value-based care models to enhance patient outcomes is propelling the market.

To get more information on this market Request Sample

Population Health Management Market Trends:

Favorable Government Policies

The launch of numerous initiatives by regulatory bodies to help healthcare providers integrate population health management software, as it improves patient outcomes and reduces overall healthcare expenditures, is propelling the market. For example, in July 2022, the UK Parliament passed the Health and Care Bill to grant legal responsibilities to integrated care systems (ICSs). Additionally, government bodies in the U.S. implemented the Affordable Care Act (ACA) to prevent chronic diseases and promote the adoption of healthcare IT solutions. Besides this, the Affordable Care Act (ACA) creates opportunities for population health management service providers to collect and maintain data for patients. Moreover, public and private medical organizations are focusing on digitizing the collection and processing of health-related information, which is also bolstering the population health management market demand. For instance, in February 2024, UNICEF handed over 40 computers funded by the Government of Canada to the Ministry of Health and Population in the Central African Republic to improve the management of vaccine and medicine stocks across the country. In addition to this, in May 2024, Lichfield District Council, a local government district in Staffordshire, England, collaborated with Impera Analytics Ltd, one of the data analytics companies in the UK, to enhance the wellbeing of the community by sharing anonymized NHS health data. These above-mentioned initiatives mark a significant advancement in public health management, which is anticipated to drive the market over the forecasted period.

Rising Healthcare IT Solutions

The increasing inclination among individuals towards value-based reimbursement structures and accountable care is acting as a significant growth-inducing factor. Apart from this, the escalating demand for better-personalized medicine is offering significant potential prospects for market players. Moreover, healthcare IT solutions help PHM providers in collecting data and enabling insurers to get the most out of their healthcare expenditures. This, in turn, represents one of the population health management market's recent opportunities. According to the findings from a survey of CIOs and IT executives, 92% of healthcare IT leaders said that their organizations are placing a high priority on data integration planning. Additionally, owing to the elevating penetration of smartphones, the rising popularity of mHealth applications for improved chronic disease management is further bolstering the market. As per a Mass Media Data report, around 5.31 billion individuals were using mobile phones at the beginning of 2022. Besides this, the inflating focus among key players on digitizing healthcare services for providing enhanced population health management is also strengthening the market. For example, in September 2021, the Prime Minister of India introduced the Pradhan Mantri Digital Health Mission to establish an accessible and secure digital healthcare system across the country, enabling individuals to access, store, and authorize the sharing of their health records. Furthermore, numerous mergers and acquisitions (M&A) activities among industry players are elevating the population health management market's recent price. For instance, in March 2023, Osigu acquired Servinte, one of the largest electronic health records (EHRs) and healthcare software providers in Columbia, Mexico, to enhance Servinte's capabilities through the integration of cutting-edge technologies.

Several Technological Innovations

The introduction of big data technologies and advanced analytics platforms that enable healthcare organizations to analyze and process vast amounts of data from various sources, including insurance claims, electronic health records (EHRs), patient-generated data, etc., is catalyzing the market. By leveraging this data, healthcare providers can predict health trends, identify at-risk individuals, customize treatment plans to address specific community health needs effectively, etc. This, in turn, is positively influencing the population health management market outlook. For example, in April 2024, Pine Park Health, one of the fast-growing primary care companies currently serving residents of senior living communities in Arizona, California, and Nevada, adopted Innovaccer’s leading healthcare AI platform to optimize population health analytics. Apart from this, the increasing integration of machine learning and artificial intelligence (AI) algorithms with PHM systems is also fueling the global market. For instance, in March 2024, Reperio Health, the only provider of onsite and at-home comprehensive health screenings with instant results, partnered with Applied Health Analytics to provide medical insights to healthcare professionals. Additionally, in February 2024, Persistent Systems, one of the global digital engineering and enterprise modernization leaders, launched an innovative Generative AI-powered population health management (PHM) solution in collaboration with Microsoft. The solution identifies Social Determinants of Health (SDoH) to determine the non-clinical needs of patients.

Population Health Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the population health management market forecast at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the component, mode of delivery, and end user.

Breakup by Component:

- Software

- Services

Services currently exhibit a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services. According to the report, services represent the largest segment.

The demand for population health management services is escalating among hospitals and other healthcare organizations to involve third parties to assess patient data. Moreover, the growing requirement for integrated healthcare systems is also augmenting the segment's growth. Apart from this, the rising investments in R&D activities by prominent players to launch innovative population health management services are bolstering the market. For example, in December 2022, the Morris Heights Health Center (MHHC) entered into a partnership with Garage, one of the population health management technology companies, for using Garage's software as a service population health management platform called Bridge that provided enhanced care to 50,000 patients across the Bronx community, U.S. Moreover, the platform is specifically designed to connect care teams and providers to facilitate the exchange of patient information, patient tracking and communication, secure messaging, referral management, clinical integration, etc.

Breakup by Mode of Delivery:

- Cloud-based

- Web-based

- On-premises

Cloud-based dominates the population health management market share

The report has provided a detailed breakup and analysis of the market based on the mode of delivery. This includes cloud-based, web-based, and on-premises. According to the report, cloud-based represented the largest market segmentation.

A cloud-based population health management system is gaining extensive traction, as it involves the integration of cutting-edge data technologies and advanced analytics. In line with this, cloud-based platforms enable workflow automation, offer improved care management, assist in providing better clinical results, etc. Consequently, they are widely utilized by private and public healthcare organizations. For example, in March 2024, Innovaccer Inc., one of the healthcare AI platform companies, received the top ratings from hospitals and was recognized as the leading population health management (PHM) vendor in the Black Book customer survey.

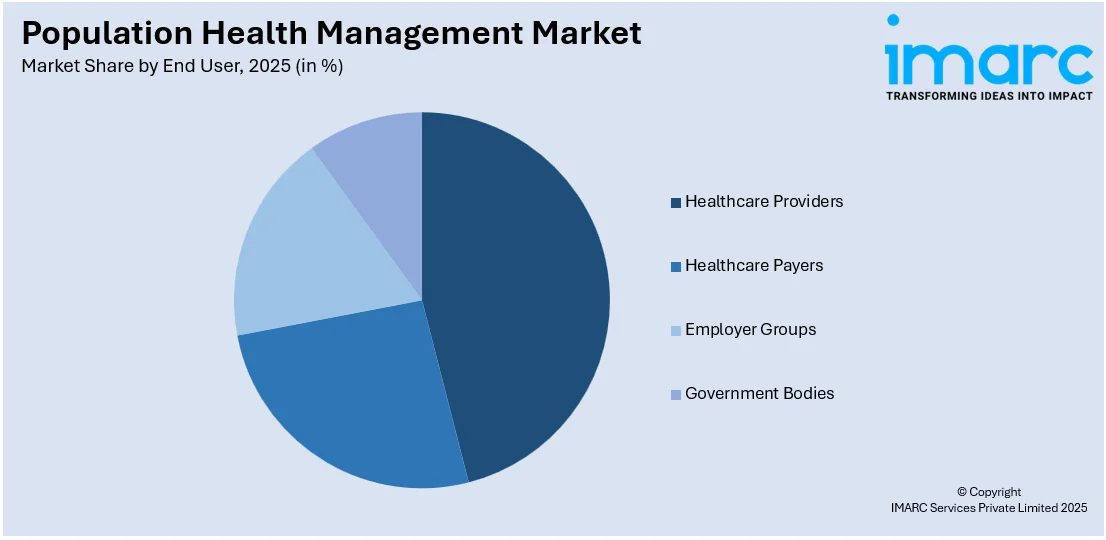

Breakup by End User:

Access the comprehensive market breakdown Request Sample

- Healthcare Providers

- Healthcare Payers

- Employer Groups

- Government Bodies

As per the population health management market statistics, healthcare providers account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes healthcare providers, healthcare payers, employer groups, and government bodies. According to the report, healthcare providers represented the largest segment.

Healthcare providers are investing in population health management solutions to offer better outcomes, which is fueling the segment's growth. Additionally, they can be used to analyze data of patients, which, in turn, aids in providing insights into their health. Apart from this, the sudden outbreak of the COVID-19 pandemic helped healthcare providers to offer physicians an integrated electronic medical record (EMR) and create registries.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest market for population health management.

Minimizing healthcare costs, favorable regulatory scenarios, and the widespread adoption of IT solutions in the healthcare industry represent some of the primary factors augmenting the population health management market revenue in North America. Moreover, in this region, the U.S. is one of the key hubs that offer commercialized PHM services, with more than 100 companies operating in the country. Apart from this, the rising focus of key players on providing patient-centric care is also acting as another significant growth-inducing factor. Additionally, the escalating popularity of big data and cloud computing and continuous reforms by government bodies are projected to stimulate the regional market over the forecasted period. For instance, the Affordable Care Act (ACA) was implemented by regulatory bodies in the U.S. to minimize the prevalence of chronic diseases. Furthermore, the ACA aids population health management service providers in collecting and maintaining patients’ data, which is creating significant opportunities for industry players.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major population health management market companies have also been provided. Some of the key players in the market include:

- Athenahealth

- Cedar Gate Technologies

- Conifer Health Solutions

- eClinicalWorks

- Health Catalyst

- Lightbeam Health Solutions

- Medical Information Technology, Inc.

- NXGN Management, LLC

- Optum, Inc.

- Oracle

- Veradigm LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Population Health Management Market Recent Developments:

- May 2024: Senseonics Holdings, Inc., one of the medical technology companies focused on the development of long-term, implantable continuous glucose monitor (CGM) systems, collaborated with Ascensia Diabetes Care and St. Louis-based Mercy to improve diabetes population health management.

- April 2024: Pine Park Health leveraged the healthcare AI platform of Innovaccer to optimize population health analytics for senior living communities in California, Arizona, and Nevada, U.S.

- March 2024: Reperio Health and Applied Health Analytics partnered to offer immediate access to at-home biometric screening data to support employee health.

- February 2024: Persistent Systems, one of the prominent digital engineering and enterprise modernization leaders, collaborated with Microsoft to introduce an innovative, generative AI-powered population health management (PHM) solution.

Population Health Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Services |

| Mode of Deliveries Covered | Cloud-based, Web-based, On-premises |

| End Users Covered | Healthcare Providers, Healthcare Payers, Employer Groups, Government Bodies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Athenahealth, Cedar Gate Technologies, Conifer Health Solutions, eClinicalWorks, Health Catalyst, Lightbeam Health Solutions, Medical Information Technology, Inc., NXGN Management, LLC, Optum, Inc., Oracle, Veradigm LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the population health management market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global population health management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the population health management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global population health management market was valued at USD 101.0 Billion in 2025.

We expect the global population health management market to exhibit a CAGR of 15.11% during

2026-2034.

The introduction of numerous government policies for improving population health, enhancing overall patient experience, and easing healthcare outcomes is currently driving the global population health management market growth.

The sudden outbreak of the COVID-19 pandemic has led to the growing adoption of population health management solutions for providing real-time access to medical information of patients suffering from the coronavirus infection.

Based on the component, the global population health management market can be categorized into software and services, where services currently exhibit a clear dominance in the market.

Based on the mode of delivery, the global population health management market has been segmented into cloud-based, web-based, and on-premises. Among these, cloud-based represents the largest market share.

Based on the end user, the global population health management market can be bifurcated into healthcare providers, healthcare payers, employer groups, and government bodies. Currently, healthcare providers account for the majority of the global market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global population health management market include Athenahealth, Cedar Gate Technologies, Conifer Health Solutions, eClinicalWorks, Health Catalyst, Lightbeam Health Solutions, Medical Information Technology, Inc., NXGN Management, LLC, Optum, Inc., Oracle and, Veradigm LLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)