Popcorn Market Size, Share, Trends and Forecast by Type, Distribution Channel, End Consumer, and Region, 2025-2033

Popcorn Market Size and Share:

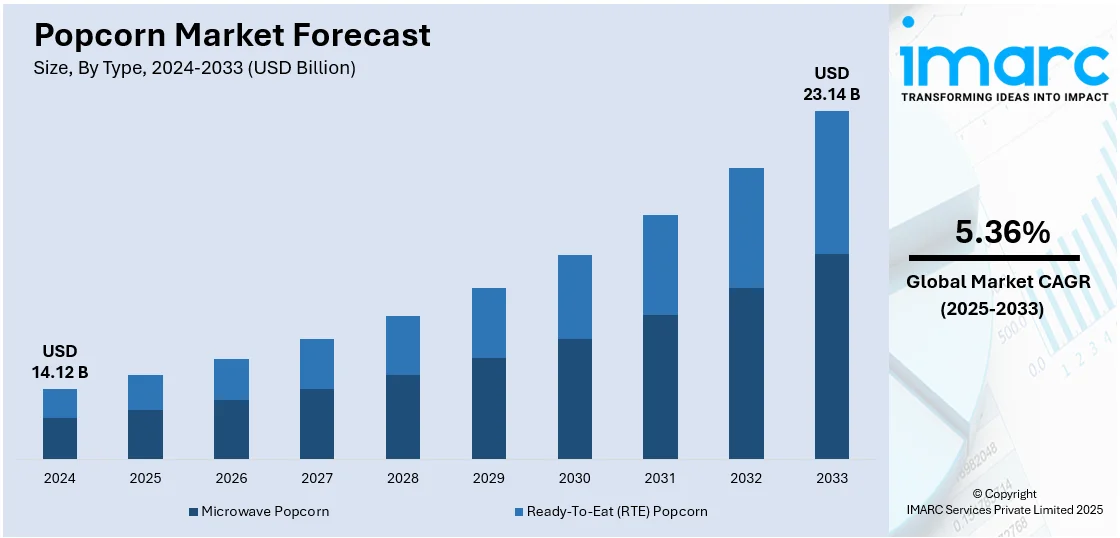

The global popcorn market size was valued at USD 14.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.14 Billion by 2033, exhibiting a CAGR of 5.36% during 2025-2033. North America currently dominates the market, holding a significant market share of over 48.3% in 2024. Surging health-conscious consumers favoring low-calorie, high-fiber snacks, the convenience of ready-to-eat (RTE) options, innovative flavor and premium product introductions by key players, the cinema industry's expansion, burgeoning per capita income, advancements in packaging technology, and the rising demand among vegan and gluten-free populations are some of the factors propelling the popcorn market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.12 Billion |

|

Market Forecast in 2033

|

USD 23.14 Billion |

| Market Growth Rate 2025-2033 | 5.36% |

The growing need for healthier snack options is a major impetus for market growth. With consumers increasingly health-aware, they are looking for low-calorie, high-fiber snacks, and popcorn is a good choice because of its natural, whole-grain nature. Additionally, the growth in on-the-go lifestyles and convenience foods has driven the popularity of popcorn as a convenient and easy-to-eat snack. Third, innovations in the popcorn flavor and product varieties, like gourmet, organic, and flavored popcorn, have drawn a wider consumption base. Moreover, the increasing popularity of home streaming and movie night activities has helped boost the popcorn demand, historically associated with movie outings. Also, the increase in retail and internet platforms has increased popcorn accessibility and availability to a greater public. Apart from this, rising availability of microwave and ready-to-eat popcorn has contributed to consumer convenience and market growth.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by its innovative approach to the snack industry. As one of the major consumers of popcorn, the US has witnessed a remarkable transformation in consumer attitudes with increased demands for healthier, convenient, and gourmet snack foods. US companies have responded to this by bringing out a wide variety of flavors, organic, and low-calorie types, widening the reach of popcorn beyond conventional movie snacks. Popcorn's popularity as an at-home entertainment product, especially with the boom in streaming services, continues to fuel demand further. The US market is also a pioneer in technological innovations, including microwave popcorn and automatic popcorn machines, which make the snack more convenient and accessible to consumers. The nation's robust retail infrastructure, both online and offline, also guarantees popcorn's availability everywhere.

Popcorn Market Trends:

Rising popularity of healthy snacking options

The worldwide move toward healthier lifestyles has had a profound effect on snack foods, with popcorn taking the lead in the healthy snacking category. The global market for healthy snacks was USD 91.1 Billion in 2024 and is expected to grow at a CAGR of 5.19% between 2025-2033, as per the IMARC Group. Popcorn, as a whole grain, is inherently rich in dietary fiber and antioxidants and low in calories when air-popped and lightly seasoned, which also fits well with the growing consumer trend for snacks that are supportive of weight management and overall health. The trend is also supported by the increased awareness and education about the advantage of eating whole grains and less processed foods containing high levels of sugars and saturated fats.

Expansion of the ready-to-eat (RTE) popcorn segment

The RTE popcorn segment has witnessed fast growth, fueled by consumers' need for convenience due to busy lifestyles and hectic schedules. It provides a convenient snacking solution, with no preparation and cooking required, which is highly attractive to the urban population and youth. According to the World Bank Group, 56% of the world's population in 2023 resided in urban centers, which totaled 4.4 Billion individuals. The manufactures have reacted with an investment in creative packaging structures that maintain freshness and flavor, further propelling the desirability of the product. Growth in RTE popcorn segment parallels the overall drift toward convenient, nutritious, and tasty snack alternatives.

Innovative flavor introductions and premium product offerings

The popcorn market outlook shows a surge in innovative flavor introductions and premium product offerings, catering to evolving consumer tastes and preferences for novelty and gourmet options. Manufacturers are experimenting with a plethora of flavors ranging from sweet, savory, and spicy to artisanal combinations like truffle, caramel sea salt, and cheese. Additionally, premium popcorn brands are focusing on sourcing high-quality, non-GMO kernels and employing artisanal cooking methods, further elevating the product's status. As per industry reports, the global non-GMO food market size reached USD 2.7 Billion in 2024 and is expected to grow at a CAGR of 11.3% during 2025-2033. These innovative flavors not only satisfy diverse palates but also add a sense of indulgence to the snacking experience.

Growth of the cinema industry globally

The international expansion of the cinema sector is a key driver of popcorn consumption, as it is the traditional movie snack. The World Intellectual Property Organization indicates that in 2023, box office revenue globally grew by about 29.4%, to USD 33.2 Billion. The experiential link between popcorn and watching a movie has a long history across cultures, making it a key part of the movie-going experience. As the cinema business grows, with more multiplexes and cinemas being opened in emerging economies, demand for popcorn as a value-added product keeps growing.

Popcorn Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global popcorn market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, and end consumer.

Analysis by Type:

- Microwave Popcorn

- Ready-To-Eat (RTE) Popcorn

Ready-to-eat (RTE) popcorn stands as the largest component in 2024, holding around 68.2% of the market. The ready-to-eat (RTE) popcorn segment is driven by the increasing trend towards healthier snack options. People are looking for snacks that not only fill their stomachs but also provide some nutritional value. RTE popcorn, which is commonly promoted as a lower-calorie, whole-grain, and high-fiber snack, attracts health-conscious consumers. Further, its market reach has widened through the range of gourmet and artisanal products available, capturing the interest of a multi-layered customer group in need of superior quality, hassle-free snacking convenience.

Microwave popcorn segment is fueled by the heightened need for convenient, easy-to-make snack products among busy-lifestyle consumers. Ease of preparation, extensive availability, and the range of flavors available to suit the needs of varied taste buds play a key role in fueling its growth. The category gains from innovation in packaging for longer shelf life and retention of taste, due to which it is becoming a choice product for in-home movie night consumption and midnight snacking cravings.

Analysis by Distribution Channel:

- On-Trade

- Off-Trade

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channel

- Other Channels

The on-trade segment is driven by the increasing consumer demand for gourmet and artisanal popcorn experiences, often found in cinemas, entertainment venues, and specialty stores. This trend is fueled by a growing interest in unique flavor profiles, premium ingredients, and the desire for healthier snacking options. Consumers are willing to pay a premium for these experiences, which has led to innovations in popcorn offerings, including organic and non-GMO options, catering to health-conscious customers. The on-trade segment benefits from the social aspects of popcorn consumption, where it is often shared among friends or enjoyed during a movie, enhancing the consumer's overall experience.

The off-trade segment is driven by the increasing demand for convenient, ready-to-eat snack options among consumers leading busy lifestyles. Supermarkets, hypermarkets, and online retailers are the primary channels facilitating this segment's growth, offering a wide range of products that cater to the convenience factor. The off-trade segment capitalizes on the consumer's desire for quick and easy snack options, leading to the proliferation of microwaveable and ready-to-eat popcorn in various flavors and packaging sizes. Additionally, the rise of e-commerce has made it easier for consumers to purchase gourmet and specialty popcorn from the comfort of their homes, further driving the off-trade segment's growth.

Analysis by End Consumer:

- Households

- Commercial

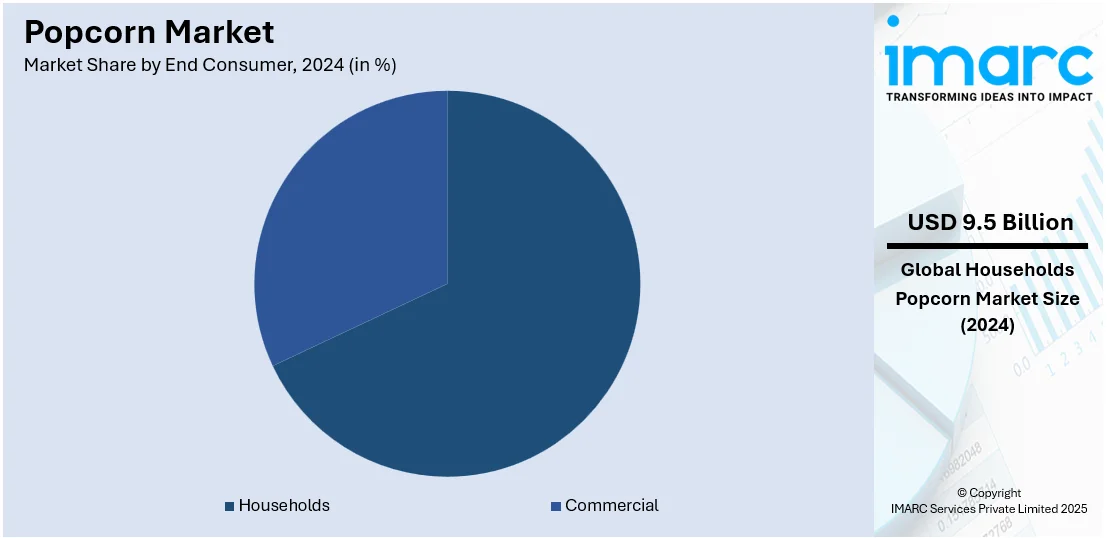

Households lead the market with around 67.5% of market share in 2024. The household segment in the popcorn market is driven by the increasing demand for convenient and easy-to-prepare snack options. With busy lifestyles and the growing trend of at-home movie nights and family gatherings, consumers are seeking quick, tasty, and healthier alternatives to traditional snacks. Popcorn fits this niche perfectly, offering a whole grain, fiber-rich option that can be easily made in a microwave or on the stovetop. Additionally, the availability of a wide range of flavors, from classic butter and salt to gourmet combinations, caters to diverse palates, further boosting its appeal in households.

The commercial segment is driven by the expanding cinema and entertainment industry, alongside the rising popularity of gourmet and specialty popcorn in retail outlets. Cinemas and movie theaters have traditionally relied on popcorn sales as a significant revenue source, due to its high-profit margin and strong association with movie-watching experiences. In addition, gourmet popcorn shops and specialty flavors are increasingly common in shopping malls and as part of online offerings, attracting consumers looking for premium, artisanal, and unique snack options.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 48.3%. The North America popcorn market is driven by the increasing demand for convenient and healthy snack options among consumers. The region's strong entertainment industry, particularly in the United States, has also played a significant role in popularizing popcorn as a must-have snack during movie screenings and events. Additionally, the introduction of various flavors and healthier options, such as organic and non-GMO popcorn, caters to the growing health-conscious segment, further fueling market growth.

Europe's popcorn market is driven by the rising popularity of on-the-go snacks and an increasing focus on healthier eating habits among consumers. European consumers are showing a keen interest in innovative flavors and gourmet popcorn, which has encouraged manufacturers to expand their product lines. Furthermore, the market is supported by the growing trend of home movie nights and streaming services, making popcorn a preferred snack choice.

In the Asia Pacific region, the popcorn market is driven by the growing influence of Western culture and the increasing number of multiplexes and cinema halls. The region experiences a significant demand for RTE snack options due to the fast-paced lifestyle of consumers, particularly in urban areas. Additionally, the introduction of local flavors and spices in popcorn varieties has made the product more appealing to the Asian palate, contributing to market growth.

Latin America's popcorn market is driven by the growing demand for convenient and affordable snack options. The region sees a significant uptake in the consumption of popcorn during social gatherings and family occasions. Moreover, the expansion of retail distribution channels and the introduction of microwave popcorn have made it easier for consumers to prepare popcorn at home, further boosting the market growth.

The Middle East and Africa popcorn market is driven by the expanding retail sector and the increasing number of multiplexes across the region. There is a growing preference for flavored popcorn among consumers, which has led to the introduction of a variety of flavors suited to local tastes. Additionally, the rising awareness of health benefits associated with consuming popcorn, such as its high fiber content, has positively impacted the market's growth in this region.

Key Regional Takeaways:

United States Popcorn Market Analysis

In 2024, the United States accounted for over 85.00% of the popcorn market in North America. The US popcorn industry is expanding, with changing tastes, increased frequency of snacking, and innovations driving growth. Health-consciousness is a new impetus with consumers turning to air-popped, low-calorie, organic popcorn as a healthier, better-for-you snack food. Gourmet popcorn, with sweet, savory and spicy flavorings, is toward the forefront, with craft brands and premium offerings leading the way. RTE popcorn is also increasingly popular in supermarkets, convenience stores, and online because of convenience. Home entertainment growth, facilitated by streaming services, is also creating demand for RTE and microwave popcorn. For example, California-based Netflix, one of the world's largest subscription streaming services, added 5 Million additional members from the last quarter and increased earnings to USD 9.8 Billion, recording a 15% increase from the same quarter last year. E-commerce expansion, subscription snack boxes, and direct-to-consumer models are also expanding access. Clean-label and plant-based trends are driving companies to use non-GMO corn, natural flavor, and environmentally friendly packaging, appealing to consumers who care about health and the environment. According to a recent study in the United States, in 2022, 25.8% of respondents followed plant-rich diets during the previous 12 months. Also propelling brand awareness and consumer access are marketing campaigns on social media and endorsement by influencers.

Asia Pacific Popcorn Market Analysis

The Asia Pacific market for popcorn is expanding at a rapid pace, due to numerous factors. Growing health consciousness among consumers has motivated the demand for healthier foods, and popcorn has become a new favorite food, owing to its low-calorie level and high fiber content. Entertainment industry that encompasses multiplex theatres and sporting events, has also been on the rise, leading to greater consumption of ready-to-eat popcorn in these places. Growing urbanization and consumer disposable income in countries such as China and India also lead to demand for convenient-to-eat, on-the-go snacks like popcorn, fueling urban and entertainment segment consumption. According to industry reports, in 2025, 37.1% of India's total population resides in urban areas, whereas, in China, 67.5% of its total population resides in urban cities. Innovative and gourmet flavors have also brought attractions to a diversified customer base with varying tastes. With the popularity of e-commerce portals, greater availability of popcorn products has also favored market growth.

Europe Popcorn Market Analysis

Europe's popcorn industry is expanding with changing consumer demand, increasing distribution channels, and increasing demand for convenient snacking. Health-conscious consumers are leading demand for organic and low-calorie popcorn as a healthier alternative to fried snacks. Clean-label and non-GMO trends are compelling manufacturers to use natural ingredients, less processing, and eco-friendly packaging. The growing popularity of American snacking culture, and by extension that of microwave and ready-to-eat (RTE) popcorn, driven particularly by the medium of film and streaming, is driving demand. Premiumization is also a factor, as gourmet versions of truffle, cheese, caramel, and spice blends become increasingly popular, and particularly in Western European economies. Expansion of e-commerce, subscription snack packaging, and direct-to-consumer retailing is also expanding access to the product. According to a report by the IMARC Group, the European e-commerce market is expected to reach USD 8.46 Trillion by 2033, recording a CAGR of 8.30% during 2025-2033. Market drivers also consist of increased retail distribution via supermarket chains, convenience stores, and specialty food stores. Seasonal and event-driven demand like sport events and celebrations remains a major driver.

Latin America Popcorn Market Analysis

The emerging trend of snackification, where customers are looking for smaller portions during the day, is propelling the Latin America popcorn market. As a healthy and affordable snack, popcorn is ideal for a busy lifestyle. In addition, the increased availability of flavored types of popcorn and gourmet products such as cheese, caramel, and spicy types are gaining popularity with more consumers. The growth of newer retail formats, including supermarkets, convenience stores, and online shopping enables easier access to these products. Also, a younger demography is fueling the market as they are more receptive to new snack experiences. For example, as per recent reports, youth make up 24.4% of the overall population of Mexico. A rise in disposable income in large markets like Brazil, Mexico also plays a large role in consumption and fuels the market growth further.

Middle East and Africa Popcorn Market Analysis

The growth of the snack food market and its consumption during social gatherings and leisure time is driving the Middle East & Africa popcorn market. Popcorn has become popular in more casual small parties as global food trends and Western influences find their way in the region. Urbanization in the region is also supporting the trend with busy consumers seeking convenience and portability in snack food. For example, in 2025, 81.1% of the UAE's total population resides in urban areas whereas in Saudi Arabia, 92.1% of the total population resides in urban areas. International fast food and cinema chains have also grown, boosting popcorn consumption as it is one of the most prevalent snacks throughout these places. Additionally, increasing consumer demand for premium and exotic flavors is drawing a more diverse consumer base.

Competitive Landscape:

Several leading companies in the popcorn market are driving its growth through various strategic efforts aimed at meeting consumer demands and expanding their market share. The big brands are emphasizing innovation through the introduction of varied and different flavors, from traditional butter to unusual varieties such as truffle, cheese, and caramel flavors. This trend extends to healthier variants, as more companies are spending money on organic, gluten-free, and low-calorie popcorn to meet the increasing health-aware consumer demand. With growing demand for convenience, brands are also transforming product formats, such as microwave and ready-to-consume popcorn, to make consumption easier at home or on-the-go. In addition, leading players are increasing their reach in traditional and online stores, making their products more widely available and convenient for customers. Promotional activities are another critical approach, as most businesses leverage the cultural adoption of movie nights, sporting events, and online streaming services, where popcorn usage is ingrained. Cinema and food service chain partnerships also contribute to brand exposure. Also, businesses are tapping into sustainability trends, including green packaging and utilizing non-GMO corn, to appeal to environmentally aware consumers.

The report provides a comprehensive analysis of the competitive landscape in the popcorn market with detailed profiles of all major companies, including:

- Conagra Brands Canada, Inc.

- Eagle Family Foods Group LLC

- Frito-Lay North America, Inc. (Pepsico Inc.)

- Great American Popcorn

- Intersnack Group

- Joe's Gourmet Foods Ltd.

- Popcorn & Company

- Popz USA LLC

- Preferred Popcorn LLC

- Proper

- The Hershey Company

- Weaver Popcorn, LLC

Latest News and Developments:

- February 2025: B Pop, one of the most prominent premium popcorn companies in India, has ventured into the FMCG Sector with the introduction of its most recent product, gourmet popcorn in pillow packs. This is a major turning point for the brand as it grows beyond its upscale outlets to attract a larger audience through modern distribution channels throughout India and internationally.

- September 2024: The snack company 4700BC has partnered with streaming giant Netflix to introduce two novel popcorn products, Cheese & Caramel and Sweet & Salty. The new products were introduced with a commercial campaign that included renowned director Karan Johar, as well as television stars Karanvir Bohra and Karan Wahi.

- August 2024: G.H. Cretors, a company known for its handmade popcorn, has entered into a partnership with Tajín Clásico to introduce a new line of gourmet popcorn that combines the robust, tangy flavor of Tajín Clásico seasonings with the premium popcorn of G.H. Cretors. At present, the product is exclusively offered by Costco USA in the Northwestern area and Costco Mexico.

- June 2024: Netflix and Popcorn Indiana have collaborated to develop the "Netflix Now Popping" popcorn range. The company has launched two innovative flavors in this product line, the Swoonworthy Cinnamon Kettle Corn and the Cult Classic Cheddar Kettle Corn, which will be available in stores starting this month.

- January 2023: Santa Cruz Fun Foods has partnered with ICEE to introduce a new popcorn product line in celebration of National Popcorn Day. The popcorn comes in two distinct flavors and will soon be available in amusement parks, stadiums, cinemas, and various other attractions.

Popcorn Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Microwave Popcorn, Ready-To-Eat (RTE) Popcorn |

| Distribution Channels Covered |

|

| End Consumers Covered | Households, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Regions Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Conagra Brands Canada, Inc., Eagle Family Foods Group LLC, Frito-Lay North America, Inc. (Pepsico Inc.), Great American Popcorn, Intersnack Group, Joe's Gourmet Foods Ltd., Popcorn & Company, Popz USA LLC, Preferred Popcorn LLC, Proper, The Hershey Company, Weaver Popcorn, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the popcorn market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global popcorn market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the popcorn industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The popcorn market was valued at USD 14.12 Billion in 2024.

The popcorn market is projected to exhibit a CAGR of 5.36% during 2025-2033.

The popcorn market is driven by increasing demand for healthy snacks, convenience, and innovation in flavors. Health-conscious consumers favor low-calorie, high-fiber popcorn, while busy lifestyles boost on-the-go consumption. The growth of streaming and movie experiences, along with advancements in product variety and retail access, also fuels market expansion.

North America currently dominates the market driven by growing health-consciousness, with consumers preferring low-calorie, whole-grain snacks.

Some of the major players in the popcorn market include Conagra Brands Canada, Inc., Eagle Family Foods Group LLC, Frito-Lay North America, Inc. (Pepsico Inc.), Great American Popcorn, Intersnack Group, Joe's Gourmet Foods Ltd., Popcorn & Company, Popz USA LLC, Preferred Popcorn LLC, Proper, The Hershey Company, Weaver Popcorn, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)