Polyvinyl Alcohol (PVA) Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Polyvinyl Alcohol (PVA) Price Trend, Index and Forecast

Track real-time and historical polyvinyl alcohol (PVA) prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Polyvinyl Alcohol (PVA) Prices January 2026

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 1.56 | 5.4% ↑ Up |

| Europe | 3.52 | 16.9% ↑ Up |

| North America | 3.13 | 1.0% ↑ Up |

Polyvinyl Alcohol (PVA) Price Index (USD/KG):

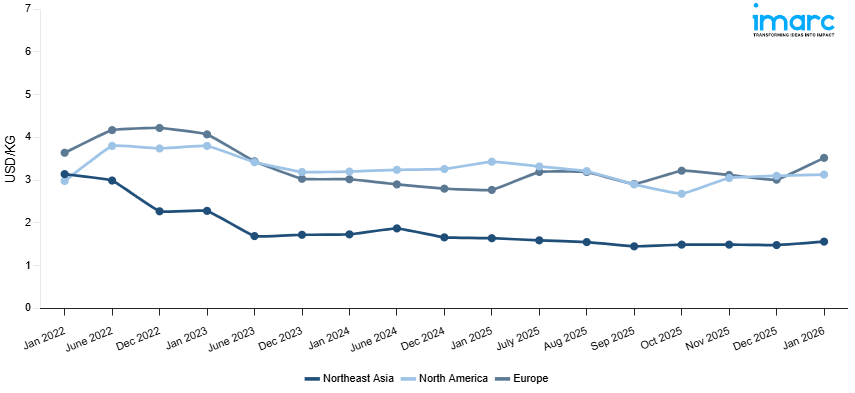

The chart below highlights monthly polyvinyl alcohol (PVA) prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: Prices in Northeast Asia recorded a decline. The downward trend was primarily influenced by reduced demand in the textile and paper industries across China, Japan, and South Korea. On the supply side, regional producers maintained steady output levels, while a moderate easing of raw material costs, particularly vinyl acetate monomer (VAM), contributed to price corrections. Currency fluctuations, especially the relative strengthening of the Japanese yen against the US dollar, slightly mitigated cost pressures for imported PVA grades. Domestic logistics, including intercity transport and warehousing, remained stable, exerting minimal impact on pricing. Additionally, regulatory compliance costs for environmental and safety standards did not significantly change, keeping operational expenditures relatively constant.

Europe: European PVA prices fell sharply. The decline was driven by lower demand in Germany, France, and Italy, particularly from the adhesive and packaging sectors. On the supply side, domestic producers maintained consistent output, placing additional downward pressure on domestic prices. Key cost components, including international freight, port handling, and customs duties, remained steady, though currency volatility, notably the euro against the US dollar, influenced pricing slightly. Compliance costs for environmental and sustainability regulations remained unchanged, keeping operational overhead predictable.

North America: In North America, PVA prices decreased. The drop was mainly attributable to softening demand in the US and Canada from the paper, textile, and coatings sectors, which delayed procurement and reduced spot market activity. On the supply side, regional producers maintained consistent production levels, while inventory buildups at major distribution centers contributed to downward pricing pressure. Cost drivers such as domestic logistics, intermodal transportation, and warehouse operations remained stable, whereas international shipping costs slightly declined, facilitating lower import-related expenditures. Currency fluctuations, particularly the US dollar versus the euro and Asian currencies, had a moderate impact on import costs. Additionally, regulatory compliance for occupational safety and environmental standards did not materially change, leaving production overheads steady.

Polyvinyl Alcohol (PVA) Price Trend, Market Analysis, and News

IMARC's latest publication, “Polyvinyl Alcohol (PVA) Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the polyvinyl alcohol (PVA) market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of polyvinyl alcohol (PVA) at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed polyvinyl alcohol (PVA) prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting polyvinyl alcohol (PVA) pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

.webp)

Polyvinyl Alcohol (PVA) Industry Analysis

The global polyvinyl alcohol (PVA) industry size reached USD 1.20 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 1.76 Billion, at a projected CAGR of 4.33% during 2026-2034. The market is driven by the rising demand from packaging, textiles, and construction, growing adoption in water-soluble films, increasing use in adhesives and coatings, advancements in biodegradable materials, and expanding applications in pharmaceuticals and electronics.

Latest developments in the Polyvinyl Alcohol (PVA) industry:

- January 2025: Kuraray announced its participation at the European Coatings Show in Nuremberg. One of its units, Poval, highlighted polyvinyl alcohol innovations, debuting the new EXCEVAL™ OKE 975 grade, designed for easier processing and improved sustainability in coatings applications.

- 2024: Eastman, a global specialty materials company selected Longview, Texas for a new $1.2 billion manufacturing facility. The project will create 1,000 construction jobs and 600 permanent positions, significantly boosting the local economy. The facility will produce advanced materials for various industries, including automotive and electronics.

- 2024: DuPont and Point Blank Enterprises formed an exclusive partnership to offer body armor made with Kevlar EXO aramid fiber for North American State and Local Law Enforcement departments.

Product Description

Polyvinyl alcohol, also known as PVA, is a kind of synthetic polymer that is soluble in water and also possesses unique properties which makes it a highly versatile polymer across various industries. Poly vinyl polymer is produced by the polymerization of vinyl acetate followed by a process called hydrolysis which removes the acetate groups to leave behind the hydrophilic alcohol groups. This transformation imparts PVA with its characteristic water solubility.

Polyvinyl alcohol is generally known for its excellent film forming abilities resistance to grease and oils and good adhesive strength. These properties make it an ideal for use in creating protective barriers in packaging especially for products sensitive to moisture and air. Its biodegradability and non-toxic nature also make it popular in environmental applications such as water treatment and biodegradable films.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Polyvinyl Alcohol |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Polyvinyl Alcohol Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of polyvinyl alcohol pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting polyvinyl alcohol price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The polyvinyl alcohol price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The polyvinyl alcohol (PVA) prices in January 2026 were 1.56 USD/Kg in Northeast Asia, 3.52 USD/Kg in Europe, and 3.13 USD/Kg in North America.

The polyvinyl alcohol (PVA) pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for polyvinyl alcohol (PVA) prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)