Polypropylene Copolymer Market Report by End-Use (Rigid Packaging, Textiles, Technical Parts, Films, Consumer Products, and Others), and Region 2025-2033

Market Overview:

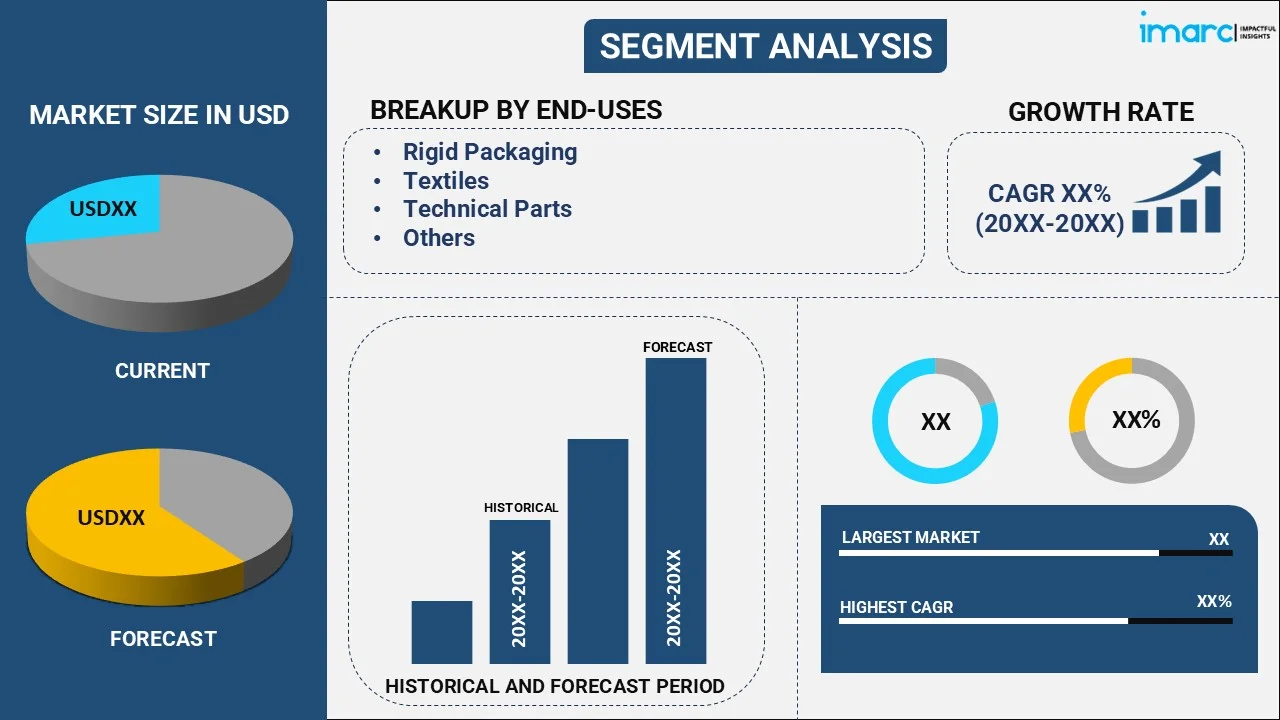

The global polypropylene copolymer market size reached USD 60.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 89.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The rapidly evolving automotive industry, the growing product adoption in the electrical and electronics industry, extensive research and development (R&D) activities, and the increasing product application in medical devices are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 60.7 Billion |

|

Market Forecast in 2033

|

USD 89.1 Billion |

| Market Growth Rate (2025-2033) | 4.15% |

Polypropylene copolymer refers to a thermoplastic polymer widely used in industrial applications due to its excellent thermal, chemical, and mechanical properties. It is synthesized using the copolymerization process, involving the polymerization of propylene with a mixture of monomers. Polypropylene copolymer is widely used in packaging, automotive components, medical devices, household goods, textiles, and electronic devices. It is a cost-effective, lightweight, and durable material that offers high tensile strength and provides resistance against impact, abrasion, chemicals, and fatigue. Polypropylene copolymer is also recyclable and aids in reducing waste generation and minimizing the utilization of virgin materials.

The widespread product utilization in medical devices, such as syringes, medical tubing, intravenous (IV) components, and laboratory equipment, owing to its excellent biocompatibility, chemical resistance, and ease of sterilization, is providing an impetus to the market growth. Furthermore, the growing demand for polypropylene copolymer used in the manufacturing of household products, such as storage containers, kitchenware, garden tools, and furniture, is positively influencing the market growth. Additionally, the rising product application in the textile industry to produce fibers, nonwoven fabrics, and geotextiles is acting as another growth-inducing factor. Moreover, the increasing product adoption in three-dimensional (3D) printing for prototyping and manufacturing functional parts for industrial machinery is positively influencing the market growth. Other factors, including the rapid industrialization, increasing investment in the development of advanced products, and the rising product demand in construction activities, are anticipated to drive the market growth.

Polypropylene Copolymer Market Trends/Drivers:

The widespread product utilization in the automotive industry

Polypropylene copolymer is extensively used in the manufacturing of automotive interior components, such as instrument panels, door trims, center consoles, dashboard components, and pillar trims. It offers excellent design flexibility, ease of processing, and superior surface finish, which enhances the overall aesthetic appeal of the vehicle interior. Furthermore, the widespread product utilization in manufacturing automotive bumpers and body panels, due to its high impact resistance, toughness, and dimensional stability, is supporting the market growth. Moreover, the rising utilization of polypropylene copolymer in the production of engine covers, air intake manifolds, battery housings, and fluid reservoirs is contributing to the market growth. Additionally, the increasing product application in automotive heating, ventilation, and air conditioning (HVAC) components, such as air ducts, vents, and heater boxes is favoring the market growth.

The growing product adoption in the electrical and electronics industry

Polypropylene copolymer finds extensive applications in the electrical and electronics industry owing to its excellent electrical insulation, thermal stability, flame retardancy, and chemical resistance. It is widely used as an insulating material for wires and cables due to its high dielectric strength that prevents electrical leakage and ensures efficient signal transmission. Furthermore, the increasing product utilization in the manufacturing of film capacitors owing to its low dissipation factor and high insulation resistance is favoring the market growth. Moreover, the extensive application of polypropylene copolymer as a substrate or laminate in printed circuit boards (PCBs) is strengthening the market growth. Additionally, the rising product demand to produce electrical housing and enclosures, as it provides superior mechanical strength, impact resistance, and protection against environmental factors, is boosting the market growth.

Extensive research and development (R&D) activities

The recent development of high-performance polypropylene copolymers that exhibit enhanced stiffness, impact resistance, and heat resistance compared to traditional products is positively influencing the market growth. Additionally, the introduction of sustainable polypropylene copolymers that are derived from recycled and renewable feedstocks, which aids in minimizing waste generation, lowering carbon footprint, and reducing the reliance on fossil fuels, is supporting the market growth. Moreover, the utilization of metallocene catalysts in product manufacturing to enable better control over the polymerization process, improve clarity, enhance product quality, and increase yield is catalyzing the market growth. Apart from this, the addition of specific chemical groups or functional moieties to the polypropylene copolymers structure to enhance adhesion, enable surface modification, and increase compatibility with other materials is strengthening the market growth.

Polypropylene copolymer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global polypropylene copolymer market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on end-use.

Breakup by End-Use:

- Rigid Packaging

- Textiles

- Technical Parts

- Films

- Consumer Products

- Others

Rigid packaging dominates the polypropylene copolymer market

The report has provided a detailed breakup and analysis of the polypropylene copolymer market based on the end-use. This includes rigid packaging, textiles, technical parts, films, consumer products, and others. According to the report, rigid packaging represented the largest market segment.

Polypropylene copolymer is widely used in rigid packaging due to its high structural integrity and excellent barrier property. It is used to manufacture food packaging products, such as containers, cups, lids, trays, films, pouches and bottles. Furthermore, the increasing product utilization in beverage packaging, owing to its lightweight nature, transparency, and high impact resistance, is acting as another growth-inducing factor. Moreover, the growing product demand to produce packaging for personal care items, such as creams, shampoos, lotions, and cosmetics, is positively influencing the market growth. Apart from this, the rising product applications in pharmaceutical packaging, such as bottles, vials, and blister packs, due to its chemical resistance and ease of sterilization, are positively influencing the market growth.

Breakup by Region:

- Asia Pacific

- North and South America

- Western and Central Europe

- Middle East and Africa

- Others

Asia Pacific exhibits a clear dominance in the market, accounting for the largest polypropylene copolymer market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes Asia Pacific, North and South America, Western and Central Europe, Middle East and Africa, and others. According to the report, Asia Pacific represented the largest market segment.

Asia Pacific is dominating the polypropylene copolymer market due to rapid industrialization activities. Polypropylene copolymer is widely used in the automotive, electrical and electronics, packaging, and construction industries. Along with this, the presence of a well-established manufacturing base, easy availability of skilled labor, and favorable investment regulations are contributing to the market growth. Furthermore, the easy access to raw materials and low labor cost in the region has resulted in the production of polypropylene copolymer at competitive prices. Moreover, the implementation of supportive policies by the regional governments to encourage manufacturing, improve infrastructure, and create business-friendly environments is favoring the market growth. Apart from this, the growing demand for reliable and durable packaging solutions owing to the significant growth in the e-commerce industry is boosting the market growth.

Competitive Landscape:

The leading companies in the polypropylene copolymer market are investing in research and development (R&D) projects to create new and innovative products with improved mechanical properties, heat resistance, impact resistance, and sustainability features. Furthermore, several key players are expanding their market presence by establishing distribution networks, strategic partnerships, and collaborations to ensure the wider availability of their polypropylene copolymer products globally. Moreover, the increasing emphasis on the customer-centric approach has prompted manufacturers to design customized products that fit the specific requirements of the clients. Additionally, the growing focus on supply chain optimization to reduce lead time and ensure timely delivery of products is contributing to the market growth.

The report has provided a comprehensive analysis of the competitive landscape in the global polypropylene copolymer market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- LyondellBasell

- Sinopec Group

- Braskem Group

- SABIC

- PetroChina Group

Recent Developments:

- In July 2022, LyondellBasell joined the NEXTLOOPP initiative to create circular food-grade recycled polypropylene (FGrPP) from post-consumer packaging.

- In December 2020, Russia approved the participation of Sinopec Group in a mega petrochemical project, which aims to produce 2.3 million tonnes of polyethylene and 400,000 tonnes of polypropylene per year beginning in 2024-2025.

- In June 2020, Braskem Group completed the construction of a new polypropylene production facility in La Porte, Texas. This new facility has the capability to produce the entire polypropylene portfolio, including homopolymers, impact copolymers, and random copolymers.

Polypropylene Copolymer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| End-Uses Covered | Rigid Packaging, Textiles, Technical Parts, Films, Consumer Products, Others |

| Regions Covered | Asia Pacific, North and South America, Western and Central Europe, Middle East and Africa, Others |

| Companies Covered | LyondellBasell, Sinopec Group, Braskem Group, SABIC, and PetroChina Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the polypropylene copolymer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global polypropylene copolymer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the polypropylene copolymer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global polypropylene copolymer market was valued at USD 60.7 Billion in 2024.

We expect the global polypropylene copolymer market to exhibit a CAGR of 4.15% during 2025-2033.

The increasing demand for polypropylene copolymer in various industries, such as packaging, automotive, injection molding, etc., as it offers low specific gravity, high stiffness and high-temperature resistance to chemicals, good process ability, etc., is primarily driving the global polypropylene copolymer market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for polypropylene copolymer.

Based on the end-use, the global polypropylene copolymer market can be segmented into rigid packaging, textiles, technical parts, films, and consumer products. Currently, rigid packaging holds the majority of the total market share.

On a regional level, the market has been classified into Asia, North and South America, Western and Central Europe, Middle East and Africa, and others, where Asia Pacific currently dominates the global market.

Some of the major players in the global polypropylene copolymer market include LyondellBasell, Sinopec Group, Braskem Group, SABIC, and PetroChina Group.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)