Polymer Stabilizers Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

Polymer Stabilizers Market Size and Share:

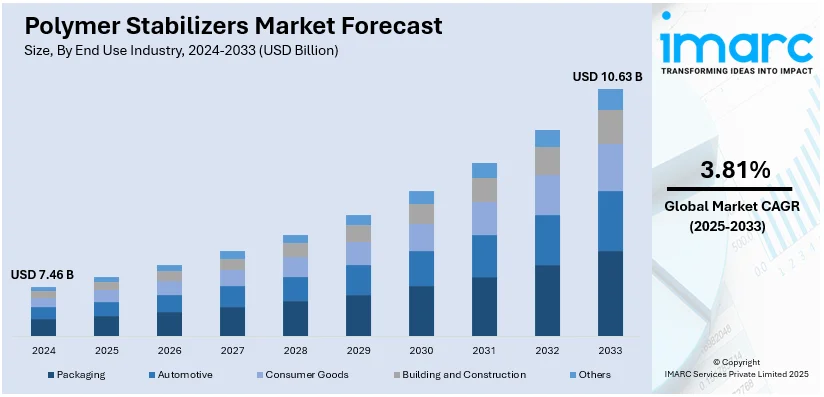

The global polymer stabilizers market size was valued at USD 7.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.63 Billion by 2033, exhibiting a CAGR of 3.81% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.3% in 2024. The increasing demand for durable and high-performance materials across industries such as automotive, packaging, and construction is majorly driving the market. Additionally, technological advancements in stabilizer formulations and the rising focus on sustainability and eco-friendly products further enhance the polymer stabilizers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.46 Billion |

| Market Forecast in 2033 | USD 10.63 Billion |

| Market Growth Rate (2025-2033) | 3.81% |

The global market is driven by the augmenting demand for durable and high-performance plastics across the automotive, construction, and packaging industries. Along with this, rapid urbanization and industrialization are influencing the need for materials with enhanced thermal, UV, and oxidation resistance. On 29th April 2024, Clariant, a leader in sustainable specialty chemicals, announced its newest developments at the American Coatings Show 2024, including 100% bio-based VITA polyglycols and ethylene oxide derivatives for paints and coatings. In addition, AddWorks IBC 760, the latest polymer stabilizer with excellent UV and thermal protection for SMP sealants will be introduced at the event. Additionally, growing environmental awareness and regulatory pressure to improve product longevity have accelerated the adoption of stabilizers in polymer production. Besides this, continual advancements in technology and the development of eco-friendly stabilizers are further fueling the polymer stabilizers market growth. Moreover, the expanding applications of polymers in the electronics and healthcare sectors also contribute to the rising demand for effective stabilization solutions to ensure performance and durability.

The United States stands out as a major regional market, primarily driven by the rising need for high-performance materials that can withstand harsh conditions. This demand for advanced materials is reflected in recent industry developments. For instance, on 6th May 2024, Baerlocher USA, a business unit of the international Baerlocher Group, announced exhibiting its most innovative sustainable solutions at NPE2024 in Orlando. In the list are BAEROPOL T-Blend stabilizers for recycled polyolefins, PFAS-free polymer processing aids, bio-plasticizers, calcium-based PVC stabilizers, and RSPO-certified metal soaps. Moreover, considerable growth in sectors such as the construction industry, where weather-resistant plastics are in demand, and the packaging sector, which requires extended shelf-life for products, plays a significant role in expanding the scope of the market. Besides this, the emerging trend towards the adoption of lightweight materials in automotive manufacturing, aimed at enhancing fuel efficiency, also supports the uptake of polymer stabilizers. Furthermore, increasing investments in research and development (R&D) activities involving advanced stabilizers, along with the growing focus on sustainability and eco-friendly solutions, are further contributing to the polymer stabilizers market outlook in the United States.

Polymer Stabilizers Market Trends:

Growing Demand for Eco-friendly Solutions

The emphasis on sustainability and environmental responsibility is driving the market toward envioronment-friendly alternatives. According to industrial reports, the U.S. recycled only 5–6% of its plastic waste in 2021, highlighting the urgent need for more efficient recycling solutions. Manufacturers are making significant efforts in this regard to achieve global regulatory standards and fulfill the consumers' quest for greener products as they opt for bio-based, non-toxic, and biodegradable stabilizers. This trend is propelled by mounting concern over plastic waste, the adverse environmental impact of hazardous additives, and increasing demand for products that align with sustainability regulations. Environmentally friendly stabilizers not only reduce the potential harm of toxic chemicals released into the environment but also contribute toward the strengthening of recyclable polymer materials. The drive for this transition is being facilitated by strict regulations in regions including the European Union and the U.S., where governments are imposing restrictions on the use of harmful substances in plastics. This will further drive demand for stabilizers that support a circular economy, opening avenues for manufacturers to innovate in green polymer stabilization solutions.

Expansion of Automotive and Packaging Sectors

The growth of key industries such as automotive and packaging is acting as one of the significant polymer stabilizers market trends. According to the U.S. Department of Energy, in 2022, approximately 13.8 million light vehicles were sold in the U.S., many of which use advanced polymer materials for components such as bumpers, dashboards, and interior trims. These materials must include stabilizers to enhance the heat resistance, shock resistance, and UV protectors in them. Packaging sectors in the making of food and beverages packages require high end polymer stabilizers so that long life of their product with an assurance of good integrity can be made. For ensuring shelf stability packaging materials have stabilizers against thermal, moisture and light to make products safer for human use and better quality. As both industries expand, the need for effective stabilizers that will improve the durability and performance of the materials will also grow, fueling market growth.

Advancements in Polymer Stabilization Technologies

Technological advances in polymer stabilization are playing an important role in shaping the future of the market. Innovations in stabilization technologies, including the development of multifunctional stabilizers and nanotechnology-based solutions, are enhancing the performance and efficiency of polymer products. Multifunctional stabilizers that are all-in-one additive types which incorporate the characteristics of an antioxidant, UV stabilizer, and a processing stabilizer in a single component have been receiving considerable attention for providing improved resistance against thermal degradation, oxidation, and UV damage of polymers. Also, nanotechnology incorporation is also creating the opportunity for developing new generation stabilizers that can show excellent dispersion with superior resistance against environmental stress cracking. These improvements help polymer materials better perform under diverse applications in construction, electronics, for which durability and lifespan are factors of utmost importance. The National Nanotechnology Initiative (NNI), which coordinates federal nanotechnology research in the U.S., allocated a budget of USD 1.99 billion in 2023 for its efforts. This funding supports the development of advanced materials, including multifunctional stabilizers and nanocomposites that improve polymer performance. As companies need higher-grade and more reliable polymers, ongoing improvements in stabilization technology of polymers will be another reason for driving growth in this market, improving efficiency and performance of polymer material.

Polymer Stabilizers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global polymer stabilizers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end use industry.

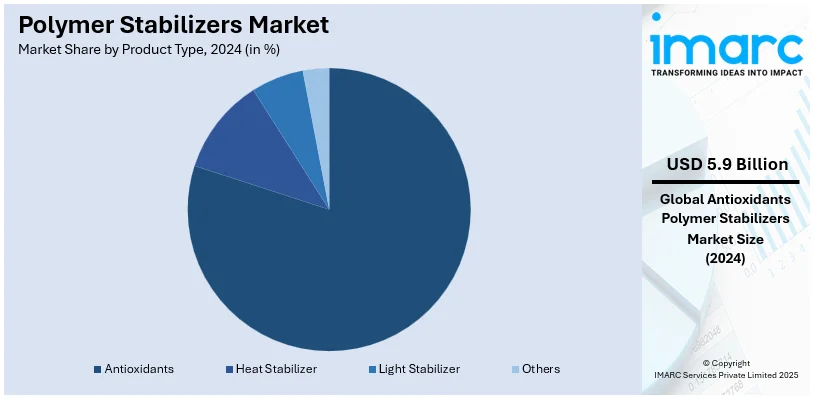

Analysis by Product Type:

- Antioxidants

- Heat Stabilizer

- Light Stabilizer

- Others

Antioxidants lead the market with around 79.3% of market share in 2024 due to their critical role in enhancing the durability and performance of polymers. These stabilizers effectively prevent the degradation of polymer materials caused by oxidation, UV radiation, and thermal stress. As automotive, packaging, and construction industries rely heavily on polymers, the demand for antioxidants continues to rise. Their ability to prolong the lifespan of polymer-based products and maintain their structural integrity under various environmental conditions drives their widespread use. This growing need for high-performance materials that offer improved resistance to aging and environmental factors is fueling the dominance of antioxidants in the market.

Analysis by End Use Industry:

- Packaging

- Automotive

- Consumer Goods

- Building and Construction

- Others

Packaging leads the market in 2024, driven by the growing demand for durable and lightweight plastic materials. Polymer stabilizers play a critical role in enhancing the performance of packaging materials by improving their resistance to heat, UV radiation, and oxidative degradation, ensuring product longevity and integrity. The thriving e-commerce sector and the need for effective food and beverage packaging are also impelling the polymer stabilizers market demand. In addition, the increasing focus on sustainable and recyclable packaging solutions has led to the development of eco-friendly stabilizers. With expanding applications in flexible and rigid packaging, this segment is projected to maintain its dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.3%, driven by robust demand across key automotive, construction, and packaging industries. The region's well-established manufacturing base, in confluence with significant investments in technological advancements, has positioned it as a leader in polymer stabilization solutions. Additionally, stringent environmental regulations and a growing focus on sustainability push companies to adopt high-performance stabilizers that extend the longevity and quality of polymer products. The region’s thriving end-use industries, particularly in the U.S. and Canada, further contribute to the increasing consumption of polymer stabilizers. With an enhanced focus on innovation and eco-friendly alternatives, North America remains dominant in shaping the global market landscape.

Key Regional Takeaways:

United States Polymer Stabilizers Market Analysis

In 2024, the US accounted for around 86.80% of the total North America polymer stabilizers market. The U.S. market has been growing substantially, with major drivers being key sectors such as automotive, construction, and packaging. According to an industrial report, in 2023, the United States produced 130 billion pounds of plastics, which were 3.7% greater than in the previous year. Of this amount, 113 billion pounds of thermoplastic polymers-which include, among others, polyethylene terephthalate (PET)-point to an important need for polymer stabilizers to improve resistance and performance. The increasing focus on sustainability and tough environmental regulations is making manufacturers adopt non-toxic and eco-friendly stabilizers. The market will thus witness more innovation. Industry leaders such as BASF and Dow Chemical are at the forefront by launching stabilizers customized for high-performance applications. With the automotive industry switching to lightweight materials, demand for stabilizers that improve plastic resilience and longevity is also accelerating. With an emphasis on advanced materials as well as sustainable practices, the market is geared for long-term expansion under the steady growth of industry and innovation in the U.S.

Europe Polymer Stabilizers Market Analysis

The European polymer stabilizers market is growing due to sustainability programs and the demand for high-performance plastics. Packaging production and waste management in the EU sector registered a total turnover of €370 billion (USD 409.17 billion) in 2023, representing strong industrial activities in the region, as per reports. Moreover, the EU exported more plastics than it imported in 2023 with an export surplus of €5.4 billion (USD 5.97 billion). This enhances the region's strong position in plastic production and trade, improving demand for advanced stabilizers that enhance product durability and meet environmental standards. Countries such as Germany, France, and Italy are on the leading edge in adopting innovative stabilizer solutions with support from the EU's regulatory framework, always pushing for eco-friendly practices. Leading players including LANXESS and Clariant invest in R&D to develop non-toxic, sustainable stabilizers tailored for different applications. These developments, with the rising requirement for recyclable plastics, position Europe as the key player in the global market for polymer stabilizers.

Asia Pacific Polymer Stabilizers Market Analysis

The Asia Pacific market is poised to grow considerably amid industrial development, urbanization, and growing demand for durable plastics. As an ADB brief titled "Managing Plastic Waste in the People's Republic of China" indicated, China produced about 80 million metric tons of plastics in 2021 - that's roughly one-third of all global production. The overall dominance of this region in plastics and the important role of stabilizers to maintain material performance with longer lifeline is highlighted through this. Emerging markets such as India and China are fueling demand in the market through infrastructure and automotive manufacturing besides packaging applications, while sustainability needs and government compliances are on the anvil to make adoption of green stabilizers. Key players, including LG Chem and Mitsubishi Chemical, are focusing on innovation to cater to vast array of applications. The emphasis on high-performance materials and recycling technologies is increasingly positioning the Asia Pacific as a key player in the market.

Latin America Polymer Stabilizers Market Analysis

The Latin America polymer stabilizers market is growing with industrial expansion and increasing demand for durable plastics. Brazil, the largest economy in the region, mainly drives this sector. In 2023, Brazil's processed plastics industry generated a revenue of 123.4 billion Brazilian reals (USD 25.4 billion), showing a small decline from the previous year, as per reports. Annual production of plastic in the country was around 7 million tons. Of this amount, 44% consisted of disposable and single-use plastics, including those used in food packaging. This significant amount necessitates polymer stabilizers to strengthen material durability and performance. Support from the government through domestic manufacturing and environmentally friendly policies strengthens the market. With the increase in the use of biodegradable and recyclable plastics, global sustainability trends offer opportunities for novel stabilizer formulations. Leading companies have been investing more in research and development to keep up with diverse needs in the region. Awareness of environmental regulations along with the demand for green technology is likely to propel the growth of the market for polymer stabilizers across Latin America.

Middle East and Africa Polymer Stabilizers Market Analysis

The Middle East and Africa polymer stabilizers market is increasing due to robust industrial activity and the growing demand for high-performance plastics. As per an industrial report from December 2024, Saudi Arabia ranked among the top five primary polymer-producing nations in 2023, along with China, the United States, India, and South Korea. In other words, the region is undergoing multiple restructuring waves, with primary plastic production driving enormous demand for stabilizers in improving plastic durability and performance. The Middle East, especially Saudi Arabia and the United Arab Emirates, invests considerably in petrochemical manufacturing and polymer production, backed by natural gas reservoirs. Growing construction, automotive, and packaging sectors also suffice the manufacturing business of the region with polymers. The adoption of eco-friendly stabilizers, driven by increasing environmental regulations, further supports market growth. As the Middle East and Africa continue to strengthen their industrial base, the demand for innovative and sustainable stabilizer solutions is expected to rise.

Competitive Landscape:

The market is highly competitive, with major players focusing on strategies such as product innovation, capacity expansion, and partnerships to strengthen their market presence. Companies are making substantial investments in research and development (R&D) activities to create advanced, sustainable stabilizer solutions that meet changing environmental regulations and consumer preferences. The development of lead-free, non-toxic, and eco-friendly stabilizers has become a major focus, thus highlighting the growing demand for environmentally responsible products. Additionally, some players are expanding their geographic footprint by establishing manufacturing facilities in emerging markets to capitalize on regional growth opportunities. Moreover, strategic collaborations with industries such as packaging, construction, and automotive are also helping manufacturers align their offerings with industry-specific requirements.

The report provides a comprehensive analysis of the competitive landscape in the polymer stabilizers market with detailed profiles of all major companies, including:

- Adeka Corporation

- Albemarle Corporation

- Baerlocher GmbH

- BASF SE

- Chitec Technology Co. Ltd.

- Clariant AG

- Evonik Industries AG

- R.T. Vanderbilt Holding Company Inc.

- SABO S.p.A.

- Solvay S.A.

- SONGWON Industrial Co. Ltd.

- Valtris Specialty Chemicals

Latest News and Developments:

- November 2024: Chitec Technology’s Chiguard® R-455 obtained a patent for enhancing UV protection in polymer materials, particularly polyurethane. The innovative technology improves UV yellowing resistance, offering stable protection without compromising visible light transmittance. Its applications span electronics, solar panels, vehicles, and more, addressing long-standing weather resistance challenges.

- November 2024: Clariant has transitioned to a fully PFAS-free additive portfolio by December 2023, showcasing its commitment to sustainable solutions. This includes the launch of Ceridust™ 8170 M for powder coatings and AddWorks™ PPA polymer processing aids. The move anticipates global regulations, offering customers eco-friendly alternatives without compromising performance.

- September 2024: Saudi Arabia launched a USD 100 million film fund aimed at attracting global film studio investments. The Saudi Cultural Development Fund, MEFIC Capital, and Roaa Media Ventures are key investors. The initiative aligns with the Saudi Film Commission's Confex event, which brings industry experts together in Riyadh.

- August 2024: ADEKA launched two chemical foaming agents for the automotive sector: ORGATER MB.BA.33 and ORGATER MB.BA.34. These agents provide lightweight plastics, energy savings, and odor reduction, improving mechanical properties while maintaining eco-friendliness. Both are designed for sustainability and enhance part production, transport, and comfort.

- July 2024: BASF launched Tinuvin® NOR® 211 AR, a heat and light stabilizer for sustainable farming practices. Part of BASF’s VALERAS® portfolio, it helps reduce polymer usage in plasticulture, extending the lifespan of agricultural plastics exposed to UV radiation, thermal stress, and chemicals including sulfur and chlorine, supporting environmental goals.

Polymer Stabilizers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Antioxidants, Heat Stabilizer, Light Stabilizer, Others |

| End Use Industries Covered | Packaging, Automotive, Consumer Goods, Building and Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adeka Corporation, Albemarle Corporation, Baerlocher GmbH, BASF SE, Chitec Technology Co. Ltd., Clariant AG, Evonik Industries AG, R.T. Vanderbilt Holding Company Inc., SABO S.p.A., Solvay S.A., SONGWON Industrial Co. Ltd., Valtris Specialty Chemicals, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the polymer stabilizers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global polymer stabilizers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the polymer stabilizers industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polymer stabilizers market was valued at USD 7.46 Billion in 2024.

IMARC estimates the polymer stabilizers market to exhibit a CAGR of 3.81% during 2025-2033, reaching USD 10.63 Billion by 2033.

The polymer stabilizers market is driven by increasing demand for durable, high-performance plastics in industries such as automotive, construction, and packaging. Rapid urbanization and industrialization are further enhancing the need for materials with enhanced thermal, UV, and oxidation resistance, which is significantly supporting the market.

North America currently dominates the polymer stabilizers market, accounting for a share exceeding 38.3%. This dominance is fueled by rapid industrialization, urbanization, infrastructure growth, and growing automotive and packaging industries in countries such as China and India.

Some of the major players in the polymer stabilizers market include Adeka Corporation, Albemarle Corporation, Baerlocher GmbH, BASF SE, Chitec Technology Co. Ltd., Clariant AG, Evonik Industries AG, R.T. Vanderbilt Holding Company Inc., SABO S.p.A., Solvay S.A., SONGWON Industrial Co. Ltd. and Valtris Specialty Chemicals, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)