Polymer Gel Market Size, Share, Trends and Forecast by Raw Material, Application, and Region, 2025-2033

Polymer Gel Market Size and Share:

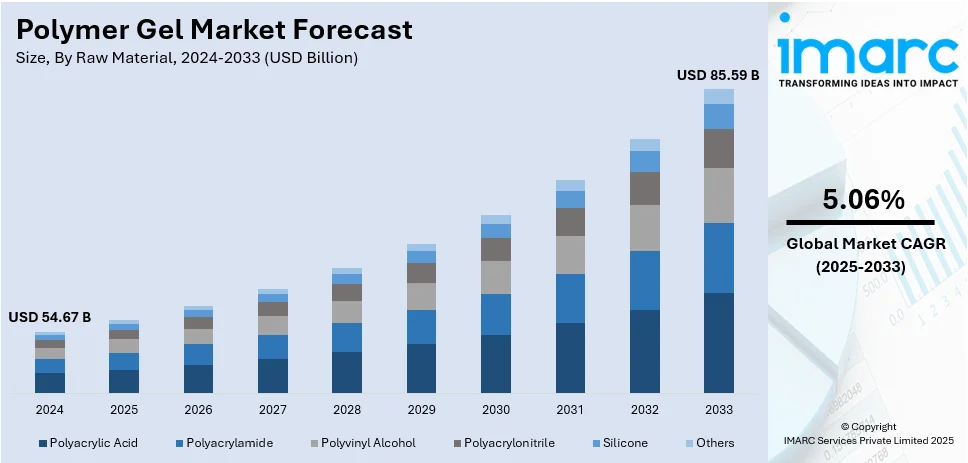

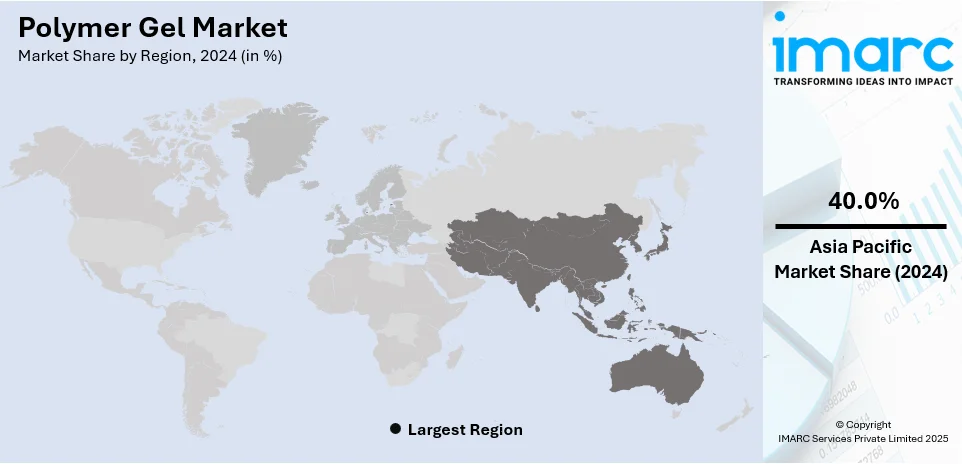

The global polymer gel market size was valued at USD 54.67 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 85.59 Billion by 2033, exhibiting a CAGR of 5.06% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 40.0% in 2024. The market is growing due to the rising demand in healthcare, personal care, and industrial applications. Additionally, advances in biomedical hydrogels, superabsorbent materials, and conductive gels drive innovation, while sustainability initiatives and regulatory compliance influence product development and market growth across multiple industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 54.67 Billion |

|

Market Forecast in 2033

|

USD 85.59 Billion |

| Market Growth Rate (2025-2033) | 5.06% |

The polymer gel market growth is driven by the increase in end-user demand across healthcare, personal care, agriculture, and industrial applications. Healthcare is a prominent market driver with superabsorbent polymer gels being used in wound care, drug delivery, and medical devices - all intended to bring improved patient benefits through their moisture retention and controlled release properties. Personal care industries also use polymer gels in common hygiene products, such as creams, lotions, and cosmetics, benefitting by higher absorption capacity and stability, thereby facilitating the polymer gel market demand. Additionally, in agriculture, a class of polymer gels improves soil conditioning, water retention, and crop yield that resolves the issues with water scarcity. Furthermore, the electronics and energy storage sectors are adopting conductive polymer gels for batteries, supercapacitors, and flexible electronics, thus paving the way for innovations in wearable technology and renewable energy solutions.

The United States continues to be the prominent market for polymer gels due to strong healthcare infrastructure, advanced R&D, and high consumer demand. The medical and pharmaceutical sectors are the most primary users that integrate polymer-based hydrogels into biomedical applications and controlled drug delivery systems, significantly increasing the polymer gel market share. Increasing emphasis on sustainability, further facilitate research on biodegradable and bio-based polymers in the form of gels to minimize their environmental impact. For instance, in May 2024, UD engineers announced that it has secured a U.S. patent for using Nodax, a biodegradable, bio-based polymer, to create piezoelectric devices. This polymer generates electricity when deformed and offers a sustainable alternative to traditional plastics, reducing environmental harm globally and enabling eco-friendly applications. Additionally, government initiatives and industry collaborations are fostering technological innovations, enabling the United States to lead in high-performance polymer gel production.

Polymer Gel Market Trends:

Numerous Innovations in Smart Gels

The rising technological advancements are catalyzing the market. The development of smart polymer gels, which respond to external stimuli, such as pH, temperature, or light, is also augmenting the market. In June 2024, researchers from numerous universities, including North Carolina State University, introduced a new class of materials known as "glassy gels" containing more than 50% liquid. These gels are difficult to break and incredibly hard. They have the potential for many uses and are easy to make. Moreover, the findings, published in Nature, underscore ongoing advancements in high-performance polymer gels for diverse commercial and scientific applications.

Extensive Applications in Healthcare

Polymer gel is used in tissue engineering, wound care, and drug delivery systems. Besides this, it can promote healing, maintain a moist environment, and reduce pain. In March 2024, Linxens, a manufacturer and designer of electronic components, collaborated with Clayens, one of the composites, polymers, and precision metal parts specialists, to develop a medical tracker directly integrated into the material. This innovation enhances patient monitoring and healthcare efficiency, reinforcing the growing demand for polymer gels in medical technology. Furthermore, such advancements are shaping the polymer gel market forecast report, fueling innovation and expanding its healthcare applications.

Growing Demand for Sustainability

With the rising environmental concerns, the market is witnessing a shift towards sustainability, thereby driving the development of eco-friendly and biodegradable gels. They can be widely useful in the agriculture industry, as these gels aid in enhancing soil moisture retention without leaving harmful residues. In April 2024, a team of researchers from the Indian Institute of Technology (IIT), Mandi, created multifunctional smart microgels made from natural polymers, bringing about a significant advancement in agricultural methods. This breakthrough is revolutionizing modern agriculture, reinforcing the importance of sustainable polymer gels in improving crop yield and reducing environmental impact.

Polymer Gel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global polymer gel market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on raw material and application.

Analysis by Raw Material:

- Polyacrylic Acid

- Polyacrylamide

- Polyvinyl Alcohol

- Polyacrylonitrile

- Silicone

- Others

Polyacrylic acid (PAA) is widely used in superabsorbent polymer (SAP) gels, particularly in hygiene products, water treatment, and biomedical applications. Its high water-absorbing capacity makes it essential for diapers, adult incontinence products, and wound dressings. In industrial applications, PAA-based gels function as thickening agents, dispersants, and stabilizers in coatings and adhesives. The demand for biodegradable PAA gels is increasing due to sustainability concerns, driving research into bio-based alternatives to reduce environmental impact while maintaining high absorption efficiency.

Polyacrylamide (PAM) is a key raw material for hydrogel-based applications in water treatment, agriculture, and enhanced oil recovery. Its high water retention and flocculation properties improve soil conditioning, reduce erosion, and enhance irrigation efficiency. In industrial processes, PAM-based polymer gels aid in wastewater treatment and sludge dewatering, supporting environmental sustainability efforts. The demand for polyacrylamide hydrogels is growing due to their role in eco-friendly water conservation practices and petroleum recovery technologies, making them crucial in the energy and environmental sectors.

Polyvinyl alcohol (PVA) is extensively used in biomedical hydrogels, contact lenses, drug delivery systems, and wound care products due to its biocompatibility and water solubility. It also plays a critical role in industrial adhesives, coatings, and films where moisture retention and flexibility are required. The increasing shift toward biodegradable polymer gels is driving demand for PVA-based formulations, particularly in eco-friendly packaging and sustainable medical applications. Advancements in crosslinking technology are further enhancing PVA’s mechanical strength and stability, expanding its application scope.

Polyacrylonitrile (PAN) is essential in high-performance polymer gels used in filtration membranes, energy storage devices, and medical textiles. Its chemical resistance and thermal stability make it ideal for ion-exchange resins, biosensors, and supercapacitors. PAN-based polymer gels are gaining traction in advanced battery technology due to their high porosity and durability. The market is witnessing increased research into PAN-derived nanogels, offering enhanced conductivity and adsorption properties, which are critical for next-generation fuel cells, medical diagnostics, and filtration systems.

Silicone-based polymer gels are widely used in medical devices, prosthetics, sealants, and personal care products due to their biocompatibility, flexibility, and temperature resistance. These gels provide soft cushioning in wound dressings, orthopedic implants, and skincare formulations, offering superior comfort and durability. Silicone hydrogels are crucial in contact lenses, ensuring high oxygen permeability for extended wear. The demand for high-performance silicone gels is increasing in electronics, aerospace, and automotive applications, where thermal stability and moisture resistance are essential for enhanced durability and performance.

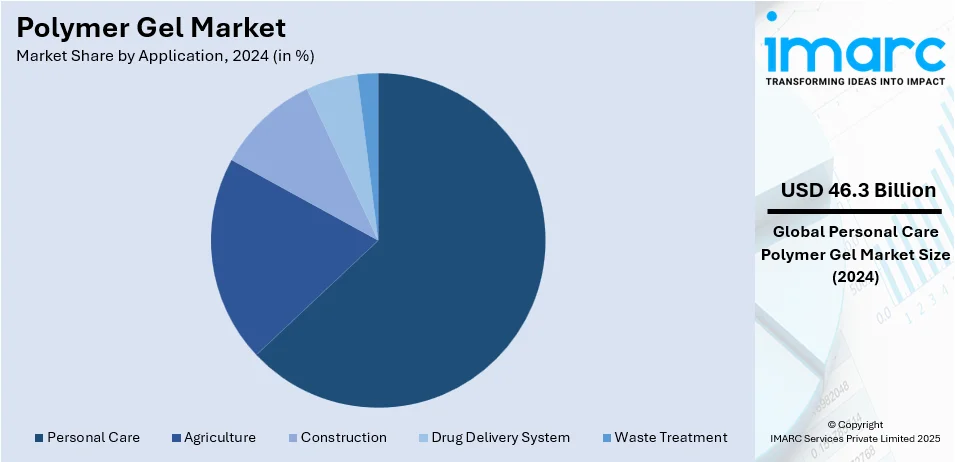

Analysis by Application:

- Personal Care

- Agriculture

- Construction

- Drug Delivery System

- Waste Treatment

Personal care leads the market with around 84.6% of market share in 2024. Polymer gels are valued for their flexibility, high water content, and smooth texture, making them essential in skincare, haircare, and cosmetic formulations. Their ability to retain moisture, enhance absorption, and improve product stability has fueled their adoption in hydrating creams, serums, and facial masks. Neutrogena’s Hydro Boost Water Gel, formulated with hyaluronic acid and polymer gels, exemplifies this trend. According to the polymer gel market outlook, growing demand for advanced skincare solutions continues to drive segment expansion and innovation.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40.0%, driven by rapid industrialization, rising disposable incomes, and increasing consumer awareness of advanced materials. The region’s strong manufacturing base and growing investments in healthcare, personal care, and electronics further fuel market expansion. Leading Japanese brands, including Shiseido and Kao, are incorporating polymer gels in skincare products, meeting the rising demand for innovative beauty solutions. The growing preference for hydrating, anti-aging, and multifunctional formulations is accelerating the adoption of polymer gels, reinforcing Asia Pacific’s leadership in the personal care and industrial applications of polymer-based technologies.

Key Regional Takeaways:

United States Polymer Gel Market Analysis

In 2024, United States accounted for 87.80% of the market share in North America. The U.S. polymer gel market is therefore growing with the advance in application in health care, agriculture, and construction. USDA's latest AFIDA report indicates that in 2023, foreign investors held as much as 45.85 million acres of U.S. agricultural land, which constitutes 3.61% of total privately held agricultural land in the United States. This is because advanced materials, such as polymer gels, are increasingly becoming essential in modern agriculture for soil improvement and water holding. As per reports, in 2023, total construction spending was at USD 1.979 trillion, which was up by 7% from 2022, and this represents the continued investment in infrastructure and smart materials where polymer gels are used for waterproofing, insulation, and structural reinforcement. Key players such as DuPont and 3M focus on innovations that ensure the efficiency of sustainable and high-performance polymer gel applications. Regulatory support toward eco-friendly materials coupled with growing R&D investment boosts market growth in the United States.

North America Polymer Gel Market Analysis

The North America market for polymer gel is growing because of increasing demand in healthcare, personal care, and industrial sectors. Superabsorbent polymers (SAPs) find extensive application in hygiene items, wound healing, and drug delivery systems, whereas conductive polymer gels facilitate electronics and energy storage innovation, thereby contributing to the market expansion. For instance, in October 2024, BASF’s Petrochemicals division invested USD 19.2 Million to upgrade its Superabsorbent Polymers (SAP) plant in Freeport, Texas. The improvements boost production efficiency, enhance polymer performance, optimize logistics, and reduce carbon footprint, reinforcing BASF’s commitment to North America’s hygiene market. The agriculture industry is also embracing polymer gels for water retention and soil conditioning to improve crop yields. In addition, sustainability issues are propelling developments in biodegradable and environmentally friendly polymer gels. Furthermore, with increasing R&D spending and advancements in technology, manufacturers are creating high-performance, multi-functional polymer gels, driving market growth in medical, consumer, and industrial applications in North America, contributing significantly to polymer gel market growth.

Europe Polymer Gel Market Analysis

Technological advances in biomedical applications, sustainability trends, and the increase in industrial usage drive the European polymer gel market. In 2023, the European Union highly invested in its agricultural sector, mainly through the Common Agricultural Policy (CAP), emphasizing this important factor strongly towards a more sustainable and resilient farming system, committing considerable funds of €307 billion (USD 316.60 billion), among others, to this course, from 2023 to 2027; the European Investment Bank also issued a special €3 billion (USD 3.09 billion) financing package solely for agriculture, forestry, and fisheries across the territory of Europe. This investment encourages innovation in adopting material such as polymer gels in soil for soil health and in water retention in the construction sectors. Horizon 2020 projects of the European Union are aimed at finding alternative building materials for energy efficiency with polymer gels. Evonik and BASF are innovators of advanced polymer gel in the high-performance category. With strict regulations towards non-toxic and environmental alternatives, the technologies of polymer gel are developed more in Europe.

Asia Pacific Polymer Gel Market Analysis

Asia Pacific polymer gel market is growing due to the demands for healthcare, agriculture, and consumer goods. Press Information Bureau indicates that, on the other hand, agriculture saw a high rise in the Indian government's budget allocation as its Department of Agriculture and Farmers' Welfare was upped to ₹1,22,528.77 crore or USD 14.1 billion in 2024-25, thus being committed to the development of the agricultural sector. Investment for the support to adopt this kind of water-retention polymers in order to improve super absorbency within gels on soils. Investment in terms of advanced construction material in areas of polymer gel from countries in regions such as China and India will enhance projects. Sumitomo Seika, Nippon Shokubai with more significant competitors will invest through research and developments so as to be able to bring about development within polymer properties that will go through different utilization procedures. The government-backed initiatives in China, India, and Japan are further driving innovation and production, which cements the region's position in the global polymer gel market.

Latin America Polymer Gel Market Analysis

Latin America polymer gel market is growing with the increasing applications in agriculture, healthcare, and personal care. According to an industry report, in agriculture, Peru has set ambitious targets to boost its agricultural exports to USD 40 billion by 2040, with plans to expand irrigated agricultural land, which may include the use of polymer gels to improve water efficiency. In the construction industries, Brazil and Mexico are already investing in such sustainable building material products, among which polymer gels will promote infrastructure resilience, energy efficiency, and other issues. Braskem is spending money on its bio-based polymer gels along with Latin American environmental sustainability focuses. International associations are further complementing local manufacturers' capabilities for technology transfer along with strengthening further the region's market expansion.

Middle East and Africa Polymer Gel Market Analysis

The polymer gel market in the Middle East and Africa is still growing, driven by increasing investments in agriculture, construction, and industrial applications. In 2023, the UAE went ahead and lent money, created incentives, and formulated policies to aid the growth of agriculture for the promotion of food security. The Emirates Development Bank gave out USD 27 million in AgTech loans in 2023 and is working to support the utilization of high-end materials, such as polymer gels for water retention and improvement in soil, in arid areas. Within the construction segment, mass infrastructure projects of Saudi Arabia and the UAE are steadily incorporating new materials including gel polymers, for strength and energy efficiency. Regional demand for high-performance polymer gels is expected to grow due to the increasing efforts of governments to promote sustainable solutions and industrial expansion. Companies such as SABIC are actively exploring new polymer formulations to address the elevated needs of different industries.

Competitive Landscape:

The market for polymer gels is highly dynamic and competitive, propelled by advances in technology, sustainability initiatives, and expanding applications in healthcare, personal care, and industrial sectors. Companies focus on developing high-performance, biodegradable, and smart polymer gels to meet regulatory requirements and consumer preferences. Additionally, the key players in the market are investing in R&D, forging strategic alliances, and diversifying their product range. For instance, in November 2024, PTT Global Chemical (GC) signed a MOU with Econic Technologies and allnex to develop eco-friendly polymer coatings using captured carbon. This collaboration aims to reduce carbon footprints, enhance durability and corrosion resistance, and advance sustainable polymer science in alignment with global sustainability goals. Additionally, the rise of biomedical hydrogels, superabsorbent materials, and conductive gels is fueling innovation. Moreover, new entrants emphasize cost-effective, eco-friendly alternatives, while established firms expand their global footprint and manufacturing capabilities, highlighting one of the key polymer gel market trends. Besides this, the increase in demand for advanced multifunctional polymer gels is stimulating competition throughout various sectors.

The report provides a comprehensive analysis of the competitive landscape in the polymer gel market with detailed profiles of all major companies, including:

- 3M Company

- Ashland LLC

- BASF SE

- Chemtex Speciality Limited

- Dow Inc

- Evonik Industries AG

- LG Chem

- Nippon Shokubai Co. Ltd

- Sanyo Chemical Industries Ltd.

- SUMITOMO SEIKA CHEMICALS CO. LTD

Latest News and Developments:

- June 2024: Researchers from numerous universities, including North Carolina State University, introduced a new class of materials known as "glassy gels," containing more than 50% liquid.

- April 2024: A team of researchers from the Indian Institute of Technology (IIT), Mandi, created multifunctional smart microgels made from natural polymers, bringing about a significant advancement in agricultural methods.

- March 2024: Linxens collaborated with Clayens, one of the composites, polymer gel, and precision metal parts specialists, to unveil a medical tracker directly integrated into the material.

Polymer Gel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Polyacrylic Acid, Polyacrylamide, Polyvinyl Alcohol, Polyacrylonitrile, Silicone, Others |

| Applications Covered | Personal Care, Agriculture, Construction, Drug Delivery System, Waste Treatment |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Ashland LLC, BASF SE, Chemtex Speciality Limited, Dow Inc, Evonik Industries AG, LG Chem, Nippon Shokubai Co. Ltd, Sanyo Chemical Industries Ltd., SUMITOMO SEIKA CHEMICALS CO. LTD, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the polymer gel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global polymer gel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the polymer gel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polymer gel market was valued at USD 54.67 Billion in 2024.

IMARC estimates the global polymer gel market to reach USD 85.59 Billion in 2033, exhibiting a CAGR of 5.06% during 2025-2033.

The polymer gel market is driven by increasing demand across various industries, including medical, cosmetics, and pharmaceuticals. Another key factor includes advancements in technology, enhanced performance characteristics, versatility in applications, and rising consumer preference for eco-friendly, bio-based products, boosting market growth.

Asia Pacific currently dominates the market, holding a market share of over 40.0% in 2024. This leadership is driven by rapid industrialization, growing healthcare and cosmetic sectors, and increasing demand for bio-based products. Moreover, strong manufacturing capabilities and expanding consumer markets further contribute to its dominant market position.

Some of the major players in the polymer gel market include 3M Company, Ashland LLC, BASF SE, Chemtex Speciality Limited, Dow Inc, Evonik Industries AG, LG Chem, Nippon Shokubai Co. Ltd, Sanyo Chemical Industries Ltd., SUMITOMO SEIKA CHEMICALS CO. LTD, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)