Polyimide Film Market Size, Share, Trends and Forecast by Application, Distribution Channel, End Use, and Region, 2025-2033

Polyimide Film Market Size and Share:

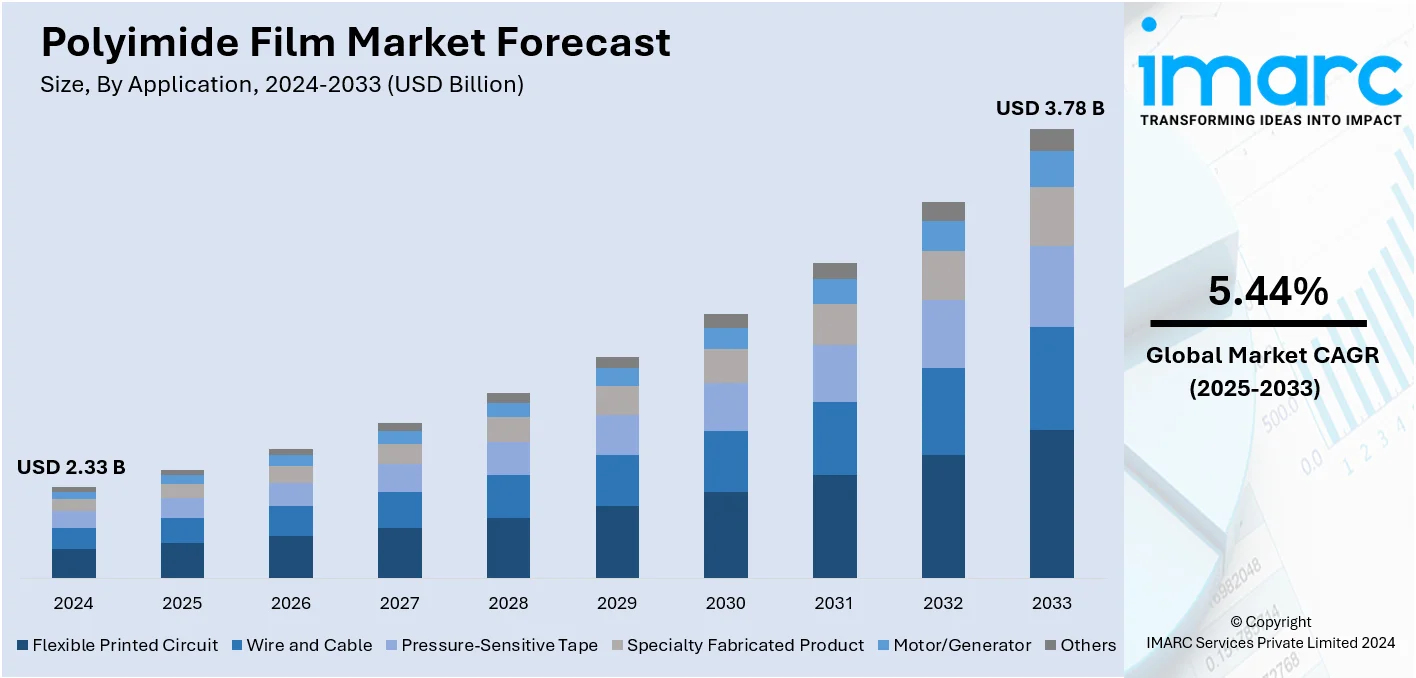

The global polyimide film market size was valued at USD 2.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.78 Billion by 2033, exhibiting a CAGR of 5.44% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 33.0% in 2024. The market is experiencing steady growth driven by the increasing demand in electronics and electrical industry, advancements in aerospace and automotive sectors, growing applications in renewable energy and medical devices, escalating demand in the telecommunications industry, and increased use of films in high-temperature applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.33 Billion |

|

Market Forecast in 2033

|

USD 3.78 Billion |

| Market Growth Rate (2025-2033) |

5.44%

|

The key drivers in the polyimide film market include increasing demand from the electronics industry for flexible and heat-resistant materials in applications like flexible circuits, insulation, and semiconductors. The growing adoption of polyimide films in the aerospace and automotive sectors, due to their lightweight, durability, and resistance to extreme temperatures, also propels market growth. Additionally, advancements in manufacturing technologies and the rising need for eco-friendly and recyclable materials are boosting their application in emerging industries such as renewable energy and electric vehicles, further expanding the market's scope. In line with this, in May 2024, BASF India announced its plans to enhance its capacity for Ultramid PA and Ultradur PBT in Panoli and Thane by over 40% to meet rising demand.

The United States polyimide film market is driven by growing demand in the electronics industry, particularly for flexible printed circuit boards, insulation, and semiconductors, due to their excellent thermal stability and electrical properties. The aerospace and automotive sectors further boost the market, leveraging polyimide films for lightweight and durable components in high-temperature environments. Additionally, advancements in 5G technology and the increasing adoption of renewable energy systems, such as solar panels, drive demand for polyimide films. According to the International Energy Agency, the U.S. solar sector saw a significant increase in installations, with 15.6 GWac added in Q1/Q2 2024 representing a 55% rise from the previous year. Rising focus on sustainable and high-performance materials also contributes to their growing use in innovative applications across various industries.

Polyimide Film Market Trends:

Growing applications in renewable energy and medical devices

The application of polyimide in renewable energy (RE) and medical industries is rapidly increasing, consequently driving the polyimide film market growth. For instance, renewable energy sources like solar, wind, and hydro, which rose by 8% in 2022, offer sustainable power solutions that enhance the production efficiency and eco-friendliness of polyimide film. This shift reduces carbon footprints while supporting high-performance material applications. In the renewable energy sector polyimide films are commonly utilized as insulation due to their excellent performance in extreme temperatures and varying weather conditions. They are particularly beneficial in solar and wind energy applications. The functions of polyimide films in the medical field are in medical tubes, circuits, and insulation of the medical devices and circuit boards of the medical instruments. The expansion of the number of hospitals and healthcare centers and the demand for better equipment to facilitate them also help in the growth of the market.

Advancements in aerospace and automotive sectors

The polyimide film market value is significantly influenced by improvements in the aerospace and automotive sectors. For instance, the global automotive sector's 12% growth in vehicle sales in 2023 has fuelled demand for polyimide film, essential for advanced insulation and durability in modern vehicles. This surge highlights the sector's pivotal role in driving polyimide film adoption. These industries need composite materials for high-temperature applications, resistance to chemicals, and stress-independent mechanical properties. Polyimide films satisfy these demanding standards, due to which they are widely used in electrical insulation, gasketing, and protective, high-temperature coatings in engines and intricate components. The rising concerns regarding emissions control, as well as the gradually emerging market for electric vehicles, are also creating a positive market outlook. Also, the ongoing advancements in aerospace engineering continuously focusing on enhancing the efficiency and reliability of aircraft propels the market growth.

This increase underscores the sector's critical role in driving polyimide film adoption.

Increasing demand in electronics and electrical industry

Polyimide films have been widely recognized due to their high thermal stability, high voltage electrical insulating ability, and mechanical strength. These qualities of polyimide films make the products indispensable in the production of flexible printed circuits, pressure sensitive tapes, as well as other related electronics products. The mobile electronics and the electronics packed in small and complex products are moving towards high reliability in small size and lightweight materials thus driving the polyimide films. According to IBEF, India's electronics manufacturing has experienced remarkable growth, surging from USD 37.1 Billion in 2015-16 to USD 67.3 Billion in 2020-21, underscoring a booming demand for advanced materials. Also, a considerable increase in the usage of consumer electronics and improvement in telecommunications networks working in tandem further creates a positive outlook for the polyimide film market overview as these films play a vital role in increasing the efficiency and durability of devices.

Polyimide Film Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global polyimide film market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on application, distribution channel, and end use.

Analysis by Application:

- Flexible Printed Circuit

- Wire and Cable

- Pressure-Sensitive Tape

- Specialty Fabricated Product

- Motor/Generator

- Others

Flexible printed circuits stand as the largest application in 2024, holding around 66.0% market share. Flexible printed circuits (FPCs) play significant roles in several sectors. Polyimide films are crucial in FPC’s due to their flexibility, high heat resistance and dielectric features. These attributes are crucial for miniaturization and the ability to improve the performance of various electronics items. FPCs are employed in portables and information appliances, automotive applications, healthcare and measuring instruments, and telecommunications and computer peripheral products. Further, the growth of the polyimide films market can be attributed by the increasing need for thin, flexible, lightweight, and high strength electronic circuits can be realized through high-performance polyimide films.

Analysis by Distribution Channel:

- Specialty Stores

- Online Stores

- Others

Specialty stores play a significant role in the distribution of polyimide films by providing customers with tailored solutions and expert advice. These stores often cater to niche markets, offering a wide variety of polyimide films that meet specific industrial requirements, such as high-temperature or electrical insulation applications. Customers benefit from direct interaction with knowledgeable staff, who can guide them in choosing the right product. This tailored approach confirms higher consumer satisfaction and drives the preference for specialty stores in the polyimide film market.

Polyimide films are becoming more popular in online stores as consumers turn towards online store for their convenience and easy accessibility. These platforms offer a wide range of options, enabling customers to compare specifications, prices, and reviews easily. Bulk ordering and doorstep delivery further enhance the appeal of online shopping, especially for industries needing large quantities. Additionally, advancements in e-commerce technology provide detailed product descriptions, helping customers make informed decisions. The growing shift towards digitalization across industries further boosts the significance of online stores in the polyimide film market.

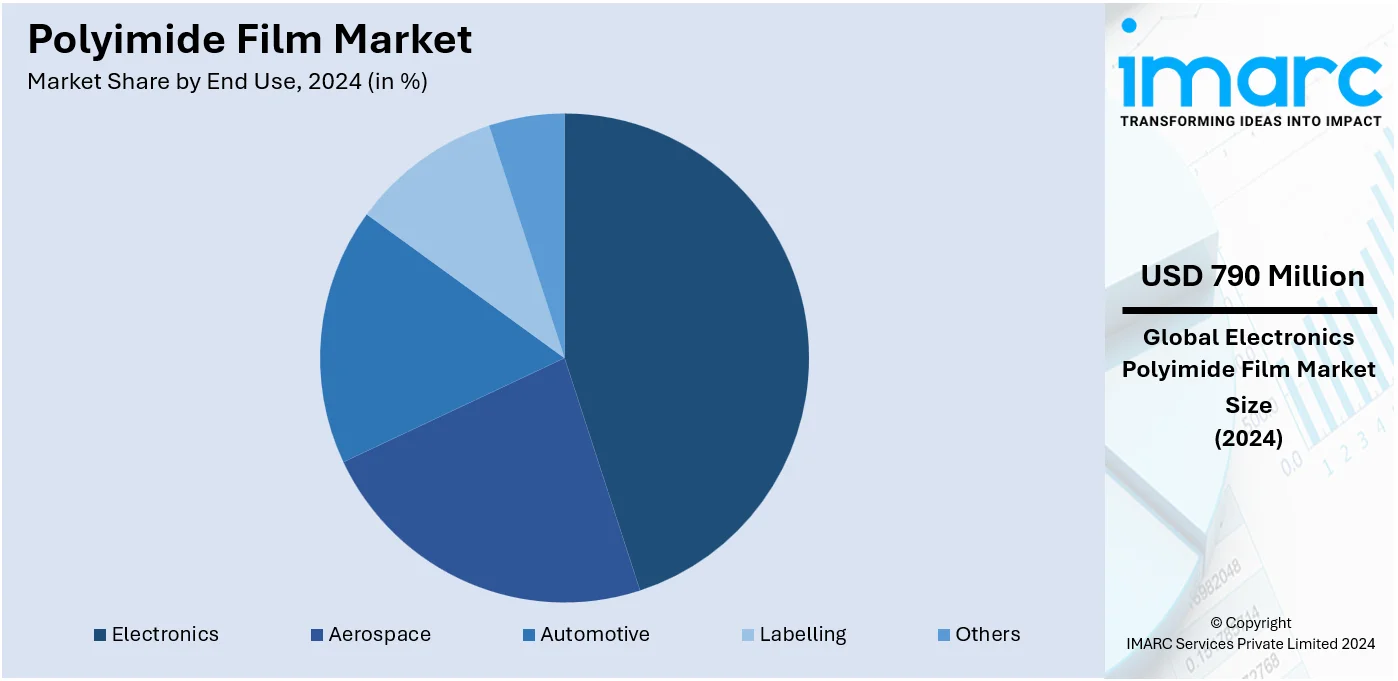

Analysis by End Use:

- Electronics

- Aerospace

- Automotive

- Labelling

- Others

Electronics leads the market with around 33.8% market share in 2024. The electronics sector leads the market due to the increasing demand for advanced electronic components and devices, thereby contributing significantly to the polyimide film market revenue. The films are crucial in the production of flex printed circuits, circuit insulating tapes, and various other parts as they possess desirable qualities of electrical conductivity and heat resistance. Moreover, considerable rise in the adoption of devices such as smartphones, tablet computers, and other wearable gadgets is augmenting this demand. Moreover, the IoT market, which currently experiences rapid growth, requiring compact and efficient electronic systems, also contributes to the need for films based on polyimide. The importance of polyimide films in this sector underlines the significance of this material in sustaining technological advancements and the stability of electronic equipment.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 33.0%. Asia Pacific dominates the polyimide film market mainly due to its strong electronics manufacturing industry and rapid industrialization. The electronics industry is highly developed especially in countries, such as China, Japan, and South Korea. Since polyimide films are a crucial component of electronics, there is a huge demand for the films. The region’s strong economic growth, growing demand for consumer electronics, and rising capital expenditures on sophisticated manufacturing technologies contribute to its leadership position. Similarly, the strategic realignment of dominant market participants, enhanced social environment, and access to high-quality raw materials augments the region’s influence.

Key Regional Takeaways:

North America Polyimide Film Market Analysis

The North America polyimide film market is driven by robust growth in the aerospace, automotive, and electronics sectors. The region’s thriving aerospace industry, emphasizing high-performance materials for extreme environments, significantly boosts demand for polyimide film in applications like wire insulation and flexible circuits. Similarly, the push for electrification and advanced safety systems in the automotive sector fosters the adoption of polyimide film for battery insulation and electronic components. The growing emphasis on lightweight and energy-efficient materials across industries, combined with advancements in electronic manufacturing, ensures sustained demand for polyimide film in North America.

In 2024, the United States captured 80.00% of the North American market. The expanding aerospace sector has significantly contributed to the increasing utilization of polyimide film, particularly in environments compelling of electric insulation and high-temperature resistance.

This trend demonstrates polyimide film's significant contribution to modifying automotive technologies and meeting the industry's developing needs.

United States Polyimide Film Market Analysis

In 2024, the United States captured 80.00% of the North American market. The expanding aerospace sector has significantly contributed to the increasing utilization of polyimide film, particularly in environments compelling of electric insulation and high temperature resistance. For instance, the growing aerospace sector, with 2,586 aircraft on order and 798 on option in the American market as of September 2024, drives demand for polyimide film due to its high-performance thermal and electrical properties, essential for advanced aircraft systems. Polyimide film's robustness in handling extreme conditions makes it ideal for components like wire insulation and flexible printed circuits used in aircraft and space exploration technologies. The rising demand for advanced aircraft and spacecraft, driven by surging air travel and space research, has bolstered its adoption. Additionally, the need for energy-efficient systems within this sector has driven the demand for lightweight yet durable materials like polyimide film. The growing emphasis on electricity optimization in aerospace systems further amplifies its necessity, as the material is widely used in electronic control systems to ensure reliability and safety. This trend demonstrates polyimide film’s significant contribution to modifying automotive technologies and meeting the industry’s developing needs.

Europe Polyimide Film Market Analysis

The automotive industry has seen a rising demand for polyimide film, primarily due to its application in advanced safety systems, electrified drivetrains, and lightweight vehicle designs. According to International Council on Clean Transportation, in 2023, new car registrations in the European Union rose by 14%, marking the first growth since 2019. This growing automotive market boosts demand for polyimide film, essential for lightweight and durable vehicle components. With the push for more efficient and sustainable vehicles, polyimide film's role in enabling the miniaturization of electronic components has become crucial. Its use in battery insulation, sensors, and flexible circuits supports the industry's drive toward enhanced vehicle functionality and reduced energy consumption. Moreover, the material's resistance to high temperatures and mechanical stress ensures reliability in harsh operating conditions, a vital aspect for automotive electronics. As innovations like autonomous systems and electric drivetrains expand, the demand for durable, high-performance materials continues to rise. This trend demonstrates polyimide film's significant contribution to advancing automotive technologies and meeting the industry's evolving needs.

Latin America Polyimide Film Market Analysis

The growth of urban populations has intensified the demand for infrastructure and technological advancements. Urbanization drives the proliferation of devices and systems that require reliable electronic components, where polyimide film excels due to its thermal and electrical properties.

For instance, urban areas housed 124.1 Million people in 2022, accounting for 61% of the population, driving demand for advanced materials like polyimide film. This growth fosters innovation in applications such as flexible household electronics, increasing the demand of polyimide film. From flexible circuits in household electronics to power management systems in urban infrastructure, polyimide film applications are diverse. This material's durability and adaptability make it suitable for emerging smart city initiatives, enhancing energy efficiency and system resilience. As urban growth continues, the reliance on materials like polyimide film, integral to modern technologies, will grow.

Middle East and Africa Polyimide Film Market Analysis

The expansion of the real estate sector has spurred the need for advanced construction materials and integrated technologies, driving the adoption of polyimide film. According to reports, the expanding real estate sector, with over 5,200 active construction projects worth USD 819 Billion in Saudi Arabia, drives demand for polyimide film in electronic components used in construction and households. Polyimide films are instrumental in energy-efficient solutions such as solar panels and HVAC systems due to their superior insulation properties. Its use in flexible electronics for building automation systems further supports the rising demand for smart building technologies. The push for sustainable infrastructure development highlights the importance of durable, versatile materials like polyimide film. Its contribution to enhancing energy optimization and improving the performance of integrated systems underscores its growing importance in the evolving real estate landscape.

Competitive Landscape:

The polyimide film market is highly competitive, driven by innovations and a growing demand for high-performance materials in industries like aerospace, electronics, and automotive. Manufacturers are focusing on enhancing thermal stability, flexibility, and durability to cater to diverse applications, such as flexible circuits, battery insulation, and sensors. The market is witnessing investments in advanced manufacturing technologies to improve cost efficiency and product quality. Additionally, sustainability goals are encouraging the development of eco-friendly production processes, giving rise to new opportunities. The competitive landscape is shaped by players emphasizing R&D, strategic partnerships, and expanding regional footprints to meet evolving industry demands.

The report provides a comprehensive analysis of the competitive landscape in the polyimide film market with detailed profiles of all major companies, including:

- Arakawa Chemicals Industries Ltd

- Compagnie de Saint-Gobain S.A.

- Flexcon Company Inc.

- I.S.T Corporation

- Kaneka Corporation

- Kolon Industries Inc.

- Shinmax Technology Ltd

- Taimide Tech Inc.

- Toray Industries Inc.

- UBE Industries Limited

Latest News and Developments:

- December 2024: PI Advanced Materials, an Arkema affiliate and global leader in polyimide materials, achieved a breakthrough with the launch of the world’s first 4 μm ultra-thin non-stretched polyimide film. This innovation highlights their expertise in advanced material technology, setting a new industry benchmark. The ultra-thin film offers enhanced applications across various sectors. This milestone reinforces PI Advanced Materials' dominance in the polyimide market.

- December 2024: Dunmore introduced the DUN-DIFFUSE™ White Kapton® Polyimide Film, a groundbreaking multi-layer insulation (MLI) innovation for aerospace applications. This film offers enhanced thermal efficiency, high emissivity, and improved adhesion for superior protection of passive thermal control systems. With its advanced properties, it serves as an alternative to traditional paint, optimizing aerospace thermal management.

- December 2024: Arkema finalized the acquisition of Dow’s flexible packaging laminating adhesives business. This move positions Arkema as a key player in the flexible packaging market by enhancing its portfolio with innovative adhesive solutions. The acquisition aligns with Arkema's strategy to strengthen its high-performance materials segment. Polyimide film, a critical material for advanced packaging, complements the expanded portfolio. This strategic addition boosts Arkema’s competitiveness in the global flexible packaging industry.

- June 2024: Arkema strengthened its high-performance polymer portfolio by acquiring a 54% stake in South Korea's PI Advanced Materials (PIAM) from Glenwood Private Equity for an enterprise value of approximately USD 800 Million USD. Specializing in Polyimide Film, PIAM enhances Arkema's advanced material offerings. This strategic acquisition enables full consolidation of PIAM into Arkema's financial accounts, expanding its presence in the high-performance polymers market. The move aligns with Arkema’s growth strategy in innovative materials.

Polyimide Film Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Flexible Printed Circuit, Wire and Cable, Pressure-Sensitive Tape, Specialty Fabricated Product, Motor/Generator, Others |

| Distribution Channels Covered | Specialty Stores, Online Stores, Others |

| End Uses Covered | Electronics, Aerospace, Automotive, Labelling, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arakawa Chemicals Industries Ltd, Compagnie de Saint-Gobain S.A., Flexcon Company Inc., I.S.T Corporation, Kaneka Corporation, Kolon Industries Inc., Shinmax Technology Ltd, Taimide Tech Inc., Toray Industries Inc., UBE Industries Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the polyimide film market from 2019-2033.

- The polyimide film market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the polyimide film industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Polyimide film is a high-performance polymer material known for its exceptional thermal stability, mechanical strength, and electrical insulating properties. It is widely used in industries such as electronics, aerospace, and automotive for applications like flexible printed circuits, insulation, and high-temperature coatings.

The global polyimide film market was valued at USD 2.33 Billion in 2024.

IMARC estimates the global polyimide film market to exhibit a CAGR of 5.44% during 2025-2033.

Key drivers include the rising demand for flexible and heat-resistant materials in electronics, increased use in aerospace and automotive sectors, advancements in renewable energy technologies, and growing applications in medical devices and telecommunications.

In 2024, Flexible Printed Circuits (FPCs) represented the largest segment by application, driven by their essential role in miniaturized, lightweight, and high-performance electronics.

The electronics sector is the leading segment by end use, driven by the increasing demand for advanced electronic components and devices, particularly in consumer electronics and IoT applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global polyimide film market include Arakawa Chemicals Industries Ltd, Compagnie de Saint-Gobain S.A., Flexcon Company Inc., I.S.T Corporation, Kaneka Corporation, Kolon Industries Inc., Shinmax Technology Ltd, Taimide Tech Inc., Toray Industries Inc., UBE Industries Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)