Point-of-Care Diagnostics Market Size, Share, Trends and Forecast by Product Type, Platform, Prescription Mode, End-User, and Region, 2025-2033

Point-of-Care Diagnostics Market Size and Share:

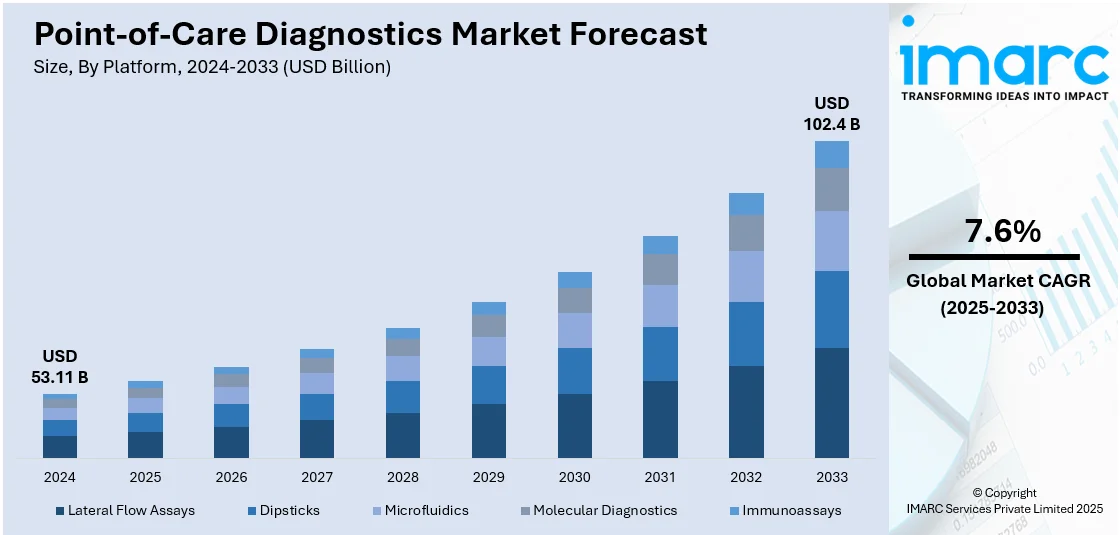

The global point-of-care diagnostics market size was valued at USD 53.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 102.4 Billion by 2033, exhibiting a CAGR of 7.6% during 2025-2033. North America currently dominates the market in 2024. The increasing demand for faster and more convenient diagnostic solutions, rising prevalence of infectious diseases across the globe, and advancements in technology and miniaturization represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 53.11 Billion |

|

Market Forecast in 2033

|

USD 102.4 Billion |

| Market Growth Rate (2025-2033) | 7.6% |

The global market is majorly driven by the prevalence of chronic and infectious diseases requiring faster and accurate diagnostic solutions for effective management. In addition to this, increasing demand for rapid testing kits in emergency and remote settings is augmenting the adoption of point-of-care diagnostics, thereby promoting the accessibility of healthcare services. Furthermore, the integration of sophisticated technologies, including biosensors and microfluidics, into the processes for streamlining diagnosis, resulting in increased efficiency and reliability, is propelling the market. Moreover, continual improvements the healthcare infrastructure, along with an increasing focus on early detection of diseases for timely intervention, are creating a positive market outlook. Besides this, research and development (R&D) expenditures for innovative diagnostic solutions are encouraging the growth in point-of-care technologies. The increasing demand for digital platforms and connectivity in diagnostics is also making it easier to manage data and consequently improving overall outcomes for the patient. Furthermore, the increased applications of point-of-care diagnostics in such areas as oncology, cardiology, and infectious disease management have strengthened the growth of this market.

The United States stands out as a key regional market, driven by the increasing prevalence of chronic and infectious diseases among the masses. Besides, the accelerating demand for home-based and portable testing devices is also propelling the point-of-care diagnostics market by facilitating greater patient convenience. Also, the increasing usage of advanced technologies such as AI and biosensors in diagnostics has streamlined the process and helped in better accuracy and efficiency, which is creating lucrative opportunities in the market. In addition, positive regulatory policies driving innovation and increasing the availability of products in all healthcare settings is impelling the market. As of February 22, 2024, the FDA's Diagnostic Data Program launched an initiative that aimed to support the development of innovative methods for collecting, harmonizing, transmitting, and analyzing diagnostic data from tests performed outside traditional laboratories. This will help integrate non-laboratory-based data streams with lab-based ones to improve public health decision-making. Also, strategic collaborations with federal agencies, such as NIH's ITAP and RADx programs, are facilitating the authorization of at-home tests by developing standardized evaluation protocols and data reporting mechanisms. Furthermore, increased investments in healthcare infrastructure is significantly expanding access to sophisticated diagnostic solutions, which is driving market growth.

Point-of-Care Diagnostics Market Trends:

The Growing Prevalence of Chronic Diseases

According to the World Health Organization (WHO), non-communicable diseases, also called chronic diseases, kills 41 million people each year, which is equivalent to 74% of all deaths globally. Similarly, infectious diseases such as HIV remain a major health challenge, with an estimated 39.0 million people living with HIV in 2022 and approximately 1.3 million acquiring the infection globally that year, according to WHO. The global rise in chronic diseases is driving the demand for POC diagnostic services. Chronic conditions, such as diabetes, cardiovascular diseases, and respiratory disorders, are becoming increasingly prevalent among the masses, posing substantial challenges to healthcare systems worldwide. POC diagnostics offer a valuable tool for spontaneous detection and continuous monitoring of these health complications, facilitating timely interventions and effective disease management. The convenience and easy availability of POC testing further contributes to the management of chronic diseases, especially in remote or rural areas where access to traditional laboratory facilities is limited or not available.

Various Technological Advancements

Technological innovations and integration play a crucial role in supporting the point-of-care diagnostics market growth. Initiatives and research in miniaturization, biosensors, and connectivity are leading to the creation of various smart and portable diagnostic devices and systems. These POC devices can perform a wide range of tests with high accuracy, which traditional laboratory-based methods often fail to deliver. They are also often integrated with expanded test menus to eliminate the need for multiple devices and reduce turnaround time for getting the test results. For instance, in February 2023, Huwel Lifesciences developed a portable RT-PCR device that can test multiple viruses. The company stated the test takes about 30 minutes and can identify respiratory and other infections using blood and gastrointestinal samples. Similarly, Abbott launched ID NOW in 2020, which is the world's fastest molecular POC test. It delivers COVID-19 results in just 13 minutes. This device is widely used in dispersed healthcare settings such as doctor's offices and urgent care clinics. In May 2023, Danaher Corporation introduced the Dxl 9000 Access Immunoassay Analyzer, capable of running up to 215 tests per hour, significantly expanding the company's POC diagnostics offerings. Companies are also planning to produce POC diagnostics systems which are compact in size and offer comprehensive testing facilities. Key market players are also collaborating with other firms to offer unique and reliable diagnostic solutions to revolutionize healthcare delivery. Molbio Diagnostics declared its partnership with SigTuple in 2023 to develop next-generation AI-enabled portable devices for many routine and diagnostic tests.

The Growing Emphasis on Personalized Medicine

The increasing need for personalized medicine among the masses is propelling the growth of the market. The National Cancer Institute (NCI) has launched a large precision medicine cancer initiative to examine the effectiveness of treating children and adults with various novel drug combinations. Moreover, as the healthcare sector is transitioning towards a more patient-centric approach, the acceptance of personalized medicine is facilitating the creation of treatment plans according to the needs of patients. The World Health Organization (WHO) reported that sharp increases in government spending on health at all income levels in 2020 underpinned a rise in global health expenditure to a new high of USD 9 Trillion, accounting for approximately 11% of global GDP. This increase in investment reflects the growing focus on advanced healthcare solutions, including precision medicine. POC diagnostics play a pivotal part in this procedure as it offers rapid and targeted diagnostic solutions that aid in precise disease identification and monitoring. They provide a sense of assurance to patients regarding their treatment and overall wellbeing, which is also responsible for their high acceptance among patients. Moreover, according to research done by Coriell Life Sciences, it is confirmed that precision medicine has reached a global tipping position for adoption.

Point-of-Care Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global point-of-care diagnostics market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product type, platform, prescription mode, and end-user.

Analysis by Product Type:

- Blood-Glucose Monitoring Kit

- Cardio-Metabolic Monitoring Kit

- Pregnancy and Fertility Testing Kit

- Infectious Disease Testing Kit

- Cholesterol Test Strip

- Hematology Testing Kit

- Others

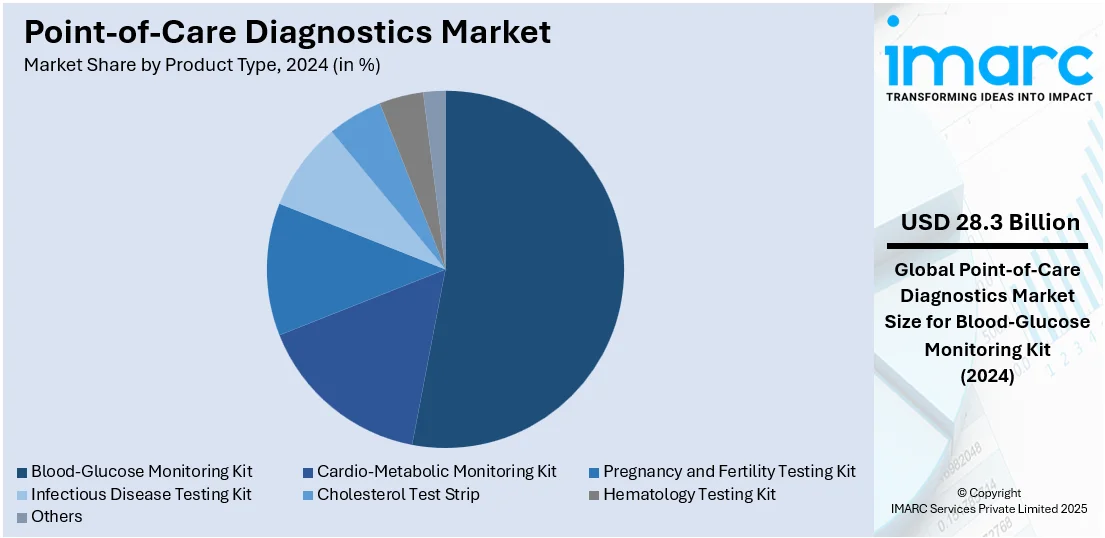

Blood- glucose monitoring kit leads the market in 2024. Blood-glucose monitoring kits are designed to be user-friendly, allowing patients to perform tests themselves without the need for specialized medical training. The simplicity and convenience of these kits are contributing to their widespread adoption, making them accessible to a broad spectrum of patients, including those in remote or underserved areas. Moreover, blood-glucose monitoring kits are often compact and portable, enabling patients to carry them wherever they go, thereby offering a favorable point-of-care diagnostics market outlook. Furthermore, based on the predictions and research by the Institute for Health Metrics and Evaluation, global diabetes cases will increase from 529 million to 1.3 billion by 2050. The US Food and Drug Administration cleared the first over the counter (OTC) continuous glucose monitoring system (CGM) in the US -- the Dexcom Stelo Glucose Biosensor System. This will help people with Type 2 diabetes who don’t need insulin to track their blood sugar for nonmedical purposes.

Analysis by Platform:

- Lateral Flow Assays

- Dipsticks

- Microfluidics

- Molecular Diagnostics

- Immunoassays

Lateral flow assays lead the market in 2024. Lateral flow assays are known for their simplicity and user-friendly design. They are easy to use, requiring minimal training for both healthcare professionals and patients. The test procedure typically involves incorporating a sample such as blood, saliva, and urine to a test strip, and the results are visually interpreted through the appearance of colored lines, eliminating the need for complex laboratory equipment. They offer stability over a wide range of environmental conditions and have a long shelf life. They also require a small sample volume to conduct tests. As a result, various organizations and institutions are investing in the development of advanced lateral flow assays. For instance, iiCON announced in 2021 that it will support Liverpool SME to develop advanced lateral flow tests, which can be performed with and without the addition of the Nano Biosols reagent.

Analysis by Prescription Mode:

- Prescription-Based Testing

- OTC Testing

Prescription-based testing leads the market in 2024. Prescription-based testing involves diagnostic tests that require a healthcare professional's order or prescription before they can be performed. These tests often undergo rigorous regulatory approval processes to ensure their safety, efficacy, and accuracy. The involvement of healthcare professionals in prescribing these tests ensures appropriate medical supervision and interpretation of the results, leading to better patient care and treatment decisions. Prescription-based testing is essential for the accurate detection, staging, and monitoring of diseases such as cancer, infectious diseases, cardiovascular disorders, and autoimmune conditions. As per the reports of WHO, over 35 million new cancer cases will arise by 2050. This will further increase the need for prescription-based testing solutions.

Analysis by End-User:

- Professional Diagnostic Centers

- Home Care

- Research Laboratories

- Others

Professional diagnostics centers lead the market in 2024. Professional diagnostic centers offer a wide range of POC diagnostic tests, catering to various medical specialties and healthcare needs. These centers often have advanced equipment and well-trained personnel, allowing them to perform a diverse set of tests, including blood tests, rapid infectious disease testing, urinalysis, pregnancy tests, and more. The availability of comprehensive testing services makes professional diagnostic centers a preferred choice for both patients and healthcare providers. Moreover, professional diagnostic centers are staffed by qualified healthcare professionals, including medical technologists, clinical laboratory scientists, and physicians. For instance, according to a report by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), from 2008 to 2021, the pharmaceutical sector received the largest share of foreign direct investment, totaling USD 32 Billion. This amount notably surpassed the FDI attracted by the medical devices sector, which stood at USD 20 billion, the biotechnology industry (USD 17 billion), and healthcare (USD 10.8 Billion) subsectors. This further increased the number of professional diagnostic centers providing comprehensive healthcare services.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share. North America has a highly developed healthcare infrastructure with well-established medical facilities, laboratories, and diagnostic centers. The robust healthcare system of the region enables widespread adoption and integration of POC diagnostics into routine medical practice, contributing to their market dominance. Besides this, the high prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and respiratory conditions, is driving the demand for comprehensive testing services. POC diagnostics play a crucial role in the early detection, monitoring, and management of these chronic conditions. For instance, as per a press release by the Centers for Disease Control and Prevention, the number of Americans with diabetes will range between 1 in 3 to 1 in 5 by 2050. This will further increase the demand for point-of-care testing solutions in the region.

Key Regional Takeaways:

United States Point-of-Care Diagnostics Market Analysis

The increasing cancer incidence in the United States is a strong growth factor for the point-of-care diagnostics market in the country. Early detection of cancer improves patient outcomes and the demand for advanced diagnostic solutions is on the rise. According to Cancer.org 2021 data, approximately 1.9 million new cancer cases were diagnosed in the U.S., with 608,570 deaths reported. These alarming statistics call for some innovative diagnostic technologies that should enable timely and accurate disease detection. Moreover, the market leaders have been bringing innovative products due to growing demand for this emerging need. For instance, last October 2022, F. Hoffmann-La Roche Ltd. received its first companion diagnostic, which allows the identification of patients suffering from HER2-low metastatic breast cancer, eligible to receive ENHERTU. This diagnostic breakthrough would mark an important step ahead in cancer care, and it is the role of point-of-care diagnostics that becomes vital in providing patient-specific and targeted solutions. Such innovation will most likely propel the U.S. POC diagnostics market since they respond to the growing need for customized and accurate health care.

Europe Point-of-Care Diagnostics Market Analysis

The increasing prevalence of chronic diseases in Europe is a key growth driver for this region's point-of-care diagnostics market. The International Diabetes Federation (IDF) reports that the prevalence of diabetes in the European region is going to increase by 13%. The number of people afflicted with this disease will reach 61 million by 2045. This growing diabetes burden increases the demand for POC diagnostic solutions to monitor glucose levels and manage the disease effectively. Also, cardiovascular diseases (CVD), which are the cause of death in Europe, also drive the POC diagnostics market. The National Institutes of Health reported that CVD accounts for 45% of all deaths in the region, with over 4 million deaths annually, primarily from coronary heart disease and stroke. With a rising incidence of these conditions, there is a need for prompt, on-site diagnostic solutions to detect early, manage, and monitor. POC diagnostics offer an efficient way to address these healthcare challenges, contributing to the market’s growth.

Asia Pacific Point-of-Care Diagnostics Market Analysis

One major driving force for the POC diagnostics market in Asia Pacific is the accelerating patients with chronic diseases. Notably, the OECD 2021 states that, out of 227 million people living with type 2 diabetes in the Asia-Pacific region, close to half remain undiagnosed or without realizing their long-term complications. This increase in trend is leading to an escalating demand for early detection and monitoring and thereby propelling the utilization of POC diagnostics. Additionally, the miniaturized diagnostic models and the measures undertaken in hospitals and clinics to reduce the duration of hospital and clinic stay will further propel the demand for POC devices. Moreover, improving health outcomes require accessible and efficient solutions for diagnostics, especially in rural and underserved areas. Also, the market is also being driven by rapid technological advancements, high prevalence of both chronic and infectious diseases, and continuous efforts by local companies and organizations to improve healthcare access. For instance, in January 2023, Cipla Limited launched Cippoint, a POC device capable of testing a wide range of parameters, including diabetes, cardiac markers, fertility, and infectious diseases. This innovation reflects the growing trend of comprehensive, multi-disease diagnostics in the region, further boosting the adoption of POC technologies.

Latin America Point-of-Care Diagnostics Market Analysis

This market is gaining momentum in Latin America, primarily due to the increase in prevalence of chronic diseases, along with the growth need for early disease diagnosis. The World Cancer Research Fund International reported that nearly 101,703 cancer cases were diagnosed in Mexico in 2022, which points out the growing demand for appropriate and easily accessible diagnostic devices. POC diagnostics are highly important as early detection of a condition, such as cancer or any other dangerous disease, can lead to positive health outcomes and lessen further health burdens. The rising chronic diseases, including diabetes and cardiovascular diseases, have been stimulating the demand for POC devices as it can offer an immediate and cost-effective diagnosis that results in proper and efficient care of these patients. Also, increasing healthcare technologies and an increase in the awareness levels for preventive health are also significant growth-inducing factors for the market across this region.

Middle East and Africa Point-of-Care Diagnostics Market Analysis

The World Heart Federation says that CVD is the leading cause of death in the MENA region, accounting for more than one-third of all deaths or approximately 1.4 million fatalities annually. In 2024, the percentage of CVD deaths varies from country to country in the region, which ranges from 40 percent of total deaths in Oman to 10 percent in Somalia. High prevalence rates of cardiovascular diseases will fuel point-of-care diagnostics growth in Middle East and Africa. POC diagnostics in the management of cardiovascular disease ensure early detection, monitoring, and management of this type of disease, making a timely intervention possible. Growing cardiovascular diseases weigh much on the region. Adoption of POC technologies across the region is likely to gain momentum because of an increasing demand for accessible, rapid, and cost-effective diagnostic solutions. MENA region healthcare systems that have prioritized efficient and preventive care are also going to create an even greater need for POC diagnostics, hence accelerating market growth.

Competitive Landscape:

The competitive landscape of the market comprises a wide variety of players, which comprises established companies, emerging startups, and specialized firms. Major players are focusing significant investment on R&D innovation and development of the latest POC diagnostic solutions. Also, they are placing their emphasis on accuracy, sensitivity, and speed of the tests. Top companies expand the range of analytes and diseases detectable by POC devices. R&D activities also encompass the design of innovative technologies, such as biosensors, microfluidics, and systems that are lab-on-a-chip, in pursuit of improving the performance capabilities of POC diagnostics. In addition, they adjust the designs of their products to meet specific health needs and regulatory requirements in various countries. For instance, the company Cipla expanded its product portfolio with the launch of a point-of-care testing device for different forms of non-communicable diseases and other diseases/health conditions. The point-of-care diagnostics market statistics clearly show a very strong growth trajectory, led by higher demands for rapid testing, new technologies, and increasing attention to decentralized healthcare.

The report provides a comprehensive analysis of the competitive landscape in the point-of-care diagnostics market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- F. Hoffmann-La Roche AG

- Instrumentation Laboratory

- Johnson & Johnson

- Nova Biomedical Corporation

- Pts Diagnostics

- Qiagen

- Siemens

- Trinity Biotech

Recent Developments:

- April 2024: Roche Diagnostics India launches its point-of-care (PoC) NT-proBNP test to screen diabetes patients at risk of cardiovascular diseases, most notably, heart failure.

- December 2023: Thermo Fisher Scientific Inc. and Project HOPE, a leading global health and humanitarian organization, collaborated with each other to expand access to HIV testing services by Thermo Fisher among the HIV Positive Youth in Sub-Saharan Africa.

- January 2023: Beckman Coulter, Inc. said it has formed a strategic partnership with MeMed to develop and commercialize a host immune response diagnostic test.

Point-of-Care Diagnostics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blood-Glucose Monitoring Kit, Cardio-Metabolic Monitoring Kit, Pregnancy and Fertility Testing Kit, Infectious Disease Testing Kit, Cholesterol Test Strip, Hematology Testing Kit, Others |

| Platforms Covered | Lateral Flow Assays, Dipsticks, Microfluidics, Molecular Diagnostics, Immunoassays |

| Prescription Modes Covered | Prescription-Based Testing, OTC Testing |

| End Users Covered | Professional Diagnostic Centers, Home Care, Research Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Beckman Coulter, Inc., Becton, Dickinson and Company, F. Hoffmann-La Roche AG, Instrumentation Laboratory, Johnson & Johnson, Nova Biomedical Corporation, Pts Diagnostics, Qiagen, Siemens, Trinity Biotech etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the point-of-care diagnostics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global point-of-care diagnostics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the point-of-care diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Point-of-care (POC) diagnostics are medical testing tools designed to provide immediate diagnostic results at or near the site of patient care, enabling quick decision-making and improving healthcare efficiency.

The global point-of-care diagnostics market was valued at USD 53.11 Billion in 2024.

IMARC estimates the global point-of-care diagnostics market to exhibit a CAGR of 7.6% during 2025-2033.

The market is primarily driven by the rising prevalence of chronic and infectious diseases, advancements in diagnostic technology, increasing demand for home-based testing, and growing awareness of preventive healthcare.

In 2024, blood-glucose monitoring kits represented the largest segment by product type, driven by their ease of use and widespread adoption.

Lateral flow assays lead the market by platform owing to their simplicity and ability to provide rapid results without complex laboratory setups.

Prescription-based testing is the leading segment by prescription mode, driven by its regulatory approval and involvement of healthcare professionals for accurate disease management.

Professional diagnostic centers are the leading segment for end user in 2024, driven by their comprehensive testing services and access to advanced diagnostic equipment operated by qualified healthcare professionals.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global point-of-care diagnostics market include Abbott Laboratories, Beckman Coulter, Inc., Becton, Dickinson and Company, F. Hoffmann-La Roche AG, Instrumentation Laboratory, Johnson & Johnson, Nova Biomedical Corporation, Pts Diagnostics, Qiagen, Siemens, and Trinity Biotech, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)