Point-of-Care Data Management Software Market Size, Share, Trends and Forecast by Mode of Delivery, Application, End User, and Region, 2025-2033

Point-of-Care Data Management Software Market Size and Share:

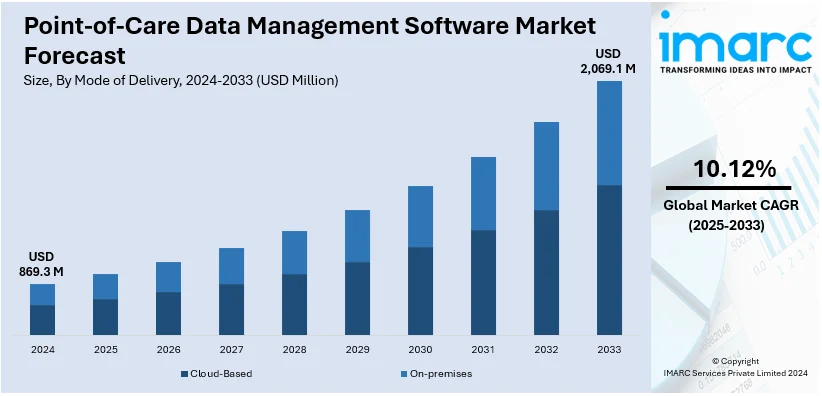

The global point-of-care data management software market size was valued at USD 869.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,069.1 Million by 2033, exhibiting a CAGR of 10.12% during 2025-2033. North America currently dominates the market, holding a significant market share of over 42.0% in 2024. The increasing investments in healthcare IT, the rising need for real-time patient data, the advancements in software technology, and the growing importance of real-time data access for patient-centered care are some of the factors propelling the market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 869.3 Million |

|

Market Forecast in 2033

|

USD 2,069.1 Million |

| Market Growth Rate (2025-2033) | 10.12% |

The global point-of-care (POC) data management software market is driven by the increasing adoption of digital healthcare solutions to enhance efficiency and accuracy in clinical settings. The growing prevalence of chronic diseases and the rising demand for rapid diagnostic solutions have fueled the need for seamless data integration at the point of care. Advances in healthcare IT infrastructure, along with the increasing use of connected devices, support the adoption of POC data management systems. Additionally, regulatory requirements for accurate patient data recording and reporting encourage healthcare facilities to invest in robust software solutions. The emphasis on real-time data access and improved patient outcomes further accelerates the market's growth, as providers seek streamlined workflows and enhanced decision-making capabilities.

The United States stands out as a key regional market, primarily driven by the increasing emphasis on value-based care and the need for advanced technological solutions in healthcare facilities. The expanding role of electronic health records (EHRs) and interoperability standards drives the adoption of POC software to streamline data sharing and improve clinical workflows. On 17th January 2024, PointClickCare Technologies, a leading healthcare technology platform, revealed on January 17, 2024, that it had acquired American HealthTech, Inc., a subsidiary of Computer Programs and Systems, Inc., a leading provider of electronic health record solutions and related services for the post-acute care market. With PointClickCare, AHT care teams will have access to the data they need to collaborate and intervene proactively with patients at the point of care, helping to thrive in an increasingly changing market as patient needs become more complex. Rising healthcare expenditures and investments in digital health initiatives create a favorable environment for market growth. Concurrently, the growing prevalence of personalized medicine and decentralized healthcare models necessitates efficient data management at the point of care. The demand for solutions that enhance compliance with healthcare regulations and optimize resource allocation further stimulates market expansion in the United States

Point-of-Care Data Management Software Market Trends:

Increasing popularity of point of care testing

The adoption of point-of-care testing (POCT) is on the rise as the demand for fast and decentralized diagnostic tests keeps growing. According to the IMARC Group, point-of-care diagnostics market size reached USD 53.1 Billion in 2024. This, in turn, is driving point-of-care data management software market outlook. This software helps bring together data from POCT devices into electronic health records (EHRs) or laboratory information systems (LIS), hence promoting the growth in its demand. It is more imperative now to use this software due to increased focus in patient-centered care and a need for real time access to data. The value of having immediate access to accurate patient information especially in critical care settings cannot be overemphasized.

Rapid technological advancements

Advancements in medical technology including cloud computing and data analytics, among others have also led to sophisticated software solutions development. These improvements facilitate efficient management and analysis of data obtained through POCT devices by healthcare providers leading to better patient care and decision-making. For instance, Planet Innovation launched NeoSync™, a unique, out-of-the-box product that connects medical devices to popular Electronic Health Records (EHR). As demand for POC testing continues to increase, PI has developed a connectivity solution that adds digital smarts to the growing market. Increased technological advances in the healthcare sector including AI integration and machine learning are the ongoing drivers for this market as well. This, in turn, is creating a positive outlook for the point-of-care data management software market revenue.

Growing focus on remote patient monitoring and telemedicine

A rise in telehealth services and an increasing need for effective records management solutions to facilitate remote patient monitoring and virtual consultations has led to various point-of-care data management software market recent developments, including data management solutions. According to the Centers for Disease Control and Prevention, in 2021, 37.0% of adults used telemedicine in the past 12 months. The software helps to remotely access patient information, monitor their vital signs, and follow up treatments in real-time irrespective of where patients are. This increases the efficiency of healthcare delivery by minimizing physical visits and hospitalizations. The predicted expansion of telemedicine would grow the need for sophisticated point-of-care data management software. This, in turn, will drive the point-of-care data management software market price.

Point-of-Care Data Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global point-of-care data management software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on mode of delivery, application, and end user.

Analysis by Mode of Delivery:

- Cloud-Based

- On-premises

Cloud-based stands as the largest component in 2024, holding around 63.5% of the market. The prevalence of cloud-based delivery in the point-of-care data management software market arises from its inherent advantages including cost-effectiveness, scalability, and accessibility. This eventually allows healthcare professionals to access patient’s information remotely thus enabling remote patient monitoring through telemedicine. Moreover, cloud infrastructure is highly scalable thereby allowing easy integration with existing systems and taking care of increased data volumes without high capital investments. Subsequently, cloud solutions are also affordable as they have a subscription-based pricing model which avoids up-front costs reducing total ownership expenses for better health management.

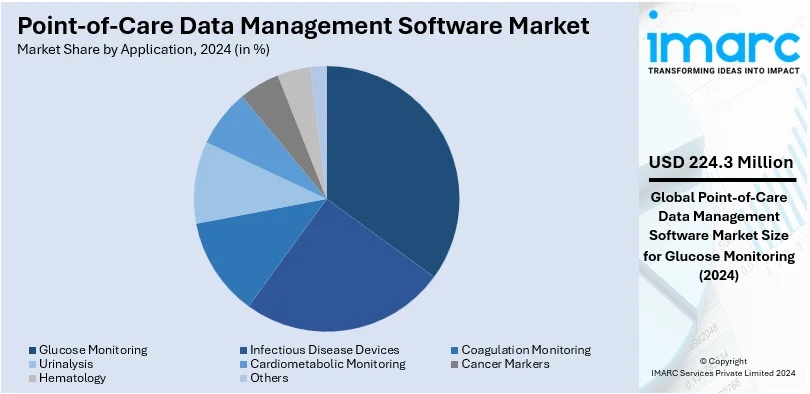

Analysis by Application:

- Infectious Disease Devices

- Glucose Monitoring

- Coagulation Monitoring

- Urinalysis

- Cardiometabolic Monitoring

- Cancer Markers

- Hematology

- Others

Glucose monitoring leads the market with around 25.8% of market share in 2024 as it plays a crucial role in diabetes management which has become a global health burden. Due to the growing prevalence of diabetes and an increasing demand for continuous glucose monitoring devices, there has been an increase in the need for effective data management solutions. POC data management software facilitates the seamless integration of CGM glucose data into electronic health records and enables real-time blood sugar level tracking according to point-of-care data management software market statistics.

Analysis by End User:

- Hospitals/Critical Care Units

- Diagnostic Centers

- Clinics/Outpatient

Hospitals/critical care units lead the market with around 40.0% of market share in 2024. Hospitals and critical care units play a role in the market as they rely on accurate patient data to make informed decisions. These healthcare facilities need solutions for managing data to handle a variety of diagnostic tests and medical procedures conducted at the point of care. Point of care software for managing data helps in integrating test results patient details and treatment plans into health records (EHRs) which improves workflow efficiency and coordination of patient care. Additionally, this software allows healthcare professionals to access information in real time enabling them to closely monitor patient conditions optimize treatment approaches and enhance clinical outcomes.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.0%. The region has a healthcare system that widely uses health records (EHRs) and advanced medical technologies. Secondly the presence of market players and active research and development efforts for innovation and product improvements. Additionally, government support for healthcare solutions and increased healthcare spending also plays a role in driving market growth. Furthermore, healthcare providers and patients in North America are well informed about the advantages of point-of-care data management software, which boosts its adoption. The projected growth of the hospital market in North America to reach a revenue of US$ 1,585.00 Billion by 2024 is a significant driver for market growth. As the hospital market expands, there will be a rise in demand for healthcare services, including diagnostic procedures, treatments, and patient management. This increased demand necessitates efficient data management solutions to handle the growing volume of patient information and streamline workflows. Overall, these factors establish North America as a leading market.

Key Regional Takeaways:

United States Point-of-Care Data Management Software Market Analysis

In 2024, the US accounted for around 74.70% of the total North America point-of-care data management software market. The market in the USA is significantly being propelled by the integration of technology in healthcare at a rapid pace. Healthcare providers are increasingly focusing on adopting point-of-care data management software to enhance operational efficiency by reducing the time consumed on manual data entry and retrieval processes. Moreover, the software is being used to ensure effortless integration with remote patient monitoring devices. These devices help track patient health data in real time and analyze the data accordingly. Hospitals and clinics are constantly working on interoperability with point-of-care devices, making it imperative to use the most advanced data management solution, while healthcare institutions also place emphasis on software adoption due to stricter norms on data security and privacy such as HIPAA in the USA. Furthermore, facilities are using data management software to reduce the administrative burden on employees, so that employees can provide direct care to patients during the shortage of healthcare professionals. According to HRSA, in primary care, there are 13269 practitioner shortages across the USA. Moreover, organizations are investing in AI capabilities that can offer predictive analytics and decision-making support capabilities thereby raising the software's value proposition in diagnostic and clinical settings.

Asia Pacific Point-of-Care Data Management Software Market Analysis

The Asia Pacific region is concentrating on implementing POC data management software to manage increasingly prevalent chronic diseases such as diabetes and cardiovascular disorders to monitor and manage patient data in real-time. According to the International Diabetes Federation, in 2021, 74,194.7 (1,000s) number of individuals are living with diabetes across India. Additionally, healthcare institutions are utilizing POC data management software to support the rapid growth of telemedicine services, ensuring remote monitoring and efficient data exchange between patients and healthcare providers. Moreover, governments and regulatory bodies enforce strict guidelines for quality reporting, compelling healthcare providers to implement software that supports accurate and timely compliance reporting. In line with this, policymakers and NGOs are encouraging the implementation of POC software in rural and underprivileged areas, where access is limited to a central location for healthcare delivery purposes.

Europe Point-of-Care Data Management Software Market Analysis

European countries are enforcing strict healthcare data regulations, including GDPR compliance and electronic medical record (EMR) standards. In order to guarantee data security and regulatory compliance, organizations are concentrating on implementing data management software. In this regard, the governments and private entities in Europe are accelerating investments in healthcare IT infrastructure, thus driving the deployment of advanced data management solutions in hospitals, clinics, and diagnostic centers. Furthermore, developers of point-of-care data management software are working actively towards the integration of AI and ML tools to improve diagnostic accuracy, patient outcome prediction, and workflow to promote its use across broad platforms. Additionally, in a trend towards home care, providers are implementing solutions that support point-of-care diagnostics and patient monitoring from home, thereby ensuring uninterrupted care. According to reports, healthcare expenditure in the EU reached USD 1,738.24 Billion in 2022. Portable diagnostic tools such as blood glucose monitors and handheld ultrasound devices are becoming more common among European healthcare providers. Point-of-care software is being increasingly used to integrate and manage data from these devices effectively.

Latin America Point-of-Care Data Management Software Market Analysis

Clinics and diagnostic centers are utilizing point-of-care data management software to analyze the data in real-time and provide individualized treatment plans. According to International Trade Administration (ITA), Brazil spends 9.47% of its GDP on healthcare. Moreover, governments and private institutions are rapidly implementing advanced point-of-care systems with data management functionalities in remote areas to make health care more accessible and efficient. In line with this, the growing penetration of smartphones as well as mobile healthcare applications is allowing the integration of point-of-care data management software for accessing and updating information in real time.

Middle East and Africa Point-of-Care Data Management Software Market Analysis

Healthcare providers are focusing on reducing diagnostic errors and enhancing the accuracy of patient data, which is resulting in increased dependency on real-time data management systems thereby propelling the market for point-of-care data management software. Since the elderly population is growing in the region, healthcare providers rely more and more on point-of-care data management software to monitor chronic conditions, manage multiple medications, and ensure better management of geriatric care. As per the International Diabetes Federation, in 2021, the number of people diagnosed with diabetes across UAE are 990.9 (1,000s).

Competitive Landscape:

The competitive landscape of the point-of-care data management software market is characterized by intense innovation and strategic collaborations. Key players are investing in research and development to introduce advanced solutions with enhanced interoperability and user-friendly interfaces. Many companies are forming strategic partnerships with healthcare providers and technology firms to expand their market presence and improve service offerings. Efforts to integrate artificial intelligence and machine learning capabilities into software platforms are gaining momentum, enabling predictive analytics and personalized healthcare. Additionally, competitors are focusing on expanding their geographic footprint through acquisitions and regional market entries. To maintain a competitive edge, market leaders are also emphasizing data security and compliance with changing healthcare regulations.

The report provides a comprehensive analysis of the competitive landscape in the point-of-care data management software market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Danaher Corporation

- Datalink LLC

- Orchard Software Corporation

- Randox Laboratories Ltd.

- Roche Holding AG

- Siemens Healthineers AG (Siemens AG)

- TELCOR Inc.

Latest News and Developments:

- January 2023: Point-of-care testing tool was introduced by Cipla Limited. This tool is also known as Cippoint. Numerous diagnostic parameters are available with this cutting-edge gadget, such as metabolic markers, coagulation markers, thyroid function, inflammation, infectious disorders, diabetes, cardiac markers, and thyroid function. The gadget is CE IVD approved, which means that the European In-Vitro Diagnostic gadget Directive has given it approval, making it a dependable testing tool.

- September 2023: In order to produce insights and actions from data, Arcadia, the top healthcare data analytics platform, introduced a generative artificial intelligence (AI) assistant that acts as a co-pilot at the point of care. The time and effort needed to improve risk factor reporting, uncover trends in healthcare consumption, create treatment plans, and more are decreased by using large language models (LLMs) from OpenAI syc through aggregated, longitudinal patient records curated within Arcadia's data platform.

- May 2022: In order to securely manage point-of-care (POC) analyzers and related data on a single, centralized platform, EKF Diagnostics, a global in vitro diagnostics firm, announced the debut of its new EKF Link digital connectivity solution.

Point-of-Care Data Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes of Delivery Covered | Cloud-Based, On-premises |

| Applications Covered | Infectious Disease Devices, Glucose Monitoring, Coagulation Monitoring, Urinalysis, Cardiometabolic Monitoring, Cancer Markers, Hematology, Others |

| End Users Covered | Hospitals/Critical Care Units, Diagnostic Centers, Clinics/Outpatient |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Danaher Corporation, Datalink LLC, Orchard Software Corporation, Randox Laboratories Ltd., Roche Holding AG, Siemens Healthineers AG (Siemens AG), TELCOR Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the point-of-care data management software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global point-of-care data management software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the point-of-care data management software industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Point-of-care (POC) data management software is a healthcare solution designed to integrate, manage, and analyze diagnostic and patient data collected at the point of care. It enables real-time access to patient information, streamlines workflows, and supports accurate decision-making to enhance patient outcomes.

The point-of-care data management software market was valued at USD 869.3 Million in 2024.

IMARC estimates the global point-of-care data management software market to exhibit a CAGR of 10.12% during 2025-2033.

The market is driven by the rising adoption of digital healthcare solutions, the increasing prevalence of chronic diseases, the demand for rapid diagnostics, advancements in healthcare IT, and the growing need for real-time data integration to improve patient outcomes.

Cloud-based represented the largest segment by mode of delivery, driven by its scalability, remote accessibility, and cost-effectiveness.

Glucose monitoring leads the market by application due to its critical role in managing diabetes and the growing demand for continuous glucose monitoring solutions.

The hospitals/critical care units segment is the leading end-user category, driven by the need for accurate patient data integration, enhanced workflows, and real-time monitoring.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, with North America currently dominating the market.

Some of the major players in the global point-of-care data management software market include Abbott Laboratories, Danaher Corporation, Datalink LLC, Orchard Software Corporation, Randox Laboratories Ltd., Roche Holding AG, Siemens Healthineers AG (Siemens AG), and TELCOR Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)