Plywood Market Size, Share, Trends and Forecast by Residential and Commercial Application, New Construction and Replacement Sector, and Region, 2026-2034

Plywood Market Size and Share:

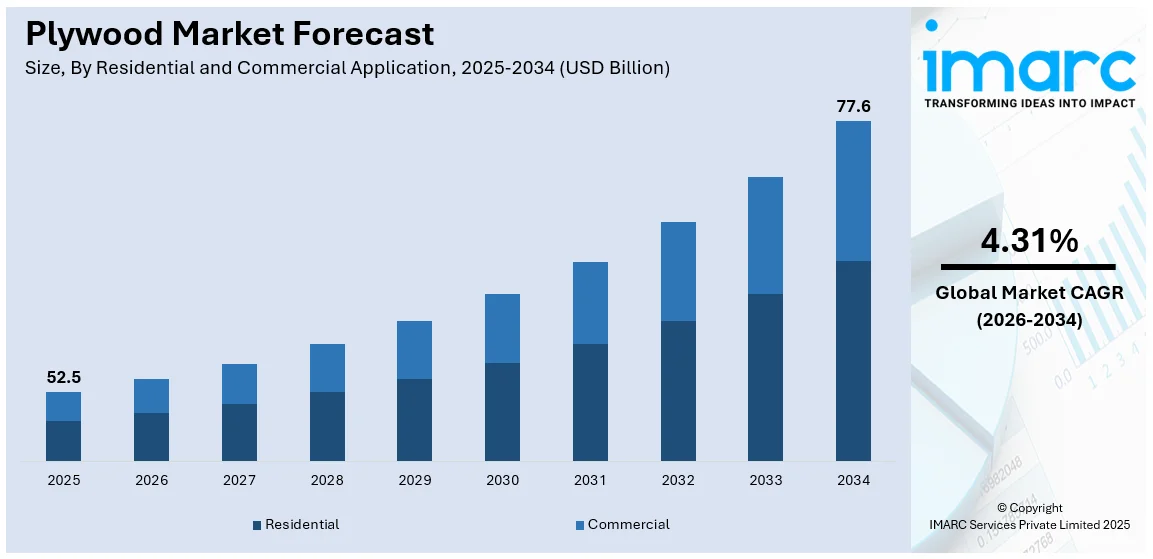

The global plywood market size was valued at USD 52.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 77.6 Billion by 2034, exhibiting a CAGR of 4.31% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 70.0% in 2025. The growing adoption of flexible products, increasing urbanization, and rising number of residential and commercial projects represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 52.5 Billion |

|

Market Forecast in 2034

|

USD 77.6 Billion |

| Market Growth Rate 2026-2034 | 4.31% |

A primary force behind the plywood industry is the rapid construction sector, especially in developing economies. As cities grow at a faster pace and infrastructure developments are on the rise, demand for plywood is heightened because of its extensive application in building structures, flooring, walls, and roofing. Its longevity, affordability, and easy installation make it a favored commodity in residential and commercial development. Moreover, government expenditures on low-cost housing and the development of infrastructure also contribute towards plywood consumption. This increase in construction activity throughout Asia-Pacific, the Middle East, and parts of Africa is considerably driving plywood market growth.

To get more information on this market Request Sample

The U.S. plywood market's growth is significantly influenced by the residential construction sector, which accounts for approximately 87.9% of plywood consumption. This is supported by data from the U.S. Census Bureau, which reported that in 2023, over 1.4 million new housing units were authorized for construction, indicating a robust demand for building materials like plywood. The use of energy-efficient building methods and practices, additionally, is accentuated by the U.S. Department of Energy's Building Technologies Office, placing additional emphasis on the demand for innovative plywood products. The inclination towards engineered wood products like laminated veneer lumber and cross-laminated timber is likewise fostered through the initiatives in sustainable forestry as well as in wood utilization brought about by the U.S. Forest Service. These all signal the leading government policies and strategies' impact towards determining the demand for plywood's market share within the U.S. market.

Plywood Market Trends:

Technological Advancements in Manufacturing

Technological advancements are transforming the plywood production process, making it more efficient and precise. Modernized plywood mills, incorporating automation and digital tools, can reduce variable costs by about 14% and increase output by 13% to 28% without needing to expand physical capacity. These innovations result in value-added plywood types, including fire-resistant and water-repellent varieties, which make the product more functional for high-end furniture and architectural use. Better machinery also enhances surface finishes, raising the product's desirability. Smart logistics and inventory systems also assist manufacturers in responding to volatile demand better, maintaining a consistent quality of the product. This transformation not only maximizes production efficiency but also saves cost, giving manufacturers a better competitive advantage in a quality-centric market.

Sustainability and Eco-Friendly Innovations

Another plywood market trend is the move toward sustainable production practices and eco-friendly materials. Increasing concern regarding deforestation and carbon emissions has motivated producers to employ responsible forestry management and low-emission adhesives. Green labeling and meeting environmental standards are becoming a key to market competitiveness. Builders and consumers are increasingly looking for eco-labeled products, and as such, the demand for low-environmental-impact plywood is on the rise. This direction is in concert with larger trends within green building and sustainable interior design, so eco-friendly plywood becomes more appealing for both residential and commercial applications. As regulatory pressure keeps building, sustainability is shifting from being a preference to an industry standard requirement.

Rising Demand in Furniture and Interior Design

The plywood market is increasingly benefiting from its widespread use in furniture manufacturing and interior décor. Plywood's strength, versatility, and aesthetic appeal make it a preferred material for modern furniture, cabinetry, and wall paneling. In 2020, the U.S. Census Bureau reported that the furniture and related product manufacturing sector contributed approximately $50 billion to the U.S. economy, with plywood being a key material in many of these products. As consumer preferences shift towards minimalistic, space-efficient designs particularly in urban areas demand for plywood in modular and custom-built furniture is rising. Designers favor plywood for its adaptability with various finishes, making it suitable for both functional and decorative applications. This trend is prominent in urban housing developments and commercial interiors, where design flexibility and material performance are crucial, solidifying the furniture sector as a significant driver of plywood consumption globally.

Plywood Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plywood market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on residential and commercial application and new construction and replacement sector.

Analysis by Residential and Commercial Application:

- Residential

- Commercial

Based on the plywood market forecast, the residential segment leads the plywood market with 65.4% demand, fueled by rising urbanization and housing requirements. Increased disposable incomes, combined with population growth, have fueled demand for new houses, especially in developing economies. Plywood is preferred in residential construction because it is cost-effective, durable, and versatile for uses like flooring, roofing, and wall sheathing. Further, the increased trend of home remodelling and do-it-yourself (DIY) projects also drives plywood consumption further. With consumers paying more attention to sustainable products, demand for green and high-quality plywood products for indoor uses, i.e., cabinetry and furniture, also drives the residential market further. The robust demand is underpinned by government incentives for low-cost housing across the world.

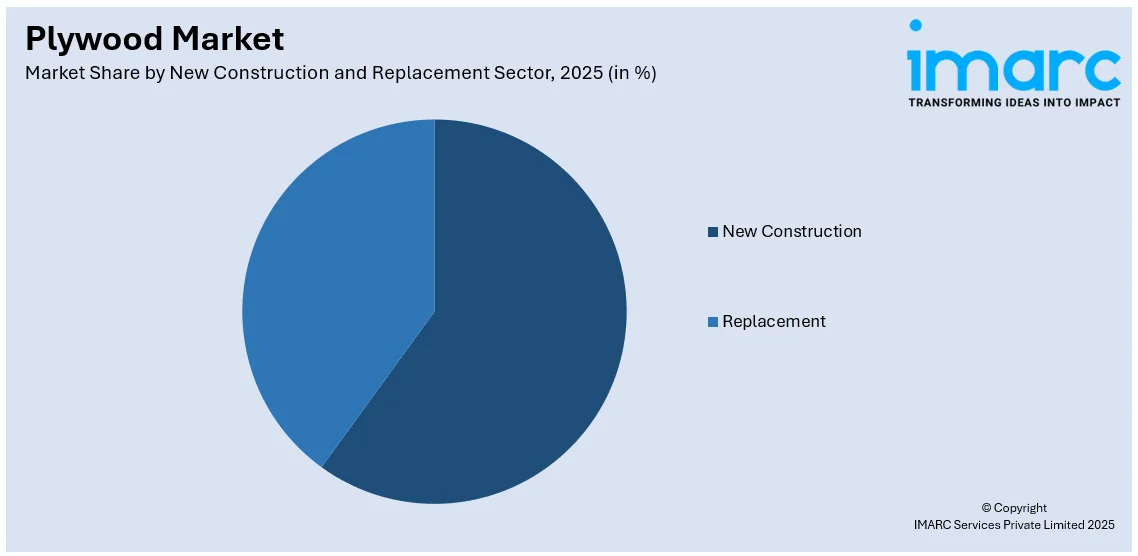

Analysis by New Construction and Replacement Sector:

Access the comprehensive market breakdown Request Sample

- New Construction

- Replacement

According to the plywood market report, new construction holds the maximum share of 81.5% in the plywood market since it is greatly utilized in structure and architectural usage. Plywood is used broadly for roofing, flooring, wall panels, and concrete formwork in new structures owing to its strength, adaptability, and affordability. Fast-paced urbanization, particularly in developing economies, is propelling huge-scale residential, commercial, and infrastructure projects, largely increasing plywood demand. Government investment in housing schemes, smart cities, and transportation infrastructure also fuel this demand. Additionally, the compatibility of plywood with contemporary building methods and the fact that it comes in multiple grades make it a favorite among builders and contractors. The continuing worldwide emphasis on urbanization and infrastructure growth continues to solidify plywood's preeminent position in new construction.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds the largest share in the plywood market, accounting for around 70% market share due to the rapid urbanization, industrial growth, and rising infrastructure development across major economies in the region. Countries like China, India, and those in Southeast Asia are witnessing a surge in residential and commercial construction activities, which significantly drives plywood consumption. Additionally, the region benefits from abundant raw material availability and a strong manufacturing base, enabling cost-effective production. The growing furniture and interior design sectors, driven by rising disposable incomes and changing lifestyle preferences, further fuel demand. Government support for affordable housing and smart city initiatives also plays a key role. The combination of economic growth, population density, and industrial expansion cements Asia Pacific's dominance in the plywood market.

Key Regional Takeaways:

North America Plywood Market Analysis

The North American plywood market is experiencing steady growth, driven by the robust demand from the construction and furniture sectors. Plywood is a critical material in residential and commercial construction, particularly in framing, flooring, and sheathing applications. As the region sees continuous urbanization, infrastructure development, and renovation projects, the demand for plywood remains strong. Additionally, the growth in the furniture and interior décor markets further contributes to the rise in plywood consumption. Plywood’s strength, versatility, and aesthetic appeal make it an ideal choice for custom furniture, cabinetry, and wall paneling, particularly in modern and space-efficient designs. Technological advancements in manufacturing have also enhanced production processes, improving product quality while reducing costs. Innovations such as automation and digital tools in plywood mills have led to increased efficiency and precision, enabling manufacturers to meet growing demand effectively. Environmental sustainability is another key factor shaping the market, with increasing consumer preference for eco-friendly and certified products. Regulatory frameworks and green certifications promote sustainable sourcing and manufacturing practices, further supporting the region’s growing plywood demand in various industries.

United States Plywood Market Analysis

United States is witnessing increased plywood adoption due to growing home renovation activities across urban and suburban areas. For instance, Americans spent USD 420 Billion in 2020 on remodeling their homes. Rising disposable incomes and an aging housing stock are encouraging homeowners to invest in remodeling and repairs, boosting the demand for plywood in walls, flooring, and cabinetry. The surge in do-it-yourself culture is also amplifying consumption of plywood products for home improvement. Sustainable and engineered plywood materials are gaining traction as consumers seek durable and cost-effective renovation solutions. This trend is supported by favorable housing policies and increased spending on residential upgrades, propelling the plywood market forward. With enhanced availability of premium wood-based panels and heightened awareness of material strength, plywood continues to be a preferred choice in home renovation. Growing home renovation is a key driver for plywood in this region.

Asia Pacific Plywood Market Analysis

Asia-Pacific is experiencing strong growth in plywood demand driven by growing investment in interior designing aimed at improving standards of living. According to India Brand Equity Foundation, the future of the Indian interior design market appears exceptionally promising, with industry experts projecting a market size of USD 81.2 Billion by 2030. Rising middle-class populations and rapid urbanization are contributing to a cultural shift toward aesthetic, modern interiors, where plywood is widely used in modular furniture, partitions, and decorative panels. Consumers are increasingly opting for customizable and space-saving interior solutions, encouraging plywood usage due to its flexibility and affordability. Interior designers and architects prefer plywood for its workability and strength, making it a central material in residential and commercial interior projects. Economic development and expanding construction activities further complement this trend, with plywood becoming a critical component in transforming interiors. Improving standards of living across metros and emerging cities continue to enhance the adoption of plywood for interior designing applications.

Europe Plywood Market Analysis

Europe is seeing steady growth in plywood consumption supported by growing demand for ecofriendly plywood for housing and furniture. According to reports, the European sustainable furniture market size was valued at USD 18.5 Billion in 2024 and is projected to reach USD 42.6 Billion by 2032, growing at a CAGR of 11.0% from 2026 to 2032. With sustainability becoming a top priority, consumers and manufacturers are turning to low-emission, certified plywood options for their projects. Plywood made from responsibly sourced timber is gaining preference in residential and commercial constructions, especially in flooring, paneling, and eco-conscious furniture designs. Green building regulations and environmental awareness are driving demand for products with minimal environmental impact, where ecofriendly plywood stands out. The increasing inclination toward minimalist and natural interiors also aligns with the use of wood-based materials. As consumers seek sustainable lifestyles, plywood’s recyclability and energy-efficient production further strengthen its appeal. Growing demand for ecofriendly plywood is shaping the housing and furniture segments across this region.

Latin America Plywood Market Analysis

Latin America is observing rising plywood demand influenced by growing residential projects due to growing urbanization and sustainable living. For instance, by 2026, 30% of new residential projects in Brazil will use sustainable building practices, showing a trend toward eco-friendly construction. The shift toward city-based living and increased housing initiatives is creating demand for versatile and cost-effective materials like plywood. Its adaptability for flooring, walls, and built-in furniture makes it suitable for fast-paced residential developments. Urban expansion across several regions is driving the need for affordable and efficient building components, where plywood plays a vital role. Growing urbanization is pushing the construction sector to adopt plywood solutions for durable and space-efficient designs in modern homes.

Middle East and Africa Plywood Market Analysis

Middle East and Africa are witnessing increased plywood usage due to growing rapid expansion in the construction industry. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. Commercial and residential infrastructure growth is accelerating demand for reliable and scalable building materials. Plywood’s strength, availability, and adaptability make it essential for framing, cabinetry, and architectural applications. The construction boom, fuelled by population growth and economic development, is intensifying plywood consumption across building projects. Rapid expansion in the construction industry continues to support market growth in this region.

Competitive Landscape:

The competitive landscape of the plywood market is marked by intense rivalry among both global and regional manufacturers. Companies compete primarily on factors such as product quality, pricing, distribution reach, and innovation. Differentiation is achieved through offering specialized plywood types like fire-resistant, moisture-proof, and eco-certified variants to cater to diverse end-use applications. Players also focus on building strong dealer networks and efficient supply chains to enhance market penetration. In addition, the shift toward digital transformation has led to the adoption of automated production technologies and online sales platforms, which are becoming key competitive tools. Strategic collaborations, capacity expansions, and investments in sustainable practices are commonly pursued to maintain relevance and respond to evolving customer demands in the dynamic plywood market.

The report provides a comprehensive analysis of the competitive landscape in the plywood market with detailed profiles of all major companies, including:

- Georgia Pacific LLC

- Potlatch Deltic Corporation

- Weyerhaeuser Company Ltd.

- Boise Cascade Company

- UPM-Kymmene Oyj

- SVEZA Forest Ltd.

- Metsä Wood (Metsäliitto Cooperative)

- Latvijas Finieris AS

- Austral Plywoods Pty Ltd.

- Eksons Corporation Berhad (BHD)

Latest News and Developments:

- December 2024: Koskisen announced a strategic investment program to boost plywood production in Järvelä. The initiative aimed to support sustainable growth within its Panel Industry business. The first phase, worth €12 Million, was planned for implementation in 2025. The program aligned with the company’s broader long-term growth objectives.

- July 2024: Kitply Industries developed India’s first formaldehyde-free plywood using an edible resin. Chairman Gaurav Goenka revealed the innovation in a discussion with Ply Reporter’s founder. The plywood was hailed as the safest option for interior-grade panels. This breakthrough aimed to transform the premium interior design segment sustainably.

- July 2024: India-based AP Wood launched the AP Wood Carb Plywood, an eco-friendly product emitting fewer toxic fumes. The plywood earned E1 Certification and CARB2 compliance for reduced emissions. It offered lower short-term and long-term exposure compared to traditional wooden options. The product aimed to enhance indoor air quality and consumer safety.

- February 2024: Royale Touche launched India’s first 100% vacuum-press treated plywood under the brand “Performance Ply.” The TER-BO KILL4X range was introduced as termite- and borer-proof with enhanced durability. The products were also fire-retardant and fully waterproof, offering superior resistance to environmental stress. The company set up an advanced unit with four-pressed technology for premium-grade plywood.

Plywood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Cubic Metres, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Residential and Commercial Applications Covered | Residential, Commercial |

| New Construction and Replacement Sectors Covered | New Construction, Replacement |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Georgia-Pacific LLC, Potlatch Deltic Corporation, Weyerhaeuser Company Ltd., Boise Cascade Company, UPM-Kymmene Oyj, SVEZA Forest Ltd., Metsä Wood (Metsäliitto Cooperative), Latvijas Finieris AS, Austral Plywoods Pty Ltd. and Eksons Corporation Berhad (BHD) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plywood market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plywood market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plywood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plywood market was valued at USD 52.5 Billion in 2025.

The Plywood market was valued at USD 77.6 Billion in 2034, exhibiting a CAGR of 4.31% during 2026-2034.

The plywood market is primarily driven by the expansion of the construction industry, increasing demand for durable and cost-effective building materials, and the rise in furniture manufacturing. Urbanization and infrastructure development, especially in emerging economies, are boosting plywood consumption. Additionally, the shift towards sustainable and engineered wood products contributes to market growth.?

Asia Pacific dominates the plywood market due to rapid urbanization, infrastructure development, and a booming construction sector, especially in countries like China and India. The region’s increasing demand for affordable housing, coupled with growing furniture manufacturing, further drives plywood consumption, making it a key player in global market growth.

Some of the major players in the plywood market include Georgia-Pacific LLC, PotlatchDeltic Corporation, Weyerhaeuser Company Ltd., Boise Cascade Company, UPM-Kymmene Oyj, SVEZA Forest Ltd., Metsä Wood (Metsäliitto Cooperative), Latvijas Finieris AS, Austral Plywoods Pty Ltd. and Eksons Corporation Berhad (BHD), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)