Plastic Processing Machinery Market Size, Share, Trends and Forecast by Product Type, Plastic Type, End-Use Industry, and Region, 2025-2033

Plastic Processing Machinery Market Size and Trends

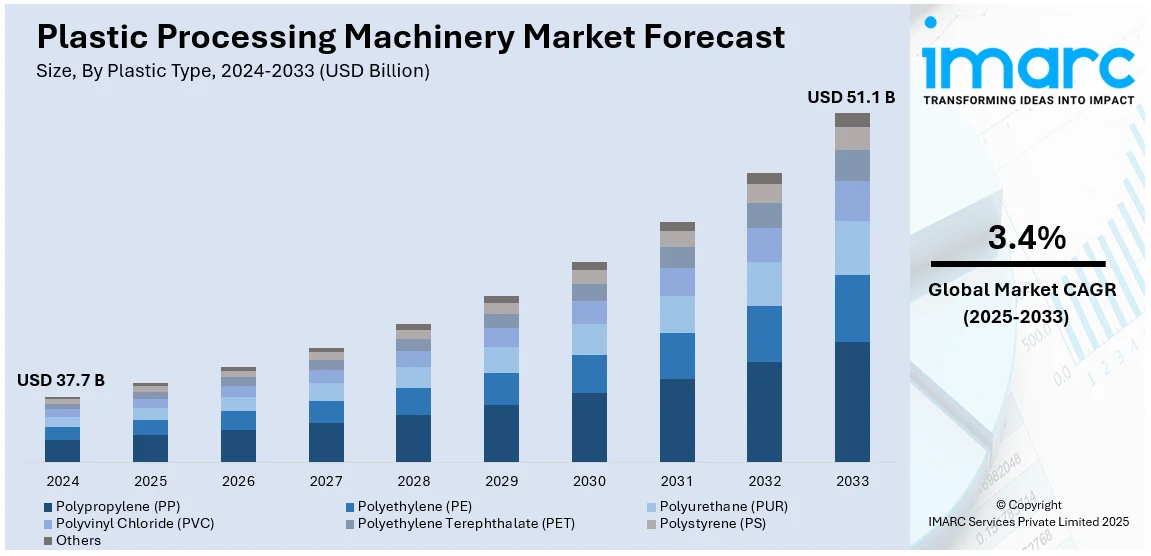

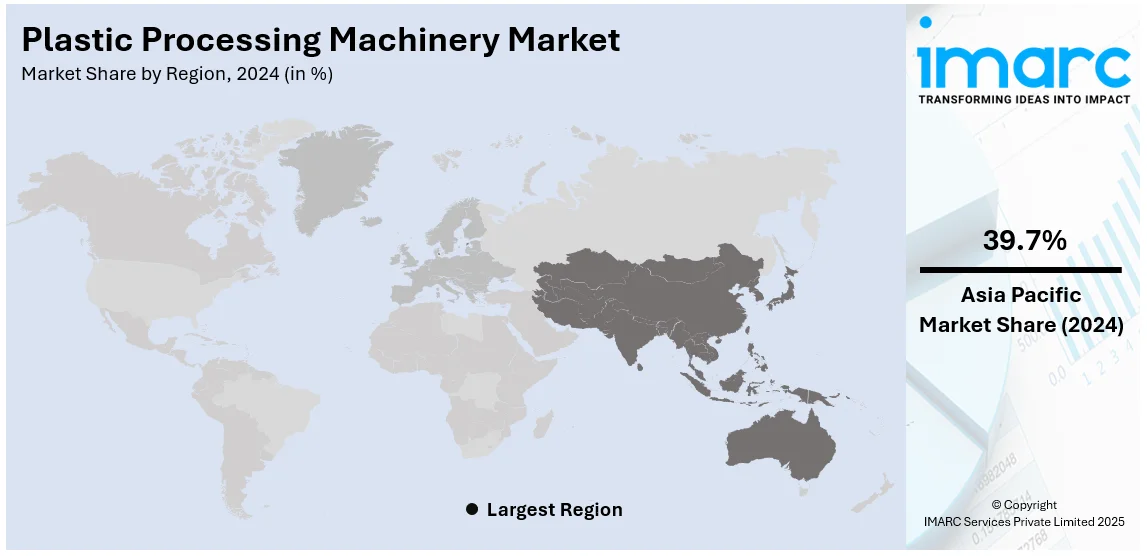

The global plastic processing machinery market size reached USD 37.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 51.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033. Asia Pacific currently dominates the plastic processing machinery market share, holding a market share of over 39.7% in 2024. Growing product demand from a variety of industries, continuous technological innovation, sustainability in production with eco-friendly mechanisms, escalating automation, a focus toward advanced materials, and rising applications in the construction and healthcare sectors are some of the factors fostering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 37.7 Billion |

|

Market Forecast in 2033

|

USD 51.1 Billion |

| Market Growth Rate (2025-2033) | 3.4% |

The global plastic processing machinery industry is principally influenced by numerous key factors, encompassing the escalating need for plastic products across major sectors such as packaging, automotive, and consumer goods. Technological innovations in machinery, emphasizing on accuracy, automation, and energy efficiency, are significantly improving production abilities. In addition to this, escalating customer preference for sustainable, lightweight, and robust plastics is heightening enhancements in processing equipment. The rapid increase in utilization of recyclable and bio-based plastics, combined with stricter environmental policies, further bolsters need for machinery that can effectively process such materials. Besides this, the augmentation of manufacturing and e-commerce fields in emerging markets also contribute to the market's expansion.

The United States holds a significant position in the global plastic processing machinery market share, driven by its advanced manufacturing capabilities and strong demand across industries such as automotive, packaging, and electronics. The country is at the forefront of adopting innovative technologies, including automation, energy-efficient machinery, and sustainable production processes. Additionally, the U.S. benefits from substantial investments in research and development, which fuel advancements in plastic processing techniques. The growing emphasis on sustainability and the increasing use of recyclable and bio-based plastics are expected to further bolster demand for cutting-edge machinery, maintaining the U.S.'s leadership in the market. For instance, as per industry reports, in July 2024, researchers at College of Agriculture and Life Sciences, U.S., announced the active development of bioplastics composed of food waste that would be biodegradable in nature. This is said to be first-of-its kind pilot project.

Plastic Processing Machinery Market Trends:

Escalating Demand for Plastic Products

One of the most essential drivers for the market is the increasing call for various plastic products due to their rising use in different industrial sectors such as packaging, automotive, and electronics. As per Thunder Said Energy, the global plastic demand was estimated at 470 metric ton per annum in 2022, rising to 1,000 metric ton per annum by 2050. The resourcefulness and cost-effectiveness of plastic have made them very valuable and a preferred material in these sectors, which is further increasing demand for stronger lightweight packaging solutions. The application of plastic requires the production of efficient machinery, which is expanding the market.

Technological Advancements

The integration of smart technologies like artificial intelligence (AI), the Internet of Things (IoT), and robotics, has unraveled opportunities remunerating the lucrativeness of the plastic processing machinery market growth. An industry report indicates that the Internet of Things (IoT) and artificial intelligence (AI) are set to drastically transform industries, enhance conventional operating models, and reveal unparalleled efficiency. With a projected market worth of USD 1.5 billion by 2032, organizations should invest in large-scale IoT connectivity now. Moreover, the advent of technologically advanced machinery that expedites quicker, efficient and precision manufacturing by leveraging processes such as injection molding, extrusion molding, and blow molding has significantly stimulated the market. These contemporary machinery are designed to integrate cutting-edge technologies and smart capabilities, which enable manufacturers to produce high-quality plastic products with minimal material waste and low energy consumption. Integration of AI in these machines, allows real-time monitoring of the machines and production lines, which enable operational costs to be minimized, human waste reduced, and production increased.

Sustainable Manufacturing Practices

The move towards sustainable manufacturing has also significantly influenced the plastic processing machinery market demand. As pet the MDPI, the plastic debris ending up in the ocean is growing exponentially, and global plastic production is projected to fluctuate between 500 and 600 million metric tons by 2025. The escalating focus on reducing the environmental footprint of plastic production, which includes reducing waste, recycling, and adopting biodegradable materials, has created a burgeoning demand for processing machinery, as companies attempt to comply with ever-escalating environmental regulations, and the increasingly judicious consumer expectations, which echoes the global push for sustainability.

Plastic Processing Machinery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plastic processing machinery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on the product type, plastic type, and end-use industry.

Analysis by Product Type:

- Blow Molding Machinery

- Compression Molding Machinery

- Extrusion Molding Machinery

- Injection Molding Machinery

- Rotational Molding Machinery

- Others

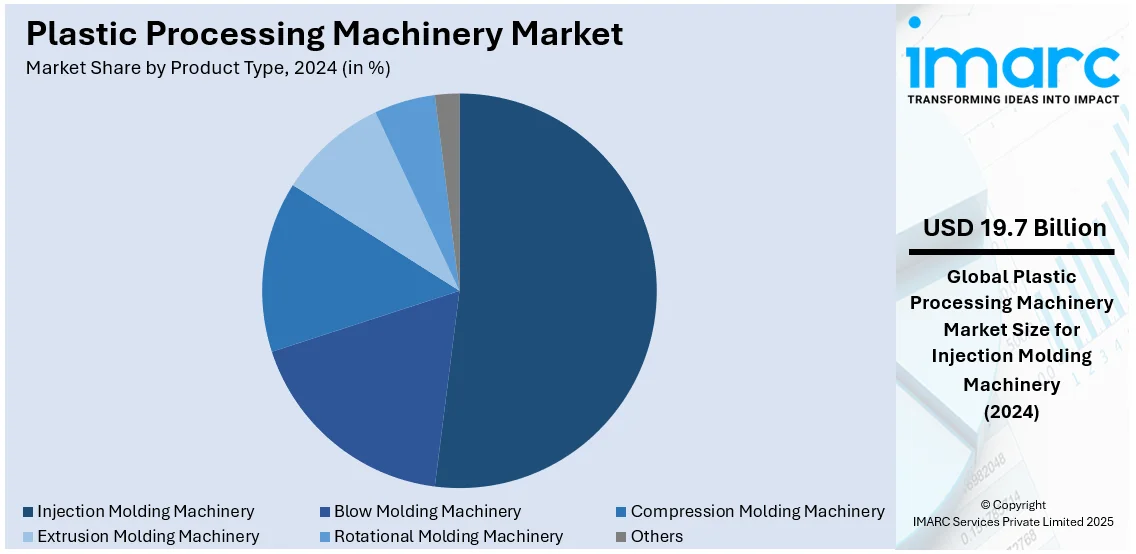

Injection molding machinery leads the market with around 52.2% of market share in 2024. The injection molding machinery segment is driven by the increasing demand for high-volume production of complex and intricate plastic parts in industries such as automotive, consumer electronics, and medical devices. This method's ability to produce parts with tight tolerances, consistent quality, and the possibility of using a wide range of materials underlines its critical role. The surge in demand for precision components, coupled with advancements in automation and energy-efficient machines, underscores the segment's robust expansion. Moreover, the accelerating trend of small-batch and custom production is further bolstering the requirement for advanced injection molding machinery. As manufacturers are currently focusing on lowering lead times and enhancing cost effectiveness, there is an intensifying inclination toward machines with better flexibility and quicker cycle times. This transformation is anticipated to drive steady innovation and growth within the injection molding segment in upcoming years.

Analysis by Plastic Type:

- Polypropylene (PP)

- Polyethylene (PE)

- Polyurethane (PUR)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Others

According to the report, polypropylene (PP) represented the largest segment. The polypropylene (PP) segment is gaining from the skyrocketing demand in packaging, automotive components, and consumer products on account of its excellent chemical resistance, fatigue resistance, and insulation properties. Industry players are pouring investments into advanced PP processing machines to churn out lightweight, high-performance materials, which are particularly in demand in a spate of applications in the automotive and electronics sectors. Furthermore, the bolstering trend for sustainability is prompting advancements in PP reprocessing as well as recycling = technologies. As concerns associated with environmental heath elevate, manufacturers are actively emphasizing on designing energy-saving machinery efficient in processing recycled PP to address both ecological and economic objectives. This inclination is suspected to further elevate the need for upgraded PP processing machinery across numerous end use segments.

Analysis by End Use Industry:

- Packaging Industry

- Construction Industry

- Automotive Industry

- Electronic and Electrical Industry

- Agriculture Industry

- Others

According to the report, packaging industry represented the largest segment. The packaging segment is driven by increasing consumer demand for convenient, lightweight, and durable packaging solutions. Innovations in sustainable packaging, along with the rising need for extended shelf life of products, are pushing advancements in plastic processing machinery market forecast. These machines offer enhanced efficiency, precision, and the ability to handle various materials, catering to the evolving packaging trends and stringent regulations regarding packaging waste. In addition to this, boosting demand for environmentally friendly and tamper-proof packaging, and the rapid inclination toward e-commerce platforms further fuel need for upgraded plastic processing machinery. As consumer choices for both functionable and sustainable packaging continue to transform, manufacturers are heavily spending on technologies that enhance production efficacy as well as environmental impact. This trend is anticipated to magnify expansion and advancements, fostering a positive plastic processing machinery market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 39.7%. Rapid industrialization, increasing disposable incomes, and demand for the same by various sectors are fueling the plastic processing machinery market in Asia Pacific. This would highly benefit manufacturing in such regions that witness a huge increase in the production of plastic, especially those countries that serve as key centers for production, such as China and India. China produced 80.1 million tons of plastic alone in 2021, according to reports, thus making it one of the most prominent contributors with large manufacturing capacities and an export-oriented economy. Industry analyses reveal that India’s packaging sector is expanding rapidly, with annual growth estimated at 22-25%, fueling an increased need for extrusion and blow molding equipment. Moreover, the increasing demand from the packaging, automotive, and electronics industry, the presence of low-cost labor, and favorable policies by the government. Besides, the region is focusing on exporting plastic goods in a huge quantity, which greatly affects the demand for advanced plastic processing machinery. The government programs that support domestic manufacturing, such as India's "Make in India" and China's "Made in China 2025," also encourage investments in high-tech, energy-efficient equipment. The region also has low labor costs, which enhance its competitiveness in the global market.

Key Regional Takeaways:

United States Plastic Processing Machinery Market Analysis

The need for lightweight materials is on the rise in the sectors of packaging, automobiles, and aeronautics, which boosts the market of plastic processing equipment in the United States. There were around 15 million vehicles produced in 2023 according to reports, so the automotive sector is particularly vital and shows a demand for plastics to reduce vehicle weight and boost fuel efficiency. The packaging sector also has considerable growth due to e-commerce with rising demand in terms of sustainable packing for customer comfort. In 2022, in the United States alone, e-commerce utilized over 800 million pounds or approximately 363 million kilogrammes of plastic-based packaging. On top of this, during 2022, Amazon recorded 30.5% in the retail market for e-commerce in the U.S., said Oceana Organization in their report. The country's growing manufacturing sector and focus on high-quality production encourage the application of advanced machinery, like injection moulding machines.

Energy-saving machines and other green technologies have been implemented due to government initiatives for plastic recycling and reduction of environmental impact. The increasing application of automation in the U.S. market is also driven by labor cost optimization and supports the plastic processing machinery market growth.

North America Plastic Processing Machinery Market Analysis

North America holds a substantial share of the plastic processing machinery industry globally, principally propelled by resilient requirement across several key sectors, mainly encompassing consumer goods, automotive, and packaging, along with its robust manufacturing infrastructure. The U.S., particularly, is a key contributing nation because of its well-established stance in pioneering advancements and manufacturing. In addition to this, the region's amplifying emphasis on energy-saving technologies, automation, and sustainability is bolstering requirement for innovative plastic processing equipment. Besides this, the heightening utilization of both bio-based and recyclable plastics is facilitating enhancements in machinery designed to manage such materials. Furthermore, with a well-structured supply chain and heavy investments in research projects, North America is anticipated to sustain its dominance in the plastic processing machinery market in the coming years. For instance, in January 2025, Nissei Plastic Industrial Co. Ltd., a leading manufacturer of injection molding machines, successfully expanded Nissei America Inc., its San Antonio, Texas subsidiary. The newly added facility is set to commence operations next month, enhancing the company's production capacity and strengthening its presence in the North American market for plastic processing machinery.

Europe Plastic Processing Machinery Market Analysis

One of the key factors that is propelling the plastic processing machinery market share is Europe's focus on sustainability and the circular economy. Following the introduction of the Plastic Strategy by the European Union, whereby all plastic packaging must become either recyclable or reusable by 2030, recycling sophisticated equipment has seen a sharp upsurge in demand. Investments in the area of biodegradable plastics in the region also include giant ventures such as that led by production giants in nations like Germany and Italy. Germany is said to be the biggest market in Europe, accounting for about 25% of demand for plastics, as per reports. It is also a manufacturing center that significantly contributes to the export of machinery and is crucial for the uptake of cutting-edge equipment. Plastics are used extensively in the automobile industry, which produces more than 18 million vehicles a year according to the European Commission data, for designs that are lightweight and energy efficient. Besides, due to the high usage of 3D printing technology in aerospace and medical segments, the demand for special plastic processing equipment is increasing in Europe.

Latin America Plastic Processing Machinery Market Analysis

The growing demand in the packaging, automotive, and agricultural industries is driving the market for plastic processing machines in Latin America. The two biggest markets are Brazil and Mexico, with Mexico being a major exporter of precision plastic parts to the United States for automotive applications. The agriculture sector in Argentina is turning to plastic films and drip irrigation systems, which would require extrusion machines. In fact, since more people consume processed foods, the packaging sector-that uses over 35% of plastic-is gaining momentum according to reports. It is reported that PET bottles form over half of the total unit volumes of Latin America's packaging. Government incentives for industrial modernization and adoption of sustainable practices are also encouraging investments in energy-efficient machinery. The sector is also supported by partnerships with foreign machinery makers to provide access to technology and production efficiency.

Middle East and Africa Plastic Processing Machinery Market Analysis

The packaging and construction sectors are the main drivers of the plastic processing machines industry in the Middle East and Africa. The food and beverage industry in the GCC is contributing to more than half of the plastics used in packaging, as per reports. The infrastructure projects, especially the residential and commercial structures which require plastic pipes and fittings, contribute to the rise in machinery demands as Saudi Arabia and the United Arab Emirates significantly invest in the sector. Local production is also augmented through the raw materials available such as polyethylene and polypropylene, that are encouraged by the oil-based economy. Extrusion equipment makes up for the high demand in Africa due to the adoption of plastic films and irrigation systems by the agricultural industry, especially in South Africa and Kenya. The market is also influenced by government programs to draw in foreign capital for production and the growing use of recycling technologies.

Competitive Landscape:

In the current market landscape, key players have been actively engaging in a range of strategic initiatives in a bid to secure their positions and drive growth. These have spanned product innovation and new product development, strategic partnerships, mergers and acquisitions, and expansion into new markets. Companies have been making sizeable investments in research and development to introduce advanced and innovative products and services that would cater to the ever-changing demands of consumers and technological advancements on their part. Further, expansion into new, emerging markets and diversification into untapped business segments have been used as strategies to lower the risks in their markets and take the bite out of untapped revenue potential. Key players are seen to be adopting agile and adaptable strategies within their respective domains so they can sail through the extreme and dynamic challenges and leverage emerging trends to their best advantage, in the course of their aim to attain sustainability and long-term profitability. For instance, in April 2024, Suzano Ventures announced a heavy investment of USD 5 million into Bioform Technologies, a Canada-based material science startup. This tactical investment will aid the development of pioneering bio-based plastic alternatives. This move can result in alterations in the materials leveraged in plastic processing, thus impacting the market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the plastic processing machinery market with detailed profiles of all major companies, including:

- Arburg GmbH

- Cosmos Machinery

- Haitian Plastics Machinery Group Co. Ltd.

- Husky Injection Molding Systems

- Japan Steel Works Ltd.

- Milacron Holdings Corporation

- Niigata Machine Techno Company Ltd.

- Sumitomo Heavy Industries

- Toshiba Machine Co. Ltd.

Latest News and Developments:

- December 2024: With a focus on the need for legally enforceable measures, the EU is pushing for a worldwide plastics convention to address plastic pollution. The plan emphasises the necessity of global collaboration to lessen the manufacturing of plastic, improve recycling, and address environmental effects. For accountability and sustainability, the EU demands creative solutions and strong oversight systems.

- June 2024: Donatelle Plastics Incorporated, a business that specialises in high-precision plastic solutions, has been acquired by DuPont. This action improves DuPont's capacity for innovation and customer-focused solutions while fortifying its portfolio in the healthcare and other advanced manufacturing areas.

- January 2023: Sumitomo Heavy Industries introduced a new series of all-electric injection molding machines featuring enhanced precision, speed, and energy efficiency. This launch marked a significant milestone in Sumitomo's ongoing commitment to developing environmentally friendly and cost-effective solutions for the plastic processing industry.

- October 2022: Husky Injection Molding Systems unveiled its next-generation HyCAP™ injection molding system, designed to deliver higher productivity and energy efficiency while reducing cycle times and material waste. The HyCAP™ system integrates advanced technologies such as predictive maintenance and real-time monitoring to optimize production processes and enhance overall equipment effectiveness.

- July 2022: Arburg GmbH announced the expansion of its production capacities with the inauguration of a new assembly hall at its headquarters in Lossburg, Germany. This development was aimed at meeting the growing global demand for its injection molding machines. The new facility is equipped with state-of-the-art technologies to enhance manufacturing efficiency and product quality.

Plastic Processing Machinery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blow Molding Machinery, Compression Molding Machinery, Extrusion Molding Machinery, Injection Molding Machinery, Rotational Molding Machinery, Others |

| Plastic Types Covered | Polypropylene (PP), Polyethylene (PE), Polyurethane (PUR), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polystyrene (PS), Others |

| End-Use Industries Covered | Packaging Industry, Construction Industry, Automotive Industry, Electronic and Electrical Industry, Agriculture Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arburg GmbH, Cosmos Machinery, Haitian Plastics Machinery Group Co. Ltd., Husky Injection Molding Systems, Japan Steel Works Ltd., Milacron Holdings Corporation, Niigata Machine Techno Company Ltd., Sumitomo Heavy Industries, Toshiba Machine Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plastic processing machinery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plastic processing machinery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plastic processing machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plastic processing machinery market covers the period from 2019 to 2033, with a projected market size of USD 37.7 Billion in 2024.

IMARC Group expects the plastic processing machinery market to reach USD 51.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033.

Key factors driving the market growth encompass the escalating requirement for plastic products across key sectors like consumer goods, automotive, and packaging. Technological innovations in sustainable manufacturing methods, automation, and energy efficiency, coupled with the magnifying utilization of bio-based as well as recyclable plastics, also foster the market expansion.

Asia Pacific currently dominates the plastic processing machinery market, accounting for a share exceeding 39.7%. This dominance is fueled by its resilient manufacturing base, magnifying industrialization, and accelerating need for plastics across numerous crucial sectors including electronics, automotive, and packaging.

Some of the major players in the plastic processing machinery market include Arburg GmbH, Cosmos Machinery, Haitian Plastics Machinery Group Co. Ltd., Husky Injection Molding Systems, Japan Steel Works Ltd., Milacron Holdings Corporation, Niigata Machine Techno Company Ltd., Sumitomo Heavy Industries, Toshiba Machine Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)