Plastic Pallets Market Size, Share, Trends and Forecast by Material, Pallet Type, End Use Industry, and Region, 2025-2033

Plastic Pallets Market 2024, Size And Trends:

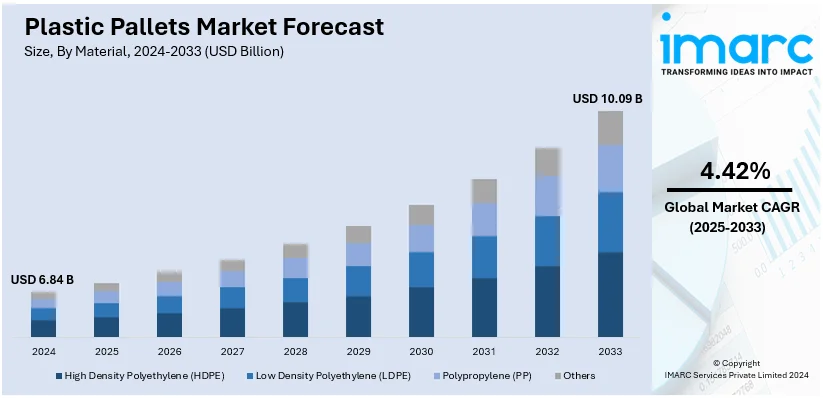

The global plastic pallets market size was valued at USD 6.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.09 Billion by 2033, exhibiting a CAGR of 4.42% from 2025-2033. Asia Pacific currently dominates the market owing to the rising need for efficient logistics services, the expanding e-commerce industry, and the incorporation of advanced tracking systems are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.84 Billion |

| Market Forecast in 2033 | USD 10.09 Billion |

| Market Growth Rate (2025-2033) | 4.42% |

The rapid expansion of e-commerce has significantly transformed global logistics, leading to increased demand for efficient and durable materials handling solutions, such as plastic pallets. In 2024, the global e-commerce market reached $26.8 trillion, and projections indicate that it will continue to rise to over $214.5 trillion by 2033, according to the latest report by the IMARC Group. This increase demands for strong logistics infrastructure to handle more volumes of products, hence companies are adopting plastic pallets due to their strength and compatibility with automated systems. The e-commerce boom has also heightened the demand for fast and efficient delivery services. The growing demand for quicker shipping options has led the logistics service providers to adapt and optimize their operations. Since plastic pallets are lightweight, moisture-resistant, and chemical-resistant, handling them is faster, thereby reducing shipping delays, which also meets the requirements of e-commerce fulfillment.

The plastic pallets market in the United States is growing at fast pace due to the expansion of the transportation and logistics industry. The U.S. logistics sector has experienced consistent growth. It is expected to grow at an annual rate of 9.02% between 2024 and 2032. This expansion necessitates efficient material handling solutions, bolstering the demand for plastic pallets. Aside from that, the growing awareness about the product’s advantages over wooden pallets is fostering the market growth. Plastic pallets offer benefits such as durability, resistance to moisture and pests, and ease of cleaning, making them preferable in industries like food and beverages, pharmaceuticals, and chemicals, where hygiene and contamination prevention are critical. Moreover, the increasing focus on sustainable material handling has led to a preference for reusable packaging solutions. Plastic pallets, especially those made from recycled materials, align with these sustainability goals, further driving their adoption.

Plastic Pallets Market Trends:

Sustainability and Environmental Concerns

The rising consumer environmental concerns towards deforestation and the elevating plastic pollution levels are shaping the plastic pallets market outlook. Additionally, the shifting preferences from traditional wooden pallets to plastic pallets, owing to their ease of handling and long-lasting performance, are also positively influencing the global market. Moreover, plastic pallets are made with high-density polyethylene or polypropylene and are recyclable. For instance, according to the report by Nelson Company in March 2023, the most popular plastic pallet resin was HDPE. HDPE exhibits advantageous properties, such as stiffness, durability, moisture resistance, etc., that are needed for the majority of common applications. Plastic pallets have the ability to be cleaned and sanitized more easily, which can help in reducing the spread of contaminants and pathogens. They also tend to have a longer lifespan than wooden pallets, thereby minimizing the need for frequent replacement and the associated environmental impact of manufacturing new pallets. For instance, the International Energy Agency, situated in Paris, projects that the world's HDPE manufacturing capacity will increase from 48.51 million metric tons in 2020 to 72.19 million metric tons in 2050. Apart from this, as companies are using sustainable practices, the demand for plastic pallets continues to grow, thereby making sustainability a pivotal driver in the plastic pallets market. For example, in April 2023, ORBIS Corporation, a global leader in reusable packaging, announced that its 40x48-inch reusable pallet, called the P3, completed 280 cycles in the FastTrack lifecycle analysis.

Stringent Hygiene and Safety Regulations

Industries, including food and beverage (F&B) and pharmaceutical, have strict hygiene requirements to ensure the safety and quality of their products. Plastic pallets have a smooth and non-porous surface that is easy to clean and sanitize, making them essential for use in environments where hygiene is critical. This helps in preventing the growth and spread of bacteria, mold, and other contaminants. For instance, Craemer Group, one of the leading manufacturers of plastic pallets, storage containers, and transport containers, introduced the TC3-5 Palgrip in September 2021. This fully closed plastic pallet prioritized safety and cleanliness with its entirely anti-slip coated top deck. Moreover, it provides complete slip resistance, even in damp or very humid environments, and is resistant to both cold and heat between -22°F (-30°C) and 104°F (40°C), which makes it particularly suitable for the dairy and oil and gas industries. Apart from this, plastic pallets are designed to meet stringent hygiene and safety regulations set by authorities, such as the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These regulations require pallets to be made from materials that are safe for use in food and pharmaceutical applications.

Cost Efficiency and Operational Benefits

According to the plastic pallets market’s recent opportunities, plastic pallets are more durable than wooden pallets and have a longer lifespan. They are resistant to moisture, chemicals, and pests, which can cause wooden pallets to degrade over time. This durability reduces the need for frequent replacement, saving on costs. Moreover, these pallets are manufactured to precise specifications, ensuring consistent size and weight. This consistency makes them ideal for use in automated systems and reduces the risk of damage to goods during handling and transportation. Also, businesses from various sectors see these practical advantages and plastic pallets as an investment that improves their supply chain effectiveness and overall profitability. Demand for plastic pallets is anticipated to increase, as companies look for ways to reduce expenses and streamline operations. As a result, cost-effectiveness and operational advantages will play a major role in the market's expansion. For instance, according to Tosca Services LLC, manufacturers and home constructors shifted from wooden pallets towards long-term smart packaging solutions, such as the use of reusable plastic pallets, in 2020 as the costs of wooden pallets increased to USD 1500 per 1000 feet. This volatility has directly impacted the adoption of wooden pallets.

Plastic Pallets Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plastic pallets market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, pallet type, and end use industry.

Analysis by Material:

- High Density Polyethylene (HDPE)

- Low Density Polyethylene (LDPE)

- Polypropylene (PP)

- Others

High-density polyethylene HDPE leads the market in 2024. HDPE is resistant to moisture and chemicals and to changes in temperature, which has given rise to the segment's growth. In addition, its resistance further prolongs its life and maintains the structure during humid warehouses. Pallets can tolerate extreme loading and harsh handling and hence best suited for industrial usage. For example, in June 2021, one of the world's largest producers of high-quality, durable plastic pallets released its new 48" x 40" model called the CR4-5 in the company's CR series, well known for their sustainability and ability to carry heavy loads.

Analysis by Pallet Type:

- Nestable

- Rackable

- Stackable

- Others

Nestable plastic pallets are taking over the market as they are highly used to save space when not in use. These pallets have a number of legs or runners which enable the pallet to nest in other copies when these pallets are stacked on each other, which reduces the volume or space taken when stored and hence is always in demand for such uses where saving on space is crucial. More emphasis on space efficiency and durability in various industries has further driven the growth of the segment.

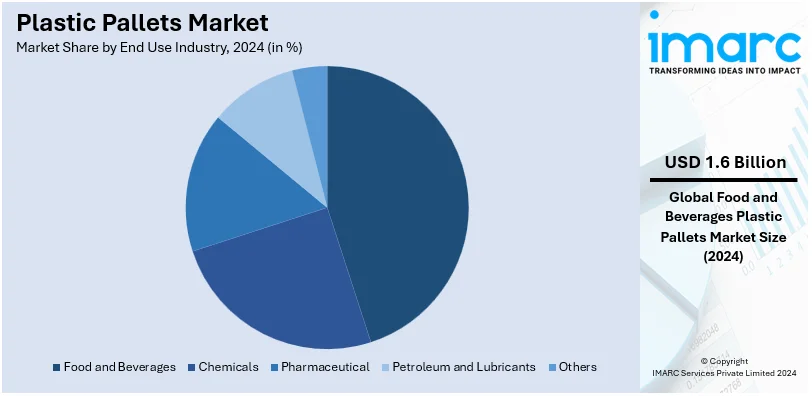

Analysis by End Use Industry:

- Food and Beverages

- Chemicals

- Pharmaceutical

- Petroleum and Lubricants

- Others

The top market leader is food and beverages in the year 2024. The plastic pallet has a smooth surface that makes it easy to clean, and hence there is the requirement for sanitizer. These hygiene standards must be maintained while handling food products to ensure no contamination within the industry. The inflation of requirements for moisture-resistant, chemicals, and acids resistant plastic pallets is helping grow the demand for the respective segment in the plastic pallets market statistics. For example, in 2022, C & T Matrics unveiled a new plastic pallet that is designed considering the specific requirements of the F&B packaging industry. Many customer-specific hygiene and BRC accreditation requirements were catered to solely through food-safe polymers in the plastic pallets.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

As for 2024, the Asia Pacific region had captured the biggest market share. Rising demands by the region for lightweight yet cost-effective and high quality plastic material are boosting its demand thereby driving the market. Beyond that, comprehensive infrastructures and warehouses also seem to be positively influencing the region. In addition, Asia Pacific has been characterized as having a robust manufacturing sector due to the presence of countries involved in the Trans-Pacific Partnership Agreement (TPP). TPP is a free trade agreement that has strengthened the trade and manufacturing sector among countries in the region, thus driving the demand for plastic pallets over the years. According to the World Trade Organization (WTO), China is not only one of the world's most populous countries, but it is also the greatest producer and exporter. Furthermore, the Asia Pacific region has witnessed a growing emphasis on sustainability and environmental responsibility. With increasing awareness of the ecological impact of material handling practices, there has been a notable shift towards eco-friendly solutions, such as plastic pallets, which are often made from recyclable materials.

Key Regional Takeaways:

North America Plastic Pallets Market Analysis

The growth of the plastic pallets market in North America is driven by the increasing emphasis on sustainable logistics solutions, rising demand for efficient material handling systems, and advancements in manufacturing technologies. Businesses are shifting toward reusable and recyclable plastic pallets to meet stringent environmental regulations and reduce carbon footprints. These pallets offer advantages such as durability, resistance to moisture and chemicals, and a longer lifespan compared to traditional wooden pallets, making them a preferred choice across industries like food and beverage (F&B), pharmaceuticals, and retail. The rapid growth of e-commerce and the need for streamlined supply chains further fuel demand for lightweight, hygienic, and standardized pallet solutions. Additionally, the adoption of automation in warehouses and distribution centers is enhancing the demand for plastic pallets that are compatible with automated storage and retrieval systems.

United States Plastic Pallets Market Analysis

Some of the factors driving the United States' plastic pallet market include stringent regulations regarding cleanliness, an increased focus on sustainability, and the rapid rise of logistics and e-commerce. Where hygiene and cleanliness are strictly enforced, like the food and beverage industry or pharmaceutical companies that need to maintain FDA and USDA standards, plastic pallets have come to dominate. They are also attractive for transportation and warehouse storage due to their chemical and moisture resistance.

The rise of e-commerce has also increased demand enormously and requires efficient storage and transportation solutions such as plastic pallets. Based on data from the U.S. Department of Commerce, Digital Commerce 360 calculated that US internet sales might exceed USD 1.03 Trillion in 2022. Because of the drive for practices to be more ecological in nature, businesses are beginning to opt for reusable plastic pallets, which actually decreases their reliance on its more traditional wooden counterpart. Increased adoption has been motivated further by initiatives that endorse the use of recyclable material in the making of the pallet. Advances in light-weight, affordable plastic pallets are also needed. Integrated with technologies such as RFID and IoT, the increased digitization of supply chains, it ensures real-time tracking of inventory that boosts the efficiency of operations. In the United States, the plastic pallet design innovations will ensure broad acceptance by industry.

Europe Plastic Pallets Market Analysis

The European market for plastic pallets is spurred by strict environmental restrictions and the importance of sustainability. Industries have been challenged to move away from short-term, non-recyclable alternatives, such as plastic pallets, through the European Union's waste management regulations and increasing restrictions on single-use plastics. With the increased demand in the food, pharmaceutical, and automotive industries, Germany, the UK, and France are taking the lead.

The region's booming export industry heavily relies on efficient and durable pallet solutions. According to figures from the European Commission, EU exports to non-EU nations produced Euro 2 526 Billion (USD 2,653 Billion) in gross value added in the EU in 2022. This accounted for 17.7% of the gross value added in the EU. The primary reason is that plastic pallets can be exported with ease and are not liable to contamination or pest issues. Moreover, plastic pallets are more in use than wood pallets in Europe as the continent automates its warehousing system, which requires precision and consistency. In line with the ecological goals of the continent, lightweight, nestable plastic pallets also gained popularity as a mean of saving shipping costs.

Asia Pacific Plastic Pallets Market Analysis

Rapid industrialisation, expansion of manufacturing hubs, and increasing exports are the primary drivers of the plastic pallets market in Asia-Pacific. China and India are major suppliers with huge demand in the food, electronics, and automobile sectors. According to the World Trade Organization data, the exports of China were USD 3.38 Trillion in 2023, and due to durability and international standards, plastic pallets are used for exports. E-commerce growth has seen lightweight and recyclable pallets in much demand due to their efficiency in a supply chain. International Trade Administration forecasts that e-commerce business will reach an estimate of around USD 28.9 Trillion in 2026 in the Asia Pacific region. The government initiative toward a sustainable cause is also witnessing an increasing adoption of plastic recyclable pallets. In other industries, such as transportation and warehouse automation where consistent and long-lasting pallet designs are important, industry grows.

Latin America Plastic Pallets Market Analysis

Increased food and logistics sectors with growing environmental awareness drive this plastic pallet industry in Latin America. Reusable pallets increase in popularity in export-based sectors in Brazil and Mexico - two key markets. Because plastic pallets are so long-lasting and hygienic, they are a fundamental need for the food and beverage industry of the region-the world's largest net food exporting region. The region exports 13% of the global seafood and agricultural products and 25% of world's total food, as per an industrial report. Analogously, the automobile sector of Mexico requires long-term pallets solutions for transporting parts. In line with trends in other parts of the world, sustainability measures are promoting the use of recyclable materials in pallet manufacture. Advances in technology to include integration with tracking devices have further promoted the adoption of plastic pallets in the region.

Middle East and Africa Plastic Pallets Market Analysis

The Middle East and Africa is fuelled by the region's expanding logistics industry, food exports, and emphasis on environmental practices for plastic pallets. The major contributors are the GCC countries, especially Saudi Arabia and the United Arab Emirates. Moreover, as per an industrial report, the Gulf Cooperation Council (GCC) food and beverage market is projected to grow with a CAGR of 4.39% during 2024-2029, creating an impressive opportunity for the market. Plastic pallets are ideal for the climate of the region as they are resistant to pests and high temperatures. In addition, the demand for strong and reusable pallet solutions has also increased because of the fast growth of infrastructure and warehouse developments in Africa. Expansions in the area are also fueled by efforts to reduce waste through the use of recyclable products.

Competitive Landscape:

Plastic pallet manufacturers focus on innovative pallet designs and materials. This consists of design for pallets with more advanced features like RFID-tracking, anti-slip surfaces, ergonomic handles, and higher load-bearing capacities. Innovation also includes the use of new materials, additives, or composites that could enhance the durability, sustainability, and performance of plastic pallets. In addition, many companies are campaigning for their environment-friendly attributes. This includes pallet production made of recycled plastics, designing pallets to be recyclable, and reducing carbon footprint during the manufacturing process. Many companies also adopt closed-loop systems, recovering and recycling pallets returned by customers. In addition, several of the key players are partnering with logistics and supply chain management companies to deliver an integrated solution. These partnerships can range from pallet tracking technology integration to bundling services.

The report provides a comprehensive analysis of the competitive landscape in the plastic pallets market with detailed profiles of all major companies, including:

- Allied Plastics Inc.

- CABKA Group

- Greystone Logistics

- Monoflo International

- Orbis Corporation (Menasha Corporation)

- Paxxal Inc.

- Perfect Pallets Inc.

- Polymer Solutions International Inc.

- Rehrig Pacific Company

- TMF Corporation

- Tranpak Inc.

Latest News and Developments:

- November 2024: LATAM Cargo Group has introduced recycled plastic pallets as part of its sustainability efforts in lowering its environmental impact by introducing recycled plastic pallets. These pallets are intended to take the place of conventional wooden pallets because they are constructed entirely of recycled materials. In addition to reducing deforestation, this modification increases operating efficiency because repurposed pallets are stronger and lighter.

- January 2024: IFCO, the global leading provider of reusable packaging containers (RPCs), announced to launch Dora, a cutting-edge reusable plastic pallet. Dora is a seamless integration into the current fresh grocery supply chain, ensuring long-term improvements in logistical efficiency and sustainability benefits for both retailers and suppliers.

- August 2023: The Brazilian branch of Höganäs AB won an AGFE 2023 ESG Award in the environmental category for their initiative to replace wooden pallets with plastic ones. The non-profit AGFE business development organization was established with the aim of creating chances for the social and economic advancement of the Mogi das Cruzes region, home to Höganäs' Brazilian operations.

Plastic Pallets Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | High Density Polyethylene (HDPE), Low Density Polyethylene (LDPE), Polypropylene (PP), Others |

| Pallet Types Covered | Nestable, Rackable, Stackable, Others |

| End Use Industries Covered | Food and Beverages, Chemicals, Pharmaceutical, Petroleum and Lubricants, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allied Plastics Inc., CABKA Group, Greystone Logistics, Monoflo International, Orbis Corporation (Menasha Corporation), Paxxal Inc., Perfect Pallets Inc., Polymer Solutions International Inc., Rehrig Pacific Company, TMF Corporation, Tranpak Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plastic pallets market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global plastic pallets market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plastic pallets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Plastic pallets are flat structures made from various types of durable plastics, designed to support and transport goods during shipping, storage, and handling. They serve as a base for stacking and securing products, facilitating efficient handling by forklifts and other material-handling equipment. Plastic pallets are widely used across industries such as logistics, warehousing, manufacturing, and retail.

The plastic pallets market was valued at USD 6.84 Billion in 2024.

IMARC estimates the global plastic pallets market to exhibit a CAGR of 4.42% during 2025-2033.

The rapid expansion of the e-commerce sector globally, rising need for efficient logistics services, the expanding e-commerce industry, and the incorporation of advanced tracking systems are some of the major factors propelling the market growth.

In 2024, high-density polyethylene (HDPE) represented the largest segment by material as it is resistant to moisture and chemicals and to changes in temperature.

Nestable leads the market by pallet type as they are highly used to save space when not in use.

The food and beverages are the leading segment by end use industry because plastic pallets have a smooth surface that makes it easy to clean, thus maintaining hygiene standards.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global plastic pallets market include Allied Plastics Inc., CABKA Group, Greystone Logistics, Monoflo International, Orbis Corporation (Menasha Corporation), Paxxal Inc., Perfect Pallets Inc., Polymer Solutions International Inc., Rehrig Pacific Company, TMF Corporation, Tranpak Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)