Plant-based Seafood Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Plant-based Seafood Market Size & Share:

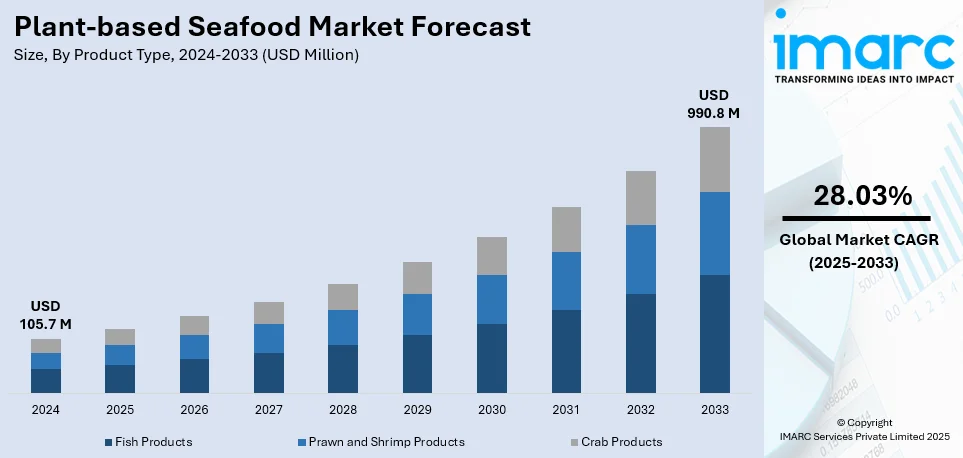

The global plant-based seafood market size was valued at USD 105.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 990.8 Million by 2033, exhibiting a CAGR of 28.03% from 2025-2033. North America currently dominates the market, holding the plant-based seafood market share of over 38.4% in 2024. The plant-based seafood market share is propelled by the increasing consumer demand for sustainable and ethical food products, increasing awareness about health benefits related to plant-based diets, increased investment and innovation in plant-based seafood alternatives, and advancements in realistic plant-based seafood textures and flavors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 105.7 Million |

| Market Forecast in 2033 | USD 990.8 Million |

| Market Growth Rate (2025-2033) | 28.03% |

The market for plant-based seafoods is expanding due to growing consciousness related to the environment and the added health benefits. Growing problems associated with overfishing, pollution of seas and oceans, and declining sizes of fish populations have compelled consumers to shift to other forms of diets. Advances in food technology have been instrumental in creating plant-based seafood products that closely mimic the taste, texture, and nutritional profile of traditional seafood, enhancing consumer acceptance. Ingredients such as algae, soy, and legumes are being utilized to replicate seafood flavors and functionality, while clean-label and allergen-free options cater to health-conscious consumers. Aggressive marketing strategies and expanding retail and foodservice channels are further boosting the visibility and accessibility of these products, propelling global market expansion.

In the United States, the plant-based seafood market is gaining significant traction, supported by environmentally conscious consumer behavior and a strong demand for sustainable food solutions. Overfishing concerns and a growing focus on ocean conservation are key drivers influencing consumer choices. The U.S. market is bolstered by innovative startups and established food companies that leverage advanced technologies to develop products catering to diverse dietary needs, including gluten-free and allergen-sensitive options. Partnerships with major restaurant chains and the expansion of retail offerings are further accelerating the adoption of plant-based seafood. For instance, in December 2023, Konscious Foods, a plant-based seafood brand, unveiled its plans to broaden its foodservice offerings across North America in 2024. The brand will enter the U.S. foodservice market and partner with Affinity Group Canada for Canadian distribution. Its chef-crafted products include plant-based sushi, poke cubes, sno’ crab, and onigiri, focusing on sustainability, quality, and operational efficiency. Additionally, government support for sustainable food systems and increased investment in plant-based innovation are fostering growth, positioning the U.S. as a key competitor in the global market.

Plant-based Seafood Market Trends:

Increasing Consumer Demand for Sustainable and Ethical Food Products

Increasing consumer awareness about the environmental impact of traditional seafood industries is a significant driver for the plant-based seafood market. Overfishing, habitat destruction, and the carbon footprint associated with conventional fishing practices have prompted consumers to seek more sustainable alternatives. This shift in consumer preferences is evident in the growing market share of plant-based foods, as 6 in 10 U.S. households purchased plant-based foods in 2023, according to the GOOD FOOD INSTITUE. Consumers are now more informed about the ecological benefits of plant-based diets, which typically have a lower environmental impact. Plant-based seafood products are seen as a solution to reduce overfishing and promote ocean health, thereby creating a positive plant-based seafood market outlook.

Increasing Awareness about Health Benefits Associated with Plant-Based Diets

Health consciousness among consumers is another critical factor driving the plant-based seafood market. Plant-based diets are often associated with numerous health benefits, such as lower risks of heart disease, diabetes, and certain cancers which further propels the market growth. For instance, as per NBC News, 50 studies have shown that individuals who follow plant-based diets are less prone to heart-related illnesses, cancer, and deaths. This health-oriented shift has spurred demand for plant-based seafood, which offers similar nutritional benefits to traditional seafood, such as high protein content and essential omega-3 fatty acids, though without the concerns of mercury contamination and other pollutants often found in ocean-sourced fish. Additionally, plant-based seafood eliminates the risk of exposure to microplastics, which are increasingly present in marine environments. By choosing plant-based alternatives, health-conscious consumers can enjoy the benefits of seafood without compromising on their well-being, contributing to the plant-based seafood market growth.

Increased Investment and Innovation in Plant-based Seafood Alternatives

The plant-based seafood market has experienced significant growth due to a rise in investment and innovation. Venture capitalists and major food industry players are increasingly backing plant-based startups, recognizing the lucrative potential of this emerging market. In 2024, retail plant-based food sector reached an unprecedented USD 8.1 Billion, according to the GOOD FOOD INSTITUE. This substantial influx of capital has empowered companies to enhance their research and development efforts, resulting in notable improvements in product quality and variety. Technological advancements have played a crucial role, with innovations in food technology, such as fermentation and cellular agriculture, enabling the creation of plant-based seafood products that closely replicate the taste and texture of traditional seafood. These advancements have made plant-based seafood more appealing to mainstream consumers, thus positively contributing to the plant-based seafood market revenue. Consequently, the industry is witnessing swift growth fueled by rising consumer enthusiasm and the ongoing innovation of advanced offerings. This plant-based seafood market trend reflects a growing recognition of the potential for plant-based seafood to meet consumer demand for sustainable, health-conscious, and high-quality alternatives to conventional seafood.

Plant-based Seafood Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plant-based seafood market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Fish Products

- Prawn and Shrimp Products

- Crab Products

Fish products lead the market with around 77.6% of market share in 2024. Fish products represent the largest segment in the plant-based seafood market by product type due to several factors. Fish is a staple in many diets around the world, making plant-based fish an attractive alternative for those seeking to maintain familiar dietary patterns while adopting a more sustainable lifestyle. The high demand for fish substitutes is driven by the increasing consumer awareness about the health and environmental impacts of traditional seafood consumption. Plant-based fish products offer similar nutritional benefits, such as high protein content and essential omega-3 fatty acids, without the risks associated with mercury contamination and overfishing.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Supermarket and hypermarkets lead the market with around 51.2% of market share in 2024. Supermarkets and hypermarkets have emerged as the largest segment in the distribution channel according to the plant-based seafood market research report due to several key factors. These retail formats provide extensive shelf space and a wide variety of products, making it easier for consumers to find and purchase plant-based seafood options. The accessibility and convenience offered by supermarkets and hypermarkets attract a broad consumer base, including those who might not actively seek out specialty health food stores. Additionally, such stores are usually fully supplied and connected with leading manufacturers of food products, resulting in providing the newest plant-based seafood products. This guarantees that consumers have variety and can easily make options and choices like plant-based fish fillets or vegan shrimp and crab cakes, among others.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- United Kingdom

- Germany

- Netherlands

- France

- Others

- Asia Pacific

- China

- Japan

- Singapore

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East & Africa

- South Africa

- UAE

- Others

In 2024, North America accounted for the largest market share of over 38.4%. North America is the largest segment in the plant-based seafood market due to several key factors. The region has a high awareness and growing demand for sustainable and healthy food alternatives, driven by increasing consumer concerns about overfishing, environmental sustainability, and health benefits associated with plant-based diets. Additionally, the market benefits from the presence of innovative food companies and startups that are continuously developing and promoting plant-based seafood. These firms leverage advancements in food technology to create realistic alternatives to traditional seafood, appealing to both vegetarians and flexitarians, solidifying North America’s leadership in the growing market.

Key Regional Takeaways:

United States Plant-based Seafood Market Analysis

In 2024, United States accounted for 82.70% of the market shares in North America. The plant-based seafood market in the US is moving very rapidly due to the following important considerations. First, a key driver of expansion in the market is increasing demand for sustainable and plant-based food substitutes. Consumers are increasingly becoming cognizant of how the production of seafood that originates from animals influences the environment through overfishing, habitat devastation, and carbon emissions. Therefore, plant-based seafood is considered a sustainable alternative, more so among Gen Z and millennials who are environmentally conscious.

Due to the health-conscious movement, the demand for plant-based seafood alternatives is also becoming increasingly popular. Plant-based fish is a healthier alternative and safer given the increasing awareness of mercury content and other contaminants in conventional seafood. The United States sold 215 Million pieces of plant-based meat and fish in 2023, according to data from the Good Food Institute. Another element is technological advancements in how these plant-based seafood is processed, which include using more seaweed, algae and more pea protein to make nutrition richer, tastes better and, subsequently, makes them more interesting for consumers. Not only consumer appetite but now the famous companies like Good Catch and New Wave Foods entered the scene bringing new dimensions about the offering of plant-based seafood within traditional supermarkets as well as restaurant chains.

Europe Plant-based Seafood Market Analysis

European seafood-based demand has grown significantly with shifting eating and environmental concerns. There is a higher population of vegans in the UK compared to any other country worldwide. Within the last four years, vegan restaurant searches that also host specific menus for only vegans increased by three times. There were more than 200,000 searches for vegan restaurants in 2020 compared to just 60,000 in 2017. Increased concern about the environmental impact of fishing industries, including overfishing and the destruction of marine ecosystems, is increasing the demand for plant-based diets, particularly in countries such as the UK, Germany, and France.

The health issues related to consumption of traditional seafood, such as its mercury levels and methods of harvesting, have motivated consumers to opt for plant-based seafood. Furthermore, the market is also driven by Europe's stringent sustainability-supporting legislation, which includes the European Green Deal that strives to make food more sustainable. These alternatives are now getting more and more popular with the availability of more plant-based seafood in supermarket chains such as Tesco and Carrefour. It is further propelled by the introduction of plant-based seafood with greater and more complex composition and processing techniques that has been witnessed through products such as plant-based prawns.

Asia Pacific Plant-based Seafood Market Analysis

Asia Pacific plant-based seafood market is growing rapidly due to changed customer preferences, greater concerns over sustainability, and a greater health awareness. Consumption of traditional seafood is on the higher side for countries like China, South Korea, and Japan, but the environmental impact through consumption is as well huge, hence creating a trend towards sea food plant-based alternatives. It also provides an attractive alternative for consumers who are increasingly worried about the sustainability of seafood products due to overfishing and marine pollution, especially younger generations who are more environmentally conscious.

The industry is also growing because of consumers' interest in plant-based diets for health reasons. There are many vegetarians and vegans in Asia. For instance, statistics by World Population Review reveal that 30% of Indians are vegetarians and 9% are vegans. Australia has the highest number of vegans in the region. The popularity of these alternatives is increasing due to the easy availability of plant-based seafood in stores and dining halls. The local entrepreneurs existing that are focusing on developing plant-based fish products are spurring innovation and creating new options for consumers.

Latin America Plant-based Seafood Market Analysis

The plant-based seafood market demand is growing in Latin America due to increased awareness by customers regarding the benefits plant-based alternatives bring to health and the environment. Latin American nations like Brazil and Argentina are becoming increasingly concerned about overfishing and fish population depletion, just like other regions. The market is also being supported by the growing popularity of vegetarianism. In January 2023, the first study measuring Veganuary's attendance in Latin America found that 5% of respondents from Chile, 7% from Argentina and Mexico, and 8% from Brazil reported taking part in the month-long event. Plant-based seafood provides an environmentally friendly alternative and fits very well with the increasing thrust towards eco-friendly food production in the region. Besides, this market is also increasing as the disposable income and acceptability of plant-based diets is also rising in the cities.

Middle East and Africa Plant-based Seafood Market Analysis

In relation to increased concerns about health and the environment, the market for plant-based seafood is gradually growing within the Middle East and Africa. As concerns regarding overfishing and food security rise, regionally heavy consumption of seafood by the region is being substituted more and more with plant-based alternatives, mainly in nations like the United Arab Emirates and South Africa. Urbanization and growing incomes are driving the demand for seafood and other plant-based food products. According to an industrial report, the GCC region’s urban population is expected to increase by 30% between 2020-2030. Moreover, younger, environmentally conscious consumers are more open to adopting plant-based alternatives and other sustainable nutritional alternatives. The market is expanding in these spaces as plant-based seafood products become more readily available in grocery stores and restaurants.

Leading Plant-based Seafood Companies

Plant-based seafood market forecast indicates a strong competition as companies are focusing on innovation and making robust marketing efforts. Companies are leading the way by developing and launching a diverse range of plant-based seafood products that closely mimic the taste, texture, and nutritional profile of traditional seafood. These companies invest heavily in research and development to create high-quality alternatives using ingredients such as legumes, seaweed, and algae, which offer a sustainable and healthy option for consumers. Moreover, major food service providers and retailers are teaming up with plant-based seafood companies to broaden their range of products and connect with a larger customer base. For instance, in August 2024, Canada's New School Foods secured USD 6 million in additional funding and launched a 28,000 sq ft commercial production facility to introduce its plant-based salmon to the U.S. and Canadian markets. This has led to increased visibility and accessibility of plant-based seafood in mainstream markets. Additionally, robust marketing campaigns focusing on the environmental benefits and health advantages of plant-based seafood are effectively educating consumers and shifting preferences toward these products.

The report provides a comprehensive analysis of the competitive landscape in the plant-based seafood market with detailed profiles of all major companies, including:

- Ahimsa Foods

- Atlantic Natural Foods

- Bonsan

- Ocean Hugger Foods

- Good Catch Foods

- Impossible Foods Inc.

- Sophie’s Kitchen Inc.

- New Wave Foods

- Gardein

- Quorn (Monde Nissin Corporation)

- Qishan Food Limited Company

- SoFine Foods

- Tofuna Fysh

- Vivera

Latest News and Developments:

- July 2024: The gourmet food brand Sherry Herring has partnered with Steakholder Foods, a leader in 3D-printed farmed and plant-based food, to launch creative vegan salads that use 3D-printed plant-based fish. The goal of this partnership is to develop premium, sustainable, and upscale plant-based fish substitutes for the expanding vegan and flexitarian markets. Sherry Herring will use her culinary skills to create high-end salads, while Steakholder Foods will use its state-of-the-art 3D bioprinting technology to create authentic fish textures and flavours.

- January 2024: Students from the NATIONAL UNIVERSITY OF SINGAPORE (NUS), have created a plant-based shrimp concept names “KEEPIN’ IT SHRIMPLE” through pea protein and lion’s mane fungi by using the extrusion technique.

- October 2023: NESTLE has introduced a new range of plant-based alternatives to white fish, including fillets, nuggets, and fingers. These products are vegan-certified and have received praise for their taste, texture, and nutritional value.

- August 2023: Unlimeat, a plant-based food firm, has added plant-based tuna to its list of products. The increasing demand for cruelty-free and sustainable seafood substitutes around the world is in line with this action. The premium, non-GMO soy protein and additional natural ingredients are used to create the plant-based tuna, which has the same texture and flavour as regular tuna. Customers who want to lessen their environmental effect and those who are health-conscious are the target market for the product.

Plant-based Seafood Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fish Products, Prawn and Shrimp Products, Crab Products |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Netherlands, China, Japan, Singapore, Brazil, Mexico, South Africa, UAE |

| Companies Covered | Ahimsa Foods, Atlantic Natural Foods, Bonsan, Ocean Hugger Foods, Good Catch Foods, Impossible Foods Inc, Sophie’s Kitchen Inc, New Wave Foods, Gardein, Quorn (Monde Nissin Corporation), Qishan Food Limited Company, SoFine Foods, Tofuna Fysh, Vivera, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plant-based seafood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global plant-based seafood market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plant-based seafood industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plant-based seafood market was valued at USD 105.7 Million in 2024.

The plant-based seafood market is projected to exhibit a CAGR of 28.03% during 2025-2033, reaching a value of USD 990.8 Million by 2033.

The plant-based seafood market is driven by growing consumer awareness of sustainability and health benefits. Rising concerns about overfishing, marine pollution, and declining fish stocks are prompting demand for sustainable alternatives. Additionally, advancements in food technology and the increasing adoption of plant-based diets are fueling market growth worldwide.

North America currently dominates the market, accounting for a share of around 38.4%. The dominance is driven by the rising consumer awareness of sustainability, increasing adoption of plant-based diets, growing demand for healthier alternatives, environmental concerns over overfishing, and innovations in plant-based seafood products.

Some of the major players in the plant-based seafood market include Ahimsa Foods, Atlantic Natural Foods, Bonsan, Ocean Hugger Foods, Good Catch Foods, Impossible Foods Inc, Sophie’s Kitchen Inc, New Wave Foods, Gardein, Quorn (Monde Nissin Corporation), Qishan Food Limited Company, SoFine Foods, Tofuna Fysh, and Vivera, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)