Plant Based Protein Market Report by Source (Soy, Wheat, Pea, and Others), Type (Concentrates, Isolates, Textured), Nature (Conventional, Organic), Application (Food, Feed), and Region 2025-2033

Plant Based Protein Market Overview:

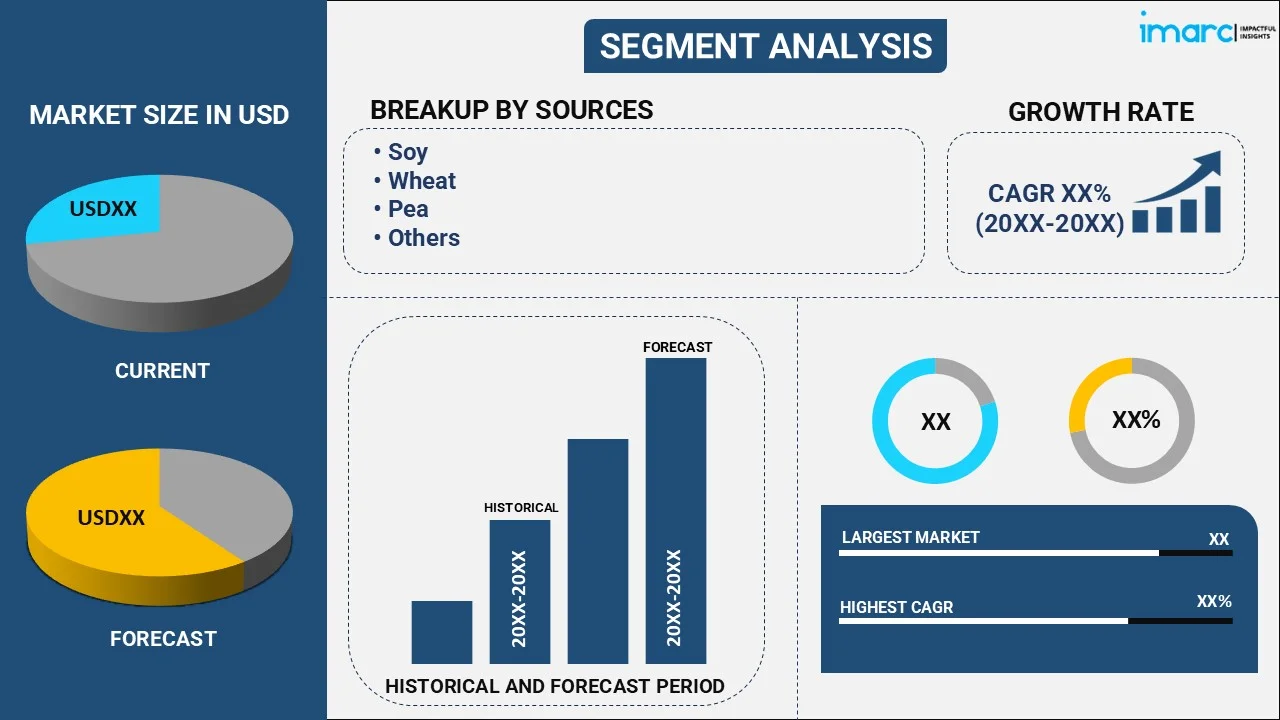

The global plant based protein market size reached USD 16.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. The rising popularity of sustainable food sources, along with the growing number of hotels, restaurants, cafes, etc., which are incorporating plant-based protein to curate various food items in their menus, is primarily driving the global market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.9 Billion |

| Market Forecast in 2033 | USD 29.9 Billion |

| Market Growth Rate (2025-2033) | 6.55% |

Plant Based Protein Market Analysis:

- Major Market Drivers: One of the key plant-based protein market drivers is the rising consumer preference for a healthy and nutritious diet. Moreover, the increasing focus of individuals on environmental sustainability and the elevating ethical considerations are also acting as growth-inducing factors.

- Key Market Trends: The plant-based protein market demand is propelled, owing to numerous primary trends, which include the rising consumer inclination towards a vegan diet and strategic partnerships between key players to gain a competitive advantage over an extensive supply chain.

- Geographical Trends: According to the report, North America exhibits a clear dominance, accounting for the largest plant-based protein market share. This is due to the rising popularity of adopting a flexitarian diet. Additionally, North America serves as a major production facility for plant-based protein, which is bolstering the regional market.

- Competitive Landscape: Some of the top companies in the plant based protein industry include AGT Food and Ingredients, Archer-Daniels-Midland Company, Axiom Foods Inc., Cargill Incorporated, Dupont De Nemours Inc., Glanbia plc, Ingredion Incorporated, Kerry Group plc, Koninklijke DSM N.V., Roquette Frères, Tate & Lyle PLC, The Scoular Company, Wilmar International Limited, among many others.

- Challenges and Opportunities: One of the key challenges hindering the plant-based protein market growth is the lack of production capacity. In line with this, to make the manufacturing process economically viable, it is important for food developers to find valuable uses for pea starch. Consequently, the rising concerns over economic feasibility can negatively impact the overall market growth. However, extensive research and development (R&D) activities by product manufacturers to diversify their portfolios by launching variants, such as soy-based protein, represent plant based protein market recent opportunities.

Plant Based Protein Market Trends:

The Expanding Vegan and Flexitarian Population

The rising focus on sustainable alternatives to animal-based meat among people, owing to the increasing environmental consciousness, ethical considerations, and the elevating health-related concerns, is catalyzing the plant based protein demand. Furthermore, the growing number of individuals who are engaging in sports and athletic activities, coupled with the shifting preferences for functional ingredients fortification in the food and beverage (F&B) industry, are also positively contributing to the plant based protein market revenue. Consequently, the rising adoption of nutritious diets is expected to propel the market growth positively in the coming years. In addition, the increasing awareness among consumers across the globe about the benefits associated with protein consumption, along with the growing demand among several age groups, is further influencing the plant-based protein products in the market. For example, a project led by Merit Foods, which became a global supplier of ingredients and plant-based food, helped manufacturers reach markets by meeting the increasing consumer demand. Moreover, the Health Ministry in Canada revamped its food guide. This included three categories, such as whole grains, vegetables and fruits, and plant-based proteins. On 23 June 2022, Roquette, a global leader in plant-based ingredients and a pioneer of plant proteins, launched two rice proteins, a bold move that adds a new botanical origin to its current portfolio.

Favorable Government Policies

Regulatory authorities of various countries are introducing initiatives to cater to the growth of protein seed production, which is also stimulating the global market. For example, governing agencies in Saudi Arabia are supporting agricultural companies to invest in foreign countries that have comparative advantages in manufacturing certain crops and re-export their products back to the country. Moreover, the crops targeted by this initiative include rice, barley, yellow corn, wheat, soybeans, green forage, and others, that are used in the production of plant-based protein. In line with this, governing agencies in the country are offering financial incentives to encourage local investors to take part in food security initiatives. Furthermore, they are introducing measures to elevate pea production in several countries. For instance, the emergence of new greening measures in Germany under the Common Agricultural Policy (CAP) elevated the production volume of peas. Similarly, numerous farm-centric programs and policies aids in attaining the desired objectives in pea production in India. Madhya Pradesh and Uttar Pradesh are the country's top pea growers. Mighty Foods, a food-tech plant-based protein brand, launched a range of products in its first launch phase in Mumbai, India on 24 March 2022. The products are designed for Indians and their eating habits and include a wide variety of easy-to-cook recipes, such as seekh kebab, galauti kebab, spring roll, grilled plant fish, spinach quesadilla, keema samosa, dim sums keema bao, burger patty, prawn in black pepper sauce, prawn thai curry, plant keema bao, and plant keema.

Continuous Product Innovations

Leading manufacturers across the globe are developing plant-based protein product variants to expand their portfolio, which is acting as a growth-inducing factor. For example, Evolved Foods introduced vegan alternatives under its Alt Protein and Alt Meat brands, seeking to replace paneer and chicken. In addition to this, a Dutch company, Schouten, brought its tempeh production system to India. Furthermore, plant-fortified food items are gaining traction among the millennial population. According to a survey, 63% of individuals in India were willing to replace meat with plant-based options. The increase in demand for these plant-based alternatives will continue to augment the market over the forecasted period. On 12 July 2023, Burcon NutraScience Corporation, a global technology leader in the development of plant-based proteins for foods and beverages, and HPS Food and Ingredients Inc., announced the upcoming launch of the world’s first high purity and soluble hempseed protein isolate at the Institute of Food Technologists 2023 Annual Meeting and Exposition.

Plant Based Protein Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on source, type, nature, and application.

Breakup by Source:

- Soy

- Wheat

- Pea

- Others

Soy accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the source. This includes soy, wheat, pea, and others. According to the report, soy represented the largest segment.

The rising inclination towards protein-based ingredients, including soya, is primarily propelling the market growth. Moreover, government bodies are launching favorable policies to increase soya production, which, in turn, is bolstering the plant based protein market growth. Furthermore, public and private companies are developing various techniques and directly engaging with farmers to improve farm incomes and elevate soybean yield. To augment the production, the Public-Private Partnership for Integrated Agriculture Development (PPPIAD) and the state government of Maharashtra, collaborated with ADM to introduce new technologies for soybean cultivation. Besides this, on 14 April 2022, ADM announced US$ 300 Million investment to expand existing production capabilities of its soy protein concentrate and open a new protein innovation center in Decatur, Illinois. The investment will nearly double the extrusion capacity at its existing production facility in Decatur where it produces its soy protein concentrate for various food applications.

Breakup by Type:

- Concentrates

- Isolates

- Textured

Isolates hold the largest share of the industry

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes concentrates, isolates, and textured. According to the report, isolates accounted for the largest market share.

Isolates proteins are gaining popularity, as they usually undergo processing to remove most of the non-protein components, which leave behind a product that is almost pure protein. Consequently, they are widely used in the preparation of protein supplements and powders. Furthermore, there is a rise in the demand for pea protein isolates due to their non-allergen and non-genetically modified organism (GMO) status, and its sustainability and versatility across many food applications. On 7 February 2024, Louis Dreyfus Company (LDC) announced the construction of a pea protein isolate production plant dedicated to its Plant Proteins business, at the site of its existing industrial complex in Yorkton, Saskatchewan, Canada.

Breakup by Nature:

- Conventional

- Organic

Conventional represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the nature. This includes conventional and organic. According to the report, conventional represented the largest segment.

The widespread adoption of conventional plant-based protein that usually involves the usage of chemical pesticides, synthetic fertilizers, and genetically modified organisms (GMOs) to improve crop yield and protect against pests is one of the key factors driving the market growth in the segmentation. In addition, the rising utilization of fertilizers is catalyzing the demand for plant based protein products. According to the Food and Agriculture Organization (FAO) of the United Nations (UN), agriculture sector used 109 million tons of nitrogen, 46 million tons of phosphorus and 40 million tons of potassium fertilizers in 2021 worldwide.

Breakup by Application:

- Food

- Meat Alternatives

- Dairy Alternatives

- Bakery Products

- Performance Nutrition

- Convenience Foods

- Others

- Feed

Food exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food (meat alternatives, dairy alternatives, bakery products, performance nutrition, convenience foods, and others) and feed. According to the report, food represented the largest segment.

The escalating demand for plant-based protein ingredients in the preparation of food products is primarily driving the market growth. The emerging popularity of meat alternatives and dairy alternatives and the rising trend of vegetarianism and veganism is supporting the market growth. As these protein ingredients cater to the evolving dietary preferences of the consumers, the market in this segment is expected to increase over the foreseeable future. Continuous advancements in food technology are also supporting the market growth. For example, Kerry announced a new purpose-built food technology and innovation center of excellence in Queensland, Australia. The facility acted as the new headquarters for Kerry in New Zealand and Australia, while its existing facility in Sydney remained as a specialist research and development applications hub. On 17 November 2023, Nestle, a leading fast-moving consumer goods (FMCG) company, developed plant–based protein food products in India.

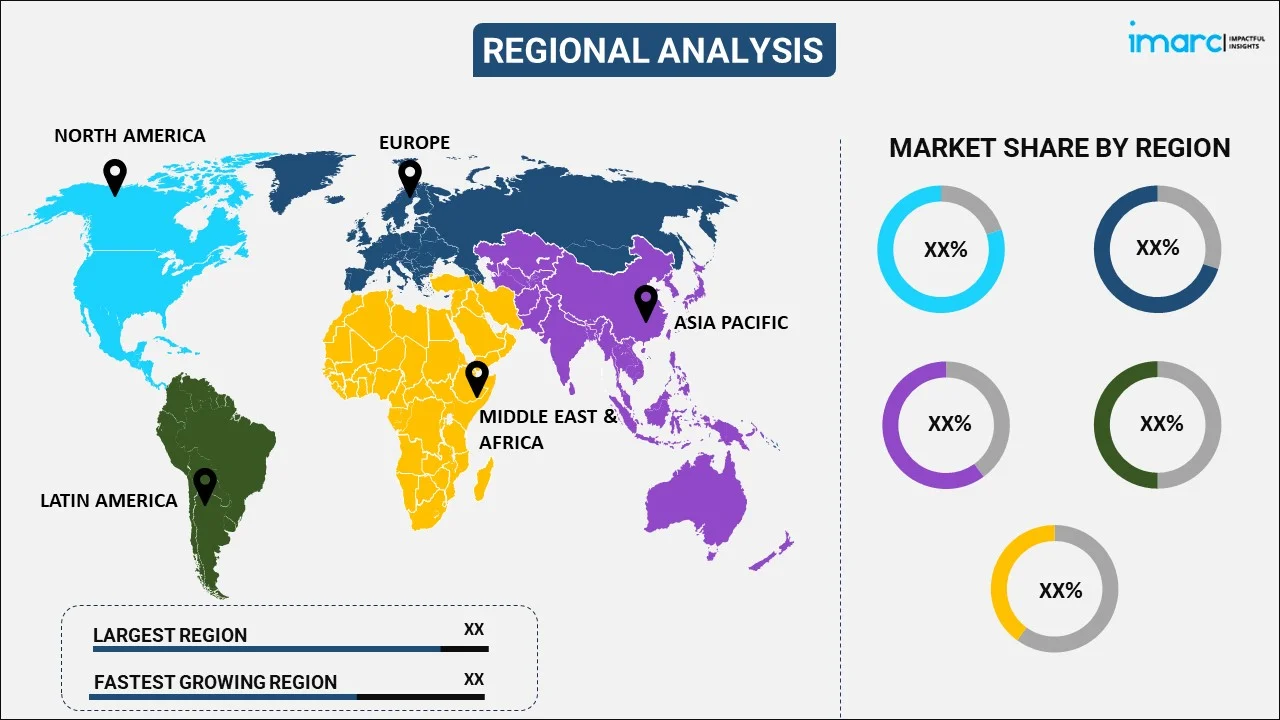

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest plant based protein market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest regional market for plant based proteins.

North America exhibits a clear dominance in the regional market, on account of the expanding consumer base and the increasing food and beverage (F&B) industry. Moreover, the emerging trend of veganism and the escalating demand for sustainability are acting as growth-inducing factors. The expanding vegan population is positively influencing the regional market. Furthermore, various companies are investing in capacity expansion, which is bolstering the market growth. On 8 September 2021, Ingredion Inc. opened new production capabilities for flours and concentrates at its pulse-based protein facility in Vanscoy, Sask. The facility currently produces flours and concentrates from pulses such as peas, lentils and fava beans that are sustainably sourced from North American farms. The added capacity includes a new production line with proprietary processing technology, will enable manufacturers to use on-trend plant-based proteins across a broader range of food and pet food applications.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the plant based protein industry include AGT Food and Ingredients, Archer-Daniels-Midland Company, Axiom Foods Inc., Cargill Incorporated, Dupont De Nemours Inc., Glanbia plc, Ingredion Incorporated, Kerry Group plc, Koninklijke DSM N.V., Roquette Frères, Tate & Lyle PLC, The Scoular Company, Wilmar International Limited.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are engaging in collaborations and mergers and acquisitions (M&A) to provide high-quality and innovative products to consumers. They are also introducing plant based protein products that offer essential benefits to the health of consumers. For instance, Royal DSM, a global purpose-led science-based company, launched Vertis™ textured pea canola protein-a world first in plant protein on 5 December 2022. The new solution is the only textured vegetable protein that contains the necessary levels of all nine essential amino acids to be a complete protein, has unique textural benefits, and is soy-free, gluten-free, and dairy-free.

Plant Based Protein Market Recent Developments:

- 12 March 2024: Protein Industries Canada launched favorable initiatives aimed at elevating the supply of protein-rich ingredients derived from hemp and sunflower across the country. This venture was due to the collaboration with Burcon NutraScience, HPS Food & Ingredients, and Puratos Canada.

- 26 March 2024: Aloha, a US plant-based snacks and drinks brand, has attracted a minority investment from SemCap Food and Nutrition to enhance their product offerings.

- 18 February 2024: Miruku, a New Zealand startup developing novel fats and dairy proteins using molecular farming and oilseed crops, raised US$ 5 Million in a pre-series A round to support its B2B model.

Plant Based Protein Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Plant Based Protein Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Soy, Wheat, Pea, Others |

| Types Covered | Concentrates, Isolates, Textured |

| Natures Covered | Conventional, Organic |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGT Food and Ingredients, Archer-Daniels-Midland Company, Axiom Foods Inc., Cargill Incorporated, Dupont De Nemours Inc., Glanbia plc, Ingredion Incorporated, Kerry Group plc, Koninklijke DSM N.V., Roquette Frères, Tate & Lyle PLC, The Scoular Company, Wilmar International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plant based protein market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plant based protein market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plant based protein industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global plant based protein market to exhibit a CAGR of 6.55% during 2025-2033.

The emerging trend of veganism, along with the rising demand for plant based proteins, including pulses, tofu, soy, etc., as they assist in reducing weight, promoting gut health, preventing obesity, etc., is primarily driving the global plant based protein market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of plant based proteins.

Based on the source, the global plant based protein market has been divided into soy, wheat, pea, and others. Among these, soy currently exhibits a clear dominance in the market.

Based on the type, the global plant based protein market can be categorized into concentrates, isolates, and textured. Currently, isolates account for the majority of the global market share.

Based on the nature, the global plant based protein market has been segregated into conventional and organic, where conventional currently holds the largest market share.

Based on the application, the global plant based protein market can be bifurcated into food and feed. Currently, food exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global plant based protein market include AGT Food and Ingredients, Archer-Daniels-Midland Company, Axiom Foods Inc., Cargill Incorporated, Dupont De Nemours Inc., Glanbia plc, Ingredion Incorporated, Kerry Group plc, Koninklijke DSM N.V., Roquette Frères, Tate & Lyle PLC, The Scoular Company, and Wilmar International Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)