Pizza Crust Market Size, Share, Trends and Forecast by Type, Size, Organic/Conventional, Distribution Channel, and Region, 2025-2033

Pizza Crust Market Size and Share:

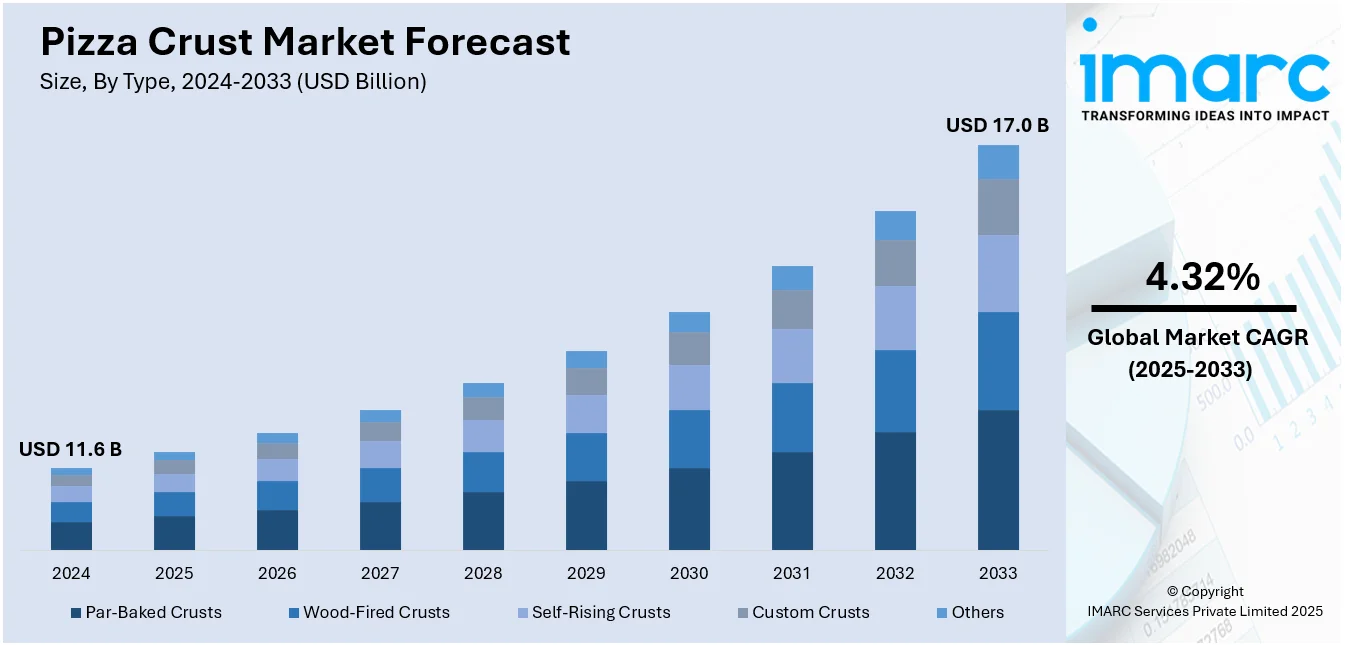

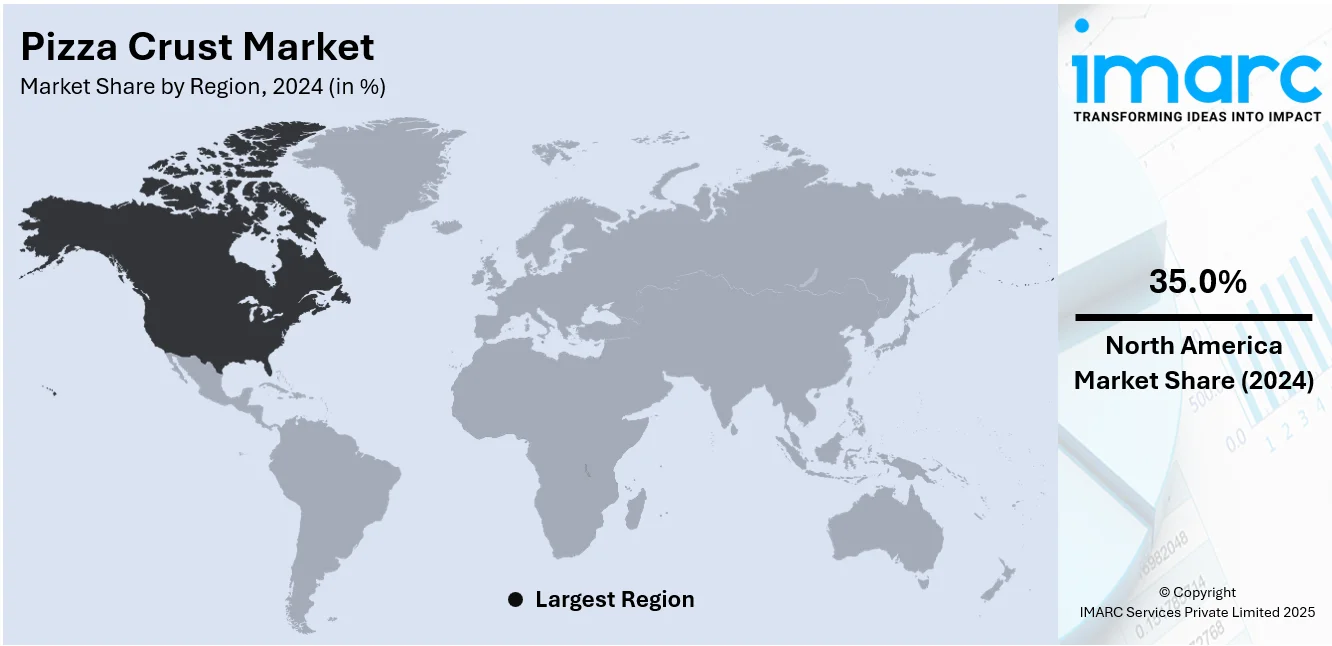

The global pizza crust market size was valued at USD 11.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.0 Billion by 2033, exhibiting a CAGR of 4.32% from 2025-2033. North America currently dominates the market, holding a market share of over 35.0% in 2024. The market is fueled by intense consumer demand for convenient meals, robust presence of quick-service restaurants (QSRs), and extensive distribution of various pizza crust products through retail and foodservice channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.6 Billion |

|

Market Forecast in 2033

|

USD 17.0 Billion |

| Market Growth Rate (2025-2033) | 4.32% |

The swift growth of quick-service restaurants (QSRs) in both developed and developing economies is a key driver for the global pizza crust market. The convenience and affordability provided by such outlets have contributed to pizza being an accepted meal option among varied consumer groups. This phenomenon is most evident in economies undergoing demographic change toward youth, who are more inclined to favor fast, customizable, and casual food choices. QSRs rely more and more on effective supply chains, such as pre-prepared pizza crusts that provide uniform quality and lower preparation time. For example, in March 2024, Rich Products debuted Italian-style pizza crusts, such as hand-stretched Pinsa and Double Zero '00' parbaked choices, providing artisanal quality and convenience to take U.S. foodservice menus to the next level. Furthermore, food culture globalization and menu standardization have resulted in a homogenized increase in demand for different kinds of pizza crusts. As QSR footprints continue to grow across the world, especially in shopping centers, transportation hubs, and urban areas, the demand for bulk, versatile, and premium-quality pizza crusts is steadily rising, directly impacting the dynamics of the global food service industry.

In the United States, heightening interest in home-based culinary experimentation is driving demand for multicultural pizza crust products, with the country accounting for 85% of market share in 2024. As food shoppers look to create exciting food experiences in their own kitchens, pizza-making kits and specialty crusts are increasingly popular. The trend is part of a larger shift toward cooking as a hobby activity instead of a daily requirement. With different crust options—thin, thick, hand-tossed, or other grain-based available where consumers have the liberty of designing personal meals to meet their preferences and dietary needs. This desire for personal cooking experience is further supported by the presence of educational content on multiple digital platforms, inviting consumers to experiment with novel toppings and crusts. Shelves in supermarkets and grocery websites today respond to this demand by providing a wide range of crusts created with convenience and creativity in mind. For instance, in January 2025, Papa John's announced its return to India with a 2025 launch plan, focusing on locally adapted pizza crusts to suit Indian taste buds and guarantee long-term market success.Moreover, home kitchens are hence transforming into active cooking spaces, accelerating in-home consumption of pizza crusts in the U.S.

Pizza Crust Market Trends:

Urbanization and the Rise of Western Cuisines

The worldwide rise in urbanization has had a tremendous impact on the mode of food consumption, especially in developing economies. The expansion of urban centers and the entry of global food chains have caused food demand to shift towards convenient and globalized food, including pizzas. Bangalore and Mumbai cities have witnessed more than 3 million orders of pizzas each in 2024, highlighting this shift. Concurrently, changing socio-economic patterns are motivating middle- and high-income buyers to try and embrace western foods, supporting the demand for diverse pizza crusts. As consumer taste changes, pizza crust producers are accelerating to meet the growing demand. The synergistic effect of a hectic city life and heightened exposure to global dining trends keeps driving the demand for pizza crusts, ensuring they remain a staple in contemporary diets and driving market growth in both developed and emerging economies.

Changing Lifestyles and Demand for Convenience Foods

A more hectic lifestyle, particularly among the working population, is propelling demand for ready-to-eat, convenient foods, with pizza crusts becoming a favorite option. This trend is complemented by growing disposable incomes, which allow consumers to spend freely on quick meal solutions without sacrificing taste or variety. With decreasing time for conventional cooking, consumers are opting for pre-prepared food options that fit their time frames. Consequently, the market for processed and convenient products such as pizza crusts is growing fast. Moreover, the spread of online platforms with home delivery services has contributed even more momentum, making it easier than ever to access various sources of pizza crusts. For the U.S., recent data from CivicScience indicates that 79% of grown-ups order pizza at least occasionally throughout the year, while 8% order on a weekly basis. These figures indicate the high consumer dependence on pre-made food items such as pizza crusts in contemporary homes.

Health Consciousness and Product Innovation

As lifestyle-related health conditions become more prominent, consumers are getting more and more watchful of their nutritional intake. This change in sentiment is driving the demand for healthier alternatives to pizza crusts, including gluten-free, dairy-free, and vegetable-based crusts. Companies are reacting with innovation, such as rice flour, cauliflower, and other nutrient-dense ingredients that respond to particular dietary requirements without sacrificing flavor. These value-added products find appeal with a wide spectrum of consumers, ranging from food-sensitive individuals to health-aware consumers looking to minimize carbohydrate consumption. The increase in health awareness is not only a Western phenomenon but is also being replicated in developing economies, where lifestyle diseases are amplifying. Consequently, the pizza crust industry is in the process of transformation with manufacturers making investments in cleaner labeling, functional ingredients, and sustainable supply to keep pace with changing consumer demands and gain a larger share in a more health-conscious global food marketplace.

Pizza Crust Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pizza crust market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, size, organic/conventional, and distribution channel.

Analysis by Type:

- Par-Baked Crusts

- Wood-Fired Crusts

- Self-Rising Crusts

- Custom Crusts

- Others

Par-baked crusts provide convenience and consistency, half baked to save prep time without sacrificing flavor. They are popular in commercial kitchens and frozen pizza formats, with shelf life extension and handling convenience. Their universality makes them adaptable for use with a wide range of toppings and baking methods throughout foodservice applications.

Wood-fired crusts are favored for their rustic charm and separate smoky flavor. Cooked in high-temperature ovens, they yield a crunchy edge with a moist center. They are prepared by traditional methods which appeal to buyers looking for traditional, gourmet-like pizzas, giving a boost to demand in top-end restaurants and specialty pizza bars with an interest in unusual culinary experiences.

Self-rising crusts contain leavening agents that are activated during baking, providing a soft, thick, and airy texture. Widely used by frozen pizza companies, self-rising crusts appeal to customers who seek a fresh-baked experience without extra preparation. Convenience and mouthfeel make them a favorite among the ready-to-eat pizza market.

Custom crusts meet special dietary requirements and individual consumer tastes, providing gluten-free, whole grain, high-protein, or vegetable-based options. These customized products mirror increasing health consciousness and cooking innovation. As consumers intensely seek customized food solutions, custom crusts continue to build momentum in retail and foodservice channels globally.

Others feature nontraditional types like filled, cheese-filled, or multi-piece styles that enhance taste and interest. Frequently offered as limited-time items or value-added upgrades, they bring novelty and distinction to menu choices. These crusts are drivers of innovation, drawing in customers who are looking for indulgent or off-the-beaten-path pizza experiences.

Analysis by Size:

- Thick Pizza Crusts

- Thin Pizza Crusts

Thin pizza crusts dominate the global pizza crust market with a share of about 29.8% of total revenue in 2024. Their global popularity lies in their crisp nature, fast cooking period, and lower calorie composition than their thick counterparts. This type enjoys popularity among health-conscious people as well as light meal consumers who do not want to sacrifice taste and customization. Thin crusts also provide an optimal balance between toppings and dough, which adds to the overall flavor experience. Their versatility to different cuisines and topping types, ranging from classic Italian to contemporary fusion, also contributes to their dominance in foodservice and home cooking categories. Moreover, their compatibility with various dietary adjustments, such as gluten-free and vegan dishes, adds to their attractiveness across consumer bases. As global food consumption trends continue to move towards lighter, artisanal food items, thin pizza crusts continue to be a consumer favorite for convenience, versatility, and sensory appeal.

Analysis by Organic/Conventional:

- Organic

- Conventional

Conventional pizza crusts continued to dominate the market in 2024. These crusts are still the manufacturers' and consumers' favorite because they are inexpensive, have a longer shelf life, and can be produced at large quantities with ease. Traditional crusts accommodate mainstream flavor profiles and permit uniform texture and taste, which are critical to achieving high-volume sales in both retail stores and foodservice establishments. Their extensive availability as well as the fact that they are used with conventional ingredients such as wheat flour and milk makes them more popular. Though the demand for alternative crusts is increasing, the traditional versions remain popular, especially in markets where health foods are still a niche. In addition, they are the foundation for many frozen, packaged, and pre-baked pizza offerings. The on-going expansion of fast-food outlets and home-based consumption further solidifies the market demand for such crusts, guaranteeing its dominant position within the international market for pizza crusts for many years to come.

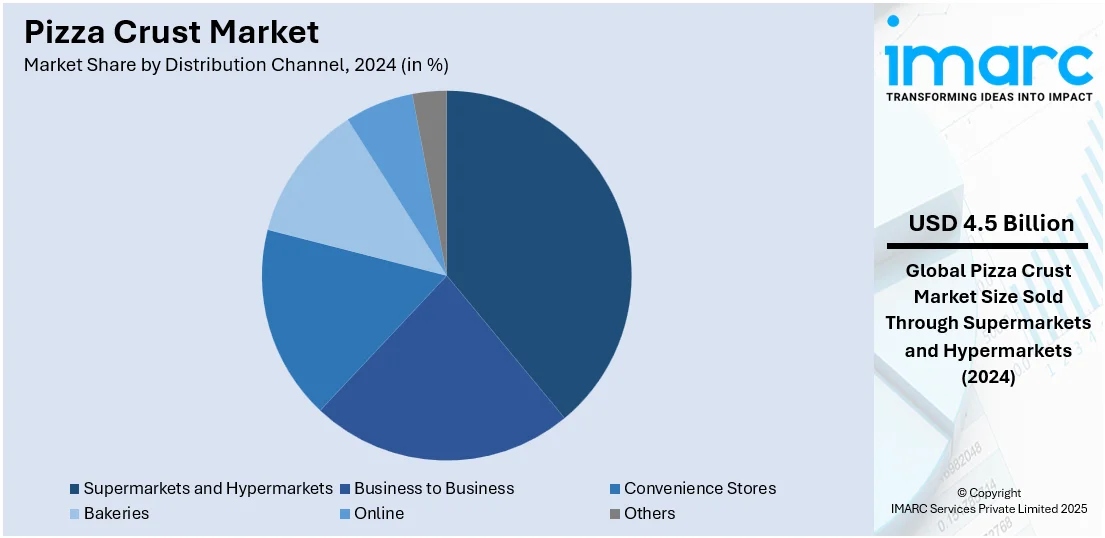

Analysis by Distribution Channel:

- Business to Business

- Supermarkets and Hypermarkets

- Convenience Stores

- Bakeries

- Online

- Others

Business-to-business (B2B) channels lead volume sales, providing bulk pizza crusts to hotels, restaurants, and foodservice operators. These relationships are built on consistent quality, punctual delivery, and value for money. With growth in global foodservice, B2B continues to be an important channel propelling large-scale purchasing in institutional and commercial food preparation operations.

Hypermarkets and supermarkets are main retail outlets, providing extensive shelf space for a variety of pizza crust products in different sizes and formats. Their extensive shelf space, promotional exposure, and high frequency of visits enable consumers to try new brands and options, making them an important channel for mainstream as well as specialty crusts.

Convenience stores make impulse buys of frozen and ready-to-bake pizza crusts. Strategically located and operating longer hours, they serve city consumers who look for speedy meal solutions. Smaller in size compared to supermarkets, convenience stores sustain consistent demand with high-turnover and restricted, fast-selling product ranges specifically designed for active lifestyles.

Bakeries provide par-baked or fresh-made pizza crusts, many of which are customized or artisanal in product type. Bakeries' focus on high-quality ingredients and their handmade approach draws customers seeking freshness and local-made appeal. While demand for gourmet and hand-made food continues to expand, bakeries serve the key niche need for satisfying emerging taste and authenticity demands.

Online distribution is growing rapidly, driven by increasing digital uptake and home cooking trends. Online platforms offer exposure to a broad variety of crust types, ranging from niche and health-oriented offerings. Convenience, subscription, and direct-to-consumer channels are driving online sales, and as such, online is a critical growth channel for new and mature brands.

Specialty food stores, organic markets, and institutional buyers such as schools and hospitals are other channels of distribution. These markets serve segmented groups of consumers who have specific dietary or nutritional requirements. Albeit smaller in volume, they diversify the market and serve strategically as a channel for regional or demographic-specific product penetration.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America became the dominant regional market for pizza crusts in 2024, holding a strong 35.0% market share worldwide. The region's strong-rooted pizza culture and high per capita consumption levels continue to propel strong demand within both retail and foodservice markets. American and Canadian consumers have strong affinities for a diverse range of crust styles, from thin and crispy to stuffed and gluten-free, favoring diversification and innovation in the market. North America also enjoys a wide distribution base, sophisticated cold chain logistics, and a developed e-commerce platform, ensuring pizza crusts are highly accessible for home preparation and commercial applications. In addition, the growth of quick-service restaurants and consumer demand for gourmet and customizable foods have intensified demand for high-quality ready-made pizza crusts. The region's focus on convenience, flavor, and variety makes it a leading driving force in the global orientation of the pizza crust industry.

Key Regional Takeaways:

United States Pizza Crust Market Analysis

The United States witnesses rising pizza crust adoption with expanding retail and food services sales, fueling frozen, fresh, and pre-baked varieties demand. Retail and food services sales in the United States for February 2025 stood at USD 722.7 Billion, which represents a growth of 0.2% compared to the previous month, seasonally adjusted and holiday varying. Increasing quick-service restaurants and fast-casual restaurants drive pizza crust innovation, responding to changing consumer tastes. Supermarkets and convenience stores boost product availability, driving market penetration. Foodservice chains launch varied crust formulations to appeal to consumers. Private-label brands increase offerings, appealing to value-conscious consumers. Shifting consumption patterns drive demand for high-quality and gluten-free products. Marketing efforts and promotional activities drive purchasing behavior. Higher investments in cold storage facilities facilitate distribution efficiency. Improved dough preparation methods improve texture and flavor consistency. The move towards premium and artisanal formulations is a response to consumer demand for authentic and health-conscious options.

Asia Pacific Pizza Crust Market Analysis

Asia Pacific is also witnessing a boom in the demand for pizza crust, fueled by the spread of pizza shops and chains in urban and semi-urban areas. Reports indicate that in India, Chandigarh has the maximum number with 2.7 pizza shops per lakh of population, followed by Goa, Bangalore, Guwahati, and Pune. The trend of rising dine-in and takeaway orders has strengthened the positions of various pizza brands, thus contributing to a steady increase in the consumption of pizzas. Lifestyle changes among consumers, triggered by busy lifestyles and an urge for convenience food, are driving the demand for premium crusts with varied tastes. The convenience of availability of trendy crust varieties, including whole wheat and gluten-free crusts, is contributing to this demand. Further, heightening disposable income and popularity of Western-style fast foods are also fuelling the consumption of ready-to-use pizza bases, making pizza crust a common inclusion in expanding food service menus.

Europe Pizza Crust Market Analysis

Europe is seeing increased pizza crust uptake on account of the growing food processing and drinks industry, with companies accelerating capacities to produce more to keep up with increasing demand. The European Commission estimated that in 2020, there were 2,91,000 firms engaged in the EU food processing and drinks business, adding €227 billion worth of value. Industry bakeries make innovations with dough recipes, enabling mass production. Emerging frozen and ready-to-eat markets drive product diversification. Ingredient suppliers launch high-protein and low-carb versions, echoing changing food trends. The foodservice industry incorporates pre-baked and par-baked options for back-of-house efficiency. Mass buying by catering companies supports wholesale distribution channels. Supplier-processor partnerships simplify supply chain management. Improved freezing technology maintains crust integrity, lengthening shelf life. Greater attention to sustainable sourcing promotes organic and locally sourced ingredients. Product differentiation tactics focus on texture, taste, and nutritional upgrading to gain consumer attention and brand loyalty.

Latin America Pizza Crust Market Analysis

Latin America is witnessing growing pizza crust uptake, driven by food industry growth and changing eating habits among consumers. Growth in the food industry in the region further complements this growth, with Brazil's food sector revenues expanding by 10% in 2024 to BRL 1.277 trillion, accounting for 10.8% of the nation's GDP, as per industry reports. The rise in the number of food service establishments, such as casual dining restaurants and quick-service restaurants, is driving the demand for varied crust types. The trend towards convenience-oriented eating habits, coupled with an increased inclination towards personalized pizza choices, favors the expansion of the market. Technological developments in frozen and pre-cooked dough products have facilitated the ability of companies to meet bulk demand while ensuring consistency.

Middle East and Africa Pizza Crust Market Analysis

Middle East and Africa lead pizza crust adoption because of the expanding food retail market. The USDA reports that Saudi Arabia's food retail market, now worth USD 30 Billion, is expected to expand by another USD 15 Billion by 2030, as consumers are spending more on a variety of food products, including condiments such as pizza crust. Convenience-driven solutions are what consumers look for, driving product innovation. Urbanization increases, fueling packaged dough substitutes. Shoppers are exposed to greater awareness by in-shop promotions and customer loyalty schemes. Extended distribution systems enhance market availability. Assortments of foods respond to consumers' dietary trends, promoting experiment and repeat sales. Imported editions complement domestic outputs, aiding pizza crust market growth overall.

Competitive Landscape:

The pizza crust market is dynamic and competitive in nature, comprising a blend of global, regional, and specialty suppliers as well as producers. The focus among players is product differentiation in terms of formulation innovation such as novel grains, plant-based content, and functional health attributes. Innovation in processing technology facilitates consistency and scalability, which satisfies diverse consumers across the foodservice and retail markets. Strategic collaborations with restaurants, supermarkets, and e-commerce sites raise brand visibility and distribution coverage. Research and development investments are rising to develop the portfolio with clean-label and custom products. Marketing efforts also are more focused on lifestyle trends like healthy eating and convenience consumption. Geographic expansion, especially in emerging markets, is also important in competitive positioning. Businesses seek to consolidate their presence by adjusting to local taste and eating habits and being responsive to both international and regional demand fluctuations within the developing pizza crust business.

The report provides a comprehensive analysis of the competitive landscape in the pizza crust market with detailed profiles of all major companies, including:

- Baker’s Quality Pizza Crusts, Inc.

- Alive & Kickin' Pizza Crust

- Tomanetti Food Products LLC

- Rizzuto Foods

- Monte Pizza Crust B.V.

- B&G Foods Inc.

- Hansen Foods LLC

Latest News and Developments:

- March 2025: Domino's US introduced its Parmesan Stuffed Crust Pizza. It consists of premium dough, filled with 100% real mozzarella, and garnished with garlic seasoning and Parmesan.

- February 2025: DiGiorno® and Hidden Valley® Ranch introduced two limited-time pizzas featuring ranch-infused crusts. The Spicy Rancheroni Thin Crust Pizza and Chicken Bacon Ranch STUFFED Crust Pizza revolutionized the pizza-ranch experience. Enthusiasts loved each layer of ranch flavor, elevating the classic combination. A limited merch collection was also launched for fans.

- August 2024: Donatos Pizza introduced its Bakery Crust Pizza, a thicker bakery-style crust topped with smoked provolone cheese and fresh toppings. The square-shaped pizza had the convenience of being able to have up to three toppings chosen from, which was great for sharing.

- June 2024: OGGI Foods Gluten Free Neapolitan Pizza Crust and Gluten Free Roman-Style Pinsa Flatbread were recognized as 2024 FABI Favorites. They were highlighted at The National Restaurant Association, Hotel-Motel Show in Chicago. Made with high-quality gluten-free and non-GMO flours, they provided authentic Neapolitan-style flavor and versatility.

- April 2024: DiGiorno introduced its Thin & Crispy Stuffed Crust pizza with a crispy thin crust and 2½ feet of cheese-stuffed edges. The new pizza debuted in three flavors: pepperoni and sausage, margherita, and pepperoni with Mike's Hot Honey.

Pizza Crust Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Par-Baked Crusts, Wood-Fired Crusts, Self-Rising Crusts, Custom Crusts, and Others |

| Sizes Covered | Thick Pizza Crusts, Thin Pizza Crusts |

| Organic/Conventional Covered | Organic, Conventional |

| Distribution Channels Covered | Business to Business, Supermarkets and Hypermarkets, Convenience Stores, Bakeries, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baker’s Quality Pizza Crusts, Inc, Alive & Kickin' Pizza Crust, Tomanetti Food Products LLC, Rizzuto Foods, Monte Pizza Crust B.V., B&G Foods Inc. and Hansen Foods LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pizza crust market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pizza crust market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pizza crust industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pizza crust market was valued at USD 11.6 Billion in 2024.

The pizza crust market is projected to exhibit a CAGR of 4.32% during 2025-2033, reaching a value of USD 17.0 Billion by 2033.

Major drivers for the pizza crust market include the rise in demand for ready-to-eat and convenient food, growing urbanization, popularity of western food, increased disposable income, and rising quick-service restaurants. Furthermore, health-aware consumers are propelling demand for gluten-free, organic, and alternative ingredient-based pizza crusts in worldwide markets.

North America currently dominates the pizza crust market, accounting for a share of 35.0%. The market is driven by strong pizza consumption rates, well-developed foodservice industry, widespread distribution of frozen products, solid retail infrastructure, and rising consumer demand for convenient, customizable, and diverse pizza crust choices.

Some of the major players in the pizza crust market include Baker’s Quality Pizza Crusts, Inc, Alive & Kickin' Pizza Crust, Tomanetti Food Products LLC, Rizzuto Foods, Monte Pizza Crust B.V., B&G Foods Inc. and Hansen Foods LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)