Pizza Boxes Market Size, Share, Trends and Forecast by Type, Material Type, Print Type, Sales Channel, and Region, 2025-2033

Pizza Boxes Market Size and Share:

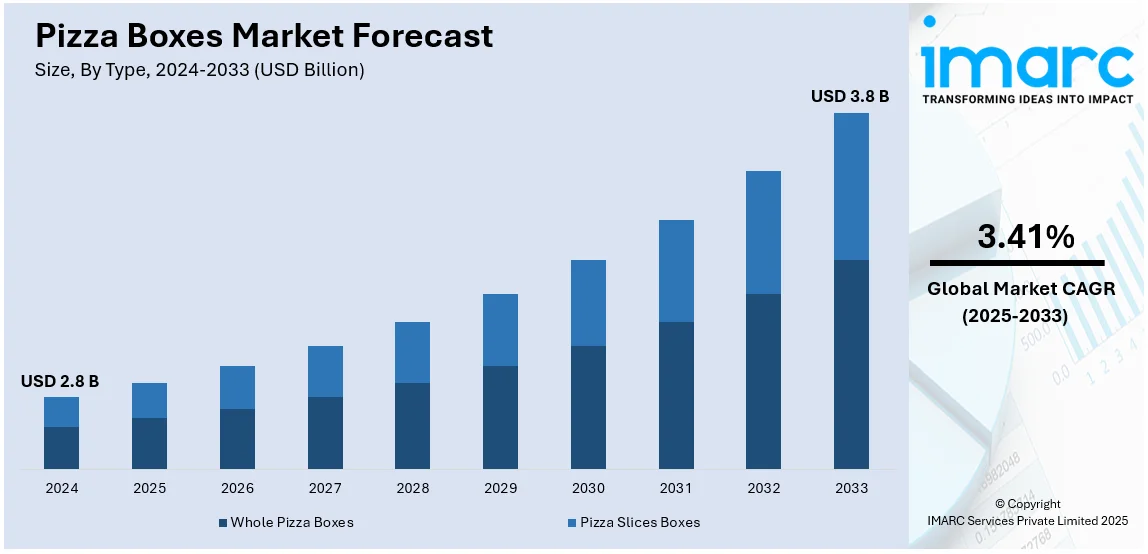

The global pizza boxes market size was valued at USD 2.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.8 Billion by 2033, exhibiting a CAGR of 3.41% from 2025-2033. North America currently dominates the market, holding the largest market share in 2024. The pizza boxes market share is increasing due to the surging demand for food delivery services, social concerns among the masses to introduce more eco-friendly packaging innovations, and the continuous growth in the global pizza industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.8 Billion |

|

Market Forecast in 2033

|

USD 3.8 Billion |

| Market Growth Rate (2025-2033) | 3.41% |

The pizza box market growth is attributed to the rising trend of takeout and home delivery services. Food businesses are increasingly focusing on the quality of packaging that provides freshness, maintains heat, and does not allow leakage of grease. Pizza boxes ensure food quality and enhance customer satisfaction. Sustainability is a dominant trend in the market. Businesses are choosing more environmentally friendly, recyclable, and biodegradable materials, and most prefer customized and branded packaging due to usage by pizzerias and food chains as a part of their marketing toward brand recognition. Feature-wise also, there is improvement in functionality for things like the introduction of ventilation holes to prevent sogginess, easy-fold designs for convenient usability, and tamper-proof seals for added security. With advancements in packaging innovation, companies are focused on lightweight and strong materials to cut costs and ensure durability. As customer expectation changes, the pizza box market will be further pushed by environmental concerns, branding, and functionality. The right packaging will protect the product and add value. Hence, much more of an integral component of the food delivery experience than considered heretofore.

The United States emerged as a key regional market for pizza boxes due to the nation's strong pizza culture and a growing demand for takeout and delivery services. Convenience and quality of food have become the highest priorities, with pizzerias and restaurant chains focusing on the durability, grease resistance, and heat retention properties of packaging. Sustainability is also a key trend, as companies are moving toward eco-friendly, compostable, and recyclable materials to abide by environmental regulations and consumer demands. Customization is also on the rise, wherein companies are using printed pizza boxes to increase visibility and engagement. Innovative designs, such as adding holes for ventilation to prevent sogginess, tamper-proof seals for safety issues, and easy-fold structures for ease of usage, improve the overall customer experience. As the use of online food delivery increases, high-quality pizza boxes will continue to be in demand.

Pizza Boxes Market Trends:

Fast-growing fast-food industry

The growing fast food industry globally is a major factor boosting the pizza boxes demand. According to an industry report, the global fast-food sector has been growing steadily, with a projected annual growth rate of 2.7%, which is expected to take its revenue to a staggering USD 1.1 trillion in the five years leading up to 2024. As pizza is one of the most popular menu items, its availability in almost all regions contributes significantly to the market growth. The ease with which pizza can be taken as an on-the-go meal has made the demand for pizzas go up, along with the rise in fast-food chains and pizza houses individually. With such a boom in demand, pizza boxes have become a necessity as they facilitate proper handling and delivery with quality and temperature intact. Online food delivery services have increased the demand as more consumers opt for home delivery, which in turn requires sturdy and efficient packaging.

Innovation in packaging materials

Sustainability concerns have drastically changed the face of pizza box materials and consequently the pizza boxes market trends. Consumers and businesses alike have become conscious of the environmental effects of packaging waste, hence making a switch toward eco-friendly packaging materials. Other packaging materials include corrugated cardboard and plant-based materials. Most of these biodegradable materials are recyclable and also offer the consumer the advantage of meeting environmental regulations, among other aspects appealing to a majority of the ever-growing consumer market. Westrock recently collaborated with Domino's back in September 2022 for the launching of a project targeted at enhancing the recycling of pizza boxes through Domino's. Westrock printed recycling messages and attached a QR code on the boxes, which directs the consumers to a website that provides educational facts about pizza box recycling. Furthermore, innovation in packaging technology has enabled the production of boxes that help maintain the freshness and flavor of pizza more efficiently, thereby improving customer satisfaction and increasing market growth.

Customization and branding opportunities

Pizza boxes offer valuable opportunities for customization and branding, which is a significant driver in their market growth. Businesses utilize pizza box surfaces for marketing and promotional purposes, turning them into a branding tool. Customized boxes featuring logos, slogans, and unique designs help companies differentiate themselves in a competitive market. The ability to customize the look and messaging of pizza boxes builds brand recognition and enhances the overall customer experience. This trend is particularly observed in the context of social media, where unique and visually appealing packaging can motivate sharing and thereby increase brand exposure. A good example would be the heart-shaped pizza delivery boxes and inserts launched by DS Smith in February 2021. These inserts are inexpensive and 100 percent recyclable to ensure the preservation of freshness through transit. More companies invest in creative and custom pizza box designs, which fuels market growth.

Technological advancements

Technological advances in packaging also spur the pizza box market. The new material and design are now more resistant to heat and moisture, thereby increasing the shelf life of pizza during delivery. The quality and freshness of pizza should be ensured. Advances in printing technology also make high-quality and aesthetically appealing pizza boxes affordable and easy to print. Branding and customization have been identified as significant issues above. With time, we can see more innovative solutions in the design and manufacturing of the pizza box with the help of technology. In the year 2020, a pizza quick-service restaurant originating from Canada, Pizza Pizza, introduced the Tamper-Proof Pizza Box. It contains a safety locking tool, which the consumer has to break to access the pizza. The box is designed so that the pizza remains fresh until it reaches the customer.

Expanding online food delivery services

The expansion of online food delivery services has been highly influential on the pizza box market. With the advent of platforms like Uber Eats, DoorDash, and Grubhub, demand for pizzas increased significantly, thereby creating more demand for pizza boxes. It is easy to see how, due to such convenience and access to a wider number of restaurants through these services, consumers order more pizzas hence the increase in the overall pizza industry. Increased demand for the consumption of pizza through these services led to an increase in orders of pizza boxes as well to satisfy the order demands. The United States Census Bureau projected U.S. retail e-commerce sales for the second quarter of 2024. In August 2024, it was USD 282.3 Billion, which is 5.3% more than the first quarter of 2023. Therefore, the growth of the e-commerce industry fuels the growth in the pizza box market.

Pizza Boxes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pizza boxes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material type, print type and sales channel.

Analysis by Type:

- Whole Pizza Boxes

- Pizza Slices Boxes

The pizza slices boxes segment dominates the market, driven by the growing popularity of pizza by the slice in quick-service restaurants, food courts, and grab-and-go establishments. This kind of box will hold a separate pizza slice so that convenient and portable consumption is served for the customers. The increase in demand for pizza slice boxes is mainly due to changing consumer preferences toward smaller, more manageable portions of pizza, especially in high-foot-traffic areas like cities. Such boxes are mainly used for single servings and are ideal for enjoying pizza without the need to buy a whole pie. In this segment, there are options for customization so that businesses can brand and promote their pizza offerings.

The market segmentation based on whole pizza boxes caters to pizzerias and restaurants that primarily offer whole pizzas for dine-in, takeout, or delivery. These are made to be able to fit complete pizzas, usually with a diameter at a personal to extra-large size. Wholesale demand for pizza boxes continues steadily since a large share of the market remains with a preference for traditional whole pizzas. These boxes also have customization features for branding and marketing, so they are valuable for pizzerias looking to create a unique and recognizable image. Whole pizza boxes are needed to ensure pizzas stay hot, fresh, and intact during transportation, catering to customers who want whole pizzas for various occasions.

Analysis by Material Type:

- Corrugated Paperboard

- Clay Coated Carboard

The corrugated paperboard segment represents the largest portion of the pizza boxes market, as it is strong, affordable, and able to keep pizzas safe during delivery. This market is also aimed at pizzerias, food delivery services, and restaurants that value the safe packaging of their pizzas. Corrugated paperboard pizza boxes are famous for their good insulating qualities that keep pizzas hot and fresh even during transportation. They come in different sizes to fit the size and type of pizza. Furthermore, the sustainability trend has been driving innovations in eco-friendly corrugated materials, thus increasing the growth rate of this segment.

Clay coated cardboard is smaller compared to corrugated paperboard, however, offers a premium appearance and printing. These pizza boxes are often chosen by upscale pizzerias and restaurants looking to enhance their brand image. Clay-coated cardboard offers a smooth surface that allows for vibrant and high-quality printing of custom designs and branding, making it an ideal choice for establishments seeking to create a distinctive packaging identity. It does not have the same insulation property as a corrugated paperboard, however, has excellent aesthetic appeal and makes the pizza packaging unique and memorable.

Analysis by Print Type:

- Printed Boxes

- Non-Printed Boxes

The printed boxes lead the market as they are designed to provide functional packing and to be a branding and marketing tool for pizzerias and food delivery services. Printed pizza boxes normally contain eye-catching designs, logos, and messages for promotions, which can help the pizzerias create a strong brand identity. They provide an opportunity to increase the overall customer experience, to make the opening process more appealing and memorable. With increasing demands for customization and branding in the food service sector, printed pizza boxes are sure to maintain market domination. Other prominent segments that can be named include non-printed pizza boxes. These would be important and have to remain relevant because they would still give them a form of pizza package without branding or marketing aspects seen on printed pizzas.

Non-printed boxes are typically made from standard corrugated or cardboard materials and are favored for their simplicity and cost-effectiveness. These boxes provide a clean and straightforward solution for pizza transportation and delivery, catering to consumers who prioritize the contents of the box over its appearance. As the pizza business continues to reach across the world, non-printed boxes are going to stick around in the market as one of the trusted and affordable options for packaging a business.

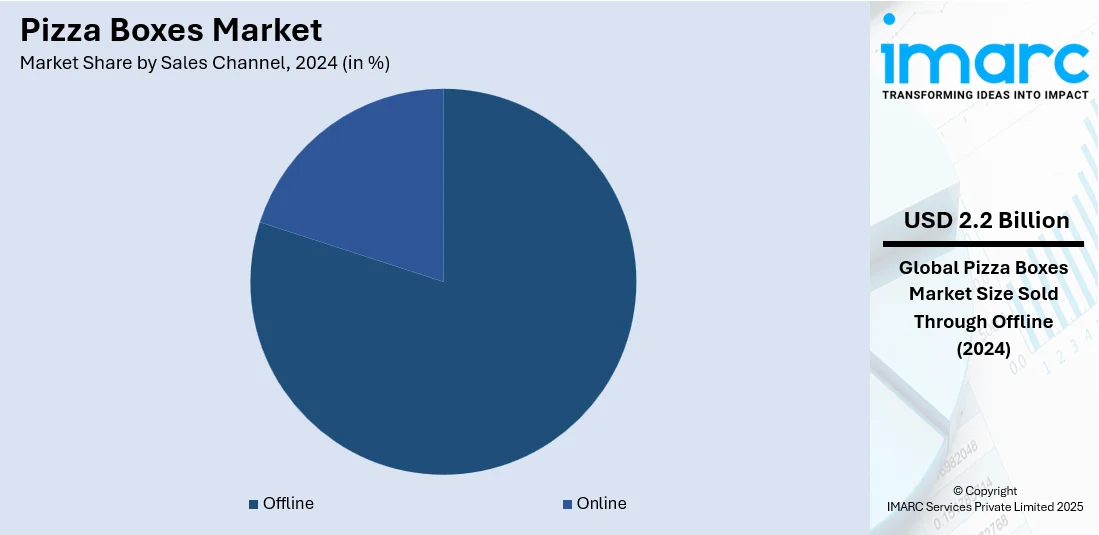

Analysis by Sales Channel:

- Online

- Offline

Offline represents the largest segment in the pizza boxes market. Offline includes local pizzerias and restaurants that are located on-site and the place through which the pizza is ordered. The offline segment, although small, is significant, especially in countries where, eating out is routine. Offline pizza boxes have to adhere to quality, however, may not necessarily be as well insulated or branded as the online version. They do the job of transporting pizzas safely from the pizzeria to the customer's location. Although the online order segment is gaining momentum, the offline segment still holds considerable value as customers love to dine in pizzerias or pick up their favorite pizzas in person.

The online segment of the pizza boxes market serves the increasing demand for online food ordering and delivery services. The growing popularity of food delivery apps and e-commerce platforms makes many consumers order pizzas online. Online home-delivery pizzas require a sturdy, insulating box for the pizza to arrive hot and in one piece at the customer's doorstep. Along with customization and branding, online is also the place where pizzerias can create brand identity and make sure customers experience a smooth flow of interaction with the brand. As food ordering digitally continues to spread, convenience-conscious consumers will lead to online pizza boxes growing steadily.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The North American market for pizza boxes is the largest and most mature segment, as the consumption of pizza is most widespread, and food delivery has become an acceptable culture in both the United States and Canada. In this region, green packaging solutions and customization are important market trends for consumers and businesses, which emphasize sustainability and branding. Technological innovations such as smart packaging options are in high demand to enhance the customer experience. The competitive landscape of packaging manufacturers provides a variety of choices that cater to the different needs of pizzerias and food delivery services.

The growing demand for convenience and takeout options fuels the adoption of pizza delivery services across the European market. Sustainability is the other major driver for the market, the eco-friendly material and the recyclable packaging solutions. Customization and branding are significant trends to help pizzerias differentiate themselves in an incredibly competitive market. Similar to North America, smart packaging and other technology are coming out to improve delivery efficiency and make the customer experience more efficient. The European market is expected to continue growing in pizza consumption since consumers still have a preference for eating pizza.

The Asia Pacific pizza box market is highly growing, considering the region's growth in pizza consumption and increased food delivery services in countries like India, China, and Japan. There is an increased demand for green packaging solutions to overcome the issues of sustainability in this dynamic market. Customization and branding are on the rise as pizzerias are looking for exclusive packaging designs to attract customers. With the Asia Pacific region increasingly becoming urbanized and westernized in terms of dining habits, the pizza box market is going to grow rapidly, thus offering an opportunity for pizza box manufacturers.

Latin America has grown and taken a large market share. The popularity of pizza as a convenient and affordable food has led to increased demand for pizza boxes in the region. As fast-food chains and independent pizzerias multiply, the demand for reliable and cost-effective packaging solutions has increased. In addition, environmental concerns have led to a shift toward sustainable packaging. Latin American countries are adopting eco-friendly pizza boxes made of recyclable and biodegradable materials. The approach is a consumer-friendly, eco-conscious method that is aligned with global sustainability goals.

The Middle East and Africa are emerging markets for pizza boxes, with increasing interest in pizza as part of the global food culture. Urban food delivery services are also fueling demand for pizza boxes in this region. Sustainability is picking up. However, more is yet to be done to embrace green packaging materials. Customization and branding are also growing trends, which enable local pizzerias to have a different identity. As the region's economies develop and consumer preferences evolve, the Middle East and Africa are expected to become increasingly important segments in the global pizza box market, presenting opportunities for manufacturers and suppliers.

Key Regional Takeaways:

United States Pizza Boxes Market Analysis

The United States market is experiencing growth as volumes of pizza consumption are on the rise and consumer preferences are changing toward it. The industry report states that the worth consumed for pizzas is around 3 Billion per year, and therefore the number of pizza boxes required per year is equal to it. Online food delivery services have become very popular, and growth in demand continues to increase in the U.S. market. Additionally, consumer expectations are altering; 56% of the customers in the U.S. prefer restaurants offering ecological packaging, found to studies. This sentiment has led businesses to change their packaging solutions toward more environmentally friendly options in the form of recyclable and biodegradable pizza boxes. As sustainability is becoming a determining factor in consumer decision-making, demand for green pizza boxes will rise, driving the market. Therefore, both the consumption of pizza and the demand for sustainable packaging are on the rise, making the U.S. pizza box market likely to grow.

Europe Pizza Boxes Market Analysis

According to an industry report, per capita disposable household income in major European economies increased by 0.2% to 3.4% in the first quarter of 2024. An increase in disposable income is one of the main growth drivers for the European pizza box market. The increase in consumers' disposable income increases dining out or ordering takeout, such as pizzas. The increased demand for pizza boxes follows. More disposable income makes consumers sensitive to the environmental impacts of their purchase decisions. Consequently, more environmentally friendly packaging like recyclable pizza boxes has been in high demand. Consequently, the market for pizzas responds with eco-friendly packaging options. This further drives the growth of the market. Increased income levels and greater environmental awareness combine to favor the continued growth of the pizza box market in Europe.

Asia Pacific Pizza Boxes Market Analysis

India's per capita disposable income, according to IBEF, was at USD 2.11 Thousand in 2019 and increased to USD 2.54 Thousand in 2023. This is the main reason for the growth in the Asia Pacific pizza box market, as high disposable income boosts spending on restaurants and takeaway dining out, which includes pizzas. This trend is very prevalent in a country like India, where the middle class is growing and looking for convenient food delivery services. In addition, with higher disposable income, consumers are becoming increasingly conscious of the environmental impact of packaging. There is an increasing demand for green and sustainable pizza boxes. Food industry businesses have started to adapt to recyclable and biodegradable packaging solutions, which drives further market growth. One prime factor driving growth in the Asia Pacific pizza box market is the rising disposable incomes along with issues of sustainability.

Latin America Pizza Boxes Market Analysis

According to industry sources, there was an 8.3% increase in the first quarter of 2022 compared to the last quarter of 2021 in household disposable income. A fundamental growth driver in the Latin America pizza boxes market, this increase in disposable incomes provides household incomes with the increasing spending power to spend outside their homes, especially on alternative and other new options such as dining out and takeaways, including pizzas. There is a growing demand for more convenience and prepared ready-to-eat meals, thus more pizza boxes are being ordered in bulk. Besides this, the growing disposable income means that consumers will only settle for product quality concerning the environmental effect of such packaging which will increasingly boost the demand for green pizza boxes made from recyclable and biodegradable materials. Greater disposable income and raising consumer awareness about environmental sustainability are currently driving the expansion of the market for pizza boxes in Latin America, thus establishing it as one of the interesting segments for food service companies.

Middle East and Africa Pizza Boxes Market Analysis

In March 2023, Dodo Pizza launched a test project in Dubai, starting during Ramadan, for delivering pizzas packed in reusable pizza boxes. Such projects reflect increasing interest in eco-friendly packaging solutions across the Middle East and Africa region, which fuels the pizza box market in this region. The reusable pizza box also reflects consumer awareness regarding the environment, and it is gaining a steady interest in green packages. Dodo Pizza is also implementing AI-based supply planning and forecasting solutions to avoid unnecessary inventory, which helps to enhance operational efficiency. This innovative approach reflects broader trends in the region where businesses are focusing on sustainability and cost-effectiveness in packaging solutions. As disposable incomes rise and consumer demand for convenient food options grows, the pizza boxes market is experiencing significant expansion. Increased eco-consciousness, as well as technological advancement in packaging logistics, is expected to drive the pizza boxes market further in the Middle East and Africa, especially as food service establishments are increasingly turning to environmentally friendly practices.

Competitive Landscape:

Key players in the pizza boxes market are actively pursuing various strategies to outdo the competition and become more responsive to the change in consumer demand. Sustainability has become a significant priority for many, who invest in eco-friendly materials and processes in manufacturing to address environmental impact concerns. The customization and branding options are extended to offer the pizzerias unique packaging designs and marketing opportunities. Technological innovations, including smart packaging solutions with tracking capabilities, are explored to enhance customer experience and optimize delivery operations. The market leaders in the food service and food delivery sectors are driven to combine quality, sustainability, and innovation for the benefit of their clients. These efforts create a positive pizza boxes market outlook.

The report provides a comprehensive analysis of the competitive landscape in the pizza boxes market with detailed profiles of all major companies, including:

- BillerudKorsnäs AB

- DS Smith Plc

- Georgia-Pacific LLC (Koch Industries Inc.)

- Huhtamaki Oyj

- International Paper Company

- Magnum Packaging NE Ltd

- Mondi plc

- New Method Packaging

- Rengo Co. Ltd.

- Smurfit Kappa Group plc

- WestRock Company

Latest News and Developments:

- April 2024: Westpak has introduced new packaging for pizza that helps to enhance heat retention on delivery and takeaway. The packaging launched under the brand HeatWave is a liner sheet that fits impeccably into existing standardized cardboard pizza boxes. The packaging is made of kraft paper, while the liners are industrially compostable and fully recyclable.

- September 2022: WestRock and Domino's partnership to print recycling messaging on pizza boxes is a notable packaging industry initiative that addresses the increasing importance of sustainability and responsible disposal. "Do Your Slice" messaging encourages consumers to take responsibility for recycling. The addition of a QR code and recycling guide on Domino's® boxes creates an interactive element that educates customers on what to recycle properly. This move is part of a larger packaging industry trend toward eco-friendliness and education of the consumer, as companies look to minimize their environmental impact and encourage more responsible consumption.

Pizza Boxes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Whole Pizza Boxes, Pizza Slices Boxes |

| Material Types Covered | Corrugated Paperboard, Clay Coated Carboard |

| Print Types Covered | Printed Boxes, Non-Printed Boxes |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BillerudKorsnäs AB, DS Smith Plc, Georgia-Pacific LLC (Koch Industries Inc.), Huhtamaki Oyj, International Paper Company, Magnum Packaging NE Ltd, Mondi plc, New Method Packaging, Rengo Co. Ltd., Smurfit Kappa Group plc, WestRock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pizza boxes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pizza boxes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pizza boxes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pizza boxes market was valued at USD 2.75 Billion in 2024.

The pizza boxes market is estimated to exhibit a CAGR of 3.41% during 2025-2033.

The pizza boxes market is driven by the surging demand for food delivery services, social concerns among the masses to introduce more eco-friendly packaging innovations, and the continuous growth in the global pizza industry.

North America currently dominates the market as the consumption of pizza is most widespread, and food delivery has become an acceptable culture in both the United States and Canada.

Some of the major players in the pizza boxes market include BillerudKorsnäs AB, DS Smith Plc, Georgia-Pacific LLC (Koch Industries Inc.), Huhtamaki Oyj, International Paper Company, Magnum Packaging NE Ltd, Mondi plc, New Method Packaging, Rengo Co. Ltd., Smurfit Kappa Group plc, WestRock Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)