Piston Engine Aircraft Market Size, Share, Trends and Forecast by Type, Maximum Take-off Weight, Application, and Region, 2025-2033

Piston Engine Aircraft Market Size and Share:

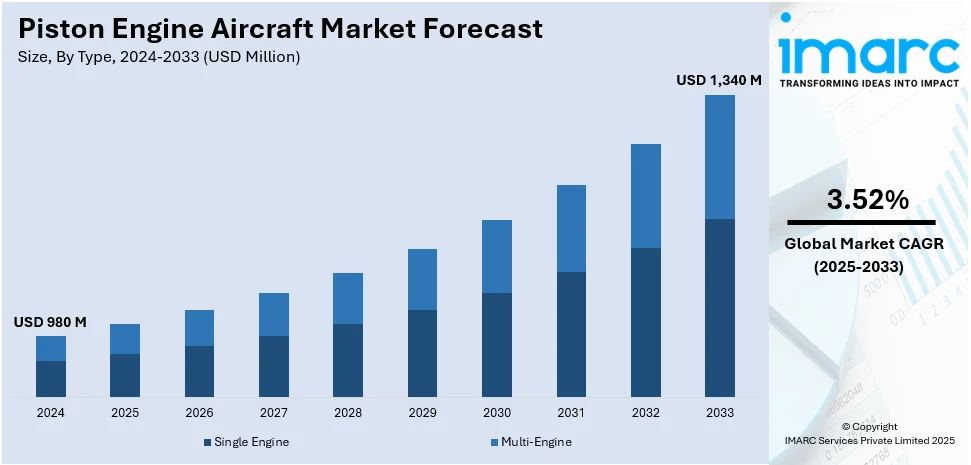

The global piston engine aircraft market size was valued at USD 980 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,340 Million by 2033, exhibiting a CAGR of 3.52% during 2025-2033. North America currently dominates the market, holding a significant market share of over 66.3% in 2024, driven by strong aviation infrastructure, extensive flight training programs, high general aviation activity, and leading aircraft manufacturers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 980 Million |

|

Market Forecast in 2033

|

USD 1,340 Million |

| Market Growth Rate (2025-2033) | 3.52% |

One major driver of the piston engine aircraft market growth is the increasing demand for pilot training and general aviation activities. Flight schools, private aviation enthusiasts, and small charter operators continue to invest in piston-powered aircraft due to their cost-effectiveness, fuel efficiency, and lower maintenance requirements compared to turbine-powered alternatives. The global shortage of commercial pilots has further accelerated the need for flight training programs, driving demand for training aircraft that predominantly utilize piston engines. For instance, in January 2025, Garmin declared that it received approval for its GFC 500 and GFC 600 digital autopilots, certified for Beechcraft Baron A55 and Robertson STOL-equipped Cessna 180/185 aircraft. GFC 500 suits single-engine pistons, GFC 600 for high-performance piston/twin-engine and turbine aircraft. Additionally, advancements in avionics and fuel technology are enhancing the operational efficiency and reliability of piston engine aircraft, further supporting their adoption across various aviation segments.

To get more information on this market, Request Sample

The United States plays a pivotal role in the piston engine aircraft market through its strong manufacturing base, extensive general aviation infrastructure, and robust pilot training ecosystem. Leading aircraft manufacturers such as Textron Aviation and Piper Aircraft drive innovation and production, ensuring a steady supply of high-performance piston-powered models, which also represents one of the key piston engine aircraft market trends in the United States. For instance, in January 2025, Textron Aviation announced the first international sale of seven Beechcraft King Air 260 aircraft to SkyAlyne and KF Aerospace for the Future Aircrew Training program of the Royal Canadian Air Force. Deliveries are to be made starting in 2028. The country’s well-developed network of flight schools and training programs sustains demand, supported by the Federal Aviation Administration’s (FAA) regulatory framework. Additionally, the US benefits from a vast network of small airports and Fixed-Base Operators (FBOs), providing essential services that enhance the operational efficiency and accessibility of piston engine aircraft.

Piston Engine Aircraft Market Trends:

The Heightened Awareness of the Cost-Effectiveness of Piston Engine Aircraft

The market is driven by the economic viability of piston engine aircraft. They not only come far cheaper than those powered by gas turbines on initial purchase price, but are also cheaper in terms of maintenance and operational costs. For instance, according to industrial reports, new piston engines range from USD 25,000 for small four-cylinder models to over USD 100,000 for larger six-cylinder versions. In contrast, turboprop engines like the Pratt and Whitney PT6A series start at approximately USD 700,000 and can exceed USD 1 million for larger variants. Maintenance costs also differ; piston engines typically have a time between overhaul (TBO) of 1,800 to 2,000 hours, whereas turboprops like the PT6A have a baseline TBO of 3,600 hours, extendable up to 8,000 hours with proper management. Fuel costs further highlight the economic advantage, with 100LL fuel averaging $5.06 per gallon and Jet-A at USD 4.68 per gallon as of December 2019.In addition to these advantages, these aircraft greatly benefit small operators, flight schools, and private owners economically. The economics are bolstered by the acquisition cost of the piston engine aircraft, making entry-level pilots and small aviation businesses viable buyers. Apart from these, maintenance is less complicated and cheaper because the mechanical parts involved are simpler than turbofan engines. Furthermore, operational costs, especially fuel consumption, have contributed greatly to their increased popularity.

Widespread Aircraft Utilization for Training and Recreational Use

Recreational flying and training make extensive use of piston engine-powered aircraft because of their simplicity of design, easy handling, and low cost. For instance, the U.S. piston-engine aircraft fleet logged approximately 15 million flight hours. Of these, 40.5% were dedicated to pilot training, and 39.2% to personal and recreational flying, as per reports. This extensive use underscores the importance of piston engine aircraft in foundational flight training and personal aviation pursuits. Apart from that, they give the students some basic skills, comparatively easy to grasp in terms of behavior, in a not-so-intimidating environment compared to the complex types of aircraft operated. Also, the popularity of this class of piston engine aircraft among aviation enthusiasts, hobbyists, and the people seeking personal flying experience has a beneficial effect on this growth. This provides an atmosphere that is more personal and hands-on, attracting all kinds of aviators-ranging from professionals to new pilots just discovering the joys of flying. Also aiding in growth further are flying clubs and organizations that promote recreational flying.

Recent Technological Advancements

The market is growing with respect to the recent technological advancements in piston engine aircraft. Comparison with old piston engines shows how modern engine designs are being more and more fuel-efficient, more reliable, and more environmentally friendly than their predecessors because research and development (R&D) in such areas as fuel injection systems, electronic engine management, and advanced materials has changed direction. Furthermore, the reliability improvements in modern engines, which are reducing downtime and maintenance costs, enhance the total value proposition of the aircraft further contributing towards market growth. For instance, in February 2024, DeltaHawk Engines introduced two new higher horsepower models, DHK200 (200 hp) and DHK235 (235 hp), expanding its jet-fueled piston engine family. Both models share DHK180’s dimensions, with 2025 availability. To this end, the integration of modern avionics and instrumentation in piston engine aircraft, which provide increased flight safety, navigation, and pilot comfort, provides additional market support. In addition, the technical evolution of piston engine aircraft makes sure that they remain competitive and widely accepted in the fast-paced world of aviation.

Increasing Demand for Air Travel

The increase in the need for air travel and air travel within emerging economies would really challenge the growth of the market. For example, the global demand in 2024 increased by 8.6 percent compared to the previous year, with an improved record-breaking load factor of 86.2%. The growth was spurred by increased international passenger demand of 10.6 percent and a 5.6 percent increase in domestic travel. In its forecast, the International Air Transport Association (IATA) noted that worldwide airline revenues would exceed one trillion dollars by 2025, with a historic 5.2 billion passengers. Like other areas, different regions are experiencing growth, which has led to increased demand for air travel for business and leisure purposes. Piston engine aircraft tend to be the first choice for short-haul or regional travel, and often even as feeder services to larger airports. They can also fly from smaller airfields and in many varied locations, so quite versatile for connecting remote and lesser-served areas where larger aircraft cannot operate conveniently. Tourism development is also greatly improving as the demand for a piston engine, which is significantly used for scenic flights, aerial tours, and adventurous activities such as skydiving, will increase tremendously.

Imposition of Stringent Regulations

Aircraft operations, pilot licensing, and airworthiness standards definitely propel the market growth. They provide assistance and ensure smooth operations, resulting in higher rates of the adoption and utilization of piston engine aircraft. Accordingly, regulations easing the path to obtaining a pilot's license or aircraft certification, thereby lowering the new pilot and operator's entry barriers, are further fostering market growth. For instance, in January 2025, MOSAIC (Modernization of Special Airworthiness Certification) will broaden rules for light sport aircraft and sport pilots, reducing certification costs. The final rule is expected by summer 2025, expanding aircraft access. Furthermore, the enforcement of regulations that ensure safety without excessive imposition, thereby enhancing public trust and acceptance in general aviation, is aiding growth. Also, the harmonization of regulations across regions, which eases cross-border operations and sales, is a contributing factor to the market growth.

Piston Engine Aircraft Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global piston engine aircraft market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, maximum take-off weight, and application.

Analysis by Type:

- Single Engine

- Multi-Engine

Single engine leads the market with around 86.2% of market share in 2024. This dominance is attributed to its cost-effectiveness, operational efficiency, and widespread use in pilot training, private aviation, and small-scale commercial operations. Flight schools prefer single-engine aircraft due to lower acquisition and maintenance costs, making them an ideal choice for beginner pilots. Additionally, technological advancements in avionics and fuel efficiency have enhanced the performance and safety of these aircraft, increasing their adoption. The availability of diverse models catering to recreational flying, business travel, and aerial surveying further strengthens demand. With ongoing regulatory support and increased pilot training programs, the single-engine segment is expected to sustain its leading market position.

Analysis by Maximum Take-Off Weight:

- Less than 1000 Kg

- 1000-2000 Kg

- More than 2000 Kg

More than 2000 kg the market with around 61.4% of market share in 2024. This dominance is attributed to its inclusion of high-performance, multi-engine aircraft designed for longer-range flights, higher payload capacities, and complex operational requirements. These aircraft are widely favored by commercial operators, charter services, and affluent individuals who seek greater power, reliability, and enhanced capabilities. Additionally, their ability to accommodate more passengers, cargo, and advanced avionics makes them suitable for a variety of applications, including business travel, advanced flight training, and specialized aviation services. The increasing demand for efficient and versatile aircraft across multiple aviation segments continues to support the growth of this market segment.

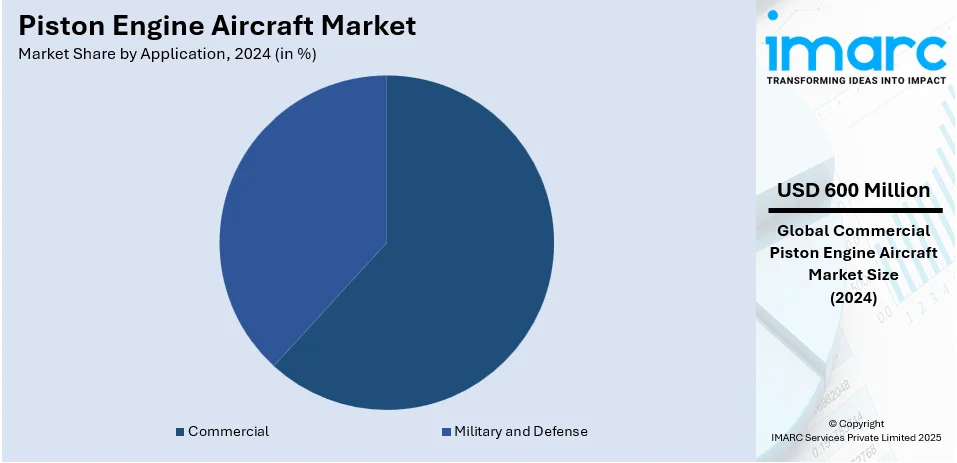

Analysis by Application:

- Military and Defense

- Commercial

Commercial leads the market with around 61.5% of market share in 2024. The commercial segment dominates the market with a range of activities, including flight training, general aviation, charter services, and aerial tourism. The piston engine commercial aircraft offer attractive cost efficiencies, versatility, and accessibility, making them an interesting option for several businesses and aviation service operators. In addition, flight schools also rely very heavily on these aircraft because of their ease of handling and operating costs, thereby training prospective pilots. Besides, operators - both corporate or private - use them for travel, as they provide an alternative to commercial airlines that are fast and easy for short-to-medium-distance trips.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 66.3%. This dominance is driven by the region’s well-established aviation industry, extensive general aviation community, and strong regulatory framework supporting aircraft operations. The presence of a high number of flight training schools, aviation clubs, and private aircraft owners fuels demand for piston engine aircraft. Additionally, personal and business aviation is deeply integrated into North American culture, further strengthening market growth. The region is home to major aircraft manufacturers, including Textron Aviation, Piper Aircraft, and Cirrus Aircraft, which not only cater to domestic demand but also export worldwide. These factors collectively reinforce North America's position as the leading market for piston engine aircraft.

Key Regional Takeaways:

United States Piston Engine Aircraft Market Analysis

US accounts for 82.90% share of the market in North America. The U.S. piston engine aircraft market continues to be strong and is supported by growing demand in general aviation, flight training, and private ownership. According to the General Aviation Manufacturers Association, or GAMA, there were 1,682 piston airplane deliveries worldwide in 2023, up 11.8% from 2022. Most of those deliveries were made in the United States, showing continued demand from flight schools and personal aviation. Aircraft purchases fuel the increasing shortage of pilots: Training schools keep adding aircraft as the shortage intensifies. Changes in fuel-saving engines and the hybrid-electric propulsion technology contribute to the shape of the growing market. Two companies lead: Textron Aviation and Piper Aircraft, both on performance improvement programs and sustainable practice initiatives. Improvements in SAF adoption through federal incentives by FAA and advancements on electric propulsion facilitate further expansion into the market. Additionally, U.S. manufacturers are leveraging global export opportunities, strengthening the country’s leadership in piston engine aircraft production.

Europe Piston Engine Aircraft Market Analysis

With increasing demand for flight training, personal aviation, and air taxi services, the European piston engine aircraft market is growing. As evidenced by the European Business Aviation Association, which reported that in 2022, there were 4,056 business aviation aircraft based in Europe, that reflects the solid general aviation sector in the region. Flight schools are the key drivers of market growth; the rising enrollments are resulting from the unprecedented global pilot shortage. Favorable regulation toward sustainable aviation, such as investments in hybrid-electric and alternative fuel technologies, is shaping the future of the market. Private aircraft adoption is driven by the active private ownership and charter operations of countries like Germany, France, and the UK. Manufacturers Diamond Aircraft and Tecnam are leading the market, focusing on fuel efficiency and lower emission. The EU-backed research programs on electrification and low-carbon emissions are also promoting technological development, and Europe is one of the most significant players in the segment.

Asia Pacific Piston Engine Aircraft Market Analysis

Asia Pacific piston engine aircraft is on an exponential growth trend because of increasing demand for flight training and private aviation. China and India are the leading contributors to regional expansion, driven by requirements for more pilots. Air India, in December 2024, announced the plans to open the largest Flying Training Organisation (FTO) in South Asia at Amravati, Maharashtra, with operations set to start by the second half of 2025. The FTO is expected to have 34 trainer aircraft, train 180 commercial pilots per year, and respond to the increasing demand for skilled pilots in the aviation sector. The flight training market in China is also growing, as many academies are expanding their piston-engine aircraft fleets to accommodate the demand for pilots. Countries such as Australia and Japan have seen steady growth in general aviation, which has been encouraged by regulatory incentives. Cirrus Aircraft and Diamond Aircraft, among others, are continually pushing the technological envelope with advancements in hybrid-electric propulsion and fuel efficiency.

Latin America Piston Engine Aircraft Market Analysis

Latin America sees an increased demand for pilot training and private aviation and is on the rise with regard to piston engine aircraft. According to data from the Brazilian National Civil Aviation Agency (ANAC), as of September 2023, there were a total of 10,042 aircraft flying regularly in Brazil. Of those, 4,479 aircraft were single-engine piston, 1,079 being twin-engine piston, which altogether amounts to 5,558 piston-engine aircraft. Other major markets include Mexico, where the demand for training and general aviation is strong. The vast geography of the region makes piston aircraft a necessity in connecting remote areas, supporting air taxi services, and agricultural operations. Government initiatives in aviation and increased investments in flight schools also contribute to growth in the market. Key manufacturers such as Embraer and Piper Aircraft are expanding their capabilities, innovating in terms of fuel efficiency and sustainability to meet the changing needs of the industry.

Middle East and Africa Piston Engine Aircraft Market Analysis

The growing demand for pilot training and general aviation drives the Middle East and Africa piston engine aircraft market. In the Middle East, indeed, countries like the United Arab Emirates (UAE) and Saudi Arabia are expanding aviation academies to meet the growing needs of the airline industry. Saudi Arabia, for example, has recognized the need for a significant number of pilots due to fleet growth and attrition replacement. Bander Khaldi, managing director of the kingdom's National Aviation Academy, mentioned that Saudi Arabia will need 8,800 pilots and 11,700 aviation technicians by 2024. This expansion is fueling demand for piston-engine training aircraft. In Africa, the pilot shortage is making a pressing demand for training aircraft, with South Africa leading the region in flight training operations. Government-led initiatives on aviation development, coupled with investment in flight schools, further bolster market growth in the region and position it as an emerging hub for aviation training.

Competitive Landscape:

The piston engine aircraft market is highly competitive, with key players focusing on innovation, performance enhancements, and regulatory compliance. Major manufacturers are offering a diverse range of single- and twin-engine models. They are differentiating through fuel efficiency, avionics advancements, and aircraft durability to attract flight schools, private owners, and charter operators. Emerging players and aftermarket service providers intensify competition by introducing cost-effective maintenance solutions and retrofit technologies. For instance, in July 2024, Textron Aviation announced a new cost-effective main landing gear repair process for Cessna Citation 560XL series, developed with Able Aerospace Services, offering timely, factory-direct support and maintenance. Strategic partnerships, acquisitions, and expansion into emerging markets further shape the competitive dynamics, reinforcing market consolidation and technological advancements within the sector.

The report provides a comprehensive analysis of the competitive landscape in the piston engine aircraft market with detailed profiles of all major companies, including:

- Cirrus Design Corporation

- Costruzioni Aeronautiche TECNAM S.p.A

- Diamond Aircraft Industries

- Piper Aircraft Inc.

- PistonPower, Inc.

- Robinson Helicopter Company

- Textron Aviation Inc.

Latest News and Developments:

- January 2025: Piper Aircraft announced the fleet agreement with FTEJerez for 20 new Piper Archer DX aircraft, with the arrival of the first ten in December 2024, strengthening the FTEJerez training capabilities in enhancing its leadership in aviation training and sustainability while developing partnerships with major airlines.

- November 2024: Diamond Aircraft expands in the Middle East through a contract for two DA40 and one DA42 aircraft for 'Project Aviation' flight school in Abu Dhabi. At the same time, during Air Expo Abu Dhabi 2024, the company delivered its first DA50 RG to the UAE.

- August 2024: ICON Aircraft finished its asset sale to SG Investment America, operating under the ICON Aircraft name. Former CEO Jerry Meyer thanked everyone for their cooperation over the years, welcoming Jason Huang to the team.

- January 2024: Cirrus Aircraft unveiled the G7, the latest generation of its best-selling single-engine piston aircraft. Features of the G7 include touchscreen interfaces, high-resolution displays, advanced safety systems, increased visibility, extra legroom, and the Cirrus IQ app that helps in monitoring real-time aircraft health.

- June 2022: LIFT Academy collaborated with Diamond Aircraft Industries to expand their flight training program by the addition of further aircraft.

Piston Engine Aircraft Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Engine, Multi-Engine |

| Maximum Take-off Weights Covered | Less than 1000 Kg, 1000-2000 Kg, More than 2000 Kg |

| Applications Covered | Military and Defense, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cirrus Design Corporation, Costruzioni Aeronautiche TECNAM S.p.A, Diamond Aircraft Industries, Piper Aircraft Inc., PistonPower, Inc., Robinson Helicopter Company, Textron Aviation Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the piston engine aircraft market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global piston engine aircraft market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the piston engine aircraft industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The piston engine aircraft market was valued at USD 980 Million in 2024.

IMARC estimates the piston engine aircraft market to reach USD 1,340 Million by 2033, exhibiting a CAGR of 3.52% during 2025-2033.

Key factors driving the piston engine aircraft market include rising demand for pilot training, cost-effective operations, advancements in avionics, and increasing general aviation activities. Regulatory support, expanding flight schools, and growing interest in personal and business aviation further contribute to market growth, alongside improved fuel efficiency and enhanced safety features.

North America currently dominates the market with 66.3% share, driven by a well-established aviation infrastructure, a high concentration of flight schools, and strong demand for general aviation. The presence of leading manufacturers and widespread use of aircraft for personal, business, and training purposes further reinforce the region’s market leadership, thereby creating a positive piston engine aircraft market outlook.

Some of the major players in the piston engine aircraft market include Cirrus Design Corporation, Costruzioni Aeronautiche TECNAM S.p.A, Diamond Aircraft Industries, Piper Aircraft Inc., PistonPower, Inc., Robinson Helicopter Company, Textron Aviation Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)