Pipeline Integrity Management Market Size, Share, Trends and Forecast by Sector, Service Type, Location of Deployment, and Region, 2025-2033

Pipeline Integrity Management Market Size and Share:

The global pipeline integrity management market size was valued at USD 10.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.08 Billion by 2033, exhibiting a CAGR of 3.02% from 2025-2033. North America currently dominates the market, holding a market share of over 38.9% in 2024. The rapid aging of pipeline infrastructure across the globe, rising demand for natural gas, introduction of stringent regulations, and significant technological advancements are some of the factors boosting the pipeline integrity management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.62 Billion |

|

Market Forecast in 2033

|

USD 14.08 Billion |

| Market Growth Rate (2025-2033) | 3.02% |

The aging of pipeline infrastructure is a significant concern globally, particularly in Europe and Asia, which is boosting the pipeline integrity management market growth. In Europe, many pipelines have been operational since the 1960s and 1970s, making them over 50 years old. This prolonged usage increases susceptibility to corrosion, wear, and potential failures, posing risks to safety and the environment. The Organization for Economic Cooperation and Development (OECD) and the World Economic Forum (WEF) estimate that from now until 2030, an annual global infrastructure investment of up to USD 3.7 trillion is required, divided equally among Europe, the U.S., and China. This investment is crucial to address the challenges posed by aging infrastructure, including pipelines. In Asia, the average power grid is approximately 30 years old, approaching the typical design lifespan of 50 years. This aging infrastructure faces increasing demands due to rapid industrialization and urbanization, leading to capacity constraints and heightened risks of failures. Addressing these challenges necessitates substantial investment in maintenance, upgrades, and replacements to ensure the safety, reliability, and efficiency of pipeline systems worldwide.

The growth of the pipeline integrity management market share in the United States is driven by several key factors, such as the aging pipeline infrastructure, which necessitates ongoing maintenance and modernization efforts to ensure safety and efficiency. The U.S market for pipeline integrity management holds up to 86.8% market share. In October 2024, the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) announced the allocation of $196 million in grants to modernize natural gas pipelines across 20 states. These grants, funded by the Bipartisan Infrastructure Law, are designated for 60 projects focused on repairing or replacing old, leak-prone pipelines, thereby mitigating safety hazards and reducing environmental impacts. Additionally, the implementation of stringent regulatory measures has heightened the demand for comprehensive integrity management solutions. PHMSA's Risk Ranking Index Model (RRIM), updated in July 2024 for 2025 planning, exemplifies the agency's commitment to proactive risk assessment and management. This model assists in prioritizing pipeline inspections based on various threat factors, thereby enhancing the overall safety and reliability of the nation's pipeline network. Collectively, these efforts underscore a comprehensive approach to maintaining and enhancing pipeline integrity in the United States, thereby driving the pipeline integrity management market demand.

Pipeline Integrity Management Market Trends:

Increasing demand for natural Gas Pipeline Infrastructure

Rising natural gas demand is driving the expansion of gas pipeline infrastructure, as pipelines remain the most cost-effective solution for transporting large volumes of natural gas, crude oil, and petroleum products over long distances. Industry sources indicate that natural gas consumption increased to 3,822.8 bcm in 2020, primarily due to higher usage in power and transport sectors. This growth trajectory is set to persist in the coming years, emphasizing the need for greater investments in gas pipeline infrastructure across various countries. As natural gas demand rises, the necessity for safe and efficient pipeline systems increases accordingly. This growth in infrastructure development will drive the demand for pipeline integrity management solutions, such as advanced monitoring, inspection, and maintenance technologies, to ensure the safe and reliable transportation of natural gas and petroleum products. The continued growth in natural gas consumption is set to be a key factor in the market expansion for pipeline integrity management.

Stringent Regulatory Requirements

The pipeline integrity management market is also driven by increasing imposition of strict regulations from governments and regulatory bodies. The primary purpose of such regulations is to prevent accidents on pipelines, reduce environmental damage, and ensure safety in all aspects of pipeline network operations. For instance, the U.S. has laws such as the National Energy Board Act (NEB Act) and Onshore Pipeline Regulations (OPR), where all oil and gas pipeline facilities are supposed to adhere. Since their adoption in 1999, various amendments have been made to these regulations to accommodate emerging safety concerns and industry advancement, according to industry reports. It would be true that as regulations were becoming stronger and stronger, pipeline integrity management system investment, coupled with high-class inspection and pipeline maintenance, will be very compulsory for meeting all the regulatory and risk reduction mandates. Growing needs for higher-capacity pipeline systems are enhancing this pipeline integrity management market as technological innovations aim for safety operation without environmental issues within the whole sector.

Technological Advancements

Integration of advanced technologies has been a prime growth driver in the pipeline integrity management market. Robotic inspection tools, sensor-based monitoring systems, and data analytics have made a significant impact on the ways pipelines are monitored and maintained. These innovations enable real-time detection of issues, predict potential failures, and ensure more efficient planning for maintenance purposes, thereby driving the growth of the market. Additionally, the trend towards urbanization is quite a big factor driving market demand. As stated in a report by the United Nations, it is projected that 68% of the global population will reside in cities by 2050, while only 55% did so in 2018. This, in turn, will fuel demand for upgraded infrastructure, including capacities for production, supply lines, and transportation pipelines, all of which will call for high-class integrity management solutions to guarantee efficiency and safety. Furthermore, strategic collaborations like the deal May 2023 made by ADNOC and Baker Hughes, which aims to promote low-carbon, environmentally friendly technologies including hydrogen and graphene, indicates growing investments in pipeline technologies cutting across top applications of the market, further boosting market growth.

Pipeline Integrity Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pipeline integrity management market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on sector, service type, and location of deployment.

Analysis by Sector:

- Crude Oil

- Gas

The global pipeline integrity management market has been segmented in various sectors of which the significant share is retained by the gas sector. A reason for that is the world's vast system of natural-gas pipelines across the globe; thus, significant integrity management requires to be incorporated for safe operations and efficiency. The increasing global demand for natural gas, driven by its relatively lower carbon emissions compared to other fossil fuels, has led to the expansion of gas pipeline infrastructures. This expansion underscores the critical need for comprehensive integrity management solutions to prevent leaks, ruptures, and other potential failures that could have severe environmental and safety consequences. With this, operators are heavily investing in advanced monitoring and maintenance technologies to ensure pipeline integrity, which will drive the growth of the market in the gas sector.

Analysis by Service Type:

- Inspection Services

- Cleaning Services

- Repair and Refurbishment Services

As per the pipeline integrity management market outlook, inspection services constitute a substantial portion, accounting for approximately 62.6% of the market share. This dominance is due to the essential role that regular inspections play in identifying potential issues such as corrosion, cracks, or mechanical damage before they escalate into critical failures. Advanced inspection techniques, including in-line inspection tools (smart pigs), ultrasonic testing, and magnetic flux leakage methods, enable operators to assess the condition of pipelines accurately. The increasing regulatory requirements mandating periodic inspections to ensure pipeline safety and environmental protection further drive the demand for these services. Consequently, companies specializing in inspection services are experiencing heightened demand, reinforcing their leading position in the market.

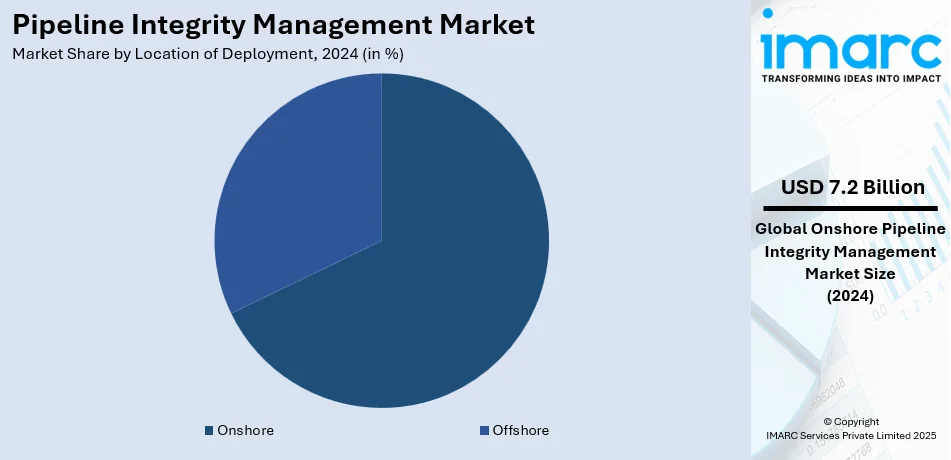

Analysis by Location of Deployment:

- Onshore

- Offshore

In terms of deployment location, onshore pipelines represent the majority, holding about 67.5% of the market share. This significant share is attributed to the extensive network of onshore pipelines used for transporting oil, gas, and other substances across vast land areas. Onshore pipelines are generally more accessible than their offshore counterparts, facilitating easier inspection, maintenance, and repair activities. However, they are still subject to various integrity threats, including third-party damages, corrosion, and geological hazards, necessitating robust integrity management programs. The focus on ensuring the safety and reliability of these critical infrastructures propels the demand for comprehensive onshore pipeline integrity management services.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the pipeline integrity management market forecast, North America is accounting for approximately 38.9% of the global share. This leadership is primarily due to the region's extensive and aging pipeline infrastructure, particularly in the United States and Canada, which requires ongoing monitoring and maintenance. Stringent regulatory frameworks governing pipeline operations in North America mandate rigorous integrity management practices to prevent incidents and protect the environment. Additionally, the region's significant oil and gas production activities necessitate a robust pipeline network, further driving the demand for integrity management solutions. The combination of these factors solidifies North America's dominant position in the global market.

Key Regional Takeaways:

United States Pipeline Integrity Management Market Analysis

The U.S. pipeline integrity management market is growing due to increased regulatory attention and the necessity for environmental protection. In July 2024, the U.S. Department of Justice proposed changes to the Lakehead pipeline system operated by Enbridge Energy, forcing the company to address previously identified cracks. This proposal is part of the broader efforts that make sure pipelines are safe because of environmental incidents such as the 2010 Kalamazoo River oil spill that led to a 2016 settlement agreement between DOJ and Enbridge.

Advanced pipeline integrity management solutions are in huge demand nowadays because of such regulations by governments towards preventing accidents and preventing environmental damage. Pipeline operators recognize the urgent need to implement advanced technologies for real-time monitoring, predictive maintenance, and swift detection of issues such as cracks and leaks. Increased awareness about pipeline safety and environmental protection has therefore fueled demand for comprehensive pipeline management solutions in the United States, driving market growth forward.

Europe Pipeline Integrity Management Market Analysis

Europe pipeline integrity management market is growing with geopolitical shifts and increasing energy diversification. Within the past year, following the invasion of Ukraine by Russia in 2022, Bulgaria, Germany, and Greece have stepped up investments into new gas pipeline projects to cut their reliance on Russian gas supplies. Industry reports indicate that this pipeline boom requires high levels of advanced integrity management solutions for safety, reliability, and efficiency - hence creating a growing need in the market.

In addition, Europe's commitment to renewable energy is further boosting the market. The UK government targets having 50% of its electricity generated from renewable sources by 2025. Germany is aiming for 65% of total energy from renewables by 2030, as per reports. As the countries make a shift towards cleaner energy, industry reports claim that the infrastructure for both the old and new systems must undergo severe integrity management to avoid leaks, ensure safety, and abide by the standards of the law. With energy security and sustainability gaining more momentum, the requirement for advanced pipeline monitoring and maintenance technologies is ever increasing across Europe.

Asia Pacific Pipeline Integrity Management Market Analysis

The Asia Pacific pipeline integrity management market is growing due to increasing demand for natural gas and energy diversification goals. In February 2024, at the International Conference of Petroleum and Natural Gas Regulators, the Indian government announced plans to increase natural gas's share in the national energy mix from 6% to 15%. This, combined with the growing natural gas production and consumption and the presence of aging gas pipeline infrastructure, has led to the increase in construction of new gas pipelines throughout the country.

China is also reported to be aiming at achieving 16% of its energy from renewables by 2030, which further enhances the requirement for secure and reliable pipeline systems. With the increasing energy requirements and expansion of natural gas infrastructure, the demand for advanced pipeline integrity management solutions is increasing. The solutions help in safety, monitor pipeline conditions, and prevent environmental risks, which is enhancing market growth across the Asia Pacific region.

Latin America Pipeline Integrity Management Market Analysis

Latin America pipeline integrity management market is on the rise, mainly due to the shift in the energy mix of the region and the increase in energy infrastructure. In 2023, oil was reported to account for 37% of Brazil's total energy supply, while biofuels and waste accounted for 33%, according to the International Energy Agency (IEA). As Brazil and other Latin American countries continue to rely heavily on oil and biofuels, the demand for secure and efficient pipeline systems to transport these energy resources is increasing.

The expansion of pipeline infrastructure to serve the increasing energy production in the region requires enhanced integrity management solutions to ensure safety in operations and minimize environmental hazards. The call for technologies including real-time monitoring, predictive maintenance, and high-end inspection equipment is on an increase as producers and transporters of energy turn their focus on reducing accidents and pipeline failures. This trend will continue to influence the market positively, leading to substantial growth of pipeline integrity management solutions in Latin America.

Middle East and Africa Pipeline Integrity Management Market Analysis

The Middle East and Africa pipeline integrity management market is growing due to the expansion of pipelines in the region and the growing demand to transport more energy. The U.S. Energy Information Administration (EIA) highlights the UAE's 1.5 million b/d pipeline, which connects its onshore oil fields to the Fujairah export terminal on the Gulf of Oman. This substantial pipeline infrastructure, along with other major pipeline projects across the region, requires robust integrity management systems to ensure operational safety, minimize risks, and prevent disruptions in energy supply.

With the increasing pipeline construction of oil and gas pipelines in the region, the demand for advanced monitoring and maintenance technologies is evolving to keep the pipelines safe, identify potential defects before accidents, and reduce costly accidents. Rising regulatory pressure on safety and environment standards also drives the need for effective pipeline integrity management solutions, leading to an escalating market growth trend in the region of the Middle East and Africa.

Competitive Landscape:

Leading players in the pipeline integrity management market are actively investing in advanced technologies, strategic partnerships, and regulatory compliance to enhance pipeline safety and efficiency. Companies are integrating IoT-based smart sensors, AI-driven predictive maintenance, and digital twins to monitor pipeline health in real-time, reducing downtime and operational risks. Many players are expanding their inspection and monitoring services using high-resolution smart pigging, drone surveillance, and ultrasonic testing to detect corrosion, cracks, and leaks early. To strengthen their market position, companies are forming strategic alliances with pipeline operators, technology providers, and regulatory bodies to develop cutting-edge solutions. Mergers and acquisitions are common, allowing companies to broaden their geographic reach and diversify their service offerings. Additionally, investments in cloud-based data analytics platforms allow operators to centralize monitoring, optimize decision-making, and ensure regulatory compliance.

The report provides a comprehensive analysis of the competitive landscape in the pipeline integrity management market with detailed profiles of all major companies, including:

- Aker Solutions ASA

- Baker Hughes Company

- Bureau Veritas

- DNV AS

- Emerson Electric Co.

- Enbridge Inc.

- Infosys Limited

- MATCOR Inc. (Brand Industrial Services Inc.)

- Pembina Pipeline Corporation

- SGS S.A.

- Shawcor Ltd.

- T. D. Williamson Inc.

- TÜV Rheinland

Latest News and Developments:

- July 2024: South Sudan and Ethiopia agreed to develop a new pipeline that connects the Nile state of South Sudan to the Gambella region of Ethiopia. The development will increase significantly the pipeline network in both South Sudan and Ethiopia.

- March 2024: Oil and gas major Equinor ASA has awarded a pipeline inspection and survey contract in the North Sea for 2024 to ocean services provider DeepOcean. The DeepOcean company will perform pipeline inspections, seabed mapping, and sometimes pipeline surveys and light construction work under the contract.

- February 2023: John Wood Group secures a deal with Pathways Alliance, the leading oil sands producer in Canada, for the carbon capture storage (CCS) pipeline project. The engineering and design service for a 400 km transportation line and lateral connections to the oil sands facility will be undertaken by the company.

Pipeline Integrity Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Crude Oil, Gas |

| Service Types Covered | Inspection Services, Cleaning Services, Repair and Refurbishment Services |

| Location of Deployments Covered | Onshore, Offshore |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aker Solutions ASA, Baker Hughes Company, Bureau Veritas, DNV AS, Emerson Electric Co., Enbridge Inc., Infosys Limited, MATCOR Inc. (Brand Industrial Services Inc.), Pembina Pipeline Corporation, SGS S.A., Shawcor Ltd., T. D. Williamson Inc., TÜV Rheinland, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pipeline integrity management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pipeline integrity management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pipeline integrity management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pipeline integrity management market was valued at USD 10.62 Billion in 2024.

IMARC estimates the pipeline integrity management market to exhibit a CAGR of 3.02% during 2025-2033, reaching USD 14.08 Billion by 2033.

The rapid aging of pipeline infrastructure across the globe, rising demand for natural gas, introduction of stringent regulations, and significant technological advancements are some of the factors boosting the pipeline integrity management market share.

North America currently dominates the market, driven by the region's extensive and aging pipeline infrastructure, particularly in the United States and Canada, which requires ongoing monitoring and maintenance.

Some of the major players in the pipeline integrity management market include Aker Solutions ASA, Baker Hughes Company, Bureau Veritas, DNV AS, Emerson Electric Co., Enbridge Inc., Infosys Limited, MATCOR Inc. (Brand Industrial Services Inc.), Pembina Pipeline Corporation, SGS S.A., Shawcor Ltd., T. D. Williamson Inc., TÜV Rheinland, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)