Pineapple Juice Market Size, Share, Trends and Forecast by Packaging, Distribution Channel, and Region, 2025-2033

Pineapple Juice Market Size and Share:

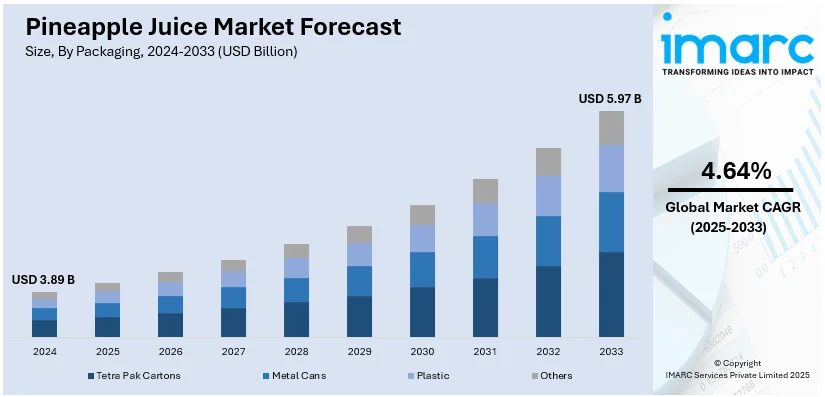

The global pineapple juice market size was valued at USD 3.89 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.97 Billion by 2033, exhibiting a CAGR of 4.64% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.5% in 2024. The increasing health consciousness, rising prevalence of digestive related conditions, and the growing consumption of ready-to-drink (RTD) beverages represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.89 Billion |

|

Market Forecast in 2033

|

USD 5.97 Billion |

| Market Growth Rate (2025-2033) | 4.64% |

The global pineapple juice industry is currently being influenced various chief factors, encompassing the elevating customer requirements for both natural and healthy beverages, which has amplified inclination towards fruit juices that are particularly rich in antioxidants or vitamins. In addition to this, the elevating trend towards organic products is impacting procurements decisions significantly, as individuals are increasingly navigating for organic pineapple juice offerings. Moreover, the proliferation of distribution channels, especially in e-commerce and retail, improves product availability. Apart from this, leading-edge marketing tactics and the launches of innovative blends as well as flavors are appealing a broad range of audience, supporting the overall expansion of the pineapple juice segment.

The United States serves as a key player in the global pineapple juice market due to its high consumption levels and diverse distribution channels. With a focus on health-conscious products, demand for natural and organic pineapple juice is increasing. The industry thrives on a robust distribution network and innovative packaging solutions, improving both product accessibility and longevity. Additionally, the U.S. imports significant volumes of pineapple juice, supporting global trade. For instance, as per industry reports, during October 2024, the U.S. imported USD 314 Million worth fruit juices. Rising awareness of tropical fruit beverages and their nutritional value further contributes to steady market growth. Moreover, manufacturers innovate with new flavors to cater to evolving consumer preferences.

Pineapple Juice Market Trends:

Increase in Health and Wellness Trends

The notable magnification in health awareness amongst consumers and increase in gain in knowledge about the nutritional profits of pineapple juice are critical factors that are significantly propelling the market growth on a global level. The accelerating incidents of chronic conditions, typically including cardiovascular diseases, further aid this trend. As per reports, around 620 Million people are living with heart and circulatory diseases across the world in 2023.Besides this, the rapid elevation in popularity of plant-based diets and the robust shift towards healthier lifestyles are also boosting the requirement for natural as well as nutritious beverages, which also include pineapple juice. In addition to this, the booming cases of digestive-associated disorders such as gastroenteritis, irritable bowel syndrome (IBS), and gastroesophageal reflux disease (GERD), is significantly supporting the heightened pineapple juice market demand, principally because of its health-promoting attributes.

Increased Participation in Sports and Fitness Activities

The notable increase in participation in fitness activities as well as recreational sports is another critical driver of the pineapple juice industry. As per the 15th annual State of the Industry Report by Sports Marketing Surveys USA and Sports & Fitness Industry Association, in 2023, 242 Million individuals in the U.S. participated in fitness and sports activities. Furthermore, pineapple juice, acknowledged for its energy-boosting and hydrating qualities, has become an ideal fruit juice for both fitness enthusiasts and athletes. Moreover, the boost in awareness regarding the health profits of pineapple, majorly encompassing its vitamin C content and anti-inflammatory properties, further bolsters its preference among sportspersons or people who accept the importance of exercise and physical activities, thereby impacting the pineapple juice market growth significantly.

Growth in Ready-to-Drink (RTD) Beverages and E-Commerce Expansion

The strong popularity of ready-to-drink (RTD) beverages is actively magnifying chiefly because of escalated purchasing power, proliferation of working population, and hectic lifestyles. The percentage of RTD consumers who enjoy RTDs more than once a week rose to 43% in 2023 from 39% in 2022. In addition to this, e-commerce platforms, offering convenience through free shipping and secure payment methods, have significantly bolstered the availability of pineapple juice. Besides, innovative marketing strategies, such as celebrity endorsements, social media campaigns, and stylish bottle designs, along with vending machine installations in high-traffic areas like airports, malls, and schools, are creating a positive pineapple juice market outlook.

Pineapple Juice Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pineapple juice market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on packaging and distribution channel.

Analysis by Packaging:

- Tetra Pak Cartons

- Metal Cans

- Plastic

- Others

Tetra pak cartons stand as the largest component in 2024, holding around 45.0% of the market, primarily due to their convenience, sustainability, and ability to preserve product quality. These cartons are designed to provide an airtight seal, which effectively protects the juice from light and oxygen, thereby extending shelf life and maintaining freshness. The reduced weight of Tetra Pak cartons minimizes both shipping expenses and ecological impact, resonating with the increasing demand among consumers for sustainable packaging alternatives. Additionally, the versatility of Tetra Pak allows for various sizes and formats, catering to diverse consumer needs, from single-serve options to larger family-sized packages. As manufacturers increasingly prioritize sustainable practices, the adoption of Tetra Pak cartons is expected to continue rising, reinforcing their dominant position in the pineapple juice market. This packaging solution not only enhances product appeal but also supports the industry's commitment to environmental responsibility.

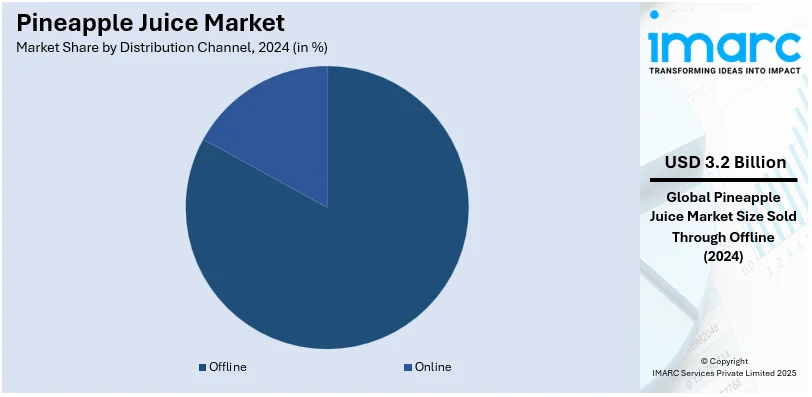

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with around 82.98% of market share in 2024, mainly propelled by the robust establishment of retail formats, including convenience stores, supermarkets, and hypermarkets. Such conventional retail outlets offer customers with a convenient access to a versatile range of pineapple juice products, enabling in-depth buying decisions through sampling choices and product transparency. The offline channel heavily profits from well-structured supply chains and logistics, guaranteeing steady product accessibility and timely replenishment. In addition to this, in-store endorsements and marketing tactics efficiently appeal customers, improving brand loyalty and incentivizing impulse purchases. While online shopping is gaining traction, the offline distribution channel remains crucial for reaching a broad demographic, particularly in regions where physical retail is preferred. As consumer habits evolve, the offline channel will continue to play a vital role in the distribution of pineapple juice, ensuring that products remain accessible and appealing to a diverse customer base.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.5%. This dominance mainly pertains to the amplifying customer consciousness regarding the health advantages related to the pineapple juice, including its exceptional digestive attributes and rich vitamin C content. The market is generating significant revenue, highlighting a fueling need for both organic and conventional juice options. In addition to this, the region's well-structured distribution networks and the magnified preference ready-to-drink beverages further expand pineapple juice market share. For instance, in July 2024, the government of Ontario, Canada, announced plans to boost ready-to-dink beverages market by enabling big-box as well as convenience stores to sell these, starting from August 2024. In line with this, above 80% of the ready-to drink beverages in Ontario are produced locally. Besides, as health-conscious customers are currently navigating for refreshing and nutritious drink substitutes, North America's pineapple juice market is anticipated to exhibit steady growth, boomed by advanced product offerings and marketing tactics that resonate with varying user tastes.

Key Regional Takeaways:

United States Pineapple Juice Market Analysis

In 2024, the United States accounted for 87.80% of the market share in North America. The pineapple juice market in the United States is driven by increasing consumer demand for healthier beverage options. Health-conscious individuals are increasingly preferring beverages that are rich in vitamins and natural nutrients. Pineapple juice, valued for its abundant vitamin C and digestive enzymes such as bromelain, attracts consumers prioritizing enhanced immunity and improved digestion. This preference is notably strong among younger audiences and active lifestyle enthusiasts. In addition, the rising number of fitness enthusiasts in the country is catalyzing the demand for pineapple juice as they are seeking natural, nutrient-rich beverages that are free from artificial additives. According to reports, 78% of Americans plan to work out more in 2023 than they did in 2022. This fitness-driven consumption trend is also encouraging manufacturers to innovate by creating fortified pineapple juice products, such as blends with electrolytes or added nutrients to target post-exercise recovery. Furthermore, there is an increase in the demand for plant-based and clean-label products. The growing popularity of smoothies and fruit-based cocktails is also boosting the demand for pineapple juice as a versatile ingredient. Additionally, the market benefits from advancements in packaging and distribution. The adoption of eco-friendly packaging and innovative bottling methods, such as aseptic cartons, extends shelf life and aligns with sustainability trends.

Asia Pacific Pineapple Juice Market Analysis

The Asia Pacific pineapple juice market is propelled by the region's significant agricultural production and export capabilities. Major pineapple-growing nations, such as the Philippines, Thailand, and India, have established themselves as key players in global supply chains. These countries leverage abundant raw materials and low production costs to provide competitively priced pineapple juice domestically and internationally. In line with this, rapid urbanization and evolving dietary preferences in the region are also driving market growth. As cities expand, more consumers opt for convenient and nutritious beverages like pineapple juice. As per the Press Information Bureau (PIB), it is anticipated that by 2030, more than 40% of India's population will live in urban areas. In many countries, the growing middle class is driving demand for premium, health-focused products. The popularity of pineapple juice as a rich source of antioxidants, vitamins, and enzymes aligns with these health-conscious consumption patterns. The surge in functional beverage trends is another major factor influencing the market. Pineapple juice is being more frequently utilized in fortified beverages promoted for targeted health advantages, including support for digestion, enhancement of immune function, and improved hydration. This trend is prompting manufacturers to introduce innovative product variations catering to diverse consumer preferences. Lastly, government initiatives to support fruit cultivation and the expansion of agro-industrial capabilities have positively impacted the market.

Europe Pineapple Juice Market Analysis

In Europe, the pineapple juice market is influenced by increasing health awareness and the rising trend of plant-based diets. European consumers are increasingly prioritizing nutrient-rich, natural beverages over sugary carbonated drinks. Pineapple juice’s reputation as a healthy source of vitamin C and digestive enzymes makes it a popular choice, particularly among health-conscious individuals. In addition, the rising participation of individuals in sports is catalyzing the demand for pineapple juice with additional health benefits. In 2023, 1.55 Million people were deployed in the sports segment in the EU, accounting for 0.76% of total employment. This is encouraging manufacturers to add more nutrients to pineapple juice varieties to attract this consumer segment. Furthermore, the region’s robust import infrastructure also drives the market, with major pineapple-producing nations like Costa Rica and the Philippines supplying high-quality raw materials. Besides this, the growing interest in exotic flavors and tropical beverages is catalyzing the demand for pineapple juice. With its distinct taste, pineapple juice serves as a versatile ingredient in beverages like cocktails, mocktails, and smoothies, aligning with consumer preferences for indulgent yet natural options. Sustainability and ethical sourcing is becoming pivotal in shaping the European pineapple juice market. Many consumers prefer products certified as organic, fair-trade, or sustainably source, which is prompting companies to adopt eco-friendly and ethical practices in their supply chains.

Latin America Pineapple Juice Market Analysis

The pineapple juice market in Latin America is mainly propelled by the region's dominance in pineapple cultivation and exports. Countries, such as Costa Rica, Mexico, and Brazil, are key producers of pineapples, allowing the region to provide high-quality juice at competitive prices. Increasing domestic consumption of natural fruit juices, fueled by rising health awareness, is bolstering the market growth. Consumers in Latin America are increasingly inclined towards fresh, locally produced beverages free of artificial additives, driving demand for pure pineapple juice. Additionally, government initiatives supporting the agricultural sector and the development of agro-processing industries further strengthen the market. These policies help enhance production efficiency and export potential, ensuring long-term growth in both local and international markets. Furthermore, rising preferences for online grocery shopping is further enhancing the accessibility of pineapple juice across various platforms, increasing its consumption. As per the International Trade Administration, Brazil has emerged as the biggest economy across the Latin American region, and is projected to sustain a strong e-commerce growth rate of 14.3% by the year 2026.

Middle East and Africa Pineapple Juice Market Analysis

Consumers are increasingly seeking alternatives to sugary soft drinks and pineapple juice's natural health benefits make it a preferred choice. Additionally, the urban population is increasingly preferring RTD juices owing to their busy lifestyle. As per the CIA, urban population in Saudi Arabia was 85% of total population in 2023. Pineapple juice is often considered an exotic beverage, and its association with health and wellness further drives consumption. Moreover, increased trade relationships with major pineapple-exporting countries, such as the Philippines and Costa Rica, is ensuring a steady supply of pineapple juice to the region, supporting market growth. Apart from this, innovations in packaging, such as recyclable and eco-friendly materials, resonate with Europe’s green initiatives, ensuring sustained consumer loyalty while supporting market expansion.

Competitive Landscape:

The global pineapple juice market is represented by significantly intensified competition amongst a wide range of industry players. Global beverage firms with robust brand recognition and comprehensive distribution networks exhibit an amplified competition to smaller regional companies as well as to local producers. In addition to this, private label firms also exert pressure on established companies by actively providing customers with more affordable product types. Besides this, the market is currently witnessing competition from other fruit juices, mainly including rape, orange, or apple, along with magnified rivalry with substitute beverages such as energy drinks, coconut water, or sparkling water. Furthermore, strategic collaborations or acquisition are currently being observed in the market, significantly steering the market dynamics and impacting the future growth outlook. For instance, In December 2024, Pracharath Rak Samakkee Phuket Ltd., strategically collaborated with pineapple as well as rubber cultivators across Phuket to utilize spare field of rubber plantations to cultivate pineapple. The company also actively coordinated with regional communities to locate ideal zones for pineapple cultivation, facilitating maximum profit earns for pineapple.

The report provides a comprehensive analysis of the competitive landscape in the pineapple juice market with detailed profiles of all major companies, including:

- Apple & Eve LLC (Lassonde Industries Inc.)

- Ariza B.V.

- Del Monte Foods Inc

- Dole Food Company Inc.

- Lakewood Inc

- Langer Juice Company, Inc.

- Ocean Spray

- Pineapple India

- SOL Organica S.A.

- Tesco Plc

- The Kraft Heinz Company

Latest News and Developments:

- August 2024: Dole Packaged Foods, LLC introduced its pineapple juice to consumers, the tropical beverage and the extraordinary people who drink it are finally getting a day of recognition with the first ever National Pineapple Juice Day.

- February 2024: Kirin Hyoketsu ntroduced two new flavours ‘Peach and Pineapple’ to its Australian line-up. Composed of pineapple juice, soda, vodka and frozen natural peach, Kirin Hyoketsu’s Peach and Pineapple flavors are produced leveraging the proprietary Hyoten Toketsu technology, with freshly squeezed juice that is frozen with temperature below 18 degrees, to sustain its sweet, crisp, and intense finish.

- September 2023: Jollibee’s introduced its new mango pineapple quencher. It features extensively grated, real mangoes with pineapple pulp, with flavor profile mimicking a tropical taste.

- June 2023: In June, Wildwonder, an AAPI-founded brand known for creating the first sparkling probiotic and prebiotic beverage for gut health globally, is introducing an exciting new flavor just in time for summer activities like beach trips and pool days. Pineapple Paradise delivers a tangy tropical twist and will be available exclusively at Sprouts stores nationwide, along with company’s website.

Pineapple Juice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packagings Covered | Tetra Pak Cartons, Metal Cans, Plastic, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apple & Eve LLC (Lassonde Industries Inc.), Ariza B.V., Del Monte Foods Inc, Dole Food Company Inc., Lakewood Inc, Langer Juice Company, Inc., Ocean Spray, Pineapple India, SOL Organica S.A., Tesco Plc, The Kraft Heinz Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pineapple juice market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pineapple juice market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pineapple juice industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pineapple juice market was valued at USD 3.89 Billion in 2024.

IMARC estimates the pineapple juice market to reach USD 5.97 Billion by 2033, exhibiting a CAGR of 4.64% during 2025-2033.

Key factors driving market expansion encompass elevating customer awareness of health benefits, magnifying need for natural and organic beverages, proliferating distribution channels, and the popularity of tropical flavors in drinks and foods. In addition, enhanced packaging solutions improve both product accessibility and appeal.

North America currently dominates the pineapple juice market, accounting for a share exceeding 37.5%. This dominance is fueled by robust customer need for healthy beverages, resilient distribution networks, and a substantial shift towards premium and organic juice options.

Some of the major players in the keyword market include Apple & Eve LLC (Lassonde Industries Inc.), Ariza B.V., Del Monte Foods Inc, Dole Food Company Inc., Lakewood Inc, Langer Juice Company, Inc., Ocean Spray, Pineapple India, SOL Organica S.A., Tesco Plc, The Kraft Heinz Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)