Phytosterols Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Phytosterols Market 2024, Size and Trends:

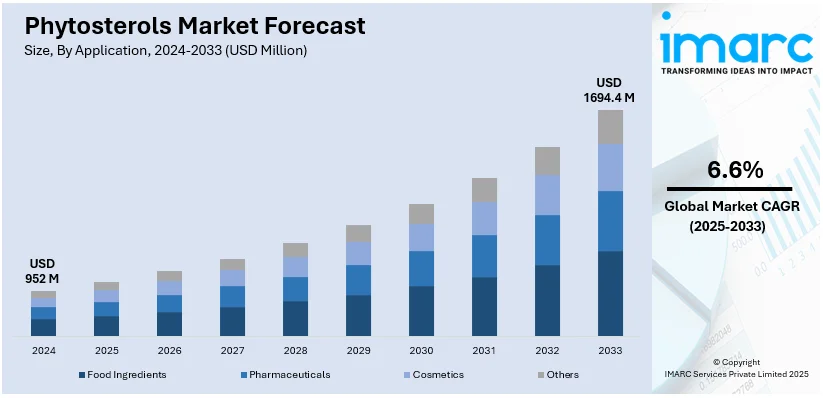

The global phytosterols market size was valued at USD 952 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,694.4 Million by 2033, exhibiting a CAGR of 6.6% during 2025-2033. Europe currently dominates the phytosterols market share by holding over 53.2% in 2024. The market is driven by the growing demand for functional foods and dietary supplements, the rising prevalence of cardiovascular diseases, rapid technological advancements in extraction processes, and the expansion of pharmaceutical applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 952 Million |

| Market Forecast in 2033 | USD 1,694.4 Million |

| Market Growth Rate (2025-2033) | 6.6% |

The global phytosterols market growth is primarily driven by consumer awareness regarding heart health and cardiovascular well-being associated with the cholesterol-lowering capabilities of phytosterols. For instance, on September 29, 2024, the World Health Organization commemorated World Heart Day with the theme "Use Heart for Action," emphasizing the urgency of addressing cardiovascular diseases (CVDs). Globally, CVDs are responsible for over 18 million deaths annually, with the WHO South-East Asia region accounting for 3.9 million of these fatalities, representing 30% of all deaths in the region. Notably, nearly half of these deaths occur prematurely, before the age of 70, underscoring the critical need for preventive measures and early management. Moreover, the escalating demand for functional food and dietary supplement products, growing demand for plant-based ingredients, and regulatory approvals favoring health claims of phytosterols propel expansion in the global market. Additionally, ongoing advancements in food technology, with increased utilization of cosmetics on account of anti-inflammatory and skin-rejuvenating properties, are some other factors propelling the growth of the market. Besides, a natural shift toward sustainable solutions is also fortifying the phytosterols market demand worldwide.

The United States stands out as a key regional market, driven by the increasing consumer awareness regarding the benefits of phytosterols in lowering cholesterol levels as well as overall cardiovascular health. Notably, on June 4, 2024, the American Heart Association projected that by 2050, 6 in 10 adults, or 60% of adults in the US will have cardiovascular disease. High blood pressure prevalence is expected to rise from 51.2% to 61%, and obesity rates from 43.1% to 60.6%. Additionally, stroke cases are anticipated to nearly double, increasing from 10 million to almost 20 million adults. Moreover, the increasing demand for functional foods and dietary supplements fortified with phytosterols drives the market growth. Additionally, stricter FDA approvals and health claims supporting their efficacy further strengthen consumer trust and adoption. Considerable growth in the aging population, along with numerous lifestyle-related diseases also bolster the demand for heart-healthy ingredients. Furthermore, innovations in food formulations and expanding applications in pharmaceuticals also contribute significantly to the market's expansion in the region.

Phytosterols Market Trends

Rising Demand for Legumes Containing Essential Phytosterols

This market is experiencing significant growth due to an increased demand for legumes that contain a high concentration of essential phytosterols. Legumes are derived from plants and have cholesterol-lowering properties, thereby gaining popularity among health-conscious consumers. Legumes such as soybeans, lentils, and chickpeas contain a high concentration of essential phytosterols, thus giving them their nutritional value and market appeal. The World Health Organization predicts that there will be over 35 million new cancer cases in 2050, representing a 77% increase from the estimated 20 million cases in 2022. These statistics make preventive health measures such as the consumption of plant-based compounds such as phytosterols, which have been shown to offer potential protective effects against certain cancers, even more important. This trend is supported by the growing consumer focus on health and wellness, along with the advancements in agricultural and processing technologies, which is augmenting the phytosterols market trends.

Growing Consumer Preference for Natural Dietary Supplements

The primary driver in the market is the growing consumer preference for natural dietary supplements. It has been demonstrated that phytosterols can outcompete dietary cholesterol in the human digestive system by activating the enzymes required for enhanced metabolism and significantly reducing the absorption of cholesterol. According to the report by NIH in 2021, the average decrease in plasma LDL cholesterol at 9–10% is the result of the correct use of phytosterols. As awareness of the adverse effects of conventional chemical compounds on health continues to grow, consumers are seeking natural dietary supplements. In line with this trend, leading companies are innovating and developing new dietary supplements that integrate plant-based components, such as phytosterols, in order to serve the health-conscious demographic. This is driving a healthy phytosterols market outlook as it goes in tandem with the consumers' demand for healthier and more natural products.

Increasing Prevalence of Cardiovascular Disease

The increasing death toll from cardiovascular disease is one of the primary factors driving the growth of the phytosterol market. As cardiovascular diseases remain a leading cause of death globally, there is a growing demand for dietary interventions that can help mitigate associated risks. Phytosterols are being increasingly accepted as an effective tool to support cardiovascular health. The demand for these is further bolstered by epidemiological data pointing to a rise in deaths related to CVD. OECD statistics indicate that CVD is responsible for nearly 670,000 deaths annually in Europe, accounting for 29% of all deaths. The FDA and the European Union have required manufacturers to label their products with the exact amount of phytosterols they contain. Furthermore, the labels must state that the products are only for consumers with heart disease. This, in turn, is increasing the phytosterols market.

Phytosterols Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type and application.

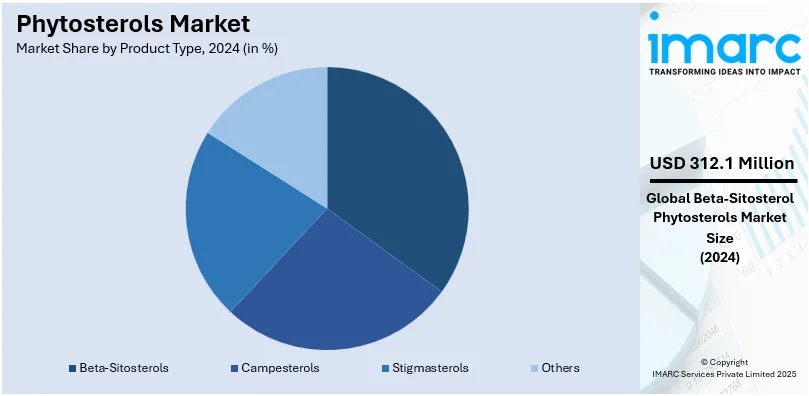

Analysis by Product Type:

- Beta-Sitosterols

- Campesterols

- Stigmasterols

- Others

Beta-Sitosterols lead the market in 2024, accounting for a share of over 32.8% due to their widespread presence in various plant sources and their well-documented efficacy in reducing cholesterol levels. This specific type of phytosterol is highly effective in blocking the absorption of cholesterol in the intestines, thereby contributing significantly to cardiovascular health. Furthermore, beta-sitosterols are extensively researched and have gained recognition for their potential therapeutic benefits, including anti-inflammatory and immune-modulating properties. The combination of their efficacy, availability, and broad acceptance in scientific and medical communities underscores their dominant position in the phytosterol market.

Analysis by Application:

- Food Ingredients

- Pharmaceuticals

- Cosmetics

- Others

Food ingredients lead the market in 2024 primarily due to the rising consumer awareness about health and nutrition. Phytosterols, known for their cholesterol-lowering properties, are increasingly incorporated into functional foods and dietary supplements aimed at promoting cardiovascular health. The growing demand for plant-based and fortified foods, driven by health-conscious consumers, further bolsters this segment. Additionally, the regulatory approval for phytosterols as a safe food additive by authorities has facilitated their widespread use in food products, contributing to the phytosterols market share.

Regional Analysis:

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

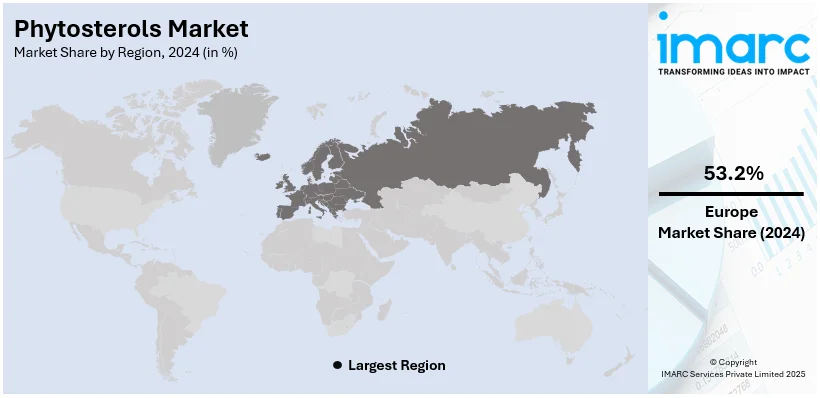

In 2024, Europe accounted for the largest market share of over 53.2%, primarily driven by the increasing demand for plant-based food items. This significant market presence highlights the region's strong consumer preference for health-conscious and plant-derived and plant-based fortified food items. To capitalize on phytosterols' cholesterol-lowering potential, firms are creating plant sterol-infused goods. Raisio, a UK-based company, has incorporated plant sterols into yogurt drinks, bars, spreads, and soft chews. Elsevier B.V. published a study on consumer purchase behavior of food with added phytosterols in European countries, which indicated that the United Kingdom has the highest penetration rate of households (12.1%) purchasing foods with added phytosterols.

Key Regional Takeaways:

United States Phytosterols Market Analysis

In 2024, the United States held 84.30% of the North America phytosterols market. The market has been growing, primarily owing to the increased awareness toward health and well-being, such as cholesterol and heart health awareness. Phytosterols are natural plant sterols that have drawn much attention towards lowering cholesterol in the body. The U.S. FDA rules dietary supplements as per the DSHEA to safeguard consumer confidence for the safety of the product in addition to proving the efficacy of these phytosterol-based formulations. One more significant element contributing to phytosterols' growing demand is that of overweightness and obesity increasingly found among both children and youngsters. TCTMD reports show that in the year 2021, as much as 36.2% among the young men and 37.2% females were hit by overweight and obesity. As age advances toward adolescence, cases become even alarming as obesity amongst boys is detected as high as 46.7% whereas for girls this was 50.8%. This concern has inspired a greater number of consumers to take up natural dietary supplements, such as phytosterols, as part of a preventive measure towards health, and this further pushes the expansion of the phytosterols market in the U.S.

Europe Phytosterols Market Analysis

Cardiac disorders are leading to disability and death in this region of the Europeans. In 2024, the report submitted by WHO informs that deaths reach more than 42.5% due to this risk in a single year. In keeping with such an ever-end health hazard, measures of preventing diseases are a regular requirement for preventive health issues, as a result, natural prevention or natural medicines and supplements aiming to be 'for the heart' have emerged into demand. The increase in using more natural health options has been associated with growing interest in the application of phytosterols, plant-based compounds known to lower cholesterol, in Europe. In light of growing awareness about the risks of CVDs, consumers are increasingly looking for help managing cholesterol levels and ensuring cardiovascular well-being through phytosterols. The trend is further supported by advancements in food technology and growing consumer confidence in natural ingredients. With more people looking for alternative plant-based alternatives for better heart health, the market for phytosterols in Europe is growing at a rapid pace.

Asia Pacific Phytosterols Market Analysis

In the Asia Pacific region, the growth in the phytosterols market can be attributed to the increase of lifestyle-related diseases such as cancer and diabetes. According to the World Health Organization, WHO, an estimated 2.37 million new cancer cases and 1.53 million cancer-related deaths occurred in the WHO South-East Asia Region in 2022, thereby, the demand for preventive health solutions is escalating. Phytosterols, known for their cholesterol-lowering and potential anti-inflammatory properties, are gaining popularity as part of a preventive health strategy. According to an IDF 2021 report, alone, China bears 1 out of every 4 adults in the global population who suffers from diabetes. This alarming percentage is driving more consumers to consume natural products, which help control their blood sugar level and cardiovascular issues, thereby increasing phytosterol-enriched product demand further. With improved health awareness, more consumers taking plant-based dietary supplements, this market for Asia Pacific is predicted to grow largely.

Latin America Phytosterols Market Analysis

The Latin America phytosterols market is growing due to the increasing older population in this region and more focus on preventive health. According to Cepal, there were 88.6 million people aged 60 and older residing in Latin America and the Caribbean in 2022. This proportion reached 13.4% of the population, it is likely to reach 16.5% by 2030. This increases the demand for solutions in health specific to older adults. With the aging population paying more attention to heart health management, cholesterol level management, and prevention of chronic diseases, the popularity of phytosterols is growing. Phytosterols have been recognized as lowering cholesterol levels and promoting cardiovascular health. Consumer interest in natural plant-based supplements further propels this trend, especially with an increasing preference for natural alternatives in daily health routines. As more individuals in the region take up phytosterols for their health benefits, the market for plant compounds is always expanding across Latin America.

Middle East and Africa Phytosterols Market Analysis

The market for phytosterols in the Middle East and Africa is expanding. It is motivated by the growth in the diabetes rate in this region and rising awareness about health and wellness. The International Diabetes Federation (IDF) 2021 report shows that the MENA region has the highest prevalence of diabetes, with 16.2% of the population affected, and the number of people suffering from diabetes is expected to rise by 86%, reaching 136 million by 2045. Such an increase in diabetes is leading to a heightened concern among the consumer for measures of preventive health and healthy living. Consumers are thus showing more interest in having phytosterols-a supplement that not only reduces cholesterol levels but also provides heart benefits-within the spectrum of healthier lifestyle choices. Consumers in this region are keenly looking out for natural and plant-based supplements for chronic conditions management, thus raising demand for phytosterols. Along with improving the awareness in health matters, the requirement of long-term health will promote the sustainable growth of phytosterol in the future across the region of MENA.

Competitive Landscape:

The phytosterols market is highly competitive due to the increased demand for cholesterol-lowering ingredients in functional foods, beverages, and supplements. Market participants are innovating and developing advanced extraction techniques and diversified product formulations catering to the various needs of consumers. Strategic partnerships with food manufacturers and pharmaceutical companies are common in order to expand market reach and applications. The regulatory compliance and sustainability of players are critical; hence, emphasis is given on eco-friendly sourcing and production methods. Besides, education of the consumer on health benefits of phytosterols adds to the competition in the market.

The report provides a comprehensive analysis of the competitive landscape in the phytosterols market with detailed profiles of all major companies, including:

- Arboris

- Archer Daniels Midland

- BASF

- Cargill

- Cognis

- Lipofoods

- Matrix Fine Sciences

- Pharmachem Laboratories Inc.

- Raisio Group

- Unilever

Recent Developments:

- June 2024: Azelis announced a partnership with BASF into a new distribution agreement to distribute a range of nutrition ingredients, including emulsifiers and phytosterol ester in China, strengthening its presence in key food industry segments. The agreement aligns with Azelis' strategy to provide innovative and sustainable formulations, expanding its customer outreach and product offerings.

- April 2024: Kensing will showcase a range of natural antioxidants and plant sterols, including synthetic phytosterols, vitamin E, and tocopherols, at Stand K34.

- September 2023: Nutrartis launched CardioSmile, a plant sterol product that will be sold in the U.S. market. The product utilizes a new water bottle technology in which phytosterols are dissolved in water.

- In January 2022, ADM announced its inaugural Science and Technology (S&T) Center in China during its recent announcement. The Company's ongoing investment commitment has reached a critical point through this facility opening to advance nutrition and health solutions in China's expanding market.

- In November 2021, AOM the leading manufacturer of specialty Natural Tocopherols and Vitamin E and Plant Sterols announced a significant industrial growth initiative. The enhanced Spanish manufacturing sites at this project will position the company as Europe’s first manufacturer of complete integrated tocopherols and sterols facility. The company operates its manufacturing facilities in Spain, positioning it as the first fully integrated producer of tocopherols, sterols, and sterol esters in Europe.

Phytosterols Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beta-Sitosterols, Campesterols, Stigmasterols, Others |

| Applications Covered | Food Ingredients, Pharmaceuticals, Cosmetics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Arboris, Archer Daniels Midland, BASF, Cargill, Cognis, Lipofoods, Matrix Fine Sciences, Pharmachem Laboratories Inc., Raisio Group, Unilever, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the phytosterols market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global phytosterols market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the phytosterols industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The phytosterols market was valued at USD 952 Million in 2024.

IMARC estimates the phytosterols market to exhibit a CAGR of 6.6% during 2025-2033, expecting to reach USD 1694.4 Million by 2033.

Key technology trends in the phytosterols market include advancements in extraction and purification techniques, such as supercritical fluid extraction, improving efficiency and sustainability. Additionally, innovative formulations are being developed for better bioavailability, driving demand in functional foods, dietary supplements, and the pharmaceutical industry.

Europe currently dominates the market, with a share of over 53.2% in 2024. The dominance is driven by rising health consciousness, increasing demand for functional foods, supportive regulatory frameworks, growing prevalence of cardiovascular diseases, and a shift towards plant-based ingredients.

Some of the major players in the phytosterols market include Arboris, Archer Daniels Midland, BASF, Cargill, Cognis, Lipofoods, Matrix Fine Sciences, Pharmachem Laboratories Inc., Raisio Group, and Unilever, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)