Physical Vapor Deposition on Plastics Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Physical Vapor Deposition on Plastics Market Size and Share:

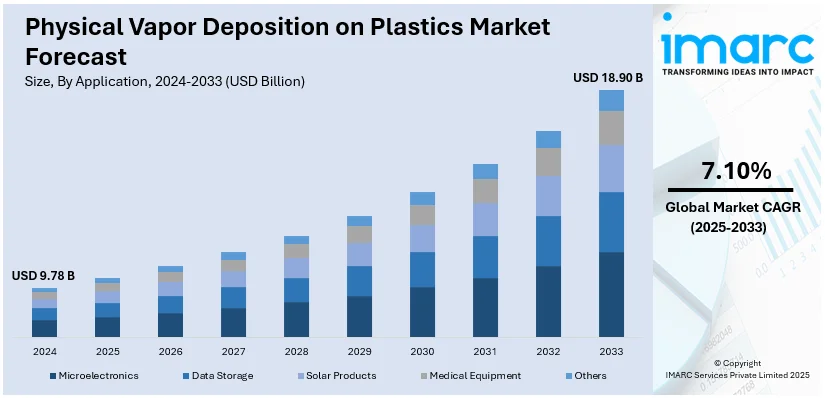

The global physical vapor deposition on plastics market size was valued at USD 9.78 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.90 Billion by 2033, exhibiting a CAGR of 7.10% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 42.5% in 2024. The major factors driving the market include the demand for enhanced durability, wear resistance, biocompatibility, and lightweight properties in industries like medical equipment, automotive, and electronics. These factors are collectively increasing the physical vapor deposition on plastics market share across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.78 Billion |

| Market Forecast in 2033 | USD 18.90 Billion |

| Market Growth Rate (2025-2033) | 7.10% |

The market is driven by factors such as an increasing demand for lightweight, high-strength, and durable advanced materials in the automotive industries, electronics sector, and medical fields. PVD coatings enhance plastics mechanically, making them highly resistant to wear, corrosion, and scratches. The application of PVD coatings enhances biocompatibility and assists in easy sterilization of plastics used in implants and surgical instruments in the medical sector. Moreover, the increasing trend of producing light weight automotive parts to enhance fuel efficiency and demand for innovative and advanced parts at lower cost also increases the physical vapor deposition on plastics adoption. Environmental regulations supporting sustainable production also support the growth of the physical vapor deposition on plastics market.

The widespread usage of PVD products in the automotive, aerospace, electronics, and medical devices represent one of the key physical vapor deposition on plastics market trends in the United States. PVD coatings offer higher endurance and corrosion with surface-appealing properties, which make them suitable for high-performance plastic parts. For example, in November 2024, a new addition was made by the StentTech Inc., StenTech BluPrint PVD Stencils, which are a state-of-the-art cutting-edge solution to reinforce the efficiency, precision, and longevity of the Surface Mount Technology manufacturing. The technologies allow for improved Physical Vapor Deposition PVD technology that will enhance productivity, decrease operational costs, and enhance solder paste deposition for manufacturers. The need for biocompatibility and sterilizability in the medical sector also accelerates the use of PVD. The pressure to reduce the weight of auto parts, given the fuel efficiency standards, drives the use of PVD technology. Environmental regulations that promote eco-friendly production processes also help the PVD on plastics market growth in the United States.

Physical Vapor Deposition on Plastics Market Trends:

Increasing Demand for Lightweight and Durable Materials

The growing need for lightweight and durable materials across industries, especially automotive and aerospace, is a major driver for the market. According to industry reports, the global automotive lightweight materials market size reached USD 84.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 151.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.4% during 2025-2033. PVD coatings improve plastic components' strength, wear, and scratch resistance, making them suitable for high-performance applications. For instance, in the automotive industry, PVD-coated plastic parts reduce vehicle weight, enhancing fuel efficiency without compromising durability. As industries focus on sustainability and efficiency, the demand for PVD-coated plastics is expected to increase, creating a positive physical vapor deposition on plastics market outlook.

Advancements in Medical Device Manufacturing

In the medical sector, PVD coatings are essential for enhancing the biocompatibility, sterilization, and mechanical properties of the plastic parts in medical equipment. As for application, requirements for higher levels of plastics in medical uses such as medical implants, surgical instruments, and diagnostics devices have been progressing, promoting the build-up of PVD technologies. PVD coatings offer surface properties necessary for medical device performance and reliability. The development of technologies in the health care sector, especially treatment apparatus such as minimally invasive surgery and implants as well as physical vapor deposition coated plastics in medical applications enhances the implementation of these technologies, thereby facilitating the physical vapor deposition on plastics market demand. For instance, the global implantable medical devices market size reached USD 141.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 209.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033.

Environmental and Regulatory Drivers

Increasing environmental concerns and stringent regulations on the use of materials and production processes are pushing industries to adopt more sustainable and cost-effective solutions, driving the growth of the PVD on plastics market. PVD is a green technology that reduces the need for chemical coatings and minimizes material waste, making it more environmentally friendly compared to traditional coating methods. For instance, in May 2024, IHI Corporation subsidiaries IHI Hauzer Techno Coating B.V. (Hauzer) and IHI Ionbond collaborated to provide a comprehensive solution for PVD coating development, coating services, and equipment for PEMFC and PEMWE. Hauzer is an expert in creating and deploying cutting-edge PVD surface coatings and coating machinery. Ionbond offers thin-film coating services through its global network of coating facilities and has more than 50 years of experience in coating technology. PVD, PACVD, CVD, CVA, and CVI technologies are all part of the portfolio. Furthermore, regulatory frameworks in industries like automotive, medical devices, and electronics are promoting the use of advanced coatings to meet safety, durability, and environmental standards. These regulatory pressures accelerate the demand for PVD technologies as a viable solution.

Physical Vapor Deposition on Plastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global physical vapor deposition on plastics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Microelectronics

- Data Storage

- Solar Products

- Medical Equipment

- Others

Medical equipment holds the largest physical vapor deposition on plastics market share because of the increasing need for biocompatible, long-lasting, and high-performing materials in healthcare applications. Medical equipment requires improved surface qualities, such as higher wear resistance, corrosion resistance, and stabilizability, which PVD coatings give plastic components. PVD is perfect for surgical instruments, implants, and medical tools because it may increase the mechanical strength of plastic while preserving its lightweight characteristics. Additionally, regulatory standards in the medical industry drive the need for precise, reliable coatings to ensure safety and longevity, further boosting PVD adoption in this sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42.5%. In the Asia Pacific region, the Physical Vapor Deposition (PVD) on plastics market is driven by the booming automotive, electronics, and packaging industries. The constantly growing manufacturing sector in nations like China, Japan, and South Korea contributes significantly to the need for PVD-coated plastic components. The market is driven by the automotive industry's growing demand for plastic components that are lightweight, strong, and visually pleasing, especially for external and interior components that need to be resistant to wear and scratches. Furthermore, the need for premium plastic coatings that enhance the functionality and aesthetics of plastic components is fueled by the region's growing consumer electronics market, which includes smartphones and other gadgets. Because PVD provides a cleaner alternative to conventional coating techniques like electroplating, its appeal is partly influenced by Asia's growing emphasis on sustainability and environmentally friendly industrial practices. Improvements in PVD technology and more R&D expenditures also contribute to the region's market expansion.

Key Regional Takeaways:

North America Physical Vapor Deposition on Plastics Market Analysis

The North American market for PVD on plastics is experiencing significant growth, due to high demand in the automotive, electronics, and consumer products industries. The USA with superior production technologies forms an important market in the region, especially in the auto components segment that need higher durability, wear resistance, and appearance. Due to enhanced focus on fuel efficiency and the production of lightweight cars, automakers have become increasingly interested in PVD-coated plastic automotive parts. In the electronics industry, increased demand for PVD in manufacturing gadgets like smartphones, tablets, and wearable electronics devices, with plastic-like surfaces is one of the major factors boosting the market. The region’s strong focus on sustainability also supports the adoption of PVD, as it offers an environmentally friendly alternative to traditional coating methods. Furthermore, advancements in PVD technology, such as improved deposition techniques and faster processing times, have led to more cost-effective solutions, contributing to the market's expansion. Strong research and development investments in North America further enhance physical vapor deposition on plastics market growth prospects.

United States Physical Vapor Deposition on Plastics Market Analysis

In 2024, the United States accounted for the largest market share of over 85.60% in North America. In the United States, the market is influenced by multiple factors, particularly the demand for high-performance coatings in industries such as automotive, electronics, and consumer goods. One important driver is the automotive industry, as producers look for vehicles that are lightweight and fuel-efficient. PVD coatings are widely employed to improve the strength, resilience to scratches, and visual appeal of plastic components, particularly on the outside and inside of automobiles. Furthermore, the usage of PVD coatings on plastic components is required for superior performance, including greater scratch resistance and aesthetic quality, due to the increasing rise of consumer electronics and mobile devices. The growing focus on sustainability is especially important because PVD offers a greener substitute for conventional coating techniques like electroplating, which use hazardous chemicals. The efficiency of PVD systems is also being increased by technological advancements and ongoing R&D expenditures, which lowers their cost to manufacturers and propels the region's market expansion.

Europe Physical Vapor Deposition on Plastics Market Analysis

The demand for high-performance coatings in the automotive and electronics industries, regulatory constraints for environmental sustainability, and technical innovation are the main factors driving the PVD on plastics market in Europe. The development of cleaner, more sustainable coating techniques is encouraged by Europe's strict environmental standards, and PVD is becoming a more environmentally acceptable substitute for conventional techniques like electroplating. Demand for PVD-coated plastic components is driven by the automotive industries in Germany, France, and Italy, particularly for lightweight automobiles that increase fuel economy and lower emissions. The growing consumer electronics industry, particularly in countries like the UK, Switzerland, and the Netherlands, further boosts the market for PVD coatings in mobile devices, displays, and housings. Additionally, the growing focus on aesthetic appeal and durability in various consumer products propels the demand for PVD-coated plastics. European companies invest heavily in research and development to create innovative PVD systems, driving efficiency and expanding market applications.

Latin America Physical Vapor Deposition on Plastics Market Analysis

In Latin America, the physical vapor deposition (PVD) on plastics market is largely driven by the growing demand for consumer electronics, automotive components, and packaging. As the region’s manufacturing industries expand, particularly in countries like Brazil and Mexico, there is an increasing need for advanced coatings on plastic parts to enhance durability, functionality, and aesthetics. The automotive industry is transitioning to lightweight, fuel-efficient vehicles, with PVD coatings being increasingly used for interior and exterior plastic components. In consumer electronics, there is a rising demand for high-quality, scratch-resistant coatings on plastic devices. Latin America also experiences a growing demand for sustainable and cost-effective manufacturing practices, further boosting the adoption of PVD. Although the market is still in the early stages compared to other regions, there are considerable opportunities for growth driven by both domestic production and increased foreign investments in advanced manufacturing technologies.

Middle East and Africa Physical Vapor Deposition on Plastics Market Analysis

The physical vapor deposition (PVD) on plastics market in the Middle East and Africa (MEA) is experiencing growth due to several factors, including rapid industrialization, the expansion of the automotive and construction sectors, and the increasing demand for durable and aesthetic plastic components. In countries like the UAE, Saudi Arabia, and South Africa, infrastructure development, particularly in the automotive industry, drives the need for lightweight, high-performance parts that require PVD coatings. Additionally, the harsh climatic conditions in the region, such as extreme temperatures and UV exposure, necessitate coatings that enhance the durability and UV resistance of plastic parts. The growing electronics sector in MEA also contributes to the demand for PVD-coated plastic components, especially in mobile devices and consumer electronics.

Competitive Landscape:

The physical vapor deposition (PVD) on plastics market is highly competitive, driven by demand in industries such as automotive, electronics, and packaging. Key players include companies like Aixtron SE, Veeco Instruments, and IHI Corporation, offering advanced PVD systems for high-performance coatings. Regional dominance is held by manufacturers in North America, Europe, and Asia-Pacific, with strong growth in emerging markets. Innovation in material coatings, like multi-layered and functionalized films, is a major focus. Competition is also fueled by technological advancements in reducing costs and improving efficiency, alongside increasing emphasis on sustainable, environmentally friendly production processes. For instance, in September 2024, Oerlikon Balzers, a top supplier of surface technologies and an Oerlikon brand, announced the release of INVENTA, its newest Physical Vapor Deposition (PVD) system. An important advancement in PVD Arc Technology is represented by the Advanced Arc Technology (AAT) found in this new coating equipment.

The report provides a comprehensive analysis of the competitive landscape in the physical vapor deposition on plastics market with detailed profiles of all major companies, including:

- Aalberts surface technologies

- Bend Plating

- HEF Group

- Mar-Bal, Inc

- RÜBIG Technologie GmbH & Co KG

Latest News and Developments:

- In April 2024, Aalberts Surface Technologies launched PVD (physical vapor deposition) coating for the automotive hydrogen fuel cell generation sector, which is available at the company’s Woonsocket, Rhode Island location.

- In September 2023, the Luxembourg Institute of Science and Technology (LIST) opened a Physical Vapor Deposition (PVD) pilot line in its Hautcharage premises, marking an important turning point in the development of coating technology. By tackling issues with scalability and innovation, LIST, which has nearly 20 years of committed research and development in PVD, is well-positioned to change the industry landscape in Luxembourg and the Greater Region.

Physical Vapor Deposition on Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Microelectronics, Data Storage, Solar Products, Medical Equipment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aalberts surface technologies, Bend Plating, HEF Group, Mar-Bal, Inc, RÜBIG Technologie GmbH & Co KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the physical vapor deposition on plastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global physical vapor deposition on plastics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the physical vapor deposition on plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The physical vapor deposition on plastics market was valued at USD 9.78 Billion in 2024.

IMARC estimates the physical vapor deposition on plastics market to reach USD 18.90 Billion by 2033, exhibiting a CAGR of 7.10% from 2025-2033.

Key factors driving the Physical Vapor Deposition (PVD) on plastics market include rising demand for durable, aesthetically appealing coatings in automotive and electronics industries, technological advancements in PVD systems, increased emphasis on sustainability, and the need for lightweight, high-performance materials in packaging, along with cost-effective and eco-friendly solutions.

Asia Pacific currently dominates identity analytics, accounting for a share of over 42.5% in 2024. Expanding automotive, electronics, and packaging industries, and rapidly growing manufacturing sector contribute to the market growth in the region. Other factors, such as an enhanced focus on sustainability and extensive research and development (R&D) activities, are creating a positive physical vapor deposition on plastics market outlook across the region.

Some of the major players in the physical vapor deposition on plastics market include Aalberts Surface Technologies, Bend Plating, HEF Group, Mar-Bal, Inc, RÜBIG Technologie GmbH & Co KG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)