Photovoltaic Materials Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

Photovoltaic Materials Market Size and Share:

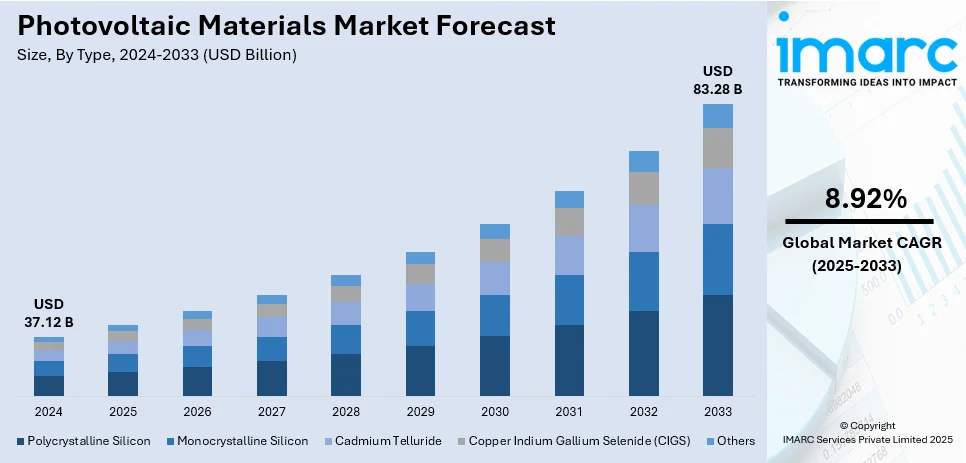

The global photovoltaic materials market size was valued at USD 37.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 83.28 Billion by 2033, exhibiting a CAGR of 8.92% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 55.4% in 2024. The rising environmental concerns and climate change, implementation of favorable government policies, rapid technological advancements, increasing investment in the development of advanced photovoltaic materials, and rising energy demands across the globe are some of the major factors propelling the photovoltaic materials market share.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.12 Billion |

| Market Forecast in 2033 | USD 83.28 Billion |

| Market Growth Rate (2025-2033) | 8.92% |

The global photovoltaic materials market is primarily driven by the growing demand for renewable energy sources, especially solar power, to combat climate change and reduce dependence on fossil fuels. Along with this, government incentives and subsidies for solar energy adoption, alongside increasing energy prices, further enhance market growth. Technological advancements in solar cell efficiency and material innovations, such as perovskite solar cells, enhance performance and cost-effectiveness. On 19th December 2024, Qcells achieved a world record 28.6% efficiency for tandem solar cells, that combines silicon and perovskite layers. Verified by Fraunhofer ISE CalLab, this breakthrough promises reduced costs and land usage, potentially revolutionizing solar projects. The record was reached on a full-area M10-sized cell produced in Germany, marking a key step toward mass production. Additionally, the rising global focus on sustainable development and the reduction of carbon footprints encourages investments in solar energy infrastructure, creating a favorable environment for the expansion of the photovoltaic materials market.

The United States stands out as a key regional market, primarily driven by favorable government policies and economic incentives. This can be attributed to the Federal tax credits, such as the Investment Tax Credit (ITC), along with state-level incentives, significantly reduce the cost of solar installations, fueling demand. The country’s commitment to clean energy targets and carbon neutrality by 2050 further accelerates market growth. As per a recent IEA report, the U.S. has introduced a set of policies on clean electricity tax credits and accelerating renewable energy connections to enhance the share of renewables in the power mix from 22% in 2023 to 34% by 2028. The U.S. is also investing more in nuclear energy, low-carbon fuels, and battery storage, six times more than it was four years ago. All these will continue to strive toward the goal of 100% carbon-free electricity by 2035. Concurrently, ongoing innovations in photovoltaic technology, including advances in efficiency and material durability, make solar energy more affordable and accessible. These factors, coupled with rising electricity costs, create a positive photovoltaic materials market outlook in the U.S.

Photovoltaic Materials Market Trends:

The rising environmental concerns and climate change

The increasing urgency to address environmental issues and mitigate climate change's effects plays a pivotal role in the growing demand for photovoltaic materials. There's an accelerating shift towards cleaner, more sustainable energy sources. Solar energy, harnessed through photovoltaic materials, offers a zero-emission solution that significantly reduces the carbon footprint. In 2023, solar PV accounted for 75% of global renewable capacity additions, according to the International Energy Agency (IEA). Moreover, compared to conventional energy sources, solar energy does not entail harmful byproducts or contribute to environmental degradation. Consequently, nations worldwide are ramping up their renewable energy targets and incorporating solar energy into their plans, which in turn is facilitating the product demand. Furthermore, photovoltaic technologies' adaptability to a wide range of applications, from residential rooftop panels to large solar farms, makes them an accessible and practical choice for many, further enhancing the market.

The implementation of supportive government policies

Government support in the form of favorable policies, incentives, and subsidies for renewable energy are acting as significant photovoltaic materials market trends. This support is in response to global commitments to reduce greenhouse gas emissions, with solar power recognized as a significant part of the solution. According to the World Meteorological Organization (WMO), global carbon dioxide (CO2) emissions reached 41.6 Billion Tonnes in 2024, up from 40.6 Billion Tonnes the previous year. Many governments across the globe are offering financial incentives to promote the installation of solar energy. For instance, feed-in tariffs, tax credits, and grants reduce the overall cost of solar installations, making solar energy more affordable and attractive. Net metering policies, allowing owners of photovoltaic systems to sell excess power back to the grid, add another financial benefit. Furthermore, several governments mandate renewable energy quotas for utilities, promoting investment in solar energy infrastructure. Collectively, these efforts stimulate the photovoltaic materials market demand.

Rapid technological advancements

Continuous technological advancements and intensive research and development (R&D) activities are also major factors driving the photovoltaic materials market. In line with this, rapid technological innovations offer more efficient, durable, and versatile photovoltaic materials that are widely used in a broader array of applications and environments is favoring the market growth. Moreover, the advent of perovskite solar cells, with their high efficiency and flexibility, opens new possibilities for solar energy usage. According to the International Energy Agency (IEA), solar PV generation was influenced by a record 270 TWh (a 26% increase) in 2022, reaching nearly 1,300 TWh. Advances in manufacturing processes are also reducing the cost of producing photovoltaic materials, making solar power more competitive with traditional energy sources. Additionally, research and development (R&D) activities are focused on developing materials that can harness more of the solar spectrum, further improving efficiency. Technological breakthroughs continue to enhance photovoltaic materials' capabilities and cost-effectiveness, which in turn is anticipated to drive the photovoltaic materials market growth.

Photovoltaic Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global photovoltaic materials market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, material, and application.

Analysis by Type:

- Polycrystalline Silicon

- Monocrystalline Silicon

- Cadmium Telluride

- Copper Indium Gallium Selenide (CIGS)

- Others

Polycrystalline silicon stands as the largest component in 2024 due to a combination of performance characteristics, manufacturing advantages, and cost-effectiveness. It exhibits excellent light-absorption characteristics, making it highly efficient in transforming sunlight into electricity. Furthermore, its high purity ensures fewer impurities, resulting in better performance and a longer lifespan, making it a preferred choice for long-term installations. Additionally, polycrystalline silicon is produced by melting silicon and pouring it into a square mold, which is less wasteful than the process used to make monocrystalline cells. This straightforward and less wasteful manufacturing process results in a lower cost per watt, a critical factor for many end-users. Moreover, it offers a competitive price-performance ratio, making it an affordable choice for large-scale installations without compromising efficiency. This balance between cost and performance makes it particularly attractive for projects with strict budget constraints.

Analysis by Material:

- Front Sheet

- Encapsulant

- Back Sheet

- Others

Encapsulant leads the market in 2024 due to their indispensable role in the protection and longevity of solar cells. They serve as a barrier against moisture, dust, and corrosive elements, all of which can affect the cells' efficiency and lifespan. This protection is critical for the photovoltaic modules to maintain their performance over decades, as required in many solar installations. Moreover, encapsulants ensure the mechanical integrity of photovoltaic modules. They provide structural stability, helping to protect the delicate internal components from physical shocks or vibrations. Additionally, they contribute to load distribution across the module during times of high wind or snow pressure, minimizing potential damage. Apart from this, high-quality encapsulant materials exhibit excellent optical properties, allowing maximum light to reach the photovoltaic cell, thus optimizing its power generation capability.

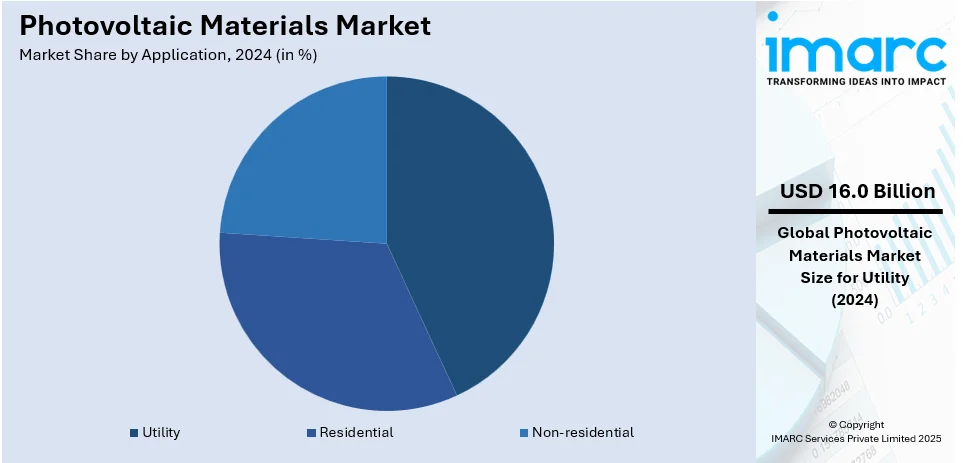

Analysis by Application:

- Utility

- Residential

- Non-residential

Utility leads the market with around 43.2% of market share in 2024 due to the sheer scale of energy production in the utility sector, which lends itself to the extensive use of photovoltaic materials. Along with this, utility-scale solar farms cover large areas of land, incorporating thousands, or even millions, of individual photovoltaic cells. This large-scale usage naturally drives a significant demand for photovoltaic materials. Furthermore, solar power aligns closely with the aims of many utility companies and governments to diversify energy sources and reduce greenhouse gas emissions. Photovoltaic technology offers a renewable, clean source of electricity that can be harnessed on a large scale, making it a practical choice for the utility sector. Besides this, the cost-effectiveness of solar power is increasingly competitive with conventional sources of electricity, especially on a utility scale.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 55.4% as it has a strong presence of some of the largest manufacturers of photovoltaic materials globally, which leads to the increasing production of solar cells and modules. Furthermore, the region has advanced manufacturing capacities and infrastructures and supportive governmental policies that favor the growth of the solar industry. This energy demand is primarily fueled by the fast process of regional country industrialization and urbanization processes, further enhancing market growth. To fulfill the increasing energy demands sustainably, the regional countries are increasingly focusing on renewable sources of energy, with solar power being a primary option. Therefore, huge investments in solar power installations have generated upward demand for photovoltaic materials. Besides that, the Asia Pacific region geographically has a further advantage, with high solar irradiance received from the sun; hence, there is practical efficiency for producing solar power energy.

Key Regional Takeaways:

United States Photovoltaic Materials Market Analysis

In 2024, the US accounted for around 92.70% of the total North America photovoltaic materials market. The photovoltaic (PV) materials market in the United States is driven by a combination of favorable government policies, technological advancements, and a growing need to address environmental concerns. According to the U.S. Environmental Protection Agency (EPA), in 2022, U.S. greenhouse gas emissions totalled 6,343 Million Metric Tons (14.0 Trillion Pounds) of carbon dioxide equivalents, highlighting the urgent need for cleaner energy solutions. Federal incentives such as the Investment Tax Credit (ITC) and the Infrastructure Investment and Jobs Act (IIJA) provide financial support to accelerate the adoption of solar energy. Improvements in PV technology involve high-efficiency solar cells. In addition, new, innovative materials under development include perovskite; thus, an upward thrust to efficiency while further lowering costs for operation will emerge. A rich U.S. research and development environment encourages innovation related to photovoltaic materials. With the heightening concerns toward climate change, as well as enhanced energy security, people are embracing this source of electricity in their residences and businesses. California, followed by Texas has been leading a shift toward increased solar energy activities. Energy independence and decentralized power generation increase the demand for photovoltaic materials, and this will play in the transitional process towards global solar energy in the US.

Asia Pacific Photovoltaic Materials Market Analysis

The photovoltaic materials market in the Asia-Pacific (APAC) region is driven by rapid industrialization, population growth, and a shift toward cleaner energy solutions. According to Global Energy Monitor, ASEAN countries now have over 28 gigawatts (GW) of operating utility-scale solar and wind capacity, marking a 20% increase from 23 GW the previous year. The major players continue to invest strongly in solar energy infrastructure, thereby driving growth-China, India, and Japan included. China also has a manufacturing advantage in solar panels, and heavy subsidies and other incentives for the development of renewables support regional demand. Advances in thin-film solar cells continue to reduce manufacturing costs and efficiency improves. Increasing regional awareness of the sustainable environment and security of energy particularly in emerging nations such as India promotes the adoption of solar. A number of policy measures by the government in the area of green transition also promote growth in photovoltaic materials.

Europe Photovoltaic Materials Market Analysis

The photovoltaic materials market in Europe is experiencing significant growth, driven by robust government policies aimed at advancing renewable energy. According to the European Parliament, the EU has set a goal to reduce greenhouse gas emissions by 55% by 2030 and achieve climate neutrality by 2050, providing a clear roadmap for the expansion of clean energy solutions. Several European countries have set ambitious renewable energy targets that support residential and commercial solar installations, such as the placement of solar systems in Germany, France, Spain, and Italy. Moreover, investments in photovoltaic technologies and infrastructure are encouraged through the EU's Green Deal and national incentives. Technological innovations, such as high-efficiency photovoltaic panels and transparent solar technologies, drive cost reductions and improvements in performance. The commitment of the continent to becoming carbon neutral raises the demand for photovoltaic materials, wherein solar energy became a significant part of Europe's transition to energy sources. In addition, the factor of energy security, especially within the recent context of geopolitical moves, is leading to the pursuit of more distributed energy systems. This increased focus on sustainability and self-sufficiency in energy is further enhancing the demand for photovoltaic materials in Europe.

Latin America Photovoltaic Materials Market Analysis

In Latin America, the photovoltaic materials market is driven by the region's growing focus on sustainable energy. According to reports, Latin America and the Caribbean generated 64% of its electricity from clean sources in 2023, significantly outperforming the global average of 39%. Countries including Brazil and Mexico are leading investments in solar energy, supported by favorable government incentives and international climate agreements. The rising demand for clean energy solutions, along with decreasing solar panel costs and technological advancements, is accelerating solar adoption, making photovoltaic materials a key component of the region’s energy transformation.

Middle East and Africa Photovoltaic Materials Market Analysis

In the Middle East, the photovoltaic materials market is expanding rapidly, driven by the region’s abundant sunlight and a strong push toward renewable energy. According to Rystad Energy, the total solar capacity in the region reached 16 Giga Watts (GW) by the end of 2023 and is expected to approach 23 GW by the end of 2024. This growth is supported by significant investments from countries such as the UAE and Saudi Arabia, which are implementing ambitious renewable energy strategies as part of their Vision 2030 initiatives. The declining cost of photovoltaic materials, combined with favorable policies, is further accelerating solar adoption across the region.

Competitive Landscape:

The top companies are heavily investing in R&D, researching improvements in the efficiency and durability of photovoltaic materials as well as their cost. They are also probing into new materials and innovations that can widely popularize solar power, including perovskite and organic solar cells. Moreover, leading companies are extending their production capacities by expanding current places and constructing new plants that would match the escalating demand for photovoltaic materials. Also, these companies are forming strategic partnerships and collaboration agreements with other industry participants, research organizations, and governments to share their resources and capabilities for collaborative research studies, product inventions, and market penetration.

The report provides a comprehensive analysis of the competitive landscape in the photovoltaic materials market with detailed profiles of all major companies, including:

- American Elements

- COVEME s.p.a.

- DuPont de Nemours Inc.

- Ferrotec Holdings Corporation

- Honeywell International Inc.

- KYOCERA Corporation

- Merck KGaA

- Mitsubishi Materials Corporation

- Novaled GmbH (Samsung SDI Co. Ltd.)

- Targray

- Tata Power Solar Systems Limited (Tata Power Company Limited)

- Wacker Chemie AG

Latest News and Developments:

- December 2024: The Ministry of New and Renewable Energy (MNRE) announced a June 2026 deadline requiring solar companies to utilize only domestically manufactured photovoltaic cells in panels for procurement programs by the government. This move aims to enhance the country's solar PV manufacturing capacity, with the new regulation to be enforced starting June 1, 2026.

- November 2024: Indielux and EPP Solar introduced a 6 kW plug-in PV system, available for pre-order across Europe. The system featured "Ready2plugin" technology for easy installation without an electrician, with outputs ranging from 3 kW to 6 kW and battery capacities from 5.1 kWh to 25.6 kWh. It offered up to 55% cost savings compared to traditional systems.

- September 2024: Silfab Solar has launched new n-type bifacial modules for large-scale PV projects, offering 23% efficiency, improved shade tolerance, and durability. Available in 620 W to 640 W versions, the modules come with a 30-year power output guarantee. The company’s new South Carolina facility will provide 1 GW of cell production and 1.3 GW of module capacity.

- June 2024: Tandem PV has secured a USD 4.7 Million award from the U.S. Department of Energy to advance its thin-film solar technology. The project aims to combine silicon with perovskite materials, potentially increasing panel efficiency by 40%. Tandem PV's current tandem panels achieve 26% efficiency, 25% higher than traditional silicon, reducing installation and land costs.

- June 2024: DuPont and Desun Energy launched flexible solar panels with DuPont™ Tedlar® frontsheet at Intersolar Europe 2024. The Tedlar frontsheet improves solar panels by providing mechanical durability, abrasion resistance, outdoor reliability, and excellent light transmittance. This solution is suited for consumer applications such as mobile charging, portable devices, and recreational vehicles. Desun Energy highlighted its ability to customize solar panels for specific consumer needs, including balcony systems and outdoor power supplies.

Photovoltaic Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polycrystalline Silicon, Monocrystalline Silicon, Cadmium Telluride, Copper Indium Gallium Selenide (CIGS), Others |

| Materials Covered | Front Sheet, Encapsulant, Back Sheet, Others |

| Applications Covered | Utility, Residential, Non-residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Elements, COVEME s.p.a., DuPont de Nemours Inc., Ferrotec Holdings Corporation, Honeywell International Inc., KYOCERA Corporation, Merck KGaA, Mitsubishi Materials Corporation, Novaled GmbH (Samsung SDI Co. Ltd.), Targray, Tata Power Solar Systems Limited (Tata Power Company Limited), Wacker Chemie AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the photovoltaic materials market from 2019-2033.

- The photovoltaic materials market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the photovoltaic materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The photovoltaic materials market was valued at USD 37.12 Billion in 2024.

IMARC estimates the photovoltaic materials market to exhibit a CAGR of 8.92% during 2025-2033, reaching a value of USD 83.28 Billion by 2033.

The key factors driving the photovoltaic materials market include growing environmental concerns, the need for sustainable energy, and favorable government policies. Additionally, technological advancements in solar cell efficiency, increasing investments in renewable energy infrastructure, and rising global energy demand are also propelling the market.

Asia-Pacific currently dominates the photovoltaic materials market, accounting for a share exceeding 55.4%. This dominance is fueled by advanced manufacturing capabilities, favorable governmental policies, and a growing demand for solar energy due to rapid industrialization and urbanization in the region.

Some of the major players in the photovoltaic materials market include American Elements, COVEME s.p.a., DuPont de Nemours Inc., Ferrotec Holdings Corporation, Honeywell International Inc., KYOCERA Corporation, Merck KGaA, Mitsubishi Materials Corporation, Novaled GmbH (Samsung SDI Co. Ltd.), Targray, Tata Power Solar Systems Limited (Tata Power Company Limited), and Wacker Chemie AG, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)