Photonic Sensor Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

Photonic Sensor Market Size and Share:

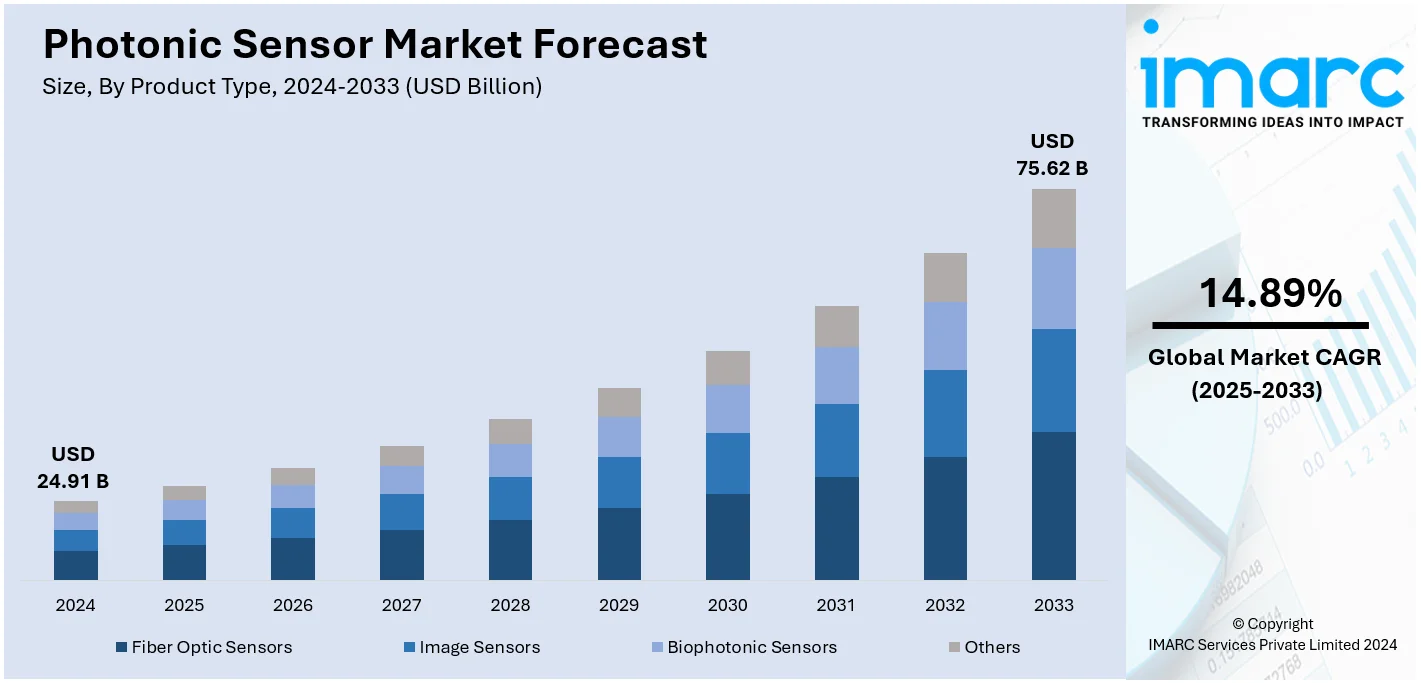

The global photonic sensor market size was valued at USD 24.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 75.62 Billion by 2033, exhibiting a CAGR of 14.89% from 2025-2033. North America currently dominates the market, holding a market share of over 34.3% in 2024. The ongoing advancements in fiber optics, increasing demand for precision in medical diagnostics, the rise of automation in manufacturing, expanding product applications in environmental monitoring, and the integration of photonics in security and defense technologies are some of the major factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.91 Billion |

|

Market Forecast in 2033

|

USD 75.62 Billion |

| Market Growth Rate (2025-2033) | 14.89% |

The market for photonic sensors is rapidly expanding. This is due to the improvement in the optical technologies and the expansion of the photonic sensors market owing to their high accuracy, performance, and capability to work in harsh environment for use in the healthcare, automobile, and telecommunication industries. Fiber optic and laser technological advancements are attributed to more investments on research & development, thus enhancing the efficiency of sensors and base of application. Besides this, photonic sensors are becoming increasingly important for contributing to industrial automation and smart infrastructure by providing monitoring and data collection capabilities. In addition, increasing attention to energy efficiency and environmental sustainability will include a contribution of photonic sensors to renewable energy systems and environmental monitoring solutions.

In the United States, the photonic sensor market is expanding rapidly due to the robust growth of the aerospace, defense, and healthcare industries. The governments’ initiative to embrace smart city and infrastructure construction has put into demand these sensors, especially in traffic management, security, and energy applications. Technological advancements in the country with the support of key manufacturers have also played a significant role to the growth of the market. Photonic sensors find application in diagnostics and imaging in the healthcare sector because of a growing need for precise and non-invasive solutions. Moreover, the growing number of partnerships between research institutions and companies is enhancing the application of the advanced photonic processes in multiple fields. For instance, in November 2024, IonQ, a U.S.-based leader in quantum computing, joined forces with imec to advance chip-scale ion trap technology and photonic integrated circuits. This partnership is focused on boosting quantum computing performance by lowering costs, minimizing hardware size, and accelerating time-to-market, all while enhancing reliability and qubit count.

Photonic Sensor Market Trends:

Increasing adoption of fiber optic sensors

One of the prominent photonic sensor market future trends strengthening the market growth is the expanding product utilization in fiber optic sensors due to their high sensitivity, immunity to electromagnetic interference, and ability to operate in harsh environments. In the oil and gas sector, fiber optic sensors are used for monitoring temperature, pressure, and strain along pipelines, ensuring safety and operational efficiency. The global fiber optics market size reached USD 14.4 billion in 2024. In aerospace, they help monitor structural health, detecting any potential issues in real-time to prevent failures. Similarly, civil engineering projects benefit from fiber optic sensors in structural health monitoring of bridges, tunnels, and buildings, providing early warnings of structural weaknesses. The telecommunications industry also employs fiber optic sensors to ensure the integrity of high-speed data transmission. The ability to provide accurate, real-time data in challenging environments is propelling the adoption of fiber optic sensors, thus contributing to the growth of the photonic sensor market growth.

Advancements in Biophotonics

Biophotonics involves the use of light-based technologies to study biological materials, and photonic sensors are integral to this field. The healthcare industry is witnessing a surge in the application of biophotonics for diagnostics, imaging, and therapeutic purposes. The global biophotonics market size reached USD 54.7 Billion in 2023. These sensors are used in medical diagnostics to detect diseases at an early stage with high precision. For instance, optical coherence tomography (OCT), a technique that employs photonic sensors, is widely used in ophthalmology for detailed imaging of the retina, encouraging the early detection of conditions like glaucoma and macular degeneration. The World Health Organization estimates that more than 2.2 Billion people worldwide experience some form of vision impairment or blindness. Besides this, photonic sensors are also used in lab-on-a-chip devices, enabling rapid and accurate analysis of blood samples and other biological fluids. The growing emphasis on non-invasive diagnostic techniques and the increasing prevalence of chronic diseases are driving the adoption of biophotonics, thereby fueling the photonic sensor market growth.

Expanding role of photonic sensors in environmental monitoring

With the increasing global focus on environmental protection and sustainability, there is a growing demand for advanced technologies to monitor and manage environmental conditions. According to PwC, 46% of consumers report purchasing more sustainable products to minimize their environmental impact. Photonic sensors are being deployed for a variety of environmental monitoring applications, including air quality monitoring, water quality assessment, and detection of hazardous gases. These sensors provide high sensitivity and specificity, enabling accurate detection of pollutants and contaminants at low concentrations. In air quality monitoring, photonic sensors can detect particulate matter, nitrogen dioxide, sulfur dioxide, and other pollutants, providing critical data for managing air pollution. In water quality assessment, they help detect contaminants such as heavy metals, pathogens, and organic compounds, ensuring the safety of drinking water and aquatic ecosystems. Consequently, the increasing regulatory requirements for environmental monitoring are bolstering the photonic sensor demand.

Photonic Sensor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global photonic sensor market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end use industry.

Analysis by Product Type:

- Fiber Optic Sensors

- Image Sensors

- Biophotonic Sensors

- Others

Fiber-optic sensors are an important area for the photonic sensor market, as they have high sensitivity to interference and appropriate performance in many harsh environments. The demand continues to drive itself in the areas of oil and gas, aerospace, civil engineering, and telecommunications, where they are primarily deployed. Temperature, pressure, and strain can be measured with great accuracy and reliability by using these sensors. Moreover, it enables operational safety and efficiency by providing accurate, real-time information even under difficult conditions, driving its extensive use. Additionally, fiber optic sensors’ capability to support high-speed data transmission and structural health monitoring further strengthens their market demand. The growing demand for robust, reliable, and high-performance sensing solutions across various sectors propels the prominence of fiber optic sensors.

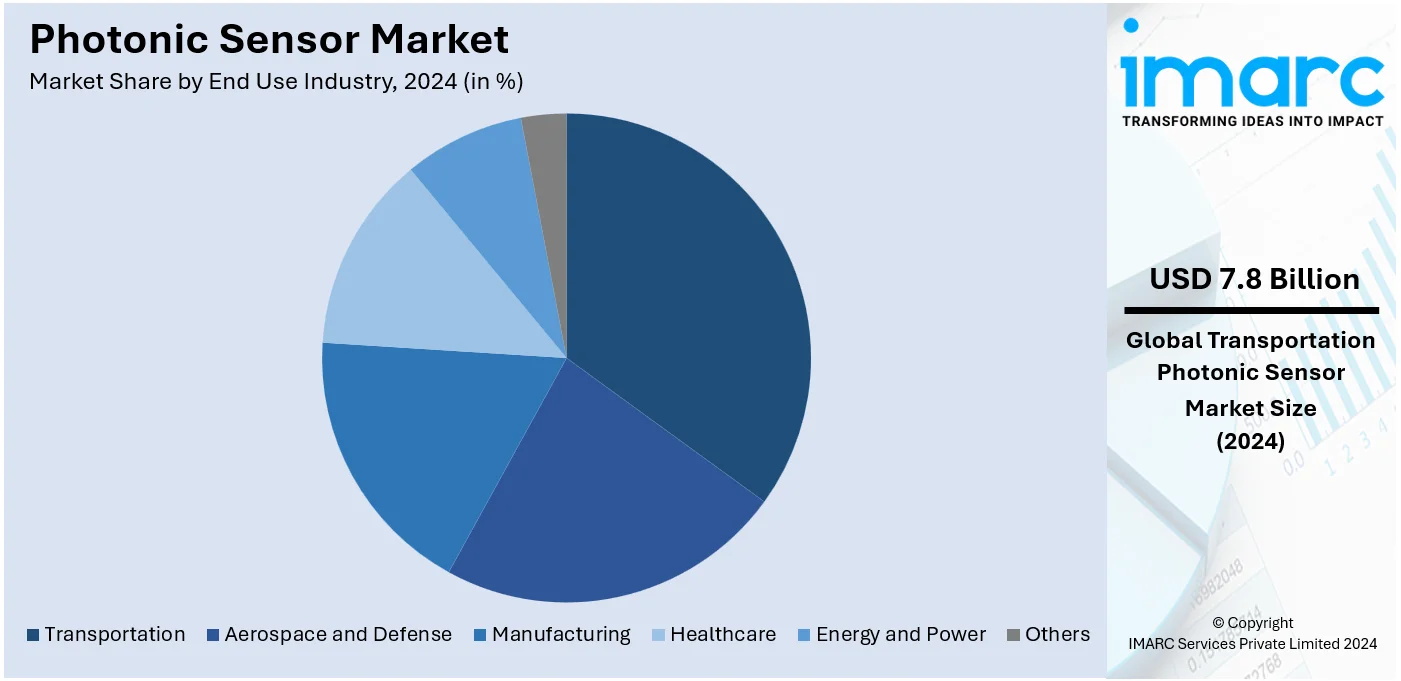

Analysis by End Use Industry:

- Aerospace and Defense

- Transportation

- Manufacturing

- Healthcare

- Energy and Power

- Others

Transportation leads the market with around 31.2% of market share in 2024. The transportation sector’s critical need for advanced sensing technologies to ensure safety, efficiency, and reliability is propelling the photonic sensor market share. Photonic sensors find applications mostly in the automotive, aerospace, and rail industries, such as structural health monitoring, collision avoidance systems, and traffic management. In the automotive sector, photonic sensors provide explicit information on the vehicle dynamics and surroundings to aid in developing advanced driver assistance systems (ADAS) and autonomous vehicles. In contrast, aerospace uses photonic sensors, which are employed to monitor structural integrity and real-time detection of any potential problems to prevent failures. The high sensitivity, accuracy, and robustness of photonic sensors make them indispensable in transportation, impelling the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.3%. Photonic sensor market analysis exhibits North America as the leading market region due to its advanced technological infrastructure, significant investments in research and development (R&D), and early adoption of innovative technologies. The region's robust industrial base, particularly in sectors like aerospace, defense, healthcare, and telecommunications, drives high demand for photonic sensors. The presence of key market players and leading research institutions fosters continuous innovation and product development. Along with this, stringent regulatory standards for safety and environmental monitoring in the United States and Canada further propel the adoption of photonic sensors. Moreover, the integration of photonics in emerging applications such as autonomous vehicles and smart cities is creating a positive outlook for market expansion.

Key Regional Takeaways:

United States Photonic Sensor Market Analysis

In 2024, United States accounted for 87.00% of the market share in North America. The U.S. photonic sensor market is experiencing significant growth, driven by technological advancements and increasing demand for automation across various industries. According to the Aerospace Industries Association (AIA), the U.S. aerospace and defense sector achieved a remarkable milestone in 2023, generating over USD 955 Billion in sales, a 7.1% increase from the previous year. This growth is directly influencing the demand for photonic sensors, particularly for applications in missile guidance, satellite monitoring, and surveillance within the aerospace and defense industry. In addition, the rise of industrial automation and the integration of photonic sensors into autonomous systems across manufacturing, transportation, and healthcare are fueling market demand. The healthcare industry’s use of photonic sensors for precise and non-invasive diagnostics is further boosting the market. Government initiatives supporting research and development in photonics and sensor technologies are also fostering innovation and market growth. Moreover, the growing adoption of photonic sensors in consumer electronics, automotive systems, and smart homes continues to open new market opportunities. As the U.S. embraces Industry 4.0 and smart manufacturing, the demand for photonic sensors is poised for accelerated growth in the coming years.

Europe Photonic Sensor Market Analysis

Europe is a key player in the global photonic sensor market, driven by advancements in technology, rising demand for automation, and a strong focus on sustainability. The region’s established presence in industries such as automotive, aerospace, and healthcare is fueling the adoption of photonic sensors in various applications. In countries like Germany, the automotive sector is driving market growth by integrating photonics into sensor systems for autonomous vehicles and advanced driver-assistance systems (ADAS). Additionally, the growing need for energy-efficient solutions in industrial automation is boosting the use of photonic sensors to optimize energy consumption and improve process control. According to the CBI, in 2021, the European average of IoT usage in enterprises stood at 29%, with the Netherlands performing below average at 21%. This points to significant opportunities for expanding the use of photonic sensors in IoT-based applications across the region. The healthcare sector is also leveraging photonic sensors for non-invasive medical diagnostics, imaging, and monitoring. Moreover, Europe's commitment to green energy and smart city initiatives is opening new avenues for photonic sensors in urban planning and environmental monitoring.

Asia Pacific Photonic Sensor Market Analysis

The Asia-Pacific region is witnessing rapid growth in the photonic sensor market, driven by significant technological advancements and increasing demand across various sectors. China is emerging as a global hub for consumer electronics and household appliances, leading the Asia-Pacific market with a sales share of approximately 48% last year, according to a recent report co-released by Ernst & Young and the China Chamber of Commerce for Import and Export of Machinery and Electronic Products. This growth is fueling the adoption of photonic sensors in consumer electronics and smart home technologies. Additionally, the region’s strong manufacturing base, particularly in China, Japan, and South Korea, is driving the integration of photonic sensors in industrial automation and robotics. The healthcare sector in APAC is also leveraging photonic sensors for advanced diagnostics and imaging, further boosting market demand. As government support for research and development in photonics technology grows, the photonic sensor market in the region is expected to continue its upward trajectory.

Latin America Photonic Sensor Market Analysis

The photonic sensor market in Latin America is growing, driven by increased demand for advanced technology in sectors such as automotive, industrial automation, and healthcare. According to the OECD, government and compulsory health insurance accounted for 57% of current health expenditure in Latin America and the Caribbean (LAC) in 2019, significantly below the OECD average of 74%. Voluntary payment schemes represented 11% of health expenditure in LAC, compared to just 6% on average in the OECD. As healthcare systems in the region evolve, there is a growing opportunity for photonic sensors in non-invasive diagnostics and medical imaging, boosting market potential.

Middle East and Africa Photonic Sensor Market Analysis

The photonic sensor market in the Middle East and Africa is gradually growing, driven by increasing industrial automation and infrastructure investments. According to the International Energy Agency (IEA), nearly 95% of electricity generated in the Middle East comes from natural gas and oil, the highest share globally, despite the region's abundant solar resources. This presents a unique opportunity for photonic sensors in energy monitoring, smart grid applications, and renewable energy projects, particularly in solar power initiatives. As governments focus on sustainability and technological advancements, the adoption of photonic sensors for energy efficiency and automation is expected to rise.

Competitive Landscape:

The photonic sensor market is intensely competitive, propelled by a robust emphasis on innovation and technological advancements to address diverse industry demands. Leading players as well as an equal number of emerging start-up companies invest heavily into research and development activities in terms of revenues for improving sensor precision, efficiency, and scalability, particularly in those areas of application such as healthcare, aerospace, and telecommunications. For instance, in June 2024, Wave Photonics, a Cambridge-based start-up, secured £4.5 million in funding, led by UK Innovation & Science Seed Fund and Cambridge Enterprise Ventures, to advance its on-chip photonics technology for quantum, biosensing, and data center applications. The funding will help transition their technology from research to commercial production, focusing on innovative applications. Strategic collaborations, mergers, and acquisitions are prevalent, allowing companies to strengthen their market positions and expand into emerging markets. Furthermore, adoption of advanced technologies lease fiber optics and laser-based solutions creates increasing opportunities of demand for innovations even speeds up competition, thereby creating new versions of improvements among the photonic sensor capabilities.

The report provides a comprehensive analysis of the competitive landscape in the photonic sensor market with detailed profiles of all major companies, including:

- A2 Photonic Sensors

- Banner Engineering Corp.

- Baumer Holding AG

- BaySpec Inc.

- Honeywell International Inc.

- LAP Laser LLC

- Mitsubishi Electric Corporation

- Omron Corporation

- Prime Photonics LC

- Samsung Electronics Co. Ltd.

- Smart Fibres Ltd. (Halliburton Company)

- Toshiba Corporation

Latest News and Developments:

- December 2024: RTX BBN Technologies is developing advanced photonic chip-scale quantum sensors under DARPA's INSPIRED program, aiming for over 10x the precision of current sensors. The project targets a sensitivity increase of 16 dB beyond conventional limits. These sensors will operate across a frequency range of 100 MHz to 10 GHz, enhancing applications in mapping, navigation, and biosensing.

- November 2024: Q.ANT launched its first commercial photonic processor, the Native Processing Unit (NPU), which promises 30x energy efficiency improvements over traditional CMOS technology. Built on the LENA architecture, it executes complex mathematics using light, enhancing performance for AI applications. Test results show a 43% reduction in parameters and a 46% decrease in operations for AI inference tasks. The NPU is available for pre-order, with delivery expected in February 2025.

- September 2024: InSpek has secured EUR 3.5 Million (USD 3.8 Million) in seed funding to advance its photonic sensor technology for real-time bioprocess monitoring. Using Photonic Integrated Circuits (PICs), InSpek’s sensors provide precise, scalable, and energy-efficient monitoring, promising improved efficiency and sustainability in biomanufacturing sectors like biopharma and biofuels.

- January 2024: Hamamatsu Photonics launched the S11639N-02 and S13496N-02 CMOS linear image sensors, designed to enhance precision in the VUV range. These sensors are tailored for spectrometers and analytical applications, offering improved sensitivity and functionality. They set new standards in imaging technology, making them ideal for a range of scientific and industrial uses.

- July 2023: Quantum Computing Inc. launched its Quantum Photonic Vibrometer (QPV), the first quantum-accelerated photonics vibrometer available on the market. This innovative device offers unprecedented sensitivity, speed, and resolution for remote vibration detection, sensing, and inspection.

Photonic Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fiber Optic Sensors, Image Sensors, Biophotonic Sensors, Others |

| End Use Industries Covered | Aerospace and Defense, Transportation, Manufacturing, Healthcare, Energy and Power, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A2 Photonic Sensors, Banner Engineering Corp., Baumer Holding AG, BaySpec Inc., Honeywell International Inc., LAP Laser LLC, Mitsubishi Electric Corporation, Omron Corporation, Prime Photonics LC, Samsung Electronics Co. Ltd., Smart Fibres Ltd. (Halliburton Company), Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the photonic sensor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global photonic sensor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the photonic sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The photonic sensor market was valued at USD 24.91 Billion in 2024.

The photonic sensor market is projected to exhibit a CAGR of 14.89% during 2025-2033, reaching a value of USD 75.62 Billion by 2033.

The market is primarily driven by the rising demand for high-precision sensing in industries like healthcare and aerospace, advancements in optical technologies, increasing adoption of IoT, and growing applications in environmental monitoring and smart infrastructure development.

North America currently dominates the market, accounting for a share of over 34.3%, driven by advancements in healthcare technology, growing industrial automation, robust R&D investments, increasing adoption in defense applications, and strong demand for smart technologies.

Some of the major players in the photonic sensor market include A2 Photonic Sensors, Banner Engineering Corp., Baumer Holding AG, BaySpec Inc., Honeywell International Inc., LAP Laser LLC, Mitsubishi Electric Corporation, Omron Corporation, Prime Photonics LC, Samsung Electronics Co. Ltd., Smart Fibres Ltd. (Halliburton Company), and Toshiba Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)