Photonic Integrated Circuit Market Size, Share, Trends and Forecast by Component, Raw Material, Integration, Application, and Region, 2026-2034

Photonic Integrated Circuit Market Size and Share:

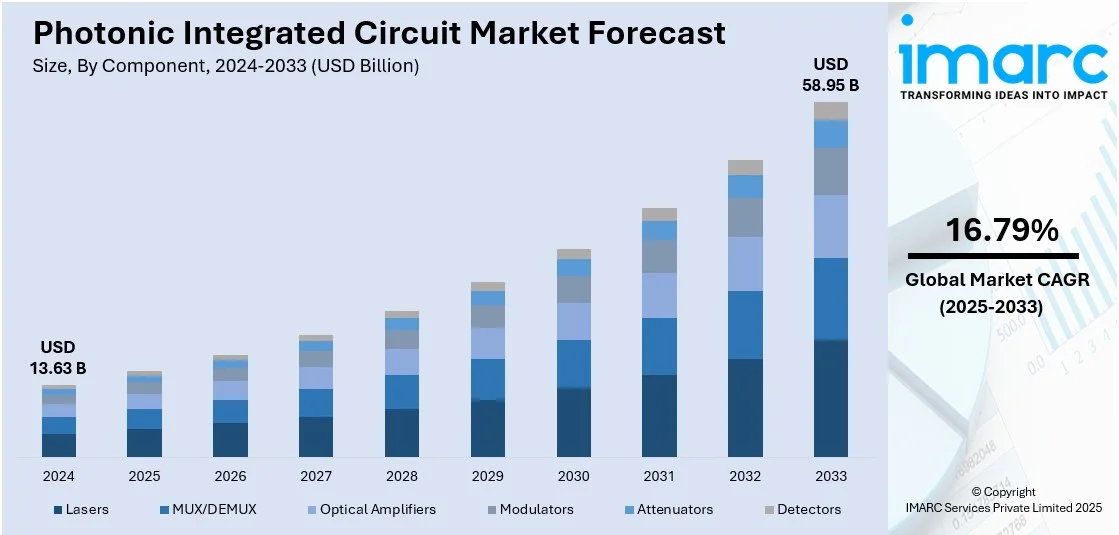

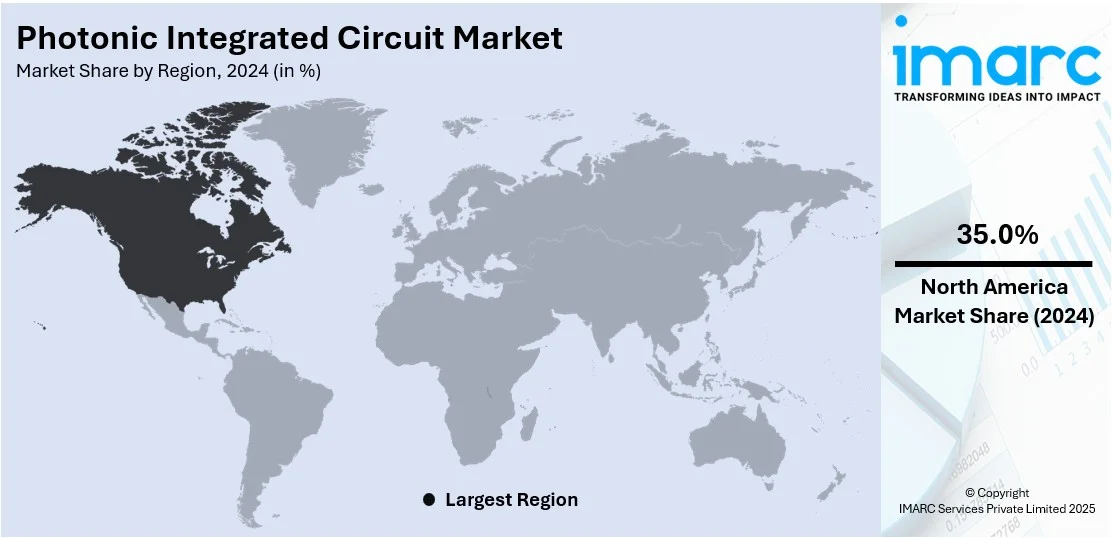

The global photonic integrated circuit market size was valued at USD 13.63 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 58.95 Billion by 2034, exhibiting a CAGR of 16.79% from 2026-2034. North America currently dominates the photonic integrated circuit market share by holding over 35.0% in 2024. The market in the region is primarily driven by strong investments in data centers, expansion of 5G infrastructure, and ongoing advanced semiconductor technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.63 Billion |

| Market Forecast in 2034 | USD 58.95 Billion |

| Market Growth Rate 2026-2034 | 16.79% |

The PIC market worldwide is fundamentally powered by the increasing data center growth, as it powers the demand for energy-efficient high-speed optical communication. For example, firms such as STMicroelectronics, partnered with Amazon Web Services (AWS), have created photonics chips via light rather than electricity to boost speed while lowering data center power consumption, solving this demand. Apart from this, the increasing 5G rollout increases the demand for sophisticated photonic chips to enable high-bandwidth, low-latency networks, supporting the market growth. Further, the growing use of artificial intelligence (AI) and cloud computing increases the demand for faster optical interconnects, supporting the market growth. Apart from this, continuous developments in silicon photonics facilitate cost-effective mass production, increasing adoption and giving a boost to the market. In addition, augmented government spending on photonic technology and quantum computing promote technological growth and commercialization, thereby driving the PIC market demand.

To get more information on this market, Request Sample

The United States holds a market share of 85.00% in the PIC market. The demand in the region is significantly driven by defense and aerospace advancements, as they fuel the demand for high-speed, secure optical communication in military and satellite applications. In line with this, strong semiconductor research and development (R&D) investments boost innovation in photonic chip design and manufacturing, thus strengthening the PIC market share. Additionally, the expansion of autonomous vehicles increases the need for LiDAR and optical sensing technologies, which is providing and impetus to the market. Furthermore, the growth in biomedical imaging and diagnostics boosts the use of PICs in advanced healthcare devices, contributing to the market expansion. Also, the rising adoption of high-performance computing (HPC) for AI and quantum computing drives demand for ultra-fast optical interconnects, aiding the market growth. Apart from this, government-backed initiatives for domestic semiconductor production enhance PIC supply chain resilience, thereby propelling the market forward.

Photonic Integrated Circuit Market Trends:

Expanding defense sector

The expanding defense sector is offering numerous opportunities for the market. The International Institute for Strategic Studies reports that in 2024 defense spending reached USD 2.46 Trillion which showed a USD 2.24 Trillion spend in 2023 with 1.9% of GDP allocation compared to 1.8% in 2023. The modern military uses advanced technology to achieve improved communication along with surveillance and precision targeting capabilities. These capabilities reach their peak performance through the role of PICs. The military also depends on secure and high-speed data transmission as a critical operational need. Moreover, optical communication systems made possible by PICs deliver higher bandwidth and faster speed along with better security characteristics than electronic systems. Besides this, the advancement of directed energy systems and laser-based weapons depends heavily on accurate control of optical signals. Furthermore, PICs serve to modify and control laser beam distribution when used for target acquisition purposes and protecting against potential threats. Photonic sensors built using PICs also boost situational awareness through their delivery of high-resolution images and infrared detection and Lidar functions. As a result, modern defense operations heavily rely on these technologies to conduct surveillance activities, perform reconnaissance duties, and detect threats. Furthermore, the defense industry widely adopts PICs because of their small size along with their capacity for seamless integration particularly in UAVs and military gear for soldiers. The market expansion is further driven by PICs as defense agencies worldwide are actively modernizing their capabilities through these photonic technologies.

Rapid technological advancements in photonics

Rapid technological advancements in photonics are influencing the PIC market trends. These advancements continually push the boundaries of what is possible regarding data processing, communication, and sensing using light-based technologies. Photonics has enabled the development of high-speed optical communication systems, essential for the ever-increasing demand for data transmission in applications like 5G, data centers, and long-distance fiber optics. As per recent industry reports, the global 5G connection count exceeded 1.76 Billion in 2023 with a 66% increase. PICs facilitate these high data rates with their ability to integrate various photonic components. Also, the development of new manufacturing methods enables the creation of smaller PICs which are more efficient. The downsizing of PICs serves critical purposes in operating mobile devices as well as biomedical equipment and aerospace systems. The foundation of modern quantum computing and quantum communication and LiDAR functions through photonics technology. Furthermore, PICs serve as essential components for managing and controlling photon behavior in modern cutting-edge fields. The evolution of photonics technology created better-performing optical sensors for environmental monitoring as well as healthcare and security applications. Apart from this, PICs maintain their role as a market-driving force in various sectors because of their versatility and efficiency which supports both technological advancements and sustained market expansion in light-based technologies.

Rapid expansion of data centers

The rapid expansion of data centers is fueling the PIC market growth. The IMARC Group reported that the data center market achieved USD 213.6 Billion in 2024 and it will pursue a 9.29% annual growth rate through 2025-2033. With the world becoming more digital every day, data centers are the pillars of cloud computing, storage, and internet services, requiring high-speed, efficient, and scalable solutions, all enhanced by PICs. Data centers need lightning-fast data transmission to process massive amounts of information. PICs provide high-speed optical communication between and within data centers, cutting latency and enhancing overall performance. The power consumption of data centers is a major concern. PICs use less energy than their electronic equivalents, enabling data centers to meet energy efficiency targets and cut operational expenses. As data centers expand to keep pace with growing data requirements, PICs offer a scalable solution. Their small form factor makes it possible to integrate them seamlessly into mature data center infrastructures. Photonic interconnects based on PICs are critical to linking servers, switches, and routers in data centers, optimizing data movement, and minimizing bottlenecks. With the relentless expansion of digital services and cloud computing, the demand for efficient, high-performance data centers remains unabated. PICs are at the forefront of this transformation, facilitating the growth and optimization of data centers and, consequently, enhancing the PIC market outlook.

Photonic Integrated Circuit Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global photonic integrated circuit market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, raw material, integration, and application.

Analysis by Component:

- Lasers

- MUX/DEMUX

- Optical Amplifiers

- Modulators

- Attenuators

- Detectors

Lasers stand as the largest component in 2024, holding around 40.3% of the market. They are fundamental components within PICs. The essential nature of lasers within PICs enables them to play a crucial role in different industry applications. The main application of optical communication systems depends on PICs through their fundamental role. The demand for high-speed data transmission, especially in 5G networks, data centers, and long-haul fiber optics, drives the need for more efficient and compact lasers within PICs. Furthermore, the devices find applications in LiDAR systems for autonomous vehicles as well as environmental monitoring and industrial process control. The ongoing advancement of such technologies requires PICs that utilize lasers to achieve better precision and reliability. Besides this, the medical field extensively uses lasers for diagnostic procedures along with surgical techniques and imaging purposes. Also, healthcare facilities advance their adoption of integrated laser PICs because these devices combine small size with affordable operation. These devices provide targeting functions, range detection features, and communication capabilities which find applications in defense and aerospace operations. The advancement of laser source technology using PICs results in more efficient laser devices. Additionally, quantum computing together with quantum communication functions because of these elements. The combination of PICs with lasers creates platforms that allow the processing of photons for quantum information needs.

Analysis by Raw Material:

- Indium Phosphide (InP)

- Gallium Arsenide (GaAs)

- Lithium Niobate (LiNbO3)

- Silicon

- Silica-on-Silicon

Indium Phosphide (InP) leads the market with around 45.6% of the market share in 2024. It is a pivotal raw material driving the growth of the PIC market. The exceptional optical and electronic properties of InP make it the base material for generating high-performance PICs. The PIC market relies on InP because of its broad bandgap range and high electron mobility which enables optical and electronic component compatibility for creating PICs that perform exceptionally in optical communication and sensing and computing applications. PICs based on InP materials also provide quick data transfer rates together with broad communication bandwidth and enhanced energy efficiency which supports the development of 5G networks and data centers as well as LiDAR systems and quantum computing. Furthermore, the continuous increase in demand for advanced optical solutions demonstrates the essential role InP plays as a raw material in developing state-of-the-art PICs. The market experiences strong growth and technological advancement because it relies on InP-based PICs.

Analysis by Integration:

- Monolithic Integration

- Hybrid Integration

- Module Integration

Monolithic Integration leads the market with around 48.9% of the market share in 2024. It is a pivotal category shaping the market. In this approach, researchers integrate all optical components such as laser waveguides and detectors onto one semiconductor substrate. Through monolithic integration, manufacturers achieve numerous essential benefits which include small dimensions alongside high functional performance and reduced costs. Moreover, PICs developed through monolithic integration provide optimal integration and efficiency performance which makes them suitable for critical applications including data centers, telecommunications networks, and optical sensing devices. Furthermore, the manufacturing process becomes straightforward through this method while alignment errors decrease, and the production of application-specific specialized PICs becomes possible. As a result, the continuous advancement of PIC technology through monolithic integration enables present-day industries to benefit from smaller yet faster photonic solutions.

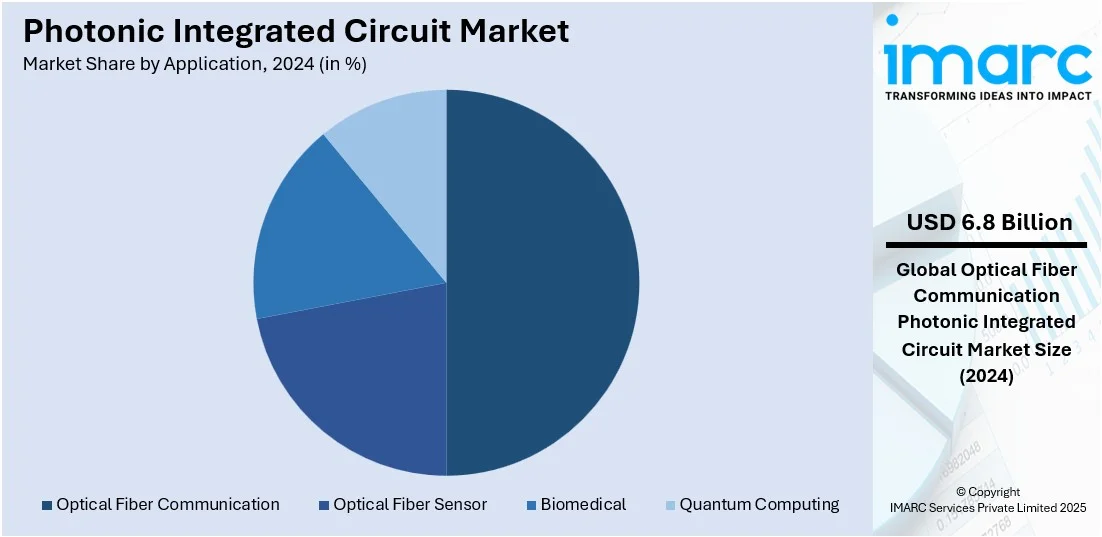

Analysis by Application:

- Optical Fiber Communication

- Optical Fiber Sensor

- Biomedical

- Quantum Computing

Optical Fiber Communication leads the market with around 50.2% of the market share in 2024. This communication is one of the primary applications propelling the growth of the PIC market. Optical fiber communication systems rely heavily on PICs because these devices operate as the fundamental infrastructure for quick data transmission and internet and telecommunication network operations. The integration of optical components including lasers and modulators with detectors and waveguides on single chips produces efficient cost-effective optical communication systems through PICs. PIC enhances data transmission speed, decreases power requirements, and enables more efficient handling of complex optical signals. Furthermore, the strong market requirement for PICs in optical fiber communication persists due to the expanding data traffic and increasing need for advanced and dependable communication systems. Apart from this, 5G technologies require PICs as essential components to fulfill rising requirements for high-capacity and low-latency optical communication networks which makes them a significant driver for market expansion in this vital application field.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0%. The region serves as a prominent region driving the market. With its growing technology sector and robust investments in research and development, it is at the forefront of PIC innovation and adoption. The region boasts a strong presence of leading PIC companies, research institutions, and universities focused on advancing photonic technologies. PICs find wide-ranging applications here, particularly in data centers, telecommunications networks, aerospace, and healthcare. Furthermore, the growing demand for high-speed internet, data analytics, and emerging technologies like 5G and quantum computing fuels the adoption of PICs. Besides, government initiatives and investments in infrastructure development bolster the expansion of optical communication networks, driving the need for more efficient and advanced PIC solutions. As a result, North America plays a pivotal role in shaping the global PIC market and remains a dynamic hub for innovation and market growth in this domain.

Key Regional Takeaways:

United States Photonic Integrated Circuit Market Analysis

The United States PIC market is primarily driven by advancements in telecommunications, data centers, and quantum computing. The increasing demand for faster data transmission and the need for efficient bandwidth utilization are significantly driving the adoption of PICs in optical communication systems. PICs solve data transmission challenges through their capability to provide quicker releases of reliable and power-efficient data delivery. The market growth for photonic chips is further supported by both cloud computing adoption and high-performance data center development since these devices perform better than conventional electronic circuits. IMARC Group reports that the United States data center market value reached USD 50.2 Billion in 2024 while experts predict it will grow to USD 65.4 Billion by 2033 with an annual growth rate of 8.9% from 2025 to 2033. Additionally, quantum computing development and sensor technology advancement depend strongly on PIC components, which drives the market growth. Furthermore, the US market growth in photonics is supported by its robust R&D capability and government backing of photonics innovation through various initiatives. As a result, the market expands due to integrated photonic innovations and sector-wide implementation of photonic integrated circuits as industries like healthcare, automotive and defense explore new applications.

Europe Photonic Integrated Circuit Market Analysis

The Europe PIC market is expanding due to the rising photonic technology scale and regional implementation of advanced manufacturing techniques. The European push to miniaturize integrated systems creates an opportunity for PICs to deliver effective complex optical solutions at affordable scales. The growth of the Internet of Things (IoT) combined with escalating demands for reliable communication networks drives the need for PICs because they deliver high-bandwidth data transfer while reducing power usage. The European emphasis on industrial automation and smart manufacturing activities creates a rising demand for photonic-based sensors along with monitoring systems. The photonic device market receives support from industry leadership partnerships as well as research institutions and startup collaborations which lead to innovative advances in photonic device technologies. The EU's digitalization efforts across the healthcare and automotive sectors and defense sectors alongside other industries generate rising demand for photonic sensors and optical interconnects with integrated solutions. The EU targets 90% of SMEs to achieve basic digital readiness before 2030 to reach digitalization goals. Business organizations within the area need to implement cloud computing and artificial intelligence solutions for at least 75% of their operational processes. PIC development receives support from European Union funding initiatives together with favorable photonics technology regulations and supportive policies that drive PIC commercialization.

Asia Pacific Photonic Integrated Circuit Market Analysis

The Asia Pacific PIC market is expanding due to rapid technological advancements and increasing demand for high-speed communication systems in the region. The rising demand for efficient data transmission comes from 5G network expansion which drives PIC adoption because these devices provide both enhanced bandwidth capabilities and power-saving advantages. For instance, according to the current industry trends, the latest 5G network connection share is 16.9% of the total connections in India which shows the penetration of the latest 5G in the country. The combination of manufacturing strength with semiconductor investments throughout the region fast-tracks photonics technology development. The demand for photonic sensors and LiDAR systems in the region is further increasing due to the growing interest in automation and autonomous vehicle technologies. The Asia Pacific market continues to expand due to government-backed research initiatives as well as healthcare and quantum computing market growth and increasing support for innovation.

Latin America Photonic Integrated Circuit Market Analysis

The Latin America PIC market is greatly benefiting from the expansion of 5G infrastructure across the region. According to current industry statistics, the 5G network connections in Latin America were estimated to be 67 million in the third quarter of 2024 with an increase of 19%. The rising amount of data requires PICs because they provide quick data transfer with decreased power usage thus becoming essential for telecommunications networks. Furthermore, the expanding focus on digital transformation together with industrial innovation within the region drives industry expansion. The market demand for high-performance optical solutions like PICs continues to rise because manufacturing and automotive industries and defense sectors adopt automation and smart technologies for faster data processing and enhanced connectivity.

Middle East and Africa Photonic Integrated Circuit Market Analysis

The Middle East and Africa PIC market is being increasingly propelled by rapid technological advancements and the region’s growing focus on diversification in sectors, such as defense, healthcare, and renewable energy (RE). The demand for high-performance low-energy solutions through PICs increased substantially because of growing infrastructural projects and smart cities applications in communication sensing and data processing. IMARC Group in its report stated that the Middle East Smart Cities market will grow at a CAGR of 22.82% during the forecast period 2025-2033. Additionally, the rising interest in quantum computing together with AI in the region drives new advancements in photonics technology. Apart from this, R&D investments coupled with international technology collaboration initiatives are significantly impelling the market growth in the region.

Competitive Landscape:

Market players in the global PIC industry are actively investing in R&D for next-generation photonic chips, focusing on higher integration, lower power consumption, and improved performance. Players are broadening strategic partnerships to hasten innovation, especially silicon photonics and quantum computing applications. Mergers and acquisitions are on the rise as leading players aim to enhance their market position and raise their technological capabilities. Market leaders are also expanding production facilities, spurred by growing demand in data centers, telecom, and autonomous technology. Startups are also emerging with disruptive PIC solutions, aimed at niche applications such as biosensing and LiDAR. Governments across the globe are investing in photonics research, leading to breakthroughs in photonic chip manufacturing and commercialization.

The report provides a comprehensive analysis of the competitive landscape in the photonic integrated circuit market with detailed profiles of all major companies, including:

- Broadcom Inc.

- ColorChip Ltd.

- Hamamatsu Photonics K.K.

- II-VI Incorporated

- Infinera Corporation

- Intel Corporation

- LioniX International

- POET Technologies

- VLC Photonics S.L. (Hitachi Ltd.).

Latest News and Developments:

- September 2025: CSEM established CCRAFT, a firm focused on the commercialization of photonic chip production. CSEM claimed to be the first company ready for manufacturing to offer integrated circuits utilizing thin-film lithium niobate (TFLN).

- May 2025: Shri S. Krishnan, Secretary of the Ministry of Electronics and Information Technology (MeitY), Government of India, launched two locally designed and developed silicon photonics products at CoE-CPPICS at the Indian Institute of Technology Madras (IIT Madras). IIT Madras collaborated with izmo Microsystems, a Bangalore-based company known for developing packaged integrated circuits, to tackle the limitations.

- January 2025: Voyant Photonics revealed the launch of its ‘CARBON’ FMCW LiDAR sensor, showcasing the globe's first genuinely efficient and cost-effective LiDAR on a chip with solid-state beam steering. Carbon’s highly integrated silicon photonic chip, with the size of a fingernail, offered high-resolution, millimeter accuracy for object identification. Voyant delivered outstanding performance and cost-effectiveness through the integration of optics on a LiDAR photonic integrated circuit.

- January 2025: Flexcompute introduced PhotonForge, an innovative platform designed to automate photonic development by integrating the entire process of creating PICs. As photonics rose to resolve the connectivity challenges of contemporary data centers, PhotonForge presented an all-encompassing strategy to address the sector's most urgent concerns.

Photonic Integrated Circuit Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Lasers, MUX/DEMUX, Optical Amplifiers, Modulators, Attenuators, Detectors |

| Raw Materials Covered | Indium Phosphide (InP), Gallium Arsenide (GaAs), Lithium Niobate (LiNbO3), Silicon, Silica-on-Silicon |

| Integrations Covered | Monolithic Integration, Hybrid Integration, Module Integration |

| Applications Covered | Optical Fiber Communication, Optical Fiber Sensor, Biomedical, Quantum Computing |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc., ColorChip Ltd., Hamamatsu Photonics K.K., II-VI Incorporated, Infinera Corporation, Intel Corporation, LioniX International, POET Technologies, VLC Photonics S.L. (Hitachi Ltd.)., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the photonic integrated circuit market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global photonic integrated circuit market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the photonic integrated circuit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The photonic integrated circuit market was valued at USD 13.63 Billion in 2024.

IMARC estimates the photonic integrated circuit market to exhibit a CAGR of 16.79% during 2025-2033, expecting to reach USD 58.95 Billion by 2033.

Key factors driving the photonic integrated circuit (PIC) market include rising data center expansion, rising 5G deployment, AI-driven high-performance computing, continuous advancements in silicon photonics, increasing demand for LiDAR in autonomous vehicles, ongoing biomedical imaging innovations, and increasing government investments in quantum computing and semiconductor manufacturing.

North America currently dominates the market, accounting for a share exceeding 35.0%. This dominance is fueled by strong semiconductor research and development (R&D) investments, rapid 5G and data center expansion, rising demand for artificial intelligence (AI)-driven computing, government support for domestic chip production, and increasing adoption of photonic technologies in defense and healthcare.

Some of the major players in the photonic integrated circuit market include Broadcom Inc., ColorChip Ltd., Hamamatsu Photonics K.K., II-VI Incorporated, Infinera Corporation, Intel Corporation, LioniX International, POET Technologies, VLC Photonics S.L. (Hitachi Ltd.)., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)