Photonic Crystals Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Photonic Crystals Market Size and Share:

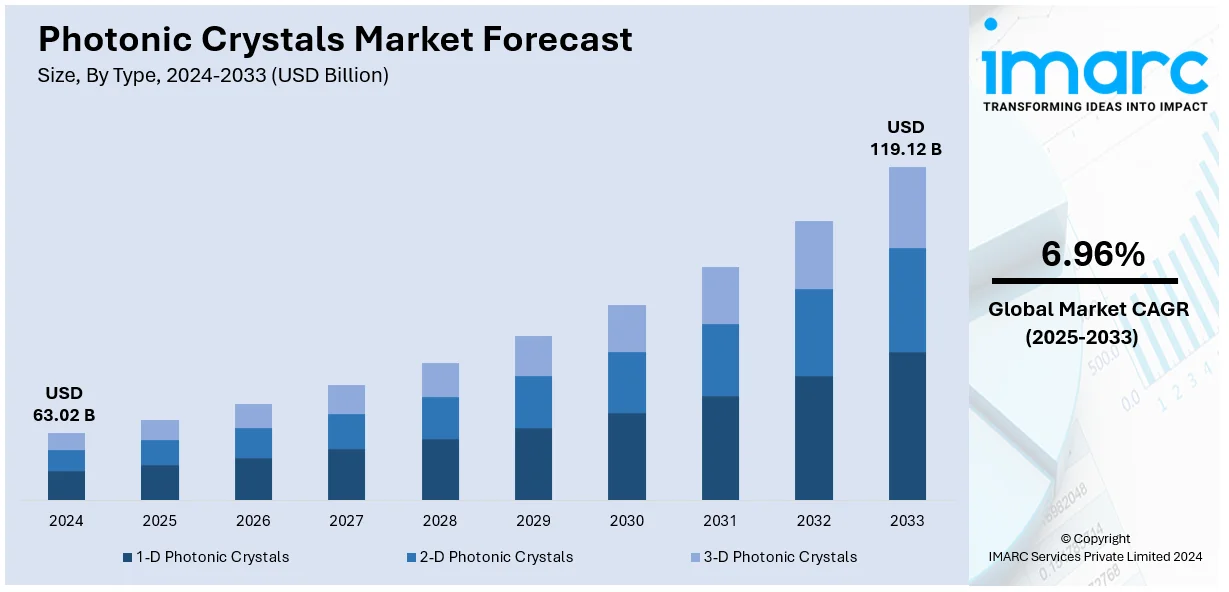

The global photonic crystals market size was valued at USD 63.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 119.12 Billion by 2033, exhibiting a CAGR of 6.96% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant photonic crystals market share of over 38.3% in 2024. Advancements in optical communication, sensor technologies, and demand for high-performance materials in electronics and photonics drive the market further toward the growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 63.02 Billion |

|

Market Forecast in 2033

|

USD 119.12 Billion |

| Market Growth Rate 2025-2033 | 6.96% |

Key factors including a rising demand for advanced materials in telecommunications, optical communications, and photonics are driving the market growth. The ability of photonic crystals to precisely control light allows the enhancement of the performance of fiber optics and communication systems. Additionally, photonic crystals find their increasing application in sensors, imaging, and displays, thus making the market grow, leading to more efficient and compact devices. Nanotechnology and material science advancements are making photonic crystals more accessible and cost-effective, encouraging adoption across industries like healthcare, automotive, and aerospace, thereby creating a positive photonic crystals market outlook. In addition to this, their role in energy-efficient applications, such as solar cells and LED technology, supports the global push for sustainable solutions. Research and development into new materials and applications continue to expand the market's potential.

To get more information on this market, Request Sample

In the United States, key factors driving the photonic crystals market include significant advancements in telecommunications and optical communication technologies. With increased demand for high-speed data transfer and efficient fiber optic networks, photonic crystals play a crucial role in enhancing performance. Strong emphasis on research and development in photonics, nanotechnology, and material science fosters innovation and application expansion in the country, while representing one of the key photonic crystals market trends. For example, a leading quantum computing company IonQ announced a partnership with NKT Photonics, a division of Hamamatsu Photonics, in November 2024, to purchase next-generation laser systems for IonQ's networking hardware and trapped-ion quantum computers. As part of the partnership, NKT Photonics will develop and supply three optical subsystem prototypes to IonQ by 2025. These subsystems will allow commercialization of its data center-ready quantum computers; these include the IonQ Tempo, as well as future barium-based devices. In addition, the advancement of sensor technologies in healthcare, automotive, and defense applications based on photonic crystals allowing greater precision and portability of devices drives demand in the market. The U.S. is also a leader in renewable energy initiatives, where photonic crystals are used in solar cells and energy-efficient lighting, which, in turn, is intensifying the photonic crystals market demand. In addition, government support for high-tech industries and infrastructure fuels market growth.

Photonic Crystals Market Trends:

Advancements in Optical Communication

The increasing demand for high-speed, reliable data transfer is driving the adoption of photonic crystals in optical communication systems. These materials allow for the precise manipulation of light, which improves the efficiency and performance of fiber optic networks and telecommunication devices. As global internet usage and digital transformation accelerate, photonic crystals play a crucial role in enhancing bandwidth, reducing signal loss, and supporting next-generation communication technologies, including 5G and beyond. Their ability to control light at nanoscale levels makes them indispensable for modern optical systems. For example, in May 2024, Lightwave Logic, a developer of optical communications technology, announced a collaboration with Advanced Micro Foundry (AMF) to manufacture polymer slot modulators on the AMF silicon photonics platform. The partnership comes after the companies had been collaborating for a year to develop electro-optic polymer slot modulators on 200-mm wafers using AMF's standard manufacturing process flow.

Expanding Applications in Sensors and Imaging

Photonic crystals are increasingly being used in advanced sensor technologies and imaging systems in various industries, such as healthcare, automotive, and aerospace, thereby driving the photonic crystals market growth. They have unique optical properties that provide high sensitivity, compact designs, and improved accuracy in detecting environmental changes, biological markers, or mechanical stress. In healthcare, they are critical for diagnostic devices, while in the automotive and aerospace sectors, they enhance safety and navigation systems. The increased adoption of such materials across different fields clearly explains their multidisciplinary adaptability and resultant demand in the market. Researchers from the study team of National Sun Yat-sen University announced the advent of new technique of "reverse electrostriction," in October 2024, which accelerates photonic crystal growth. CNA stated that technology could be applied for the highly effective photonics technology in creating optical sensors, displays, and medicinal imaging applications.

Emerging Role in Energy-Efficient Technologies

Energy-efficient applications such as solar cells and LED lighting use photonic crystals. The ability of photonic crystals to either significantly improve the absorption and emission of light helps increase the efficiency of renewable energy systems, making them play a crucial part for governments and industries that thrive in sustainability. Integration into clean energy solutions does help diminish climate change, leading to more widespread applications in green technologies. For example, Q.ANT, a leading photonic computing startup, in November 2024, released its first commercial product, Native Processing Unit (NPU) based on photonics, built based on the company's compute architecture, LENA or Light Empowered Native Arithmetics. Being based on industry-standard PCI-Express, it is completely compatible with the existing computing ecosystem. The Q.ANT NPU promises to provide at least 30 times more energy efficiency and notable computing speed increases over conventional CMOS technology by natively executing sophisticated, non-linear mathematics using light rather than electrons.

Photonic Crystals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global photonic crystals market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- 1-D Photonic Crystals

- 2-D Photonic Crystals

- 3-D Photonic Crystals

1-D photonic crystals stand as the largest type in 2024, holding around 42.2% of the market. 1-D photonic crystals dominate due to their simplicity and widespread use in optical coatings, mirrors, and filters. These crystals are easy to fabricate and cost-effective, making them ideal for applications in telecommunications, lasers, and light-emitting devices. Their ability to control light propagation in one dimension makes them essential for enhancing the efficiency of fiber optic communication and energy-efficient displays. Industries value their versatility, as they are integrated into technologies requiring precise light reflection or transmission, such as antireflective coatings and wavelength-selective filters, driving their significant market share.

Analysis by Application:

- Optical Fiber

- LED

- Image Sensor

- Solar and PV Cell

- Laser

- Discrete and Integrated Optical Component

- Others

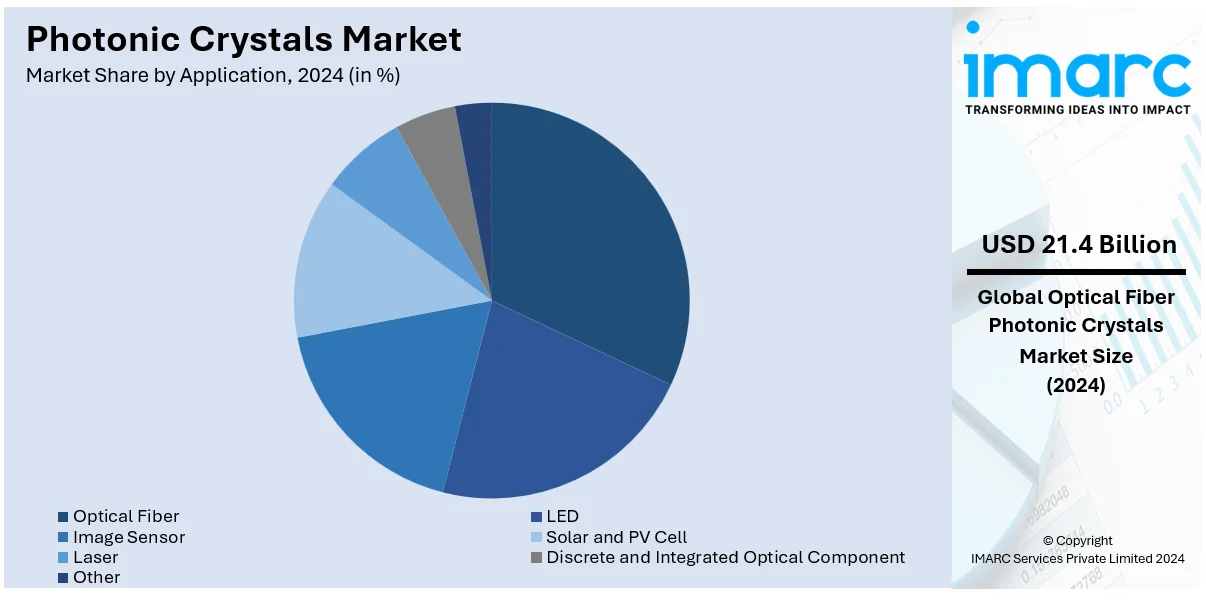

Optical fibers stand as the largest application in 2024, holding around 34.0% of the market. Optical fibers hold a large share of the photonic crystals market due to their critical role in telecommunications and data transmission. Photonic crystals enhance the performance of optical fibers by reducing signal loss, improving bandwidth, and enabling precise light control. This makes them essential for high-speed internet, 5G networks, and data centers. Additionally, their use in sensing applications, such as environmental monitoring and medical diagnostics, further boosts demand. The increasing reliance on robust optical communication systems and global digitalization ensures their continued dominance in the photonic crystals market.

Analysis by End User:

- Industrial

- Aerospace and Defense

- Life Sciences and Healthcare

- Research and Development (R&D)

- Others

The industrial sector holds a large share of the photonic crystals market due to their applications in manufacturing, automation, and precision engineering. Photonic crystals are employed in sensors, optical systems, and controls in processing providing better performance and efficiency in material characterization, quality control, and environment monitoring. Their ability to control light results in improved measurement and inspection devices used extensively in the automotive, electronics, and manufacturing industries. As companies require more reliable and effective systems, photonic crystals serve a fundamental role in enhancing the manufacturing processes and advancing overall operational efficiency.

The two main applications for photonic crystals are the aerospace and defense industries as these industries have strong demand for optical systems in navigation, communication, and surveillance, etc. Being able to manipulate light with great precision is the biggest strength of photonic crystals and is applied in sensors, radar and imaging applications that require high performance. They offer compact, energy-efficient, and long-lasting solutions due to the unforgiving conditions of aerospace and defense-related operations. The increasing capital expenditure in defense systems and a need for better targeted and accurate systems guarantee the perpetual advancement of photonic crystals in these industries.

The life sciences and healthcare sectors hold a substantial share of the photonic crystals market due to their applications in medical imaging, diagnostics, and sensor technologies. Photonic crystals enhance the sensitivity and accuracy of imaging devices like optical coherence tomography (OCT) and endoscopes, providing better resolution for medical professionals. In diagnostics, they enable more precise biosensors for detecting diseases at primitive stages. As the healthcare industry continues to invest in advanced technologies for improved patient care, the demand for photonic crystal-enabled solutions in medical devices and systems is expected to rise, further securing their dominance in this market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.3%. In the Asia-Pacific region, the rapid growth of the IT industry has fostered increased adoption of photonic crystals. As per the National Association of Software and Service Companies (NASSCOM), the IT industry in India revenue generation reached USD 227 Billion in FY22, which represents a 15.5% YoY growth, and was estimated to have reach USD 245 Billion in FY23. As businesses and organizations continue to push for faster, more efficient computing and networking solutions, photonic crystals have emerged as a viable solution to meet these demands. These optical materials offer significant improvements in data transmission speed, efficiency, and energy consumption, making them an attractive option for the growing IT infrastructure in the region. The proliferation of data centers, telecommunications, and cloud computing services has heightened the need for better optical components that can support high-speed data transfer. Photonic crystals, with their novel capacity to control light, have proven essential in applications such as optical communications, data processing, and integrated photonic circuits. As the IT sector continues to grow, the adoption of photonic crystals is expected to further increase, accelerating the development of next-generation communication networks and computing technologies.

Key Regional Takeaways:

North America Photonic Crystals Market Analysis

In North America, the photonic crystals market is driven by several factors, including the region's strong focus on research and development in advanced technologies like telecommunications, quantum computing, and photonics. Significant investments in innovation and technology by both public and private sectors foster the development of new photonic crystal applications. The rising demand for high-speed optical communication systems, including fiber optics and 5G networks, supports market growth. Additionally, North America's leadership in healthcare and life sciences sectors drives the adoption of photonic crystals in medical imaging, sensors, and diagnostic devices. The region's growing emphasis on energy-efficient solutions, including solar energy and LED lighting, further contributes to the demand for photonic crystal-based technologies, ensuring sustained market growth.

United States Photonic Crystals Market Analysis

In 2024, the United States accounted for the largest market share of over 87.80% in North America. The increasing adoption of photonic crystals is closely linked to the expansion of sectors such as aerospace and defense in the United States. According to reports, since 1980 U.S. defense spending has surged by 62%, from USD 506 Billion to USD 820 Billion by 2023, highlighting growing investment in defense sectors. The demand for advanced technologies in this area has significantly boosted the need for highly efficient and precise optical devices. Photonic crystals, known for their ability to control light at very small scales, have become critical in the development of laser systems, sensors, and communication technologies used in military and aerospace applications. The rise of complex satellite systems, surveillance technologies, and communication networks has created a demand for more effective optical materials, driving the growth of photonic crystal usage. Additionally, advancements in optics, imaging systems, and detection technologies within these industries have contributed to their widespread integration into military and aerospace projects. This growing interest underscores the role of photonic crystals in enhancing the performance and capabilities of cutting-edge equipment and infrastructure in these sectors.

Europe Photonic Crystals Market Analysis

In Europe, the rising adoption of renewable energy technologies has led to a growing demand for photonic crystals, as these materials enhance the performance of energy conversion and storage systems. According to reports, in 2023, renewable energy consumption in the EU rose to 24.5%, reflecting growth from 23.0% in 2022. Photonic crystals are increasingly utilized in solar energy applications, where they help to improve the efficiency of light absorption and conversion in photovoltaic cells. As governments and industries continue to prioritize the transition to cleaner and more sustainable energy sources, the demand for advanced optical technologies in solar power generation has surged. Additionally, photonic crystals are finding use in wind energy systems and energy storage solutions, where they contribute to the optimization of energy production and distribution. Their ability to manipulate light at various wavelengths makes them invaluable in improving the performance of renewable energy devices, ensuring more efficient harnessing and storage of energy. The growing emphasis on sustainable energy solutions in Europe has thus significantly driven the uptake of photonic crystals across various renewable energy applications.

Latin America Photonic Crystals Market Analysis

In Latin America, the healthcare sector's expansion has spurred the adoption of photonic crystals, particularly in diagnostic and imaging technologies. According to International Trade Administration, Brazil, the largest healthcare market in Latin America, drives growth with a 9.47% GDP expenditure equating to USD161 Billion. These materials, with their ability to manipulate light at a microscopic level, have found valuable applications in medical imaging systems such as optical coherence tomography (OCT) and endoscopy. As the governments of the various countries in the region continually invest in healthcare infrastructure and modern medical technologies, the demand for more efficient, high-resolution imaging tools has increased. Photonic crystals offer significant advantages in terms of image clarity, speed, and precision, making them ideal for various diagnostic purposes. Furthermore, the adoption of photonic crystal-based sensors in healthcare applications is also growing, as they provide enhanced sensitivity and accuracy in detecting biomarkers and other vital parameters.

Middle East and Africa Photonic Crystals Market Analysis

The adoption of advanced materials in the aerospace sector is bolstered by photonic crystals' role in improving operational efficiency and enabling innovative solutions. Their ability to enhance communication systems and sensor technologies supports seamless operations and improved safety in aviation services. According to reports, the UAE’s aerospace market is projected to grow from USD 308.67 Billion in 2023 to USD 369.24 Billion in 2024, marking a significant 19.6% increase. Furthermore, photonic crystals contribute to reducing the weight of components, enhancing fuel efficiency and overall performance in aircraft systems. These materials are also instrumental in developing next-generation avionics and navigation systems, ensuring reliability in challenging environments. The aerospace sector's growing focus on adopting technologies that meet stringent operational standards further underscores the significance of photonic crystals in driving progress and innovation.

Competitive Landscape:

The photonic crystals market is highly competitive, with key players focusing on innovation, product development, and strategic collaborations to expand their market presence. Major companies include NKT Photonics, Opalux Inc., Photonic Lattice Inc., and Nanoptek Corporation, which specialize in advanced photonic crystal technologies for diverse applications. Emerging startups and academic research contribute to the market with breakthroughs in nanotechnology and material science. Companies compete on factors such as cost efficiency, customization, and application versatility, targeting industries like telecommunications, healthcare, and renewable energy. Increasing investments in R&D and the growing demand for sustainable and efficient optical systems drive competition in this dynamic market.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Corning Incorporated

- G&H Group

- GLOphotonics

- Hamamatsu Photonics K.K.

- IPG Photonics Corporation

- NKT Photonics A/S

- Opalux Inc.

- Photonic Lattice Inc.

Latest News and Developments:

- December 2024: Jij Inc. and ORCA Computing have partnered to enhance quantum technology for logistics, energy, and manufacturing. Their collaboration aims to combine ORCA's photonic quantum systems with Jij's algorithm expertise to develop advanced solutions. ORCA’s room-temperature quantum technology offers practical benefits, including improved communication speed and reduced costs. This initiative aligns with Japan-UK agreements, such as the Hiroshima Accord, promoting joint innovation and technology standardization.

- December 2024: Researchers at CEA-Leti have developed a compact device that combines light sensing and modulation by integrating a liquid crystal cell with a CMOS image sensor. This innovation allows for enhanced optical alignment, scalability, and improved optical wavefront compensation, which can boost applications in microscopy and medical imaging. The device's ability to locally sense and control light-phase modulation offers significant advantages over traditional systems, enabling better performance in complex optical environments.

- December 2024: RTX’s BBN Technologies, backed by DARPA’s INSPIRED program, is developing a compact, low-power quantum photonic sensor offering over ten times the precision of conventional sensors. The collaboration with Xanadu Quantum, University of Maryland, and Raytheon’s Advanced Technology aims to create a prototype chip-scale detector that minimizes photon noise. This innovation promises to enhance defense and commercial applications like LiDAR, biosensing, and communications by achieving detection sensitivity 16 dB below the shot noise limit.

- December 2024: POET Technologies Inc. has signed agreements with Globetronics Manufacturing Sdn. Bhd. to produce optical engines in Penang, Malaysia. The company also shared updates on acquiring the minority equity interest in its Chinese joint venture, Super Photonics Xiamen (SPX). Additionally, POET addressed its recently announced public offering.

- May 2024: Hamamatsu has successfully acquired NKT Photonics, making it a subsidiary and expanding its portfolio with fiber lasers and photonic crystal fibers. The acquisition was completed for approximately USD 268 Million, higher than the initially expected price due to increased net debt. NKT Photonics will maintain its operating structure under Hamamatsu's ownership.

Photonic Crystals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | 1-D Photonic Crystals, 2-D Photonic Crystals, 3-D Photonic Crystals |

| Applications Covered | Optical Fiber, LED, Image Sensor, Solar and PV Cell, Laser, Discrete and Integrated Optical Component, and Others |

| End Users Covered | Industrial, Aerospace and Defense, Life Sciences and Healthcare, Research and Development (R&D), and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Corning Incorporated, G&H Group, GLOphotonics, Hamamatsu Photonics K.K., IPG Photonics Corporation, NKT Photonics A/S, Opalux Inc., Photonic Lattice Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the photonic crystals market from 2019-2033.

- The photonic crystals market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the photonic crystals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The photonic crystals market was valued at USD 63.02 Billion in 2024.

IMARC estimates the photonic crystals market to reach USD 119.12 Billion by 2033 exhibiting a CAGR of 6.96% during 2025-2033.

The global photonic crystals market is driven by advancements in optical communication, increasing demand for energy-efficient technologies, growth in photonic sensors for healthcare and environmental monitoring, and rising applications in solar energy and integrated photonic circuits. Additionally, innovations in nanotechnology and miniaturization contribute to market expansion.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the photonic crystals market include Corning Incorporated, G&H Group, GLOphotonics, Hamamatsu Photonics K.K., IPG Photonics Corporation, NKT Photonics A/S, Opalux Inc. and Photonic Lattice Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)