Philippines Toys & Games Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Philippines Toys & Games Market Overview:

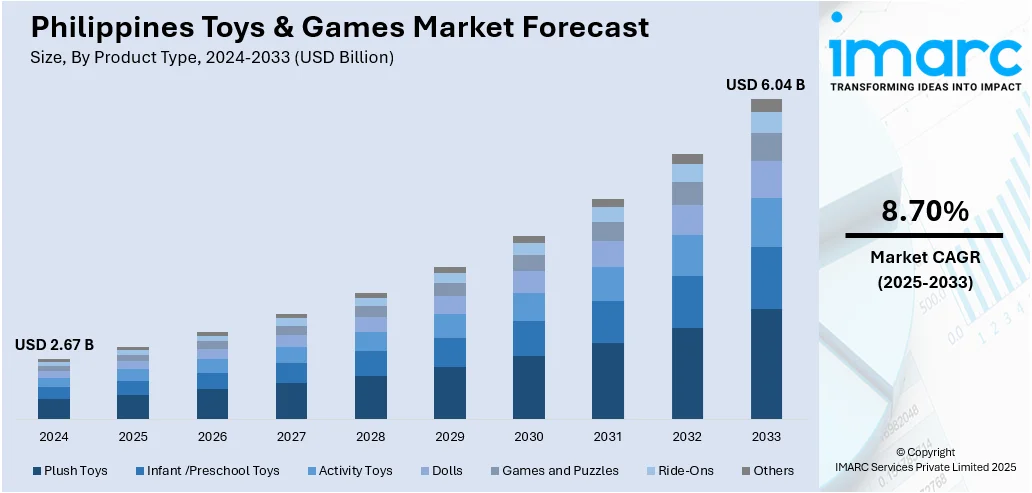

The Philippines toys & games market size reached USD 2.67 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.04 Billion by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is witnessing exponential growth, impacted by bolstering customer spending, an increasing middle class population base, and rapid emergence in requirement for both digital and educational toys. Key segments encompass action figures, dolls, and interactive games, with a robust emphasis on online retail channels, which are collectively creating a positive outlook for the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.67 Billion |

| Market Forecast in 2033 | USD 6.04 Billion |

| Market Growth Rate (2025-2033) | 8.70% |

Philippines Toys & Games Market Trends:

Growing Popularity of Educational Toys and STEM Products

In the Philippines, the demand for educational toys and STEM (Science, Technology, Engineering, and Mathematics) products is rapidly increasing. This trend is driven by the rising awareness among parents regarding the importance of early childhood education and skill development. Educational toys, including building sets, puzzles, and interactive learning devices, are seen as tools to enhance cognitive, motor, and problem-solving skills. As a result, Filipino parents are increasingly investing in products that offer both entertainment and educational value. Additionally, the government’s push for improving the country’s educational standards is influencing this demand. Retailers and brands are responding by expanding their portfolios to include STEM-related toys, which are marketed as fostering creativity and critical thinking. The expanding middle-class population and higher disposable incomes are also contributing to the rise of premium educational toys, positioning them as a lucrative segment in the toys and games market. For instance, as per industry reports, the government of Philippines has set the robust aim to transform the nation principally into a middle-class society by the year 2040.

To get more information on this market, Request Sample

Rise of Digital and Interactive Toys

Digital and interactive toys are becoming increasingly popular in the Philippine toys and games market, particularly among tech-savvy parents and children. These products blend traditional play with digital technology, offering engaging experiences through mobile apps, augmented reality (AR), or voice-controlled functions. The integration of technology in toys appeals to modern Filipino families who are seeking innovative play experiences that provide both entertainment and learning opportunities. Interactive toys such as robotic toys, programmable kits, and smart plush animals that respond to voice commands or movement are seeing significant demand. For instance, in July 2024, Tamashii Nations, a major action figure brand with robust presence in Philippines, announced the pre-order initiation of its robot toy figure Voltes V: Legacy, with a price of around P4,230. The product is set to launch in February 2025. Moreover, this trend is fueled by the growing penetration of smartphones and the internet, which has made digital play more accessible. Moreover, as the Philippines continues to improve its digital infrastructure, the potential for digital and interactive toys to expand further is high, positioning them as a future growth driver in the overall toys and games market.

Philippines Toys & Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plush Toys

- Infant /Preschool Toys

- Activity Toys

- Dolls

- Games and Puzzles

- Ride-Ons

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plush toys, infant/preschool toys, activity toys, dolls, games and puzzles, ride-ons, and others.

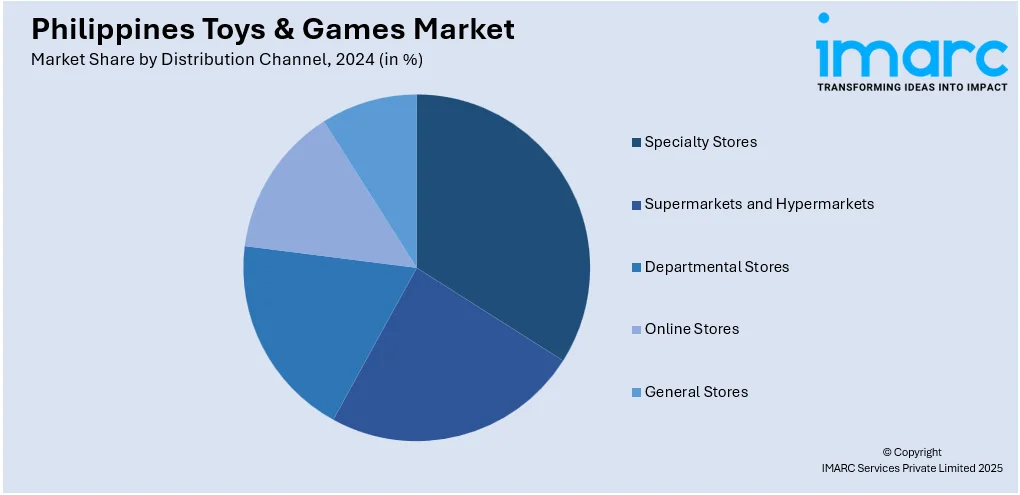

Distribution Channel Insights:

- Specialty Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- General Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores, supermarkets and hypermarkets, departmental stores, online stores, and general stores.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Toys & Games Market News:

- In October 2024, Mattel announced the launch of its new barbie doll Filipina. The doll's designing is influenced by Philippines couture style and is launched for pre-order.

- In November 2024, Pop Mart, a notable toy provider, unveiled its first pop-up outlet in Pasay City, Philippines, to cater to the magnifying demand for Labubu, a plush toy, across the nation.

Philippines Toys & Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plush Toys, Infant/Preschool Toys, Activity Toys, Dolls, Games and Puzzles, Ride-Ons, Others |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Departmental Stores, Online Stores, General Stores |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines toys & games market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines toys & games market on the basis of product type?

- What is the breakup of the Philippines toys & games market on the basis of distribution channel?

- What is the breakup of the Philippines toys & games market on the basis of region?

- What are the various stages in the value chain of the Philippines toys & games market?

- What are the key driving factors and challenges in the Philippines toys & games market?

- What is the structure of the Philippines toys & games market and who are the key players?

- What is the degree of competition in the Philippines toys & games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines toys & games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines toys & games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines toys & games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)