Philippines Remittance Market Report by Mode of Transfer (Digital, Traditional (Non-digital)), Type (Inward Remittance, Outward Remittance), Channel (Banks, Money Transfer Operators, Online Platforms (Wallets)), End Use (Migrant Labor Workforce, Personal, Small Businesses, and Others), and Region 2026-2034

Philippines Remittance Market Overview:

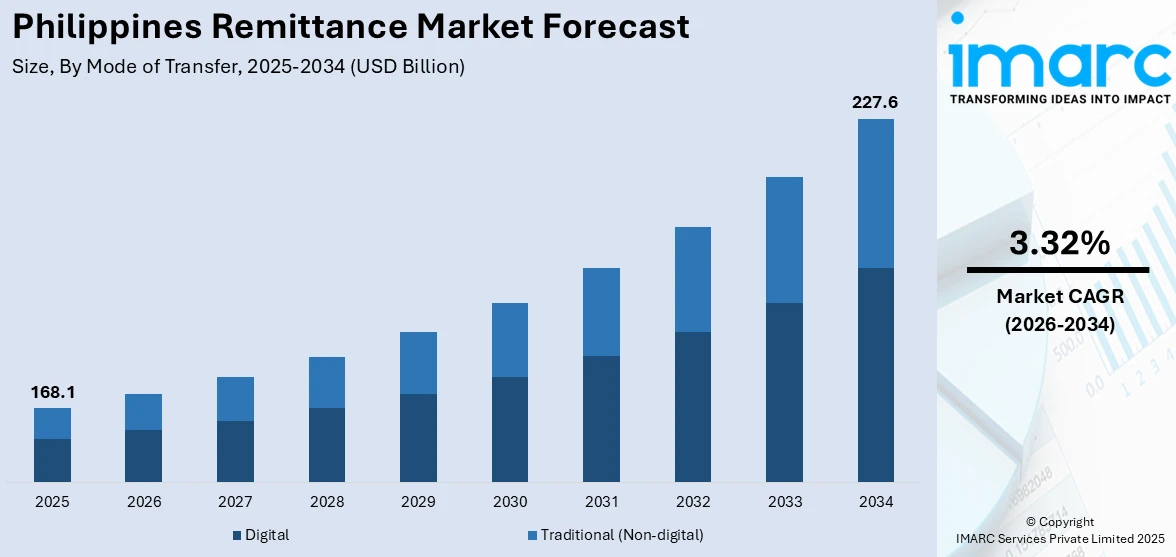

The Philippines remittance market size reached USD 168.1 Billion in 2025. Looking forward, the market is expected to reach USD 227.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.32% during 2026-2034. The market continues to thrive as overseas Filipino workers send funds home to support families, education, and small businesses. Digital transfer platforms, mobile wallets, and improved banking infrastructure enhance speed and convenience, while regulatory reforms ensure secure transactions, strengthening the country’s economic stability and consumer spending, driving growth in the Philippines remittance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 168.1 Billion |

|

Market Forecast in 2034

|

USD 227.6 Billion |

| Market Growth Rate 2026-2034 | 3.32% |

Key Trends of Philippines Remittance Market:

Growing Diaspora and Labor Migration

The Philippines' remittance market is primarily fueled by its vast diaspora of overseas Filipino workers (OFWs). These workers are spread globally, often in search of better employment opportunities, and regularly send money back to their families in the Philippines. This inflow is crucial as it provides a significant source of foreign currency and supports the livelihoods of millions of Filipinos. The Philippine government, recognizing the importance of these remittances, has implemented various programs to support OFWs, including labor agreements with foreign countries and protection policies that ensure their rights and welfare. According to the Philippines remittance market analysis, this ongoing support helps sustain the flow of remittances by facilitating safer and more reliable employment opportunities for Filipinos overseas.

To get more information on this market Request Sample

Advancements in Digital Remittance Services

Technology based remittance products such as mobile wallets and Fintech based transfer solutions have gained popularity recently as they are increasingly time effective and even instant. Digital transactions were already on the rise before the COVID-19 pandemic due to the changing nature of consumer needs and preferences, but the pandemic crosscut this growth as physical distancing reduced the feasibility of cash pickups. These platforms improve security and have a lower cost of transferring funds compared to traditional methods, creating benefits for both the sender and the receiver. It is largely anticipated that this digital shift will persist to rise as more individuals in the Philippines obtain technical knowledge and as widespread usage of smartphones in the nation progresses.

Government Initiatives and Support

The Philippine government actively contributes to the robustness of the Philippine remittance market growth through various supportive measures aimed at both easing and safeguarding the remittance process. Initiatives include improving financial literacy among OFWs and their families, streamlining remittance processes, and offering incentives for using official channels. These measures help to ensure that remittances are sent through formal channels, which are safer and more reliable. Furthermore, the government often negotiates bilateral agreements that ease labor migration and remittance flows, ensuring that OFWs have secure and legal pathways for employment abroad.

Expansion of Service Networks and Partnerships

The expansion of networks and partnerships among banks, money transfer operators, and fintech companies is crucial in increasing the accessibility and efficiency of remittance services. These partnerships are particularly beneficial in reaching rural and underserved areas where traditional banking services might be limited. They also help integrate more of the population into the formal financial system, promoting financial inclusion. By improving service delivery and expanding reach, these collaborations ensure that remittances can be sent and received more conveniently and securely across the country.

Growth Drivers of Philippines Remittance Market:

Robust Digital Infrastructure Development

The market growth is significantly accelerated by the country's rapid digital infrastructure expansion and fintech innovation. Advanced mobile payment platforms, digital wallets, and blockchain-based transfer solutions are transforming the remittance landscape by offering faster, more secure, and cost-effective alternatives to traditional banking methods. Government initiatives promoting digital financial inclusion, coupled with widespread smartphone adoption, are creating an enabling environment for digital remittance services. The integration of artificial intelligence and machine learning technologies in remittance platforms is further enhancing user experience through personalized services, fraud detection, and automated compliance processes, driving sustained market expansion.

Strategic Economic Policies and Regulatory Support

Government policy frameworks and regulatory environments play a crucial role in driving Philippines remittance market demand by creating favorable conditions for both OFWs and remittance service providers. The Philippine government's bilateral labor agreements with major destination countries, streamlined foreign exchange regulations, and incentive programs for formal remittance channels are fostering market growth. Additionally, the Bangko Sentral ng Pilipinas' progressive regulatory stance on digital payments and fintech innovations is encouraging new market entrants while maintaining consumer protection standards. These supportive policies reduce transaction costs, improve service accessibility, and enhance the overall efficiency of the remittance ecosystem.

Diversification of Overseas Employment Markets

The continuous expansion and diversification of overseas Filipino worker deployment across emerging markets and high-growth economies is creating new remittance corridors and driving the market share expansion. Beyond traditional destinations, Filipino workers are increasingly finding opportunities in countries with growing economies and favorable employment conditions. This geographic diversification reduces dependency on specific markets while creating multiple revenue streams for remittance service providers. The skilled nature of modern OFW deployment, including professionals in healthcare, engineering, and information technology sectors, ensures higher remittance volumes and contributes to sustained market growth through premium service offerings.

Philippines Remittance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on mode of transfer, type, channel, and end use.

Mode of Transfer Insights:

- Digital

- Traditional (Non-digital)

The report has provided a detailed breakup and analysis of the market based on the mode of transfer. This includes digital and traditional (non-digital).

Type Insights:

- Inward Remittance

- Outward Remittance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes inward remittance and outward remittance.

Channel Insights:

- Banks

- Money Transfer Operators

- Online Platforms (Wallets)

The report has provided a detailed breakup and analysis of the market based on the channel. This includes banks, money transfer operators, and online platforms (wallets).

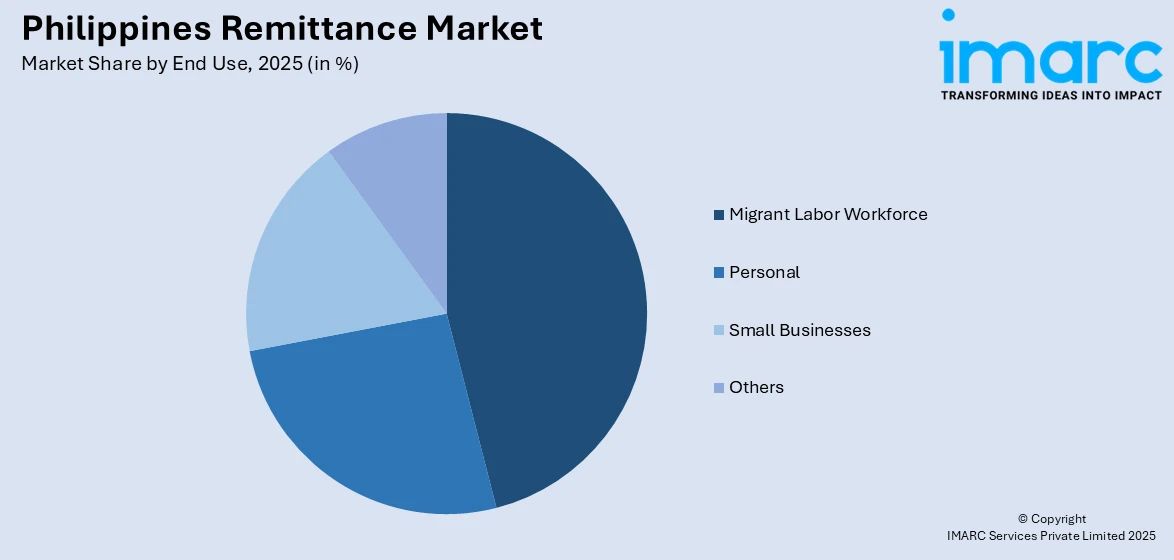

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Migrant Labor Workforce

- Personal

- Small Businesses

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes migrant labor workforce, personal, small businesses, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Remittance Market News:

- On 9th May 2024, Pomelo and Thunes partnered to drive innovation in cross-border finance with a new credit-based digital wallet solution. The strategic partnership aims to transform the way remittances are handled via Thunes’ digital wallet integration, reducing costs, and connecting families in new ways.

- On 15th November 2023, TerraPay and Maya partnered to empower seamless money transfers for Filipinos, worldwide. This collaboration aims to make international remittances more accessible, convenient, and secure for Filipinos across the world.

Philippines Remittance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Mode of Transfers Covered | Digital, Traditional (Non-digital) |

| Types Covered | Inward Remittance, Outward Remittance |

| Channels Covered | Banks, Money Transfer Operators, Online Platforms (Wallets) |

| End Uses Covered | Migrant Labor Workforce, Personal, Small Businesses, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines remittance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines remittance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines remittance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines remittance market was valued at USD 168.1 Billion in 2025.

The Philippines remittance market is projected to exhibit a CAGR of 3.32% during 2026-2034.

The Philippines remittance market is projected to reach a value of USD 227.6 Billion by 2034.

The market experiences rapid digital transformation through mobile wallets and fintech platforms, driven by the growing diaspora of overseas Filipino workers. Government supportive policies, strategic partnerships between financial institutions, and technological advancements in transfer platforms are reshaping the remittance landscape significantly.

The Philippines remittance market is driven by robust digital infrastructure development, strategic government policies supporting OFWs, and diversification of overseas employment markets. Advanced fintech solutions, regulatory support for digital payments, and expanding service networks further accelerate adoption across diverse consumer segments nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)