Philippines Pumps Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Philippines Pumps Market Size and Share:

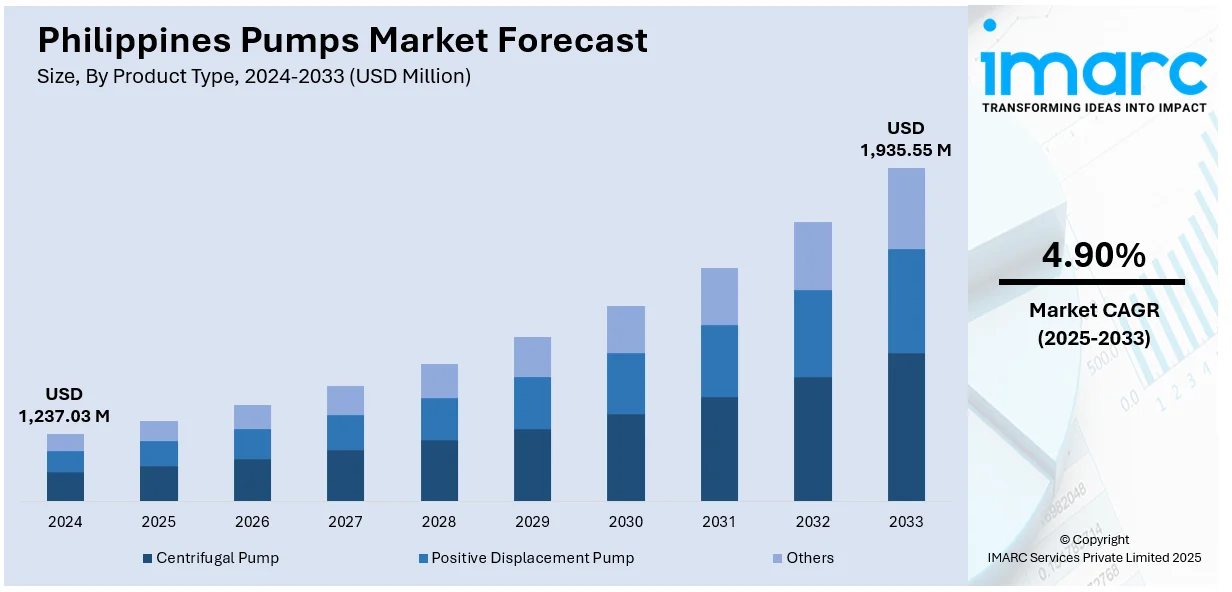

The Philippines pumps market size was valued at USD 1,237.03 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,935.55 Million by 2033, exhibiting a CAGR of 4.90% during 2025-2033. The rising infrastructure development, government initiatives toward constructing bridges, roads, and housing, agricultural expansion, rapid modernization, and adoption of smart farming methods represent some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,237.03 Million |

| Market Forecast in 2033 | USD 1,935.55 Million |

| Market Growth Rate (2025-2033) | 4.90% |

Rapid urbanization and ongoing infrastructure projects are key factors driving the market. The Philippine government's "Build, Build, Build" initiative, focusing on developing roads, bridges, water supply, and sewage systems, is fueling the demand for pumps. Expanding cities and new residential and industrial areas require efficient water distribution, drainage, and sewage management systems, boosting the Philippines pumps market growth in the construction and urban infrastructure sectors. For instance, in January 2025, a new tunnel boring machine (TBM) was introduced at the Camp Aguinaldo Station, marking another advancement in the Metro Manila Subway Project (MMSP). The Armed Forces of the Philippines (AFP) and the Department of Transportation (DOTr) introduced the JIM Technology TBM. Four TBMs will be used in Sumitomitsui Construction's construction of MMSP's Contract Package 103. Two subterranean Anonas and Camp Aguinaldo stations, along with related tunnels, will be dug 6.5 km using these robots.

To get more information on this market, Request Sample

With increasing population density and urbanization, managing water resources and wastewater treatment has become more critical. The need for improved water supply systems, wastewater treatment facilities, and flood prevention is growing. Pumps play a crucial role in ensuring efficient water distribution, sewage treatment, and stormwater management, making them essential in the development of sustainable urban infrastructure. For instance, in August 2024, The Japan International Cooperation Agency (JICA), in collaboration with the City Government of Baguio and the Japanese firm FujiClean Co. Ltd., has revealed a partnership aimed at enhancing the city's wastewater treatment systems and overall sanitation. This initiative is part of the Sustainable Development Goals (SDGs) Business Verification Survey in partnership with the private sector.

Philippines Pumps Market Trends:

Infrastructure Development and Urbanization

Rapid urbanization and ongoing infrastructure development projects in the Philippines are key drivers of the pump market. For instance, in December 2024, officials from the Philippine government met with the Coalition for Emerging Market Infrastructure Investment to introduce its first national platform, which aims to stimulate infrastructure investments in the country, especially in the energy sector. Government initiatives, such as the "Build, Build, Build" program, involve constructing roads, bridges, and water management systems, increasing the demand for pumps in water supply, wastewater treatment, and construction activities. Expanding urban areas also require efficient water and sewage systems, driving the adoption of advanced pump technologies. Additionally, industrial projects and new housing developments further contribute to the rising need for durable and energy-efficient pumps to handle water distribution and drainage challenges in growing cities and towns.

Agricultural and Irrigation Needs

The Philippines has a strong agricultural sector, and the need for efficient irrigation systems represents one of the major Philippines pumps market trends. For instance, in June 2024, in Quirino, Isabela, Philippine President Ferdinand R. Marcos Jr. officially opened the Cabaruan Solar Powered Pump Irrigation Project (SPIP), the country's largest irrigation system of its kind. With a total expenditure of PHP 65.77 million, the Cabaruan SPIP was constructed between July 6, 2023, and February 2024. It is overseen by the National Irrigation Administration (NIA) under the Mangat River Integrated Irrigation System (MARIIS). Farmers rely on pumps to irrigate crops, especially during dry seasons or in areas lacking consistent rainfall. With government support for modernizing agriculture and improving irrigation infrastructure, demand for water pumps has increased significantly. According to the Philippines pumps market forecast, advances in solar-powered and energy-efficient pumps have provided cost-effective solutions for rural and remote farming communities, which is expected to enhance productivity while reducing operational costs and energy consumption.

Water and Wastewater Management

Water scarcity and the demand for sustainable water and wastewater management solutions are critical factors driving the pump market in the Philippines. For instance, in April 2024, SUEZ and Maynilad, the biggest private water concessionaire in the Philippines, announced a partnership to lead a revolutionary wastewater treatment project in a historic partnership that was reached after a competitive bidding process. Under the Philippine government's sponsorship, this project seeks to significantly lower Manila Bay's water pollution. Residents' quality of life is expected to be improved and the environment will be protected thanks in large part to this project. Pumps are essential for water treatment plants, desalination projects, and sewage systems. As urban areas grow, the government and private sectors are investing in modern water infrastructure to meet rising demand and prevent flooding during heavy rains. Advanced pumping systems that improve water efficiency, reduce energy consumption, and ensure reliable wastewater treatment are increasingly in demand to address environmental challenges and population growth.

Philippines Pumps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Philippines pumps market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

Centrifugal pumps hold a leading position in the Philippine market because they offer versatility alongside affordability and achieve high efficiency when managing substantial fluid flows. These pumps find broad usage across multiple industries especially water treatment and agriculture along with manufacturing activities within an expansive growth market. Low-viscosity liquid applications and continuous flow capabilities make centrifugal pumps exceptional choices for water distribution systems and irrigation as well as industrial process operations. The market demand for centrifugal pumps continues to grow because of ongoing infrastructure development and water/wastewater management improvements.

Positive displacement pumps are expected to dominate the Philippine market because they process viscous fluids efficiently while offering exact flow potential. These pumping systems find widespread application in three major industrial sectors including oil and gas, food and beverage, and chemical processing activities that are experiencing growth across the region. The specific characteristics of these pumps match precise dosing operations and high-pressure workloads such as chemical injection, pharmaceutical production, and fuel transfer. Positive displacement pumps gain a strong market share due to developing industrial automation and critical operations requiring dependable pumping solutions.

Analysis by Application:

- Agriculture

- Construction and Building Services

- Water and Wastewater

- Power Generation

- Oil and Gas

- Chemical

- Others

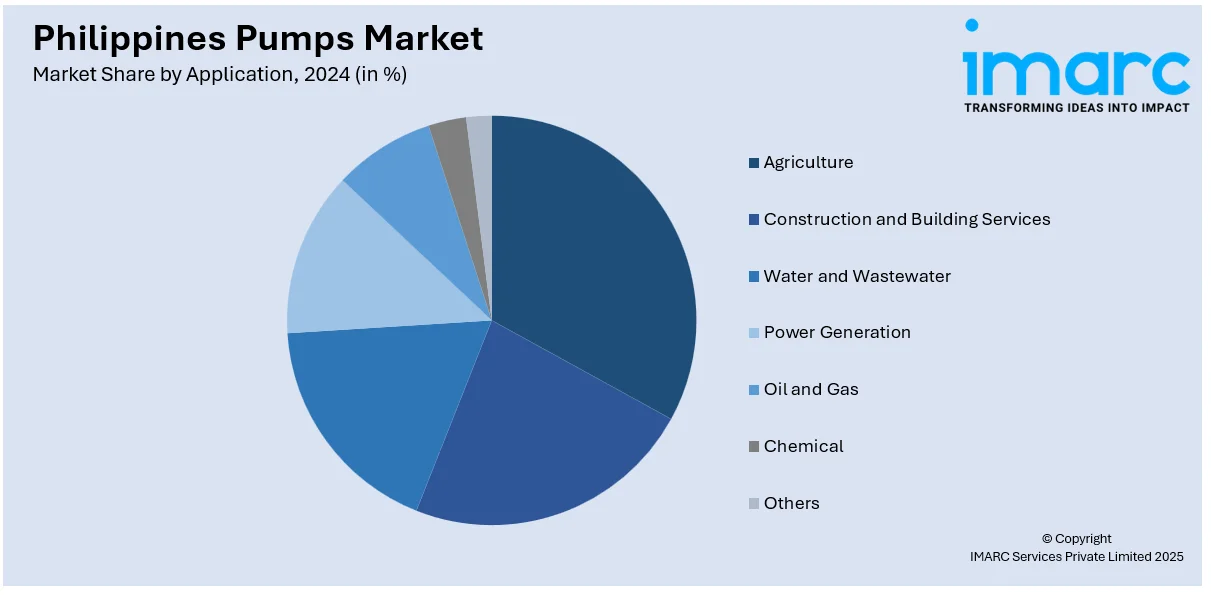

Agriculture drives significant demand for pumps in the Philippines, primarily for irrigation and water supply. With agriculture being a key economic sector, the need for efficient water management systems is critical. Pumps help optimize water usage, enhance crop yields, and support modern farming practices. Government initiatives to boost agricultural productivity and mitigate water scarcity further fuel the demand for agricultural pumps, ensuring a substantial market share in this sector.

The construction and building services sector holds a large Philippines pumps market share due to rapid urbanization and infrastructure development in the Philippines. Pumps are essential for HVAC systems, water supply, drainage, and fire protection in residential, commercial, and industrial buildings. With rising investments in real estate and public infrastructure projects, demand for reliable and energy-efficient pumps continues to grow, solidifying their importance in this expanding sector.

The water and wastewater segment dominates due to the increasing urban population and the need for effective water management systems. Pumps are crucial for water supply, sewage treatment, and flood control, addressing critical challenges in urban and rural areas. Government investments in water infrastructure and environmental sustainability initiatives, such as wastewater treatment plants, further drive demand for pumps, ensuring the sector's significant market share.

Regional Analysis:

- Luzon

- Visayas

- Mindanao

The pumps market in Luzon is driven by extensive infrastructure development, industrialization, and urbanization, particularly in Metro Manila and surrounding areas. Demand for pumps is fueled by large-scale construction projects, water and wastewater management systems, and agricultural activities in rural regions. Government initiatives to upgrade water supply infrastructure and flood control systems further boost the market. Additionally, the region’s industrial zones and economic hubs rely on pumps for manufacturing processes and energy generation, contributing to market growth.

In Visayas, the growth of the pumps market is supported by increasing tourism-related construction projects, such as hotels and resorts, and expanding agricultural activities. The need for efficient water management in flood-prone areas drives demand for pumps in water and wastewater applications. Additionally, ongoing infrastructure projects under government programs, including ports and transportation systems, contribute to the demand for construction and industrial pumps, ensuring steady market growth in the region.

Mindanao’s pumps market is driven by its strong agricultural base, requiring pumps for irrigation, water supply, and crop management. Expanding industrial activities, especially in mining and manufacturing, also boost demand. The government’s focus on rural development and infrastructure projects, including road construction and water systems, further supports market growth. Additionally, the region’s efforts to enhance flood management and wastewater treatment create opportunities for pumps in environmental and municipal applications, sustaining market expansion.

Competitive Landscape:

The Philippines pumps market is highly competitive, with key players focusing on innovation, efficiency, and after-sales services to gain market share. Prominent international companies like Grundfos, Xylem, and Sulzer dominate due to their advanced technologies and diverse product portfolios. Local manufacturers also play a crucial role by providing cost-effective solutions tailored to regional needs. The market sees strong competition in sectors like construction, agriculture, and water management. Companies are investing in partnerships, distribution networks, and digital solutions to enhance customer reach and satisfaction. Additionally, sustainability trends are pushing manufacturers to develop energy-efficient and eco-friendly pumps. The presence of both global and local players fosters a competitive environment, driving continuous innovation and market growth.

Latest News and Developments:

- In July 2024, the National Irrigation Administration of the Philippines started a procurement project with a budget of around PHP 97 million (USD 1.66 Million) to build two solar-powered pump irrigation projects on the Loboc River.

- In August 2023, Grundfos, a world leader in cutting-edge pump solutions and water technologies, introduced its new NK and NKE line in the Philippines in response to the growing demand for intelligent solutions to create more resilient, sustainable, and connected cities. The new long-coupled end-suction pumps have the highest energy efficiency in the industry, and the high-end NKE line uses smart technology to provide increased connectivity, monitoring capabilities, and ease of use.

- In March 2023, Delta Electronics and its local partner DAC Industrial Electronics, Inc. in the Philippines introduced the Delta Motor Mounted Pump Drive MPD Series, an intelligent and energy-efficient water supply system.

Philippines Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Agriculture, Construction and Building Services, Water and Wastewater, Power Generation, Oil and Gas, Chemical, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines pumps market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Philippines pumps market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pumps market in the Philippines was valued at USD 1,237.03 Million in 2024.

The growth of the Philippines pumps market is driven by rapid urbanization, increasing industrialization, and a surge in infrastructure projects. Rising demand for water management systems, agricultural irrigation, and wastewater treatment also boosts demand. Additionally, government initiatives and investments in renewable energy and construction further propel market expansion. The factors, collectively, are creating a Philippines pumps market outlook across the country.

The Philippines pumps market is projected to exhibit a CAGR of 4.90% during 2025-2033, reaching a value of USD 1,935.55 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)