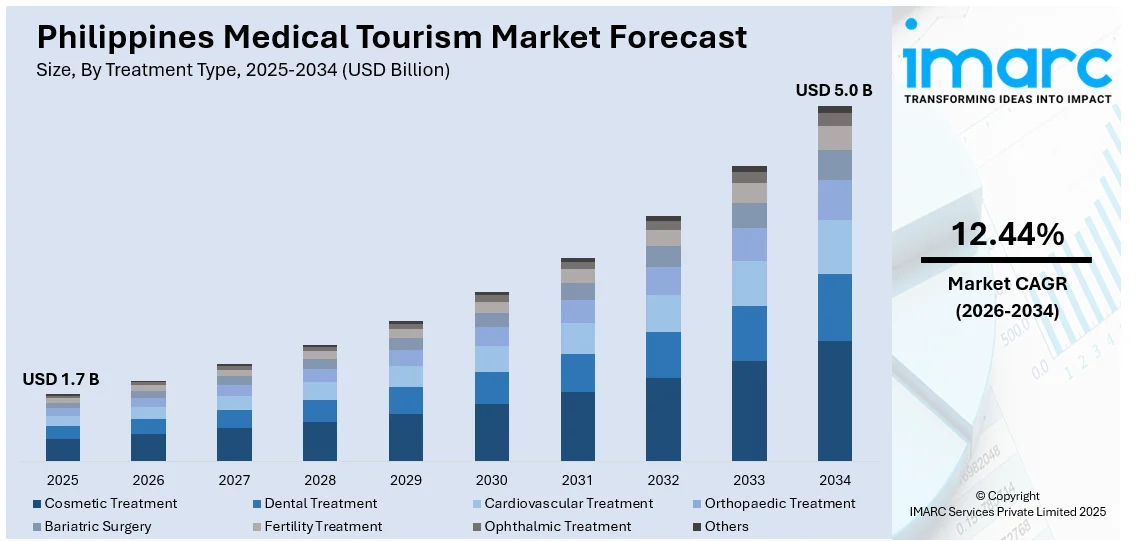

Philippines Medical Tourism Market Report by Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, and Others), Service Provider (Public, Private), and Region 2026-2034

Philippines Medical Tourism Market Size and Share:

The Philippines medical tourism market size reached USD 1.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.0 Billion by 2034, exhibiting a growth rate (CAGR) of 12.44% during 2026-2034. The market is driven by the support of governing agencies to enhance eHealth like telemedicine and teleconsultation, along with aging population, which needs improved healthcare services, such as medical procedures, therapies, and long-term care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 5.0 Billion |

| Market Growth Rate (2026-2034) | 12.44% |

Key Trends of Philippines Medical Tourism Market:

Government Support to eHealth

An article published in 2024 on the website of the International Trade Administration (ITA) shows that the Philippine House of Representatives approved “eHealth System and Services Act” to make healthcare data accessible for evidence-based decision-making. eHealth initiatives, like as telemedicine and teleconsultation, allow patients in remote places or even other nations to receive healthcare services from Filipino medical professionals. This improved accessibility entices people who might otherwise be unable to travel for medical treatment. Healthcare professionals in the Philippines can improve patient care by embracing technology. Electronic health records (EHRs) enable more efficient and accurate patient data management, resulting in better diagnostic and treatment outcomes. This improved standard of service helps to strengthen the country's reputation as a dependable medical tourism destination. eHealth solutions streamline several parts of the patient experience, including appointment scheduling and follow-up consultations. This efficiency improves the overall patient experience and makes it easier for medical tourists to access healthcare services in the country.

To get more information on this market Request Sample

Telemedicine and other eHealth services can help people save money on healthcare since they eliminate the need for traditional in-person consultations that require travel and lodging. This cost-effectiveness makes medical tourism in the Philippines even more appealing to patients looking for economical healthcare options. The government's support for eHealth initiatives helps promote medical tourism in the Philippines. By emphasizing the country's strong healthcare infrastructure and technology capabilities, the government can attract more overseas patients looking for high-quality care at affordable prices.

Aging Population Growth

According to an article published in 2024 on the website of the Philippine Statistics Authority (PSA), people aged 60 years old and over made up 9.3%, accounting for 166,678 individuals in 2020. As people are aging, there is often a greater need for healthcare services, such as medical procedures, therapies, and long-term care. This rising demand may place a strain on the local healthcare system, prompting some people, particularly those seeking specialist or fast care, to consider medical tourism choices. With an aging population, there may be an increased demand for specialist geriatric care and services. While the Philippines may have facilities and competence in geriatric care, medical tourists from other nations with limited access to such services may be drawn to the Philippines for their knowledge in this field. The demand created by an aging population might encourage investments in healthcare infrastructure and services suited to the needs of the elderly.

As people are getting older, they tend to put more emphasis on their health and wellness. The Philippines, with its natural beauty, wellness resorts, and traditional medicinal traditions, has the potential to attract older people seeking renewal, relaxation, and holistic treatment. Some retirees may contemplate relocating to nations, such as the Philippines for retirement, because of the reduced cost of living, nice climate, and access to decent healthcare.

Growth in Hospital Accreditation

Accreditation is essential for fostering trust among international patients seeking medical treatment in the Philippines. Prominent hospitals in Metro Manila and Cebu, particularly those associated with major healthcare networks, typically possess certifications from esteemed global accrediting organizations. These certifications cover various standards, including patient safety, infection control, surgical procedures, and safeguarding patient privacy. Accreditation indicates that a facility meets or surpasses international standards, which is a significant factor for medical tourists. Many overseas patients opt for the Philippines specifically due to the opportunity to receive affordable care without sacrificing safety or professionalism. The existence of accredited hospitals directly enhances the country's attractiveness as a medical destination and has contributed to the growth of the Philippines medical tourism market share in recent years.

Growth Drivers of Philippines Medical Tourism Market:

Affordable Treatment Costs

One of the key draws of the Philippines as a destination for medical tourism is its cost-effectiveness. Patients can access high-quality medical procedures at significantly lower prices compared to the US, Canada, or many European nations. Major surgeries including cardiac, cosmetic, orthopedic, and dental work often come at costs reduced by 50% to 80%. Importantly, these lower prices do not come at the expense of quality; numerous private hospitals in the Philippines adhere to international standards and utilize cutting-edge technology. The affordability extends beyond just medical treatments; expenses for hotels, post-operative care, medications, and transportation are also quite reasonable. This financial appeal attracts both uninsured patients and those looking for elective procedures that may not be covered by their home insurance plans, contributing to the growth of medical tourism in the Philippines.

English-Proficient Healthcare Workforce

Language proficiency plays a vital role for medical tourists, and the Philippines stands out due to its English-speaking healthcare professionals. Doctors, nurses, and administrative personnel are generally fluent in English, having often trained or been educated in English-speaking environments. This fluency helps eliminate communication hurdles, minimizes misunderstandings during diagnosis and treatment, and enhances the comfort level of foreign patients. Effective communication is essential for setting clear expectations, outlining procedures, ensuring proper post-operative care, and discussing complex health issues. Medical documents are also available in English, which facilitates follow-up consultations with physicians back home. This language compatibility significantly boosts the confidence and ease of international patients choosing to seek medical care in the Philippines.

Modern Private Hospitals

Private hospitals in Metro Manila and Cebu have emerged as crucial players in attracting international patients. These facilities boast advanced diagnostic equipment, cutting-edge surgical theaters, and specialists trained on a global scale. Many of them provide amenities akin to hotels, along with concierge services and tailored care to meet the needs of medical tourists. A number of these hospitals hold international accreditation, which enhances patient confidence in their safety and adherence to global standards. Increasingly, they offer services such as robotic surgery, digital imaging, minimally invasive treatments, and round-the-clock emergency care. Their commitment to delivering excellent outcomes while ensuring patient comfort has made these hospitals preferred options in the region. This full infrastructure has significantly contributed to the Philippines medical tourism market demand, particularly for specialized and elective procedures.

Opportunities of Philippines Medical Tourism Market:

Wellness and Recovery Tourism

The Philippines combines exceptional medical services with stunning natural landscapes, presenting a significant opportunity for wellness and recovery tourism. Patients can recuperate in tranquil environments, such as beachfront resorts, mountain getaways, or wellness-oriented accommodations. These soothing settings provide both emotional and physical relief during recovery, enhancing their overall experience. Incorporating spa treatments, detox programs, yoga classes, and nutritious dining options alongside medical services can attract health-conscious travelers. Regions like Batangas, Palawan, and Siargao possess the necessary environment and infrastructure to support this initiative. By branding itself as a destination for healing and relaxation, the Philippines can tap into a growing global interest in health and lifestyle-oriented travel.

Specialized Niche Services

Targeting specialized medical treatments can help the Philippines distinguish itself in the competitive landscape of medical tourism. There is high demand for services such as fertility treatments, cosmetic surgery, dental implants, and executive health check-ups among international patients. Often, these procedures are not covered by insurance in their home countries, making affordable yet quality options abroad more enticing. Clinics in Metro Manila, Cebu, and other urban locations are already building a strong reputation for these services, thanks to skilled practitioners and modern facilities. Offering specialized treatments also enables medical facilities to cater to specific demographics, such as women seeking IVF, middle-aged travelers looking for cosmetic enhancements, or busy professionals in need of comprehensive health evaluations. This focused strategy can attract high-value visitors and encourage repeat medical tourism.

Partnerships with Travel Agencies

Partnering with travel agencies and airlines offers a significant opportunity to enhance the medical tourism experience and increase patient volume. By developing comprehensive packages that encompass medical treatments, round-trip flights, visa assistance, hotel accommodations, and airport transfers, healthcare providers can deliver convenience and peace of mind to international patients. These collaborations assist patients in managing logistics and alleviating the challenges of planning, particularly for those traveling for the first time. Airlines can market these packages in specific regions, while tour operators can incorporate medical services into wellness and cultural travel experiences. This approach also contributes to the recovery of tourism and the growth of healthcare simultaneously. According to the Philippines medical tourism market analysis, combining healthcare with travel services could greatly boost patient acquisition and enhance the country's position in the global market.

Challenges of Philippines Medical Tourism Market:

Limited Global Recognition

The Philippines struggles with visibility in the international medical tourism sector. Unlike other countries, which have made significant investments in global marketing campaigns, medical tourism exhibitions, and government-supported branding initiatives, the Philippines has not achieved the same level of promotion. Consequently, many overseas patients remain unaware of the country's accessible, high-quality healthcare services. Recognition is largely driven by word of mouth, Filipino expatriates, or individual hospital advertising, rather than a unified national strategy. This hampers the nation's ability to reach new markets and diminishes its competitiveness in attracting affluent medical tourists. Enhancing international visibility through targeted marketing initiatives, alliances with healthcare facilitators, and increased participation in global events could bolster its market presence and appeal.

Infrastructure Gaps Outside Urban Centers

Medical tourism in the Philippines is predominantly centered in Metro Manila and Cebu, where private healthcare facilities are equipped with the necessary technology, personnel, and certifications to cater to international patients. In regions outside these urban areas, healthcare infrastructure tends to be less advanced many facilities are outdated, there is a lower availability of specialists, and diagnostic tools may not align with international standards. This uneven development restricts the country's capacity to distribute medical tourist traffic more broadly and hampers efforts to promote less urbanized yet appealing destinations. Addressing this disparity through investments in regional healthcare facilities and enhancing connectivity could help broaden the market and distribute demand more evenly across the country.

Visa and Travel Barriers

Travel convenience significantly influences decisions in medical tourism, and there is potential for improvement in the Philippines. Complex visa regulations for some nationalities can deter prospective patients, particularly when neighboring countries provide more accessible visa options like visa-free or visa-on-arrival entry. Furthermore, inadequate direct flight connections from certain regions in Europe, the Middle East, or Australia can increase travel time and costs, making the Philippines less attractive for medical trips. For elderly patients or those needing timely treatments, these barriers can be substantial obstacles. Simplifying visa processes for medical travelers, broadening international flight connections, and introducing dedicated medical tourism entry pathways or concierge services at airports could enhance travel logistics and make the country more inviting for prospective patients.

Philippines Medical Tourism Market News:

- May 2024: St. Luke’s Medical Center, a trailblazer in state-of-the-art healthcare technology in the Philippines, introduced the da Vinci Xi robotic system at its Quezon City facility to achieve surgical excellence.

- April 2024: MakatiMed Wellness Center and Argao Psych collaborated to fulfill the community’s growing need for basic and extended psychological services.

Philippines Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on treatment type and service provider.

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

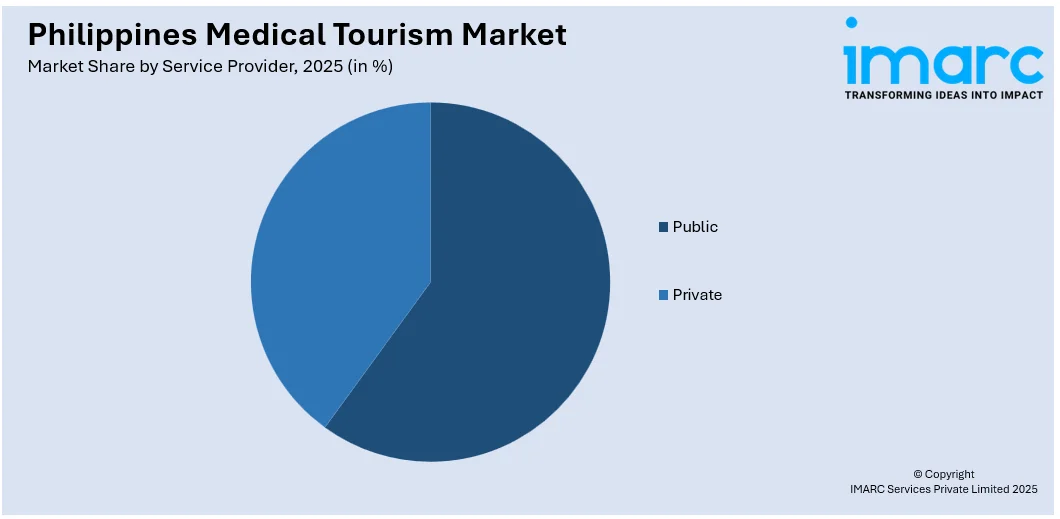

Service Provider Insights:

Access the comprehensive market breakdown Request Sample

- Public

- Private

A detailed breakup and analysis of the market based on the service provider have also been provided in the report. This includes public and private.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Service Providers Covered | Public, Private |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines medical tourism market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical tourism market in the Philippines was valued at USD 1.7 Billion in 2025.

The Philippines medical tourism market is projected to exhibit a compound annual growth rate (CAGR) of 12.44% during 2026-2034.

The Philippines medical tourism market is expected to reach a value of USD 5.0 Billion by 2034.

Competitive pricing, English-speaking healthcare professionals, government support, and increasing demand from overseas Filipinos are driving growth. The availability of internationally accredited hospitals, short wait times, and bundled treatment packages with travel and recovery options further boost the country's appeal for foreign patients seeking cost-effective, quality care.

Medical tourism in the Philippines is shifting toward wellness-integrated care, digital consultations, and preventive health check-ups. Urban hospitals are investing in advanced technologies, while concierge-style services are gaining popularity. There is also a rising interest from regional travelers and increased participation in global healthcare expos to build international presence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)