Philippines Medical Device and Pharmaceutical Market Report by Medical Device and Pharmaceutical (Medical Device, Pharmaceutical), and Region 2025-2033

Philippines Medical Device and Pharmaceutical Market Overview:

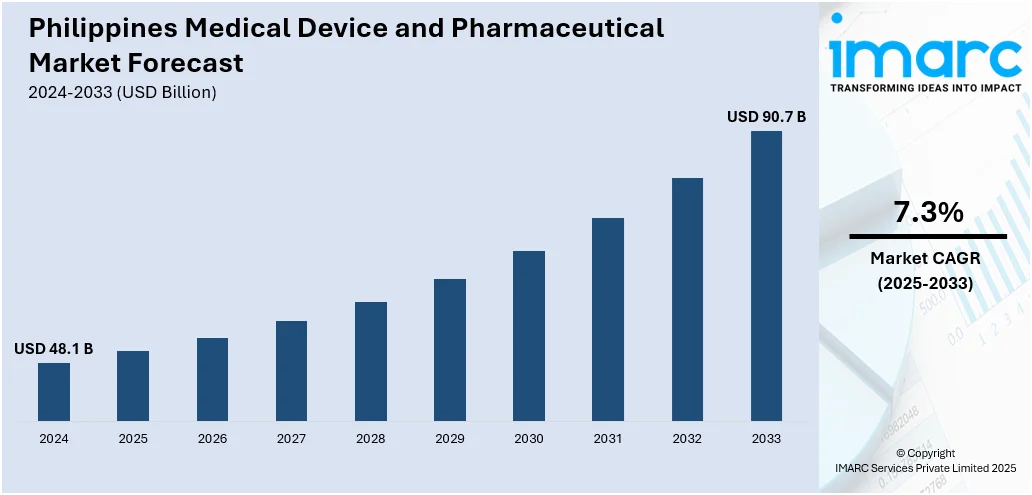

The Philippines medical device and pharmaceutical market size reached USD 48.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 90.7 Billion by 2033, exhibiting a growth rate (CAGR) of 7.3% during 2025-2033. The market is primarily driven by increased healthcare expenditure, government initiatives to enhance healthcare access, and rising demand for advanced medical technologies supported by the growing healthcare infrastructure improvements across Phillippines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.1 Billion |

|

Market Forecast in 2033

|

USD 90.7 Billion |

| Market Growth Rate 2025-2033 | 7.3% |

Philippines Medical Device and Pharmaceutical Market Trends:

Increasing Healthcare Expenditure in the Philippines

The Philippines witnessed a significant rise in healthcare spending in recent years, which is indicative of a broader commitment to improving healthcare accessibility and infrastructure. This increase is caused by the implementation of government initiatives for providing healthcare services to the wider population. As per the Philippine Statistics Authority's statistics from 2022, the total health expenditure (THE) of the nation was PhP 1.20 trillion. In 2022, the Health Capital Formation Expenditure (HK) shared 6.6% of the overall health spending, while the Current Health Expenditure (CHE) contributed 93.4%. Moreover, in 2022, government and mandatory contributory healthcare financing schemes accounted for the highest contribution of total current health expenditures (CHE), contributing 44.8%, followed by voluntary healthcare contributions, which made up 10.5% of the total. In 2022, the per capita health spending was PhP 10,059.49. Consequently, these kinds of investments are essential as they allow the construction of healthcare facilities, the acquisition of cutting-edge medical equipment, and the growth of healthcare services, all of which increase the demand for medicines and medical devices in the area.

To get more information on this market, Request Sample

Government Initiatives

The Philippine government's dedication to enhancing healthcare accessibility and quality is evidenced through several pivotal initiatives, like the Universal Health Care Act. According to the Internation Trade Administration, in 2019, the Philippine government enacted Republic Act 11223, also known as the Universal Health Care (UHC) Law, which ensures that all Filipinos, including overseas Filipino workers (OFWs), are covered by the national health insurance program managed by PhilHealth. This law requires automatic enrolment of all Filipinos in the national health insurance program, ensuring their eligibility for various health benefits. Moreover, the government has actively worked on strengthening the infrastructure needed to sustain a successful healthcare system. It includes making improvements to hospital infrastructure, recruiting and educating more healthcare workers, and improving the processes for acquiring and distributing medical devices. For instance, the medical device sector in the Philippines relies heavily on imported products, which make up 99.2% of the market, and the United States contributes 12% to this market share. As a result, the government is fostering an environment that will support the growth of the pharmaceutical and medical device industries by expanding the healthcare system's capacity and improving public access to health services across the region.

Philippines Medical Device and Pharmaceutical Market News:

- March 2024: The Philippine Economic Zone Authority (PEZA) unveiled the launch of pharmaceutical and medical device ecozone as part of the roadmap for ecozone transformation in the 2023–2028 Philippine Development Plan. This program represents a significant development in PEZA's economic growth plan and aims to support the country's medical manufacturing sector. This alliance hopes to advance the medical manufacturing industry through increased collaboration. Additionally, the recently established Pharma-Dev Zones will serve as exclusive hubs for local and foreign businesses involved in the manufacturing of pharmaceutical and medical goods. This covers things like clinical testing and trials, and research and development (R&D) activities. These ecozones are dedicated to making sure that all goods fulfill strict legal and quality requirements.

- August 2023: The FDA Philippines grants approval for the Certificate of Product Registration (CPR) for the COVID-19 vaccine Tozinameran + Famtozinameran (15 mcg/15 mcg)/0.3 mL dispersion intended for booster injections (IM) for individuals aged 12 and above.

Philippines Medical Device & Pharmaceutical Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on medical device and pharmaceutical.

Medical Device and Pharmaceutical Insights:

- Medical Device

- Breakup by Product Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- In Vitro Diagnostics

- Minimally Invasive Surgery

- Wound Management

- Diabetes Care

- Ophthalmic

- Dental

- Nephrology

- General Surgery

- Others

- Breakup by End User

- Hospitals and ASCs

- Clinics

- Others

- Breakup by Product Type

- Pharmaceutical

- Breakup by Type

- Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

- Breakup by Routes of Administration

- Oral

- Topical

- Parenteral

- Others

- Breakup by Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

- Breakup by End User

- Hospitals and ASCs

- Clinics

- Others

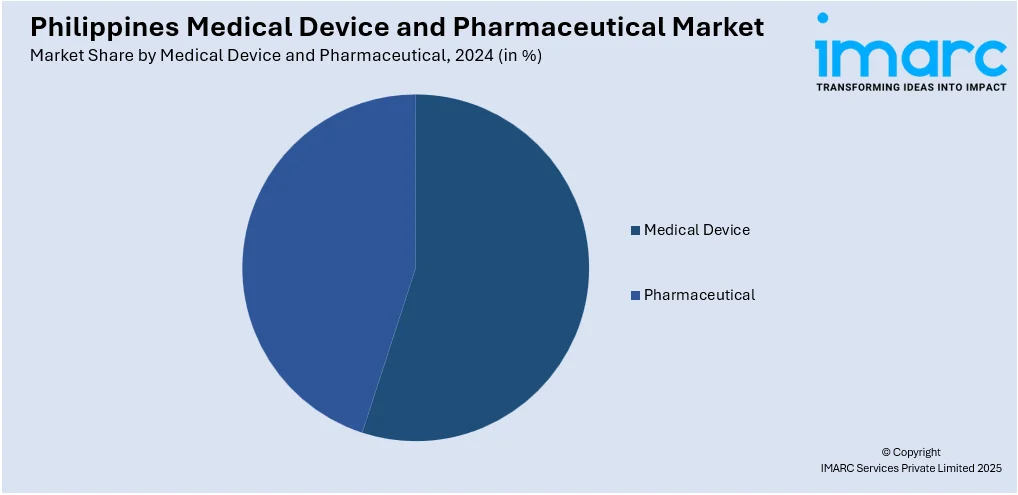

The report has provided a detailed breakup and analysis of the market based on the medical device and pharmaceutical. This includes medical device [breakup by product type (orthopedic devices, cardiovascular devices, diagnostic imaging, in vitro diagnostics, minimally invasive surgery, wound management, diabetes care, ophthalmic, dental, nephrology, general surgery, others), and breakup by end user (hospitals and ASCs, clinics, others)] and pharmaceutical [breakup by type (drugs {cardiovascular drugs, dermatology drugs, gastrointestinal drugs, genito-urinary drugs, hematology drugs, anti-infective drugs, metabolic disorder drugs, musculoskeletal disorder drugs, central nervous system drugs, oncology drugs, ophthalmology drugs, respiratory disease drugs} and biologics {monoclonal antibodies (MAbS), therapeutic proteins, vaccines}), breakup by routes of administration (oral, topical, parenteral, others), breakup by distribution channel (hospital pharmacy, retail pharmacy, online pharmacy, others), and breakup by end user (hospitals and ACSs, clinics, others)].

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Medical Device & Pharmaceutical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Medical Device and Pharmaceuticals Covered |

|

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines medical device & pharmaceutical market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Philippines medical device & pharmaceutical market?

- What is the breakup of the Philippines medical device & pharmaceutical market on the basis of medical device and pharmaceutical?

- What are the various stages in the value chain of the Philippines medical device & pharmaceutical market?

- What are the key driving factors and challenges in the medical device & pharmaceutical?

- What is the structure of the Philippines medical device & pharmaceutical market and who are the key players?

- What is the degree of competition in the Philippines medical device & pharmaceutical market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines medical device & pharmaceutical market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines medical device & pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines medical device & pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)