Philippines Luxury Goods Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Philippines Luxury Goods Market Overview:

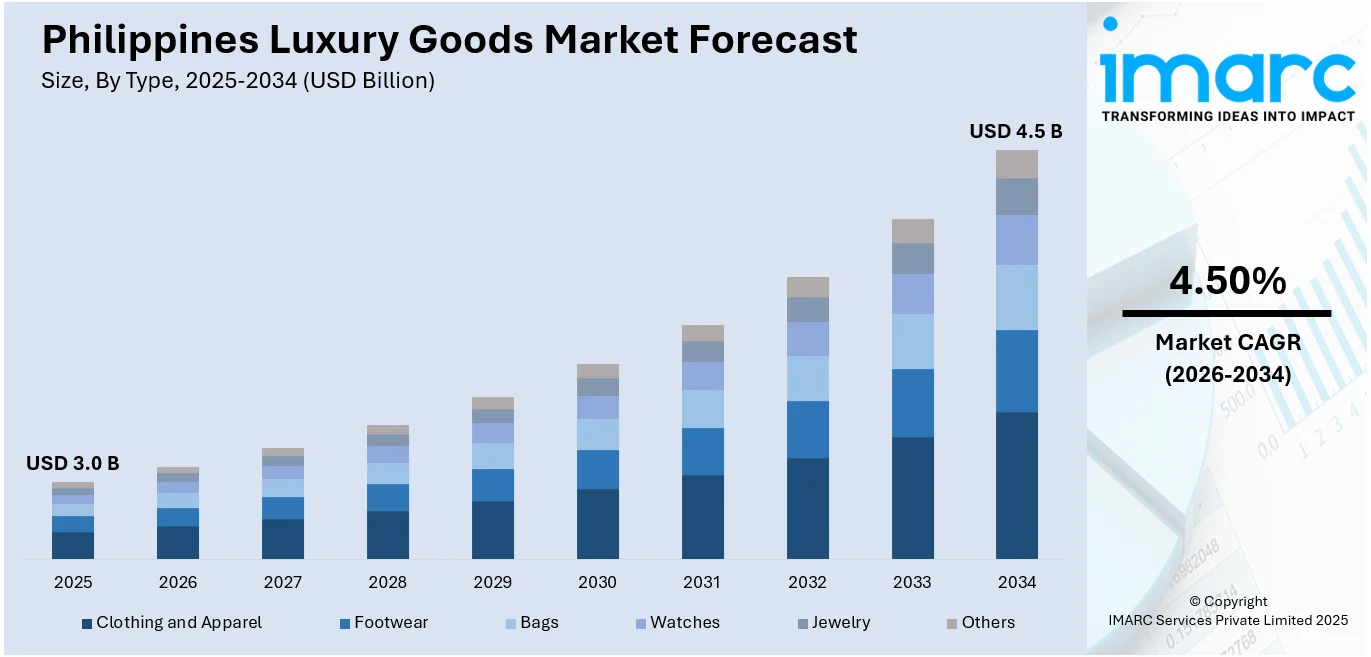

The Philippines luxury goods market size reached USD 3.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.50% during 2026-2034. The market is driven by rising disposable incomes, a growing affluent middle class, and increasing demand for premium fashion, accessories, and cosmetics. Expanding retail infrastructure, e-commerce growth, and tourism also boost sales. Brand-conscious consumers and social media influence further fuel market expansion, with international luxury brands gaining strong traction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.0 Billion |

| Market Forecast in 2034 | USD 4.5 Billion |

| Market Growth Rate 2026-2034 | 4.50% |

Philippines Luxury Goods Market Trends:

Growing Demand for Locally Inspired Luxury Products

The Philippines' high-end market is observing a growing shift towards locally conceived high-end products that capture the country's rich cultural heritage. High-end consumers are looking for products that reflect indigenous materials, traditional craftsmanship, and distinctive Filipino artistry. It is especially noticeable among luxury fashion, jewelry, and home furnishings, where handcrafted elements and eco-friendly materials like abaca, mother-of-pearl, and capiz shells are in demand. There is also amplified interest in upscale experiences that identify and celebrate indigenous customs, like one-of-a-kind travel packages for heritage destinations and bespoke artisan workshops. This also goes with raised Filipino pride as well as interest in products reflecting a stronger connection to culture. For instance, in August 2023, Versace Home debuted in the Philippines through Opulence Design Concept, showcasing luxurious home pieces and exclusive artworks by Andres Barrioquinto at a grand launch at The Metropolitan Museum. Moreover, with more consumers placing a premium on authenticity and craftsmanship, luxury brands are integrating Filipino design elements to meet this shifting demand, making locally inspired luxury a major force behind the growth of the country's high-end market.

To get more information on this market Request Sample

Surging Demand for Sustainable and Ethical Luxury

Sustainability is now a key concern in the Philippine luxury market, with high-end consumers actively looking for environmentally friendly and ethically made luxury products. Luxury consumers are becoming more aware of the social and environmental implications of their purchases, which translates to a desire for products created from sustainably sourced materials, biodegradable packaging, and fair-trade practices. This shift is particularly vivid in luxury fashion, beauty, and accessories, where eco-innovations like plant-based clothing, cruelty-free beauty, and upcycling are on the rise. The demand for slow fashion and investment items that highlight quality and endurance over fleeting fashions is also on the increase. Buyers are also demanding brands that value ethical labor standards and community-centered initiatives, underscoring the trend toward mindful luxury consumption. With sustainability as an integral expectation, luxury companies are retooling their products to address the changing priorities of socially responsible Filipino consumers.

Rise of Digital and Personalized Luxury Shopping Experiences

The Philippine luxury sector is quickly adopting digitalization, with luxury consumers anticipating smooth, personalized shopping experiences on various platforms. For example, in May 2024, Dolce & Gabbana Casa launched in Manila at Opulence Design Concept's Pop-Up Store in Greenbelt 5. The event showcased Italian luxury homeware with vibrant floral displays and celebrity guests, marking a new era of luxury living in the Philippines. Additionally, online shopping, social media, and virtual consultations are transforming the way luxury products are promoted and sold, enabling high-net-worth individuals to enjoy premium products and services remotely. Luxury brands are being accessed by high-net-worth individuals through interactive websites, virtual styling consultations, and AI-based recommendations based on their interests. Personalized shopping in the form of made-to-measure services, online product launches, and concierge-like customer service is becoming a necessity to winning over sophisticated shoppers. The merging of augmented reality (AR) and virtual reality (VR) also is making online luxury shopping richer with immersive product previews before buying. As the digital acumen keeps increasing, the Philippine high-end market is evolving towards omnichannel strategies that combine exclusivity with convenience.

Philippines Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Clothing and Apparel

- Footwear

- Bags

- Watches

- Jewelry

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes clothing and apparel, footwear, bags, watches, jewelry, and others.

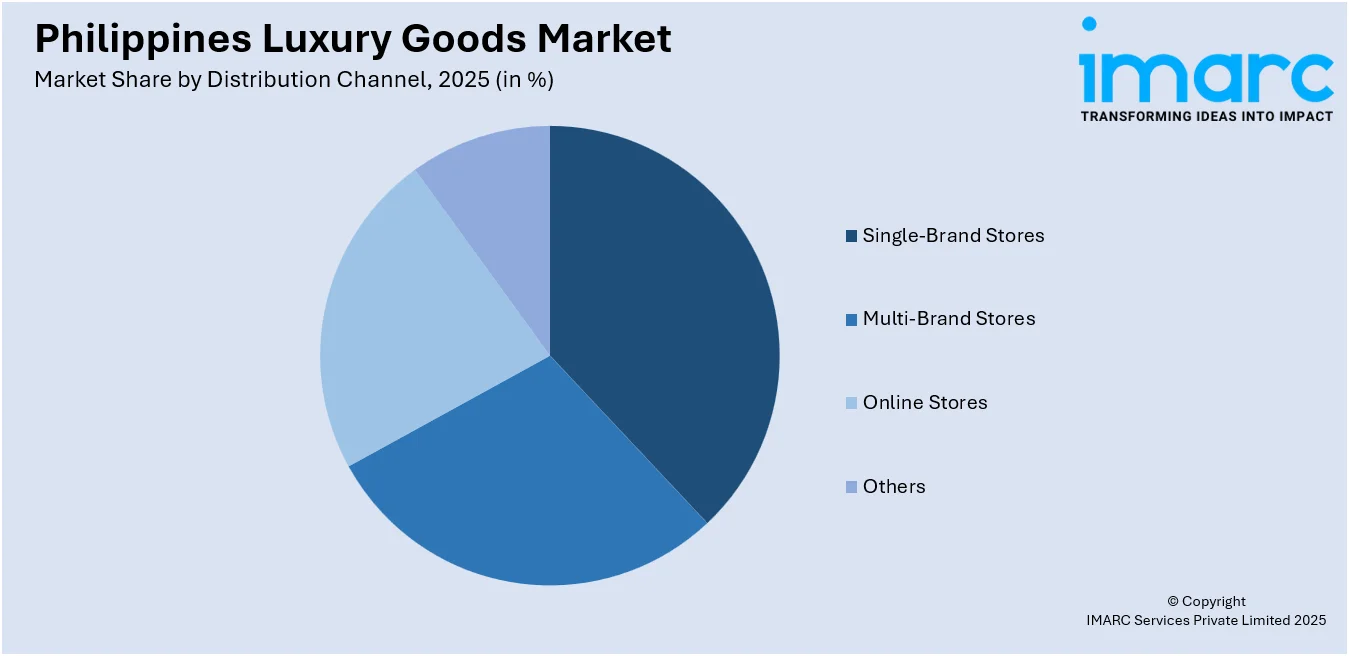

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Single-Brand Stores

- Multi-Brand Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes single-brand stores, multi-brand stores, online stores, others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Luxury Goods Market News:

- In October 2024, Manila FAME was launched at the World Trade Center Metro Manila, highlighting nearly 400 new designs from local artisans and MSMEs. The trade show, themed "ReimagiNATION," presented innovative home, fashion, and lifestyle pieces, with product development specialists guiding exhibitors to create globally relevant designs.

- In September 2024, Moda Interni, an Italian-inspired luxury furniture brand, launched its showroom in Quezon City. Featuring curated collections from renowned brands like Turri, Pedini, and Lago, it offers sophisticated, functional designs that elevate living spaces. Moda Interni sets a new standard in luxury home furnishings.

Philippines Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Clothing and Apparel, Footwear, Bags, Watches, Jewelry, Others |

| Distribution Channels Covered | Single-Brand Stores, Multi-Brand Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines luxury goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines luxury goods market on the basis of type?

- What is the breakup of the Philippines luxury goods market on the basis of distribution channel?

- What are the various stages in the value chain of the Philippines luxury goods market?

- What are the key driving factors and challenges in the Philippines luxury goods?

- What is the structure of the Philippines luxury goods market and who are the key players?

- What is the degree of competition in the Philippines luxury goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines luxury goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)