Philippines IT Training Market Report by Delivery Mode (Online Training, Offline Training), Application (IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, and Others), End User (Corporate, Schools and Colleges, and Others), and Region 2026-2034

Philippines IT Training Market Size and Share:

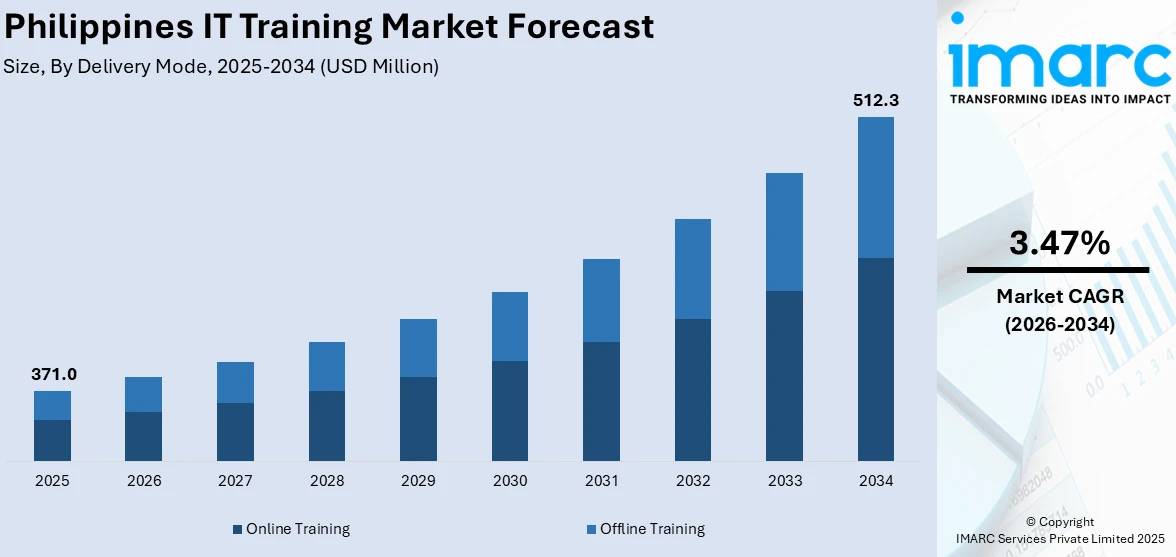

The Philippines IT training market size reached USD 371.0 Million in 2025. Looking forward, the market is projected to reach USD 512.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.47% during 2026-2034. Rapid technological advancements, increasing demand for skilled information technology (IT) professionals, corporate digital transformation initiatives, the rise of e-learning platforms, continuous education requirements, and the need for upskilling and reskilling in a competitive job market are influencing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 371.0 Million |

|

Market Forecast in 2034

|

USD 512.3 Million |

| Market Growth Rate 2026-2034 | 3.47% |

Key Trends of Philippines IT Training Market:

Rapid Pace of Technological Advancements

As technology evolves, new tools, frameworks, and methodologies are continually being introduced, requiring information technology (IT) professionals to stay updated to remain relevant. Technologies that are revolutionizing industries and increasing demand for specialized knowledge and skills include blockchain, artificial intelligence (AI), machine learning (ML), cloud computing, and cybersecurity. Companies need their employees to master these cutting-edge technologies to maintain a competitive edge and drive innovation. For instance, UnionBank of the Philippines partnered with Informatica to enhance its data management capabilities while integrating Citibank's retail banking business. This strategic move aims to improve banking experiences for over 12 million customers, solidifying UnionBank's position as a leading universal bank. Consequently, the need for comprehensive IT training programs that equip professionals with the latest technological skills and knowledge is growing, thereby supporting market expansion.

To get more information of this market Request Sample

Increasing Emphasis on Continuous Learning

The dynamic nature of the IT industry means that skills can quickly become outdated. Employers and employees alike recognize the importance of continuous learning to keep pace with industry changes. Employers are spending a lot of money on training initiatives to ensure that workers are upskilled and capable of handling the opportunities and new challenges that come with technology. This trend is not limited to entry-level positions; even seasoned professionals need to update their skills regularly. In the Philippines, this ongoing need for education, particularly pronounced due to the country's growing role as a hub for IT and business process outsourcing (BPO) is fueling the growth of the IT training market as professionals seek to enhance their expertise and career prospects, thereby providing an impetus to the market growth.

Rise of E-Learning Platforms

The proliferation of online learning platforms and digital resources has made IT training more accessible, flexible, and cost-effective. E-learning allows professionals to access training materials anytime and anywhere, accommodating diverse learning styles and schedules. These platforms offer a wide range of courses, from foundational knowledge to advanced specializations, often with interactive content, real-time feedback, and certification upon completion. The COVID-19 pandemic has further accelerated the adoption of e-learning, as remote work and social distancing measures made traditional in-person training impractical. This shift towards online education has expanded the reach of IT training programs, making it easier for individuals and organizations to access high-quality training resources regardless of geographical constraints.

Growth Drivers of Philippines IT Training Market:

Rising Demand for Skilled IT Professionals

The Philippines is experiencing a significant increase in the need for skilled IT professionals due to the ongoing growth of its outsourcing, software development, and digital services sectors. As the country continues to establish itself as a key player in business process outsourcing (BPO) and IT-enabled services, there is a consistent demand for workforce training in areas like programming, networking, and systems management. Companies are on the lookout for individuals with advanced technical skills to stay competitive in the global landscape. This demand is further compounded by the ongoing digital transformation across various industries, which necessitates continuous skill development. Additionally, this trend is drawing international companies to form training partnerships within the country, thus improving career prospects for local talents. This escalating need is a significant factor driving the Philippines IT training market share.

Government Initiatives for Digital Literacy and Upskilling

The Philippine government is actively pursuing initiatives aimed at bolstering digital literacy and technical competencies among its workforce. Programs such as nationwide IT training initiatives, scholarships, and collaborations with technology providers are designed to enhance the talent pool within the country. These strategies focus on preparing individuals for high-value positions in emerging sectors such as cloud computing, cybersecurity, and software development. Furthermore, partnerships between public and private entities are effectively addressing the skills gap by offering accessible training for students and professionals, including those located in rural communities. This forward-thinking approach enhances national competitiveness and promotes inclusivity in the digital landscape. Such efforts play a crucial role in sustaining the Philippines IT training market growth.

Adoption of Emerging Technologies Creating Specialized Training Needs

The swift adoption of advanced technologies including artificial intelligence (AI), cloud computing, and cybersecurity is reshaping the skill demands of the Philippine workforce. Organizations are increasingly channeling investments into training programs that focus on specialized fields such as AI model development, cloud infrastructure management, and ethical hacking. This trend is driven by the necessity to align local skill sets with global industry requirements. As companies modernize their operations, the need for tailored, high-level training escalates, creating lucrative opportunities for training providers. These advancements enhance technical skills and boost employability and innovation potential. This evolution, powered by technology, stimulates the Philippines IT training market demand.

Opportunities of Philippines IT Training Market:

Expansion of Niche Training Segments in Emerging Technologies

Niche domains like data analytics, machine learning, and blockchain are emerging as high-growth areas within the Philippine IT training sector. As global industries increasingly depend on data-driven insights, the demand for professionals skilled in these specific areas is on the rise. Training providers are developing targeted courses to meet this need, catering to both beginners and experienced practitioners. Oftentimes, these programs are created in collaboration with industry professionals to ensure relevance and practical usefulness. According to Philippines IT training market analysis, the growth of these specialized areas grants Filipino professionals a competitive advantage in international markets, making the sector more dynamic and prepared for the future.

Collaboration Between Global Tech Firms and Local Training Providers

International technology companies are joining forces with local training institutions in the Philippines to offer certification programs that are recognized globally. These partnerships introduce advanced curricula, modern tools, and industry expertise to the local market, ensuring that participants acquire skills that are competitive on an international scale. Such collaborations may also include access to proprietary software platforms, mentorship opportunities, and pathways to global career placements. This strategy enhances the authority of local training programs while concurrently strengthening the country’s position in the global IT talent supply chain. By merging global standards with local accessibility, these partnerships are considerably elevating the quality and scope of IT training in the Philippines.

Customized, Competency-Based Training for Global Job Market Alignment

The increasing demand for specialized skill development has spurred the rise of customized, competency-based IT training programs in the Philippines. These initiatives are designed to meet the precise needs of employers, emphasizing practical, job-ready skills over mere theoretical knowledge. Training providers are increasingly adjusting their curricula to align with international job market trends, ensuring that participants obtain qualifications recognized worldwide. This approach facilitates continuous learning, enabling professionals to upgrade their skills in response to evolving technologies. By equipping learners with highly relevant competencies, these programs improve employability.

Government Initiatives Philippines IT Training Market:

Nationwide Digital Literacy Programs

The Philippine government is actively rolling out nationwide digital literacy initiatives designed to equip citizens with essential technology skills. These programs concentrate on improving computer literacy, internet usage, and basic software skills for students, job seekers, and entrepreneurs. By enhancing the digital capabilities of the population, the government intends to prepare individuals for careers driven by technology and to elevate productivity across various sectors. Training is often provided through community centers, public educational institutions, and online platforms to ensure widespread accessibility. These initiatives address foundational skills gaps and serve as a stepping stone for more complex IT education, reinforcing the nation’s standing in the digital economy.

Scholarships and Financial Aid for IT Education

To promote inclusivity in IT education, the Philippine government provides scholarships and financial aid programs aimed at underprivileged students. These measures seek to eliminate financial obstacles associated with pursuing technical and IT-related courses. Recipients of scholarships typically gain access to high-quality training, internships, and industry certifications, significantly boosting their job prospects. Funding for these programs is sometimes achieved in partnership with the private sector, allowing for broader outreach and sustainability. By assisting capable individuals from low-income backgrounds, these initiatives encourage social mobility and contribute to enlarging the nation's skilled IT workforce, addressing both workforce deficits and economic development ambitions.

Public-Private Partnerships for Specialized IT Training

Public-private partnerships (PPPs) are vital for enhancing specialized IT training in the Philippines. Collaborations among government entities, industry players, and educational institutions result in customized programs that cater to specific market requirements. These partnerships afford access to cutting-edge tools, resources, and expert trainers, ensuring that graduates acquire applicable, sought-after skills. Many PPPs also provide industry-recognized certifications, enhancing participants' competitiveness in both local and international employment markets. By aligning educational instruction with real-world business needs, these collaborations help close the skills gap, improve employment opportunities, and bolster the nation’s standing in the global IT services sector.

Challenges of Philippines IT Training Market:

Skills Gap Between Education and Industry Needs

A significant challenge within the Philippine IT training landscape is the disparity between academic curricula and the rapidly evolving demands of the IT sector. Conventional education systems often have difficulty keeping pace with emerging technologies like artificial intelligence, blockchain, and cloud computing. Consequently, graduates may lack the practical skills and specialized knowledge that employers seek. This misalignment affects workforce readiness, prompting companies to spend extra resources on on-the-job training. Addressing this challenge necessitates curriculum updates, enhanced collaboration between industry and academia, and ongoing professional development initiatives to ensure graduates are adequately prepared for changing digital positions.

Limited Access to IT Training in Rural Areas

Numerous rural and remote areas in the Philippines encounter significant obstacles when it comes to accessing quality IT training. Issues such as inadequate internet connectivity, insufficient modern computer facilities, and a shortage of qualified trainers impede skill development in locations outside urban centers. This digital divide restricts opportunities for rural residents to engage in high-paying technology careers and exacerbates regional inequalities. To tackle these challenges, focused government initiatives, mobile training units, and offline learning strategies are essential. Improving IT education infrastructure in underserved regions is crucial for fostering inclusive growth and harnessing the unrealized potential of rural talent within the digital economy.

High Cost of Advanced Certification Programs

Advanced IT certification programs such as those in cybersecurity, cloud architecture, or data science often come with steep tuition costs that many students and small businesses find prohibitive. These expenses can restrict access to career-enhancing qualifications, especially among individuals from lower-income backgrounds. Lacking these certifications, professionals may struggle to remain competitive in the global IT job market. To confront this issue, the sector needs more accessible training options, flexible payment schemes, and scholarship programs. Alleviating the financial strain will boost participation rates and aid in cultivating a larger pool of highly skilled IT professionals in the nation.

Philippines IT Training Market News:

- In January 2024, ExitCertified joined the NVIDIA Partner Network, becoming a worldwide authorized training partner. This collaboration allows ExitCertified to offer NVIDIA's live, instructor-led workshops covering topics in generative AI and large language models.

- In April 2024, Nvidia collaborated with Indonesian telco giant Indosat Ooredoo Hutchison to establish a $200 million AI center in Surakarta, Central Java. The center is aimed at improving digital talent and local telecommunications infrastructure, in line with Indonesia's technological advancement vision.

Philippines IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on delivery mode, application and end user.

Delivery Mode Insights:

- Online Training

- Offline Training

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes online training and offline training.

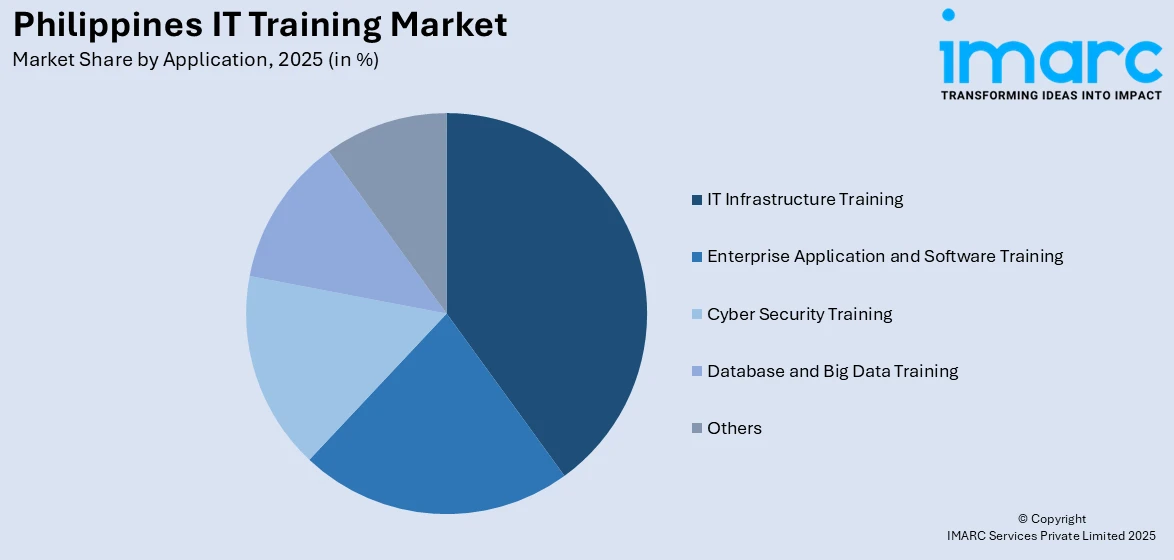

Application Insights:

Access the comprehensive market breakdown Request Sample

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes IT infrastructure training, enterprise application and software training, cyber security training, database and big data training, and others.

End User Insights:

- Corporate

- Schools and Colleges

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes corporate, schools and colleges, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Delivery Modes Covered | Online Training, Offline Training |

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End Users Covered | Corporate, Schools and Colleges, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines IT training market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IT training market in Philippines was valued at USD 371.0 Million in 2025.

The Philippines IT training market is projected to exhibit a compound annual growth rate (CAGR) of 3.47% during 2026-2034.

The Philippines IT training market is expected to reach a value of USD 512.3 Million by 2034.

The Philippines IT training market is witnessing a shift toward online and blended learning models, greater focus on emerging technologies like AI and cloud computing, and the rise of micro-credentialing. Industry-specific IT training and corporate upskilling programs are also gaining momentum to address evolving workforce needs.

Growth is driven by rising demand for skilled IT professionals, government-backed digital literacy initiatives, and increasing corporate investments in reskilling. Rapid technological adoption across industries, coupled with expanding outsourcing and software development sectors, is further boosting the need for specialized and globally competitive IT training programs in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)