Philippines ICT Market Size, Share, Trends and Forecast by Spending, Technology, and Region, 2026-2034

Philippines ICT Market Overview:

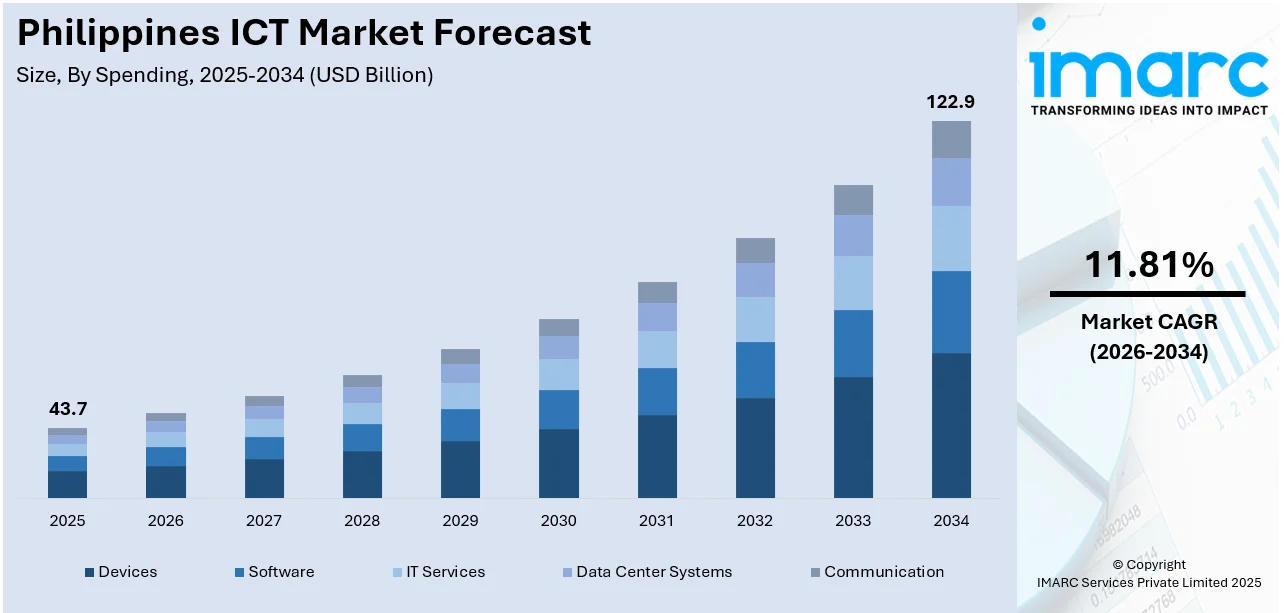

The Philippines ICT market size reached USD 43.7 Billion in 2025. Looking forward, the market is projected to reach USD 122.9 Billion by 2034, exhibiting a growth rate (CAGR) of 11.81% during 2026-2034. The market is driven by substantial public and private investments in digital infrastructure, increasing demand for enhanced connectivity, rapid cloud adoption by enterprises, government-led digital transformation initiatives, the expansion of the business process outsourcing (BPO) sector, and rising mobile and internet penetration across urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 43.7 Billion |

| Market Forecast in 2034 | USD 122.9 Billion |

| Market Growth Rate 2026-2034 | 11.81% |

Key Trends of Philippines ICT Market:

Substantial Public and Private Investments

The Philippine government is actively focusing on promoting the ICT industry through multiple initiatives and enormous budgetary allocations. The National Economic and Development Authority (NEDA) approved, in June 2024, the Philippine Digital Infrastructure Plan (PDIP), allotting PHP 16.1 billion to upgrade the country's digital infrastructure. This investment reflects the commitment of the government to upgrading digital services and facilities across the country. The private sector has also been instrumental in supporting the ICT sector. Investment approvals in the ICT sector were at PHP 96.16 billion in 2024, demonstrating a firm commitment from private firms to further enhance technological capacity. IPS Incorporated invested PHP 5.6 billion, while its subsidiary, InfiniVAN, invested another PHP 4 billion to speed up the National Broadband Plan. These investments are critical to promoting internet accessibility and dependability throughout the archipelago. The compounding effect of such investments can be seen in the performance of the digital economy. The Philippine Statistics Authority (PSA) estimates that the digital economy contributed around USD 35.4 Billion in 2023, which represented 8.4% of the nation's Gross Domestic Product (GDP). This represents a 7.7% growth from the USD 33.6 Billion generated in 2022, pointing to the contribution of continuous investment in the ICT sector.

To get more information on this market Request Sample

Robust Demand for Enhanced Connectivity

The need for enhanced connectivity in the Philippines has been a key driver in the growth of the ICT market. The COVID-19 pandemic was a huge acceleration of the demand for trustworthy digital communication tools, with remote work, online learning, and digital business becoming part of everyday life. This trend required infrastructure and service delivery to keep pace with the changing needs of businesses and consumers. The telecommunications sector has reacted with rising investments in communication equipment and infrastructure. Despite of the high mobile penetration, there is still a huge potential for growth in internet services. The government's initiatives to bridge the digital divide involve efforts to improve broadband services, especially in underserved and rural communities. Public-private partnerships are intended to offer affordable and reliable internet access, thus promoting inclusive digital participation. The intersection of expanding investments and rising demand for connectivity has placed the Philippines ICT market on a strong growth curve. Forecasts suggest that the market will sustain its growth fueled by continued development of infrastructure as well as by a population seeking digital revolution.

Cloud Computing Adoption

Cloud computing adoption is becoming a significant trend in the Philippines ICT market, as businesses seek scalable, cost-effective, and flexible IT solutions. Organizations across various industries including banking, retail, and manufacturing are transitioning workloads to cloud platforms to lower infrastructure expenses, enhance operational efficiency, and support remote work capabilities. Additionally, cloud solutions facilitate quicker application deployment, enable seamless team collaboration, and provide real-time data access, which is vital in a competitive business landscape. The rising need for hybrid and multi-cloud strategies allows companies to optimize performance while maintaining data security and adhering to regulatory requirements. Small and medium enterprises (SMEs) are capitalizing on cloud services to gain access to high-quality IT capabilities without significant upfront costs. This rapid adoption is bolstering the overall Philippines ICT market share and fueling long-term digital transformation.

Growth Drivers of Philippines ICT Market:

Remote Work and Hybrid Work Models

The shift toward remote and hybrid work setups is significantly propelling the adoption of ICT in the Philippines. Organizations are increasingly dependent on cloud-based collaborative tools, virtual meeting solutions, and secure remote access technologies to sustain productivity and connectivity among dispersed teams. This shift has been expedited by employee expectations for flexible working arrangements and the imperative for business continuity. Companies are pouring resources into strong IT infrastructure, such as VPNs, secure endpoints, and digital workflow management tools, to facilitate smooth operations. The uptake of these technologies fosters effective communication, document sharing, and project management across different locations, ensuring minimal disruptions. As a result, the emergence of remote and hybrid work models is a fundamental factor enhancing ICT solution deployment across various industries.

Growth of IT Outsourcing and BPO Sector

The Philippines remains a global leader in IT outsourcing and business process outsourcing (BPO), creating significant demand for ICT infrastructure. Firms that provide customer support, back-office functions, software development, and other ICT-enabled services require dependable networks, data centers, and tailored enterprise software solutions. Investments in high-speed connectivity, cloud integration, and sophisticated IT systems ensure operational efficiency and service quality. This expanding sector attracts foreign investment and broadens employment opportunities in ICT-related fields. Companies are increasingly in search of scalable, secure, and high-performance ICT solutions to meet client needs and global benchmarks. This ongoing growth fuels rising Philippines ICT market demand, positioning the outsourcing and BPO sector as a primary catalyst for the ICT ecosystem.

Investment in Cybersecurity

As digital transformation accelerates within organizations in the Philippines, investment in cybersecurity has emerged as a crucial priority. The growing dependence on cloud platforms, remote work tools, and connected devices exposes businesses to cyber threats, data breaches, and operational risks. Organizations are adopting advanced firewalls, intrusion detection systems, encryption technologies, and employee training programs to safeguard sensitive data. Regulatory compliance and maintaining customer trust further necessitate comprehensive cybersecurity strategies. This trend spans various sectors, including finance, healthcare, and BPO, where data protection is vital. The increased focus on cybersecurity reduces risks and builds trust in digital operations, allowing companies to utilize ICT solutions more effectively. Therefore, investment in cybersecurity is a key driver of ICT adoption and resilience in the Philippines.

Government Initiatives for Philippines ICT Market:

National Broadband and Connectivity Projects

The Philippine government has prioritized national broadband and connectivity initiatives to expand high-speed internet access across both urban and rural areas. These projects aim to bridge the digital divide, ensuring that underserved communities can access essential online services, including education, healthcare, e-commerce, and government portals. Investments include building fiber-optic networks, improving wireless coverage, and enhancing mobile connectivity infrastructure. Reliable internet connectivity is critical for businesses adopting cloud services, remote work solutions, and digital platforms. By strengthening the nation’s digital backbone, these projects support economic growth, innovation, and social inclusion. The expansion of broadband infrastructure also facilitates seamless integration of smart city solutions, IoT systems, and other advanced ICT technologies, creating long-term benefits for citizens and enterprises alike.

ICT Skill Development Programs

The Philippine government is actively implementing ICT skill development programs to enhance digital literacy and prepare the workforce for emerging technologies. Initiatives target students, professionals, and industry practitioners, offering training in areas such as cloud computing, cybersecurity, AI, and data analytics. By equipping individuals with relevant technical skills, these programs help address talent shortages in the ICT sector and support business adoption of modern technologies. Partnerships with educational institutions, training centers, and industry players ensure practical, hands-on learning opportunities. These initiatives improve employability while fostering innovation, entrepreneurship, and competitiveness in the digital economy. Developing a skilled ICT workforce is crucial for sustaining long-term growth and supporting the Philippines’ transformation into a digitally enabled nation.

Support for Startups and Tech Innovation

The Philippine government is promoting startup growth and technological innovation through grants, incubators, and funding programs targeting ICT-driven businesses. These initiatives provide financial support, mentorship, and resources to early-stage companies developing innovative software, applications, and digital solutions. By fostering entrepreneurship, the government encourages the creation of new products, services, and business models, stimulating the ICT ecosystem. Startups benefit from access to co-working spaces, networking opportunities, and industry partnerships, enabling them to scale operations and compete in global markets. Supporting innovation drives economic diversification while strengthening the country’s technology sector, attracting investment, and generating employment. These measures are critical in accelerating digital adoption and promoting sustainable growth in the Philippines’ ICT market.

Opportunities of Philippines ICT Market:

Growth in E-Government and Digital Public Services

The Philippines is making substantial investments in the digitization of public sector services, which is creating noteworthy opportunities for ICT providers. Government initiatives are centered around modernizing administrative processes, launching online portals, and enhancing citizen engagement through digital platforms. These efforts demand robust software solutions, cloud infrastructure, and secure networks to ensure efficiency, transparency, and accessibility. ICT vendors can offer services such as system integration, data management, cybersecurity, and technical support to facilitate these projects. Furthermore, transitioning to digital public services decreases reliance on paperwork, optimizes workflows, and boosts service delivery, all while promoting innovation within government operations. The increasing focus on e-governance thus serves as a strong impetus for ICT adoption and solution implementation across the public sector.

Development of Smart Cities and IoT Solutions

The rise of smart cities in the Philippines presents substantial growth opportunities for ICT firms. Urban regions are progressively investigating connected infrastructure, IoT-driven traffic management systems, smart lighting solutions, and energy-efficient technologies to enhance urban living conditions. These initiatives necessitate integrated networks, cloud platforms, and data analytics capabilities to oversee and optimize city operations. According to Philippines ICT market analysis, investment in IoT and smart city endeavors is anticipated to drive demand for sensors, software solutions, and ICT services that facilitate real-time decision-making and efficient resource management. For ICT providers, this opens the door to deliver comprehensive solutions that merge connectivity, automation, and analytics, promoting sustainable urban development and long-term digital transformation.

AI and Automation Adoption

Many businesses in the Philippines are progressively embracing artificial intelligence (AI) and automation to boost operational efficiency, reduce expenses, and enhance their decision-making capabilities. Organizations are leveraging AI-driven analytics, machine learning techniques, and robotic process automation (RPA) to improve workflows, optimize resource allocation, and raise the quality of customer service. AI is also being leveraged for predictive maintenance, supply chain management, and financial forecasting, supplying actionable insights and enabling data-driven strategies. The growing embrace of automation lessens manual tasks, reduces errors, and frees employees to concentrate on strategic initiatives. For ICT providers, this trend provides opportunities to deliver specialized software solutions, consulting services, and implementation support, solidifying the role of intelligent technologies in shaping the digital business landscape of the Philippines.

Challenges of Philippines ICT Market:

Limited Digital Infrastructure in Rural Areas

The limited digital infrastructure presents a significant challenge for the ICT market in the Philippines. Urban areas enjoy high-speed broadband and dependable connectivity, while many rural and remote locations suffer from inconsistent network coverage and inferior internet quality. This digital gap limits access to cloud services, e-learning platforms, and digital business tools, hindering ICT adoption beyond major cities. Businesses and government initiatives aiming to implement technology-driven solutions face obstacles in reaching these underserved areas. Additionally, poor connectivity impacts e-commerce, telemedicine, and online collaboration, restricting economic opportunities and efficiency gains for rural communities. To ensure inclusive ICT development and close the urban-rural digital divide, it is essential to address these infrastructure issues through investments in broadband expansion, wireless technologies, and partnerships between public and private sectors.

High Implementation Costs

High implementation expenses are a significant obstacle to ICT adoption, especially for small and medium enterprises (SMEs) in the Philippines. Advanced solutions such as cloud platforms, enterprise software, cybersecurity systems, and AI tools often necessitate considerable upfront investments in hardware, software licenses, and technical support. Ongoing costs for maintenance, training, and upgrades further compound the financial strain, making it difficult for smaller organizations to fully utilize modern ICT capabilities. Budget limitations may force SMEs to depend on outdated systems or limited solutions, hindering operational efficiency and competitiveness. Mitigating these cost barriers through flexible pricing models, scalable cloud options, and government incentives could enhance ICT adoption and enable more businesses to benefit from digital transformation within the country.

Talent Shortage and Skills Gap

The Philippines ICT market grapples with a notable challenge stemming from a shortage of skilled professionals. Although the demand for IT specialists, data analysts, cybersecurity experts, and AI developers is increasing, the supply of suitably trained individuals has not kept up. This skills gap restricts organizations' capacity to implement, manage, and innovate with advanced ICT solutions. Companies frequently find it challenging to attract talent with specialized expertise, leading to delays in digital transformation initiatives and heightened operational costs. Furthermore, the absence of ongoing professional development programs worsens the situation, as employees may not remain up to date with emerging technologies. Addressing this issue necessitates focused investment in ICT education, vocational training, and upskilling initiatives to foster a workforce capable of supporting long-term digital growth.

Philippines ICT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/ country level for 2026-2034. Our report has categorized the market based on spending and technology.

Spending Insights:

- Devices

- Software

- IT Services

- Data Center Systems

- Communication

The report has provided a detailed breakup and analysis of the market based on the spending. This includes devices, software, IT services, data center systems, and communication.

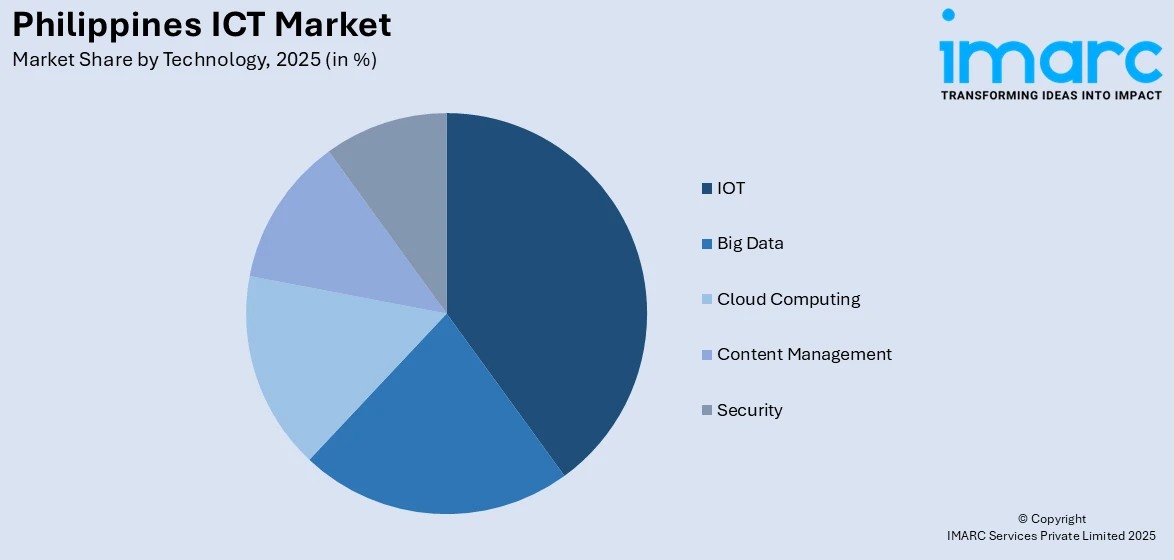

Technology Insights:

Access the comprehensive market breakdown Request Sample

- IOT

- Big Data

- Cloud Computing

- Content Management

- Security

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes IOT, big data, cloud computing, content management, and security.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines ICT Market News:

- May 2024: The Philippines ICT market is receiving a significant boost with Fujitsu's launch of its first Digital Innovation Hub in Southeast Asia, located in the country.

- April 2024: PLDT Inc. and its mobile subsidiary Smart Communications have bolstered the Philippines' ICT development by creating a Cloud Center of Excellence (CCOE), in line with the country’s rising investments in digital infrastructure. This initiative improves workforce agility and operational efficiency, helping to meet the strong demand for better connectivity and cloud services.

Philippines ICT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Spendings Covered | Devices, Software, IT Services, Data Center Systems, Communication |

| Technologies Covered | IOT, Big Data, Cloud Computing, Content Management, Security |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines ICT market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines ICT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines ICT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ICT market in Philippines was valued at USD 43.7 Billion in 2025.

The Philippines ICT market is projected to exhibit a compound annual growth rate (CAGR) of 11.81% during 2026-2034.

The Philippines ICT market is expected to reach a value of USD 122.9 Billion by 2034.

The Philippines ICT market is witnessing trends such as widespread cloud adoption, increasing use of AI and automation, and expansion of IoT-enabled smart solutions. Growing remote work, digital government initiatives, and investments in cybersecurity are further shaping ICT service demand across business and public sectors.

Market growth is driven by rising digital transformation initiatives, expansion of high-speed connectivity, and government programs supporting ICT adoption. The increasing demand for remote work technologies, IT outsourcing services, and skilled ICT professionals further fuels adoption, while businesses and public institutions increasingly prioritize efficiency, innovation, and secure digital operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)