Philippines Gravity-Based Water Purifier Market Size, Share, Trends and Forecast by Product Type and Distribution Channel, 2026-2034

Philippines Gravity-Based Water Purifier Market Size and Share:

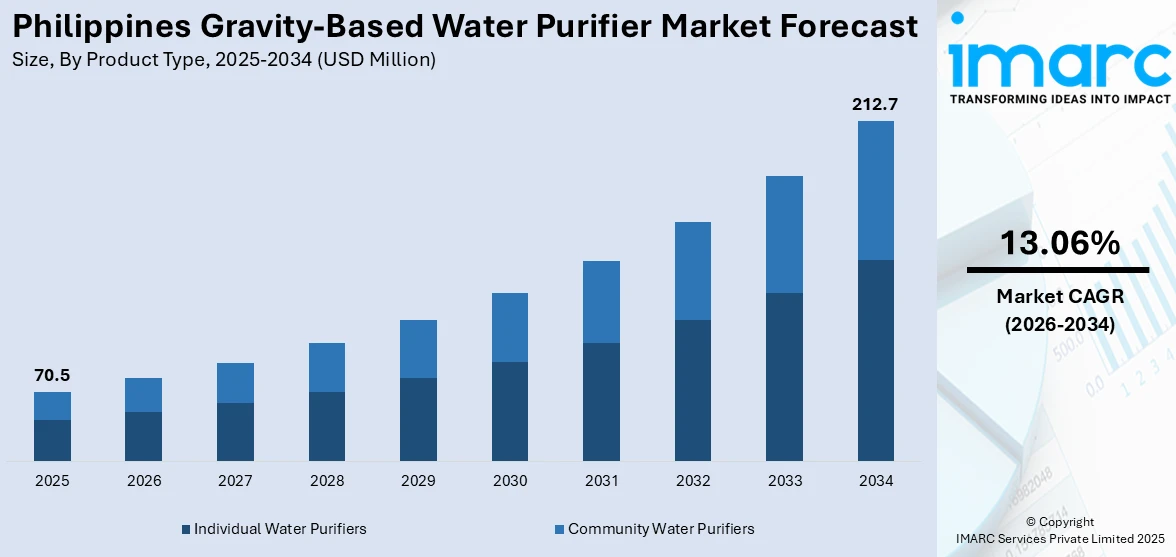

The Philippines gravity-based water purifier market size was valued at USD 70.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 212.7 Million by 2034, exhibiting a CAGR of 13.06% from 2026-2034. The demands of the market continue to rise due to the requirement for affordable, non-electric filtration solutions, as a result of water quality issues and limited access to piped water. Additionally, technologies, such as activated carbon and multi-stage filtration, are widely preferred by consumers. The support of governmental initiatives combined with the expansive distribution networks are factors that will favor the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 70.5 Million |

|

Market Forecast in 2034

|

USD 212.7 Million |

| Market Growth Rate 2026-2034 | 13.06% |

The market is growing due to increasing concerns over water quality and accessibility. Many households and rural communities lack reliable access to safe drinking water, driving demand for affordable, non-electric filtration solutions. For instance, as per industry reports, the Philippines is experiencing a water crisis, with approximately 11 Million families lacking access to clean water as the dry season approaches, worsening supply shortages and public health risks. Moreover, consumers prefer gravity-based purifiers for their cost-effectiveness, easy maintenance, and ability to remove contaminants without requiring electricity. Government initiatives promoting safe water access and hygiene further support market expansion. Additionally, rising awareness of waterborne diseases has encouraged consumers to invest in effective, chemical-free purification methods, boosting adoption in both urban and remote areas.

To get more information on this market Request Sample

Product innovation and retail expansion are further driving market growth. Manufacturers are introducing multi-stage filtration systems with activated carbon, ceramic, and silver-impregnated filters to improve purification efficiency. Expanding e-commerce platforms and retail distribution networks are making these purifiers more accessible across the country. For instance, as per industry reports, in 2024, the Philippines' e-commerce market grew significantly, reaching USD 28 Billion, with forecasts estimating an expansion to USD 40.5Bbillion by 2027. Additionally, affordable pricing strategies and installment payment options are increasing adoption among middle- and lower-income households. Companies are also focusing on durable designs, long-lasting filters, and easy-to-clean models to enhance customer convenience.

Philippines Gravity-Based Water Purifier Market Trends:

Growing Demand for Affordable and Non-Electric Water Purification Solutions

The Philippines gravity-based water purifier market is witnessing increasing demand for affordable, non-electric filtration systems, particularly in rural and low-income households where access to clean drinking water is limited. Consumers prefer gravity-based purifiers due to their cost-effectiveness, easy maintenance, and reliability in filtering contaminants without requiring electricity. The rising concerns over waterborne diseases and increasing awareness of safe drinking water further drive adoption. Manufacturers focus on affordable pricing, durable materials, and effective filtration technologies, such as activated carbon and ceramic filters, to cater to the expanding consumer base seeking safe and sustainable water purification solutions. For instance, in July 2024, Sitio Danao-Danao, Barangay Polopiña, Concepcion, unveiled a solar-powered potable water system using reverse osmosis technology, benefiting 213 families with affordable clean water.

Expansion of Online and Offline Distribution Channels

Retail expansion is reshaping the Philippines gravity-based water purifier market, with companies strengthening both online and offline sales channels to improve accessibility. E-commerce platforms such as Lazada and Shopee play a crucial role in reaching urban and remote consumers, offering a variety of brands, price ranges, and product comparisons. For instance, in April 2024, Shopee sales in the Philippines reached USD 405 Million, making it the fourth-highest among six Southeast Asian countries. Meanwhile, supermarkets, appliance stores, and dedicated water filtration outlets provide in-store demonstrations to educate customers about purifier benefits. This multi-channel approach is increasing consumer trust and convenience, enabling manufacturers to expand their market presence and tap into new customer segments across different regions.

Innovation in Filtration Technology and Product Design

Advancements in filtration technology are driving product differentiation in the Philippines gravity-based water purifier market. Manufacturers are integrating multi-stage filtration systems, antibacterial coatings, and enhanced water storage capacities to improve purification efficiency. The growing focus on removing bacteria, viruses, and heavy metals has led to the introduction of nanotechnology and silver-infused filters. Additionally, compact and space-saving designs cater to urban households with limited kitchen space. Companies emphasize durability, ease of maintenance, and extended filter life, ensuring cost-effective solutions that meet consumer preferences for safe, clean, and accessible drinking water in both residential and commercial settings. For instance, in March 2024, Planet Water Foundation partnered with Watts Water Technologies, Xylem, and Capital One Philippines to install AquaTower filtration systems in Quezon Province and Greater Manila. These systems remove harmful bacteria and provide safe drinking water.

Philippines Gravity-Based Water Purifier Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Philippines gravity-based water purifier market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Individual Water Purifiers

- Community Water Purifiers

Individual water purifiers are the leading product type segment in the market, driven by their affordability, convenience, and ease of use. These purifiers cater to households and small-scale consumers who require simple, non-electric solutions to address water quality issues. Individual purifiers typically utilize activated carbon, ceramic, or multi-stage filtration systems to remove contaminants, making them suitable for rural and urban areas with limited access to clean, piped water. Their compact design and low maintenance requirements contribute to their popularity. As demand for accessible, low-cost water purification options rises, individual water purifiers continue to dominate the market.

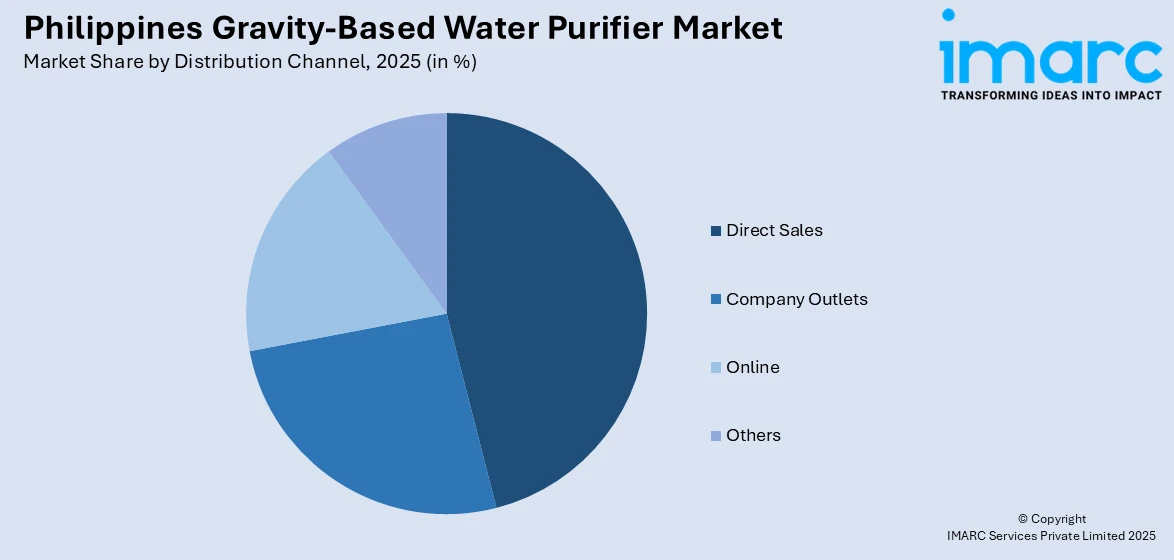

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Company Outlets

- Online

- Others

Direct sales are the leading distribution channel segment for the market, propelled by the growing preference for personalized customer service and product education. This channel allows manufacturers and distributors to engage directly with consumers, offering tailored solutions based on specific water quality needs. Direct sales enable efficient delivery, fostering trust and brand loyalty. Additionally, this approach allows companies to maintain better control over pricing, inventory, and after-sales support. With increasing awareness about water safety, direct sales channels provide an effective means to reach target audiences in both urban and rural areas, contributing significantly to market growth.

Competitive Landscape:

The Philippine market for gravity-based water purifiers is intensely competitive, propelled by increasing demand for low-cost, non-electric filtration solutions in response to water quality issues and limited access to piped water. Additionally, players such as domestic brands and overseas manufacturers compete based on filtration technology, durability, and price positioning. Moreover, growing consumer interest in activated carbon, ceramic, and multi-stage filtration technologies shapes product development. Extending retail distribution, online sales, and after-sales support increase market penetration. Furthermore, government initiatives promoting safe drinking water impact industry growth, while companies focus on branding, affordability, and technological advancements to differentiate products and strengthen their market presence. For instance, in March 2024, the International Committee of the Red Cross (ICRC) collaborated with local communities in Misamis to construct a water system, installing a five-kilometer pipeline, storage tanks, and multiple water faucets, significantly improving access to safe drinking water in the area.

The report provides a comprehensive analysis of the competitive landscape in the Philippines gravity-based water purifier market with detailed profiles of all major companies, including:

- A.O Smith

- Amway

- Culligan

- Kent RO Systems

- Toray

- Unilever PLC

- Waters Philippines

- Woongjin Coway Co Ltd.

Latest News and Developments:

- In October 2024, the Department of Social Welfare and Development (DSWD) in Bicol distributed 20 family water filtration kits to Camarines Sur LGUs affected by Severe Tropical Storm Kristine. These kits help provide clean, potable water, supporting the region's relief efforts, with additional kits ready for other affected areas.

- In June 2024, the Cordova Desalination Plant, located in Cebu, commenced operations, marking the first desalination facility in the Philippines. The plant initially produces 5 million liters of water daily and utilizes seawater reverse osmosis technology.

Philippines Gravity-Based Water Purifier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Individual Water Purifiers, Community Water Purifiers |

| Distribution Channels Covered | Direct Sales, Company Outlets, Online, Others |

| Companies Covered | A.O Smith, Amway, Culligan, Kent RO Systems, Toray, Unilever PLC, Waters Philippines and Woongjin Coway Co Ltd |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines gravity-based water purifier market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Philippines gravity-based water purifier market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines gravity-based water purifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines gravity-based water purifier market was valued at USD 70.5 Million in 2025.

The key factors driving the market include growing concerns over water quality, limited access to piped water, and increasing consumer demand for affordable, non-electric filtration solutions. Additionally, government initiatives promoting safe drinking water and rising awareness of health and hygiene further propel market growth.

IMARC estimates the global Philippines gravity-based water purifier market to reach USD 212.7 Million in 2034, exhibiting a CAGR of 13.06% during 2026-2034.

Individual Water Purifiers segment accounted for the largest product type market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)