Philippines Food and Grocery Retail Market Size, Share, Trends, and Forecast by Product, Distribution Channel, and Region, 2026-2034

Philippines Food and Grocery Retail Market Overview:

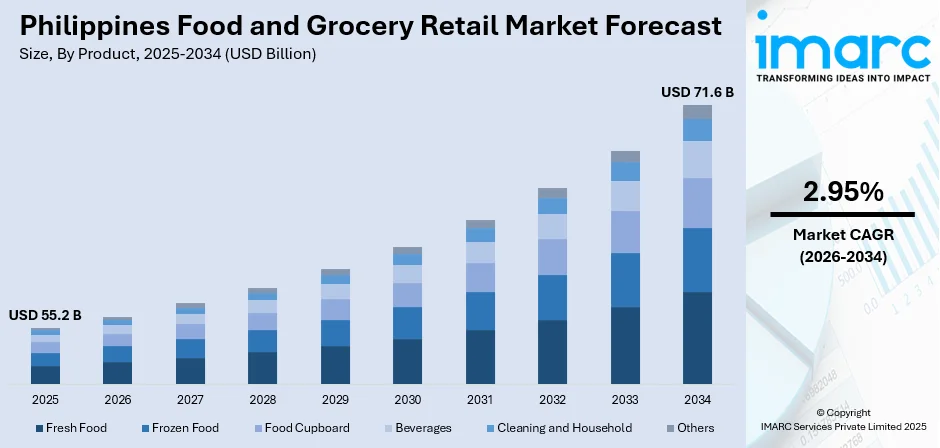

The Philippines food and grocery retail market size reached USD 55.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 71.6 Billion by 2034, exhibiting a growth rate (CAGR) of 2.95% during 2026-2034. An expanding middle class population, rapid urbanization, inflating disposable incomes, and a significant shift toward e-commerce platforms are expanding the industry. In line with this, the industry is flourishing due to consumer demand for eco-friendly packaging solutions, healthier food options, and convenience items.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 55.2 Billion |

| Market Forecast in 2034 | USD 71.6 Billion |

| Market Growth Rate 2026-2034 | 2.95% |

Philippines Food and Grocery Retail Market Trends:

E-commerce Expansion and Online Grocery Shopping

The growth of e-commerce in the Philippines is transforming the food and grocery retail landscape. For instance, industry reports indicate that the Philippines' e-commerce market reached USD 28 Billion in 2024 and is projected to grow to USD 40.5 Billion by 2027. Key trends include a high preference for mobile devices (57% of transactions) and digital wallets (34% of payment volume). More customers, especially in cities, are turning to online platforms for their grocery shopping. Supermarket chains are expanding their digital presence to meet this growing demand. Increased product variety and home delivery options make buying online more desirable, with monthly subscription packages for recurring home food delivery taking off as well. This change is revolutionizing shopping, prompting brick-and-mortar stores to invest capital in their online enhancements in order to stay in the game in the increasingly virtual marketplace. Retailers are making large investments in technology to simplify online shopping interfaces and streamline supply chain logistics to deliver improved customer experience and speed of fulfillment. Contactless payment systems have also gained popularity, providing consumers with convenience and security while paying. As a result, physical stores are building click-and-collect facilities and home delivery operations, combining a physical retailing experience with a hybrid system that satisfies the convenience-focused lifestyle of today's consumers along with their needs for cost-effective and reliable buying solutions.

To get more information on this market, Request Sample

Sustainability and Eco-Friendly Packaging

The Philippines' retail food and grocery market is changing as a result of the push for sustainability. Eco-friendly packaging and sustainable sourcing are becoming prevalent as consumers gain awareness about plastic waste and its effects on the environment. In response, retailers are using less plastic and packaging their products in recyclable or biodegradable materials. Initiatives to lessen food waste and encourage resource consumption are also being introduced by key players. In urban areas, where environmentally conscious consumers demand sustainable practices, this trend is especially noticeable. By working with suppliers to provide sustainable options and establishing themselves as socially conscious businesses, retailers are embracing circular economy models. For instance, Back to Basics Ecostore (BtB), an alternative grocery store in Philippines, promotes sustainability through a zero-waste, eco-friendly grocery model. Customers bring their containers to refill with household and personal care products, reducing packaging waste. BtB encourages suppliers to take back used containers, supporting a circular economy. The store also collaborates with local partners for recycling and upcycling initiatives. BtB aims to normalize reuse and refill systems, reduce plastic waste, and foster environmental responsibility, making a significant impact on both the community and the environment.

Philippines Food and Grocery Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Fresh Food

- Frozen Food

- Food Cupboard

- Beverages

- Cleaning and Household

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes fresh food, frozen food, food cupboard, beverages, cleaning and household, and others.

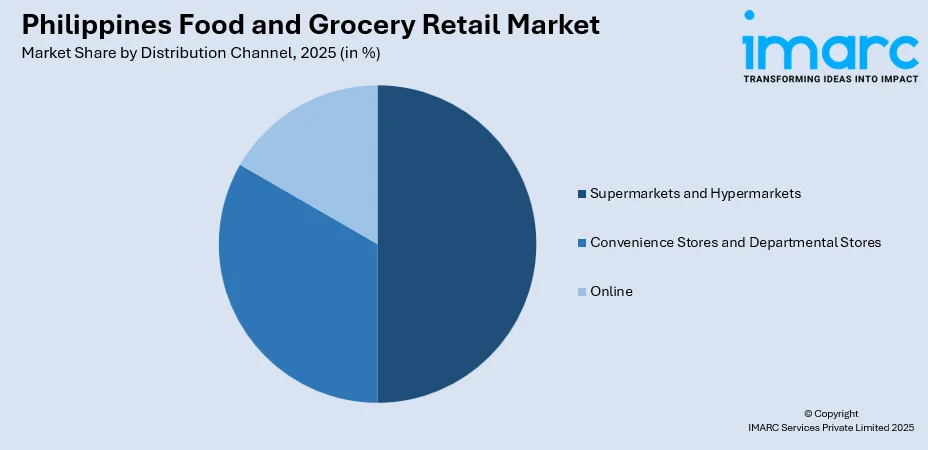

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores and Departmental Stores

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores and departmental stores, and online.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Food and Grocery Retail Market News:

- In March 2024, Discount grocery chain Dali Discount secured a USD 25 Million investment from Singapore's Venturi Partners, alongside Navegar, Creador, the Asian Development Bank, and other investors. The investment will support Dali's expansion, operational efficiency, and market presence in the Philippines.

- In February 2025, Ayala Land International Sales, Inc. (ALISI) has partnered with Island Pacific Supermarket to provide real estate investment opportunities for Filipino-Americans in the U.S. Through in-store activations across Island Pacific’s California and Nevada locations, Ayala Land will showcase property options from its 53 estates in the Philippines. This initiative aims to strengthen engagement with Overseas Filipinos, making homeownership in the Philippines more accessible.

- In October 2024, Philippine Seven Corporation (PSC) announced plans to open 500 new 7-Eleven stores in the Philippines in 2024, with a USD 103 Million investment. Expansion efforts are focused outside Metro Manila, particularly in Visayas and Mindanao, where 25% of total stores are located. PSC aims to strengthen its logistics network and accelerate store openings to meet increasing demand in these regions.

Philippines Food and Grocery Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fresh Food, Frozen Food, Food Cupboard, Beverages, Cleaning and Household, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores and Departmental Stores, Online |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines food and grocery retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines food and grocery retail market on the basis of product?

- What is the breakup of the Philippines food and grocery retail market on the basis of distribution channel?

- What are the various stages in the value chain of the Philippines food and grocery retail market?

- What are the key driving factors and challenges in the Philippines food and grocery retail market?

- What is the structure of the Philippines food and grocery retail market and who are the key players?

- What is the degree of competition in the Philippines food and grocery retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines food and grocery retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines food and grocery retail market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines food and grocery retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)