Philippines Esports Market Size, Share, Trends, and Forecast by Revenue Source, Games, Platform, and Region, 2026-2034

Philippines Esports Market Overview:

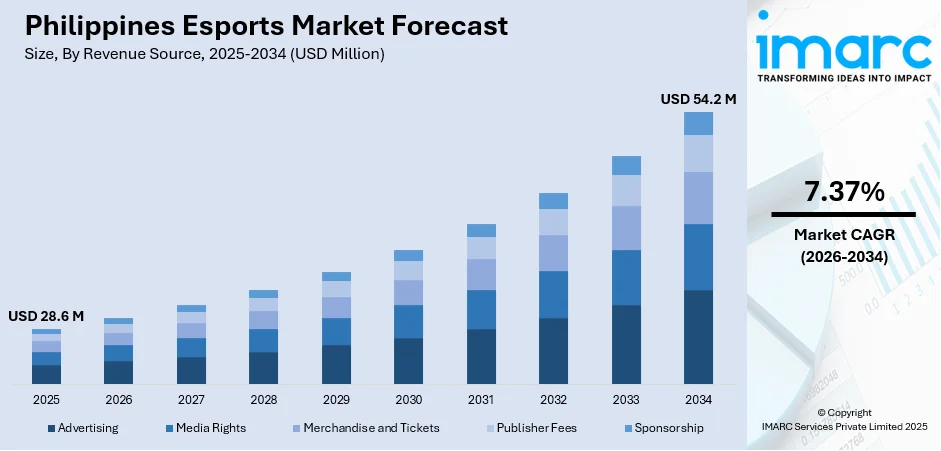

The Philippines esports market size reached USD 28.6 Million in 2025. Looking forward, the market is projected to reach USD 54.2 Million by 2034, exhibiting a growth rate (CAGR) of 7.37% during 2026-2034. The market is notably expanding, impacted by elevating internet penetration, mobile gaming popularity, and robust youth engagement. The market encompasses competitive gaming tournaments, sponsorships, streaming, and esports-related merchandise, providing substantial prospects for investment and industry expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.6 Million |

| Market Forecast in 2034 | USD 54.2 Million |

| Market Growth Rate (2026-2034) | 7.37% |

Trends of Philippines Esports Market:

Mobile Gaming Domination

The Philippines esports market is witnessing a surge in mobile gaming, which now dominates the competitive gaming scene. With increasing smartphone penetration, mobile esports titles like Mobile Legends: Bang Bang (MLBB) and Call of Duty: Mobile have witnessed exponential growth. For instance, as per industry reports, in 2024, Philippines reinforced its position as a global esports hub, with ONIC Philippines, under the Fnatic banner, dominating the M6 World Championship for MLBB with an exceptional performance. Such achievements elevate market demand in the nation, attracting amplified sponsorships and investments. Mobile gaming's accessibility, low entry cost, and flexible play style contribute to its popularity, particularly among younger demographics. With esports tournaments, such as the Mobile Legends Professional League (MPL), Philippines have seen significant sponsorships, enhancing brand visibility. This trend is supported by improved mobile internet infrastructure, driving the growth of mobile esports leagues, tournaments, and live-streaming events. As mobile gaming continues to dominate, the Philippines is positioning itself as a competitive esports hub in Southeast Asia, attracting local and international sponsorship deals and media rights, creating an ecosystem that bolsters both grassroots and professional-level competitions.

To get more information on this market, Request Sample

Rise of Esports Streaming and Content Creation

Esports streaming platforms like Facebook Gaming, YouTube Gaming, and Twitch are increasingly central to the Philippines esports market. Content creators and professional players are gaining massive followings through live streams and esports-related content. The shift towards digital media consumption accelerated the growth of live streaming as a primary medium for esports engagement. For instance, as per industry reports, Philippines ranks sixth globally for Facebook utilization, with 86.9 million active users. Influencers, streamers, and professional teams are monetizing their content through advertisements, fan donations, and exclusive sponsorships, creating new revenue channels. This trend is fueling the rise of esports personalities, allowing them to generate income through media partnerships, while also boosting the visibility of esports to a broader audience. The growing popularity of esports streaming has led to significant investments in local and regional streaming platforms, reinforcing the Philippines' position as an emerging esports content hub in Southeast Asia. This trend is expected to continue, with growing participation and viewership across digital channels. For instance, as per industry reports, esports market in Philippines encompasses more than 43 Million gamers.

Professionalization of eSports Careers

The eSports sector in the Philippines is experiencing a notable transition toward the professionalization of gaming roles, with an increasing number of players viewing eSports as a legitimate full-time career. Competitive gamers are now engaging in organized training regimens, working with coaches in team settings, and dedicating themselves to intense practice sessions to enhance their skills. Organizations are investing in the growth of their players by offering salaries, securing sponsorships, and providing performance-based incentives. New training facilities and boot camps are emerging, granting access to state-of-the-art equipment and strategic coaching. This professional framework is boosting player performance and garnering international attention for Filipino talent. Consequently, the rising count of professional teams and athletes is helping to expand the Philippines esports market share within the global competitive gaming arena.

Growth Drivers of Philippines Esports Market:

High Smartphone and Internet Penetration

The swift increase in smartphone usage and better internet access throughout the Philippines is considerably enhancing participation in online and mobile-based eSports competitions. With affordable mobile devices and competitive data plans, gaming has become accessible to a wide demographic, ranging from casual gamers to serious competitors. Mobile eSports games are especially favored, enabling players to compete anytime and anywhere, which leads to a rise in active involvement. This accessibility motivates more individuals to enter tournaments, stream their gameplay, and participate in online communities. As technological infrastructure continues to improve, the growing acceptance of mobile gaming is poised to further boost Philippines esports market demand, establishing it as a key foundation for industry growth moving forward.

Growing Youth Gaming Community

The Philippines is home to a sizable, tech-savvy youth demographic that exhibits strong engagement with online gaming, accelerating the swift growth of the eSports sector. Young gamers are participating in competitive tournaments and forming communities through streaming, social platforms, and content creation. This group is highly adaptable to new games, platforms, and competitive formats, ensuring persistent market development. Educational institutions are increasingly recognizing eSports as a legitimate extracurricular activity and career option, further legitimizing the field. The passion and skill levels present in this youthful gamer community are anticipated to drive Philippines esports market growth, positioning the nation as an emerging hotspot for competitive gaming in Asia.

Sponsorship and Brand Investments

The surge in sponsorship and brand investments is reshaping the eSports landscape in the Philippines, creating more avenues for players, teams, and event organizers. Both gaming-related and non-gaming brands are providing financial support for tournaments, team endorsements, and promotional efforts, significantly elevating the industry's visibility. Such investments enable the execution of large-scale, high-quality events with appealing prize pools, attracting both local and international competitors. They also aid in infrastructure development, including training facilities and professional team management. According to Philippines esports market analysis, partnerships with brands enhance visibility and contribute to the long-term viability of the sector, driving its transformation into a widely-recognized entertainment and sports industry.

Opportunities of Philippines Esports Market:

Expansion of Mobile eSports Tournaments

The Philippines’ vibrant mobile gaming community creates significant opportunities for the growth of mobile eSports tournaments. With a high rate of smartphone usage and accessible internet, mobile games have emerged as the favored medium for competitive gaming. Hosting more extensive and well-financed tournaments can draw both local and international competitors, enhancing the nation’s eSports visibility. These events also present revenue generation opportunities through sponsorships, ticket sales, and live streaming. By engaging the vast mobile gamer population, organizers can encourage community involvement, identify emerging talent, and elevate the competitive landscape. This growth could further establish the Philippines as a leader in mobile eSports in the region.

Integration of eSports in Education

The increasing acceptance of eSports within educational systems is paving the way for new prospects for young talent in the Philippines. Educational institutions are beginning to offer eSports scholarships, create varsity teams, and implement structured training initiatives to support aspiring competitive gamers. This integration cultivates strategic thinking, teamwork, and leadership qualities while establishing legitimate career paths within the gaming industry. Schools and universities also act as talent incubators, offering resources, equipment, and organized competitions. By incorporating eSports into academic programs, the sector enhances its credibility and sustainability, providing students with skill development and educational backing. This strategy solidifies the talent pipeline for the country’s eSports ecosystem.

International Tournament Hosting

The Philippines possesses strong potential to host significant international esports tournaments, propelled by its expanding gamer community, proficiency in English, and strategic geographical position in Southeast Asia. Hosting these global events can boost tourism, generate revenue, and enhance the country's standing as an esports center. Such tournaments also allow local players to compete at elevated levels without needing to travel abroad. Collaborations with international organizations can introduce advanced infrastructure, sponsorships, and media exposure to the local landscape. Successfully hosting large-scale events could position the Philippines as a premier destination for competitive gaming within the Asia-Pacific region, promoting long-term industry development.

Challenges of Philippines Esports Market:

Limited Professional Training Infrastructure

A major hurdle in the Filipino esports arena is the insufficient professional training infrastructure. Despite a wealth of player interest and talent, there is a scarcity of dedicated facilities equipped with high-performance systems, coaching personnel, and strategic training programs. Many players depend on self-directed training, which may hinder their competitive abilities. This shortcoming makes it challenging for local talent to meet the preparation levels of international teams. Investing in esports academies, boot camps, and performance centers could help bridge this divide, allowing players to hone their skills in a professional environment and compete more effectively on the world stage.

Cybersecurity and Fair Play Concerns

As esports popularity rises in the Philippines, issues related to cybersecurity and fair play have become increasingly important. Problems such as hacking, cheating software, and account breaches threaten the integrity of competitions and tarnish player reputations. Online tournaments, in particular, are susceptible to these risks without adequate protections. Ensuring fair play is essential to uphold audience trust and competitive credibility. It is vital to introduce robust security measures, anti-cheating systems, and stringent tournament regulations to maintain industry growth. Proactively addressing these challenges will safeguard both players and event organizers while fostering a secure and trustworthy competitive gaming atmosphere.

Lack of Standardized Regulations

The lack of a centralized governing body for esports in the Philippines leads to inconsistencies in rules, contracts, and player rights. Without standardized regulations, complications such as unfair contracts, prize disputes, and scheduling conflicts can emerge, impacting players and teams alike. A clear regulatory framework would safeguard professional gamers, promote transparency, and uphold fair competition standards. It would also enable better coordination among event organizers, sponsors, and stakeholders. Establishing a national governing authority for esports could bring structure, professionalism, and long-term stability to the industry, allowing it to operate on par with other globally recognized sports sectors.

Philippines Esports Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on revenue source, games, and platform.

Revenue Source Insights:

- Advertising

- Media Rights

- Merchandise and Tickets

- Publisher Fees

- Sponsorship

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes advertising, media rights, merchandise and tickets, publisher fees, and sponsorship.

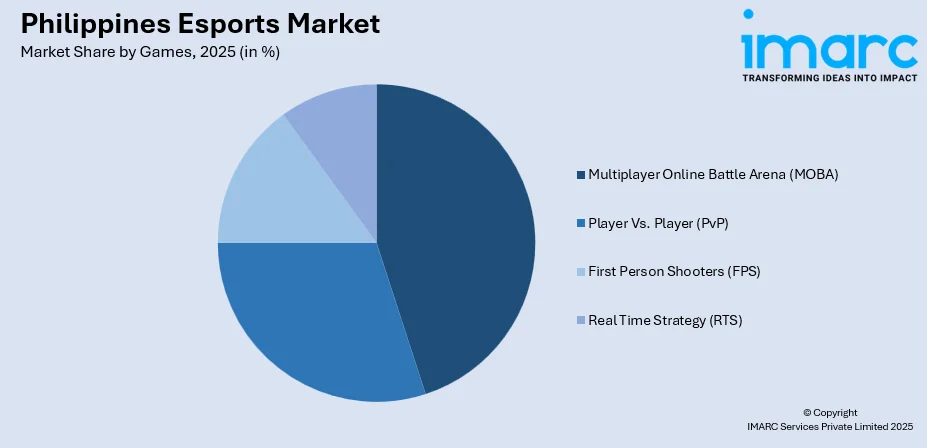

Games Insights:

- Multiplayer Online Battle Arena (MOBA)

- Player Vs. Player (PvP)

- First Person Shooters (FPS)

- Real Time Strategy (RTS)

A detailed breakup and analysis of the market based on the games have also been provided in the report. This includes multiplayer online battle arena (MOBA), player Vs. player (PvP), first person shooters (FPS), and real time strategy (RTS).

Platform Insights:

- PC-Based Esports

- Consoles-Based Esports

- Mobile and Tablets

- Real Time Strategy (RTS)

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes PC-based esports, consoles-based esports, mobile and tablets, and real time strategy (RTS).

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Esports Market News:

- In January 2025, Twisted Minds and Team Falcons, both renowned organizations from Saudi Arabia, officially joined the Mobile Legends: Bang Bang Professional League (MPL) Philippines for Season 15. Team Falcons highlighted the Philippines' dominance in MLBB as a key factor in their decision to enter the market, noting the region's strong performance at international events like the Esports World Cup.

- In July 2024, Aurora Gaming, a major esports company, announced its official launch in Philippines, with the firm strategically collaborating with prominent gamers V33Wise.

Philippines Esports Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Sources Covered | Advertising, Media Rights, Merchandise and Tickets, Publisher Fees, Sponsorship |

| Games Covered | Multiplayer Online Battle Arena (MOBA), Player Vs. Player (PvP), First Person Shooters (FPS), Real Time Strategy (RTS) |

| Platforms Covered | PC-Based Esports, Consoles-Based Esports, Mobile and Tablets, Real Time Strategy (RTS) |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines esports market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines esports market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines esports industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines esports market was valued at USD 28.6 Million in 2025.

The Philippines esports market is projected to exhibit a compound annual growth rate (CAGR) of 7.37% during 2026-2034.

The Philippines esports market is expected to reach a value of USD 54.2 Million by 2034.

The Philippines esports market is evolving with the rise of mobile-based tournaments, growing integration of gaming in education, and the emergence of professional training setups. Streaming platforms, brand partnerships, and international event hosting are further enhancing player visibility, audience engagement, and global competitiveness.

Growth of esports market in Philippines is fueled by a large youth gaming community, improving internet connectivity, and increasing corporate sponsorships. Educational institutions offering eSports programs, the expansion of content creation opportunities, and rising recognition of gaming as a viable career path are further accelerating market development and industry professionalization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)