Philippines Construction Market Size, Share, Trends and Forecast by Sector and Region, 2026-2034

Philippines Construction Market Overview:

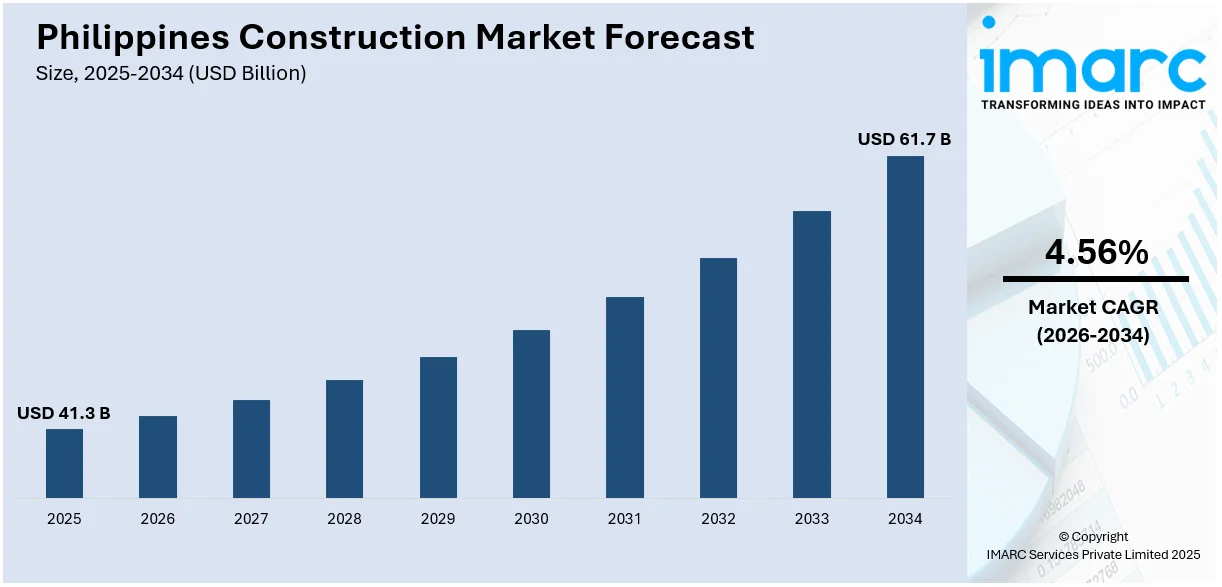

The Philippines construction market size reached USD 41.3 Billion in 2025. Looking forward, the market is projected to reach USD 61.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.56% during 2026-2034. The rising infrastructure investments, rapid urbanization, government-backed projects, growing foreign direct investments, increasing demand for residential and commercial spaces, expansion of transport networks, and technological advancements in construction methods are some of the factors positively impacting the Philippines construction market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 41.3 Billion |

| Market Forecast in 2034 | USD 61.7 Billion |

| Market Growth Rate 2026-2034 | 4.56% |

Key Trends of Philippines Construction Market:

Government Infrastructure Initiatives

The market is driven by large-scale infrastructure programs aimed at improving connectivity and economic growth. The government-funded projects focus on transportation, water resources, energy, and digital infrastructure. The increased construction of road networks, rail systems, and airports facilitates the Philippines construction market growth. The construction of bypass roads enhances logistics efficiency, fostering industrial and commercial development. Public-private partnerships (PPPs) stimulate foreign investments in infrastructure development with modernized facilities and services. Smart city projects utilize digital solutions for effective urban planning and management. Also, infrastructure development initiatives extend opportunities for construction companies, suppliers of materials, and service providers, which creates employment opportunities and economic upliftment.

To get more information on this market Request Sample

The government's commitment to infrastructure generation ensures that there will be an uninterrupted flow of projects into the construction sector. According to an industry report, the Philippine Public-Private Partnership (PPP) Center announced the roll-out of 173 infrastructure projects worth about USD 56 Billion, with transportation, health, and information technology as the main sectors. This initiative consists of 95 solicited projects with a value of USD 21 Billion and 78 unsolicited projects with a value of USD 37 Billion. In line with this, to increase the economic potential of the construction industry, the Society of Construction Law Philippines (SCLP) and the Department of Trade and Industry's Construction Industry Authority of the Philippines (DTI-CIAP) signed a MoU. The goals of this collaboration are to create standardized contract templates that cater to the demands of various stakeholders and to start awareness campaigns and training initiatives on construction rules and standard contract conditions.

Emphasis on Sustainable and Green Building Practices

The increasing environmental awareness and evolving industry standards are positively influencing the Philippines construction market outlook. Green building practices reduce energy consumption, waste, and consumption of resources. Developers have started using eco-friendly building materials-recycled concrete, bamboo, and low-carbon cement to minimize environmental impact. Smart building systems are being adopted widely, which include features such as light automation, ventilation control, and water management, thereby ensuring maximum energy use. Additionally, there is an increasing number of certification programs to ensure compliance with green building standards, which are connected to sustainable development. With the increasing demand for eco-friendly design in residential, commercial, and industrial projects, construction companies are compelled to innovate environmentally responsible growing solutions in line with international environmental objectives. On November 28, 2024, the Department of Trade and Industry's Construction Industry Authority of the Philippines (DTI-CIAP), in collaboration with the Philippine Constructors Association (PCA), convened the 5th Philippine Construction Congress to promote sustainable and innovative building practices. The program brought together industry leaders, stakeholders, and experts to discuss sustainable construction, regulatory innovation, and green construction trends.

Urban Housing Boom

The rapid urbanization taking place in the Philippines is propelling a huge growth in residential development particularly in urban areas. Growing population density and a growing middle class are fueling the demand for both budget-friendly housing and high-rise condominiums. Many families are seeking modern housing close to central business areas, schools, and shopping centers leading to an increase in vertical housing projects. Developer-backed affordable housing programs and government subsidies are targeting the needs of low to mid-income households. This expansion in housing enhances living conditions and greatly increases Philippines construction market demand as it necessitates substantial quantities of materials, skilled labor, and cutting-edge construction techniques to satisfy the escalating urban housing requirements.

Growth Drivers of Philippines Construction Market:

Industrial and Economic Zone Expansion

The growth of industrial and economic zones of the Philippines is creating huge impetus for the construction industry. The establishment of manufacturing centers, logistics centers, and export processing zones requires massive construction of factories and warehouses as well as associated infrastructures. These developments enhance the industrial backbone of the nation and enhance trade competitiveness. As the need for state-of-the-art facilities increases, construction firms play a critical role in meeting the requirements of domestic as well as foreign investors. The continuous expansion of these areas guarantees a steady demand for construction labor, materials, and services, ensuring the construction of industrial and economic centers plays a major role in fostering long-term market development.

Foreign Direct Investments (FDIs)

Foreign Direct Investments are crucial for the growth of the construction industry in the Philippines providing essential capital and expertise for large-scale initiatives. Global investors are directing funds into real estate, commercial developments, and infrastructure projects creating new opportunities for construction firms. According to Philippines construction market analysis, FDIs also promote the implementation of global best practices, advanced technologies, and sustainable construction methods elevating industry standards. Furthermore, foreign investments frequently lead to partnerships with local companies contributing to job creation and enhancing market competitiveness. As confidence in the Philippine economy increases among investors FDIs are anticipated to continue playing a significant role in the expansion of the construction sector.

Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs) are crucial in expediting large-scale construction ventures throughout the Philippines. By forming these collaborations the government utilizes private sector expertise and financing to undertake infrastructure projects such as expressways, rail systems, airports, and water supply networks. This approach alleviates the financial burden on public resources while ensuring timely project completion and improved efficiency. For the construction industry PPPs provide a continuous stream of projects granting opportunities for both local and foreign contractors. Additionally, PPPs encourage innovation and modern construction methodologies as private enterprises introduce advanced technologies. By aligning public objectives with private efficiency PPPs considerably enhance the long-term growth potential of the Philippine construction market.

Opportunities of Philippines Construction Market:

Tourism Infrastructure Growth

The booming tourism sector in the Philippines is generating substantial opportunities for the construction industry notably through the creation of hotels, resorts, airports, and related facilities. As the country continues to attract both local and international visitors there is a persistent need for contemporary hospitality and transportation infrastructure. The development of regional airports and seaports improves access to various island locations further driving construction activity. In addition, both international hotel brands and local developers are investing in new ventures to accommodate the increasing number of tourists. This phenomenon creates a ripple effect boosting the demand for commercial spaces, entertainment venues, and essential service infrastructure. With tourism remaining a crucial factor for economic expansion construction firms are well-positioned to benefit from a continuous stream of projects designed to support this sector.

Rural Development Projects

Rural development is becoming a vital area of growth for the construction market in the Philippines, as the government aims to bridge the gap between urban and rural regions. Building critical infrastructure such as schools, hospitals, housing, and road networks in underdeveloped areas is leading to a rise in demand for construction services and materials. These projects enhance access to education, healthcare, and job opportunities, promoting balanced economic growth. Additionally, rural infrastructure initiatives improve connectivity between isolated communities and urban areas, fostering trade and investment. For construction companies, this presents an opportunity to tap into markets beyond conventional city projects. As public funding continues to support regional development, rural construction efforts will play a significant role in long-term growth throughout the nation.

Technological Integration

The integration of technology is transforming the construction landscape in the Philippines, enhancing project efficiency, cost-effectiveness, and sustainability. Implementing Building Information Modeling (BIM) facilitates superior project planning, increases design accuracy, and minimizes execution errors. At the same time, automating construction processes accelerates project timelines and reduces reliance on manual labor, addressing the shortage of skilled workers. Additionally, prefabrication and modular construction techniques are becoming more prevalent, allowing for quicker completion of housing and commercial developments with reliable quality. These advancements contribute to lowering overall costs while improving productivity and safety measures. By embracing cutting-edge technologies, construction companies can satisfy increasing demand, boost their competitiveness, and align with global industry standards. This digital transformation positions the sector for enduring change and expansion.

Challenges of Philippines Construction Market:

High Construction Costs

One of the most significant obstacles in the Philippine construction market is the elevated construction costs, which are primarily influenced by the increasing prices of raw materials, fuel, and labor. The volatility of global commodity markets and dependence on imported materials like steel and cement put additional strain on project budgets. Expenses are further inflated by rising transportation and logistics costs due to congested infrastructure. These financial pressures often lead to project delays, reduced designs, or the postponement of major projects. Higher costs decrease profitability for developers and complicate the execution of affordable housing and infrastructure initiatives. In response to these challenges, construction firms are increasingly adopting cost-effective strategies, such as prefabrication and bulk procurement. Nonetheless, without comprehensive solutions, ongoing high construction costs will continue to hinder the industry's growth and competitiveness.

Regulatory Delays

Regulatory delays represent a significant barrier for the construction market in the Philippines, impeding the swift execution of projects. The lengthy processes required for securing permits, land clearances, and complying with environmental regulations create considerable uncertainty for developers and contractors. These bureaucratic challenges prolong project timelines and escalate overall costs due to idle labor, equipment, and capital investments. In certain cases, these delays may deter investors, especially for large-scale real estate and infrastructure initiatives. Furthermore, inconsistent regulation enforcement across different regions complicates the operations of construction companies with national reach. Although reforms have been launched to simplify these processes, a more transparent and efficient regulatory framework is essential for supporting industry growth. If these delays are not addressed, the market risks losing its momentum in delivering crucial projects on schedule.

Skilled Labor Shortage

The construction industry in the Philippines faces a significant challenge in the form of a skilled labor shortage, which includes engineers, architects, and trained construction workers. The rapid expansion of infrastructure and real estate projects has heightened competition for talent, resulting in an imbalance between supply and demand. Many skilled workers are opting for employment overseas, lured by higher salaries, leaving domestic projects lacking adequate staffing. This labor shortage adversely impacts productivity, quality, and project timelines, compelling firms to depend on overtime or less experienced workers, which may hinder efficiency. Initiatives for training and upskilling are vital for closing this gap, but current efforts fall short of meeting industry demands. As the market grows, tackling the skilled labor shortage is crucial for sustaining growth, ensuring safety standards, and maintaining global competitiveness in construction.

Philippines Construction Market Segmentation:

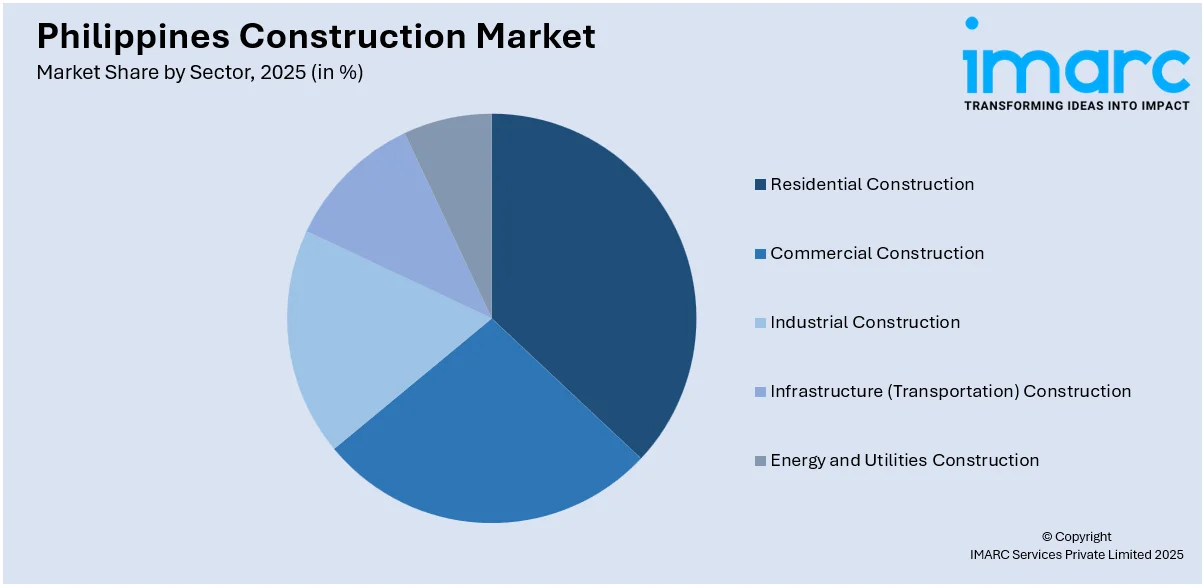

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on sector.

Sector Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure (Transportation) Construction

- Energy and Utilities Construction

The report has provided a detailed breakup and analysis of the market based on the sector. This includes residential construction, commercial construction, industrial construction, infrastructure (transportation) construction, and energy and utilities construction.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Construction Market News:

- July 2024: The Philippine Domestic Construction Board (PDCB) conducted a 16-hour training course titled "Training Course on Understanding Construction Contracts," aimed at enhancing the expertise of academic professionals in the construction sector. This initiative reflects PDCB's commitment to advancing construction education and ensuring that educators are well-versed in contractual aspects of the industry.

- October 17, 2024: President Ferdinand Marcos Jr. led the groundbreaking ceremony of the MTerra Solar Project, recognized as the world's largest integrated solar and battery storage facility. The construction of this project, which is full swing, signifies a significant milestone in renewable energy development, highlighting the country's commitment to sustainable and clean energy solutions.

Philippines Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Residential Construction, Commercial Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utilities Construction |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction market in Philippines was valued at USD 41.3 Billion in 2025.

The Philippines construction market is projected to exhibit a compound annual growth rate (CAGR) of 4.56% during 2026-2034.

The Philippines construction market is expected to reach a value of USD 61.7 Billion by 2034.

The Philippines construction market is witnessing trends such as sustainable building practices, increasing adoption of digital tools like BIM, and rising demand for high-rise housing in urban centers. Expansion of smart city projects, prefabrication methods, and foreign investment participation are also reshaping construction activities across the country.

Market is driven by government infrastructure programs, expansion of industrial and economic zones, and rising foreign direct investments. Increasing tourism-related projects, urban housing demand, and rural development initiatives further drive construction. Public-private partnerships and a growing middle-class population also add momentum, ensuring strong and diversified growth in the Philippines construction industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)