Philippines Clinical Laboratory Services Market Report by Test Type (Human and Tumor Genetics, Clinical Chemistry, Medical Microbiology and Cytology, and Others), Service Provider (Hospital-Based Laboratories, Stand-Alone Laboratories, Clinic-Based Laboratories), Application (Bioanalytical and Lab Chemistry Services, Toxicology Testing Services, Cell and Gene Therapy Related Services, Preclinical and Clinical Trial Related Services, Drug Discovery and Development Related Services, and Others), and Region 2026-2034

Philippines Clinical Laboratory Services Market Overview:

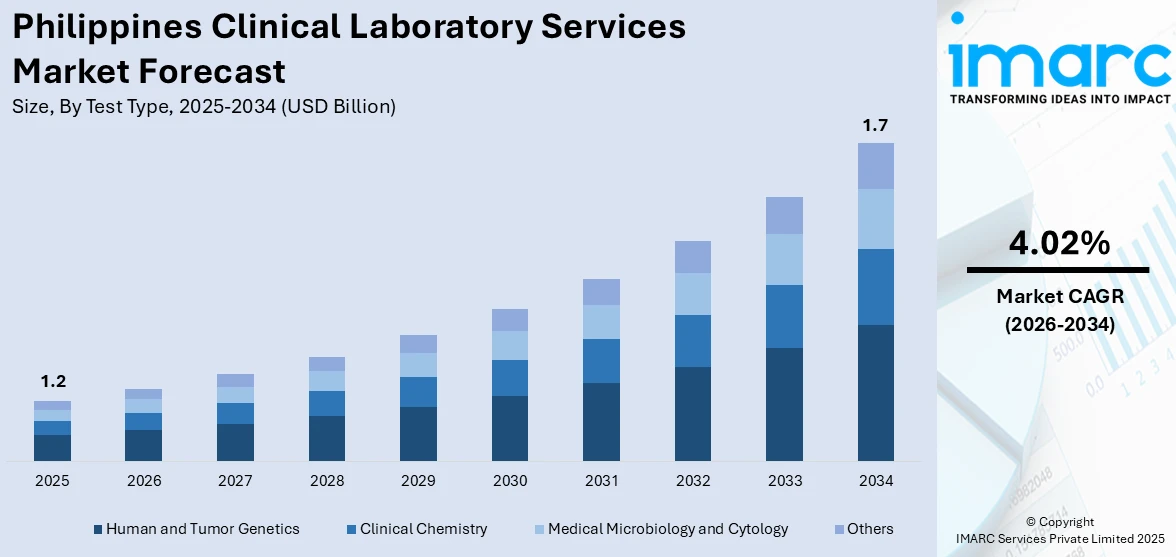

The Philippines clinical laboratory services market size reached USD 1.2 Billion in 2025. Looking forward, the market is expected to reach USD 1.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.02% during 2026-2034. The increasing prevalence of chronic diseases, advancements in laboratory technology and automation, and the expanding scope of health insurance coverage under the Universal Health Care (UHC) Act are some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 1.7 Billion |

| Market Growth Rate 2026-2034 | 4.02% |

Key Trends of Philippines Clinical Laboratory Services Market:

Increasing Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a major driver for the growth of clinical laboratory services in the Philippines. Non-communicable diseases such as diabetes, cardiovascular diseases (CVDs), and cancer are becoming more common due to lifestyle changes, urbanization, and an aging population. These conditions require regular monitoring and diagnostic testing, fueling the demand for clinical laboratory services. For instance, diabetes management involves frequent blood glucose testing, while CVDs necessitate regular lipid profile tests. The rise in cancer cases drives the need for various diagnostic and monitoring tests, including tumor marker tests, biopsy examinations, and genetic testing. This trend not only boosts the volume of tests conducted but also increases the complexity and range of tests required, pushing laboratories to expand their capabilities and services.

To get more information on this market Request Sample

Advancements in Laboratory Technology and Automation

Advancements in laboratory technology and automation significantly impact the Philippines clinical laboratory services market growth. The adoption of cutting-edge technologies, such as polymerase chain reaction (PCR), next-generation sequencing (NGS), and mass spectrometry has revolutionized diagnostic capabilities, allowing for more accurate, rapid, and comprehensive testing. Automation in laboratories enhances efficiency by reducing human error, speeding up turnaround times, and enabling high-throughput testing. Automated analyzers, robotic sample handlers, and integrated laboratory information management systems (LIMS) streamline operations and improve workflow efficiency. These technological advancements not only enhance diagnostic accuracy and reliability but also enable laboratories to offer a broader range of tests, including advanced molecular and genetic testing. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in diagnostic processes is paving the way for predictive analytics and personalized medicine, further bolstering the demand for clinical laboratory services.

Expanding Scope of Health Insurance Coverage

The expanding scope of health insurance coverage is another crucial trend driving the Philippines clinical laboratory services market demand. The government’s efforts to achieve universal healthcare coverage through the UHC Act have significantly increased access to healthcare services, including laboratory diagnostics. The UHC Act aims to provide equitable access to quality health services for all Filipinos, emphasizing preventive care and early diagnosis. With more people covered by health insurance, there is a greater propensity for individuals to seek medical attention and undergo necessary diagnostic tests. This increase in insured patients leads to higher demand for laboratory services, as insurance coverage often includes reimbursement for a wide range of diagnostic tests. Furthermore, private health insurance companies are also expanding their coverage options, providing additional benefits and incentives for preventive and diagnostic testing. This broader insurance coverage not only makes laboratory services more affordable for patients but also ensures steady revenue streams for clinical laboratories, encouraging further investment and expansion in the sector.

Growth Drivers of Philippines Clinical Laboratory Services Market:

Rising Healthcare Infrastructure Investment and Government Support

The Philippine government's substantial healthcare infrastructure investments through programs like the Universal Health Care Act and Bayanihan to Heal as One Act are creating significant opportunities for clinical laboratory services expansion. These initiatives include funding for regional medical centers, primary healthcare facilities, and specialized diagnostic centers that require comprehensive laboratory services. Government partnerships with private sector entities facilitate technology transfer, equipment procurement, and capacity building programs that strengthen laboratory capabilities nationwide. The Department of Health's strategic focus on strengthening diagnostic capabilities at all healthcare levels drives demand for diverse laboratory services from basic chemistry panels to advanced molecular diagnostics. Additionally, public-private partnerships enable cost-sharing arrangements for expensive diagnostic equipment and technology upgrades, making advanced laboratory services more accessible across different regions. These government-led initiatives create a supportive environment for laboratory service providers to expand their operations and invest in cutting-edge technologies.

Aging Population Demographics and Disease Pattern Shifts

The Philippines' rapidly aging population, with citizens over 65 expected to reach 7.9 million by 2030, creates substantial demand for comprehensive laboratory services focused on age-related health conditions. Elderly populations require frequent monitoring for chronic diseases, regular health screenings, and complex diagnostic workups that drive consistent laboratory service utilization, thereby fueling the Philippines clinical laboratory services market share. Age-related conditions such as diabetes, hypertension, kidney disease, and cardiovascular disorders necessitate specialized laboratory panels, biomarker testing, and ongoing therapeutic monitoring. The demographic shift toward an older population structure creates predictable, long-term demand patterns for laboratory services, encouraging investment in geriatric-focused diagnostic capabilities. Healthcare providers are expanding their laboratory service portfolios to include advanced aging-related biomarkers, genetic predisposition testing, and comprehensive metabolic panels tailored to elderly patients. This demographic transformation represents a fundamental shift in healthcare needs that positions clinical laboratory services as essential components of comprehensive elderly care management.

Digital Health Integration and Laboratory Information Systems

The accelerating digital transformation of Philippine healthcare systems creates significant growth opportunities for clinical laboratory services through enhanced connectivity, data sharing, and integrated diagnostic workflows. Electronic health record implementation requires seamless laboratory information system integration, enabling real-time result sharing between healthcare providers and improving care coordination. Cloud-based laboratory management systems facilitate remote monitoring, quality control, and data analytics capabilities that enhance operational efficiency and diagnostic accuracy. Telemedicine adoption drives demand for point-of-care testing, home collection services, and remote diagnostic capabilities that extend laboratory services beyond traditional facility boundaries. Digital health platforms create opportunities for laboratories to offer direct-to-consumer testing services, wellness panels, and preventive screening programs. The integration of artificial intelligence and machine learning technologies in laboratory operations enables predictive analytics, automated quality control, and personalized medicine applications that differentiate service providers and create new revenue streams.

Opportunities of Philippines Clinical Laboratory Services Market:

Medical Tourism and International Patient Services Expansion

The Philippines' growing medical tourism industry presents substantial opportunities for clinical laboratory services to serve international patients seeking high-quality, cost-effective diagnostic services. The country's strategic location in Southeast Asia, English-speaking healthcare workforce, and competitive pricing position it as an attractive destination for patients from neighboring countries requiring comprehensive diagnostic workups. International accreditation programs like CAP (College of American Pathologists) and ISO 15189 enable Philippine laboratories to meet global quality standards, attracting international patients and medical tourism facilitators. Specialized laboratory services for pre-travel health assessments, tropical disease diagnostics, and comprehensive executive health programs create niche market opportunities with premium pricing potential. Partnerships with international hospitals, insurance companies, and medical tourism agencies facilitate patient referral networks and expand market reach beyond domestic boundaries. The development of specialized international patient service departments within clinical laboratories creates opportunities for premium service offerings and enhanced revenue generation.

Personalized Medicine and Genetic Testing Market Development

The emerging personalized medicine landscape in the Philippines creates significant opportunities for clinical laboratory services to develop specialized genetic testing, pharmacogenomics, and precision medicine capabilities. Growing physician and patient awareness of genetic predisposition testing, targeted cancer therapies, and personalized treatment protocols drives demand for advanced molecular diagnostic services. According to the Philippines clinical laboratory services market analysis, the establishment of genetic counseling programs and precision medicine initiatives in major medical centers creates referral networks for specialized laboratory services. Partnerships with international genetic testing companies enable Philippine laboratories to offer comprehensive genomic panels, ancestry testing, and rare disease diagnostics through collaborative arrangements. The development of Filipino-specific genetic databases and population genetics research creates opportunities for laboratories to contribute to research initiatives while building specialized testing capabilities. Consumer interest in direct-to-consumer genetic testing for wellness, nutrition, and fitness applications represents an expanding market segment with significant growth potential.

Rural Healthcare Access and Mobile Laboratory Services

The Philippines' archipelagic geography and rural healthcare access challenges create substantial opportunities for innovative laboratory service delivery models including mobile laboratories, point-of-care testing, and satellite facility networks. Remote island communities, mountainous regions, and underserved rural areas represent untapped markets for laboratory services that can be accessed through creative delivery mechanisms. Mobile laboratory units equipped with automated analyzers, specimen collection capabilities, and telemedicine connectivity can serve multiple rural communities on rotating schedules. Partnership opportunities with local government units, barangay health centers, and rural hospitals facilitate sustainable business models for extended laboratory services. The development of solar-powered, internet-connected point-of-care testing devices enables laboratory services in areas with limited infrastructure. Drone delivery systems for specimen transport and result delivery create opportunities to overcome geographic barriers while maintaining service quality and turnaround times.

Philippines Clinical Laboratory Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on test type, service provider and application.

Test Type Insights:

- Human and Tumor Genetics

- Clinical Chemistry

- Medical Microbiology and Cytology

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes human and tumor genetics, clinical chemistry, medical microbiology and cytology, and others.

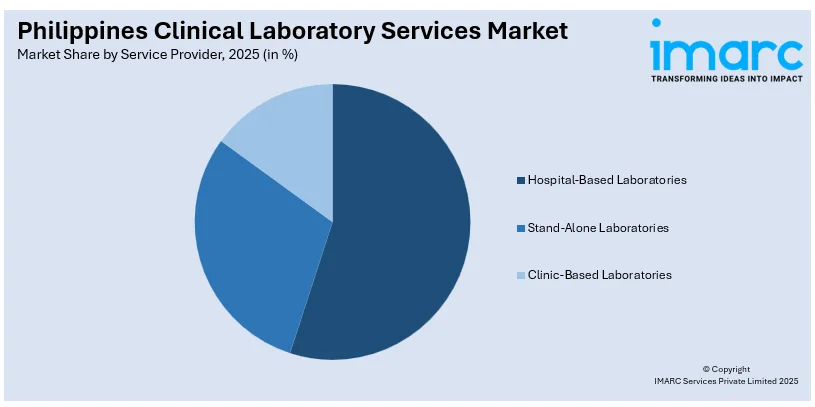

Service Provider Insights:

Access the comprehensive market breakdown Request Sample

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

A detailed breakup and analysis of the market based on the service provider have also been provided in the report. This includes hospital-based laboratories, stand-alone laboratories, and clinic-based laboratories.

Application Insights:

- Bioanalytical and Lab Chemistry Services

- Toxicology Testing Services

- Cell and Gene Therapy Related Services

- Preclinical and Clinical Trial Related Services

- Drug Discovery and Development Related Services

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes bioanalytical and lab chemistry services, toxicology testing services, cell and gene therapy related services, preclinical and clinical trial related services, drug discovery and development related services, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Clinical Laboratory Services Market News:

- In June 2025, Central Luzon Doctors' Hospital (CLDH) formed a strategic alliance with Medi Linx Laboratory to enhance and streamline its clinical laboratory services. The agreement was formalized during a signing ceremony attended by senior executives and department heads from both organizations, led by Dr. Ferdinand Francis Maria D.L. Cid, President and CEO of CLDH, and Ms. Maria Estella P. Diokno, President and CEO of Medi Linx Laboratory.

- In July 2023, Marubeni Corporation, LSI Medience Corporation, and Metro Pacific Health Corporation had an agreement to expand Medi Linx Laboratory Inc. in the Philippines. The agreement aims to improve the quality of clinical laboratory testing services in the country.

Philippines Clinical Laboratory Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Test Types Covered | Human and Tumor Genetics, Clinical Chemistry, Medical Microbiology and Cytology, Others |

| Service Providers Covered | Hospital-Based Laboratories, Stand-Alone Laboratories, Clinic-Based Laboratories |

| Applications Covered | Bioanalytical and Lab Chemistry Services, Toxicology Testing Services, Cell and Gene Therapy Related Services, Preclinical and Clinical Trial Related Services, Drug Discovery and Development Related Services, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines clinical laboratory services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines clinical laboratory services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines clinical laboratory services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The clinical laboratory services market in the Philippines was valued at USD 1.2 Billion in 2025.

The Philippines clinical laboratory services market is projected to exhibit a CAGR of 4.02% during 2026-2034.

The Philippines clinical laboratory services market is projected to reach a value of USD 1.7 Billion by 2034.

The market experiences growth driven by increasing chronic disease prevalence requiring regular monitoring, advanced laboratory technology adoption, including PCR and NGS capabilities, and expanding Universal Health Care coverage, enhancing diagnostic service accessibility across diverse patient populations.

The Philippines clinical laboratory services market is driven by substantial healthcare infrastructure investments through government programs, rapidly aging population demographics, and accelerating digital health integration, enabling enhanced connectivity and diagnostic workflows nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)