Philippines Bakery Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Philippines Bakery Market Size and Share:

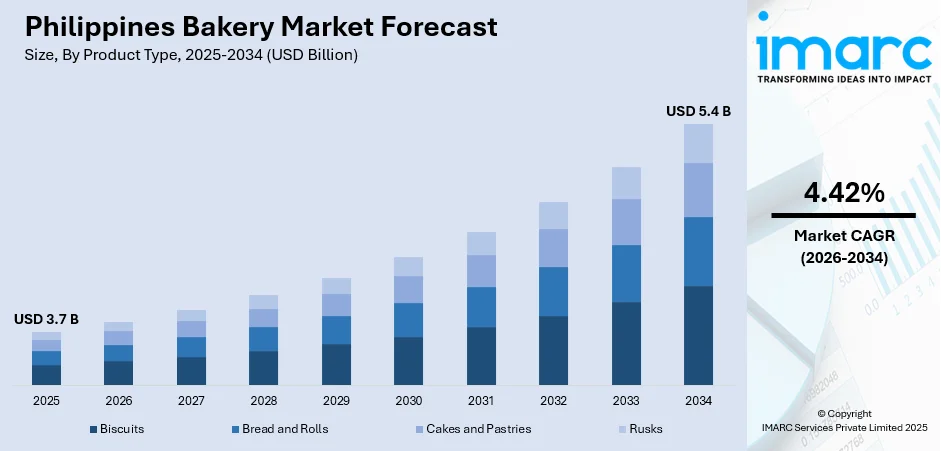

The Philippines bakery market size was valued at USD 3.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.4 Billion by 2034, exhibiting a CAGR of 4.42% from 2026-2034. The changing consumer lifestyles seeking convenience, rising disposable incomes, increasing demand for healthier and premium products, strong cultural preference for traditional bakery goods, expansion of bakery franchise expansion, and the emergence of online food delivery services are fueling the expansion of the Philippines bakery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.7 Billion |

|

Market Forecast in 2034

|

USD 5.4 Billion |

| Market Growth Rate (2026-2034) | 4.42% |

The Philippine economy's growth has led to an increase in disposable incomes for many individuals. In 2023, per capita disposable income in the country grew by 3.7% compared to the previous year. Furthermore, estimates for 2023-2028 suggest a 28.4% hike in per capita disposable income. This encourages individuals to spend more money on a wider variety of food, including bakery products. Consumers are now able to buy premium bakery goods, such as artisanal bread, cakes, and pastries, which were once considered luxury items. The rise in disposable income also translates to an increased willingness among individuals to try new flavors and products, shifting away from basic and traditional bakery options to more innovative and fancy treats.

To get more information on this market, Request Sample

As per the Philippines bakery market outlook, health-conscious eating is becoming a significant trend in the country, with bakery products being no exception. A 2023 Kantar survey revealed that 99% of Filipinos prioritize staying healthy, with 97% acknowledging the importance of purchasing nutritious food products, such as bakery items made with whole grains, organic ingredients, or reduced sugar. As a result, healthier bakery options, such as gluten-free bread, vegan pastries, and low-sugar cakes, have become increasingly popular. To align with this, major bakery chains like The French Baker and Gardenia have already introduced healthier options, further reflecting the shift in consumer choices.

Philippines Bakery Market Trends:

Changing Consumer Lifestyles and Growing Demand for Convenience

As life gets busier, people are looking for quick and easy meals and snacks that fit into their hectic schedules. Bakery products like bread, pastries, and sandwiches are becoming go-to options because they are fast and easy to grab on the way to work, school, or even during breaks, thus boosting the Philippines bakery market demand. With more families having both parents working and more young people living independently, the demand for ready-to-eat (RTE) and convenient food has risen. People are looking for products that taste good and are also available at affordable prices and can be eaten on the go. The growing trend of urbanization, where more Filipinos are moving into cities, also fuels this demand. The urban population of the Philippines reached 56,658,695 in 2023, reflecting a 2.2% growth compared to 2022. As cities get busier and lifestyles get faster, bakeries are adjusting their offerings, making them more suitable for the convenience-seeking consumer.

Expansion of Bakery Chains and Franchises

As per the Philippines bakery market trends, bakery chains and franchises have seen tremendous growth in the country, making it easier for consumers to access freshly baked products wherever they are. This is particularly true in urban areas and shopping malls, where chains like Pan de Manila, Red Ribbon, and French Baker are a common sight. The country's franchising industry was set to grow by at least 12 to 15 percent in the year 2023 as the industry continues to promote franchising as a growth strategy for entrepreneurs. This trend extends beyond major cities, reaching smaller towns and provinces as well. With a franchise model, bakery businesses can quickly scale and reach a broader audience, offering familiar, affordable, and reliable products.

Flourishing E-commerce and Online Delivery Services

E-commerce is significantly reshaping the country economy and has become a major driver for the Philippine bakery market growth. By 2025, the sector is expected to generate USD 24 billion in revenue. E-commerce and online food delivery have significantly transformed the way people shop for and enjoy bakery products in the Philippines. The growth of online platforms has enabled consumers to conveniently order their favorite baked goods without leaving their homes. Even traditional bakeries are embracing online platforms to meet customers' changing shopping habits, offering delivery services for freshly baked bread, cakes, and pastries. This shift is especially helpful for people who lack the time to visit bakeries in person due to busy work schedules. It also benefits consumers who are looking for unique or customized cakes for special occasions, as many bakeries now accept orders online.

Philippines Bakery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Philippines bakery market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Biscuits

- Cookies

- Cream Biscuits

- Glucose Biscuits

- Marie Biscuits

- Non-Salt Cracker Biscuits

- Salt Cracker Biscuits

- Milk Biscuits

- Others

- Bread and Rolls

- Sandwich Breads

- Hamburgers

- Croissants

- Others

- Cakes and Pastries

- Packed Cupcakes

- Pastries

- Muffins

- Layer Cakes

- Donuts

- Swiss Roll

- Others

- Rusks

As per the Philippines bakery market forecast, biscuits have been showing steady growth across the industry with 42.5% because of their popularity as cheap and convenient snacks. They are consumed among all age groups with sweet and savory flavors being the favorite ones among Filipino consumers. With the brands, such as Monde and Chipsters, holding higher market places, it caters for the wide variation of flavors and sizes of packaging. There has been a trend toward healthier biscuits, such as whole grain or low sugar, to cater to the health-conscious consumer base in recent years. The segment is expected to continue growing because of its accessibility, versatility, and ongoing innovations.

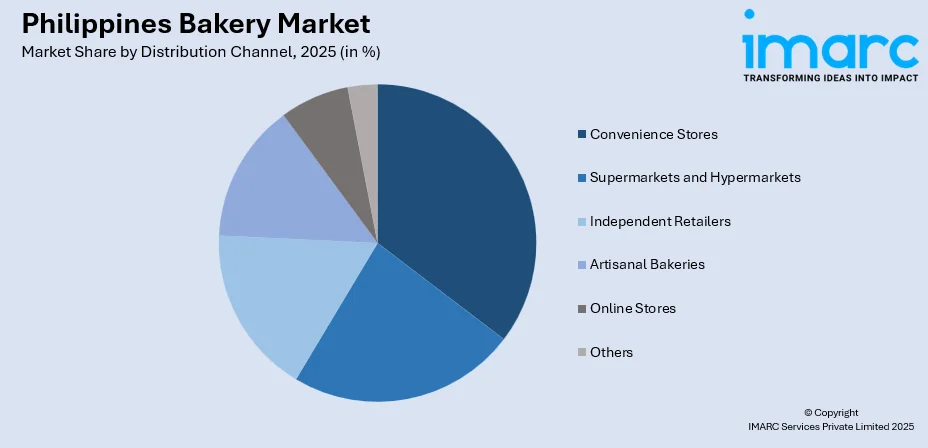

Analysis by Distribution Channel:

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online Stores

- Others

Supermarkets and hypermarkets have been one of the primary modes of distribution of bakery products with 32.6% of Philippines bakery market share. Chain stores are majorly visited by customers as they offer a vast range of fresh and packaged baked goods. In recent years, supermarkets and hypermarkets have become one of the highly preferred places to buy mass-produced bread, cakes, and other snacks, where convenience, variety, and reasonable prices are available. Growth of the middle-class sector and upward surging disposal income also increased the desire to shop more often in a supermarket, including in-house bakery operation stores, that attract consumers who are eager to buy bread fresh from ovens and some sweet pastries, which cements the trends to one-stop shop for groceries and bakery continues as the strong retailing selling platform.

Regional Analysis:

- Luzon

- Visayas

- Mindanao

Luzon, the largest and most populous island in the Philippines, plays a significant role in the bakery market, particularly in terms of sales and distribution with 44.7%. Luzon's metropolises demand a high focus on bakery products, particularly premium items like artisanal bread, cakes, and pastries. There is a great touch of expansion in the bakery market here because of the diversified consumer base, disposable income, and fast urban lifestyle largely responsible for the increase. The major supermarket chains, convenience stores, and online platforms flourish in the region, offering both mass market and specialty bakery store items catering to a variety of tastes and preferences.

Competitive Landscape:

Leading market players are proactively responding to shifting consumer preferences and trends by widening their portfolios of products and extending their operations across markets. They are taking opportunities in the rising needs for healthier alternatives by innovating whole wheat and low sugar varieties of bread. Others strengthen their position through the opening of new outlets both in the urban and the province, as well as expanding their offerings into premium and artisanal breads. Some companies innovate with new flavors of cakes and offer customized cakes for special occasions, catering to both traditional and modern preferences. Major participants also focus on quality products and introduce international bakery trends, such as croissants and gourmet sandwiches. Additionally, many are repositioning themselves through e-commerce platforms and delivery services to strengthen digital presence to cater to demand in the convenience of purchasing bakery products online.

The report provides a comprehensive analysis of the competitive landscape in the Philippines bakery market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, the Jollibee Group inaugurated the company’s first Tiong Bahru Bakery branch in the Philippines. This branch aims to offer its fresh viennoiseries and handmade pastries to Filipinos with exciting and world-class dining experiences.

- In December 2024, London-based bakery Bread Ahead announced their plans to debut in the Philippines through an exclusive franchise partnership with Good Eats by SSI. Under the collaboration, Good Eats by SSI will open in 15 locations across the Philippines along with a dedicated bakery school.

- In April 2024, SPC Group, Paris Baguette’s parent company, announced that its Malaysian franchisee Berjaya Food is launching in the Philippines. Berjaya Food planned to open five sites in the Philippines by the end of 2024.

- In July 2023, Monde Nissin invested 21.7 Million USD in its facility in Davao City on the Southern Philippine island of Mindanao. The facility features a bakery dedicated to producing its signature brands, Butter Coconut, a crispy sweet biscuit, and Monde Mamon, a classic Filipino sponge cake.

Philippines Bakery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Independent Retailers, Artisanal Bakeries, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines bakery market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Philippines bakery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines bakery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines bakery market was valued at USD 3.7 Billion in 2025.

The growth of the Philippine bakery market is driven by factors such as increasing demand for convenient and ready-to-eat products, rising disposable incomes, a shift toward healthier and premium bakery options, rapid urbanization, heightened influence of Western bakery trends, expansion of bakery chains, and the growth of online delivery services.

IMARC Group estimates the market to reach USD 5.4 Billion by 2034, exhibiting a CAGR of 4.42% from 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)